The agreement is in line with recent trends towards locking in longer-term supply of products in Asia

Giant containers of plush bathrobes, air fryers, scooters and flat-screen televisions have made their way from Asia to the U.S. in time to fill retailers’ shelves for the start of the holiday shopping season.

Retailers also ordered shipping containers and containers of cookware, toys, appliances and mattresses, according to import and shipping data from August through October as tracked by Ocean Audit, a firm that assists companies with freight issues.

Kohl’s is betting on shopper demand for ladies’ cardigans, cable knit holiday stockings, cook pots and radio-controlled toys, the data show. Amazon ordered 50 containers full of Paw Patrol Ultimate toy fire trucks. Target shipped 32,000 Razor A2 Elite scooters, 24,375 Sunbeam microwave ovens and 30,798 18-quart turkey roasters.

“These are classic doorbusters,” said Ocean Audit CEO Steve Ferreira, who analyzed the data for CNBC.

The large shipments, which left Asia in July packed in 40-foot containers on ships bound for the U.S., come amid an escalating trade conflict. China has slapped tariffs on billions of dollars of U.S. goods in retaliation for the duties the Trump administration has applied to $200 billion of its imports.

Source: Ocean Audit

A 40-foot container fits the equivalent of a three-bedroom apartment or 800 flat-screen TVs, according to BoxHub.co. Ocean Audit’s data show toy shipments are up 22 percent from last year, with some 64,512 units on order.

The data can be used to forecast what retailers are planning to promote for the year-end holiday rush, Ferreira said. “Retailer’s give a ‘tell,’ like a poker player, on what they are planning and then actually importing. These unusual container surges between August and October mean three things: Black Friday, Christmas merchandise and tariffs.”

Amazon loaded up on mattresses, which are subject to the latest U.S. tariffs imposed in September. From August to October, the e-commerce giant imported 4,000 containers of mattresses, a 397 percent increase from last year. That’s 1.6 million mattresses, assuming 400 fit on a container.

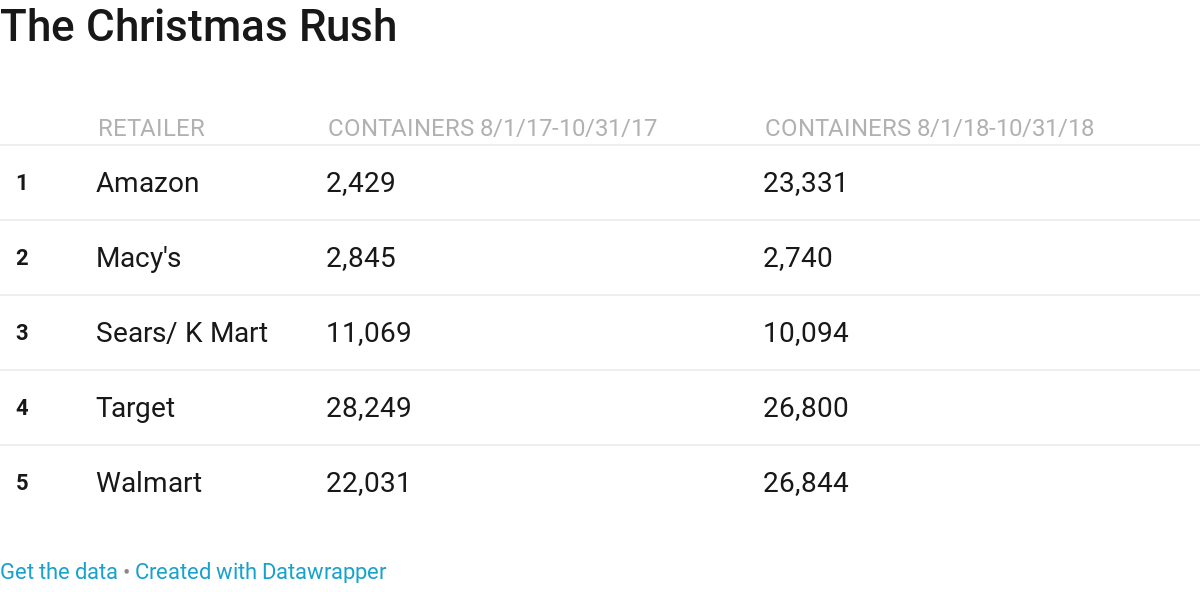

Amazon’s orders shot up the most among the retailers from August to Halloween, with 23,331 containers compared with just 2,429 in the period last year. According to the company’s freight bills, over 97 percent of its container shipments originate from China, where Amazon recently started a logistics company that enables it to work with smaller exporters.

“We are starting to see the full effects of their ability to roll up small- and medium-size Chinese exporters into one large shipment,” Ferreira said. By reaching smaller sellers, Amazon can cut deals competitors don’t have access to, he added. A men’s exotic belt might be $400 at Nordstrom but $125 at Amazon as “Amazon is reaching more smaller, boutique type exporters in China, offering arrays of products at price points we’ve never seen before.”

https://www.cnbc.com/2018/11/01/black-friday-secrets-goods-shipped-to-retailers-offer-holiday-hints.html