Epoxy

March 21, 2022

Inventories

Inventory growth hits all-time high as warehouse prices soar in latest LMI

Zach Strickland, FW Market Expert & Market Analyst Follow on Twitter Saturday, March 19, 2022 3 minutes read Listen to this article 0:00 / 4:28 BeyondWords

Chart of the Week: Logistics Managers’ Index – Inventory Levels, Inventory Costs, SONAR: LMI.INVL, LMI.INVC

The February Logistics Managers’ Index (LMI), which measures directional changes in transportation and warehousing activity, showed inventories growing at the fastest pace since the index was created in 2016 with a monthly value of 80.16. With companies finally making significant headway in restocking, orders may begin to slow, which may allow for supply chains to stabilize.

Companies have been struggling to replenish depleted inventory levels for the past 18 months thanks in large part to unprecedented surges in demand and production disruptions resulting from the pandemic. Inventory-to-sales ratios have been averaging about 12% lower than pre-pandemic levels over the past year with no sign of improvement, according to the Census Bureau.

After about a month of sheltering at home in April 2020, consumers got busy ordering items online and revamping their houses. This activity was completely unexpected as many companies stopped ordering goods due to the uncertainty of what was to happen next. The result was a rapid depletion of existing inventory that pushed truckload tender volumes to record levels.

The Outbound Tender Volume Index (OTVI), which measures total truckload tenders from shippers requesting capacity, increased by 70% from May to September as inventory levels plummeted.

With inventories beginning to recover at a much faster pace in January and February, trucking demand appears to be showing early signs of waning in March with the OTVI falling 7.5% through the first three weeks of March — hitting its lowest non-holiday point since February 2021.

On this week’s Freightonomics episode, Zac Rogers, a main contributor to the LMI from Colorado State University, discussed how many large retailers like Amazon and Walmart are holding inventory upstream in the supply chain as demand has waned slightly from peak levels.

It is no secret that inflation is thought to be the primary culprit of eroding demand as the CPI is up nearly 8% over the past year with gas (up 38%) and food being heavy contributors. Consumer debt for credit cards has also rebounded as savings rates have dropped, indicating consumers may not have the discretionary income for goods that they had in 2021.

Rogers states that some demand-side erosion is probably a good thing as the current level of chaos is unsustainable and unhealthy in the long run. The Fed increased interest rates a quarter point this week because it also knows this is true. The main concern is over the “bullwhip effect” to the economy as prices inflate too rapidly leading to a sudden drop in demand — potentially creating a recession.

There is no sign of a recession at this point as there is still plenty of growth arising from a lagging industrial sector, a white-hot construction environment and consumers still spending well beyond pre-pandemic levels on retail goods. Services have also made a comeback.

Rogers used the analogy that a 65-degree day in June feels a lot cooler than a 65-degree day in February, basically stating any cooling of an overheated environment feels substantial even though it is still overheated.

The logistics environment remains unstable regardless of the inventory build. Warehouse vacancies are at or near all-time lows, according to ProLogis, while imports are still flowing into the country. These goods have to go somewhere and inventory and supply chain managers still have a long way to go before they can relax.

About the Chart of the Week

The FreightWaves Chart of the Week is a chart selection from SONAR that provides an interesting data point to describe the state of the freight markets. A chart is chosen from thousands of potential charts on SONAR to help participants visualize the freight market in real time. Each week a Market Expert will post a chart, along with commentary, live on the front page. After that, the Chart of the Week will be archived on FreightWaves.com for future reference.

SONAR aggregates data from hundreds of sources, presenting the data in charts and maps and providing commentary on what freight market experts want to know about the industry in real time.

The FreightWaves data science and product teams are releasing new datasets each week and enhancing the client experience.

To request a SONAR demo, click here.

March 17, 2022

Housing Starts Surge

US Housing Starts Surged To 16 Year High In Feb

by Tyler DurdenThursday, Mar 17, 2022 – 08:35 AM

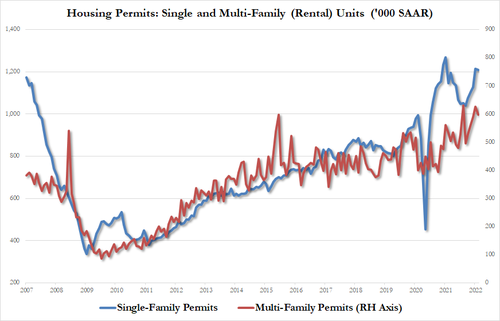

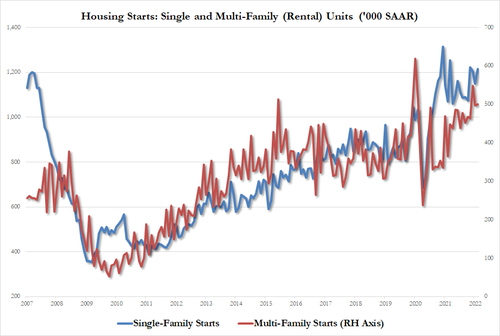

After January’s surprise drop in Housing Starts MoM, analysts expected February to see a rebound and vice verse, following Jan’s rise, February was expected to see Permits drop MoM, and that is what we saw with Starts surging 6.8% MoM (better than the +3.8% exp) and Permits dropped 1.9% MoM (better than the -2.4% expected).

Source: Bloomberg

Single-family permits were down -0.5% but multi-family permits tumbled 4.5% MoM…

The surge in Starts was driven by a 5.7% MoM spike in Single-family (from 1.150MM to 1.215MM). Multi-family starts rose 0.8% from 497K to 501K

This pushed Housing Starts to their highest SAAR since June 2006 as Permits pulls back from similar highs…

Source: Bloomberg

This surge in starts comes as homebuilder sentiment for sales six-months ahead tumbles and mortgage rates soar.

https://www.zerohedge.com/personal-finance/us-housing-starts-surged-16-year-high-feb

March 17, 2022

Housing Starts Surge

US Housing Starts Surged To 16 Year High In Feb

by Tyler DurdenThursday, Mar 17, 2022 – 08:35 AM

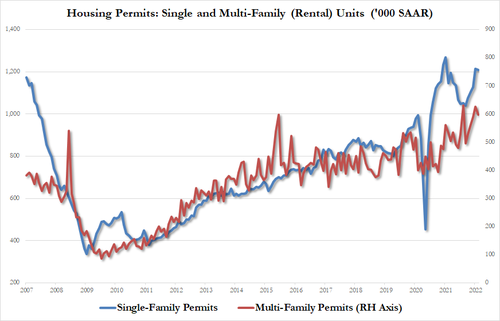

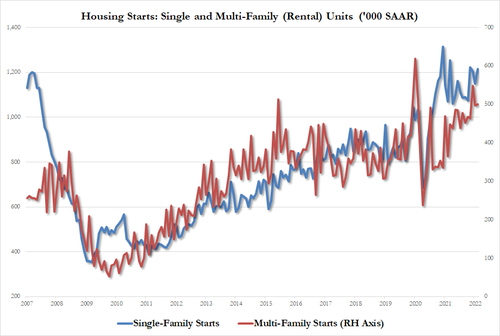

After January’s surprise drop in Housing Starts MoM, analysts expected February to see a rebound and vice verse, following Jan’s rise, February was expected to see Permits drop MoM, and that is what we saw with Starts surging 6.8% MoM (better than the +3.8% exp) and Permits dropped 1.9% MoM (better than the -2.4% expected).

Source: Bloomberg

Single-family permits were down -0.5% but multi-family permits tumbled 4.5% MoM…

The surge in Starts was driven by a 5.7% MoM spike in Single-family (from 1.150MM to 1.215MM). Multi-family starts rose 0.8% from 497K to 501K

This pushed Housing Starts to their highest SAAR since June 2006 as Permits pulls back from similar highs…

Source: Bloomberg

This surge in starts comes as homebuilder sentiment for sales six-months ahead tumbles and mortgage rates soar.

https://www.zerohedge.com/personal-finance/us-housing-starts-surged-16-year-high-feb

March 16, 2022

Huntsman Letter to Investors

Huntsman Chairman and CEO Issues Open Letter to Shareholders

Download as PDF March 16, 2022 7:00am EDT

Emphasizes successful execution of strategic plan, historic results and 5-Year TSR of 91%1, substantial progress achieving 2022-2024 targets

Highlights fully refreshed and fit for purpose Board holding management accountable

Urges Shareholders to Vote “FOR ALL” of Huntsman’s Highly Qualified Director Nominees on the WHITE Proxy Card

THE WOODLANDS, Texas, March 16, 2022 /PRNewswire/ — Peter R. Huntsman, Chairman of the Board of Directors of Huntsman Corporation (NYSE: HUN), issued the following letter to all Huntsman’s shareholders in advance of its upcoming 2022 Annual Meeting of Stockholders, scheduled to be held on March 25, 2022:

Dear Fellow Shareholders,

We’re less than 10 days away from our annual meeting and, like many of you, I remain puzzled as to why we find ourselves in a proxy fight. Glass Lewis wondered about that too when they recommended in favor of all 10 of Huntsman’s nominees earlier in the week: “Huntsman would not appear to be a logical target of a proxy contest. The diversified chemicals company had its best year ever in 2021 following a number of significant changes to its product portfolio in recent years, its stock price has outperformed peers and the broader market in recent periods, and eight of the Company’s 10 directors have joined the board since 2018, including three earlier this year.”2

Unfortunately, a proxy fight is where we are. Starboard and its CEO, Jeff Smith, want to replace four of your directors with their own nominees, jeopardizing the critical diversity we’ve worked hard to create and which we know your fellow shareholders value. But I can confidently say that your current Board has the superior skillsets required to effectively oversee our sustainable long-term growth and I wanted to explain to all of you why you should vote to re-elect them in my own words.

First, Huntsman is just coming off a record year in 2021 and our success is delivering value directly to you. Our stock is trading near its all-time high and it’s substantially higher than it was on our Investor Day on November 9, 2021, beating our next best peer by double digits. More critically, our 1-year, 3-year and 5-year TSR of 36%, 76% and 91%3 respectively, exceed our peers as well as the S&P 500 by a long margin over the same time period.

I don’t believe we need to replace any members of a Board that is already fully refreshed and fit for purpose under these circumstances and doing so puts the value we’ve created for you at risk and threatens to kill the momentum we’ve been developing.

Over the past few years, the Board has taken meaningful actions to oversee our ‘value over volume’ strategy, transform our balance sheet, and enhance our governance through an extensive refreshment plan. As a result of all these actions, 2021 was the very best year in our history with the strongest profit and margin performance we’ve ever achieved with our current portfolio. I’m incredibly proud that we’ve successfully transformed Huntsman into a downstream and differentiated chemical business and I am confident that we’re perfectly positioned – especially under the oversight of our fully refreshed Board with its well-constructed mix of expertise, experience, perspective and diversity – to take the Company forward.

Second, Starboard has been criticizing us for failing to meet the performance targets we set in 2014, 2016 and 2018 and we’ve tried to explain why those criticisms were not well founded. Here, I want to focus you on our future. I want to remind you of our 2021 Investor Day targets and tell you how far along the path to meeting them we’ve already come.

The record results we delivered in 2021 were used as the baseline for a robust set of specific operational and financial goals we announced at our November 2021 Investor Day. Those goals focus on key financial metrics that long-term shareholders care most about – Adjusted EBITDA margin, cost optimization, and free cash flow – and the results coming out of our four divisions on each of these metrics to date are excellent.

As you know, after reporting a record third quarter last October, we reported a record fourth quarter and record full year 2021 earnings on February 15, noting that our adjusted EBITDA for Q4 was $349 million, a 45% increase from prior year, that free cash flow from continuing operations was just under $700 million, and that we had demonstrated sustainable growth and margin improvement. We also provided positive guidance for Q1 2022 but just three weeks later, on March 7, we had to increase that guidance and reported that we were now expecting adjusted EBITDA in the first quarter “would be at or even above the high end of the previously communicated range of $350 million to $380 million, and that adjusted EBITDA margin for the first quarter was trending to 17% even in the face of significant energy cost escalation in Europe.”

Moreover, by the end of 2021, each of our four divisions was already well on their way to meeting the adjusted EBITDA margin targets we said they would reach by 2024 (one has already met its 2024 target) and each division had also identified specific improvements to ensure those target were timely met. Half of the $240 million in identified cost savings and synergies has been delivered ahead of schedule and we have clear line of sight to a total of 300-350 basis points of improvement, including execution of in progress investments aligned with upgrading our polyurethanes portfolio, as well as targeted projects into the electric vehicle, energy-saving insulation and semiconductor markets. The quantifiable progress we’ve made to date, shown below, demonstrates that we are on the right path to delivering you the value we promised.

Finally, Starboard continues to criticize the Board for not holding me and the rest of the management team accountable for the Company’s performance in the past and I wanted to offer a few observations about that.

As I think about the integral role our Board is playing in Huntsman’s continued transformation, I note that the independent directors who led (and now lead) our Nominating & Corporate Governance Committee have just completed an extensive board refreshment plan that began when I became Chairman at the end of 2017. I’m incredibly proud of the hard work they’ve done that has resulted in the appointment of eight new independent directors since 2018, including four female directors and two racially diverse directors, and the appointment of a new Lead Independent Director. Failure to give us credit for this refreshment is wrong.

The Board also changed each of the statutory committee chairs – all of whom are now highly-qualified women, an important sign of Huntsman’s commitment to diversity – and announced the retirement of four longer-tenured directors as part of the purposeful transition of skillsets and expertise intended to align with our transformed portfolio and go-forward differentiated and downstream strategy. Our fully refreshed Board is led by independent directors with highly relevant experience at global institutions and they possess the right mix of expertise, experience and diversity to oversee Huntsman’s continued transformation.

I very much believe that replacing any of our directors with a Starboard nominee would deprive us of experience and expertise essential to effectively overseeing our sustainable long-term growth and driving shareholder value, including differentiated chemicals and industrials experience, R&D and customer-focused innovation, and portfolio management expertise.

Our independent directors also take their role in ensuring the accountability of management for the Company’s performance seriously. Over the last few years, the Board has dramatically shifted compensation towards at-risk elements, including favoring performance share units for equity incentives. And when I approached the Board with our ambitious Investor Day performance targets, they agreed that alignment and accountability were keys to ensuring shareholder confidence in our delivery on those targets. The Board then implemented a new, multi-year compensation program that ensures the very direct alignment of these robust targets with our global management team’s financial interests. Specifically, the Board has tied 100% of the cash bonuses and 70% of the stock grants for our top 80 managers in 2022 and 2023 to achieving those specific Adjusted EBITDA margin, cost optimization, and free cash flow goals.

I have no doubt that our refreshed Board will hold me and your management team accountable for our performance and they are perfectly aligned with our transformed business portfolio, our going forward strategy and our demonstrated positive trajectory. Glass Lewis agreed with me and I think you should too. We have a formula for continued success and, respectfully, I’d ask you not to change it:

Nor is there any doubt that your Board is delivering real value to you right now and it is primed to continue delivering value as they oversee the Company’s execution. As Glass Lewis concluded in its recent report, there is just no reason to change course:

Huntsman’s recent financial and stock price performance indicate the Company is on the right track and, ultimately, we fail to see a compelling case that further changes beyond those the board has already made are either warranted at this time or likely to result in incremental improvement. Further, the Dissident’s campaign appears to be backwards-looking in several respects, in our view, and we believe it lacks new ideas or a detailed plan to improve Huntsman’s performance going forward. Considering there is little if any disagreement between the Company and the Dissident on Huntsman’s strategy and objectives – only execution and accountability – the matter seems to boil down to which nominees are better qualified and situated to oversee the Company’s management and direction. Although Starboard seeks to replace directors who it believes lack true independence or qualifications for the board, not only do we find insufficient cause to remove current directors, we also aren’t convinced that Starboard’s nominees have particularly relevant, timely or incremental experience to add to the board at this time.4

Thank you for taking some time to read this note. I would have preferred to have spoken with each and every one of you face to face, but that just wasn’t possible with only a week or so before your votes have to be in. On that point, I would like to remind you that every vote is important no matter how many shares it represents, and I would also urge you to discard any blue proxy materials you may have received and only vote using the WHITE proxy card.

If you need help voting your shares, you can call toll-free our proxy solicitor, Innisfree M&A Incorporated, at (877) 750-0926, and you can find additional relevant material regarding the Board’s voting recommendations for the 2022 Annual Meeting online at voteforhuntsman.com.

Thank you again,

Peter R. Huntsman

March 16, 2022

Huntsman Letter to Investors

Huntsman Chairman and CEO Issues Open Letter to Shareholders

Download as PDF March 16, 2022 7:00am EDT

Emphasizes successful execution of strategic plan, historic results and 5-Year TSR of 91%1, substantial progress achieving 2022-2024 targets

Highlights fully refreshed and fit for purpose Board holding management accountable

Urges Shareholders to Vote “FOR ALL” of Huntsman’s Highly Qualified Director Nominees on the WHITE Proxy Card

THE WOODLANDS, Texas, March 16, 2022 /PRNewswire/ — Peter R. Huntsman, Chairman of the Board of Directors of Huntsman Corporation (NYSE: HUN), issued the following letter to all Huntsman’s shareholders in advance of its upcoming 2022 Annual Meeting of Stockholders, scheduled to be held on March 25, 2022:

Dear Fellow Shareholders,

We’re less than 10 days away from our annual meeting and, like many of you, I remain puzzled as to why we find ourselves in a proxy fight. Glass Lewis wondered about that too when they recommended in favor of all 10 of Huntsman’s nominees earlier in the week: “Huntsman would not appear to be a logical target of a proxy contest. The diversified chemicals company had its best year ever in 2021 following a number of significant changes to its product portfolio in recent years, its stock price has outperformed peers and the broader market in recent periods, and eight of the Company’s 10 directors have joined the board since 2018, including three earlier this year.”2

Unfortunately, a proxy fight is where we are. Starboard and its CEO, Jeff Smith, want to replace four of your directors with their own nominees, jeopardizing the critical diversity we’ve worked hard to create and which we know your fellow shareholders value. But I can confidently say that your current Board has the superior skillsets required to effectively oversee our sustainable long-term growth and I wanted to explain to all of you why you should vote to re-elect them in my own words.

First, Huntsman is just coming off a record year in 2021 and our success is delivering value directly to you. Our stock is trading near its all-time high and it’s substantially higher than it was on our Investor Day on November 9, 2021, beating our next best peer by double digits. More critically, our 1-year, 3-year and 5-year TSR of 36%, 76% and 91%3 respectively, exceed our peers as well as the S&P 500 by a long margin over the same time period.

I don’t believe we need to replace any members of a Board that is already fully refreshed and fit for purpose under these circumstances and doing so puts the value we’ve created for you at risk and threatens to kill the momentum we’ve been developing.

Over the past few years, the Board has taken meaningful actions to oversee our ‘value over volume’ strategy, transform our balance sheet, and enhance our governance through an extensive refreshment plan. As a result of all these actions, 2021 was the very best year in our history with the strongest profit and margin performance we’ve ever achieved with our current portfolio. I’m incredibly proud that we’ve successfully transformed Huntsman into a downstream and differentiated chemical business and I am confident that we’re perfectly positioned – especially under the oversight of our fully refreshed Board with its well-constructed mix of expertise, experience, perspective and diversity – to take the Company forward.

Second, Starboard has been criticizing us for failing to meet the performance targets we set in 2014, 2016 and 2018 and we’ve tried to explain why those criticisms were not well founded. Here, I want to focus you on our future. I want to remind you of our 2021 Investor Day targets and tell you how far along the path to meeting them we’ve already come.

The record results we delivered in 2021 were used as the baseline for a robust set of specific operational and financial goals we announced at our November 2021 Investor Day. Those goals focus on key financial metrics that long-term shareholders care most about – Adjusted EBITDA margin, cost optimization, and free cash flow – and the results coming out of our four divisions on each of these metrics to date are excellent.

As you know, after reporting a record third quarter last October, we reported a record fourth quarter and record full year 2021 earnings on February 15, noting that our adjusted EBITDA for Q4 was $349 million, a 45% increase from prior year, that free cash flow from continuing operations was just under $700 million, and that we had demonstrated sustainable growth and margin improvement. We also provided positive guidance for Q1 2022 but just three weeks later, on March 7, we had to increase that guidance and reported that we were now expecting adjusted EBITDA in the first quarter “would be at or even above the high end of the previously communicated range of $350 million to $380 million, and that adjusted EBITDA margin for the first quarter was trending to 17% even in the face of significant energy cost escalation in Europe.”

Moreover, by the end of 2021, each of our four divisions was already well on their way to meeting the adjusted EBITDA margin targets we said they would reach by 2024 (one has already met its 2024 target) and each division had also identified specific improvements to ensure those target were timely met. Half of the $240 million in identified cost savings and synergies has been delivered ahead of schedule and we have clear line of sight to a total of 300-350 basis points of improvement, including execution of in progress investments aligned with upgrading our polyurethanes portfolio, as well as targeted projects into the electric vehicle, energy-saving insulation and semiconductor markets. The quantifiable progress we’ve made to date, shown below, demonstrates that we are on the right path to delivering you the value we promised.

Finally, Starboard continues to criticize the Board for not holding me and the rest of the management team accountable for the Company’s performance in the past and I wanted to offer a few observations about that.

As I think about the integral role our Board is playing in Huntsman’s continued transformation, I note that the independent directors who led (and now lead) our Nominating & Corporate Governance Committee have just completed an extensive board refreshment plan that began when I became Chairman at the end of 2017. I’m incredibly proud of the hard work they’ve done that has resulted in the appointment of eight new independent directors since 2018, including four female directors and two racially diverse directors, and the appointment of a new Lead Independent Director. Failure to give us credit for this refreshment is wrong.

The Board also changed each of the statutory committee chairs – all of whom are now highly-qualified women, an important sign of Huntsman’s commitment to diversity – and announced the retirement of four longer-tenured directors as part of the purposeful transition of skillsets and expertise intended to align with our transformed portfolio and go-forward differentiated and downstream strategy. Our fully refreshed Board is led by independent directors with highly relevant experience at global institutions and they possess the right mix of expertise, experience and diversity to oversee Huntsman’s continued transformation.

I very much believe that replacing any of our directors with a Starboard nominee would deprive us of experience and expertise essential to effectively overseeing our sustainable long-term growth and driving shareholder value, including differentiated chemicals and industrials experience, R&D and customer-focused innovation, and portfolio management expertise.

Our independent directors also take their role in ensuring the accountability of management for the Company’s performance seriously. Over the last few years, the Board has dramatically shifted compensation towards at-risk elements, including favoring performance share units for equity incentives. And when I approached the Board with our ambitious Investor Day performance targets, they agreed that alignment and accountability were keys to ensuring shareholder confidence in our delivery on those targets. The Board then implemented a new, multi-year compensation program that ensures the very direct alignment of these robust targets with our global management team’s financial interests. Specifically, the Board has tied 100% of the cash bonuses and 70% of the stock grants for our top 80 managers in 2022 and 2023 to achieving those specific Adjusted EBITDA margin, cost optimization, and free cash flow goals.

I have no doubt that our refreshed Board will hold me and your management team accountable for our performance and they are perfectly aligned with our transformed business portfolio, our going forward strategy and our demonstrated positive trajectory. Glass Lewis agreed with me and I think you should too. We have a formula for continued success and, respectfully, I’d ask you not to change it:

Nor is there any doubt that your Board is delivering real value to you right now and it is primed to continue delivering value as they oversee the Company’s execution. As Glass Lewis concluded in its recent report, there is just no reason to change course:

Huntsman’s recent financial and stock price performance indicate the Company is on the right track and, ultimately, we fail to see a compelling case that further changes beyond those the board has already made are either warranted at this time or likely to result in incremental improvement. Further, the Dissident’s campaign appears to be backwards-looking in several respects, in our view, and we believe it lacks new ideas or a detailed plan to improve Huntsman’s performance going forward. Considering there is little if any disagreement between the Company and the Dissident on Huntsman’s strategy and objectives – only execution and accountability – the matter seems to boil down to which nominees are better qualified and situated to oversee the Company’s management and direction. Although Starboard seeks to replace directors who it believes lack true independence or qualifications for the board, not only do we find insufficient cause to remove current directors, we also aren’t convinced that Starboard’s nominees have particularly relevant, timely or incremental experience to add to the board at this time.4

Thank you for taking some time to read this note. I would have preferred to have spoken with each and every one of you face to face, but that just wasn’t possible with only a week or so before your votes have to be in. On that point, I would like to remind you that every vote is important no matter how many shares it represents, and I would also urge you to discard any blue proxy materials you may have received and only vote using the WHITE proxy card.

If you need help voting your shares, you can call toll-free our proxy solicitor, Innisfree M&A Incorporated, at (877) 750-0926, and you can find additional relevant material regarding the Board’s voting recommendations for the 2022 Annual Meeting online at voteforhuntsman.com.

Thank you again,

Peter R. Huntsman