The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

June 21, 2019

200 Years Of Rapid Global Population Growth Will Come To An End

Authored by Max Roser via OurWorldInData.org,

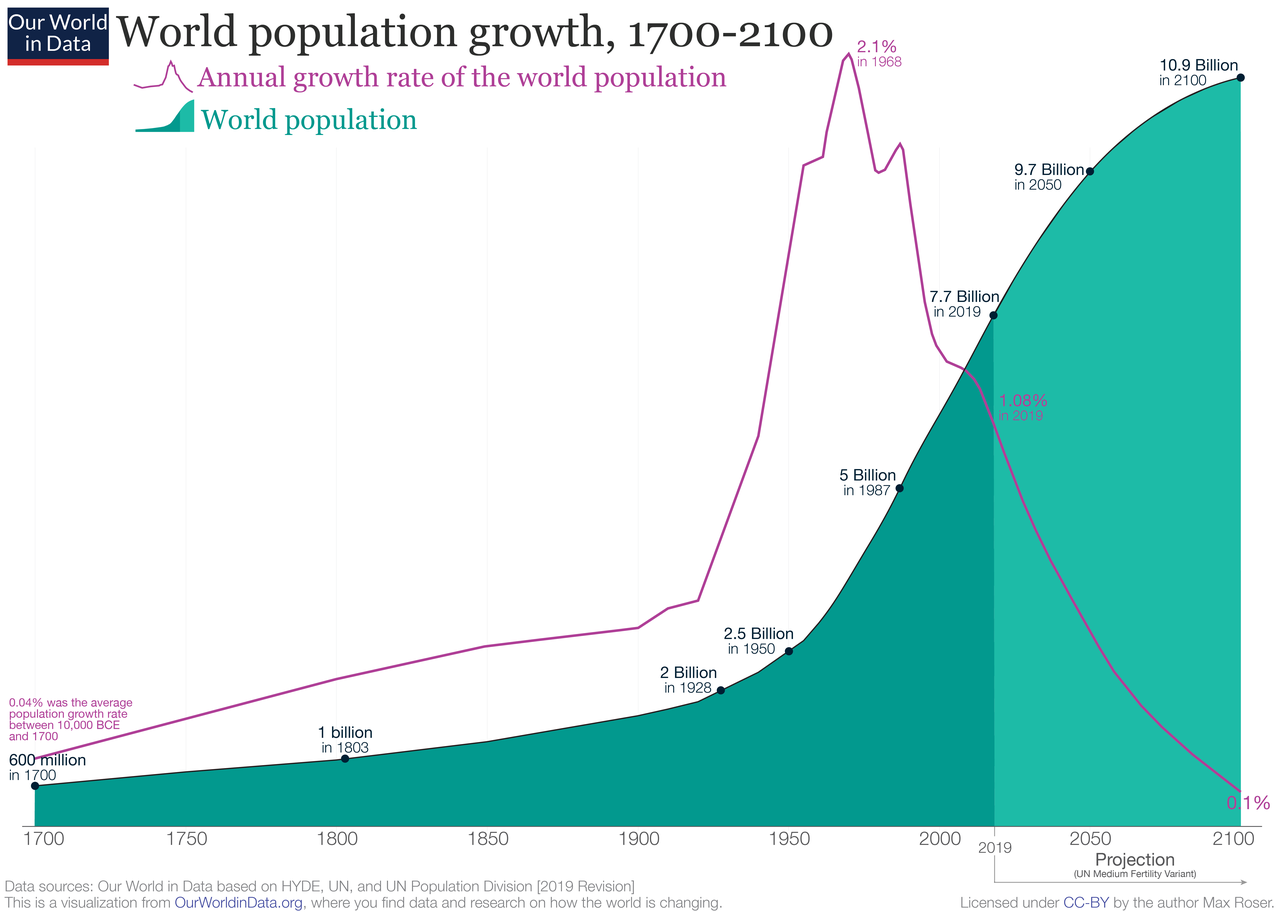

One of the big lessons from the demographic history of countries is that population explosions are temporary. For many countries the demographic transition has already ended, and as the global fertility rate has now halved we know that the world as a whole is approaching the end of rapid population growth.

The visualization below presents this big overview of the global demographic transition – with the very latest data from the UN Population Division just published.

As we explore at the beginning of the entry on population growth, the global population grew only very slowly up to 1700 – only 0.04% per year. In the many millennia up to that point in history very high mortality of children counteracted high fertility. The world was in the first stage of the demographic transition.

Once health improved and mortality declined things changed quickly. Particularly over the course of the 20th century: Over the last 100 years global population more than quadrupled. As we see in the chart, the rise of the global population got steeper and steeper and you have just lived through the steepest increase of that curve. This also means that your existence is a tiny part of the reason why that curve is so steep.

The 7-fold increase of the world population over the course of two centuries amplified humanity’s impact on the natural environment. To provide space, food, and resources for a large world population in a way that is sustainable into the distant future is without question one of the large, serious challenges for our generation. We should not make the mistake of underestimating the task ahead of us. Yes, I expect new generations to contribute, but for now it is upon us to provide for them. Population growth is still fast: Every year 140 million are born and 58 million die – the difference is the number of people that we add to the world population in a year: 82 million.

Where do we go from here?

In red you see the annual population growth rate (that is, the percentage change in population per year) of the global population. It peaked around half a century ago. Peak population growth was reached in 1968 with an annual growth of 2.1%. Since then the increase of the world population has slowed and today grows by just over 1% per year. This slowdown of population growth was not only predictable, but predicted. Just as expected by demographers (here), the world as a whole is experiencing the closing of a massive demographic transition.

This chart also shows how the United Nations envision the slow ending of the global demographic transition. As population growth continues to decline, the curve representing the world population is getting less and less steep. By the end of the century – when global population growth will have fallen to 0.1% according to the UN’s projection – the world will be very close to the end of the demographic transition. It is hard to know the population dynamics beyond 2100; it will depend upon the fertility rate and as we discuss in our entry on fertility rates here fertility is first falling with development – and then rising with development. The question will be whether it will rise above an average 2 children per woman.

The world enters the last phase of the demographic transition and this means we will not repeat the past. The global population has quadrupled over the course of the 20th century, but it will not double anymore over the course of this century.

The world population will reach a size, which compared to humanity’s history, will be extraordinary; if the UN projections are accurate (they have a good track record), the world population will have increased more than 10-fold over the span of 250 years.

We are on the way to a new balance. The big global demographic transition that the world entered more than two centuries ago is then coming to an end: This new equilibrium is different from the one in the past when it was the very high mortality that kept population growth in check. In the new balance it will be low fertility keeps population changes small.

https://www.zerohedge.com/news/2019-06-20/200-years-rapid-global-population-growth-will-come-end

June 19, 2019

Covestro to sell European Systems Houses

business to H.I.G. Capital

Sales proceeds in the high-double-digit euro million range

Systems houses with revenues of EUR 230 million

Covestro to remain a key supplier to European Systems Houses

New ownership allows unit to further grow and to position itself as

an independent player

Covestro has signed an agreement with H.I.G. Capital (“H.I.G.”) for the sale of

Covestro’s European Systems Houses business. H.I.G. focuses on investments in small and mid-sized companies. The sales proceeds amount to a high-

double-digit euro million sum. The decision to sell the systems houses was taken as part of Covestro’s ongoing portfolio optimization process that includes

the sale of Covestro’s North American spray polyurethane foam systems house

in 2017.

“Our focus is future growth and value creation. That’s why evaluating and

optimizing our portfolio is part of our daily business”, said CFO Dr Thomas

Toepfer. “Providing tailor-made solutions, systems houses serve relevant market

needs. However, in an advanced polyurethanes market like Europe we focus on

a more centralized approach to efficiently address the needs of our customers.”

With its new owner H.I.G., the European Systems Houses now have the

perspective to position themselves as an independent, focused player for mid-

sized customers. In Asia with its developing polyurethane markets, Covestro will

continue to serve its customers through its established systems houses network.

The systems houses are part of the company’s Polyurethanes segment and are

offering tailor-made polyurethanes systems for customers. The European Systems Houses business comprises facilities in the Netherlands, Denmark,

Spain, Germany and further businesses in Italy. Approximately 250 employees

are generating annual sales of some EUR 230 million. Operations will continue

at the current facilities while Covestro will continue to have strong ties with the

systems houses as a key polyurethanes supplier.

Polyurethanes are a class of plastics that can be found in many areas of modern

life – be it in the form of soft or rigid foam or as thermoplastic polyurethane

(TPU). They are used in numerous applications like, for instance, mattresses,

automobile seats, sports equipment or as insulating material in buildings and

refrigerators.

With view on scale and capabilities as well as the solid asset base, the

European Systems Houses perfectly fits into H.I.G.’s buy-and-build approach.

H.I.G. aims to further develop their pan-European presence and to build a

strong and independent European group of polyurethane systems houses with a

clear focus on mid-sized customers. The company intends to continue working

with the current experienced management team of the systems houses to

further improve the business. The closing of the transaction is expected for the

second half of 2019 after the required antitrust clearance.

About H.I.G. Capital

H.I.G. is a leading global private equity and alternative assets investment firm

with over €26 billion of equity capital under management. Based in Miami, and

with offices in New York, Boston, Chicago, Dallas, Los Angeles, San Francisco,

and Atlanta in the U.S., as well as international affiliate offices in London,

Hamburg, Madrid, Milan, Paris, Bogotá, Rio de Janeiro and São Paulo, H.I.G.

specializes in providing both debt and equity capital to small and mid-sized

companies, utilizing a flexible and operationally focused / value-added

approach:

1. H.I.G.’s equity funds invest in management buyouts, recapitalizations

and corporate carve-outs of both profitable as well as underperforming

manufacturing and service businesses.

2. H.I.G.’s debt funds invest in senior, unitranche and junior debt financing

to companies across the size spectrum, both on a primary (direct

origination) basis, as well as in the secondary markets. H.I.G. is also a

leading CLO manager, through its WhiteHorse family of vehicles, and

manages a publicly traded BDC, WhiteHorse Finance.

3. H.I.G.’s real estate funds invest in value-added properties, which can

benefit from improved asset management practices.

Since its founding in 1993, H.I.G. has invested in and managed more than 300

companies worldwide. The firm’s current portfolio includes more than 100

companies with combined sales in excess of €28 billion. For more information,

please refer to the H.I.G. website at www.higcapital.com.

June 19, 2019

Covestro to sell European Systems Houses

business to H.I.G. Capital

Sales proceeds in the high-double-digit euro million range

Systems houses with revenues of EUR 230 million

Covestro to remain a key supplier to European Systems Houses

New ownership allows unit to further grow and to position itself as

an independent player

Covestro has signed an agreement with H.I.G. Capital (“H.I.G.”) for the sale of

Covestro’s European Systems Houses business. H.I.G. focuses on investments in small and mid-sized companies. The sales proceeds amount to a high-

double-digit euro million sum. The decision to sell the systems houses was taken as part of Covestro’s ongoing portfolio optimization process that includes

the sale of Covestro’s North American spray polyurethane foam systems house

in 2017.

“Our focus is future growth and value creation. That’s why evaluating and

optimizing our portfolio is part of our daily business”, said CFO Dr Thomas

Toepfer. “Providing tailor-made solutions, systems houses serve relevant market

needs. However, in an advanced polyurethanes market like Europe we focus on

a more centralized approach to efficiently address the needs of our customers.”

With its new owner H.I.G., the European Systems Houses now have the

perspective to position themselves as an independent, focused player for mid-

sized customers. In Asia with its developing polyurethane markets, Covestro will

continue to serve its customers through its established systems houses network.

The systems houses are part of the company’s Polyurethanes segment and are

offering tailor-made polyurethanes systems for customers. The European Systems Houses business comprises facilities in the Netherlands, Denmark,

Spain, Germany and further businesses in Italy. Approximately 250 employees

are generating annual sales of some EUR 230 million. Operations will continue

at the current facilities while Covestro will continue to have strong ties with the

systems houses as a key polyurethanes supplier.

Polyurethanes are a class of plastics that can be found in many areas of modern

life – be it in the form of soft or rigid foam or as thermoplastic polyurethane

(TPU). They are used in numerous applications like, for instance, mattresses,

automobile seats, sports equipment or as insulating material in buildings and

refrigerators.

With view on scale and capabilities as well as the solid asset base, the

European Systems Houses perfectly fits into H.I.G.’s buy-and-build approach.

H.I.G. aims to further develop their pan-European presence and to build a

strong and independent European group of polyurethane systems houses with a

clear focus on mid-sized customers. The company intends to continue working

with the current experienced management team of the systems houses to

further improve the business. The closing of the transaction is expected for the

second half of 2019 after the required antitrust clearance.

About H.I.G. Capital

H.I.G. is a leading global private equity and alternative assets investment firm

with over €26 billion of equity capital under management. Based in Miami, and

with offices in New York, Boston, Chicago, Dallas, Los Angeles, San Francisco,

and Atlanta in the U.S., as well as international affiliate offices in London,

Hamburg, Madrid, Milan, Paris, Bogotá, Rio de Janeiro and São Paulo, H.I.G.

specializes in providing both debt and equity capital to small and mid-sized

companies, utilizing a flexible and operationally focused / value-added

approach:

1. H.I.G.’s equity funds invest in management buyouts, recapitalizations

and corporate carve-outs of both profitable as well as underperforming

manufacturing and service businesses.

2. H.I.G.’s debt funds invest in senior, unitranche and junior debt financing

to companies across the size spectrum, both on a primary (direct

origination) basis, as well as in the secondary markets. H.I.G. is also a

leading CLO manager, through its WhiteHorse family of vehicles, and

manages a publicly traded BDC, WhiteHorse Finance.

3. H.I.G.’s real estate funds invest in value-added properties, which can

benefit from improved asset management practices.

Since its founding in 1993, H.I.G. has invested in and managed more than 300

companies worldwide. The firm’s current portfolio includes more than 100

companies with combined sales in excess of €28 billion. For more information,

please refer to the H.I.G. website at www.higcapital.com.

June 19, 2019

Europe ethylene, propylene in cautious mode after H1 expectations disrupted by global woes

Source: ICIS News

2019/06/18

LONDON (ICIS)–European ethylene and propylene players will have been revising their original plans for the remainder of 2019 to show much more caution after the first half did not go according to expectations.

The 2019 turnaround slate, and in particular the coinciding outages at Europe’s two largest crackers this spring, led to extensive preparations including derivative outages and structural imports.

Many consumers also extended their contractual supply exposure.

The first half of 2019 was also littered by unplanned issues and, together, all of these supply constraints under normal market conditions would have led to heightened demand for volumes and, potentially, very high spot prices.

However, demand did not hold up to expectations.

LOWER DEMAND, MORE CAPACITIES

The US-China trade dispute, slower economic growth in China, and other macro economic worries have led to uncertainty going forward and, subsequently, a lack of buyer confidence.

At this point, there is not a great deal of optimism that this uncertainty will wane, and there are concerns over how the supply and demand landscape will look when all the 2019 turnarounds are over.

That demand has slowed in 2019 is especially worrying as new monomer and polymer capacities are either on-stream, or soon due to be, in the US.

While players had anticipated some detrimental impact on Europe’s polymer markets as a result of US volumes usurping Europe’s in Asia, the fact that a large proportion of European supply would be offline this year was widely expected to insure against any major shocks.

Europe is now faced with the prospect of more US volumes coming direct to its shores.

Additionally, while the European market has been focused on supply constraints, elsewhere prices are soft and well below Europe’s.

The ready-availability of both ethylene and propylene volumes from outside of Europe has been another factor behind the better-than-expected balances in the markets.

On the flip side, this has impacted heavily on some of Europe’s derivatives, with high costs limiting export potential and creating issues with affordability.

JULY CONTRACTS TO SET DEMAND TONE

The July contract reference prices had yet to be established at the time of writing, but they are being viewed as an important settlement as demand opportunities over the summer months could be hinging on the settlements’ outcome.

Feedstock prices have plummeted month on month but, for many, an improved price position relative to the rest of the world is key.

A trickier consideration is that, on paper, European production should be back to normal by the end of July, but this is of course not yet proven.

Aside from appropriate pricing, planned turnarounds in the autumn should help provide some support although sources remark that the outages will be less concentrated in just the one area.

This should minimise some of the logistical challenges seen in the first half of 2019, but a repeat of last year’s River Rhine low water levels, and potentially some hurricane-related disruptions to imports ex US, could also help offset low demand conditions.

Given players’ experiences over the first half, buyers are more relaxed over their options for the remainder of the year, but there is growing tension among sellers.

Global ethylene price evolution

–

Global propylene price evolution

–

Focus article by Nel Weddle

https://www.icis.com/explore/resources/news/2019/06/18/10379838/europe-ethylene-propylene-in-cautious-mode-after-h1-expectations-disrupted-by-global-woes

June 19, 2019

Europe ethylene, propylene in cautious mode after H1 expectations disrupted by global woes

Source: ICIS News

2019/06/18

LONDON (ICIS)–European ethylene and propylene players will have been revising their original plans for the remainder of 2019 to show much more caution after the first half did not go according to expectations.

The 2019 turnaround slate, and in particular the coinciding outages at Europe’s two largest crackers this spring, led to extensive preparations including derivative outages and structural imports.

Many consumers also extended their contractual supply exposure.

The first half of 2019 was also littered by unplanned issues and, together, all of these supply constraints under normal market conditions would have led to heightened demand for volumes and, potentially, very high spot prices.

However, demand did not hold up to expectations.

LOWER DEMAND, MORE CAPACITIES

The US-China trade dispute, slower economic growth in China, and other macro economic worries have led to uncertainty going forward and, subsequently, a lack of buyer confidence.

At this point, there is not a great deal of optimism that this uncertainty will wane, and there are concerns over how the supply and demand landscape will look when all the 2019 turnarounds are over.

That demand has slowed in 2019 is especially worrying as new monomer and polymer capacities are either on-stream, or soon due to be, in the US.

While players had anticipated some detrimental impact on Europe’s polymer markets as a result of US volumes usurping Europe’s in Asia, the fact that a large proportion of European supply would be offline this year was widely expected to insure against any major shocks.

Europe is now faced with the prospect of more US volumes coming direct to its shores.

Additionally, while the European market has been focused on supply constraints, elsewhere prices are soft and well below Europe’s.

The ready-availability of both ethylene and propylene volumes from outside of Europe has been another factor behind the better-than-expected balances in the markets.

On the flip side, this has impacted heavily on some of Europe’s derivatives, with high costs limiting export potential and creating issues with affordability.

JULY CONTRACTS TO SET DEMAND TONE

The July contract reference prices had yet to be established at the time of writing, but they are being viewed as an important settlement as demand opportunities over the summer months could be hinging on the settlements’ outcome.

Feedstock prices have plummeted month on month but, for many, an improved price position relative to the rest of the world is key.

A trickier consideration is that, on paper, European production should be back to normal by the end of July, but this is of course not yet proven.

Aside from appropriate pricing, planned turnarounds in the autumn should help provide some support although sources remark that the outages will be less concentrated in just the one area.

This should minimise some of the logistical challenges seen in the first half of 2019, but a repeat of last year’s River Rhine low water levels, and potentially some hurricane-related disruptions to imports ex US, could also help offset low demand conditions.

Given players’ experiences over the first half, buyers are more relaxed over their options for the remainder of the year, but there is growing tension among sellers.

Global ethylene price evolution

–

Global propylene price evolution

–

Focus article by Nel Weddle

https://www.icis.com/explore/resources/news/2019/06/18/10379838/europe-ethylene-propylene-in-cautious-mode-after-h1-expectations-disrupted-by-global-woes