Epoxy

March 25, 2021

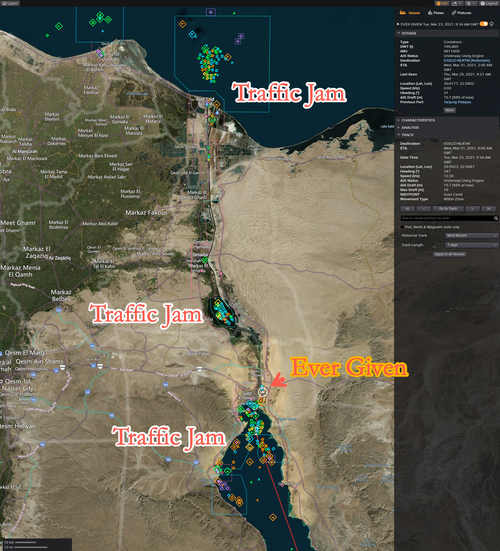

Suez Canal Blocked

“Might Take Weeks” – Suez Canal Still Closed As “Enormous Beached Whale” Ship Remains Stuck

by Tyler DurdenThursday, Mar 25, 2021 – 06:35 AM

Update (0956ET): Daily Mail’s deputy political editor John Stevens tweets the British government “stands ready” to support operations to free the containership blocking the Suez Canal.

Boris Johnson’s spokesman:

“We are ready to provide any assistance that we can but have not been asked yet.”

* * *

Update (0942 ET): The massive containership blocking the Suez Canal remains stuck in place and unable to refloat on Thursday. Each day the canal is blocked, it halts about $9.6 billion of traffic through the world’s most important shipping lane.

The Suez Canal Authority’s knock-on effects on closing the 120-mile long canal will likely cause shipping traffic jams at both entrances of the canal, delayed shipments, supply chain disruptions, rising prices of certain commodities, and may push up freight rates. https://platform.twitter.com/embed/Tweet.html?dnt=false&embedId=twitter-widget-0&frame=false&hideCard=false&hideThread=false&id=1375080625942724608&lang=en&origin=https%3A%2F%2Fwww.zerohedge.com%2Fenergy%2Fmight-take-weeks-suez-canal-still-closed-enormous-beached-whale-ship-remains-stuck&siteScreenName=zerohedge&theme=light&widgetsVersion=e1ffbdb%3A1614796141937&width=550px

* * *

The Suez Canal Authority (SCA) reported Thursday it had suspended traffic along the 120-mile long canal while eight tugboats worked to free a massive containership, according to Reuters.

SCA’s statement said thirteen vessels had sailed south along the canal on Wednesday and were waiting in the canal’s lakes until the containership was refloated. On either side of the canal’s entrances, dozens of ships are piling up as the world’s most crucial shipping lane grinds to a halt.

The container ship called the Ever Given, owned by Evergreen Marine Corp., “could be stuck in the canal for weeks,” according to the firm working to dislodge the vessel.

Peter Berdowski, CEO of Dutch company Boskalis which has been tasked to dislodge Ever Given, was quoted by the Daily Mail as saying:

“We can’t exclude it might take weeks, depending on the situation. It’s an enormous weight on the sand. We might have to work with a combination of reducing the weight by removing containers, oil and water from the ship, tug boats, and dredging of sand.”

Berdowski compared the 1,312ft-long, 175ft-wide, 200,000-ton vessel to an “enormous beached whale” as he suggested offloading cargo might be one solution to refloat the ship.

A source familiar with the matter told Bloomberg that Ever Given is “lodged approximately 5 meters into the canal’s bank, hindering efforts to re-float it fully.”

As many as 50 vessels pass through the canal on a given day, which means upwards of 150 vessels could be waiting to transit the canal. By now, some vessels have opted for alternative routes.

NYMEX WTI crude oil futures are down 2% in the overnight session and don’t seem to care about the canal’s continued shuttering. Perhaps, oil traders are refocusing on virus troubles in Europe, hindering demand.

But as we must note, if the SCA were to release a statement indicating a prolonged shutdown of the canal, crude prices would likely continue to rise. This is because 12% of global trade and 8% of liquefied natgas traverse the canal and nearly one million oil barrels each day.

On top of global supply chains already stretched thin due to the virus pandemic, the world’s most important shipping lane is paralyzed.

March 22, 2021

Rail Merger

Canadian Pacific Buys Kansas City Southern For $25BN In Largest Deal Of 2021

by Tyler DurdenSunday, Mar 21, 2021 – 10:25 AM

Canadian Pacific Railways has agreed to buy Kansas City Southern for $25 billion ($28.9 billion including debt) in the largest takeover deal this year. The transaction which sees CP take over the smallest of the seven Class 1 railway operators that dominate a significant share of freight activity in the US, is the biggest in CP’s history and will create a 20,000-mile rail network including the first U.S.-Mexico-Canada railroad.

As the FT, which first reported the transaction, notes, the deal marks the latest effort to shake up a structure among the big railroads in the US and Canada that has been unchanged since CSX and Norfolk Southern — the two big operators in the eastern US — took over Conrail and divided it between themselves in 1999.

The transaction gives CP access to the Kansas City, Missouri-based company’s sprawling Midwestern rail network that connects farms in Kansas and Missouri to ports along the Gulf of Mexico. It would also give it reach to Mexico, which made up almost half of Kansas City Southern’s revenue last year, and create the only network that cuts through all three North American countries

“This transaction will be transformative for North America,” CP President and Chief Executive Officer Keith Creel said, adding that “this will create the first US-Mexico-Canada railroad . . . [and combine the] two best performing Class 1 railroads for the past three years on a revenue growth basis.”

The Calgary-based company will pay $275 per share – a 23% premium to Friday’s record close – comprised of $90 in cash and the remainder with its stock, receiving 0.489 CP shares for every share they own. To pay for the deal, CP will issue 44.5 million new shares and raise $8.6bn in debt. according to a statement from both companies on Sunday. Shares of Kansas City Southern have more than doubled in the past year. Last September, the company rejected a takeover bid from a Blackstone and Global Infrastructure Partners-led consortium that valued its shares at $21BN.

The two companies notified the Surface Transportation Board, the US freight rail regulator that will need to approve the combination, about the deal on Saturday, people with direct knowledge of the matter said.

Investors have been concerned that any further consolidation would run into problems with the STB. As it stands, there are two competing big operators in Canada (CP and Canadian National), CSX and Norfolk Southern in the eastern US and Union Pacific and BNSF in the west. Kansas City Southern, the smallest Class 1, is the only operator focused on north-south operations.

The FT also notes that Kansas City Southern’s performance has been closely tied to trade between the US, Canada and Mexico, with its main routes linking the two countries neighbouring the US. It also has extensive operations in Mexico and owns a 50% stake in the Panama Canal Railway Company. The railway sector was hit hard in the early phase of the pandemic because of restrictions imposed by the US government to contain the spread of coronavirus.

As a result, Kansas City Southern reported an 8% drop in revenues in 2020 to $2.6bn and a 23% increase in net income to $617m. But prospects have improved in recent months, as the US accelerated its rollout of vaccines and business activity picked up. Biden’s efforts to strengthen US-Mexico trade relations – especially if Mexico agrees to hold the migrants that Biden initially invited – are expected to further boost railway activity. KCS employs about 6,200 staff compared with nearly 12,000 at the Canadian group.

Canadian Pacific shares have climbed 80% over the past year and have a market value of C$63bn ($50bn). The company’s largest shareholder is Chris Hohn’s TCI hedge fund, which had an 8.4% stake, according to filings from the end of last year.

Canadian Pacific previously approached first CSX and then Norfolk Southern about potential mergers in 2014 and 2016 under Hunter Harrison, the chief executive who was installed after a campaign by Bill Ackman, the activist investor. Both bids were rebuffed and there have been no further attempts at mergers since Harrison unexpectedly resigned from CP in January 2017. Harrison joined CSX two months later, shortly before his death in December that year.

Creel will be CEO of the new company, based in Calgary, and is expected to remain at the helm until at least early 2026, according to a separate statement. The combined entity, to be called Canadian Pacific Kansas City, or CPKC, will have revenue of about $8.7 billion and almost 20,000 employees.

https://www.zerohedge.com/markets/canadian-pacific-buys-kansas-city-soutern-25bn-largest-deal-2021

March 22, 2021

Rail Merger

Canadian Pacific Buys Kansas City Southern For $25BN In Largest Deal Of 2021

by Tyler DurdenSunday, Mar 21, 2021 – 10:25 AM

Canadian Pacific Railways has agreed to buy Kansas City Southern for $25 billion ($28.9 billion including debt) in the largest takeover deal this year. The transaction which sees CP take over the smallest of the seven Class 1 railway operators that dominate a significant share of freight activity in the US, is the biggest in CP’s history and will create a 20,000-mile rail network including the first U.S.-Mexico-Canada railroad.

As the FT, which first reported the transaction, notes, the deal marks the latest effort to shake up a structure among the big railroads in the US and Canada that has been unchanged since CSX and Norfolk Southern — the two big operators in the eastern US — took over Conrail and divided it between themselves in 1999.

The transaction gives CP access to the Kansas City, Missouri-based company’s sprawling Midwestern rail network that connects farms in Kansas and Missouri to ports along the Gulf of Mexico. It would also give it reach to Mexico, which made up almost half of Kansas City Southern’s revenue last year, and create the only network that cuts through all three North American countries

“This transaction will be transformative for North America,” CP President and Chief Executive Officer Keith Creel said, adding that “this will create the first US-Mexico-Canada railroad . . . [and combine the] two best performing Class 1 railroads for the past three years on a revenue growth basis.”

The Calgary-based company will pay $275 per share – a 23% premium to Friday’s record close – comprised of $90 in cash and the remainder with its stock, receiving 0.489 CP shares for every share they own. To pay for the deal, CP will issue 44.5 million new shares and raise $8.6bn in debt. according to a statement from both companies on Sunday. Shares of Kansas City Southern have more than doubled in the past year. Last September, the company rejected a takeover bid from a Blackstone and Global Infrastructure Partners-led consortium that valued its shares at $21BN.

The two companies notified the Surface Transportation Board, the US freight rail regulator that will need to approve the combination, about the deal on Saturday, people with direct knowledge of the matter said.

Investors have been concerned that any further consolidation would run into problems with the STB. As it stands, there are two competing big operators in Canada (CP and Canadian National), CSX and Norfolk Southern in the eastern US and Union Pacific and BNSF in the west. Kansas City Southern, the smallest Class 1, is the only operator focused on north-south operations.

The FT also notes that Kansas City Southern’s performance has been closely tied to trade between the US, Canada and Mexico, with its main routes linking the two countries neighbouring the US. It also has extensive operations in Mexico and owns a 50% stake in the Panama Canal Railway Company. The railway sector was hit hard in the early phase of the pandemic because of restrictions imposed by the US government to contain the spread of coronavirus.

As a result, Kansas City Southern reported an 8% drop in revenues in 2020 to $2.6bn and a 23% increase in net income to $617m. But prospects have improved in recent months, as the US accelerated its rollout of vaccines and business activity picked up. Biden’s efforts to strengthen US-Mexico trade relations – especially if Mexico agrees to hold the migrants that Biden initially invited – are expected to further boost railway activity. KCS employs about 6,200 staff compared with nearly 12,000 at the Canadian group.

Canadian Pacific shares have climbed 80% over the past year and have a market value of C$63bn ($50bn). The company’s largest shareholder is Chris Hohn’s TCI hedge fund, which had an 8.4% stake, according to filings from the end of last year.

Canadian Pacific previously approached first CSX and then Norfolk Southern about potential mergers in 2014 and 2016 under Hunter Harrison, the chief executive who was installed after a campaign by Bill Ackman, the activist investor. Both bids were rebuffed and there have been no further attempts at mergers since Harrison unexpectedly resigned from CP in January 2017. Harrison joined CSX two months later, shortly before his death in December that year.

Creel will be CEO of the new company, based in Calgary, and is expected to remain at the helm until at least early 2026, according to a separate statement. The combined entity, to be called Canadian Pacific Kansas City, or CPKC, will have revenue of about $8.7 billion and almost 20,000 employees.

https://www.zerohedge.com/markets/canadian-pacific-buys-kansas-city-soutern-25bn-largest-deal-2021

March 21, 2021

Gulf Coast Update

Post-freeze US petrochemical restarts progressing

- Author

- Kristen Hays

- Editor

- Richard Rubin

- Commodity

- Petrochemicals

Houston — Most US Gulf Coast petrochemical plants that were shut when sustained sub-freezing temperatures hit the region in mid-February have resumed operations or expect to restart by the end of March.

Not registered?

Receive daily email alerts, subscriber notes & personalize your experience. Register Now

Restarts have been gradual and operating rates remained reduced as producers have continually checked for any leaks in miles of pipe that was exposed to frigid cold for more than 72 hours. The industry remained focused on bringing crackers back online to produce ethylene needed to feed downstream plants that produce plastic resins and other products.

Numerous force majeures declared the week of Feb. 15 remained in effect as producers sought to clear backlogs of contract orders.

LyondellBasell CEO Bob Patel said at an energy conference March 16 that US resin supply could take the rest of 2021 to catch up to demand after weather-related setbacks in 2020 and the February freeze, particularly as already strong demand grows alongside economic recovery boosted by COVID-19 vaccinations becoming more available worldwide.

“As vaccines are rolled out, the year-over-year demand growth and the additional recovery-related growth in demand is still in front of us,” he said. “And supply is going to have to catch up all year long to meet this level of demand that we expect this year.”

Here is a rundown of fallout from the freeze:

FORCE MAJEURES

**Dow Chemical: Declared Feb. 19, on 2-ethylhexanol and butanol products from its Texas City, Texas complex

**Formosa Plastics USA: Declared Feb. 19 on US polyethylene

**BASF: Declared Feb. 19 on dioctyl terephthalate (DOTP), a plasticizer, at its Pasadena, Texas, site

**Westlake Chemical: Declared Feb. 19 on US caustic soda, chlorine, PVC and VCM; company has 2.9 million mt/year of US caustic soda capacity, more than 2 million mt/year of PVC capacity, 2.6 million mt/year of VCM; more than 2.26 million mt/year of chlorine capacity at five affected sites

**Formosa Plastics USA: Declared Feb. 18 on US PVC, 1.3 million mt/year of capacity at Point Comfort, Texas, and Baton Rouge, Louisiana, complexes.

**Dow Chemical: Declared Feb. 18 on multiple intermediate chemicals produced at plants in Deer Park, Freeport, Texas City and Bayport Texas, Hahnville, Louisiana, and Louisville, Kentucky; declaration includes vinyl acetate monomer (VAM), methyl methacrylate (MMA), glacial methacrylic acid (GMAA), butyl methacrylate (BMA), glycidyl methacrylate (GMA), 2-ethylhexyl Acrylate (2EHA), butyl acrylate (BA), and others; Dow informed South American customers

**Celanese: Declared force majeure Feb. 18 on multiple intermediate chemicals normally sold to customers in the US, Europe and the Middle East, including acetic acid, VAM, ethyl acetate and ethylene vinyl acetate (EVA)

**Total: Declared Feb. 17 on polypropylene produced at its 1.15 million mt/year La Porte, Texas, facility

**Formosa Plastics USA: Declared Feb. 17 on all chlor-alkali products

**LyondellBasell: Declared Feb. 16 on styrene monomer

**Vestolit: Declared Feb. 16 on PVC produced at its Colombia and Mexico plants on lack of upstream vinyl chloride monomer feedstock from US suppliers; plants have a combined 1.8 million mt/year of capacity

**Olin: Declared Feb. 16 on US chlorine, caustic soda, ethylene dichloride, epoxy, hydrochloric acid and other products produced at its Freeport, Texas, complex; ; on Feb. 18 Olin expanded the declaration in a separate letter to customers to include products made system-wide

**MEGlobal: Declared Feb. 15 on MEG produced at its Freeport, Texas, site

**LyondellBasell: Declared Feb. 15 on US polyethylene

**Flint Hills Resources: Declared Feb. 15 on polypropylene produced at Longview, Texas

**OxyChem: Declared Feb. 15 on US chlorine, caustic soda, EDC, vinyl chloride monomer and polyvinyl chloride.

**LyondellBasell: Declared Feb. 15 on US polypropylene

**INEOS Olefins and Polymers USA: Declared Feb. 15 on polypropylene

**OQ Chemicals: Declared Feb. 15 on US oxo-alcohols, aldehydes, acids and esters produced at its Bat City, Texas, operations

SHUTDOWNS

**Shell: two crackers with a combined 961,000 mt/year of capacity, Deer Park, Texas

**Nan Ya Plastics: cumulative 1.17 million mt/year of monoethylene glycol, Point Comfort, Texas

**CP Chem: 998,000 mt/year HDPE, Pasadena, Texas

**TPC Group: Houston site, including 544,310 mt/year butadiene unit

**CP Chem: three crackers with a combined capacity of 1.36 million mt/year of capacity, Sweeny, Texas

**INEOS: 1.89 million mt/year of ethylene capacity, Chocolate Bayou, Texas

**LyondellBasell: 1.134 million mt/year cracker, Corpus Christi, Texas

**Dow Chemical: 827,000 mt/year cracker, Orange, Texas

**Indorama Ventures: 435,000 mt/year EO, 358,000 mt/year MEG, Clear Lake, Texas

**LyondellBasell: 265,000 mt/year MEG, Bayport, Texas

RESTARTS

**Dow Chemical: Three crackers with a cumulative capacity of 3.68 million mt/year of capacity and two LDPE units with 552,000 mt/year and 186,000 mt/year HDPE, Freeport, Texas; 490,000 mt/year LLDPE and 390,000 mt/year HDPE, Seadrift, Texas

**Formosa Plastics USA, Point Comfort, Texas: 1.2 million mt/year cracker; 875,000 mt/year HDPE; 400,000 mt/year of LDPE; 465,000 mt/year of LLDPE; 798,000 mt/year of PVC; 1 million mt/year of caustic soda and 910,000 mt/year of chlorine; 753,000 mt/year of VCM; 1.478 million mt/year of EDC; two PP units with combined capacity of 1.7 million mt/year

**Westlake Chemical: 331,763 mt/year cracker, 249,475 mt/year chlorine, 274,423 mt/year caustic soda, 680,388 mt/year vinyl chloride monomer, 680,388 mt/year polyvinyl chloride, Calvert City, Kentucky

**Eastman Chemical: 730,000 mt/year ethylene capacity, Longview, Texas

**LyondellBasell: 3 million mt/year of ethylene capacity in Channelview and La Porte, Texas

**CP Chem: Two crackers with cumulative 2.53 million mt/year capacity, Cedar Bayou, Texas

**Lotte Chemical: 700,000 mt/year MEG, 1 million mt/year joint-venture cracker, Lake Charles, Louisiana

**Olin: Freeport, Texas complex, with 3 million mt/year of caustic soda and 2.73 million mt/year of chlorine capacity; 748,000 mt/year of EDC

**OxyChem: 544,000 mt/year cracker; 248,000 mt/year chlor-alkali; 680,000 mt/year EDC, Ingleside, Texas; Deer Park and Pasadena, Texas, 1.27 million mt in PVC capacity, Deer Park and Pasadena, Texas; 1.79 million mt/year of VCM, 580,000 mt/year chlor-alkali, La Porte, Texas

**Shintech: Freeport, Texas: 1.45 million mt/year PVC; one of three PVC lines shut down week of March 15 for a planned turnaround

**Indorama Ventures: 235,867 mt/year cracker; 1 million mt/year ethylene oxide/MEG unit, 238,135 mt/year propylene oxide unit, and 988,000 mt/year of MTBE capacity, Port Neches, Texas

**Westlake Chemical, 632,000 mt/year cracker, Lake Charles, Louisiana

**MEGlobal: 750,000 mt/year monoethylene glycol (MEG) plant, Freeport, Texas

**Nan Ya Plastics, two MEG units with a cumulative 1.17 million mt/year capacity, Point Comfort, Texas

**Dow Chemical: 300,000 mt/year MEG, Seadrift, Texas

**Indorama Ventures: 300,000 mt/year MEG, Clear Lake, Texas

**CP Chem, two crackers with a combined 1.9 million mt/year of capacity, Cedar Bayou, Texas

**CP Chem, 853,000 mt/year cracker, Port Arthur, Texas

**Braskem: 360,000 mt/year PP Freeport, Texas; 450,000 mt/year PP, La Porte, Texas

**Motiva Chemicals: 635,000 mt/year mixed-feed cracker, Port Arthur, Texas

**Shell: Norco, Louisiana, restarted two crackers with a combined 1.4 million mt/year of capacity

**Baystar Polymers: 408,000 mt/year HDPE unit at Bayport, Texas

**Flint Hills Resources: 658,000 mt/year PDH unit, Houston

**Dow Chemical: 750,000 PDH, Freeport, Texas

**ExxonMobil: Beaumont, Texas; 826,000 mt/year cracker; 225,000 mt/year HDPE; 240,000 mt/year LDPE; 1.19 million mt/year LLDPE with some HDPE capacity

**ExxonMobil: Baytown, Texas; three crackers with a combined capacity of 3.8 million mt/year; 800,000 mt/year PP

**Sasol: 380,000 mt/year EO/MEG, Lake Charles, Louisiana

**Formosa Plastics USA: 513,000 mt/year PVC, 653,000 mt/year VCM, Baton Rouge, Louisiana

**LyondellBasell: Lake Charles, Louisiana, joint-venture 470,000 mt/year LLDPE; 420,000 mt/year LDPE

PRICES

**The FD Mont Belvieu spot ethylene price has risen 53% since Feb. 12 to 55.50 cents/lb on March 19, while the FD Choctaw marker has risen 61% in that span to 58 cents/lb

**Spot polymer-grade propylene prices rose 27% from Feb. 12 to an all-time high of $1.24.75/lb FD USG when all three US PDH plants were shut – two on the freeze, one for a turnaround – but have since declined 32% to 84 cents/lb FD USG on March 19.

**US export PVC prices reached a fresh all-time high of $1,700/mt March 17 on deals done amid tight post-freeze supply and turnarounds.

March 21, 2021

Gulf Coast Update

Post-freeze US petrochemical restarts progressing

- Author

- Kristen Hays

- Editor

- Richard Rubin

- Commodity

- Petrochemicals

Houston — Most US Gulf Coast petrochemical plants that were shut when sustained sub-freezing temperatures hit the region in mid-February have resumed operations or expect to restart by the end of March.

Not registered?

Receive daily email alerts, subscriber notes & personalize your experience. Register Now

Restarts have been gradual and operating rates remained reduced as producers have continually checked for any leaks in miles of pipe that was exposed to frigid cold for more than 72 hours. The industry remained focused on bringing crackers back online to produce ethylene needed to feed downstream plants that produce plastic resins and other products.

Numerous force majeures declared the week of Feb. 15 remained in effect as producers sought to clear backlogs of contract orders.

LyondellBasell CEO Bob Patel said at an energy conference March 16 that US resin supply could take the rest of 2021 to catch up to demand after weather-related setbacks in 2020 and the February freeze, particularly as already strong demand grows alongside economic recovery boosted by COVID-19 vaccinations becoming more available worldwide.

“As vaccines are rolled out, the year-over-year demand growth and the additional recovery-related growth in demand is still in front of us,” he said. “And supply is going to have to catch up all year long to meet this level of demand that we expect this year.”

Here is a rundown of fallout from the freeze:

FORCE MAJEURES

**Dow Chemical: Declared Feb. 19, on 2-ethylhexanol and butanol products from its Texas City, Texas complex

**Formosa Plastics USA: Declared Feb. 19 on US polyethylene

**BASF: Declared Feb. 19 on dioctyl terephthalate (DOTP), a plasticizer, at its Pasadena, Texas, site

**Westlake Chemical: Declared Feb. 19 on US caustic soda, chlorine, PVC and VCM; company has 2.9 million mt/year of US caustic soda capacity, more than 2 million mt/year of PVC capacity, 2.6 million mt/year of VCM; more than 2.26 million mt/year of chlorine capacity at five affected sites

**Formosa Plastics USA: Declared Feb. 18 on US PVC, 1.3 million mt/year of capacity at Point Comfort, Texas, and Baton Rouge, Louisiana, complexes.

**Dow Chemical: Declared Feb. 18 on multiple intermediate chemicals produced at plants in Deer Park, Freeport, Texas City and Bayport Texas, Hahnville, Louisiana, and Louisville, Kentucky; declaration includes vinyl acetate monomer (VAM), methyl methacrylate (MMA), glacial methacrylic acid (GMAA), butyl methacrylate (BMA), glycidyl methacrylate (GMA), 2-ethylhexyl Acrylate (2EHA), butyl acrylate (BA), and others; Dow informed South American customers

**Celanese: Declared force majeure Feb. 18 on multiple intermediate chemicals normally sold to customers in the US, Europe and the Middle East, including acetic acid, VAM, ethyl acetate and ethylene vinyl acetate (EVA)

**Total: Declared Feb. 17 on polypropylene produced at its 1.15 million mt/year La Porte, Texas, facility

**Formosa Plastics USA: Declared Feb. 17 on all chlor-alkali products

**LyondellBasell: Declared Feb. 16 on styrene monomer

**Vestolit: Declared Feb. 16 on PVC produced at its Colombia and Mexico plants on lack of upstream vinyl chloride monomer feedstock from US suppliers; plants have a combined 1.8 million mt/year of capacity

**Olin: Declared Feb. 16 on US chlorine, caustic soda, ethylene dichloride, epoxy, hydrochloric acid and other products produced at its Freeport, Texas, complex; ; on Feb. 18 Olin expanded the declaration in a separate letter to customers to include products made system-wide

**MEGlobal: Declared Feb. 15 on MEG produced at its Freeport, Texas, site

**LyondellBasell: Declared Feb. 15 on US polyethylene

**Flint Hills Resources: Declared Feb. 15 on polypropylene produced at Longview, Texas

**OxyChem: Declared Feb. 15 on US chlorine, caustic soda, EDC, vinyl chloride monomer and polyvinyl chloride.

**LyondellBasell: Declared Feb. 15 on US polypropylene

**INEOS Olefins and Polymers USA: Declared Feb. 15 on polypropylene

**OQ Chemicals: Declared Feb. 15 on US oxo-alcohols, aldehydes, acids and esters produced at its Bat City, Texas, operations

SHUTDOWNS

**Shell: two crackers with a combined 961,000 mt/year of capacity, Deer Park, Texas

**Nan Ya Plastics: cumulative 1.17 million mt/year of monoethylene glycol, Point Comfort, Texas

**CP Chem: 998,000 mt/year HDPE, Pasadena, Texas

**TPC Group: Houston site, including 544,310 mt/year butadiene unit

**CP Chem: three crackers with a combined capacity of 1.36 million mt/year of capacity, Sweeny, Texas

**INEOS: 1.89 million mt/year of ethylene capacity, Chocolate Bayou, Texas

**LyondellBasell: 1.134 million mt/year cracker, Corpus Christi, Texas

**Dow Chemical: 827,000 mt/year cracker, Orange, Texas

**Indorama Ventures: 435,000 mt/year EO, 358,000 mt/year MEG, Clear Lake, Texas

**LyondellBasell: 265,000 mt/year MEG, Bayport, Texas

RESTARTS

**Dow Chemical: Three crackers with a cumulative capacity of 3.68 million mt/year of capacity and two LDPE units with 552,000 mt/year and 186,000 mt/year HDPE, Freeport, Texas; 490,000 mt/year LLDPE and 390,000 mt/year HDPE, Seadrift, Texas

**Formosa Plastics USA, Point Comfort, Texas: 1.2 million mt/year cracker; 875,000 mt/year HDPE; 400,000 mt/year of LDPE; 465,000 mt/year of LLDPE; 798,000 mt/year of PVC; 1 million mt/year of caustic soda and 910,000 mt/year of chlorine; 753,000 mt/year of VCM; 1.478 million mt/year of EDC; two PP units with combined capacity of 1.7 million mt/year

**Westlake Chemical: 331,763 mt/year cracker, 249,475 mt/year chlorine, 274,423 mt/year caustic soda, 680,388 mt/year vinyl chloride monomer, 680,388 mt/year polyvinyl chloride, Calvert City, Kentucky

**Eastman Chemical: 730,000 mt/year ethylene capacity, Longview, Texas

**LyondellBasell: 3 million mt/year of ethylene capacity in Channelview and La Porte, Texas

**CP Chem: Two crackers with cumulative 2.53 million mt/year capacity, Cedar Bayou, Texas

**Lotte Chemical: 700,000 mt/year MEG, 1 million mt/year joint-venture cracker, Lake Charles, Louisiana

**Olin: Freeport, Texas complex, with 3 million mt/year of caustic soda and 2.73 million mt/year of chlorine capacity; 748,000 mt/year of EDC

**OxyChem: 544,000 mt/year cracker; 248,000 mt/year chlor-alkali; 680,000 mt/year EDC, Ingleside, Texas; Deer Park and Pasadena, Texas, 1.27 million mt in PVC capacity, Deer Park and Pasadena, Texas; 1.79 million mt/year of VCM, 580,000 mt/year chlor-alkali, La Porte, Texas

**Shintech: Freeport, Texas: 1.45 million mt/year PVC; one of three PVC lines shut down week of March 15 for a planned turnaround

**Indorama Ventures: 235,867 mt/year cracker; 1 million mt/year ethylene oxide/MEG unit, 238,135 mt/year propylene oxide unit, and 988,000 mt/year of MTBE capacity, Port Neches, Texas

**Westlake Chemical, 632,000 mt/year cracker, Lake Charles, Louisiana

**MEGlobal: 750,000 mt/year monoethylene glycol (MEG) plant, Freeport, Texas

**Nan Ya Plastics, two MEG units with a cumulative 1.17 million mt/year capacity, Point Comfort, Texas

**Dow Chemical: 300,000 mt/year MEG, Seadrift, Texas

**Indorama Ventures: 300,000 mt/year MEG, Clear Lake, Texas

**CP Chem, two crackers with a combined 1.9 million mt/year of capacity, Cedar Bayou, Texas

**CP Chem, 853,000 mt/year cracker, Port Arthur, Texas

**Braskem: 360,000 mt/year PP Freeport, Texas; 450,000 mt/year PP, La Porte, Texas

**Motiva Chemicals: 635,000 mt/year mixed-feed cracker, Port Arthur, Texas

**Shell: Norco, Louisiana, restarted two crackers with a combined 1.4 million mt/year of capacity

**Baystar Polymers: 408,000 mt/year HDPE unit at Bayport, Texas

**Flint Hills Resources: 658,000 mt/year PDH unit, Houston

**Dow Chemical: 750,000 PDH, Freeport, Texas

**ExxonMobil: Beaumont, Texas; 826,000 mt/year cracker; 225,000 mt/year HDPE; 240,000 mt/year LDPE; 1.19 million mt/year LLDPE with some HDPE capacity

**ExxonMobil: Baytown, Texas; three crackers with a combined capacity of 3.8 million mt/year; 800,000 mt/year PP

**Sasol: 380,000 mt/year EO/MEG, Lake Charles, Louisiana

**Formosa Plastics USA: 513,000 mt/year PVC, 653,000 mt/year VCM, Baton Rouge, Louisiana

**LyondellBasell: Lake Charles, Louisiana, joint-venture 470,000 mt/year LLDPE; 420,000 mt/year LDPE

PRICES

**The FD Mont Belvieu spot ethylene price has risen 53% since Feb. 12 to 55.50 cents/lb on March 19, while the FD Choctaw marker has risen 61% in that span to 58 cents/lb

**Spot polymer-grade propylene prices rose 27% from Feb. 12 to an all-time high of $1.24.75/lb FD USG when all three US PDH plants were shut – two on the freeze, one for a turnaround – but have since declined 32% to 84 cents/lb FD USG on March 19.

**US export PVC prices reached a fresh all-time high of $1,700/mt March 17 on deals done amid tight post-freeze supply and turnarounds.