The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

August 22, 2022

Massachusetts-based foam fabricator expanding into ABQ

By Matthew Narvaiz / Journal Staff Writer

Published: Thursday, August 18th, 2022 at 2:46PM

Updated: Thursday, August 18th, 2022 at 6:55PM

A Massachusetts-based foam fabricator is bringing jobs to Albuquerque in an expansion announced on Thursday.

Rogers Foam, which converts flexible materials for the medical, automotive and bedding industries, is moving into the Albuquerque area to an existing 40,000-square-foot facility at 5154 Edith NE in September. The company plans to hire for 20 jobs at the facility.

The company’s move to New Mexico was partly due to the relationship the company has with Tempur Sealy International — the parent company of Tempur-Pedic — which has operated in Albuquerque since 2007 in an 850,000-square-foot facility on Atrisco Vista Boulevard.

Albuquerque Regional Economic Alliance, an economic development organization with a focus on bringing out-of-state businesses into the region, played a large part in Rogers Foam’s recruitment.

Rogers Foam’s presence in our region have a positive impact on Tempur Sealy, but its non-bedding expertise also lines up with the high value industries that AREA is working to develop in the region,” AREA CEO and President Danielle Casey said. “This is a win for everyone.”The City of Albuquerque’s Economic Development Department and AREA are working with Rogers Foam to help them in getting funding resources through the state’s Job Training Incentive Program. Casey said that development is “very preliminary” and still in the process.

“As they work to recruit, that is going to dictate where those holes are,” Casey said.

Rogers Foam’s headquarters are located in Somerville, Massachusetts, and the company — which has been operational for 75 years — also has a location in Santa Teresa, New Mexico. The company has production locations in four other states and in Mexico.

Erick Johnson of Johnson Commercial Real Estate helped broker the transaction for the leased facility.

https://www.abqjournal.com/2525524/massachusettsbased-foam-fabricator-expanding-into-abq.html

August 19, 2022

Housing hurts: Stocks look past dismal data

August 19, 2022

By Lindsey Bell, chief markets & money strategist for Ally

Housing data has been depressing.

When talk of a recession comes up, housing weakness is a typical justification as to why we are in a recession. But what if bad news is good news? Hear me out.

In general, stocks “price in” bad news early and they tend to rebound before the worst shows up in the economic data. Stocks are forward looking, and economic data is mostly backward looking. Lately, the stock market has been effectively absorbing weak economic data. Housing-related data has accounted for a lot of that data, but not all of it. Could it be that the market is beginning to bet on the economy bottoming soon (if not already), and quickly moving past all this negative news?

Let’s look at the housing market for clues.

The bad news first

Brace yourself, this isn’t pretty. You don’t have to look far to see a bleak housing picture. New and existing home sales have fallen dramatically. This week we learned July existing homes sales declines are picking up steam, with July marking the 12th consecutive month of decline. Not surprisingly, homebuilder sentiment plunged into contraction territory for the month of August, which was the first reading under the key 50 level since the onset of COVID.

That’s not all. Housing starts, a key indicator of economic activity, declined nearly 10% in July. Meanwhile, more prospective home buyers are backing out of deals. Data from Redfin show 16% of homes that went under contract last month fell through, up from just 12.5% in July last year. Why are folks pulling out of deals? It’s not employment concerns, as the jobs market remains robust. It’s likely an affordability issue as home prices and borrowing costs rise together. The National Association of Realtors confirmed what so many would-be first-time buyers feel: Affordability is at the lowest level since June 1989.

What’s moving in the right direction

I told you that was going to be depressing. Now that we got that out of the way, let’s talk about glimmers of hope underneath the surface. Inventory of existing homes for sale has been rising, and at 3.3 months’ supply its the highest level since August 2020. Granted, there is still much work to be done as that level is still below the 6 months of supply that is historically considered balanced for the housing market. Home prices are starting to moderate from the double digit increases that became the norm in the post-pandemic world. Over time, more houses on the market at lower prices will spur demand.

Another silver lining in the housing market is commodity prices easing: The price of lumber is down 65% from its pandemic high. As the input costs decline, it becomes cheaper to build a house. Another positive trend lately has been moderation and stabilization in the mortgage rate market. After surging above 6% in June, the average rate for a conventional 30-year mortgage has settled into the 5% to 5.5% range for now. Maybe the market is realizing that under any scenario (a hard landing, soft landing, or something in between) peak rates may be in. These types of trends are important to improve the affordability constraint on many looking for a home.

Finding strength in housing stocks

Despite what feels like a long road ahead for the housing market, price action in housing-related stocks is telling a more upbeat story. Since mid-June, the S&P Homebuilders ETF (XHB) has gained 30%, well above the 17% gain in the S&P 500 over the same time period.

The pop in the homebuilders ETF follows a 40% plunge between December and its June low. Over that period, investors priced in a severe slowdown in housing activity before much of the negative economic data was even seen.

To be sure, many of the homebuilders expect demand for new homes to cool in the coming months, driven by interest rates and inflationary pressures. Despite this outlook, the stocks reacted well to recent earnings reports. And while their price-to-earnings ratio has begun to lift off depressed levels, their valuations remain cheap by historical standards.

Looking beyond the homebuilders, shares of home improvement retailers Home Depot and Lowe’s have also performed better than the broad market during the summer rally. This week both companies provided guidance that were better than feared and suggested demand for home projects is improving.

While none of these housing focused companies signaled an all-clear signal, investors seem to be focused on the possibility of better times ahead for housing.

The bottom line

The housing market needs to cool off. There are indications that is happening, and it’s not crushing the economy. I see the sharp rally in homebuilder stocks as a sign that the worst could be in the rearview mirror for investors and recent economic gauges point to some normalization occurring over time.

August 19, 2022

Housing hurts: Stocks look past dismal data

August 19, 2022

By Lindsey Bell, chief markets & money strategist for Ally

Housing data has been depressing.

When talk of a recession comes up, housing weakness is a typical justification as to why we are in a recession. But what if bad news is good news? Hear me out.

In general, stocks “price in” bad news early and they tend to rebound before the worst shows up in the economic data. Stocks are forward looking, and economic data is mostly backward looking. Lately, the stock market has been effectively absorbing weak economic data. Housing-related data has accounted for a lot of that data, but not all of it. Could it be that the market is beginning to bet on the economy bottoming soon (if not already), and quickly moving past all this negative news?

Let’s look at the housing market for clues.

The bad news first

Brace yourself, this isn’t pretty. You don’t have to look far to see a bleak housing picture. New and existing home sales have fallen dramatically. This week we learned July existing homes sales declines are picking up steam, with July marking the 12th consecutive month of decline. Not surprisingly, homebuilder sentiment plunged into contraction territory for the month of August, which was the first reading under the key 50 level since the onset of COVID.

That’s not all. Housing starts, a key indicator of economic activity, declined nearly 10% in July. Meanwhile, more prospective home buyers are backing out of deals. Data from Redfin show 16% of homes that went under contract last month fell through, up from just 12.5% in July last year. Why are folks pulling out of deals? It’s not employment concerns, as the jobs market remains robust. It’s likely an affordability issue as home prices and borrowing costs rise together. The National Association of Realtors confirmed what so many would-be first-time buyers feel: Affordability is at the lowest level since June 1989.

What’s moving in the right direction

I told you that was going to be depressing. Now that we got that out of the way, let’s talk about glimmers of hope underneath the surface. Inventory of existing homes for sale has been rising, and at 3.3 months’ supply its the highest level since August 2020. Granted, there is still much work to be done as that level is still below the 6 months of supply that is historically considered balanced for the housing market. Home prices are starting to moderate from the double digit increases that became the norm in the post-pandemic world. Over time, more houses on the market at lower prices will spur demand.

Another silver lining in the housing market is commodity prices easing: The price of lumber is down 65% from its pandemic high. As the input costs decline, it becomes cheaper to build a house. Another positive trend lately has been moderation and stabilization in the mortgage rate market. After surging above 6% in June, the average rate for a conventional 30-year mortgage has settled into the 5% to 5.5% range for now. Maybe the market is realizing that under any scenario (a hard landing, soft landing, or something in between) peak rates may be in. These types of trends are important to improve the affordability constraint on many looking for a home.

Finding strength in housing stocks

Despite what feels like a long road ahead for the housing market, price action in housing-related stocks is telling a more upbeat story. Since mid-June, the S&P Homebuilders ETF (XHB) has gained 30%, well above the 17% gain in the S&P 500 over the same time period.

The pop in the homebuilders ETF follows a 40% plunge between December and its June low. Over that period, investors priced in a severe slowdown in housing activity before much of the negative economic data was even seen.

To be sure, many of the homebuilders expect demand for new homes to cool in the coming months, driven by interest rates and inflationary pressures. Despite this outlook, the stocks reacted well to recent earnings reports. And while their price-to-earnings ratio has begun to lift off depressed levels, their valuations remain cheap by historical standards.

Looking beyond the homebuilders, shares of home improvement retailers Home Depot and Lowe’s have also performed better than the broad market during the summer rally. This week both companies provided guidance that were better than feared and suggested demand for home projects is improving.

While none of these housing focused companies signaled an all-clear signal, investors seem to be focused on the possibility of better times ahead for housing.

The bottom line

The housing market needs to cool off. There are indications that is happening, and it’s not crushing the economy. I see the sharp rally in homebuilder stocks as a sign that the worst could be in the rearview mirror for investors and recent economic gauges point to some normalization occurring over time.

August 19, 2022

Wayfair Is Laying Off About 5% Of Its Workforce

by Tyler DurdenFriday, Aug 19, 2022 – 09:00 AM

More layoffs are here, even in the face of the latest super-duper jobs number that we swear doesn’t include people taking on their 2nd or 3rd jobs just to make ends meet and catch up with inflation.

Wayfair has just become the latest in a long line of companies to pare back its workforce, announcing this morning that it was going to cutting its labor by about 5%.

In a Form 8-K filed on Friday morning, the online retailer discussed the layoffs, amidst other cost cutting measures. Wayfair “announced a workforce reduction involving approximately 870 employees in connection with its previously announced plans to manage operating expenses and realign investment priorities.”

The filing continued: “This reduction represents approximately 5% of our global workforce and approximately 10% of our corporate team. Concurrently, the Company is in the process of making substantial reductions in its third party labor costs.

The company said it was going to take “between approximately $30 million and $40 million of costs” in Q3 2022 as a result of the layoffs.

These layoffs come a year after reports that Amazon was planning with a premium service that lets customers opt to have furniture or appliances assembled as soon they arrive at their homes.

Recall, we wrote a piece just days ago helping our readers visualize all of the latest major layoffs at U.S. corporations. We noted that in June 2022, Insight Global found that 78% of American workers fear they will lose their job in the next recession. Additionally, 56% said they aren’t financially prepared, and 54% said they would take a pay cut to avoid being laid off.

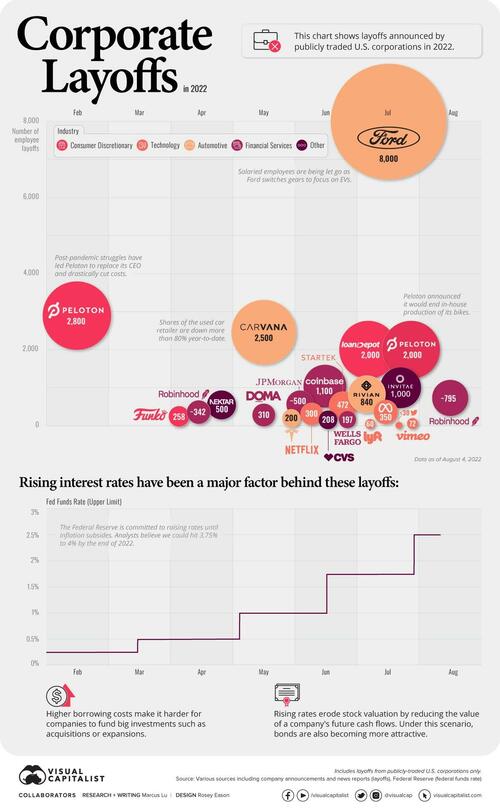

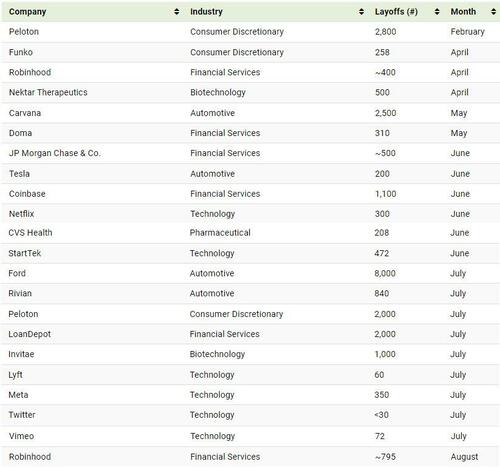

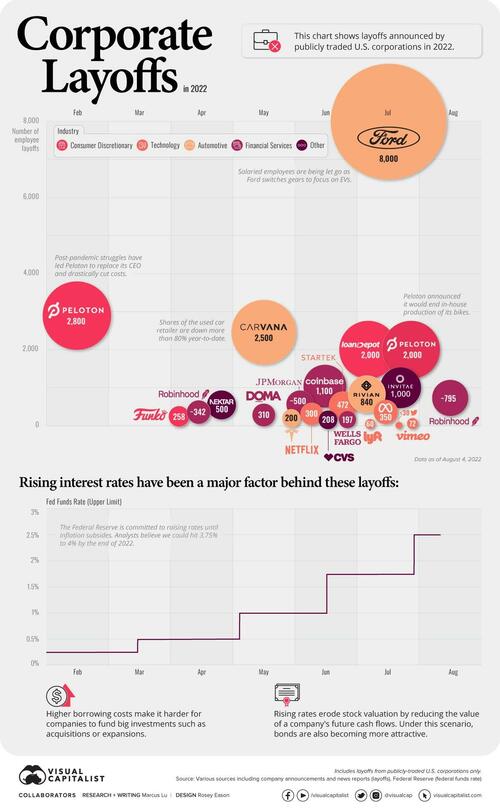

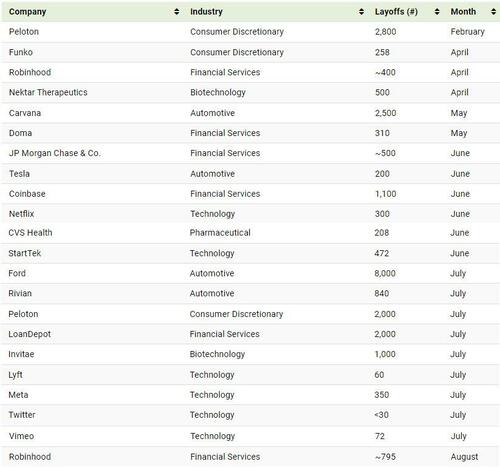

In this infographic, Visual Capitalist’s Marcus Lu visualizes major layoffs announced in 2022 by publicly-traded U.S. corporations.

Note: Due to gaps in reporting, as well as the very large number of U.S. corporations, this list may not be comprehensive.

An Emerging Trend

Layoffs have surged considerably since April of this year. See the table below for high-profile instances of mass layoffs.

Layoffs are expected to continue throughout the rest of this year, as metrics like consumer sentiment enter a decline. Rising interest rates, which make it more expensive for businesses to borrow money, are also having a negative impact on growth.

In fact just a few days ago, trading platform Robinhood announced it was letting go 23% of its staff. After accounting for its previous layoffs in April (9% of the workforce), it’s fair to estimate that this latest round will impact nearly 800 people.

https://www.zerohedge.com/markets/wayfair-laying-about-5-its-workforce

August 19, 2022

Wayfair Is Laying Off About 5% Of Its Workforce

by Tyler DurdenFriday, Aug 19, 2022 – 09:00 AM

More layoffs are here, even in the face of the latest super-duper jobs number that we swear doesn’t include people taking on their 2nd or 3rd jobs just to make ends meet and catch up with inflation.

Wayfair has just become the latest in a long line of companies to pare back its workforce, announcing this morning that it was going to cutting its labor by about 5%.

In a Form 8-K filed on Friday morning, the online retailer discussed the layoffs, amidst other cost cutting measures. Wayfair “announced a workforce reduction involving approximately 870 employees in connection with its previously announced plans to manage operating expenses and realign investment priorities.”

The filing continued: “This reduction represents approximately 5% of our global workforce and approximately 10% of our corporate team. Concurrently, the Company is in the process of making substantial reductions in its third party labor costs.

The company said it was going to take “between approximately $30 million and $40 million of costs” in Q3 2022 as a result of the layoffs.

These layoffs come a year after reports that Amazon was planning with a premium service that lets customers opt to have furniture or appliances assembled as soon they arrive at their homes.

Recall, we wrote a piece just days ago helping our readers visualize all of the latest major layoffs at U.S. corporations. We noted that in June 2022, Insight Global found that 78% of American workers fear they will lose their job in the next recession. Additionally, 56% said they aren’t financially prepared, and 54% said they would take a pay cut to avoid being laid off.

In this infographic, Visual Capitalist’s Marcus Lu visualizes major layoffs announced in 2022 by publicly-traded U.S. corporations.

Note: Due to gaps in reporting, as well as the very large number of U.S. corporations, this list may not be comprehensive.

An Emerging Trend

Layoffs have surged considerably since April of this year. See the table below for high-profile instances of mass layoffs.

Layoffs are expected to continue throughout the rest of this year, as metrics like consumer sentiment enter a decline. Rising interest rates, which make it more expensive for businesses to borrow money, are also having a negative impact on growth.

In fact just a few days ago, trading platform Robinhood announced it was letting go 23% of its staff. After accounting for its previous layoffs in April (9% of the workforce), it’s fair to estimate that this latest round will impact nearly 800 people.

https://www.zerohedge.com/markets/wayfair-laying-about-5-its-workforce