The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

July 30, 2019

https://seekingalpha.com/article/4278924-huntsman-corporation-2019-q2-results-earnings-call-slides

July 30, 2019

https://seekingalpha.com/article/4278924-huntsman-corporation-2019-q2-results-earnings-call-slides

July 30, 2019

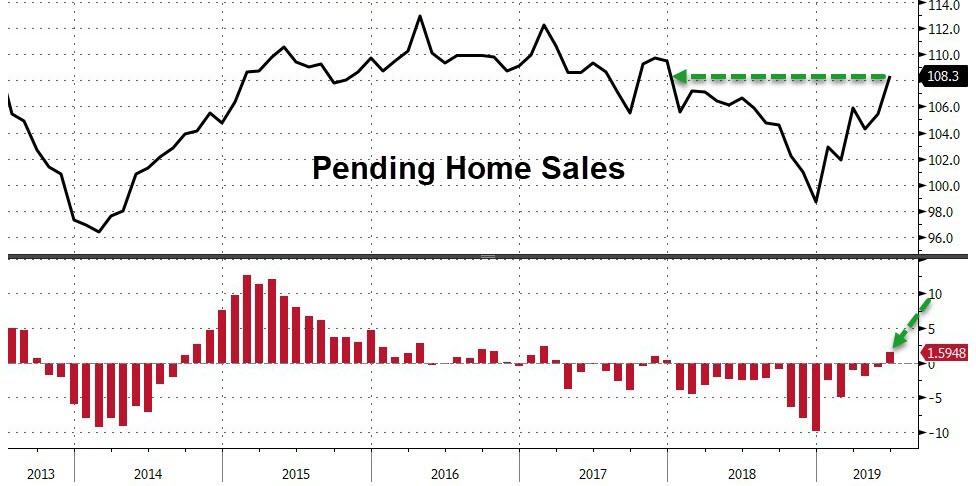

Pending Home Sales Jump In June, Break 17-Month Losing Streak

After mixed home sales data (new higher and existing lower), pending home sales were expected to increase by 0.5% MoM but beat handily, rising 2.8% MoM.

As Bloomberg notes, contract signings to purchase previously owned U.S. homes rose in June by the most in three months, indicating demand may pick up with the help of lower mortgage rates and steady job growth.

“Job growth is doing well, the stock market is near an all-time high and home values are consistently increasing,” NAR Chief Economist Lawrence Yun said in a statement.

“When you combine that with the incredibly low mortgage rates, it is not surprising to now see two straight months of increases.”

Pending home sales broke a 17 month losing streak, rising 1.6% YoY – the most since Feb 2017…

Contract signings increased 5.4% from the prior month in the West, the most in three months; rose for a fourth month in the Midwest; and advanced in the South and Northeast.

Pending home sales are often looked to as a leading indicator of existing-home purchases and a measure of the health of the housing market in the coming months.

https://www.zerohedge.com/news/2019-07-30/pending-home-sales-jump-june-break-17-month-losing-streak

July 30, 2019

Pending Home Sales Jump In June, Break 17-Month Losing Streak

After mixed home sales data (new higher and existing lower), pending home sales were expected to increase by 0.5% MoM but beat handily, rising 2.8% MoM.

As Bloomberg notes, contract signings to purchase previously owned U.S. homes rose in June by the most in three months, indicating demand may pick up with the help of lower mortgage rates and steady job growth.

“Job growth is doing well, the stock market is near an all-time high and home values are consistently increasing,” NAR Chief Economist Lawrence Yun said in a statement.

“When you combine that with the incredibly low mortgage rates, it is not surprising to now see two straight months of increases.”

Pending home sales broke a 17 month losing streak, rising 1.6% YoY – the most since Feb 2017…

Contract signings increased 5.4% from the prior month in the West, the most in three months; rose for a fourth month in the Midwest; and advanced in the South and Northeast.

Pending home sales are often looked to as a leading indicator of existing-home purchases and a measure of the health of the housing market in the coming months.

https://www.zerohedge.com/news/2019-07-30/pending-home-sales-jump-june-break-17-month-losing-streak

July 30, 2019

Huntsman Announces Second Quarter 2019 Earnings; Strong Cash Flow Generation in the Quarter

THE WOODLANDS, Texas, July 30, 2019 /PRNewswire/ —

Second Quarter Highlights

- Second quarter 2019 net income of $118 million compared to $623 million in the prior year period; second quarter 2019 diluted earnings per share of $0.47 compared to $1.71 in the prior year period.

- Second quarter 2019 adjusted net income of $146 million compared to $246 million in the prior year period; second quarter 2019 adjusted diluted earnings per share of $0.63 compared to $1.01 in the prior year period.

- Second quarter 2019 adjusted EBITDA of $318 million compared to $415 million in the prior year period.

- Second quarter 2019 net cash provided by operating activities was $304 million. Free cash flow was $240 million for the quarter.

- Balance sheet remains strong with a net leverage of 1.7x.

- Second quarter 2019 share repurchases of approximately 4 million shares for approximately $81 million.

- On July 26, 2019 announced a definitive agreement with Sasol to acquire the 50% interest that Huntsman does not own in the Sasol-Huntsman maleic anhydride joint venture located in Moers, Germany for $92.5 million, adjusted for net debt and other agreed upon adjustments.

|

Three months ended |

Six months ended |

|||||||||

|

June 30, |

June 30, |

|||||||||

|

In millions, except per share amounts |

2019 |

2018 |

2019 |

2018 |

||||||

|

Revenues |

$ 2,194 |

$ 2,404 |

$ 4,228 |

$ 4,699 |

||||||

|

Net income |

$ 118 |

$ 623 |

$ 249 |

$ 973 |

||||||

|

Adjusted net income(1) |

$ 146 |

$ 246 |

$ 254 |

$ 483 |

||||||

|

Diluted income per share |

$ 0.47 |

$ 1.71 |

$ 0.98 |

$ 2.82 |

||||||

|

Adjusted diluted income per share(1) |

$ 0.63 |

$ 1.01 |

$ 1.09 |

$ 1.98 |

||||||

|

Adjusted EBITDA(1) |

$ 318 |

$ 415 |

$ 575 |

$ 820 |

||||||

|

Net cash provided by operating activities from continuing operations |

$ 304 |

$ 228 |

$ 273 |

$ 339 |

||||||

|

Free cash flow(2) |

$ 240 |

$ 174 |

$ 139 |

$ 230 |

||||||

|

See end of press release for footnote explanations |

||||||||||

Huntsman Corporation (NYSE: HUN) today reported second quarter 2019 results with revenues of $2,194 million, net income of $118 million, adjusted net income of $146 million and adjusted EBITDA of $318 million.

Peter R. Huntsman, Chairman, President and CEO, commented:

“We are pleased with the relative resilience of the margins in our core downstream portfolio. In spite of challenging economic conditions, we generated $240 million of free cash flow in the quarter and reaffirm our stated objective of generating 40% free cash flow to adjusted EBITDA. Regardless of second half economic uncertainties, we will continue to control our costs, protect our margins and focus on maintaining a strong balance sheet and cash generation. We will continue to follow a balanced approach to capital allocation between maintaining a competitive dividend, ongoing share repurchases and strategic organic and inorganic growth in our downstream portfolio.”

Segment Analysis for 2Q19 Compared to 2Q18

Polyurethanes

The decrease in revenues in our Polyurethanes segment for the three months ended June 30, 2019 compared to the same period of 2018 was due to lower average MDI and MTBE selling prices, partially offset by higher MDI and MTBE sales volumes. MDI average selling prices decreased primarily due to a decline in component MDI selling prices in China and Europe. MTBE average selling prices decreased in China primarily as a result of lower pricing for high octane gasoline. MDI sales volumes increased primarily due to the start-up of our new Chinese MDI facility in 2018 and the acquisition of Demilec in the second quarter of 2018. The decrease in adjusted EBITDA was primarily due to lower MDI margins driven by lower MDI pricing and lower PO/MTBE margins in China, partially offset by higher sales volumes.

https://ir.huntsman.com/news-releases/detail/414/huntsman-announces-second-quarter-2019-earnings-strong