Current Affairs

November 20, 2021

Container Imports Normalizing?

Peak Season Over: Container-Ship Arrivals In Southern California Fall

by Tyler DurdenSaturday, Nov 20, 2021 – 05:30 PM

By Greg Miller of Freightwaves

Amid all the headlines on consumer demand, imports to America’s primary container gateway — the ports of Los Angeles and Long Beach — have sunk back to pre-COVID levels, not only due to congestion stranding massive amounts of cargo offshore, but also due to a pullback in ship arrivals that’s being obscured by the congestion story.

LA-LB imports normalizing

The Port of Los Angeles held its monthly press briefing on Tuesday, featuring Transportation Secretary Pete Buttigieg, but the port didn’t have its monthly numbers ready at the time of the event.

Two days later, the country’s largest port belatedly reported that it imported 467,287 twenty-foot equivalent units of containerized cargo in October, down 8% from October 2020 and down 4% from October 2018, pre-COVID.

Looking at LA-LB volumes combined, October import volumes totaled 852,287 TEUs, down 6% from last October and flat with October 2018 levels. Monthly imports to LA-LB in October were down 13% from this year’s May peak of 980,450 TEUs.

LA-LB imports are still on track for a record year. Also, at the end of last month, statistics from the Marine Exchange of Southern California showed ships waiting offshore with a capacity of 637,326 TEUs. In other words, October would have been by far the best import month ever for Southern California, if only all that cargo could have made it ashore.

Ship arrivals are falling

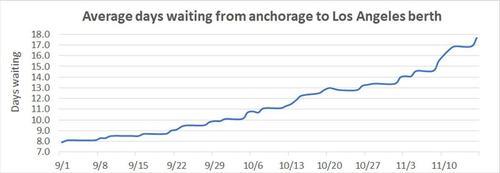

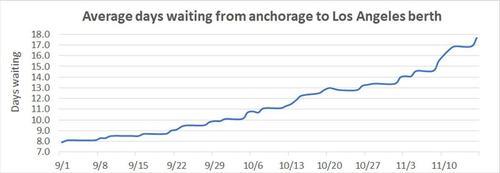

The number of container ships arriving in LA-LB is actually falling as wait times from anchorage to berth are simultaneously surging.

The rising number of ships at anchor or loitering is creating the perception of a rising tide of U.S. imports, when in fact, higher wait times for ships are being caused by landside logistics issues and gridlock at the ports — not higher inbound container-ship arrivals.Chart: American Shipper based on data from ports of Los Angeles and Long Beach

The Marine Exchange publishes a daily harbor traffic update showing the number of container ships scheduled to arrive the following day. American Shipper analyzed the daily Marine Exchange data on scheduled arrivals for the following day from Aug. 1 through Wednesday.

In the second half of this year, container-ship daily arrivals in LA-LB peaked in September, at a monthly average of 6 per day, up from 5.2 in August. Average daily arrivals then fell to 5.6 per day in October and 5.4 in November to date.Chart: American Shipper, calculated from American Shipper based on scheduled arrival data from Marine Exchange of Southern California as of the day prior to arrival.

Despite the pullback in arrivals, the average time it has taken for a container ship to get from waiting offshore (at anchorage or loitering) to a berth at the Port of Los Angeles has spiked 133% between Sept. 1 and Thursday, to 18.4 days.

An all-time high of 86 container ships were waiting offshore of Los Angeles and Long Beach on Tuesday, according to the Marine Exchange. In November to date, an average of 78.7 containers ships per day have been stuck offshore, up 37% from the monthly average of 57.4 ships in September, despite a 10% decrease in the monthly average of arriving container ships in November to date versus September.Chart: American Shipper based on data from Port of Los Angeles, Port Optimizer. Note: Daily average is 30-day moving average

Decrease in outbound empty containers

During a public hearing on Oct. 29, Matt Schrap, CEO of the Harbor Trucking Association, argued that the biggest source of Los Angeles/Long Beach congestion is not import containers that dwell too long, but rather, empty outbound containers that dwell too long. “Empties are the issue here,” he said.Chart: American Shipper based on data from Marine Exchange of Southern California

To reduce port gridlock, outbound empty volumes need to increase, but in Los Angeles, they are decreasing. On Thursday, the port reported that 337,106 TEUs of empties were exported last month, down from 358,581 TEUs in September and 364,212 TEUs in August.

The situation with empties piling up at the terminals has gotten even worse in November, Port of Los Angeles Executive Director Gene Seroka confirmed on Tuesday’s call. “We’ve got about 65,000 empty container units sitting on the docks right now,” he said. “That’s up from 55,000 just a couple of Fridays ago.”

Seroka is encouraging liner companies to bring in “sweepers,” ships that are deployed to return empties. “We’ve seen six sweeper ships so far pick up a little more than 17,500 TEUs of empties and there are another two on their way that can probably pick up another 2,500 TEUs, but we’ve got to do a lot more than that.”

https://www.zerohedge.com/markets/peak-season-over-container-ship-arrivals-southern-california-fall

November 19, 2021

Chinese Power Outlook

China power crisis: Zhejiang scraps rationing as electricity crunch shows signs of easing

Zhejiang province ended electricity rationing on Monday, but warned cities to watch consumption and reduce energy use The State Grid Corporation of China, the electric utility provider for most provinces, also says power shortages have eased

Luna Sun + FOLLOW

Published: 8:30pm, 9 Nov, 2021

Updated: 10:25pm, 9 Nov, 2021e

China has been ramping up its coal production since October, which has helped ease the nation’s power crisis. Photo: AFP

China’s eastern Zhejiang province has called time on electricity rationing that has throttled the nation’s economy over the past two months, offering relief to factories and businesses struggling to operate.

The Zhejiang Energy Bureau announced rationing would end on Monday, but said cities in the province must continue to watch consumption and reduce energy use, while remaining vigilant about further power cuts in the future.

China has endured one of its worst power crises in decades since September, a result of thermal coal shortages and Beijing’s carbon emissions targets, which prompted local governments to impose sudden electricity cuts to meet the goals.

But there are signs power supply may be normalising. The State Grid Corporation of China (SGCC), the electric utility provider in 26 of 31 provincial-level jurisdictions, said at the weekend power shortages have eased and supply and demand in the network have reached equilibrium. The supply of thermal coal has also increased, it said.

The company said most provinces affected by the power cuts had returned to normal electricity use late last week.

However, the company warned there were challenges ahead in winter, when power usage will peak.

“With the compounded challenges of high power consumption, the demand for winter heating in the north and a shortage of water for hydropower production, the grid is faced with a tight overall balance and regional shortages this winter and next spring,” SGCC said in a statement. Every Saturday SCMP Global Impact Newsletter By submitting, you consent to receiving marketing emails from SCMP.

“The grand challenge of electricity supply is still ongoing.”

Chinese manufacturing thrown into disarray as country’s electricity crisis rolls on

The slowdown in manufacturing is adding further pressure to China’s economic growth, which slowed in the third quarter to 4.9 per cent year on year, down from 7.9 per cent growth in the previous quarter.

The underwhelming third quarter gain came amid a host of economic challenges, but indications electricity supply is starting to normalise will be welcomed by policymakers in Beijing.

In addition to SGCC, China Southern Power Grid, which supplies electricity to five southern provinces, said it started easing power rationing last week – the first time blackouts had stopped since May.

The thermal coal inventory in Guangdong, Guangxi, Yunnan, Guizhou and Hainan provinces was also enough to last 23 days, the company said in a statement on the weekend.

China increases coal production to ensure winter supplies, easing energy shortage

State media outlet, the People’s Daily, has said last week most of the country has resumed regular power supply.

Officials say the main driver of the crisis, a shortage of thermal coal used to generate power, is easing.

On Monday, the National Development and Reform Commission (NDRC), the nation’s top economic planning agency, said domestic coal production has been rising since October, boosting inventories at power plants. The NDRC expected thermal coal prices to keep falling after hitting record highs this year.

Prices of thermal coal at mine-mouth electric plants – which are built close to coal mines – in Ordos city, Inner Mongolia, fell below 1,200 yuan (US$187) a tonne from 1,800 yuan a tonne in mid October, coal analyst SX Coal said.

Coal exports from Mongolia in October – a key supplier to China – also rose, but remained lower than a year ago, SX Coal said, using data from the Mongolian Customs General Administration.

Power cuts, no power cuts, they both just happened out of the blue Huang Feng

While relieved, many manufacturers in Zhejiang are still wary about the volatility of the country’s power supply.

“Power cuts, no power cuts, they both just happened out of the blue,” said Huang Feng, a textile manufacturer and exporter.

Before the announcement, Huang was bracing for limited production until the end of the year, but his factories have now resumed full operation.

On Tuesday, some companies in parts of Zhejiang were still operating at reduced capacity.

Yao Xiangmin, a factory worker from Taizhou city, said the car parts manufacturer he works for was still only running four weeks a day due to the rationing.

Factory owners are also grappling with raw material prices. Additionally, once production resumes, Huang said shipping costs might also rise.

Additional reporting by Su-Lin Tan

November 19, 2021

Chinese Power Outlook

China power crisis: Zhejiang scraps rationing as electricity crunch shows signs of easing

Zhejiang province ended electricity rationing on Monday, but warned cities to watch consumption and reduce energy use The State Grid Corporation of China, the electric utility provider for most provinces, also says power shortages have eased

Luna Sun + FOLLOW

Published: 8:30pm, 9 Nov, 2021

Updated: 10:25pm, 9 Nov, 2021e

China has been ramping up its coal production since October, which has helped ease the nation’s power crisis. Photo: AFP

China’s eastern Zhejiang province has called time on electricity rationing that has throttled the nation’s economy over the past two months, offering relief to factories and businesses struggling to operate.

The Zhejiang Energy Bureau announced rationing would end on Monday, but said cities in the province must continue to watch consumption and reduce energy use, while remaining vigilant about further power cuts in the future.

China has endured one of its worst power crises in decades since September, a result of thermal coal shortages and Beijing’s carbon emissions targets, which prompted local governments to impose sudden electricity cuts to meet the goals.

But there are signs power supply may be normalising. The State Grid Corporation of China (SGCC), the electric utility provider in 26 of 31 provincial-level jurisdictions, said at the weekend power shortages have eased and supply and demand in the network have reached equilibrium. The supply of thermal coal has also increased, it said.

The company said most provinces affected by the power cuts had returned to normal electricity use late last week.

However, the company warned there were challenges ahead in winter, when power usage will peak.

“With the compounded challenges of high power consumption, the demand for winter heating in the north and a shortage of water for hydropower production, the grid is faced with a tight overall balance and regional shortages this winter and next spring,” SGCC said in a statement. Every Saturday SCMP Global Impact Newsletter By submitting, you consent to receiving marketing emails from SCMP.

“The grand challenge of electricity supply is still ongoing.”

Chinese manufacturing thrown into disarray as country’s electricity crisis rolls on

The slowdown in manufacturing is adding further pressure to China’s economic growth, which slowed in the third quarter to 4.9 per cent year on year, down from 7.9 per cent growth in the previous quarter.

The underwhelming third quarter gain came amid a host of economic challenges, but indications electricity supply is starting to normalise will be welcomed by policymakers in Beijing.

In addition to SGCC, China Southern Power Grid, which supplies electricity to five southern provinces, said it started easing power rationing last week – the first time blackouts had stopped since May.

The thermal coal inventory in Guangdong, Guangxi, Yunnan, Guizhou and Hainan provinces was also enough to last 23 days, the company said in a statement on the weekend.

China increases coal production to ensure winter supplies, easing energy shortage

State media outlet, the People’s Daily, has said last week most of the country has resumed regular power supply.

Officials say the main driver of the crisis, a shortage of thermal coal used to generate power, is easing.

On Monday, the National Development and Reform Commission (NDRC), the nation’s top economic planning agency, said domestic coal production has been rising since October, boosting inventories at power plants. The NDRC expected thermal coal prices to keep falling after hitting record highs this year.

Prices of thermal coal at mine-mouth electric plants – which are built close to coal mines – in Ordos city, Inner Mongolia, fell below 1,200 yuan (US$187) a tonne from 1,800 yuan a tonne in mid October, coal analyst SX Coal said.

Coal exports from Mongolia in October – a key supplier to China – also rose, but remained lower than a year ago, SX Coal said, using data from the Mongolian Customs General Administration.

Power cuts, no power cuts, they both just happened out of the blue Huang Feng

While relieved, many manufacturers in Zhejiang are still wary about the volatility of the country’s power supply.

“Power cuts, no power cuts, they both just happened out of the blue,” said Huang Feng, a textile manufacturer and exporter.

Before the announcement, Huang was bracing for limited production until the end of the year, but his factories have now resumed full operation.

On Tuesday, some companies in parts of Zhejiang were still operating at reduced capacity.

Yao Xiangmin, a factory worker from Taizhou city, said the car parts manufacturer he works for was still only running four weeks a day due to the rationing.

Factory owners are also grappling with raw material prices. Additionally, once production resumes, Huang said shipping costs might also rise.

Additional reporting by Su-Lin Tan

November 16, 2021

Congestion Fees Delayed

California Ports Defer Congestion Fee At The Last-Minute

by Tyler DurdenTuesday, Nov 16, 2021 – 02:40 PM

Authored by Greg Miller via FreightWaves.com,

Did ports defer fee plan because of progress or political peril?

It came down to the wire, but the highly controversial Los Angeles/Long Beach congestion fee is not happening — at least, not yet.

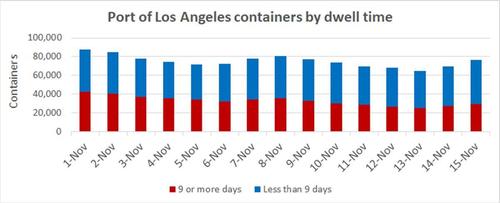

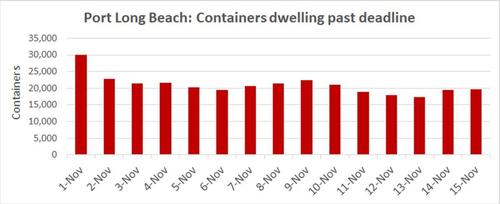

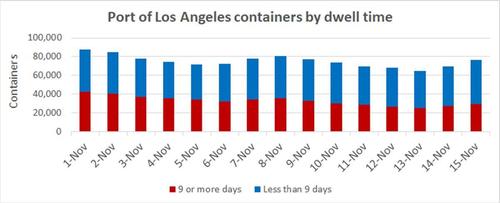

The ports were scheduled to begin charging ocean carriers $100 per import container starting Monday for boxes moving by truck that dwelled for nine or more days, and for boxes dwelling for six or more days that move by rail. The charge was scheduled to escalate by $100 a day until the container left the property.

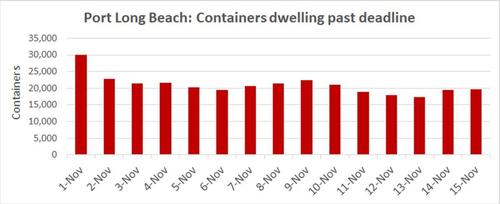

The ports announced Monday that they will “delay consideration” of the fee until Nov. 22, citing a 26% reduction in long-dwelling containers since the plan was announced on Oct. 25.

“There’s been significant improvement in clearing import containers from our docks in recent weeks,” said Port of Los Angeles Executive Director Gene Seroka. According to Port of Long Beach Executive Director Mario Cordero, “Clearly, everyone is working together to speed the movement of the cargo and reduce the backlog of ships off the coast as quickly as possible.”

Political risks of fee plan

Another reason the ports may not have pulled the trigger: the political peril of doing so.

Carriers explicitly stated that they would pass the cost along to importers. As of Monday, Long Beach had 19,656 containers on its terminals that would have been charged the late fee. There were at least 29,249 containers that would have incurred fees at the Port of Los Angeles (not including containers moving by rail that were between six and nine days late, which are not included in the data).

That means the aggregate fees to all carriers on Monday alone would have exceeded $4.8 million. And because the proposed fee would increase daily, the aggregate cost would have quickly risen into the tens of millions per day, and would have likely topped $100 million per day by the end of the first week.

During a conference call on Friday, Hapag-Lloyd CEO Rolf Habben Jansen warned, “If there’s cargo in those boxes that is not very valuable, you may end up with a lot of abandoned cargo that is going to stay at the terminal for much, much longer.”

Consultant Jon Monroe wrote in his weekly newsletter, “While I understand the intention, this is really a dumb idea for one good reason: The ports cannot measure the days that the container has been available to deliver.

“Under the current conditions, when a terminal discharges a container, it puts a percentage of the containers into closed lanes,” Monroe explained.

“Whenever a container is in a closed lane, it is unavailable for pickup by the trucker. No appointment can be made. Depending upon the terminal, anywhere from 20% to 80% of the containers will be put into a closed lane for an amount of time that varies. It is not unheard of for containers to sit in a closed lane for weeks. How will the ports account for containers that are in closed lanes?”

In a letter to the Federal Maritime Commission sent Monday, 85 business associations including the National Retail Federation wrote, “We are especially concerned about the announcements by the carriers that they intend to pass the charges through to the cargo owners.”

The groups warned that the new fee, if implemented, would “add substantial costs to the supply chain” due to “ongoing challenges that many cargo owners and drayage trucking companies are experiencing with the ability to retrieve cargo because of port congestion, restrictive empty return policies, and subsequent chassis shortages that result.”

During the inaugural meeting of the National Shippers Advisory Council on Oct. 27, various members called the Los Angeles/Long Beach congestion fee plan “catastrophic,” “crazy” and “out of left field.”

Long way to go

The two port bosses cited significant progress with clearing the terminals, yet the numbers show that most of the gains occurred in late October and early November. In recent days, the numbers have actually gotten worse.

In the port of Los Angeles, the number of containers dwelling nine day or more on Monday was up 18% from where it stood on Saturday and was the highest since last Wednesday. The total number of containers on the port — 76,613 — is higher than the number on Nov. 4.

Chart: American Shipper based on data from Port of Los Angeles. Note: Containers dwelling six or more days that move by rail would also incur a fee.

According to Los Angeles’ data platform with Port Optimizer, 45% of containers at the APM Terminals facility were still past deadline, dwelling for nine days or more, as of Monday. The share of “late” containers was 40% at Everport Terminal Services and 48% at West Basin Container Terminal.

Charts: Port of Long Angeles, Port Optimizer

In the port of Long Beach, the number of containers that were past the time limit on Monday was up 14% from Saturday. The number is now higher than where it stood back on Nov. 6.

Chart: American Shipper based on data from Port of Long Beach. Note: containers past deadline include boxes moving by both rail and truck.

Meanwhile, cargo continues to flood into the two ports from the trans-Pacific trade lane.

On Friday and Monday, yet another record was set for the number of container ships stuck at anchor or in holding patterns off the ports: 83. The average wait time at anchor for ships arriving in Los Angeles hit yet another fresh peak on Tuesday: 16.9 days.

November 16, 2021

Congestion Fees Delayed

California Ports Defer Congestion Fee At The Last-Minute

by Tyler DurdenTuesday, Nov 16, 2021 – 02:40 PM

Authored by Greg Miller via FreightWaves.com,

Did ports defer fee plan because of progress or political peril?

It came down to the wire, but the highly controversial Los Angeles/Long Beach congestion fee is not happening — at least, not yet.

The ports were scheduled to begin charging ocean carriers $100 per import container starting Monday for boxes moving by truck that dwelled for nine or more days, and for boxes dwelling for six or more days that move by rail. The charge was scheduled to escalate by $100 a day until the container left the property.

The ports announced Monday that they will “delay consideration” of the fee until Nov. 22, citing a 26% reduction in long-dwelling containers since the plan was announced on Oct. 25.

“There’s been significant improvement in clearing import containers from our docks in recent weeks,” said Port of Los Angeles Executive Director Gene Seroka. According to Port of Long Beach Executive Director Mario Cordero, “Clearly, everyone is working together to speed the movement of the cargo and reduce the backlog of ships off the coast as quickly as possible.”

Political risks of fee plan

Another reason the ports may not have pulled the trigger: the political peril of doing so.

Carriers explicitly stated that they would pass the cost along to importers. As of Monday, Long Beach had 19,656 containers on its terminals that would have been charged the late fee. There were at least 29,249 containers that would have incurred fees at the Port of Los Angeles (not including containers moving by rail that were between six and nine days late, which are not included in the data).

That means the aggregate fees to all carriers on Monday alone would have exceeded $4.8 million. And because the proposed fee would increase daily, the aggregate cost would have quickly risen into the tens of millions per day, and would have likely topped $100 million per day by the end of the first week.

During a conference call on Friday, Hapag-Lloyd CEO Rolf Habben Jansen warned, “If there’s cargo in those boxes that is not very valuable, you may end up with a lot of abandoned cargo that is going to stay at the terminal for much, much longer.”

Consultant Jon Monroe wrote in his weekly newsletter, “While I understand the intention, this is really a dumb idea for one good reason: The ports cannot measure the days that the container has been available to deliver.

“Under the current conditions, when a terminal discharges a container, it puts a percentage of the containers into closed lanes,” Monroe explained.

“Whenever a container is in a closed lane, it is unavailable for pickup by the trucker. No appointment can be made. Depending upon the terminal, anywhere from 20% to 80% of the containers will be put into a closed lane for an amount of time that varies. It is not unheard of for containers to sit in a closed lane for weeks. How will the ports account for containers that are in closed lanes?”

In a letter to the Federal Maritime Commission sent Monday, 85 business associations including the National Retail Federation wrote, “We are especially concerned about the announcements by the carriers that they intend to pass the charges through to the cargo owners.”

The groups warned that the new fee, if implemented, would “add substantial costs to the supply chain” due to “ongoing challenges that many cargo owners and drayage trucking companies are experiencing with the ability to retrieve cargo because of port congestion, restrictive empty return policies, and subsequent chassis shortages that result.”

During the inaugural meeting of the National Shippers Advisory Council on Oct. 27, various members called the Los Angeles/Long Beach congestion fee plan “catastrophic,” “crazy” and “out of left field.”

Long way to go

The two port bosses cited significant progress with clearing the terminals, yet the numbers show that most of the gains occurred in late October and early November. In recent days, the numbers have actually gotten worse.

In the port of Los Angeles, the number of containers dwelling nine day or more on Monday was up 18% from where it stood on Saturday and was the highest since last Wednesday. The total number of containers on the port — 76,613 — is higher than the number on Nov. 4.

Chart: American Shipper based on data from Port of Los Angeles. Note: Containers dwelling six or more days that move by rail would also incur a fee.

According to Los Angeles’ data platform with Port Optimizer, 45% of containers at the APM Terminals facility were still past deadline, dwelling for nine days or more, as of Monday. The share of “late” containers was 40% at Everport Terminal Services and 48% at West Basin Container Terminal.

Charts: Port of Long Angeles, Port Optimizer

In the port of Long Beach, the number of containers that were past the time limit on Monday was up 14% from Saturday. The number is now higher than where it stood back on Nov. 6.

Chart: American Shipper based on data from Port of Long Beach. Note: containers past deadline include boxes moving by both rail and truck.

Meanwhile, cargo continues to flood into the two ports from the trans-Pacific trade lane.

On Friday and Monday, yet another record was set for the number of container ships stuck at anchor or in holding patterns off the ports: 83. The average wait time at anchor for ships arriving in Los Angeles hit yet another fresh peak on Tuesday: 16.9 days.