Epoxy

November 19, 2020

Existing Home Sales Surge

Existing Home Sales Soar To Highest In 15 Years

by Tyler Durden Thu, 11/19/2020 – 10:07

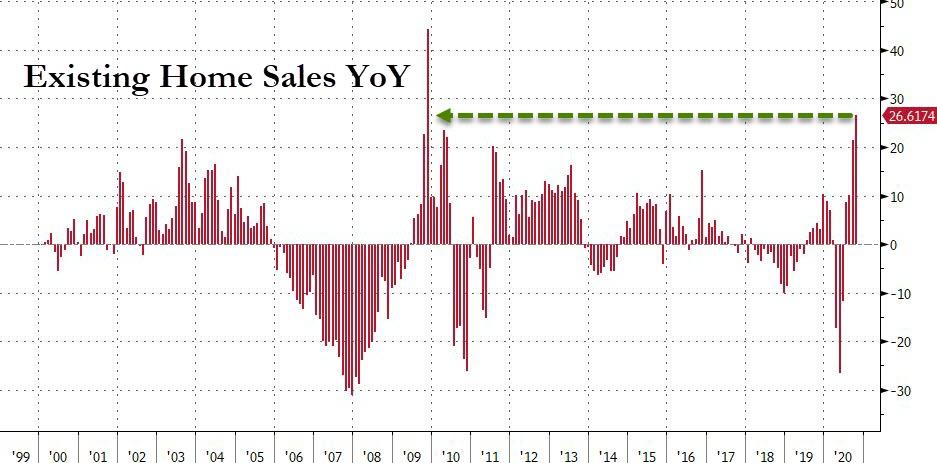

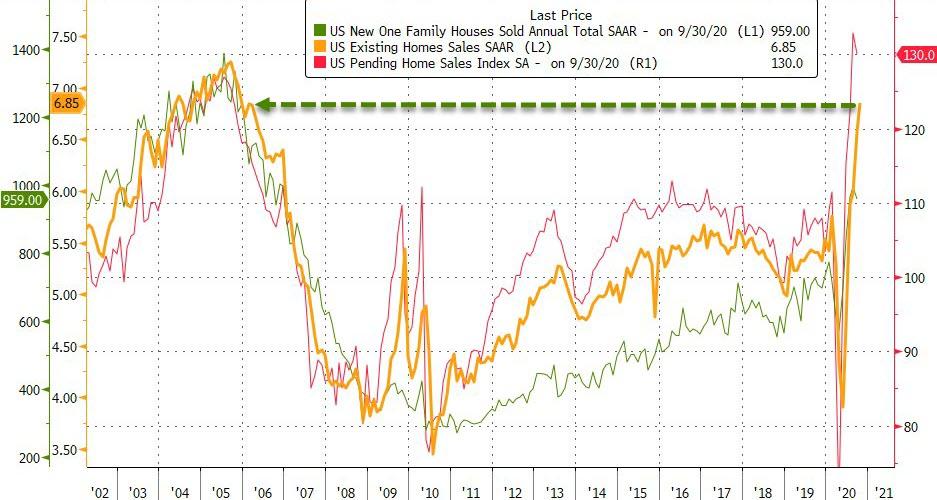

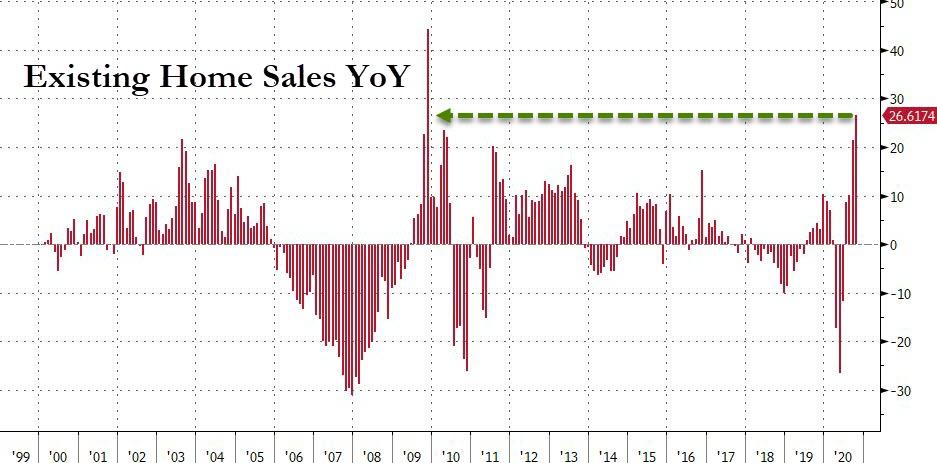

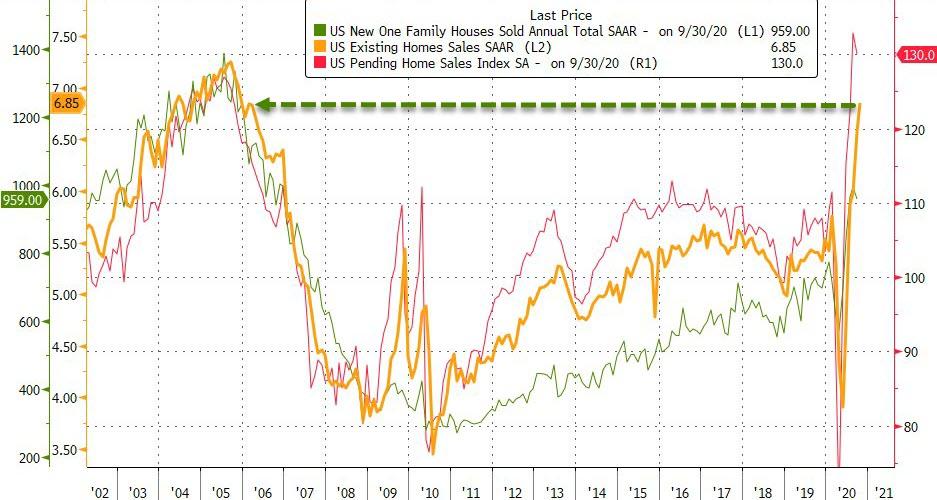

Existing home sales bucked the trend in September (rising to highest since May 2006 as new- and pending-home sales slipped) and analysts expect it too catch down a little in October, but yet again, it surprised to the upside, surging 4.3% MoM (vs a 1.1% MoM expected drop), and September’s jump was revised higher to a 9.9% spike…

This surprise rise has pushed the YoY jump in sales to 26.6% – the biggest spike since Nov 2009

Source: Bloomberg

This is the highest existing home sales print since November 2005…

Source: Bloomberg

Christophe Barraud explains why the number was so ‘surprisingly’ good:

- Buyers continued to benefit from favorable market conditions in October with mortgage rates still close to the lowest level on record

- Local/state reports confirm that sales kept rising by more than 20% YoY (non-seasonally adjusted: NSA) in October, which should translate into a bounce on a MoM basis (seasonally adjusted: SA)

- Recent announcements from corporates suggest that home-improvement activity (correlated to existing home sales) is still booming

Median home price rose 15.5% from last year to $313,000, an all-time high, according to NAR.

“It’s quite amazing, and certainly surprising me,” Lawrence Yun, NAR’s chief economist, said on a call with reporters.

“It’s quite remarkable given that we’re still in the midst of the pandemic and the high unemployment rate.”

Finally, we note that while homebuilder sentiment is at record highs (but building permits stumbled?), homebuyer sentiment remains low and has rolled over…

Source: Bloomberg

And don’t expect The Fed to come to the rescue with ‘rate-cuts’ anytime soon.

https://www.zerohedge.com/personal-finance/existing-home-sales-soar-highest-15-years

November 19, 2020

Existing Home Sales Surge

Existing Home Sales Soar To Highest In 15 Years

by Tyler Durden Thu, 11/19/2020 – 10:07

Existing home sales bucked the trend in September (rising to highest since May 2006 as new- and pending-home sales slipped) and analysts expect it too catch down a little in October, but yet again, it surprised to the upside, surging 4.3% MoM (vs a 1.1% MoM expected drop), and September’s jump was revised higher to a 9.9% spike…

This surprise rise has pushed the YoY jump in sales to 26.6% – the biggest spike since Nov 2009

Source: Bloomberg

This is the highest existing home sales print since November 2005…

Source: Bloomberg

Christophe Barraud explains why the number was so ‘surprisingly’ good:

- Buyers continued to benefit from favorable market conditions in October with mortgage rates still close to the lowest level on record

- Local/state reports confirm that sales kept rising by more than 20% YoY (non-seasonally adjusted: NSA) in October, which should translate into a bounce on a MoM basis (seasonally adjusted: SA)

- Recent announcements from corporates suggest that home-improvement activity (correlated to existing home sales) is still booming

Median home price rose 15.5% from last year to $313,000, an all-time high, according to NAR.

“It’s quite amazing, and certainly surprising me,” Lawrence Yun, NAR’s chief economist, said on a call with reporters.

“It’s quite remarkable given that we’re still in the midst of the pandemic and the high unemployment rate.”

Finally, we note that while homebuilder sentiment is at record highs (but building permits stumbled?), homebuyer sentiment remains low and has rolled over…

Source: Bloomberg

And don’t expect The Fed to come to the rescue with ‘rate-cuts’ anytime soon.

https://www.zerohedge.com/personal-finance/existing-home-sales-soar-highest-15-years

November 13, 2020

Epoxy Comments from Huntsman Investors’ Call

Peter Huntsman

Turning to Slide #4, our Advanced Materials business reported adjusted EBITDA of $25 million, down from $51 million in last year’s third quarter. The decline in adjusted EBITDA was primarily a result of revenues being down in aerospace by 68% year-over-year. The aerospace market remains depressed. While we believe it has bottomed in the third quarter, we do not expect it to begin to start to recover until the supply chain fully destock and adjust to expected much lower production build rates over the next couple of years. Our Advanced Materials segment should be viewed in two segments.

Looking beyond the depressed aerospace segment, there is a much better recovery story within our other formulated Advanced Materials business. Our Specialties businesses excluding aerospace improved throughout the third quarter with revenues down only 15% and EBITDA down 21%. This includes our Indian do it yourself, DIY business which was heavily locked down during the first half of the quarter. Our sales into the power, electronics, transportation, industrial markets strengthened throughout the quarter, as our EBITDA improved by 50% from the beginning to the end of the quarter and this momentum has carried into October.

The integration of our recent acquisition of CVC Thermoset is on track and delivered a modest contribution to EBITDA during the third quarter of about $2 million. As we stated in our last earnings call, the results of this acquisition are being negatively impacted by a needed inventory adjustment of about $5 million in the second half of this year. With cost synergies expected from integration efforts underway, we expect 2021 EBITDA related to this acquisition to be close to 2019 levels despite approximately 15% of the business being exposed to the aerospace market. We remain confident that we will achieve a $15 million run-rate synergies by the end of 2021. Would expect to exceed this target as we move through 2022 and beyond as we anticipate identifying additional cost savings and commercial opportunities.

Looking towards the fourth quarter, we would expect our non-aerospace specialty businesses EBITDA to be close to the same levels as prior year and for CVC to make a modest contribution. We’re on the back of continued weakness in our aerospace business and the sale of our Indian DIY adhesives business, we expect the Advanced Materials segment EBITDA to be slightly lower than the third quarter. Just to be clear on a pro forma basis, meaning if we were to include the DIY business in our estimates for the fourth quarter, our adjusted EBITDA for the Advanced Materials group would likely be modestly higher in the fourth quarter.

Our Performance Amines volumes, which make up about half of the Performance Products segment volumes declined by approximately 6% in the quarter versus the prior year, primarily due to volumes in the gas treating. Yet the related EBITDA increased approximately 11% from lower costs and a favorable product mix. The strength in Performance Amines comes as a result of specialty products used in composites going into the Chinese wind market, coatings and adhesives going into construction markets and our low emission catalysts that provide VOC free solutions going into markets such as installation, betting and automotive.

In May, we closed on the CVC Thermoset Specialties business as we sort to further expand and diversify our Advanced Materials division. While we’re disappointed to see the slowdown of our commercial aerospace business due to COVID-19 pandemic, the CVC acquisition will help fill the void created from this temporary loss in sales and EBITDA. As this valuable aerospace business begins to recover over the next year or two, it will be additive to what we are building with the CVC acquisition and other ends of our Advanced Materials division. We are also well on track to deliver the previously announced $15 million of synergies.

In July we announced our initiative to realign our cost and streamline our operations. At the time, we outlined $100 million of savings from these efforts, which includes acquisition synergies. We are now targeting approximately $112 million and I would expect this number may well grow. We expect some $20 million to be realized by end of this year and we should be running in excess of $100 million by the end of next year.

Last night, we announced the sale of our Indian based DIY business to Pidilite in an all-cash transaction valued at potentially $285 million. Full transaction value represents a multiple of 15x our 2019 EBITDA. Huntsman will receive $157 million in cash at closing, which is expected to take place within the next week. Then we will have the potential to receive up to an additional $28 million in cash within 18 months depending upon achieving certain revenue milestones that approximate 2019 level.

We built this business from nothing over these past 15 years and have taken this business about as far as we can without material expansion or investment. Pidilite is a respected adhesives business based in India and is well-positioned to now take this business to the next level. This is a win-win transaction to unlock significant value for Huntsman that we will redeploy in the near term to further reshape our Advanced Materials business. Win a multiple of our sale at the beginning of the year and our — of our intermediates business and now this India-based DIY business. These two divestitures should demonstrate the quality of our businesses and divisions. We will continue to assess other assets in our portfolio, but given our balance sheet and global footprint, one should expect more acquisitions than divestitures.

John Roberts

Thank you. Peter, do you have any thoughts on how quickly Performance Products in the non-aerospace part of epoxies can get back to pre-COVID levels?

Peter Huntsman

Yes, I think that as we look at it, I think by the early part of next year, I think that if present trends continue — and again I want to emphasize that if you are asking me that question 10 days ago versus today, kind of pre-European lockdown versus post-European lockdown, there’s just a lot of noise and static in fourth quarter and I’m generally a pretty optimistic person, so I mean, take that for what it’s worth.

But as we look at the non-aerospace segment of Advanced Materials, I think that you’re — we’re somewhere around to 90% of where we were. Today, we’re somewhere about 90% of where we were a year ago. And I would expect that to be back on year-over-year, non-COIVD sort of volumes by the early part of next year, again assuming that we continue recovery, not that we fall back down.

The aerospace segment of that. Just again, looking at what’s been said by Boeing and by others, I think that you’re simply looking — I’m looking at kind of a two-phased approach. One is, how long does it take us to get back to a normal — a post-COVID normalized build rate, if that makes any sense, because right now I think that Boeing essentially is going to stop production, just clear the inventory of planes that are sitting around Victorville and all over the place waiting for customers to take those.

Once the existing inventory of planes clear out, then you go to what I would call that new normal, which is a greatly reduced production rate. And then probably a couple of years down the road, you kind of get back to a post — a pre-COVID, sort of a level of fly again. And what that world looks like and which planes are actually put back into the fleet and so forth, time will tell.

But the non-aero business of Advanced Materials continues to do well, continues to grow well, and I think we’ll have a lot of applications as we look to that excess capacity going elsewhere.

November 13, 2020

Epoxy Comments from Huntsman Investors’ Call

Peter Huntsman

Turning to Slide #4, our Advanced Materials business reported adjusted EBITDA of $25 million, down from $51 million in last year’s third quarter. The decline in adjusted EBITDA was primarily a result of revenues being down in aerospace by 68% year-over-year. The aerospace market remains depressed. While we believe it has bottomed in the third quarter, we do not expect it to begin to start to recover until the supply chain fully destock and adjust to expected much lower production build rates over the next couple of years. Our Advanced Materials segment should be viewed in two segments.

Looking beyond the depressed aerospace segment, there is a much better recovery story within our other formulated Advanced Materials business. Our Specialties businesses excluding aerospace improved throughout the third quarter with revenues down only 15% and EBITDA down 21%. This includes our Indian do it yourself, DIY business which was heavily locked down during the first half of the quarter. Our sales into the power, electronics, transportation, industrial markets strengthened throughout the quarter, as our EBITDA improved by 50% from the beginning to the end of the quarter and this momentum has carried into October.

The integration of our recent acquisition of CVC Thermoset is on track and delivered a modest contribution to EBITDA during the third quarter of about $2 million. As we stated in our last earnings call, the results of this acquisition are being negatively impacted by a needed inventory adjustment of about $5 million in the second half of this year. With cost synergies expected from integration efforts underway, we expect 2021 EBITDA related to this acquisition to be close to 2019 levels despite approximately 15% of the business being exposed to the aerospace market. We remain confident that we will achieve a $15 million run-rate synergies by the end of 2021. Would expect to exceed this target as we move through 2022 and beyond as we anticipate identifying additional cost savings and commercial opportunities.

Looking towards the fourth quarter, we would expect our non-aerospace specialty businesses EBITDA to be close to the same levels as prior year and for CVC to make a modest contribution. We’re on the back of continued weakness in our aerospace business and the sale of our Indian DIY adhesives business, we expect the Advanced Materials segment EBITDA to be slightly lower than the third quarter. Just to be clear on a pro forma basis, meaning if we were to include the DIY business in our estimates for the fourth quarter, our adjusted EBITDA for the Advanced Materials group would likely be modestly higher in the fourth quarter.

Our Performance Amines volumes, which make up about half of the Performance Products segment volumes declined by approximately 6% in the quarter versus the prior year, primarily due to volumes in the gas treating. Yet the related EBITDA increased approximately 11% from lower costs and a favorable product mix. The strength in Performance Amines comes as a result of specialty products used in composites going into the Chinese wind market, coatings and adhesives going into construction markets and our low emission catalysts that provide VOC free solutions going into markets such as installation, betting and automotive.

In May, we closed on the CVC Thermoset Specialties business as we sort to further expand and diversify our Advanced Materials division. While we’re disappointed to see the slowdown of our commercial aerospace business due to COVID-19 pandemic, the CVC acquisition will help fill the void created from this temporary loss in sales and EBITDA. As this valuable aerospace business begins to recover over the next year or two, it will be additive to what we are building with the CVC acquisition and other ends of our Advanced Materials division. We are also well on track to deliver the previously announced $15 million of synergies.

In July we announced our initiative to realign our cost and streamline our operations. At the time, we outlined $100 million of savings from these efforts, which includes acquisition synergies. We are now targeting approximately $112 million and I would expect this number may well grow. We expect some $20 million to be realized by end of this year and we should be running in excess of $100 million by the end of next year.

Last night, we announced the sale of our Indian based DIY business to Pidilite in an all-cash transaction valued at potentially $285 million. Full transaction value represents a multiple of 15x our 2019 EBITDA. Huntsman will receive $157 million in cash at closing, which is expected to take place within the next week. Then we will have the potential to receive up to an additional $28 million in cash within 18 months depending upon achieving certain revenue milestones that approximate 2019 level.

We built this business from nothing over these past 15 years and have taken this business about as far as we can without material expansion or investment. Pidilite is a respected adhesives business based in India and is well-positioned to now take this business to the next level. This is a win-win transaction to unlock significant value for Huntsman that we will redeploy in the near term to further reshape our Advanced Materials business. Win a multiple of our sale at the beginning of the year and our — of our intermediates business and now this India-based DIY business. These two divestitures should demonstrate the quality of our businesses and divisions. We will continue to assess other assets in our portfolio, but given our balance sheet and global footprint, one should expect more acquisitions than divestitures.

John Roberts

Thank you. Peter, do you have any thoughts on how quickly Performance Products in the non-aerospace part of epoxies can get back to pre-COVID levels?

Peter Huntsman

Yes, I think that as we look at it, I think by the early part of next year, I think that if present trends continue — and again I want to emphasize that if you are asking me that question 10 days ago versus today, kind of pre-European lockdown versus post-European lockdown, there’s just a lot of noise and static in fourth quarter and I’m generally a pretty optimistic person, so I mean, take that for what it’s worth.

But as we look at the non-aerospace segment of Advanced Materials, I think that you’re — we’re somewhere around to 90% of where we were. Today, we’re somewhere about 90% of where we were a year ago. And I would expect that to be back on year-over-year, non-COIVD sort of volumes by the early part of next year, again assuming that we continue recovery, not that we fall back down.

The aerospace segment of that. Just again, looking at what’s been said by Boeing and by others, I think that you’re simply looking — I’m looking at kind of a two-phased approach. One is, how long does it take us to get back to a normal — a post-COVID normalized build rate, if that makes any sense, because right now I think that Boeing essentially is going to stop production, just clear the inventory of planes that are sitting around Victorville and all over the place waiting for customers to take those.

Once the existing inventory of planes clear out, then you go to what I would call that new normal, which is a greatly reduced production rate. And then probably a couple of years down the road, you kind of get back to a post — a pre-COVID, sort of a level of fly again. And what that world looks like and which planes are actually put back into the fleet and so forth, time will tell.

But the non-aero business of Advanced Materials continues to do well, continues to grow well, and I think we’ll have a lot of applications as we look to that excess capacity going elsewhere.

November 11, 2020

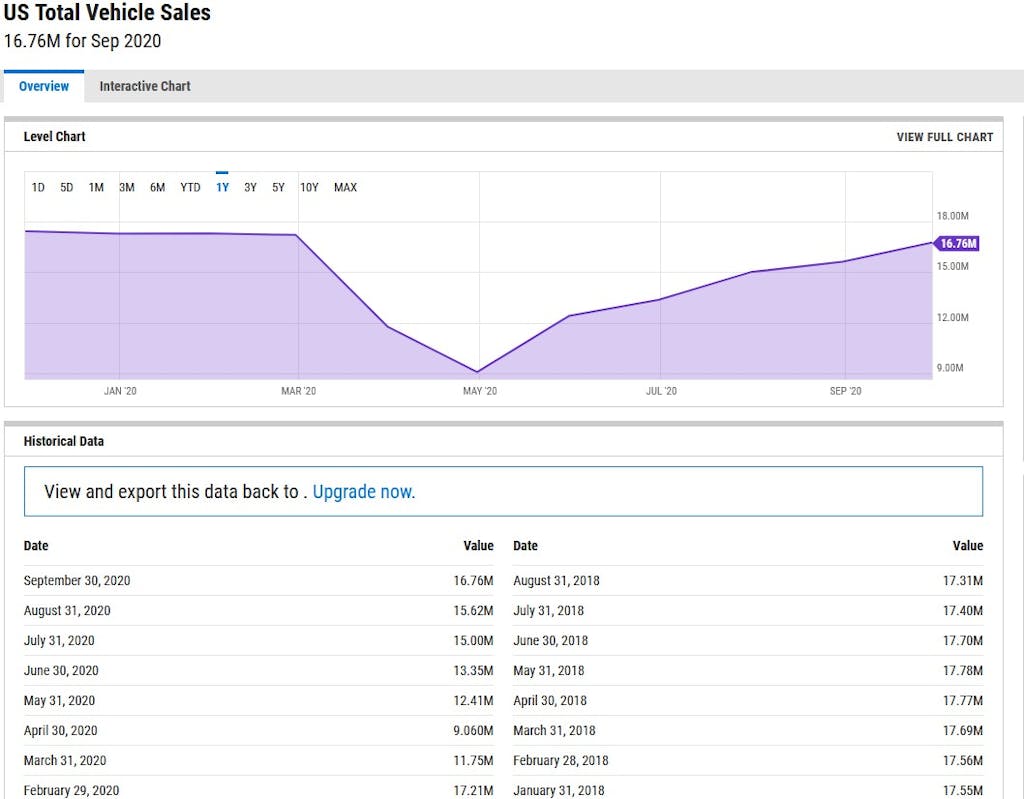

Auto Sales Back to Close to 17MM/yr Rate in Sept