Epoxy

September 27, 2022

Good News for Spray Foam

New Home Sales Unexpectedly Soar With Second Biggest Increase On Record

by Tyler Durden

Tuesday, Sep 27, 2022 – 10:36 AM

After last month’s jarring 12.6% tumble, which sent the SAAR to the lowest level since Jan 2016, US new home sales were expected to slide again if at a far more moderate pace: instead, we got another shocker because just minutes after Case-Shiller confirmed the first sequential drop in US home prices since 2012, the Census Bureau reported that in August, new homes unexpectedly soared by 28.8% – the 2nd biggest monthly increase on record (only behind the 30.6% spike in June 2020) smashing expectations of a -2.2% drop, and a massive reversal from last month’s upward revised -8.6% drop.

And so after 6 declines in the past 7 months, the actual SAAR number of new home sales exploded higher from 532K, the lowest in six years, to 685K, the highest since March!

Thanks to the unexpected surge in sales, the supply of new homes – which last month hit the highest since 2009 – collapse by more than 2 months, to just 8.1 months of supply.

And as one would expect, the surge in sales took place as both Median and Average new home sales prices dipped, if just modestly.

After hitting a record high of $466,300 just last month, the median new home price slumped 6.3% to $436,800 which still is one of the highest prices on record.

While the surge in new home sales is likely a delayed aftereffect of yields which dropped in the late summer and have since exploded to the highest level in a decade – which likely assures that next month we may well see the biggest drop in new home sales on record – the Fed will not be happy to see this latest surge in new home sales which will be a sign that even more tightening is required.

https://www.zerohedge.com/energy/new-home-sales-unexpectedly-soar-second-biggest-increase-record

September 27, 2022

Housing Drops

The Housing Bubble Has Officially Burst : Case-Shiller Records First Drop In Home Prices Since 2012

by Tyler Durden

Tuesday, Sep 27, 2022 – 09:33 AM

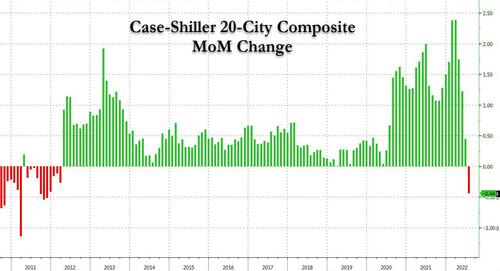

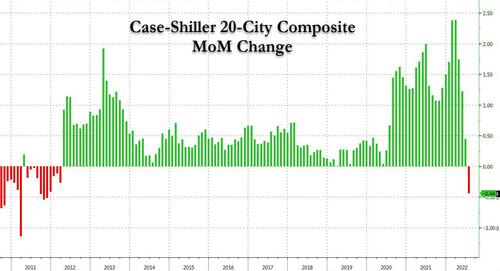

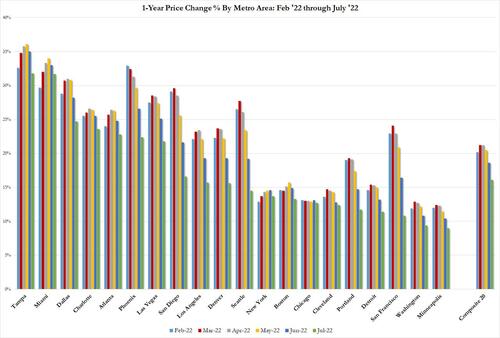

Analysts expected Case-Shiller Home Price growth to continue its modest deceleration in August (the latest available data in this heavily lagged and smoothed data set), but the result was a doozy: the 20-City Composite index tumbled 0.44% MoM, far below the 0.20% expected increase, and a sharp decline from the downward revised 0.19% increase in July; more importantly, this was the first sequential drop in home prices tracked by Case-Shiller since March 2012, or ten and a half years.

On a Y/Y basis, home prices rose just 16.06%, down from 18.66% YoY in July, and missing expectations of a 17.1% increase. The headline national average price index rose 15.77% YoY in August.

Comments confirmed that the mood is dismal and turning uglier by the day: “Although U.S. housing prices remain substantially above their year-ago levels, July’s report reflects a forceful deceleration,” says Craig J. Lazzara, Managing Director at S&P DJI.

“For example, while the National Composite Index rose by 15.8% in the 12 months ended July 2022, its year-over-year price rise in June was 18.1%. The -2.3% difference between those two monthly rates of gain is the largest deceleration in the history of the index. We saw similar patterns in our 10-City Composite (up 14.9% in July vs. 17.4% in June) and our 20-City Composite (up 16.1% in July vs. 18.7% in June). On a month-over-month basis, all three composites declined in July.”

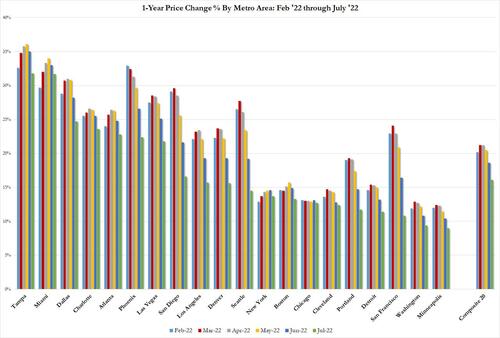

“The theme of strong but decelerating prices was reflected across all 20 cities. July’s year-over-year price change was positive for each one of the 20 cities, with a median gain of 15.0%, but in every case July’s gain was less than June’s. Prices declined in 12 cities on a month-to-month basis. Tampa (+31.8%) narrowly edged Miami (+31.7%) to remain at the top of the league table for the fifth consecutive month, with Dallas (+24.7%) holding on to third place. As has been the case for the last several months, price growth was strongest in the Southeast (+27.5%) and South (+26.9%).

Lazzara concluded by noting that “as the Federal Reserve continues to move interest rates upward, mortgage financing has become more expensive, a process that continues to this day. Given the prospects for a more challenging macroeconomic environment, home prices may well continue to decelerate.”

Finally, we note that drops such as this are absolutely critical to avoid a total implosion in the housing sector, whose affordability just hit a record low last month, but managed to rebound modestly in July, as a result of dropping prices. That said, prices will have to drop by a lot more if housing is again to become affordable to ordinary Americans.

September 27, 2022

Housing Drops

The Housing Bubble Has Officially Burst : Case-Shiller Records First Drop In Home Prices Since 2012

by Tyler Durden

Tuesday, Sep 27, 2022 – 09:33 AM

Analysts expected Case-Shiller Home Price growth to continue its modest deceleration in August (the latest available data in this heavily lagged and smoothed data set), but the result was a doozy: the 20-City Composite index tumbled 0.44% MoM, far below the 0.20% expected increase, and a sharp decline from the downward revised 0.19% increase in July; more importantly, this was the first sequential drop in home prices tracked by Case-Shiller since March 2012, or ten and a half years.

On a Y/Y basis, home prices rose just 16.06%, down from 18.66% YoY in July, and missing expectations of a 17.1% increase. The headline national average price index rose 15.77% YoY in August.

Comments confirmed that the mood is dismal and turning uglier by the day: “Although U.S. housing prices remain substantially above their year-ago levels, July’s report reflects a forceful deceleration,” says Craig J. Lazzara, Managing Director at S&P DJI.

“For example, while the National Composite Index rose by 15.8% in the 12 months ended July 2022, its year-over-year price rise in June was 18.1%. The -2.3% difference between those two monthly rates of gain is the largest deceleration in the history of the index. We saw similar patterns in our 10-City Composite (up 14.9% in July vs. 17.4% in June) and our 20-City Composite (up 16.1% in July vs. 18.7% in June). On a month-over-month basis, all three composites declined in July.”

“The theme of strong but decelerating prices was reflected across all 20 cities. July’s year-over-year price change was positive for each one of the 20 cities, with a median gain of 15.0%, but in every case July’s gain was less than June’s. Prices declined in 12 cities on a month-to-month basis. Tampa (+31.8%) narrowly edged Miami (+31.7%) to remain at the top of the league table for the fifth consecutive month, with Dallas (+24.7%) holding on to third place. As has been the case for the last several months, price growth was strongest in the Southeast (+27.5%) and South (+26.9%).

Lazzara concluded by noting that “as the Federal Reserve continues to move interest rates upward, mortgage financing has become more expensive, a process that continues to this day. Given the prospects for a more challenging macroeconomic environment, home prices may well continue to decelerate.”

Finally, we note that drops such as this are absolutely critical to avoid a total implosion in the housing sector, whose affordability just hit a record low last month, but managed to rebound modestly in July, as a result of dropping prices. That said, prices will have to drop by a lot more if housing is again to become affordable to ordinary Americans.

September 23, 2022

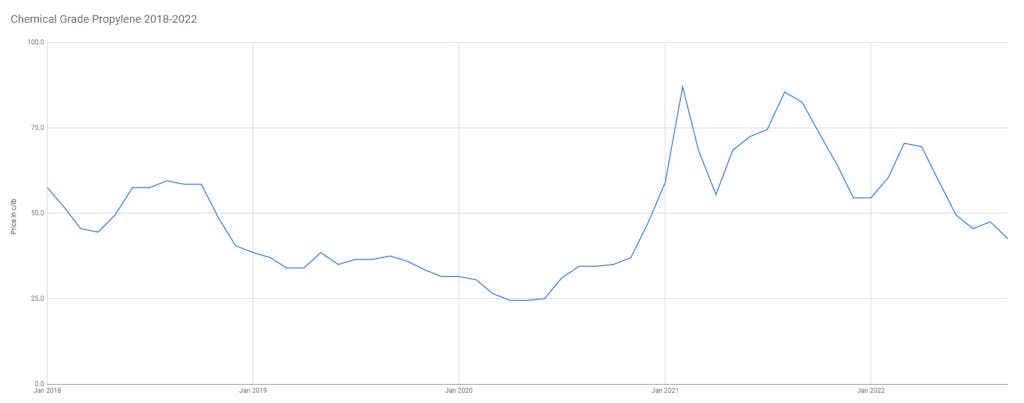

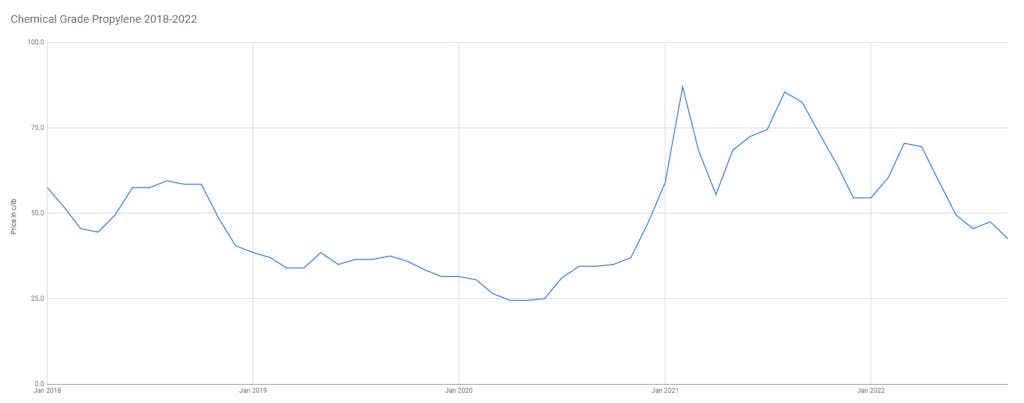

Propylene Falls 5c/lb in September

Chemical grade is now $0.425/lb

September 23, 2022

Propylene Falls 5c/lb in September

Chemical grade is now $0.425/lb