Epoxy

September 19, 2021

Have Spot Rates Peaked?

Shipping Lines Think Spot Rates Have Peaked

By Ann Koh September 14, 2021, 3:58 AM EDT

- Hapag-Lloyd halts spot rate hikes for Asia-Europe and U.S.

- Extreme freight rates on these routes are peaking, Hapag says

1:21

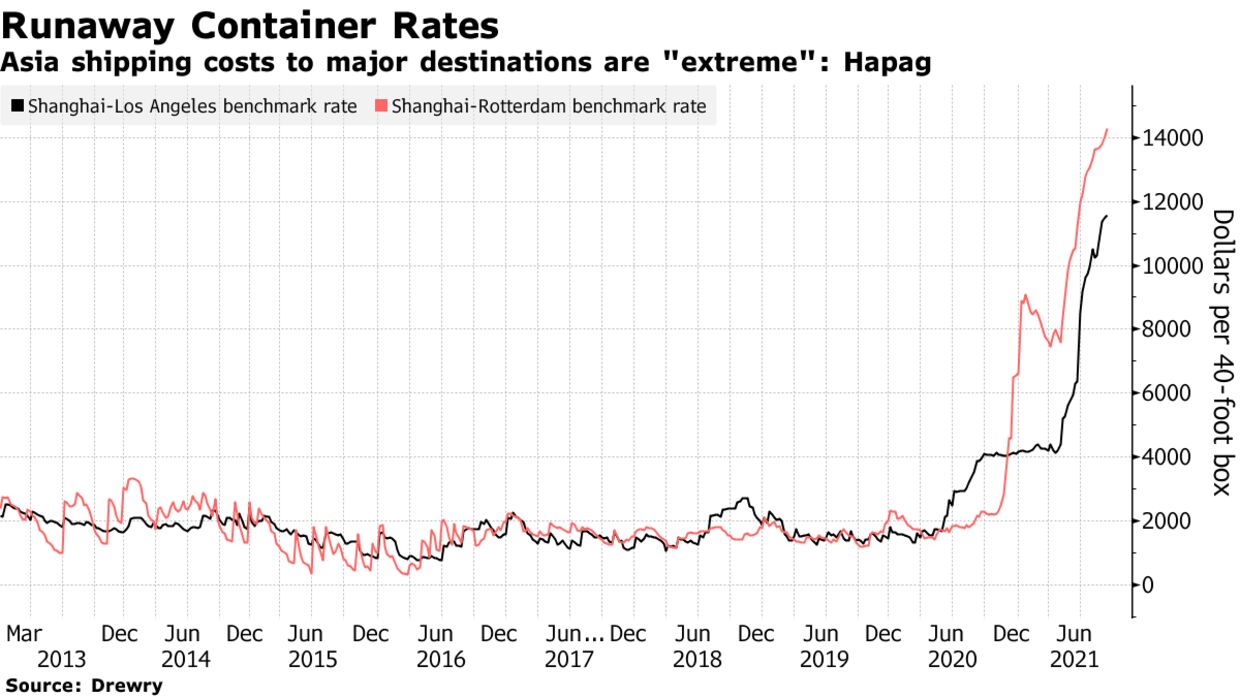

One of the world’s biggest shipping lines has decided to stop increasing spot freight rates on routes out of Asia to Europe and the U.S. as it sees an end to the rally that has seen prices hit records.

Hapag-LLoyd AG thinks spot rates have peaked and further increases are “not necessary,” according to Nils Haupt, the Hamburg-based company’s head of corporate communications. The move comes after French rival CMA CGM SA last week froze rates, saying it was prioritizing long-term relationships following a rally that has seen some spot rates jump more than sixfold in the past year.

The price gains came as the economic recovery coincided with reduced shipping capacity, putting inflationary pressure on manufacturers in Asia already grappling with higher commodity and electricity prices. While the historic rally led maritime regulators in the U.S., China and Europe to meet virtually last week to discuss the impact on snarled global supply chains, Hapag-LLoyd’s decision “was not requested by governments or regulators,” Haupt said.

While many shipping lines have taken advantage of rising spot prices, the rally is expected to “come to an end at some point,” said Jim Bureau, chief executive officer of logistics digital platform provider JAGGAER.

“The supply chain is extremely fragile right now,” he said. “How much more cost can carriers practically take on without increasing financial risk on both buyer and supplier?”

September 19, 2021

Have Spot Rates Peaked?

Shipping Lines Think Spot Rates Have Peaked

By Ann Koh September 14, 2021, 3:58 AM EDT

- Hapag-Lloyd halts spot rate hikes for Asia-Europe and U.S.

- Extreme freight rates on these routes are peaking, Hapag says

1:21

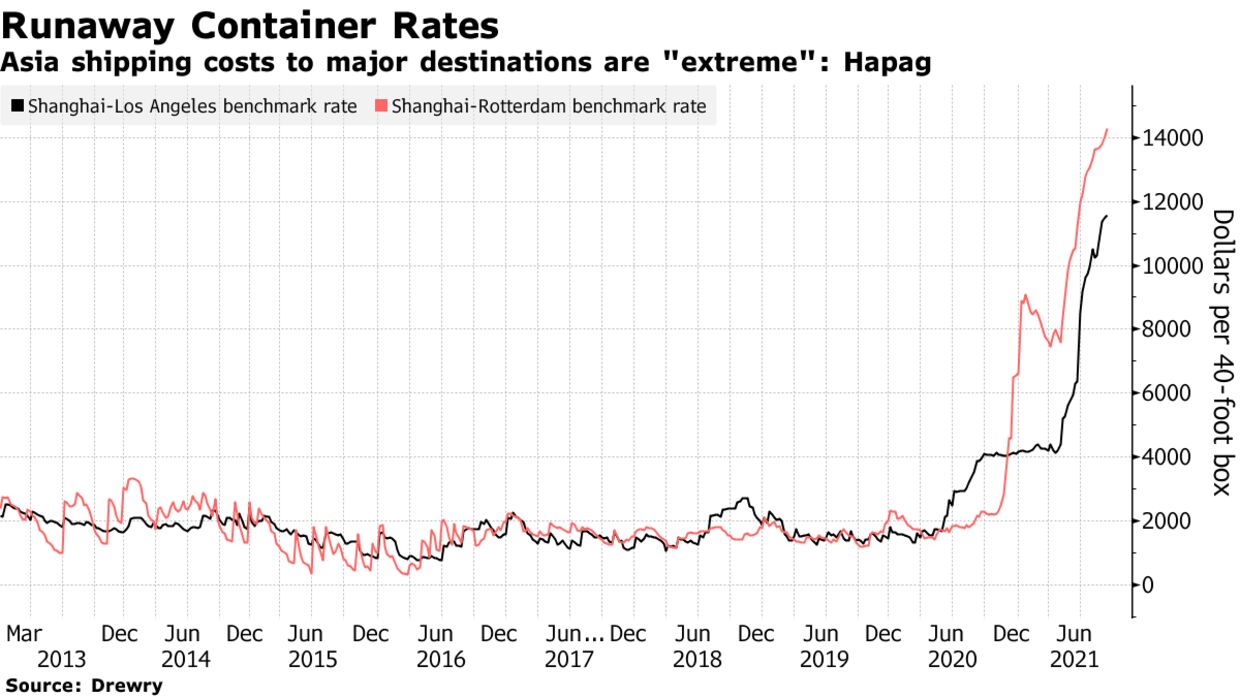

One of the world’s biggest shipping lines has decided to stop increasing spot freight rates on routes out of Asia to Europe and the U.S. as it sees an end to the rally that has seen prices hit records.

Hapag-LLoyd AG thinks spot rates have peaked and further increases are “not necessary,” according to Nils Haupt, the Hamburg-based company’s head of corporate communications. The move comes after French rival CMA CGM SA last week froze rates, saying it was prioritizing long-term relationships following a rally that has seen some spot rates jump more than sixfold in the past year.

The price gains came as the economic recovery coincided with reduced shipping capacity, putting inflationary pressure on manufacturers in Asia already grappling with higher commodity and electricity prices. While the historic rally led maritime regulators in the U.S., China and Europe to meet virtually last week to discuss the impact on snarled global supply chains, Hapag-LLoyd’s decision “was not requested by governments or regulators,” Haupt said.

While many shipping lines have taken advantage of rising spot prices, the rally is expected to “come to an end at some point,” said Jim Bureau, chief executive officer of logistics digital platform provider JAGGAER.

“The supply chain is extremely fragile right now,” he said. “How much more cost can carriers practically take on without increasing financial risk on both buyer and supplier?”

September 17, 2021

Chinese Production Update

TOPIC PAGE: Coronavirus, oil price direction – impact on chemicals

Author: Will Beacham

2021/09/17

China’s PP prices have risen slowly since September amid limited plant production capacity, and the peak season in September and October may not be as obvious as in previous years. Watch the video as ICIS industry analyst Shawn Xiao tells us about the current uptrend in domestic PP prices.

China’s domestic propylene oxide (PO) market sees fresh round of price adjustments amid tight supply and weak exports of polyether polyols. Listen in as ICIS analyst Jady Ma and senior information director Chris Qi discuss the market dynamics in the latest ICIS podcast.

The domestic polyethylene (PE) market in China will gain momentum in the fourth quarter as supply may be tightened by operational cutbacks at some domestic plants from September, as well as expected turnarounds in the Middle East.

Domestic epichlorohydrin (ECH) supply may tighten in China as a major facility in Jiangsu province may shut in the wake of the country’s newly minted environmental policies.

Asia’s glycerine market is likely to continue to face upward pressure from soaring container freight rates and strong demand amid concerns over supply security.

Meanwhile, ongoing robust demand across most segments, persistent feedstock constraints and import delays continue to strain Europe epoxy resins supply and the tightness could extend into Q4, as Asian import disruption intensifies.

European toluene availability continues to have some length in the bulk sector, with consumption limited. Market conditions are expected by some to remain stable throughout September.

By contrast, European monoethylene glycol (MEG) spot supply remains limited for larger quantities, but imports are expected to improve in the next couple of months.

Updated on 17 Sep

September 17, 2021

Chinese Production Update

TOPIC PAGE: Coronavirus, oil price direction – impact on chemicals

Author: Will Beacham

2021/09/17

China’s PP prices have risen slowly since September amid limited plant production capacity, and the peak season in September and October may not be as obvious as in previous years. Watch the video as ICIS industry analyst Shawn Xiao tells us about the current uptrend in domestic PP prices.

China’s domestic propylene oxide (PO) market sees fresh round of price adjustments amid tight supply and weak exports of polyether polyols. Listen in as ICIS analyst Jady Ma and senior information director Chris Qi discuss the market dynamics in the latest ICIS podcast.

The domestic polyethylene (PE) market in China will gain momentum in the fourth quarter as supply may be tightened by operational cutbacks at some domestic plants from September, as well as expected turnarounds in the Middle East.

Domestic epichlorohydrin (ECH) supply may tighten in China as a major facility in Jiangsu province may shut in the wake of the country’s newly minted environmental policies.

Asia’s glycerine market is likely to continue to face upward pressure from soaring container freight rates and strong demand amid concerns over supply security.

Meanwhile, ongoing robust demand across most segments, persistent feedstock constraints and import delays continue to strain Europe epoxy resins supply and the tightness could extend into Q4, as Asian import disruption intensifies.

European toluene availability continues to have some length in the bulk sector, with consumption limited. Market conditions are expected by some to remain stable throughout September.

By contrast, European monoethylene glycol (MEG) spot supply remains limited for larger quantities, but imports are expected to improve in the next couple of months.

Updated on 17 Sep

September 15, 2021

Hurricane Nicholas Overview

Minimal impact to plant ops after Nicholas arrives as Category 1 hurricane

Author: Adam Yanelli

2021/09/14

HOUSTON (ICIS)–Refineries and chemical plants in the US Gulf appeared to have sustained minimal damage as Hurricane Nicholas made landfall late Monday night as a category 1 storm near Matagorda, Texas.

ExxonMobil said its Texas refineries and chemical complexes in Baytown and Beaumont are operating as normal and that there was no significant damage or flooding at the sites.

Shell is conducting a thorough post-storm damage assessment at its complex in Deer Park, Texas.

“At this early stage there does not appear to be serious damage from wind, rain or storm surge. Operations at the facility remain normal,” the company said.

LyondellBasell safely shut down its Matagorda Complex in Bay City, Texas, because of widespread power outages in the region.

The company said its Houston, Texas, refinery and other Gulf coast facilities were operating normally.

CITGO said its refineries in Corpus Christi, Texas, and Lake Charles, Louisiana, are operating normally.

Ascend said its operations at its Cedar Bayou acrylonitrile plant are normal.

All three trains at Freeport LNG are offline as of 14 September, according to a Freeport LNG spokeswoman, likely related to power issues.

STORM UPDATE

According to the National Hurricane Center, the system could continue to generate heavy rainfall as it moves to the northeast.

As of 16:00 GMT, the system was moving slowly across the Houston metropolitan area at about 6 miles/hour, with maximum sustained winds of 45 miles/hour (75km/hour).

A category 1 storm is defined by having maximum sustained winds of at least 74 miles/hour according to the Saffir-Simpson scale.

Rainfall totals for the region are expected to be around 5-10 inches, with as much as 20 inches in some regions, according to the National Weather Service.

Electrical service provider CenterPoint Energy reported about 440,000 customers without power as of Tuesday morning.

CenterPoint crews have begun damage assessments and the service restoration process.

The restoration process begins with facilities vital to safety, health and welfare, such as hospitals, water treatment plants and public service facilities, the company said.

Further south in the Corpus Christi area, power provider AEP Texas said Nicholas damaged transmission lines and that at least 13 substations were offline as of Tuesday morning, causing power outages to about 13,500 customers in Matagorda County.

“Damage assessment teams will continue to identify downed utility poles, power lines and other safety hazards as crews begin the restoration process today,” AEP Texas said.

RAILROADS

Union Pacific (UP) suspended local operations temporarily at the Settegast and Englewood intermodal ramps in the Houston area on Monday evening but said it would reopen on Tuesday morning.

The company took steps to address potential outages including generators at strategic locations, private on call contractors to support network outages and positioning track inspections ahead of trains following flash flooding events.

PORTS

Some ports in the Texas Gulf Coast region and southwestern Louisiana are closed.

According to the US Coast Guard (USCG), the closed Texas ports include Beaumont/Port Arthur, Galveston, Freeport and Houston, as well as the ports of Lake Charles, Louisiana.

The port in Corpus Christi, Texas, has resumed operations after they were suspended on Monday.

Port Houston said its terminals will remain closed on Tuesday and resume normal operations on Wednesday. This included the Turning Basin Terminal, Barbours Cut and Bayport Container Terminals.

Additional reporting by Janet Miranda, Ruth Liao, Anna Matherne, Zachary Moore and Deniz Koray