Company News

January 25, 2024

Urethane Highlights from Dow Investors Call

Dow Inc. (DOW) Q4 2023 Earnings Call Transcript

Jan. 25, 2024 12:12 PM ETDow Inc. (DOW) Stock

143.29K Followers

Dow Inc. (NYSE:DOW) Q4 2023 Earnings Conference Call January 25, 2024 8:00 AM ET

Company Participants

Pankaj Gupta – Vice President, Investor Relations

Jim Fitterling – Chair and Chief Executive Officer

Jeff Tate – Chief Financial Officer

Jim Fitterling

Thank you, Pankaj.

Beginning on Slide 3, in the fourth quarter, we continue to execute with discipline and advance our long-term strategy in face of a dynamic macroeconomic environment. Net sales were $10.6 billion, down 10% versus the year-ago period, reflecting declines in all operating segments. Sales were down 1% sequentially as volume gains in Packaging & Specialty Plastics were more than offset by seasonal demand declines in Performance Materials & Coatings.

Volume increased 2% year-over-year, with gains across all regions except Asia Pacific, which was flat. Sequentially volume decreased by 1%, including the impact of an unplanned event from a storm that was equivalent to a Category 1 hurricane at our Bahía Blanca site in Argentina.

Local price decreased 13% year-over-year, with declines in all operating segments due to lower feedstocks and energy costs. Sequentially, price was flat, reflecting modest gains in most regions.

Operating EBIT for the quarter was $559 million, down $42 million year-over-year, primarily driven by lower prices. Sequentially, operating EBIT was down $67 million, as gains in Packaging & Specialty Plastics were more than offset by seasonally lower volumes in Performance Materials & Coatings.

Our cash flow generation and working capital management enabled us to deliver cash flow from operations of $1.6 billion in the quarter. We continued to reduce costs and focused on cash generation, completing our $1 billion of cost savings for the year. And in the fourth quarter, we pursued additional de-risking opportunities for our pension plans, including annuitization and risk transfer of $1.7 billion in pension liability and a one-time non-cash and non-operating settlement charge of $642 million. We also advanced our long-term strategy while returning $616 million to shareholders. And we reached final investment decision with our Board of Directors for our Path2Zero project in Fort Saskatchewan, Alberta.

Now, turning to our full year performance on Slide 4. Our 2023 results demonstrate strong execution and a commitment to financial discipline. Against the dynamic macroeconomic backdrop, Team Dow continued to take proactive actions. As a result, we generated $5.2 billion in cash flow from operations for the year, reflecting a cash flow conversion of 96%. We also returned $2.6 billion to shareholders through dividends and share repurchases.

Our efforts continue to be recognized externally through industry-leading awards, certifications and recognitions, and we continue to outpace our peers on leadership diversity. I’m proud of how Team Dow is delivering for our customers, driving shareholder value and supporting our communities as we progress our long-term strategy.

Moving to the Industrial Intermediates & Infrastructure segment, operating EBIT was $15 million compared to $164 million in the year-ago period. Results were driven by lower local prices in both businesses as well as reduced supply availability in Industrial Solution. Sequentially, operating EBIT was down $6 million, driven by seasonally lower volumes in building and construction end markets, which were partially offset by seasonally higher demand for deicing fluid and higher demand for mobility applications.

Jeff Tate

Thank you, Jim.

Before I begin, I’d like to mention how excited I am to have rejoined Dow last November. I’ve been connecting with key stakeholders, analysts and shareholders, including many of you on this call today. And I look forward to meeting with so many others in the future.

After four years serving in a CFO role outside of Dow, I’m pleased to see that Dow’s culture of execution, commitment to advancing our ambition and the focus everyone has demonstrated on delivering on our financial priorities since then remains. This is an exciting time for the company. As CFO, I’m proud to carry forward Dow’s commitment to maintaining a disciplined and balanced approach to capital allocation over the economic cycle as we advance our growth strategies and deliver long-term value for shareholders.

Now, for our outlook on Slide 6. As we enter 2024, we expect near-term demand to remain pressured by elevated inflation, high interest rates and geopolitical tension, particularly in building and construction and durable goods end markets. That said, we are seeing some initial positive indicators. While inflation is still elevated compared to pre-COVID levels, the growth rate is moderating, supporting more stable economic conditions. In addition, the destocking that began in late 2022 has largely run its course, resulting in low inventory levels throughout most of our value chains.

In the U.S., industrial activity continues to be moderate. In December, industrial production increased 1% year-over-year, and chemical railcar loadings are up 9.6% in January versus the prior year. U.S. consumer spending has remained resilient with retail trade sales up 4.8% in December. We’re also encouraged by recent forecast from the American Coatings Association, which expects market demand to grow approximately 3% in 2024 following three consecutive years of declines.

In Europe, while inflation has moderated, consumer demand remains weak with retail trade sales down 1.1% year-over-year in November. In December, manufacturing PMI remains in contractionary territory and new car registrations fell 3.3% year-over-year after 16 consecutive months of growth.

We continue to monitor China where we see improving conditions, which could provide a source of demand recovery following the Lunar New Year. Industrial production was up 6.8% year-over-year last month, exceeding market estimates of 6.6%. December auto sales also continue to be strong in China, supported by year-end incentives.

In other regions around the world, industrial activity remains constructive. While India Manufacturing PMI remains expansionary, ASEAN Manufacturing PMI entered contractionary territory last month. In Mexico, November marked the 25th consecutive month of industrial production growth.

In the Industrial Intermediates & Infrastructure segment, we expect margin expansion on higher MDI and MEG spreads as well as lower European energy costs, resulting in a $50 million tailwind. Increased season demand for deicing fluid is expected to provide a $25 million tailwind despite being partly offset by continued weakness in consumer durables demand. We also expect a headwind of $50 million due to planned maintenance activity in the quarter, primarily related to a PDH turnaround and catalyst change.

Hassan Ahmed

Good morning, Jim. Jim, a couple of times through the prepared remarks you talked about inventory. It just seems that there are two camps out there in terms of the thought process with regards to what a potential restocking may look like, and I’d love to hear your views about that. On one side of the debate, people are sitting there and saying, hey, look, since the second half of 2022, the destocking was quite significant, and maybe as and when we should expect an equally impressive restock. But then on the other side of the camp, you have some of the folks sort of debating that buying cartons across the supply chain has changed quite dramatically coming out of the pandemic and maybe a restock could not look that impressive. So, I’d love to hear your views. And if you could also sort of elaborate on that within some of the main product chains, be it polyethylene, polyurethanes and the like?

Jim Fitterling

Good morning, Hassan. I think that’s a great question. I think one of the reasons that December and fourth quarter ended up stronger than expected, especially I’ll use Packaging & Specialty Plastics as an example, was because you had a pretty mixed year in 2023. And in December, you can sometimes see the behavior of that. In the last half of December, things slowdown and people manage cash and they don’t buy. That was not what we experienced in December. We actually experienced strong demand right through the month. I don’t think that’s an indication of restocking, but I do think it’s an indication that inventories are low through the supply chain and the consumer demand was resilient, and so people had to buy to keep their supply chains moving. So, I would say through the value chains today and almost all the businesses, it looks like there’s not an excess of inventory out there. And as demand is coming, people are having to buy to keep the chains full.

Vincent Andrews

Hi, thanks. Maybe two quick ones for me. Just on Slide 7, you have some project starts that are going from ’24 to ’26. Talk about how material some of that might be for 2024? And then also if you could just give us an update on what you did with the pension ending the year?

Jim Fitterling

Yes. On project starts, we’ve got the things that we’ve got coming up, obviously, is we’ve got some alkoxylation capacity that came up in ’22 and ’23, it’s running really well. We started up the MDI distillation facility in Freeport in the third quarter. I think that will start to show some positive benefit to us as we move forward. That’s about a 30% increase in MDI distillation, and also reduction of a footprint getting us out of the La Porte site.

We’ve got CDF alkoxylation, second wave expansion in fourth quarter of this year, and then Terneuzen in fourth quarter of 2025, both of that supports growing demand and energy and also consumer solutions and pharma business, so that’s good. Amines business for carbon capture is growing well, and so that’s good.

When you get into polyolefins, our polyurethanes and propylene oxide, a little bit different story. That capacity come on in China. We’ve seen the same in siloxanes last year. I think we’re working through that. The silicones growth is going to eat up that siloxane capacity, but we’ve got to see the durable goods market and the housing markets come back to tighten up PO.

Propylene Glycol side has been strong. But as you know housing and automotive drives PPE a lot. Those two things drive the propylene markets and we’re going to keep a close eye on them.

Jeff Zekauskas

Thanks very much. Recently, there was a cold snap in Texas. And I didn’t notice that there was any penalty in EBITDA for the first quarter. Are you still assessing what the amounts might be, or do you think that it’s zero?

And then, secondly, you pulled out $1 billion in costs. Can you allocate the $1 billion across your three segments?

Jim Fitterling

Sure. I’ll take the cold snap, and then, Jeff, I’ll have you take a look at the costs. Look, on the freeze, Jeff, I just want to go back, two years ago, this is the third consecutive year of freeze on the Gulf Coast. And we’ve improved plans every year to be able to be ready for that. This year will be the lowest impact we’ve had of any of the three years. And so, the big impacts that hit us were at Deer Park and at Seadrift, but almost all of that is back up and running now. So, we were able to rebound pretty quickly. You never go completely unscathed, but I think we managed through it pretty well. We haven’t had to disrupt any customers because of downtime. And I think we’re going to recover pretty strong here and be running hard by the end of this month.

David Begleiter

Thank you. Good morning. Jim, you highlight the U.S. chemical railcar loading is up 10%. What do you think is driving that? And given the strong start to the quarter, do you expect volumes to be up in all three segments in Q1? Thank you.

Jim Fitterling

Yeah. Look, I think on chemical railcar loading, industrial production in the U.S. is starting to come back. The U.S. has a tremendous cost advantage. Operating rates in most of the sectors are up. And I think the destocking being — it’s always hard to have enough visibility to call the end of it, but I think what we saw in December were signs that destocking has worked through. So, any downstream demand is turning into orders and I think that’s what you’re seeing with the railcar loadings. Also remember, railcars service the Mexican market as well. Mexico has been very strong. They’ve benefited a lot from near-shoring. And so, having both China volumes up and Mexico volumes up, I think is a positive here.

I would say, on volumes, my expectations, we have volume growth for all three segments for 2024. I think that’s going to start the materialize. I think plastics is underway right now. I think construction, chemicals, housing-related demand on polyurethanes will probably be geared more towards the back half of the year. I think downstream silicones, Industrial Solutions will be throughout the year, and then we’ll have a step up in Industrial Solution when we get the Glycol 2 plant back in Plaquemines. And I think I can speak for the business here. As soon as we get that plant back up, we’ll have it sold out. So, we’re working really hard to get that thing back online.

Patrick Cunningham

Hi, good morning. So you mentioned — in II&I, you mentioned turnarounds maybe weighted towards the first quarter, Plaquemine coming back in 2Q, Freeport bringing on the increase in MDI distillation. Should we expect more significant sequential earnings improvement through the year, and maybe help size where we can exit the year for this segment? And then if you could also just briefly comment on what’s driving the direction of MDI and MEG spreads into 1Q, that would be great. Thanks.

Jim Fitterling

Yeah. I think generically that’s true, Patrick, that I think you’ll see that build through the year. First quarter, obviously, we mentioned the turnaround. But second quarter, we expect to get Glycol 2 back in Plaquemine, that will be positive. And then the third quarter will be more positive, so it will ramp into the back half of the year.

On isocyanates, obviously, the biggest driver is on construction-related and durable goods related markets. Obviously, there’s some impact in automotive as well, any of the rigids is where most of that volume gets consumed. So as that — those volumes start to pick up, you’ll start to see MDI take off. And that’s usually a driver of value across the entire portfolio, both the polyols and the MDI side of things. So, I’m hoping that we start to stimulate some of that demand in the back half of the year. And I think it was what China is doing in the markets, in the financial markets to try to stimulate some things. Could be between U.S. interest rates and what’s going on in China that we see some momentum build in the back half of this year.

January 24, 2024

German Rail Strike

BASF Hauling More Product by Road as German Train Strike Starts — OPIS

Provided by Dow Jones

Jan 24, 2024 1:26 PM EST

German chemicals major BASF expects a six-day nationwide rail strike in Germany starting Wednesday will have more of an adverse impact on hauling the company’s products than previous strikes and necessitate a greater use of road transport.

“In normal circumstances, we handle about 30% of our transports by rail. Due to the rail strike, we are now forced to shift railway transports on a large scale to trucks,” said Uwe Liebelt, President of European Verbund Sites at BASF, in a statement shared with OPIS on Wednesday. “This will increase logistics costs and CO2 emissions.”

BASF said that it had taken measures to cushion the effects of the upcoming strike on production sites and customers, but added that its operations were still recovering from adverse weather and a previous rail strike earlier in January.

“The fact that the strikes are occurring very close together, giving BASF very little preparation time, and the existing backlog due to last week’s snowfall that has not yet been cleared, significantly complicates the situation,” the company’s statement said.

The international competitiveness of Germany, “which is already under considerable pressure due to high energy and raw material costs, will be further damaged,” said Liebelt, who is in charge of BASF’s chemical production sites that have highly interlinked product flows.

BASF’s Ludwigshafen site is one of the world’s largest integrated chemical complexes. The site is home to a dense network of 200 plants that create a variety of products and petrochemicals for diverse industries, according to the company’s website.

The company declined to say whether run rates at any of its sites have been impacted by the strike.

German train drivers began the record six-day strike starting January 24 after their union rejected state-owned rail operator Deutsche Bahn’s latest wage offer. The country’s cargo train drivers began their strike on the evening of January 23.

GDL, the trade union representing Germany’s train drivers, said the fourth round of strikes in the ongoing wage dispute will last until January 29, 6pm Central European Time.

Later on Wednesday, Germany-based chemicals producer Covestro told OPIS that there were no “restrictions” on production at its sites due to the strikes.

“We have made the best possible preparations for the strike and, wherever possible, switched to road and inland waterway transportation at an early stage,” said a spokesperson for the company. “We currently see only limited effects on Covestro and can continue production without restrictions. At the same time, the changeover is naturally accompanied by increased operating expenses.”

January 19, 2024

BASF Adjusts Expectations

BASF Group releases preliminary figures for full year 2023

- Sales and EBIT before special items below the ranges forecasted by BASF and slightly below the respective analyst consensus

- EBIT and net income considerably below the respective analyst consensus due to non-cash-effective impairments

- Cash flows from operating activities above prior year

Ludwigshafen – January 19, 2024 – Expected BASF Group sales for the full year 2023 of €68,902 million are below the range of €73 billion to €76 billion forecasted by BASF and below average analyst estimates for 2023 (Vara: €70,579 million). Sales in 2022 amounted to €87,327 million.

Expected income from operations (EBIT) before special items of €3,806 million in 2023 is below the range of €4.0 billion to €4.4 billion forecasted by BASF and below the level of average analyst estimates for 2023 (Vara: €3,934 million). EBIT before special items in 2022 amounted to €6,878 million. The decrease compared with the prior year is due to sales-related lower margins, which could not be offset by the achieved fixed cost reduction.

The average analyst estimates for EBIT before special items of the segments are slightly exceeded in 2023 by Industrial Solutions, Materials and Agricultural Solutions. In the Chemicals segment, EBIT before special items in 2023 falls considerably short of average analyst estimates, among other things due to unplanned plant shutdowns. In the Surface Technologies and Nutrition & Care segments, EBIT before special items in 2023 remains slightly below the respective analyst consensus. In Other, EBIT before special items in 2023 is slightly weaker than expected by analysts on average.

The BASF Group’s expected EBIT in 2023 amounts to €2,240 million; this is below analyst consensus for 2023 (Vara: €3,691 million) and below the figure for the prior year (2022: €6,548 million). This is primarily attributable to non-cash-effective impairments in the amount of €1.1 billion. These mainly relate to the Surface Technologies, Agricultural Solutions and Materials segments.

Net income of BASF Group is expected to amount to €225 million in 2023. This is an improvement of €852 million compared with the prior-year figure (2022: minus €627 million), which included non-cash-effective impairments on Russia-related assets of Wintershall Dea in the amount of €6.5 billion. Analyst consensus for net income in 2023 (Vara: €2,247 million) is, however, not achieved.

Cash flows from operating activities are expected to reach €8.1 billion in 2023 and are thus above the prior-year figure of €7,709 million. Free cash flow is expected to amount to €2.7 billion (2022: €3,333 million).

January 19, 2024

Huntsman Lowers Expectations

Huntsman Updates Fourth Quarter 2023 Outlook; To Discuss Fourth Quarter 2023 Results on February 22, 2024; Results to be Released After Market Close on February 21, 2024

Download as PDFJanuary 19, 2024 7:00am EST

THE WOODLANDS, Texas, Jan. 19, 2024 /PRNewswire/ — Huntsman Corporation (NYSE: HUN) now expects fourth quarter 2023 adjusted EBITDA to be in the range of $40 million to $45 million compared to our original guidance range of $65 million to $90 million as communicated on October 31, 2023. The lower range compared to prior guidance is primarily due to continued pressure in our Polyurethanes segment, including lower equity earnings and the negative impact of an unplanned outage during the quarter at the Rotterdam, Netherlands facility, which has now been resolved. These are preliminary results and are subject to completion of the corporation’s annual audit process.

Huntsman Corporation will hold a conference call on Thursday, February 22, 2024, at 10:00 a.m. ET to discuss its fourth quarter 2023 financial results. Following some opening remarks, the call will move into a question and answer session.

The earnings press release, including financial statements and segment information, will be distributed after the market closes on Wednesday, February 21, 2024. The earnings slide presentation and prepared remarks will be available at www.huntsman.com/investors after the market closes on Wednesday, February 21, 2024.

Webcast link:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=4YckWj4j

| Participant dial-in numbers: | |

| Domestic callers: | (877) 402-8037 |

| International callers: | (201) 378-4913 |

The conference call will be accessible via the webcast link and Huntsman’s investor relations website, www.huntsman.com/investors. Upon conclusion of the call, the webcast replay will be accessible via Huntsman’s website.

January 17, 2024

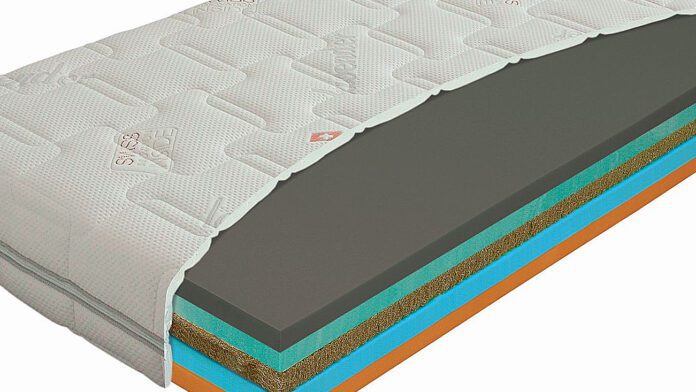

Mattress Tagging in Europe

Euro bedding giant Aquinos to tag a million mattresses by 2027, starting next year

January 17, 2024

US materials science and digital identification company Avery Dennison is working with European mattress manufacturer Aquinos Group to tag bedding products from 2024 with radio frequency identification (RFID) technology so fewer go to waste, and the company plays an active role in the circular economy, according to a press statement. The project will make Aquinos the first company in its sector to comply with new European Union (EU) Digital Product Passport (DPP) rules.

Avery Dennison makes labeling materials, bonding solutions, and tagging solutions for industrial, medical, and retail applications. It has engaged RFID specialist TripleR on the project. Aquinos Group is one of Europe’s largest mattress manufacturers and operates 20 European factories. It sells products under the BEKA, Lattoflex, Schlaraffia, Sembella, Superba, and Swissflex mattress brands. It forecasts RFID tags will be used in one million of its mattresses by 2027, and “usher in a new era of transparency and circularity” for the firm.

Data from the RFID tags will connect to Avery Dennison’s atma.io platform via RFID readers as they are scanned, creating a digital twin of their whereabouts and history. Data will show information about the origins and materials used in the production of the mattresses. They will also be scanned at recycling centres so that “product dismantlers” can separate materials from the mattresses more efficiently for recycling, and reuse. Consumers will also be able to scan QR codes with smartphones to access product information before and after purchase.

The EU’s new DPP rules will deliver information about products’ environmental sustainability, accessible by scanning a data carrier. Data will include attributes such as the durability and reparability, the recycled content or the availability of spare parts of a product. The DPP scheme is due to come into force for mattresses in 2027. By then, it will have already shipped a million tagged units, it reckons. DPP rules for mattresses will be active sooner in certain European markets, such as Belgium (by 2025), where Aquinos is based.

Aquinos said it will be the “first producer to comply with the DPP scheme at a pan-EU scale”. Aquinos and TripleR are in alliance with the Belgian industry association Valumat as part of a collaboration that also includes product dismantlers.

Benjamin Marien, international commercial director for bedding at Aquinos, said: “DPP sets the next important step in circularity. By being the first in the industry to begin compliance, we want to lead by example to inspire the markets, our industry partners, and the bedding sector to advance environmentally responsible practices…. We will use the power of [our] brands to raise external awareness of the importance of DPPs… We are moving bedding sustainability beyond niche implementation to mainstream. This will be crucial to put an end to bedding materials going to waste.”

Michael Goller, senior director for atma.io at Avery Dennison, said: “We are proud to be working on this project with Aquinos and TripleR. Mattresses are complex and bulky products that require a highly sophisticated sorting and dismantling process. To date, it has proven difficult to do this in a cost-efficient manner – leading to millions of mattresses going to landfill each year. This is precisely why DPPs have been established and we are excited to push boundaries with our partners towards greater traceability, efficiency, and circularity.”

Stefaan Cognie, co-founder at TripleR, commented: “This project is an important milestone and sets a benchmark for how the DPP scheme will operate across Europe to enable sustainability and circularity. We have already developed a digital Identification standard in the bedding industry in Belgium and are engaging with extended producer responsibility (EPR) bodies and mattress associations in different European countries, as well as with the overarching European Mattress Association EBIA to bring DPP compliance to fruition.”