The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

July 24, 2019

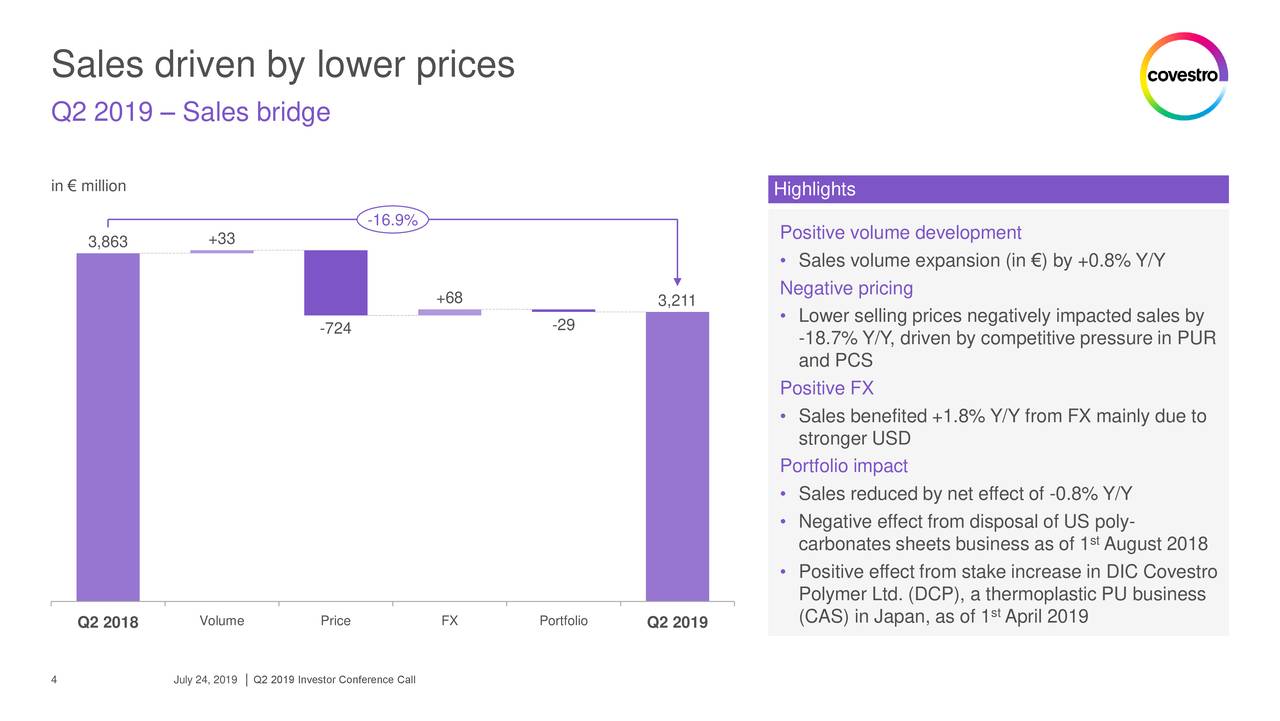

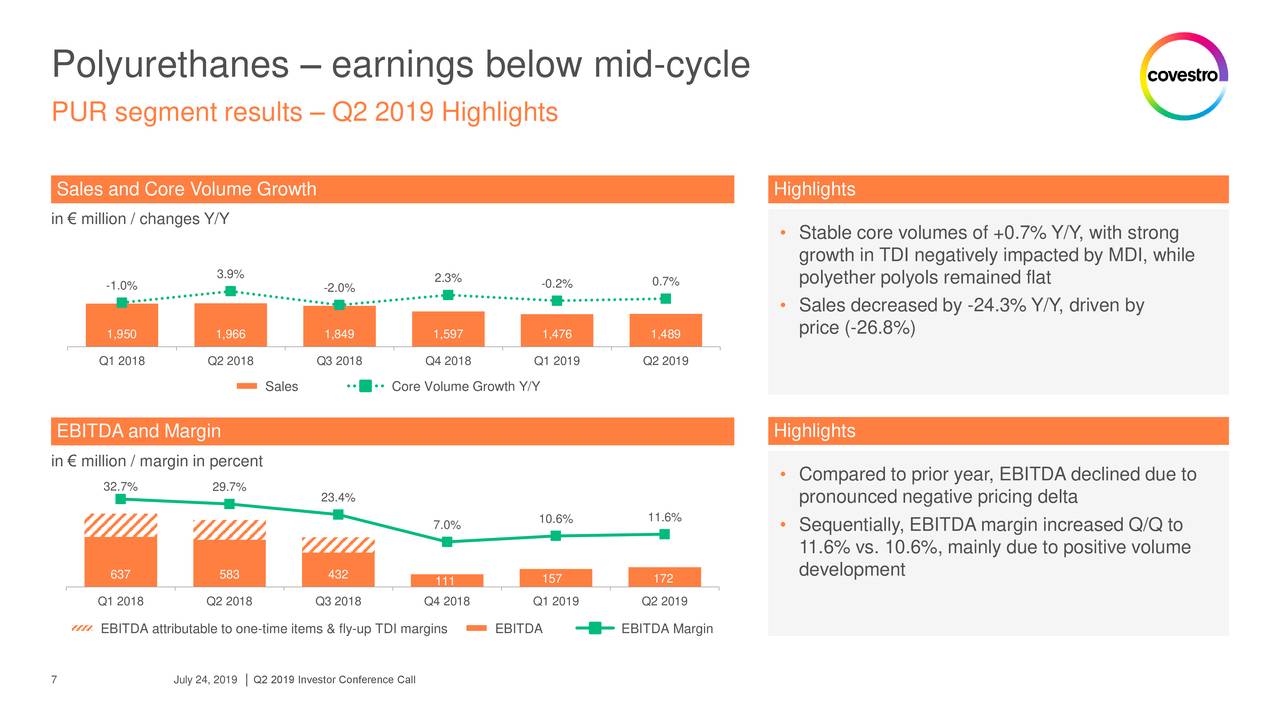

https://seekingalpha.com/article/4276974-covestro-ag-2019-q2-results-earnings-call-slides

July 24, 2019

ATA Truck Tonnage Index Fell 1.1% in June

Index 1.5% Higher than June 2018

Arlington, Va. — American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 1.1% in June after falling 4% in May. In June, the index equaled 115.2 (2015=100) compared with 116.5 in May.

“Tonnage continues to show resilience as it posted the twenty-sixth year-over-year increase despite falling for the second straight month sequentially,” said ATA Chief Economist Bob Costello. “The year-over-year gain was the smallest over the past two years, but the level of freight remains quite high. Tonnage is outperforming other trucking metrics as heavy freight sectors, like tank truck, are witnessing better freight levels than sectors like dry van, which has a lower average weight per load.”

May’s reading was revised up compared with our June press release.

Compared with June 2018, the SA index increased 1.5%, the smallest year-over-year gain since April 2017.

The not seasonally adjusted index, which represents the change in tonnage actually hauled by the fleets before any seasonal adjustment, equaled 117.6 in June, 3.3% below May level (121.7). In calculating the index, 100 represents 2015.

Trucking serves as a barometer of the U.S. economy, representing 70.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 10.77 billion tons of freight in 2017. Motor carriers collected $700.1 billion, or 79.3% of total revenue earned by all transport modes.

ATA calculates the tonnage index based on surveys from its membership and has been doing so since the 1970s. This is a preliminary figure and subject to change in the final report issued around the 5th day of each month. The report includes month-to-month and year-over-year results, relevant economic comparisons, and key financial indicators.

https://www.trucking.org/article/ATA-Truck-Tonnage-Index-Fell-1.1-Percent-in-June

July 24, 2019

ATA Truck Tonnage Index Fell 1.1% in June

Index 1.5% Higher than June 2018

Arlington, Va. — American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 1.1% in June after falling 4% in May. In June, the index equaled 115.2 (2015=100) compared with 116.5 in May.

“Tonnage continues to show resilience as it posted the twenty-sixth year-over-year increase despite falling for the second straight month sequentially,” said ATA Chief Economist Bob Costello. “The year-over-year gain was the smallest over the past two years, but the level of freight remains quite high. Tonnage is outperforming other trucking metrics as heavy freight sectors, like tank truck, are witnessing better freight levels than sectors like dry van, which has a lower average weight per load.”

May’s reading was revised up compared with our June press release.

Compared with June 2018, the SA index increased 1.5%, the smallest year-over-year gain since April 2017.

The not seasonally adjusted index, which represents the change in tonnage actually hauled by the fleets before any seasonal adjustment, equaled 117.6 in June, 3.3% below May level (121.7). In calculating the index, 100 represents 2015.

Trucking serves as a barometer of the U.S. economy, representing 70.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 10.77 billion tons of freight in 2017. Motor carriers collected $700.1 billion, or 79.3% of total revenue earned by all transport modes.

ATA calculates the tonnage index based on surveys from its membership and has been doing so since the 1970s. This is a preliminary figure and subject to change in the final report issued around the 5th day of each month. The report includes month-to-month and year-over-year results, relevant economic comparisons, and key financial indicators.

https://www.trucking.org/article/ATA-Truck-Tonnage-Index-Fell-1.1-Percent-in-June

July 22, 2019

Chemical Deal Results

| Seller | Buyer | Business | Date |

|---|---|---|---|

| Custom Ingredients and CA Specialties | Charkit (LBB Specialties) | manufacture and distribution of specialty ingredients for the personal care market | 2nd Quarter 2019 |

| Molecule Corp. | Henkel | advanced solutions for 3D printing applications | 2nd Quarter 2019 |

| AIM Aerospace | Sekisui Chemical | carbon fiber reinforced plastics – $178s/$510v | 2nd Quarter 2019 |

| Rive Technology | WR Grace | Molecular Highway zeolite technology | 2nd Quarter 2019 |

| Firestone (Bridgestone) | Lion Elastomers | Orange TX production site | 2nd Quarter 2019 |

| Renewable Energy Group | Genomatica | certain life science division assets | 2nd Quarter 2019 |

| Schul International and Willseal | Tremco (RPM) | joint sealants for commercial construction – $15s | 2nd Quarter 2019 |

| Cray Valley (Total SA) | Polyscope Polymers BV | styrene maleic anhydride | 2nd Quarter 2019 |

| Pro Marine Supplies | Polytek Development (Arsenal Capital) | epoxy coating resins for a variety of professional and hobbyist applications | 2nd Quarter 2019 |

| HB Fuller | Tiarco (Textile Rubber and Chemical) | surfactants, thickeners and dispersants – $71v | 2nd Quarter 2019 |

| Seller | Buyer | Business | Date |

|---|---|---|---|

| US Corrosion Technologies | Corrosion Technologies | corrosion control, lubrication, cleaning and detailing products, polymer coatings and release agents | 2nd Quarter 2019 |

| Prinova | Nagase | manufacture and distribution of premium nutrition ingredients for the global food and wellness industries | 2nd Quarter 2019 |

| Fine Organics Corporation | Cosco Enterprises | cleaning chemicals | 2nd Quarter 2019 |

| Superior Petroleum | PetroChoice | lubricants distribution | 2nd Quarter 2019 |

| Digital Specialty Chemicals | Entegris | organometallic precursors used in semiconductor fabrication – ~$20s | 2nd Quarter 2019 |

| ArrMaz (Golden Gate Capital) | Arkema | specialty surfactants for crop nutrition, mining and infrastructure markets – $290s/$570v | 2nd Quarter 2019 |

| Environmental Technology, Inc. | Polytek Development (Arsenal Capital) | coating, casting and molding products | 2nd Quarter 2019 |

| Specialty Products | Versaflex (Dalfort Partners) | spray-applied polyurea elastomers, polyurethane foams and custom plural component equipment | 2nd Quarter 2019 |

| Lord Corporation | Parker-Hanifin | acquisition of whole company (adhesives, coatings and specialty materials as well as vibration and motion control technologies) – $1,100s/$3,700v | 2nd Quarter 2019 |

| VanDeMark Chemical | Comvest Capital | specialty phosgene derivatives | 2nd Quarter 2019 |

| Seller | Buyer | Business | Date |

|---|---|---|---|

| Ineos | Prefere Resins | Ineos Melamines & Paraform (melamine resins and formaldehyde and downstream derivatives) | 2nd Quarter 2019 |

| Triwater Holdings (JZ Partners and The Edgewater Fund) | Behrman Capital | Waterline Renewal Technologies (products used in trenchless repair of sewer systems and wastewater lines) | 2nd Quarter 2019 |

| Versum Materials | Merck KGaA | acquisition of whole company (high-purity process chemicals, gases and equipment for semiconductor manufacturing)- €1,200s, €5,800v | 2nd Quarter 2019 |

| DuPont | LG Chem | soluble OLED technologies and assets – $175v | 2nd Quarter 2019 |

| Inchem | Joe Wilson | Duncan SC facility | 2nd Quarter 2019 |

| Nilodor | HOSPECO | odor control and neutralizing products for the facility care and pet care markets | 2nd Quarter 2019 |

| E.V. Roberts | Graco Supply | distribution, formulation and packaging of specialty chemicals for the aerospace and other advanced manufacturing markets | 2nd Quarter 2019 |

http://www.chemicaldeals.com/Results.aspx?searchtext=&quarter=2nd%20Quarter%202019

July 22, 2019

Chemical Deal Results

| Seller | Buyer | Business | Date |

|---|---|---|---|

| Custom Ingredients and CA Specialties | Charkit (LBB Specialties) | manufacture and distribution of specialty ingredients for the personal care market | 2nd Quarter 2019 |

| Molecule Corp. | Henkel | advanced solutions for 3D printing applications | 2nd Quarter 2019 |

| AIM Aerospace | Sekisui Chemical | carbon fiber reinforced plastics – $178s/$510v | 2nd Quarter 2019 |

| Rive Technology | WR Grace | Molecular Highway zeolite technology | 2nd Quarter 2019 |

| Firestone (Bridgestone) | Lion Elastomers | Orange TX production site | 2nd Quarter 2019 |

| Renewable Energy Group | Genomatica | certain life science division assets | 2nd Quarter 2019 |

| Schul International and Willseal | Tremco (RPM) | joint sealants for commercial construction – $15s | 2nd Quarter 2019 |

| Cray Valley (Total SA) | Polyscope Polymers BV | styrene maleic anhydride | 2nd Quarter 2019 |

| Pro Marine Supplies | Polytek Development (Arsenal Capital) | epoxy coating resins for a variety of professional and hobbyist applications | 2nd Quarter 2019 |

| HB Fuller | Tiarco (Textile Rubber and Chemical) | surfactants, thickeners and dispersants – $71v | 2nd Quarter 2019 |

| Seller | Buyer | Business | Date |

|---|---|---|---|

| US Corrosion Technologies | Corrosion Technologies | corrosion control, lubrication, cleaning and detailing products, polymer coatings and release agents | 2nd Quarter 2019 |

| Prinova | Nagase | manufacture and distribution of premium nutrition ingredients for the global food and wellness industries | 2nd Quarter 2019 |

| Fine Organics Corporation | Cosco Enterprises | cleaning chemicals | 2nd Quarter 2019 |

| Superior Petroleum | PetroChoice | lubricants distribution | 2nd Quarter 2019 |

| Digital Specialty Chemicals | Entegris | organometallic precursors used in semiconductor fabrication – ~$20s | 2nd Quarter 2019 |

| ArrMaz (Golden Gate Capital) | Arkema | specialty surfactants for crop nutrition, mining and infrastructure markets – $290s/$570v | 2nd Quarter 2019 |

| Environmental Technology, Inc. | Polytek Development (Arsenal Capital) | coating, casting and molding products | 2nd Quarter 2019 |

| Specialty Products | Versaflex (Dalfort Partners) | spray-applied polyurea elastomers, polyurethane foams and custom plural component equipment | 2nd Quarter 2019 |

| Lord Corporation | Parker-Hanifin | acquisition of whole company (adhesives, coatings and specialty materials as well as vibration and motion control technologies) – $1,100s/$3,700v | 2nd Quarter 2019 |

| VanDeMark Chemical | Comvest Capital | specialty phosgene derivatives | 2nd Quarter 2019 |

| Seller | Buyer | Business | Date |

|---|---|---|---|

| Ineos | Prefere Resins | Ineos Melamines & Paraform (melamine resins and formaldehyde and downstream derivatives) | 2nd Quarter 2019 |

| Triwater Holdings (JZ Partners and The Edgewater Fund) | Behrman Capital | Waterline Renewal Technologies (products used in trenchless repair of sewer systems and wastewater lines) | 2nd Quarter 2019 |

| Versum Materials | Merck KGaA | acquisition of whole company (high-purity process chemicals, gases and equipment for semiconductor manufacturing)- €1,200s, €5,800v | 2nd Quarter 2019 |

| DuPont | LG Chem | soluble OLED technologies and assets – $175v | 2nd Quarter 2019 |

| Inchem | Joe Wilson | Duncan SC facility | 2nd Quarter 2019 |

| Nilodor | HOSPECO | odor control and neutralizing products for the facility care and pet care markets | 2nd Quarter 2019 |

| E.V. Roberts | Graco Supply | distribution, formulation and packaging of specialty chemicals for the aerospace and other advanced manufacturing markets | 2nd Quarter 2019 |

http://www.chemicaldeals.com/Results.aspx?searchtext=&quarter=2nd%20Quarter%202019