Epoxy

December 8, 2021

Saint-Gobain Acquisition of GCP

Saint-Gobain to buy construction chemical maker GCP for $2.3 billion

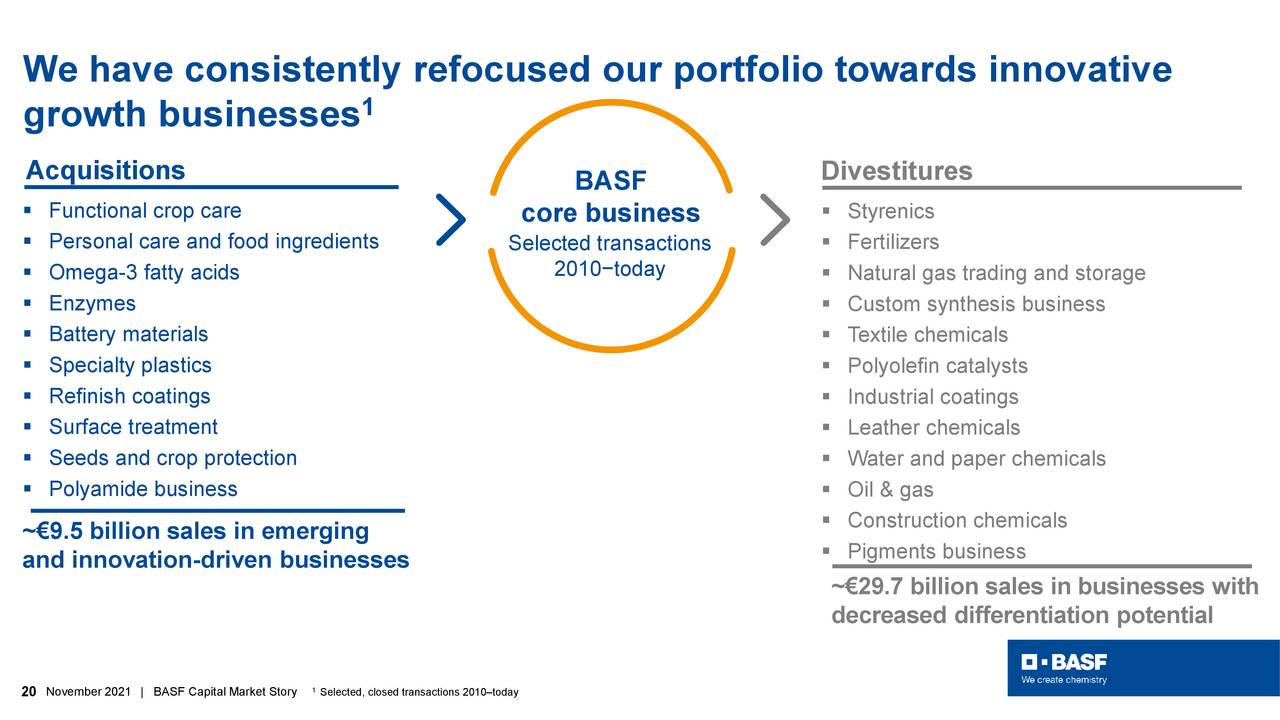

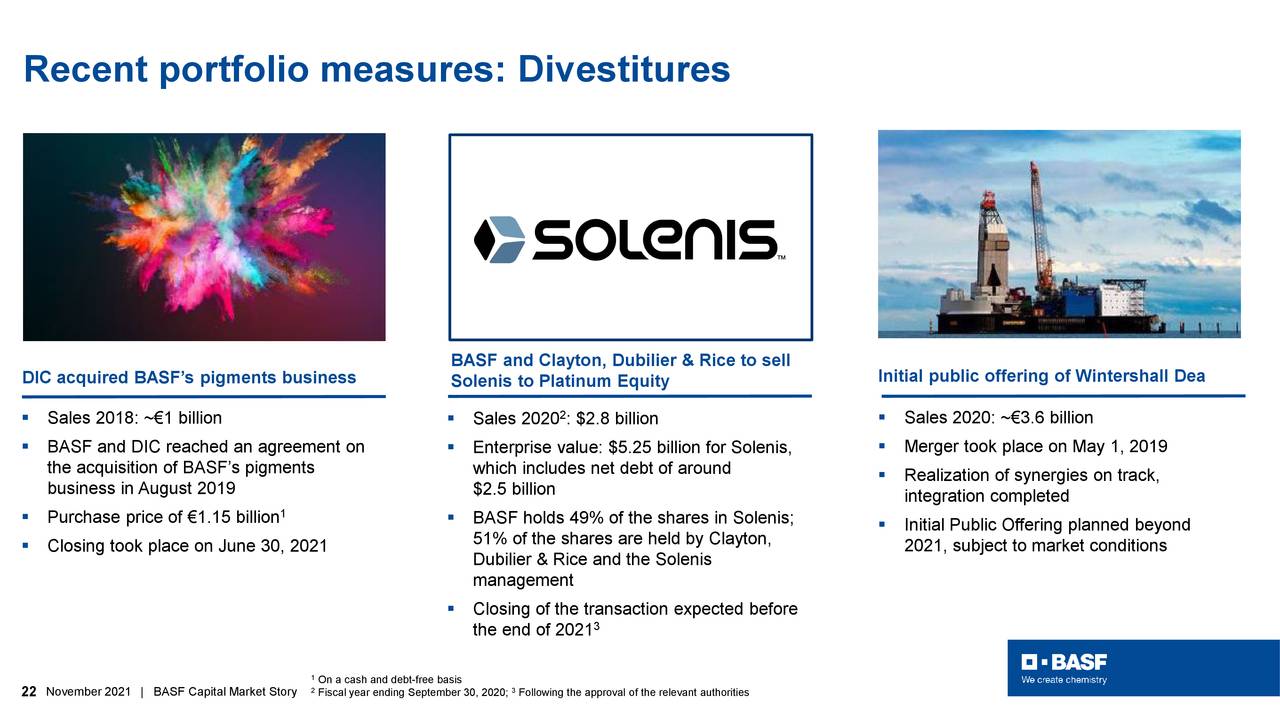

Deal follows Sika’s recent purchase of BASF’s former construction chemical business

by Craig Bettenhausen

December 7, 2021

Credit: Shutterstock GCP Applied Technologies makes additives for spray concrete, among other construction chemicals.

Credit: Shutterstock GCP Applied Technologies makes additives for spray concrete, among other construction chemicals.

Continuing consolidation in the construction chemical field, the French glass and building materials firm Saint-Gobain has agreed to pay $2.3 billion for GCP Applied Technologies, the construction chemical firm that used to be a part of W.R. Grace.

GCP makes concrete additives as well as sheet and spray-on barriers to control water, air, and vapor diffusion. GCP reported earnings of $101 million last year on sales of $903 million. The firm has 50 factories and 1,800 employees. Saint-Gobain says the deal will create a construction chemical business with annual sales of more than $4.5 billion.

In September, Saint-Gobain purchased Chryso, another maker of concrete additives. Chryso is strong in Africa, Europe, and the Middle East, while GCP is positioned well in North America, Latin America, and the Asia-Pacific region, according to Saint-Gobain. Both firms have product lines aimed at lowering the carbon footprint of concrete, an issue of increasing emphasis in the construction industry.

Similarly, Saint-Gobain will merge GCP’s barriers unit with related products it sells under the CertainTeed brand. Overall, the French firm says it has identified $85 million in annual costs it can shave by cutting staff and eliminating overlaps in sales and administration.

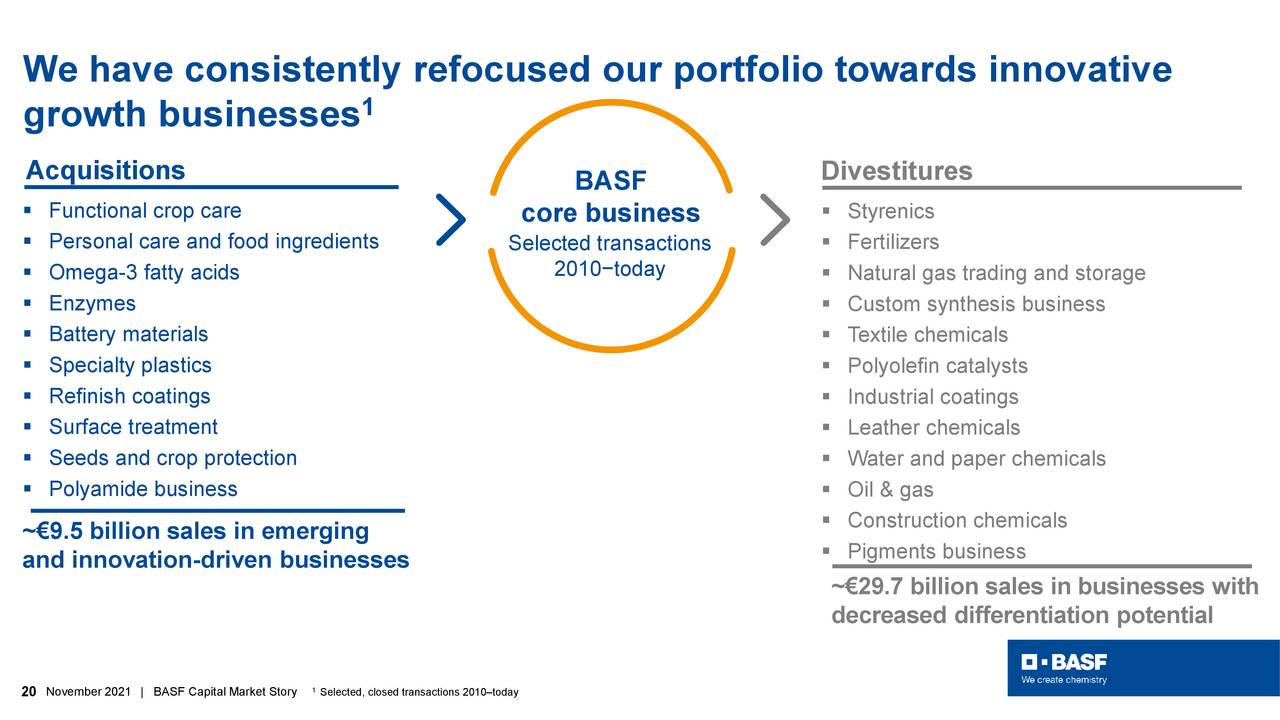

The purchase follows BASF’s 2020 divestment of its construction chemicals unit. The building products company Sika agreed last month to buy the former BASF unit, now called MBCC Group, for $5.9 billion.

The Chryso purchase, along with other moves in construction chemicals, places Saint-Gobain in direct competition with Sika, and that will be even more true after Saint-Gobain absorbs GCP, says Ian George, a managing director in the chemical group at the investment banking firm Piper Sandler.

Both the GCP and MBCC sales are part of a trend of construction chemical firms becoming part of broader building-product companies, he says. However, GCP was one of the last large bolt-on acquisitions available, George says, and it will be interesting to see how M&A plays out from here among the long tail of smaller firms.

In 2020, Saint-Gobain ended a 6-year attempt at a hostile takeover of Sika. Though Saint-Gobain didn’t succeed in assembling a controlling interest in its rival, it did make $1.7 billion selling the Sika stock it had collected along the way.

December 8, 2021

Another Arsenal Acquisition

Arsenal’s Meridian Acquires American Sealants Inc (ASI) HOUSTON, Texas, December 7, 2021 – Meridian Adhesives Group (Meridian) announced today the acquisition of American Sealants Inc (ASI).

Located in Fort Wayne, Indiana, ASI specializes in the innovation of product assembly adhesives and sealants. These dynamic solutions are used in multiple applications and markets, including industrial, DIY, transportation, residential and commercial building, and construction.

ASI will join Meridian’s Industrial Division, which serves the Flooring, Packaging and Product Assembly markets. The company brings a broad product line and technology base to the division’s Product Assembly category.

“ASI is a valuable addition to the Meridian portfolio, further extending our reach as a full-service solution provider of high-performance adhesives and sealants to our customers,” said Daniel Pelton, CEO of Meridian Adhesives Group. “We are excited to have ASI drive our Product Assembly focus, and we are looking forward to the company’s extensive product offering and technology base broadening the solutions we can offer our customers.” Established in 1987, ASI provides sealant and adhesive technical support and packaging solutions to customers around the world. The company offers high volume users the opportunity to private label silicone and sealant products, while simultaneously providing custom packaging innovations.

The company will be led by President Andrew Zaremba, as past president, Chris Zaremba, steps into a consulting role.

“Our ASI team is enthusiastic about joining Meridian,” said Andrew Zaremba. “Having the backing of Meridian will allow us to further grow our business and support our customers. I have worked with the Meridian team in the past and am looking forward to the innovative technology and expertise this portfolio of leading companies brings to this partnership.” For more information regarding ASI, visit https://www.americansealantsinc.com.

About Meridian Adhesives Group Meridian Adhesives Group is a leading manufacturer of high-value adhesive technologies. With a broad portfolio of dynamic solutions, Meridian serves the electronics, infrastructure, and industrial (flooring, packaging and product assembly) markets. The group’s operations are located in the Americas and EMEA, with a multitude of sales/service offices worldwide that are positioned to serve Meridian’s global customer base. For more information, visit https://meridianadhesives.com.

About Arsenal Capital Partners Arsenal is a leading private equity firm that specializes in investments in middle-market industrials and healthcare companies. Since its inception in 2000, Arsenal has raised institutional equity investment funds of more than $7.0 billion, completed more than 200 platform and add-on investments, and achieved more than 30 realizations. The firm works with management teams to build strategically important companies with leading market positions, high growth, and high value–add. For more information, please visit www.arsenalcapital.com.

December 8, 2021

Another Arsenal Acquisition

Arsenal’s Meridian Acquires American Sealants Inc (ASI) HOUSTON, Texas, December 7, 2021 – Meridian Adhesives Group (Meridian) announced today the acquisition of American Sealants Inc (ASI).

Located in Fort Wayne, Indiana, ASI specializes in the innovation of product assembly adhesives and sealants. These dynamic solutions are used in multiple applications and markets, including industrial, DIY, transportation, residential and commercial building, and construction.

ASI will join Meridian’s Industrial Division, which serves the Flooring, Packaging and Product Assembly markets. The company brings a broad product line and technology base to the division’s Product Assembly category.

“ASI is a valuable addition to the Meridian portfolio, further extending our reach as a full-service solution provider of high-performance adhesives and sealants to our customers,” said Daniel Pelton, CEO of Meridian Adhesives Group. “We are excited to have ASI drive our Product Assembly focus, and we are looking forward to the company’s extensive product offering and technology base broadening the solutions we can offer our customers.” Established in 1987, ASI provides sealant and adhesive technical support and packaging solutions to customers around the world. The company offers high volume users the opportunity to private label silicone and sealant products, while simultaneously providing custom packaging innovations.

The company will be led by President Andrew Zaremba, as past president, Chris Zaremba, steps into a consulting role.

“Our ASI team is enthusiastic about joining Meridian,” said Andrew Zaremba. “Having the backing of Meridian will allow us to further grow our business and support our customers. I have worked with the Meridian team in the past and am looking forward to the innovative technology and expertise this portfolio of leading companies brings to this partnership.” For more information regarding ASI, visit https://www.americansealantsinc.com.

About Meridian Adhesives Group Meridian Adhesives Group is a leading manufacturer of high-value adhesive technologies. With a broad portfolio of dynamic solutions, Meridian serves the electronics, infrastructure, and industrial (flooring, packaging and product assembly) markets. The group’s operations are located in the Americas and EMEA, with a multitude of sales/service offices worldwide that are positioned to serve Meridian’s global customer base. For more information, visit https://meridianadhesives.com.

About Arsenal Capital Partners Arsenal is a leading private equity firm that specializes in investments in middle-market industrials and healthcare companies. Since its inception in 2000, Arsenal has raised institutional equity investment funds of more than $7.0 billion, completed more than 200 platform and add-on investments, and achieved more than 30 realizations. The firm works with management teams to build strategically important companies with leading market positions, high growth, and high value–add. For more information, please visit www.arsenalcapital.com.

December 2, 2021

Interesting Presentation

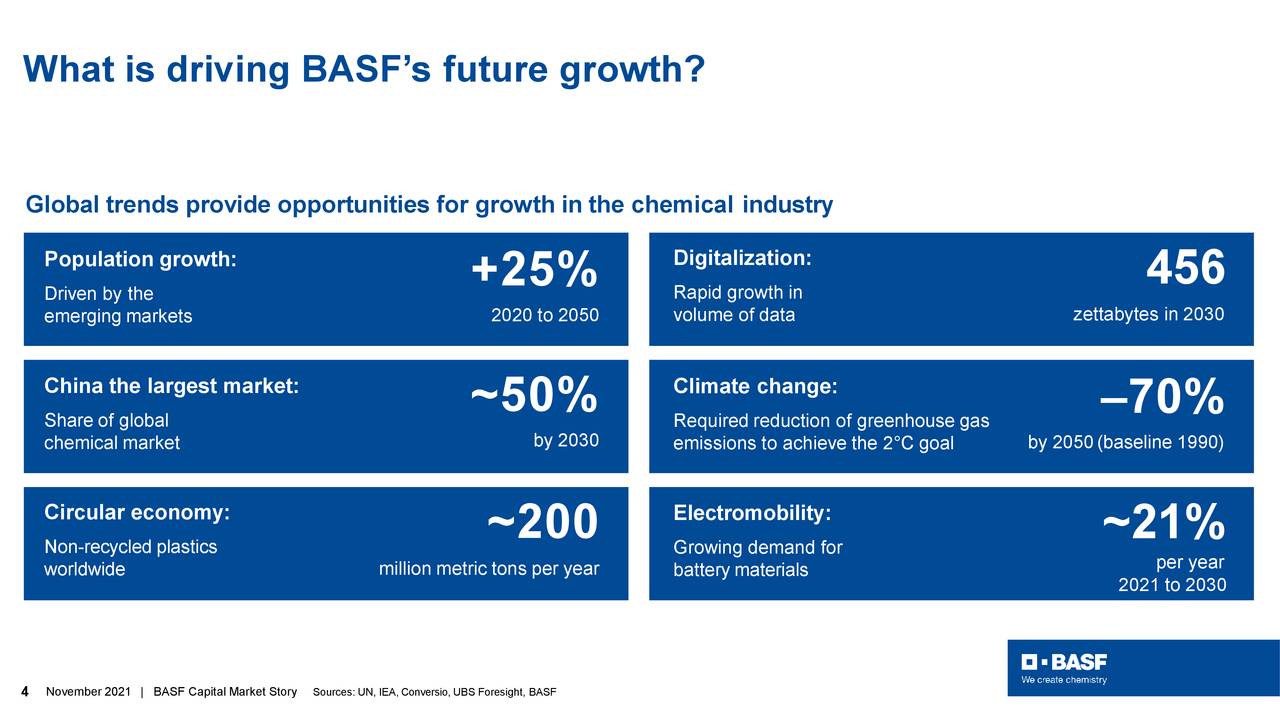

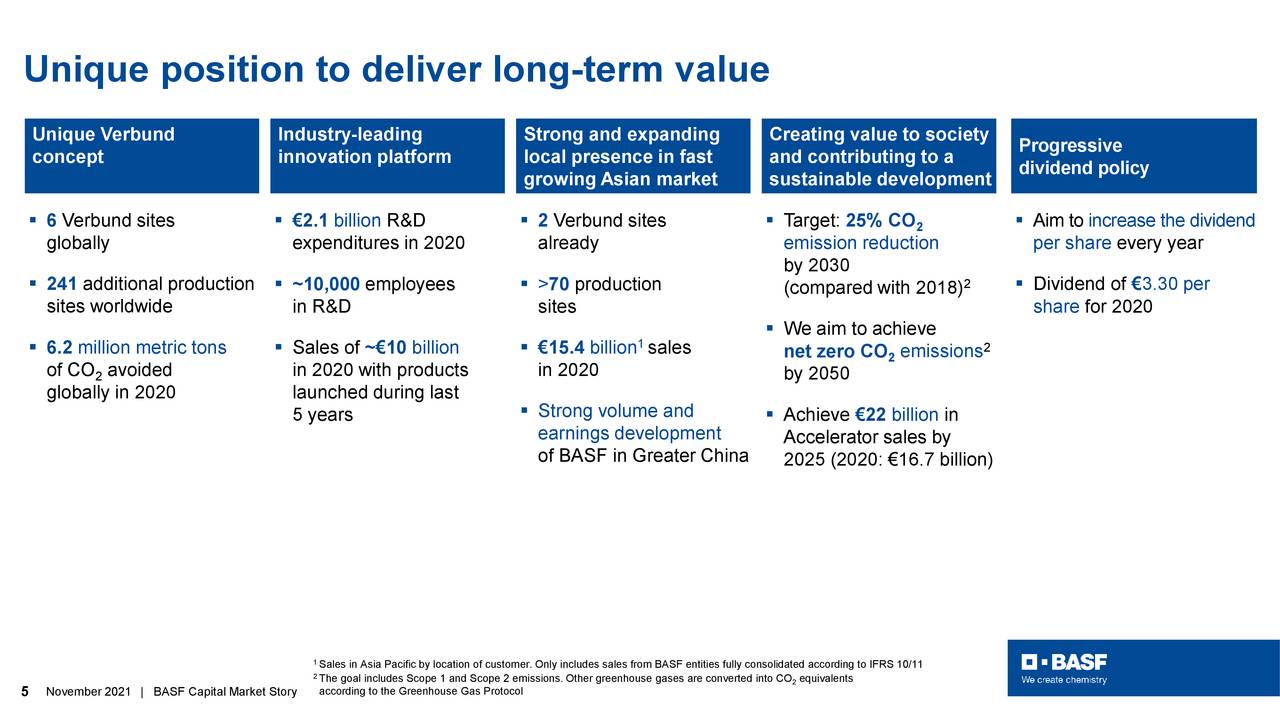

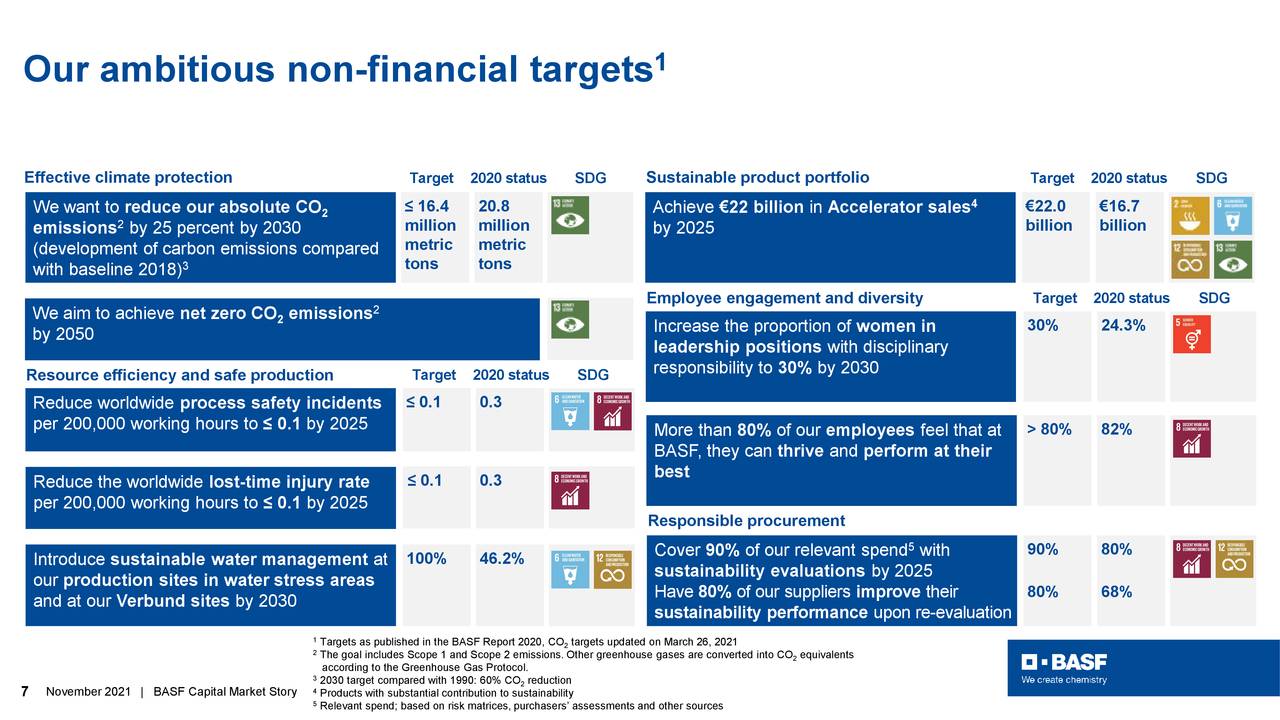

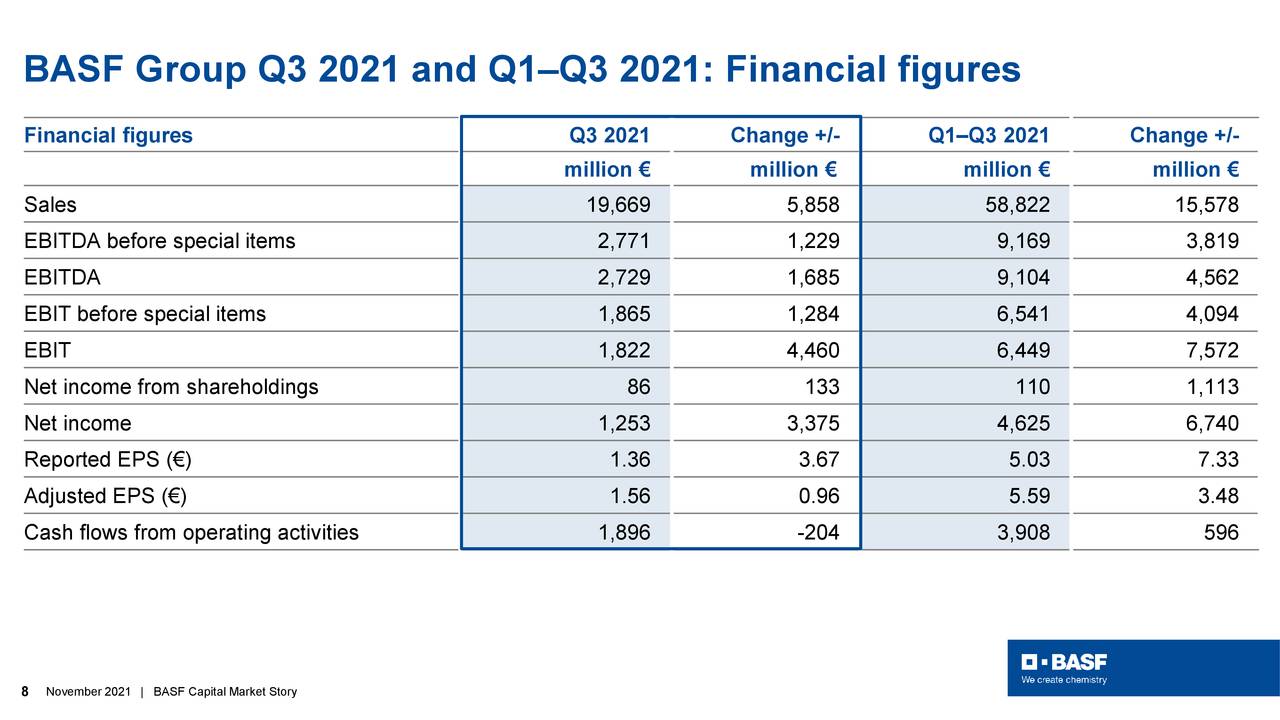

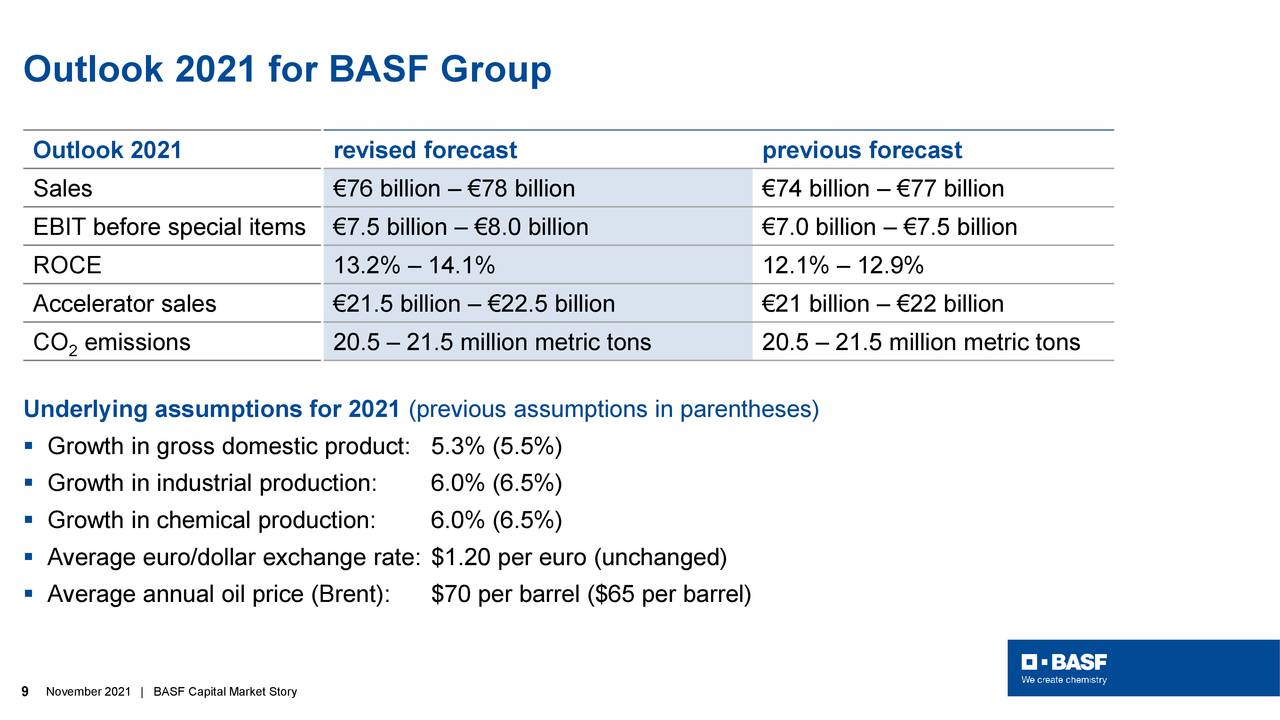

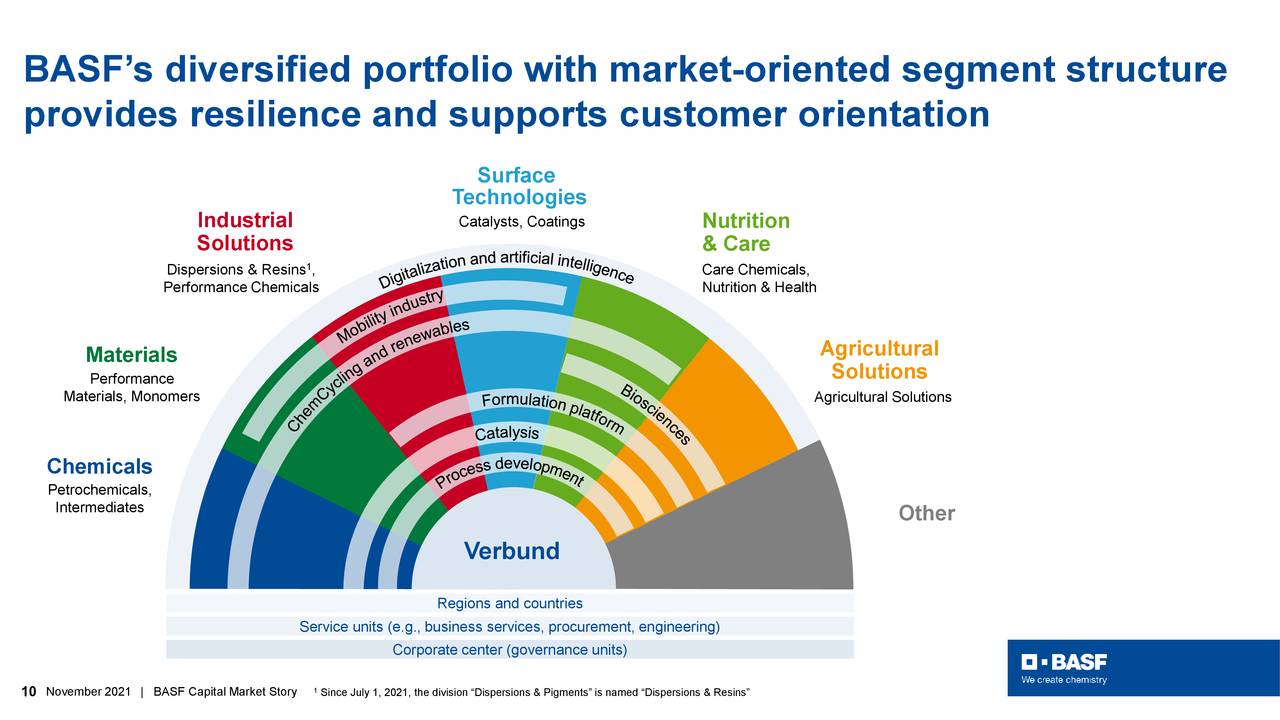

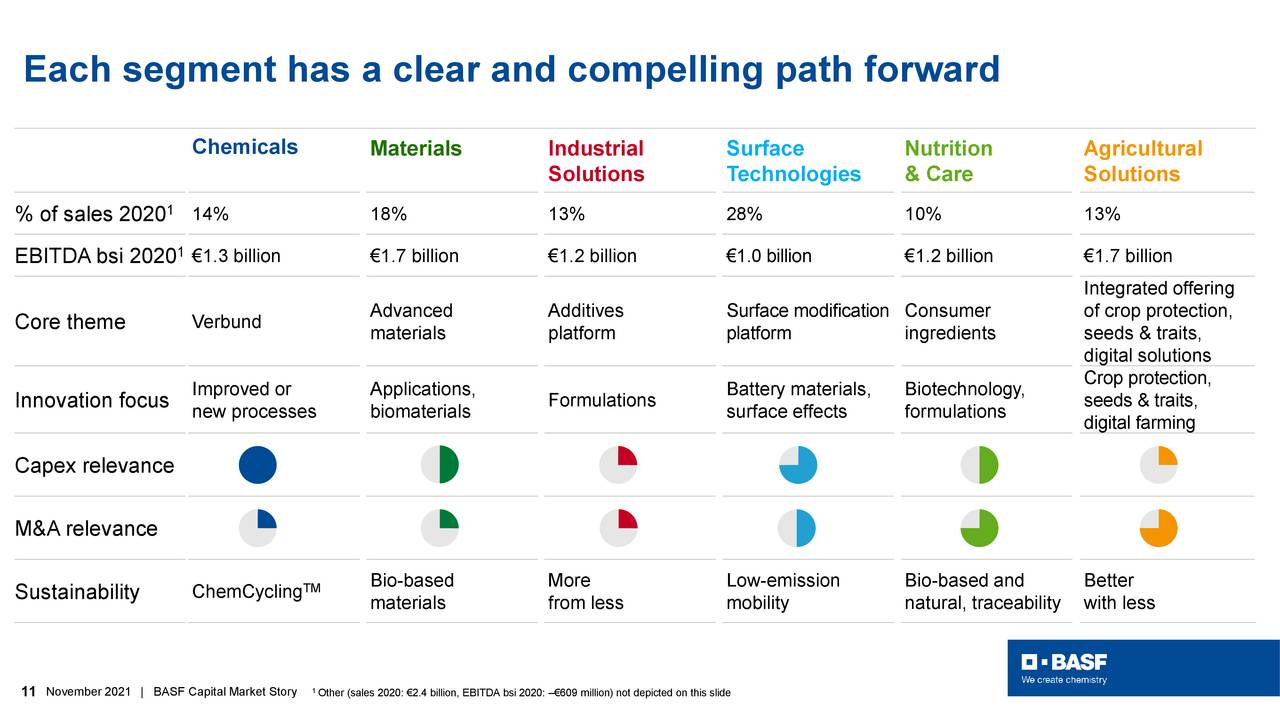

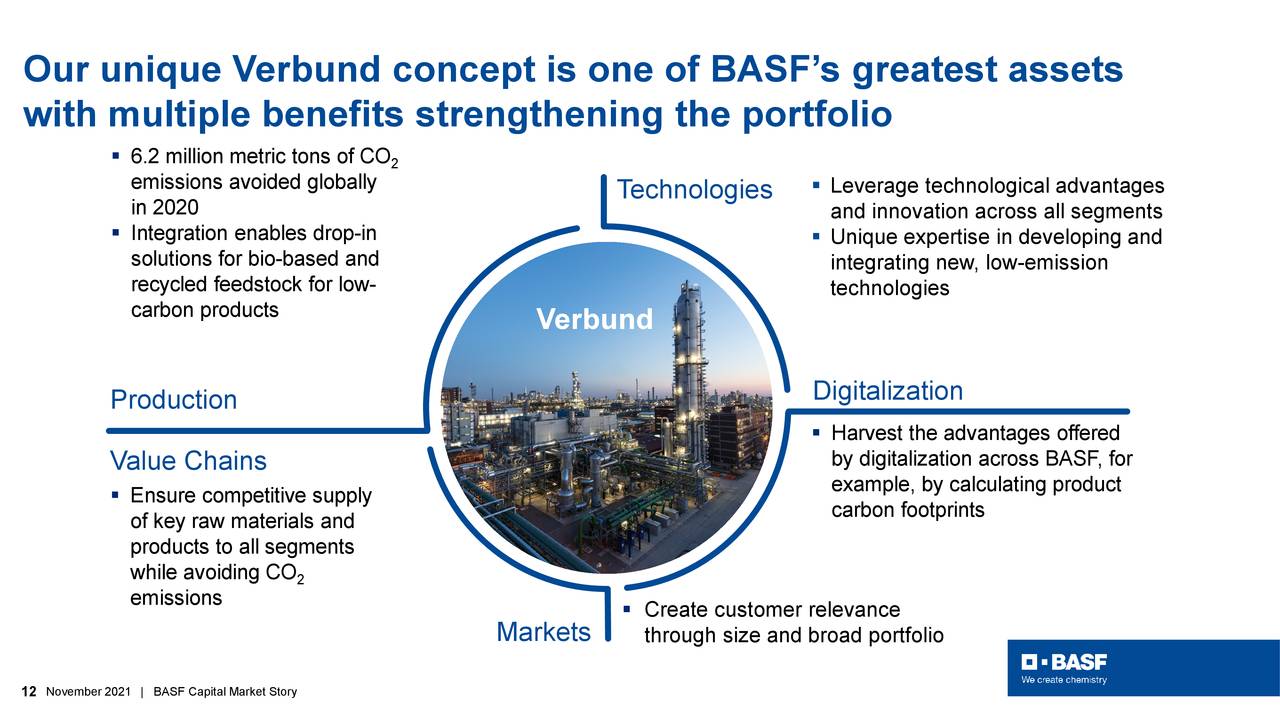

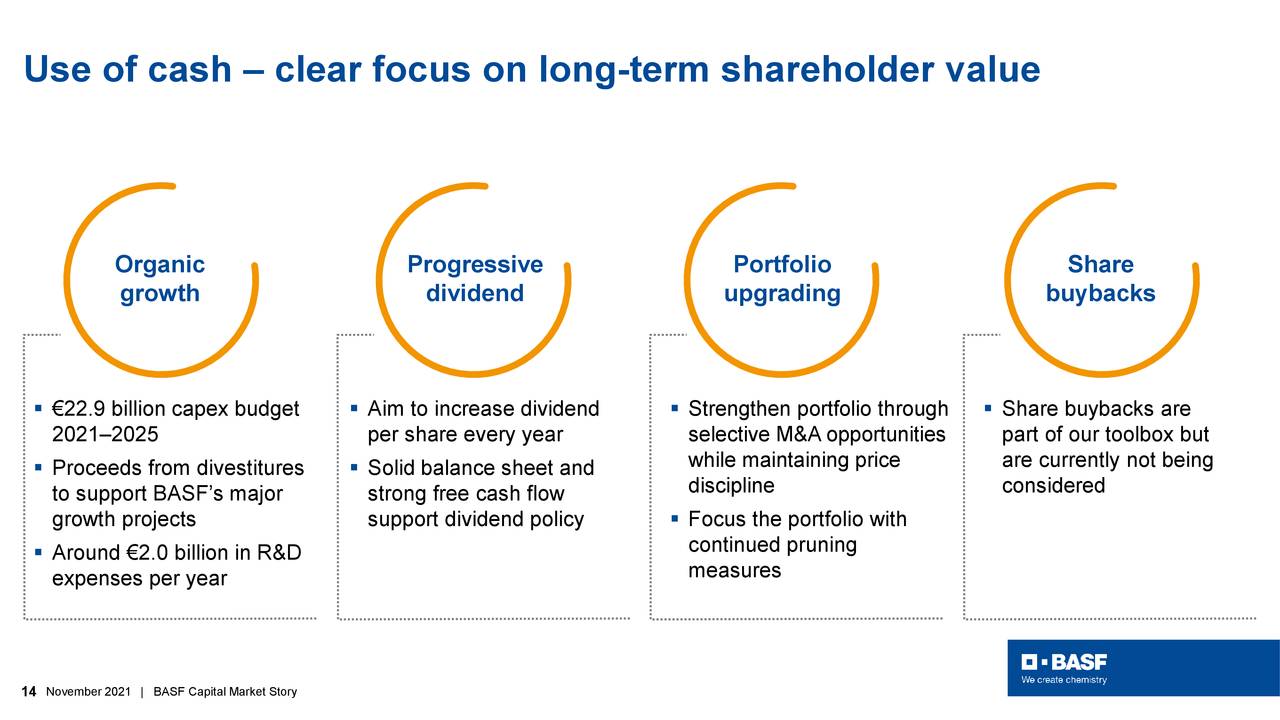

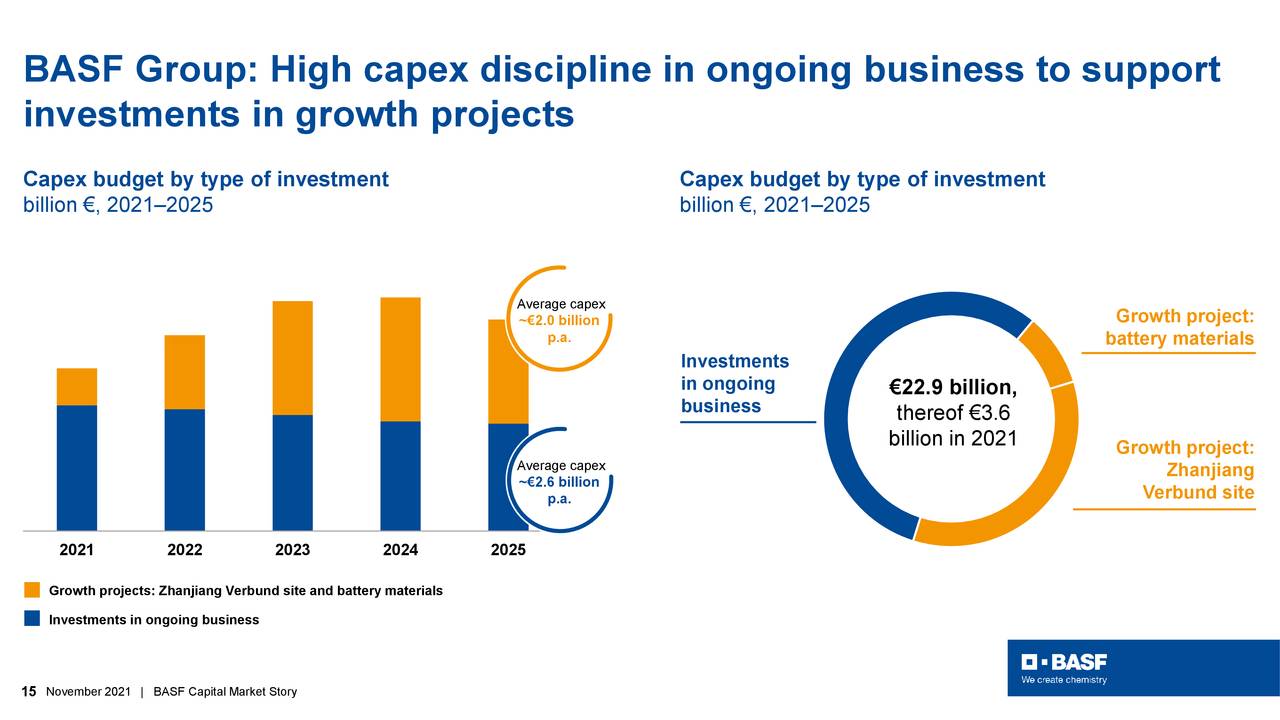

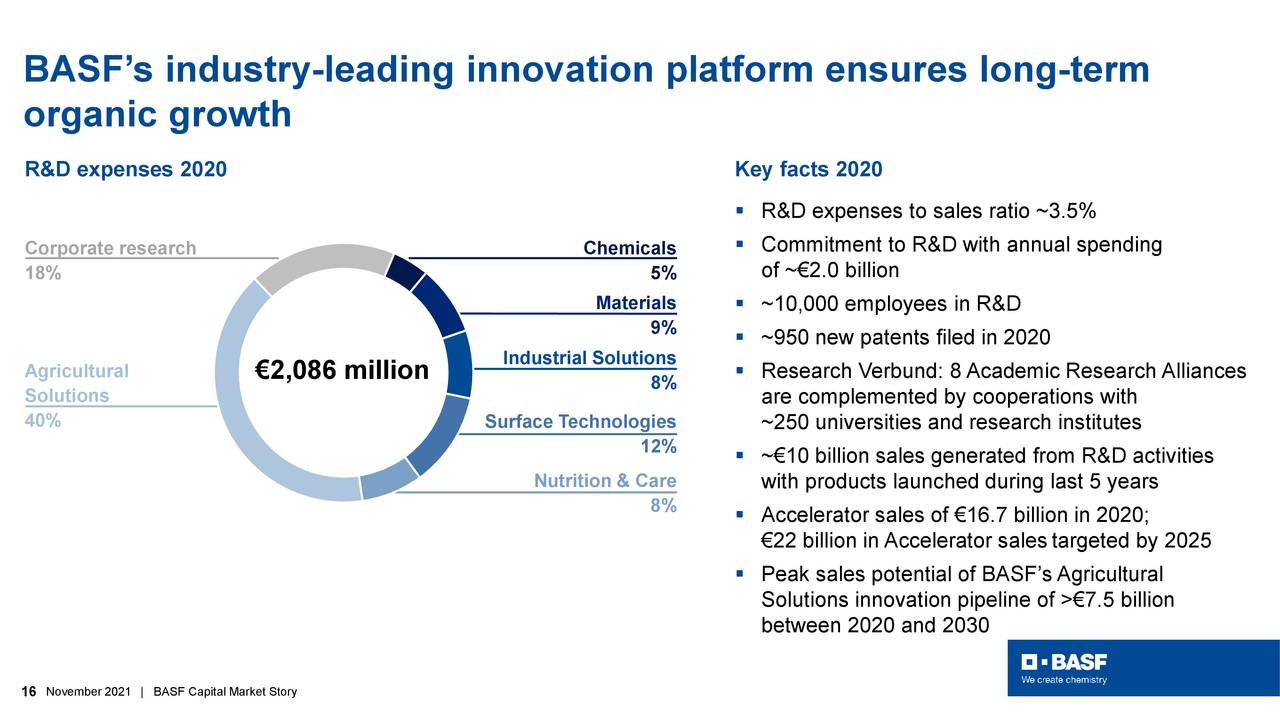

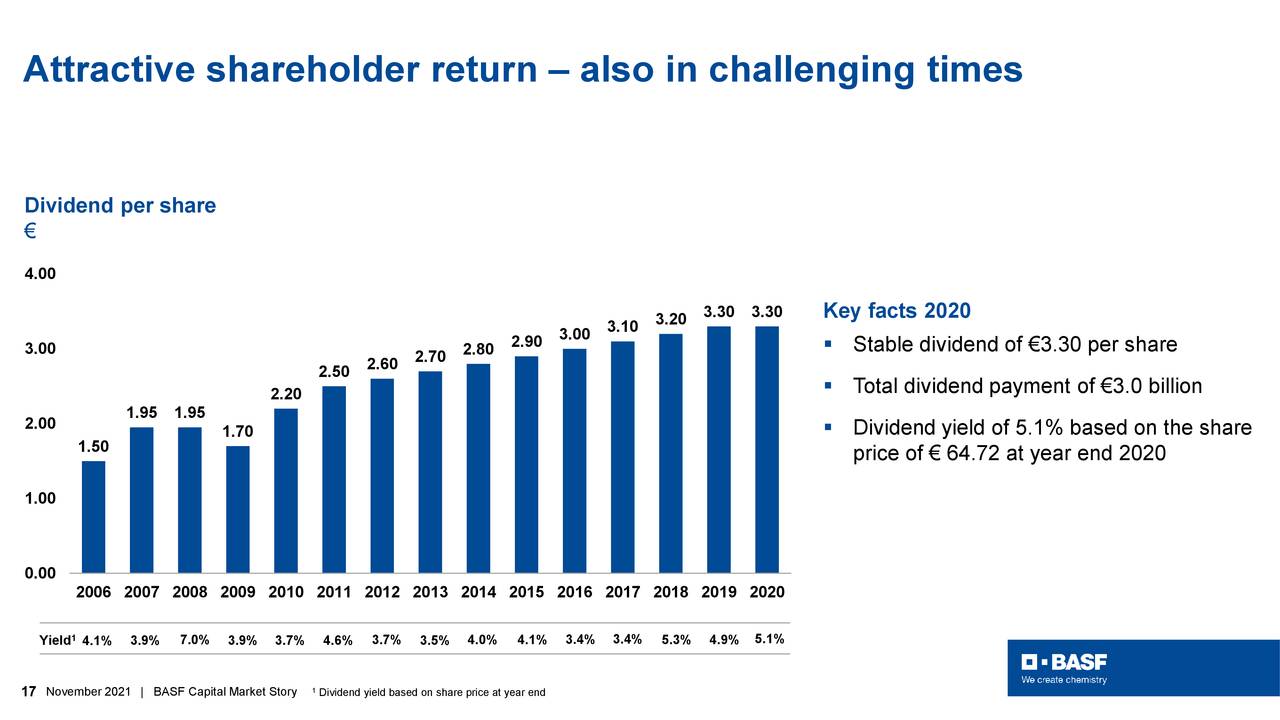

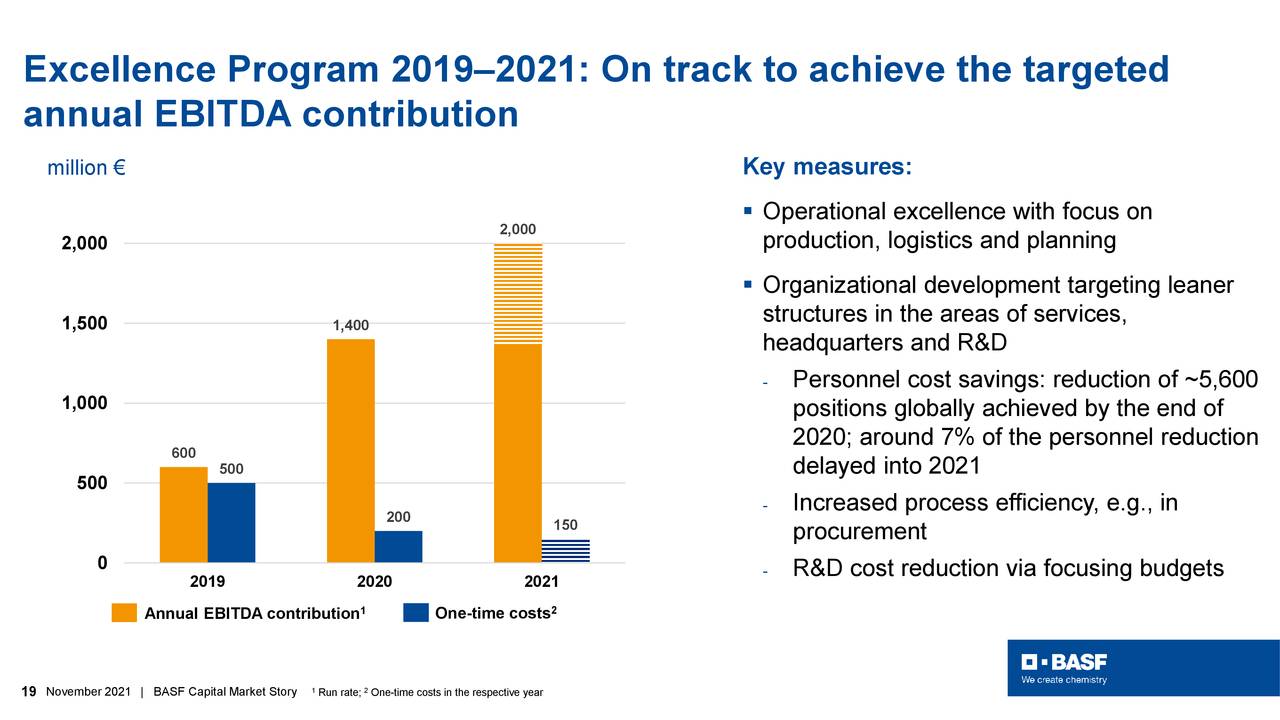

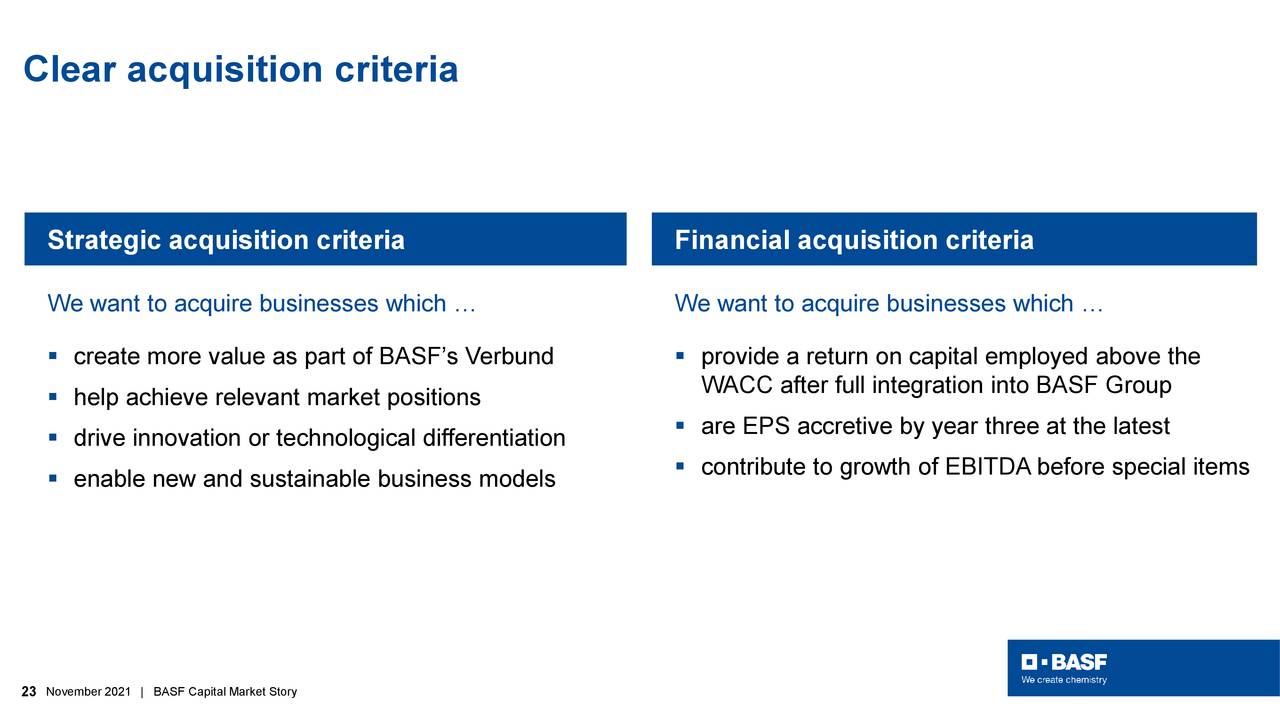

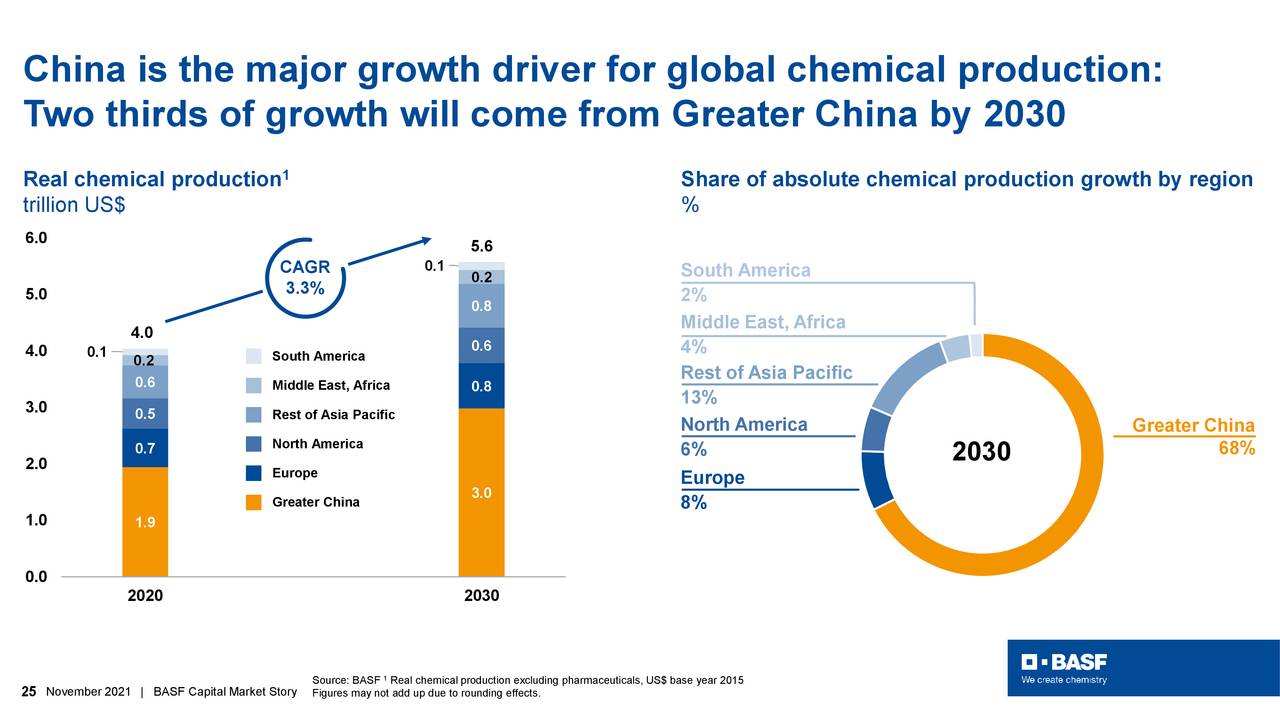

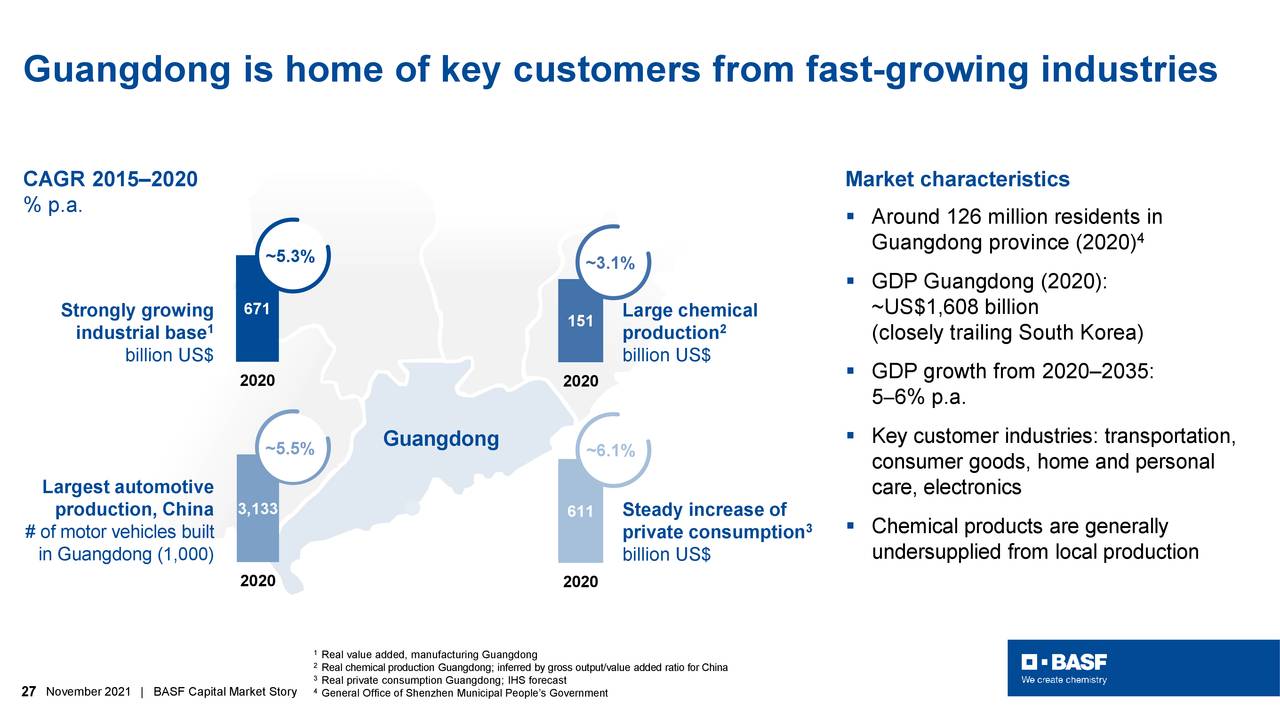

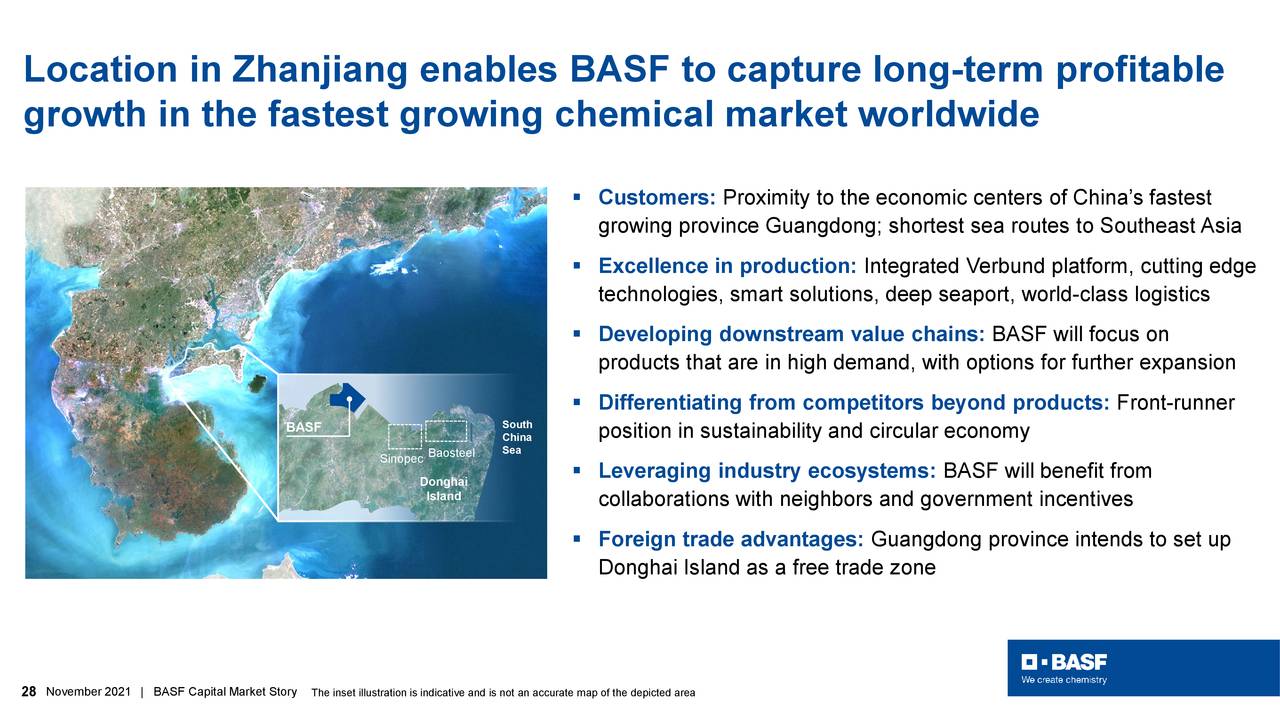

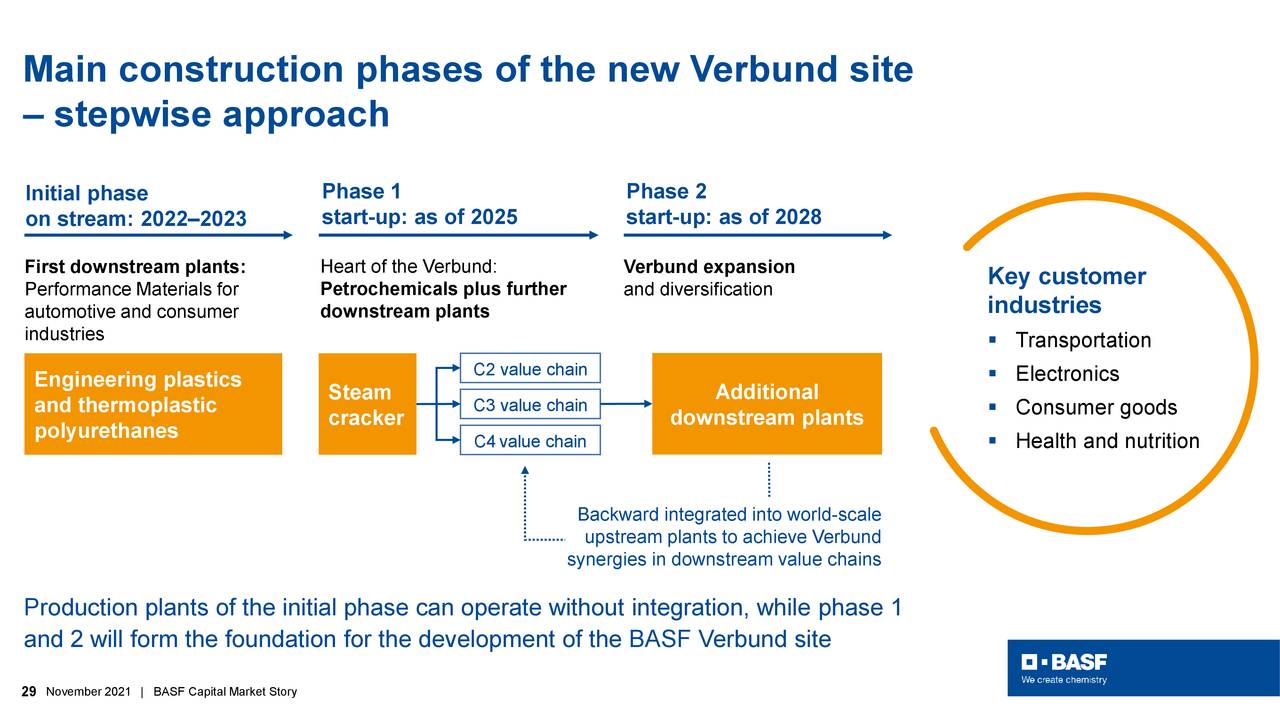

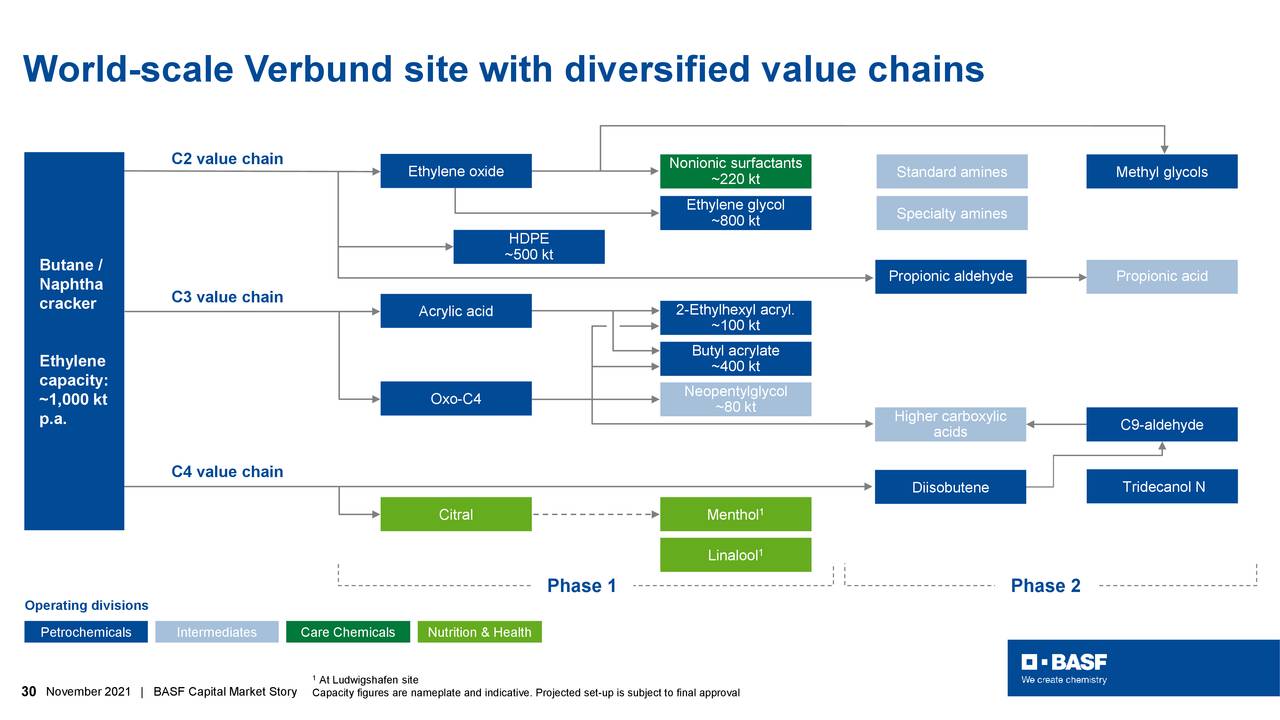

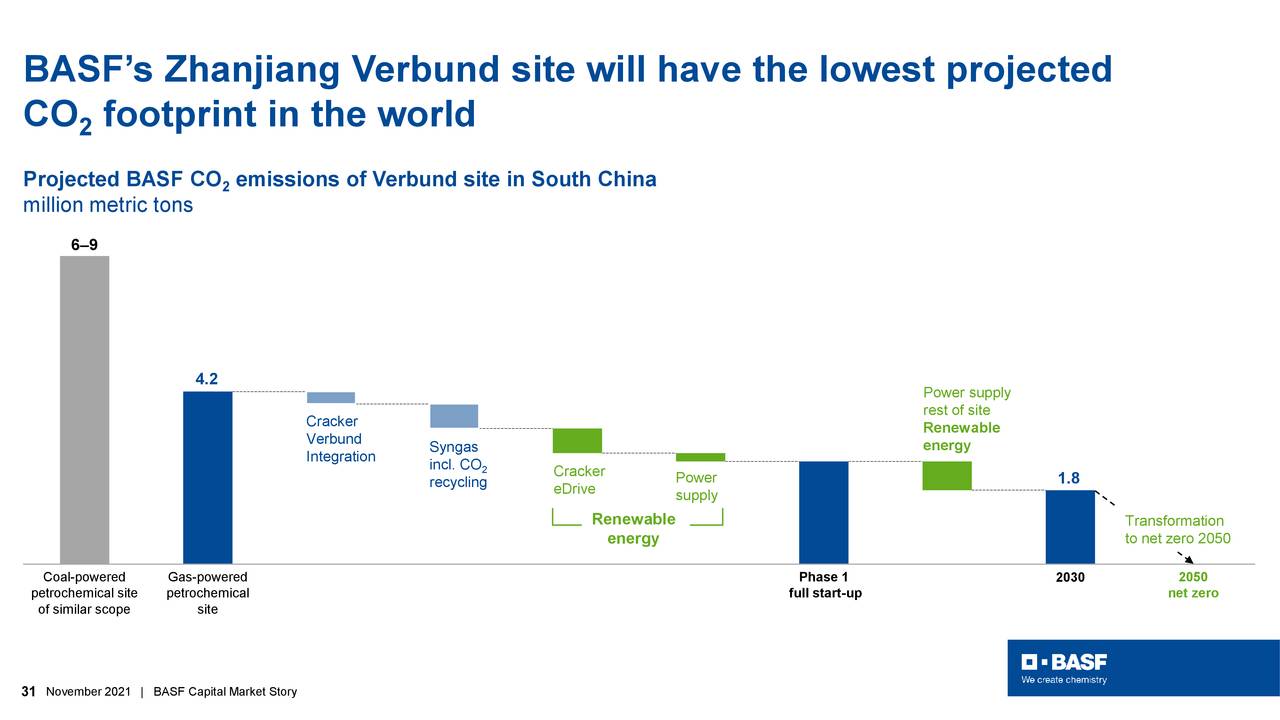

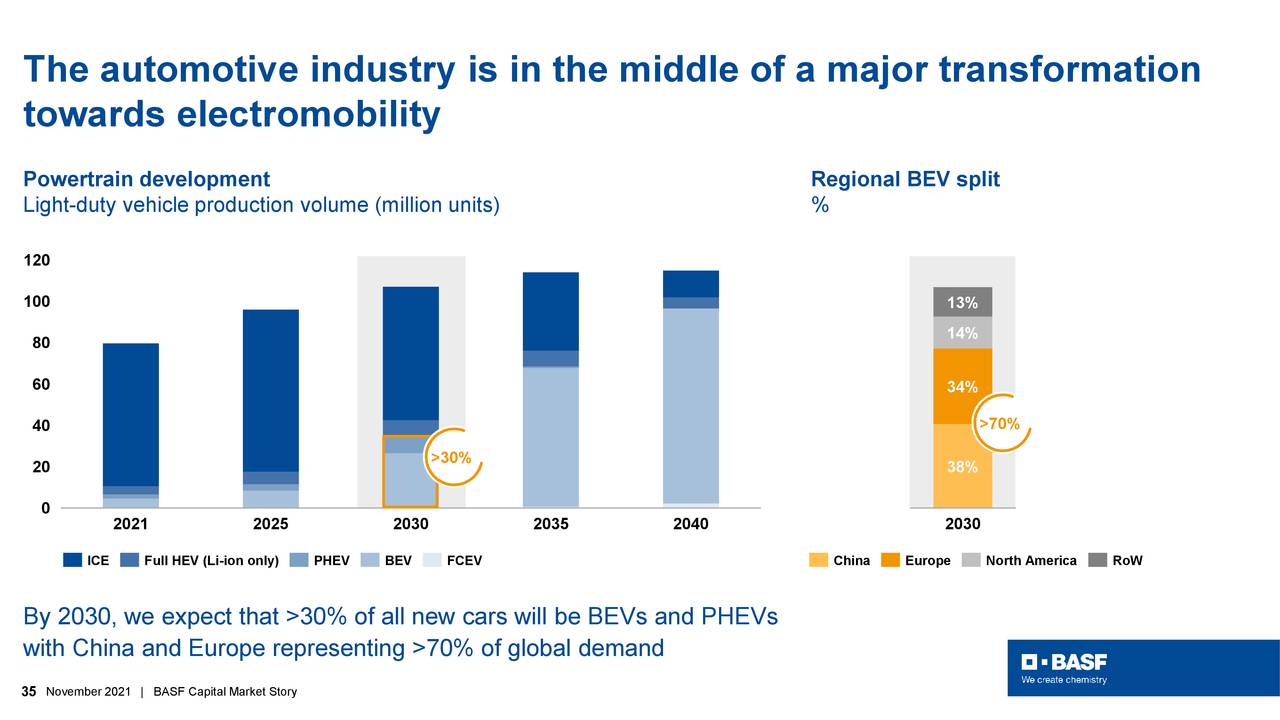

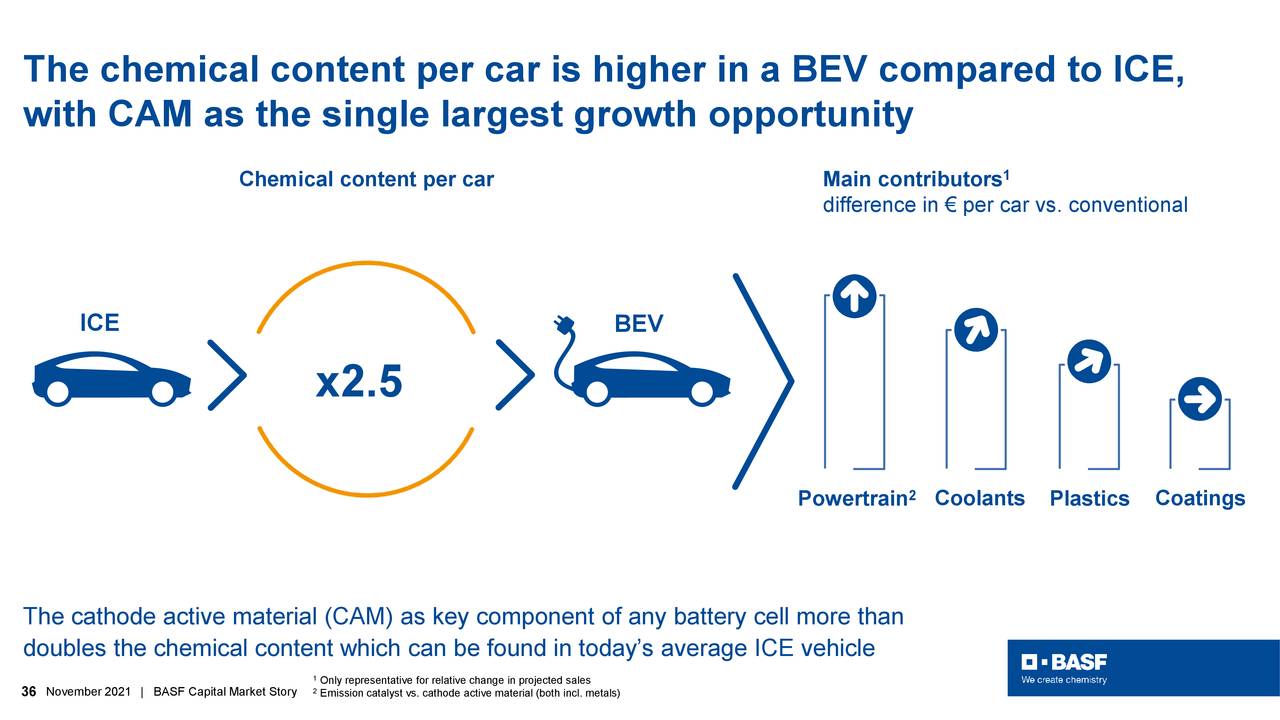

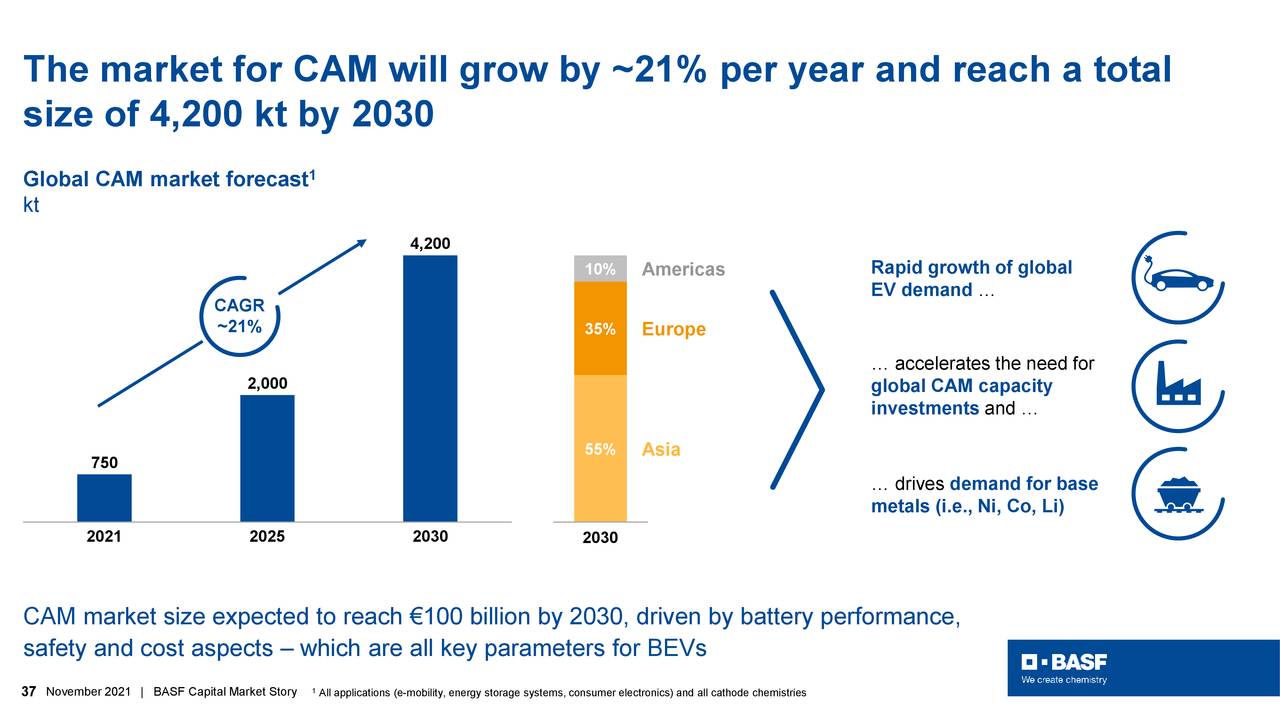

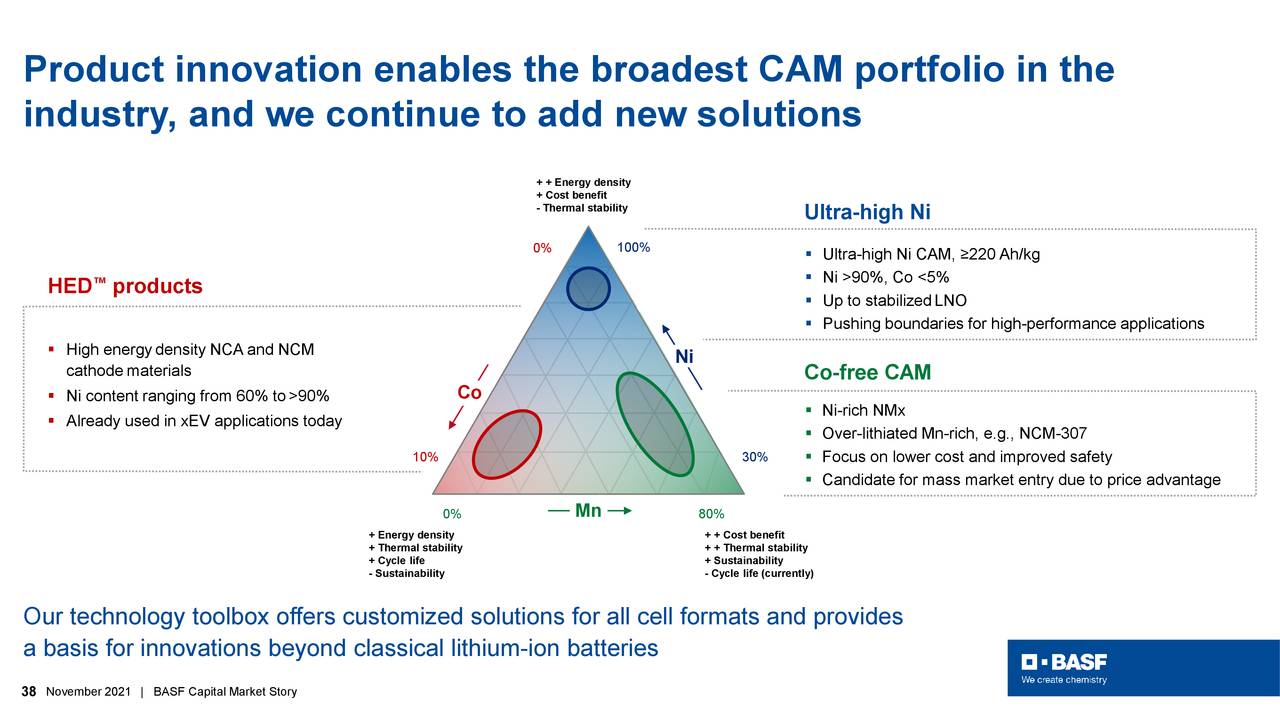

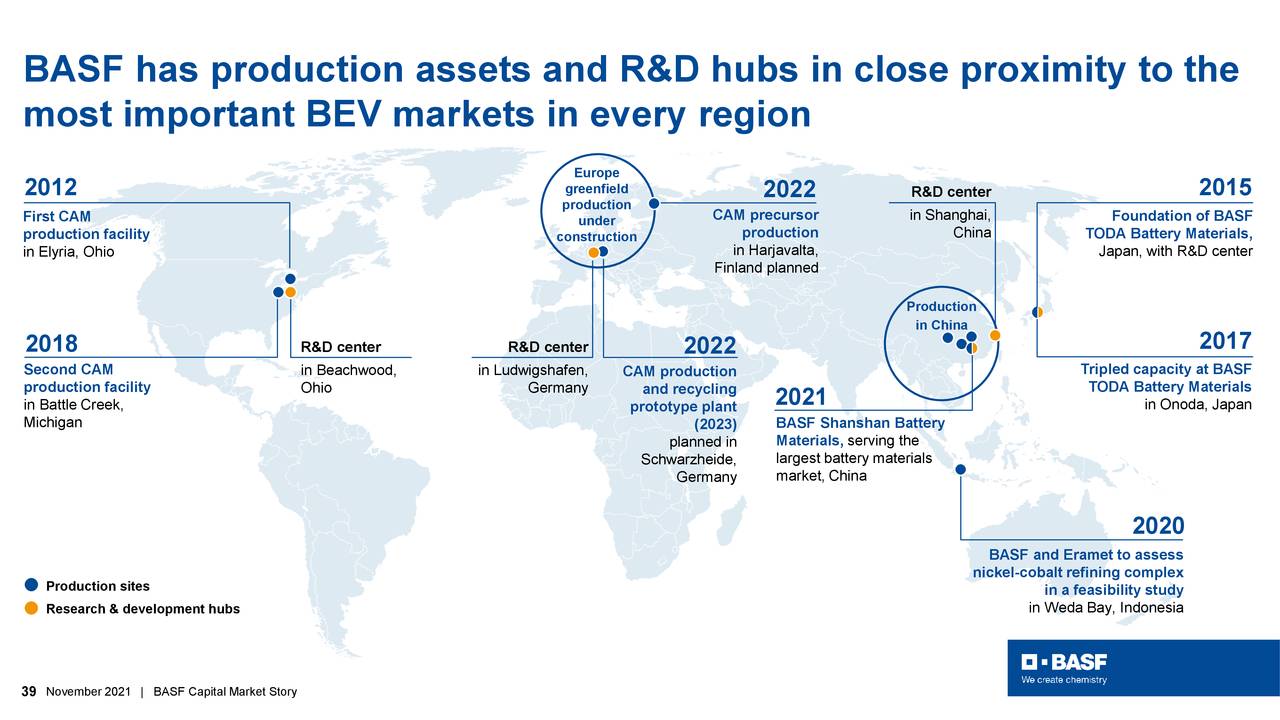

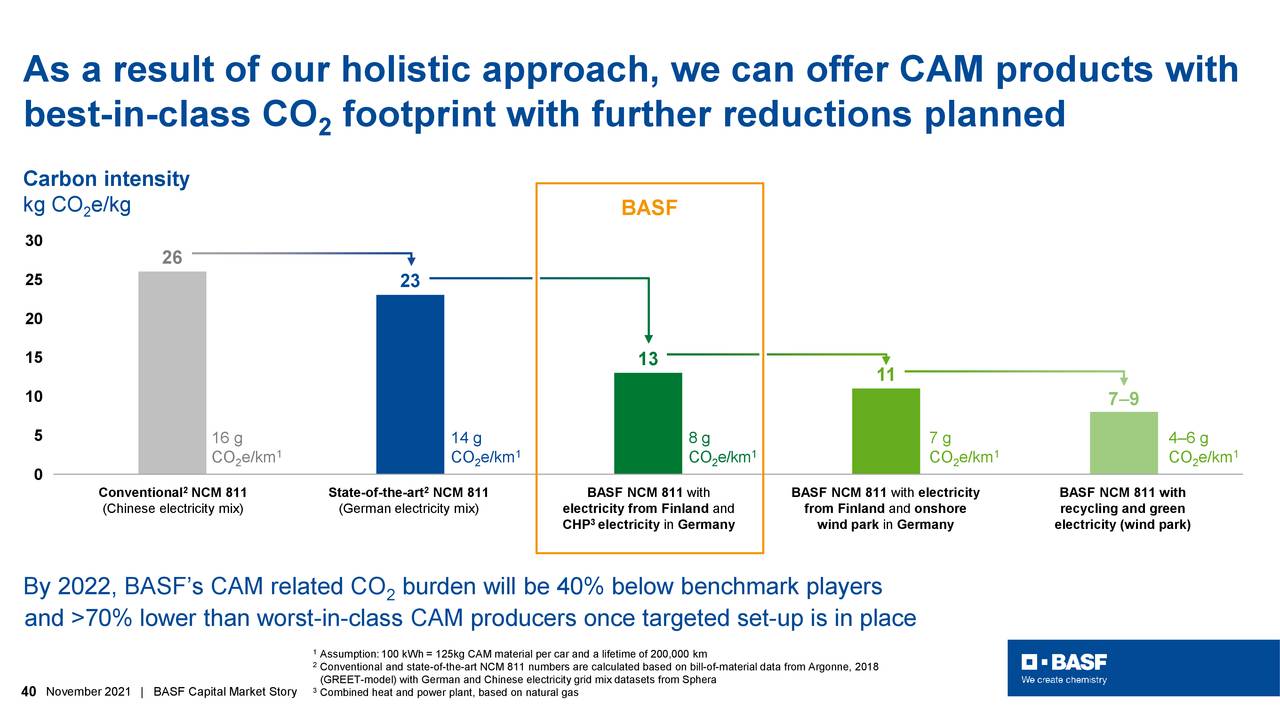

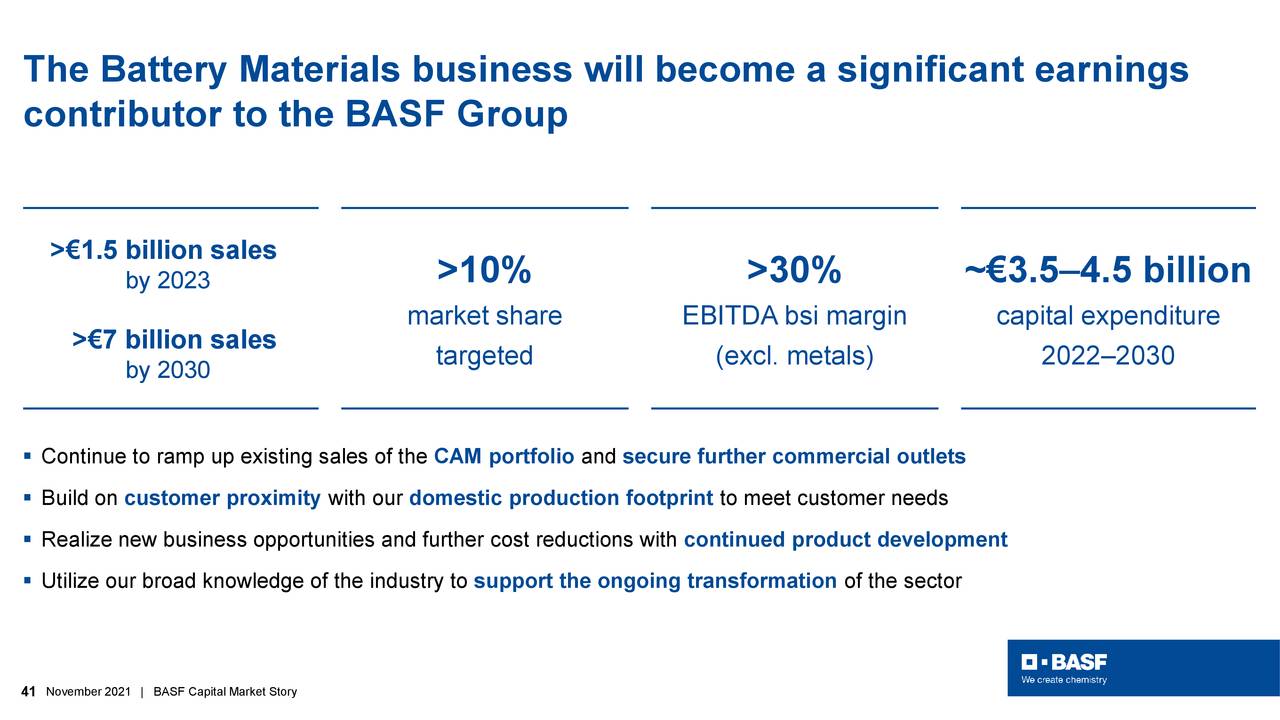

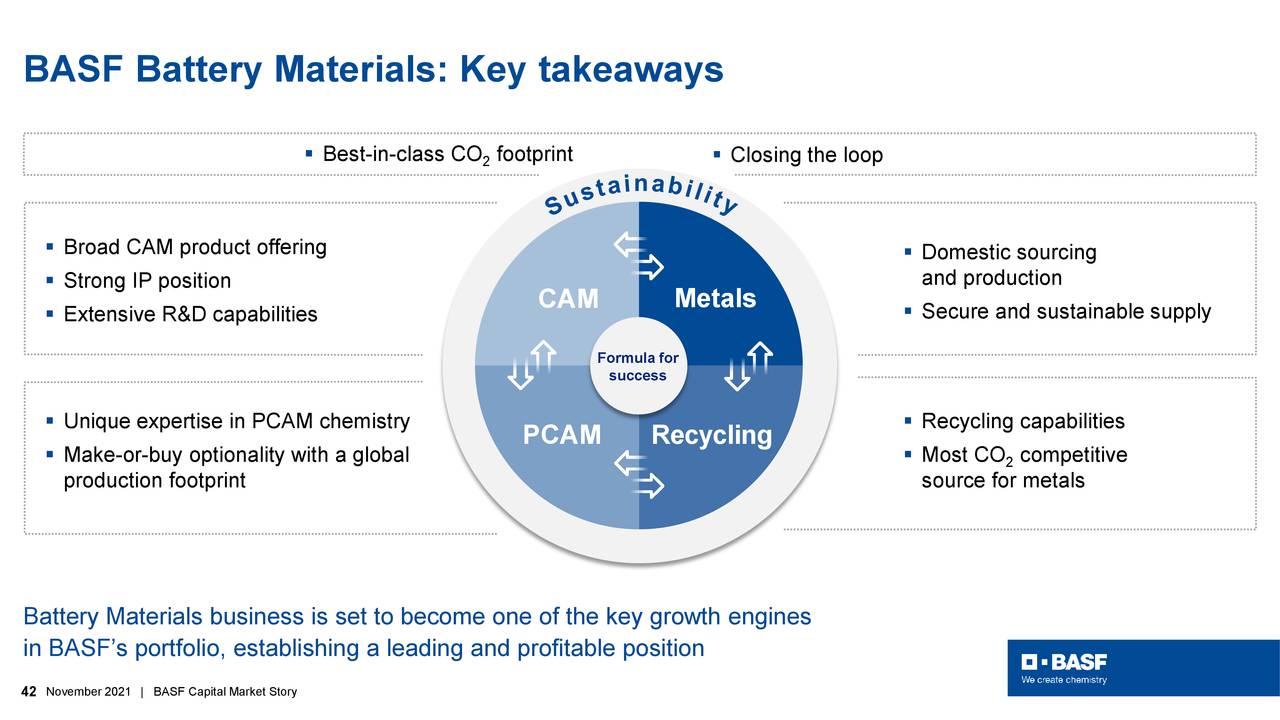

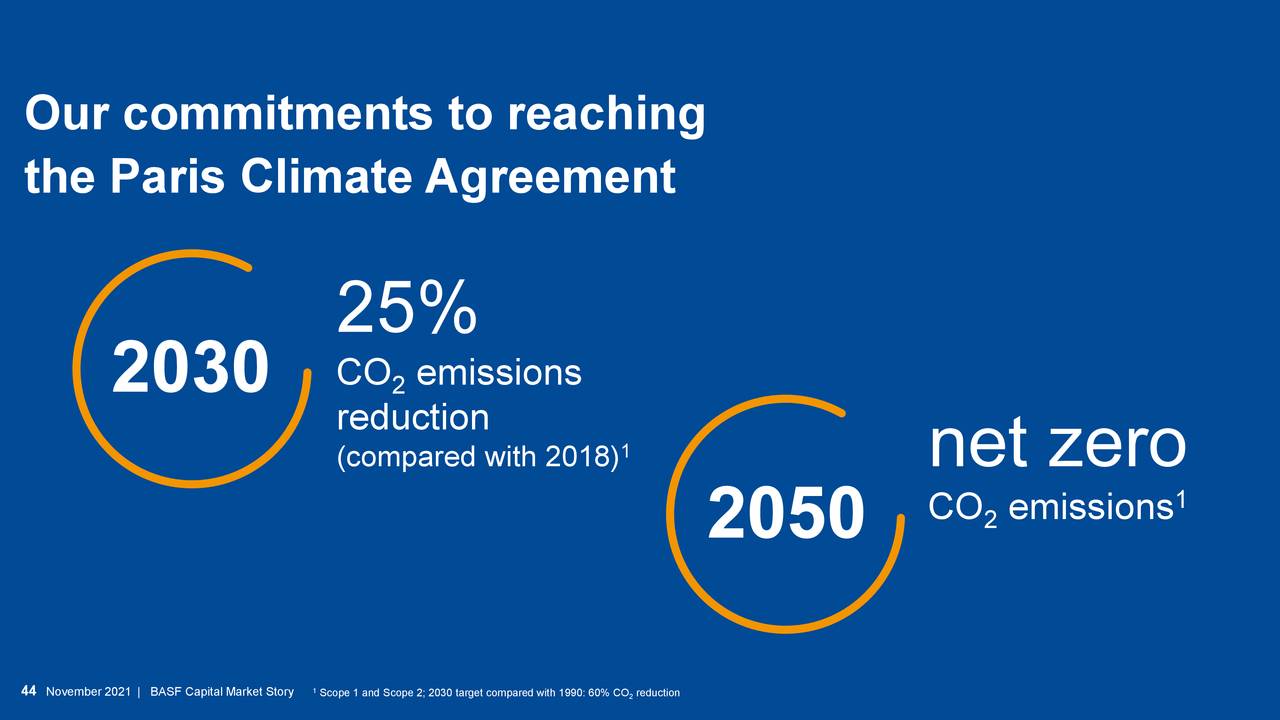

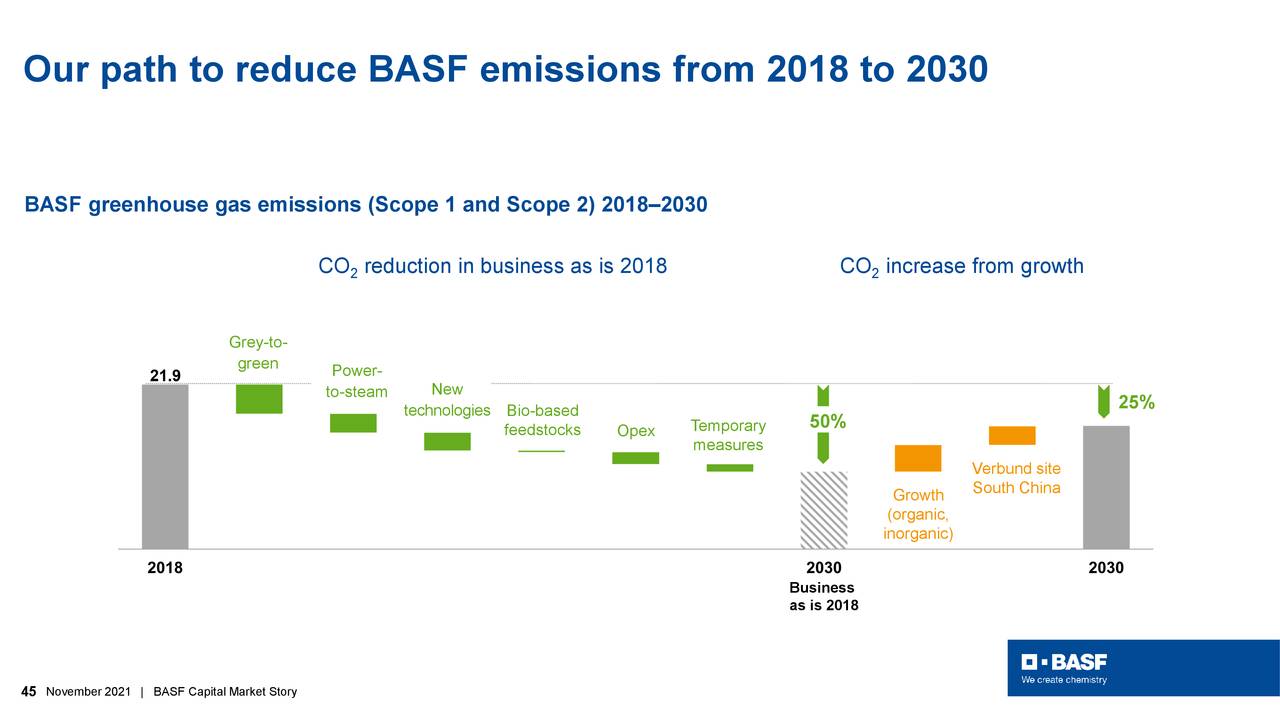

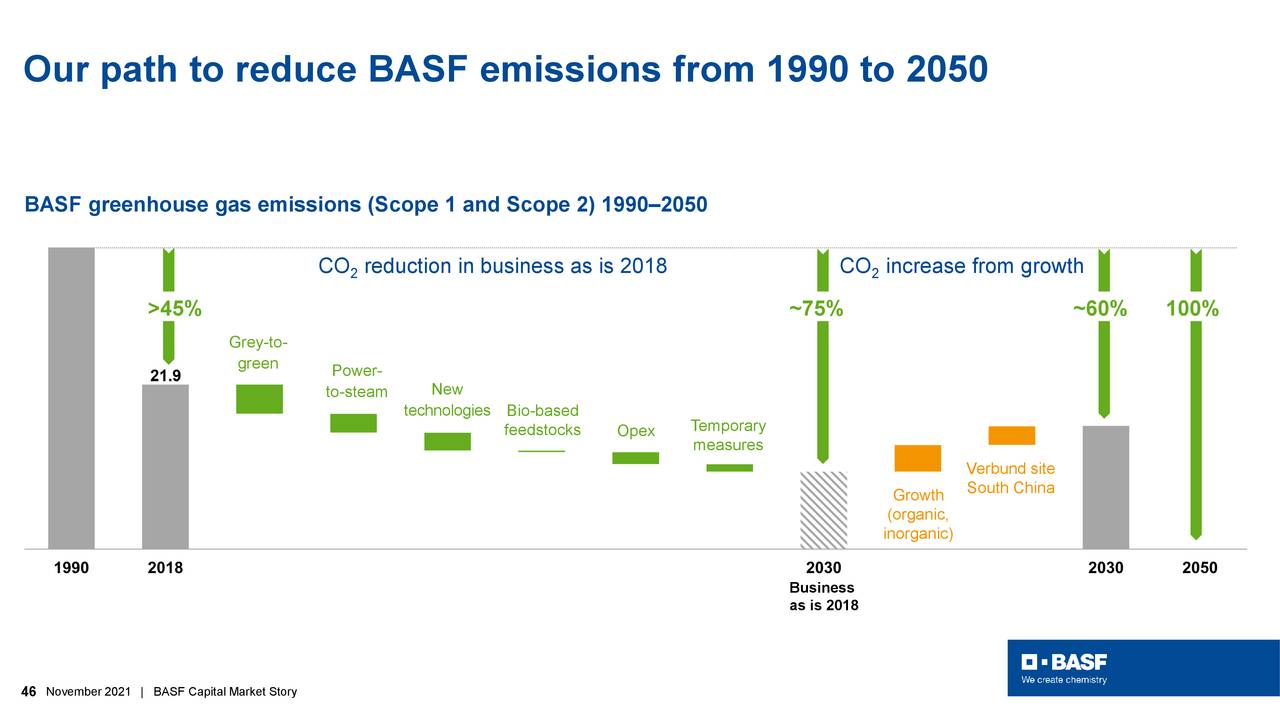

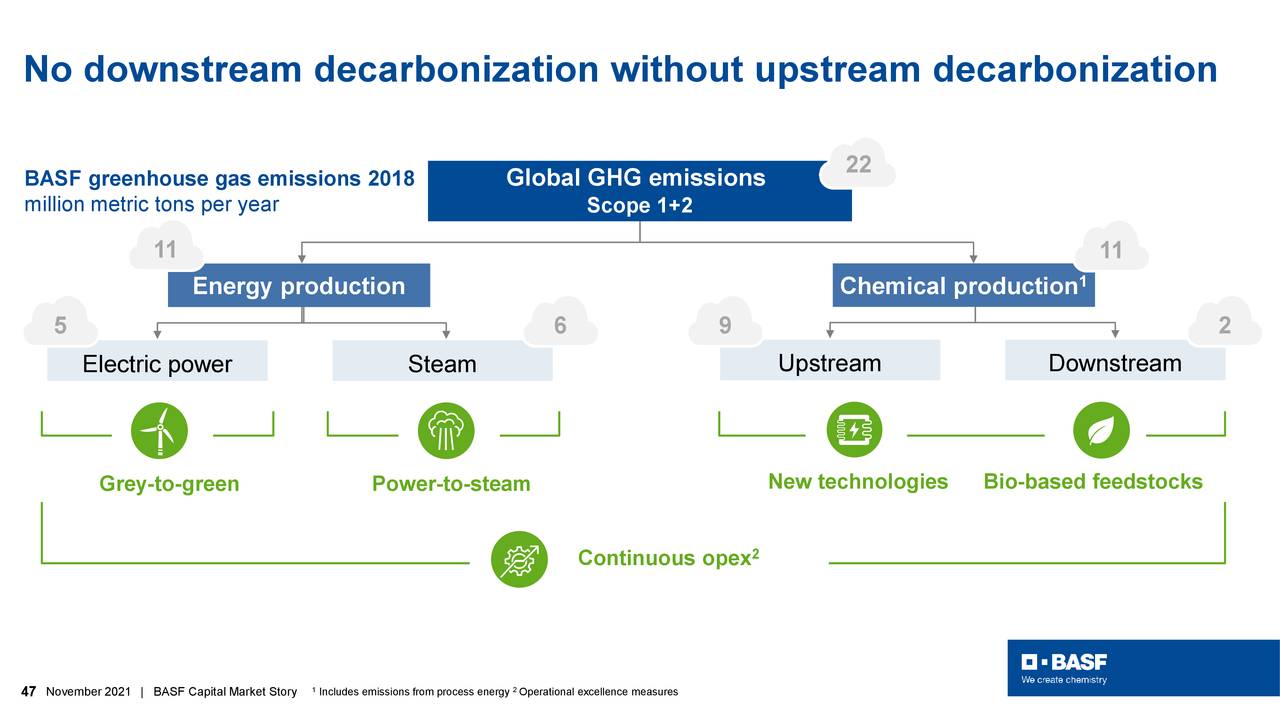

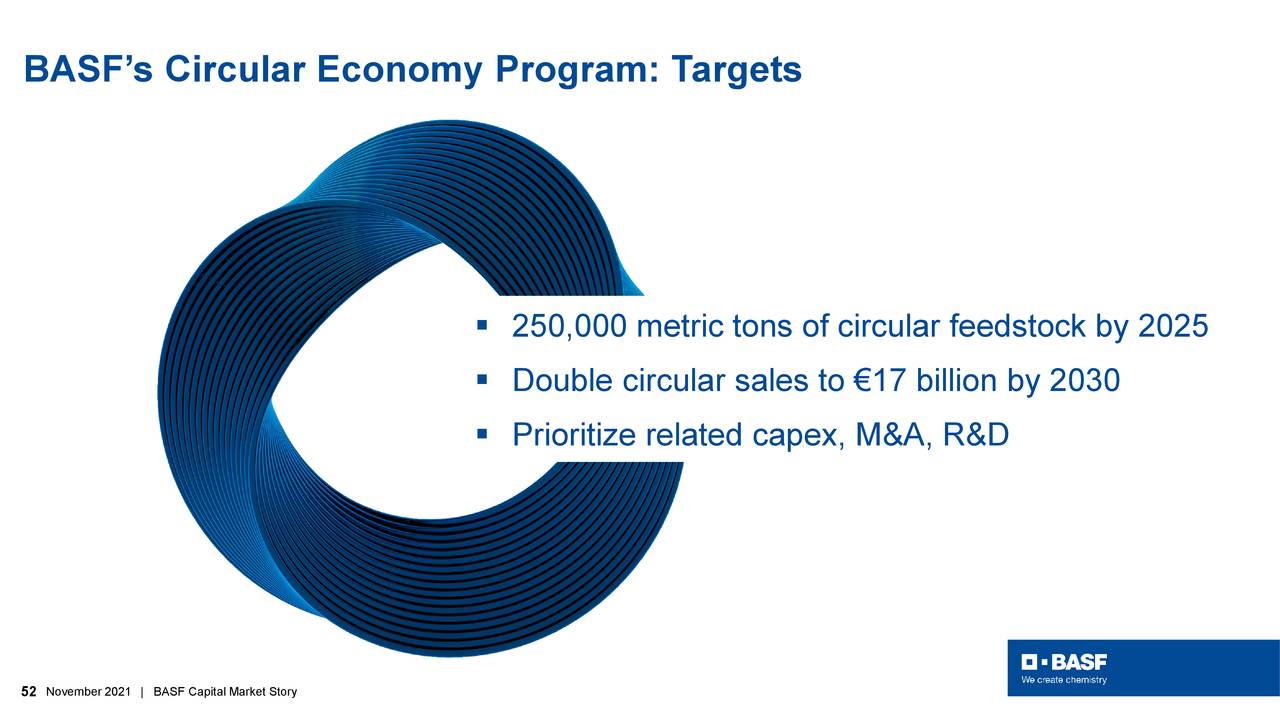

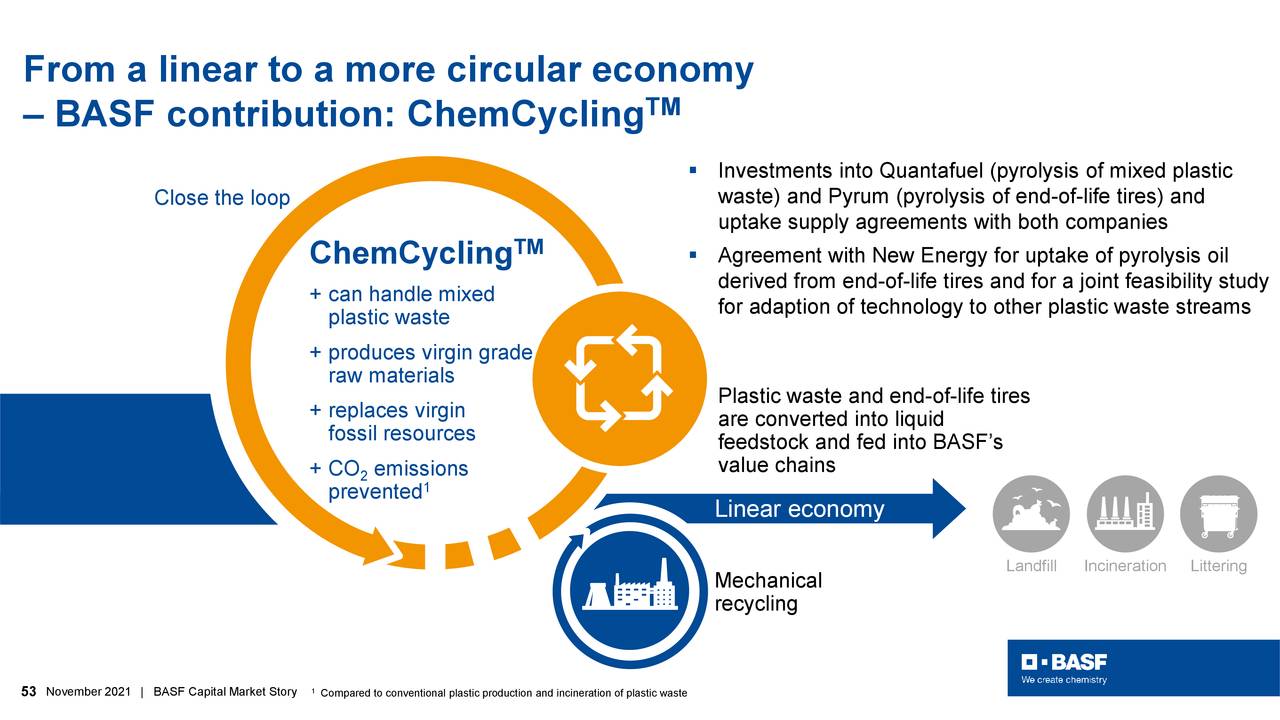

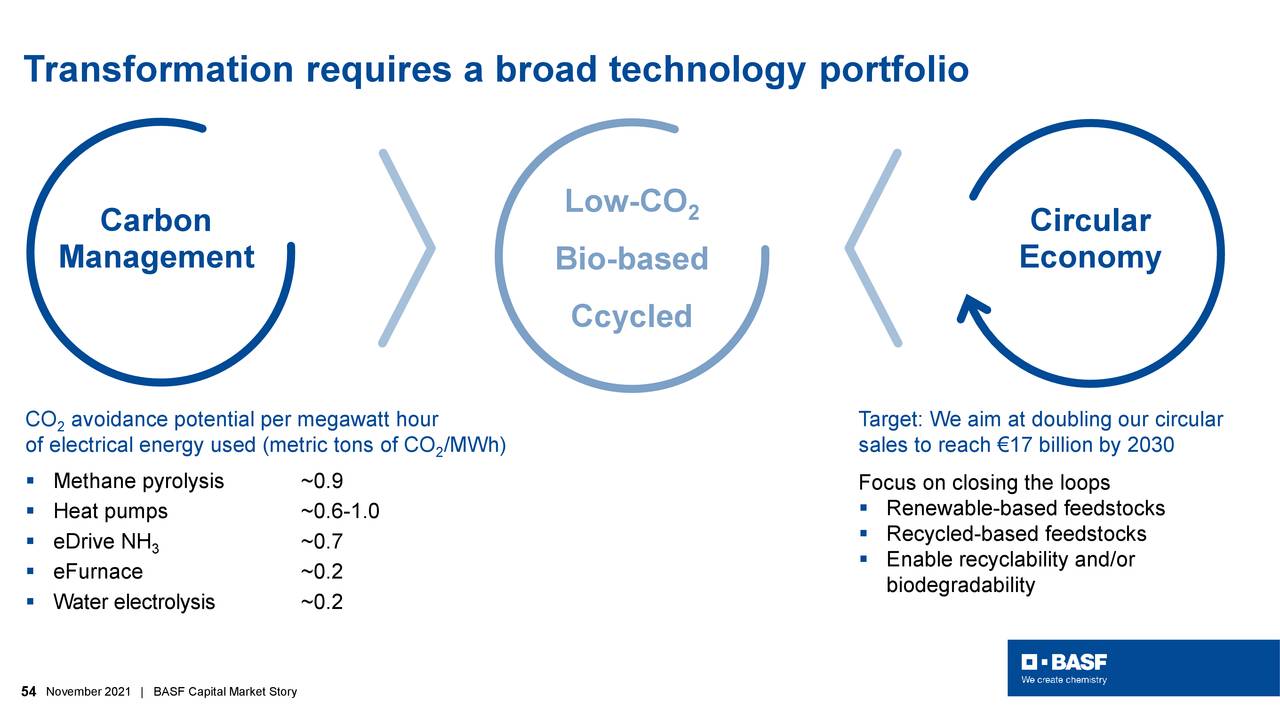

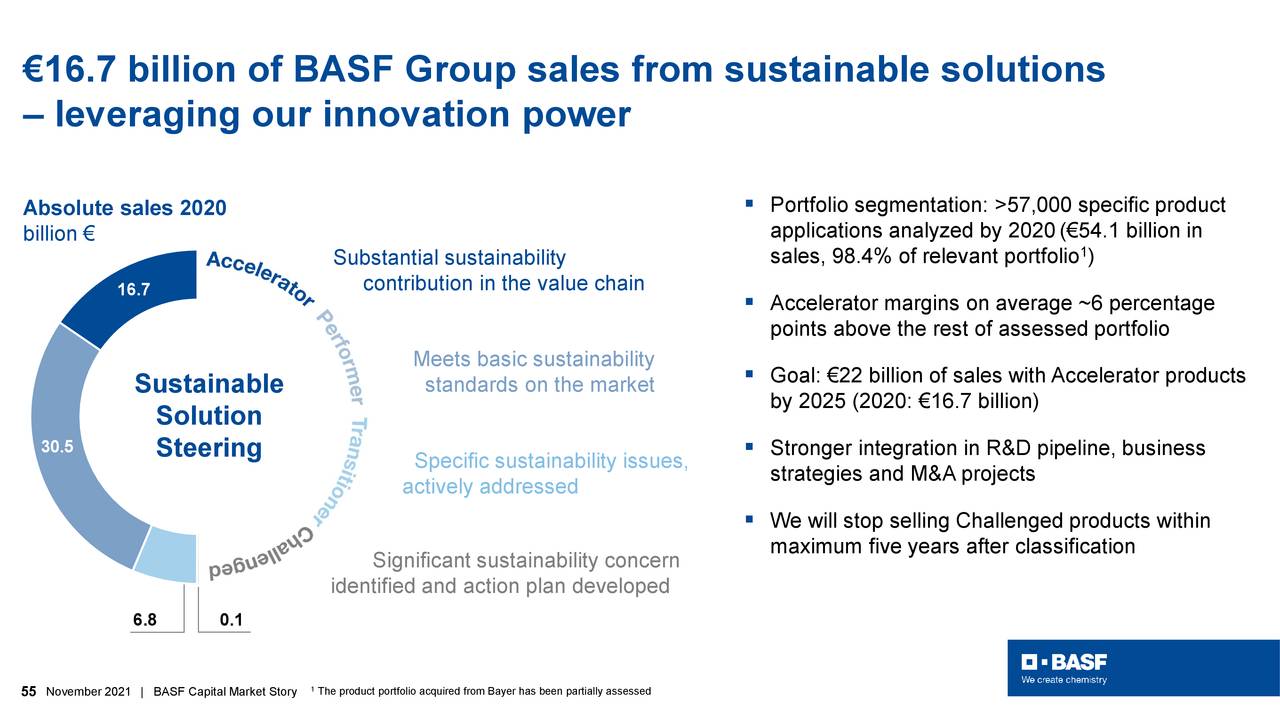

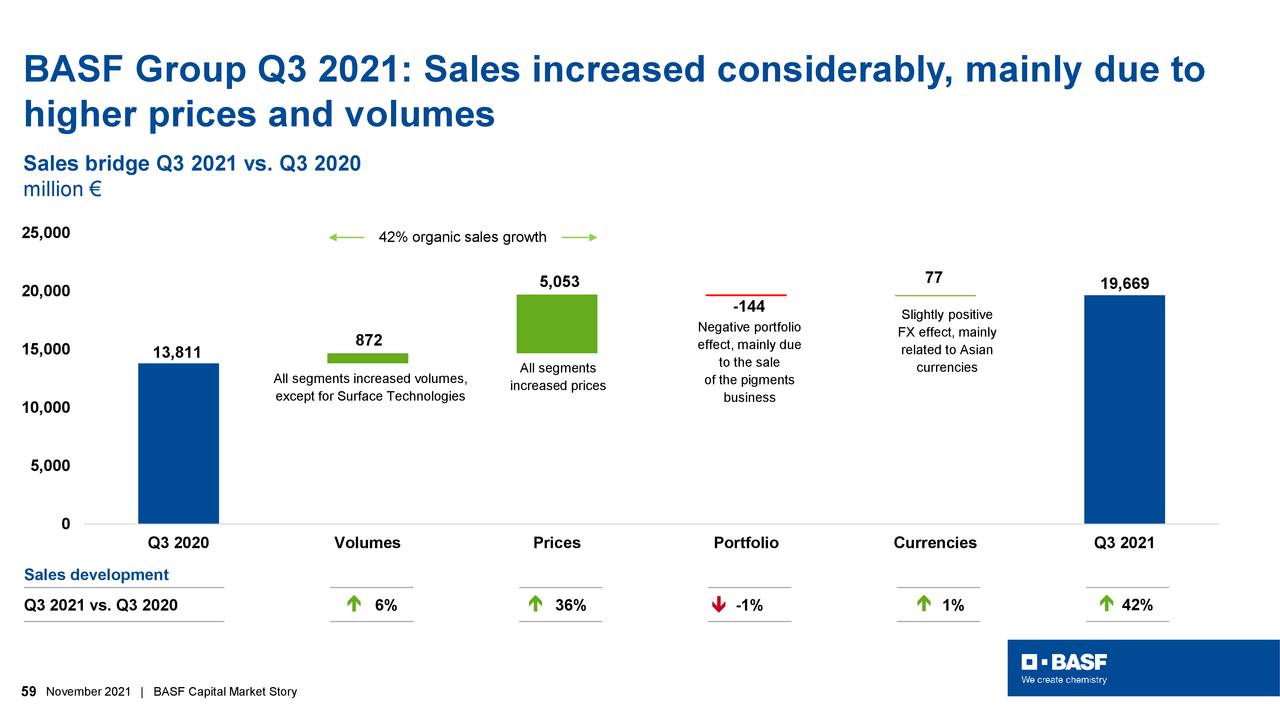

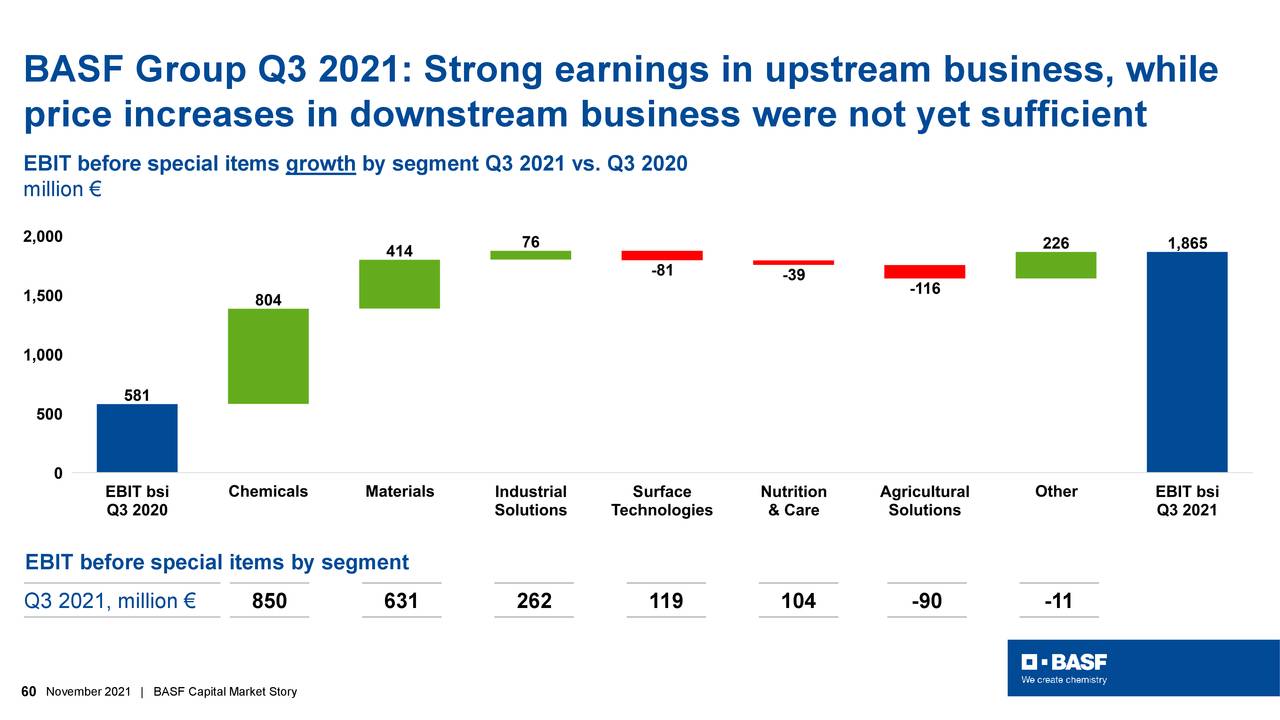

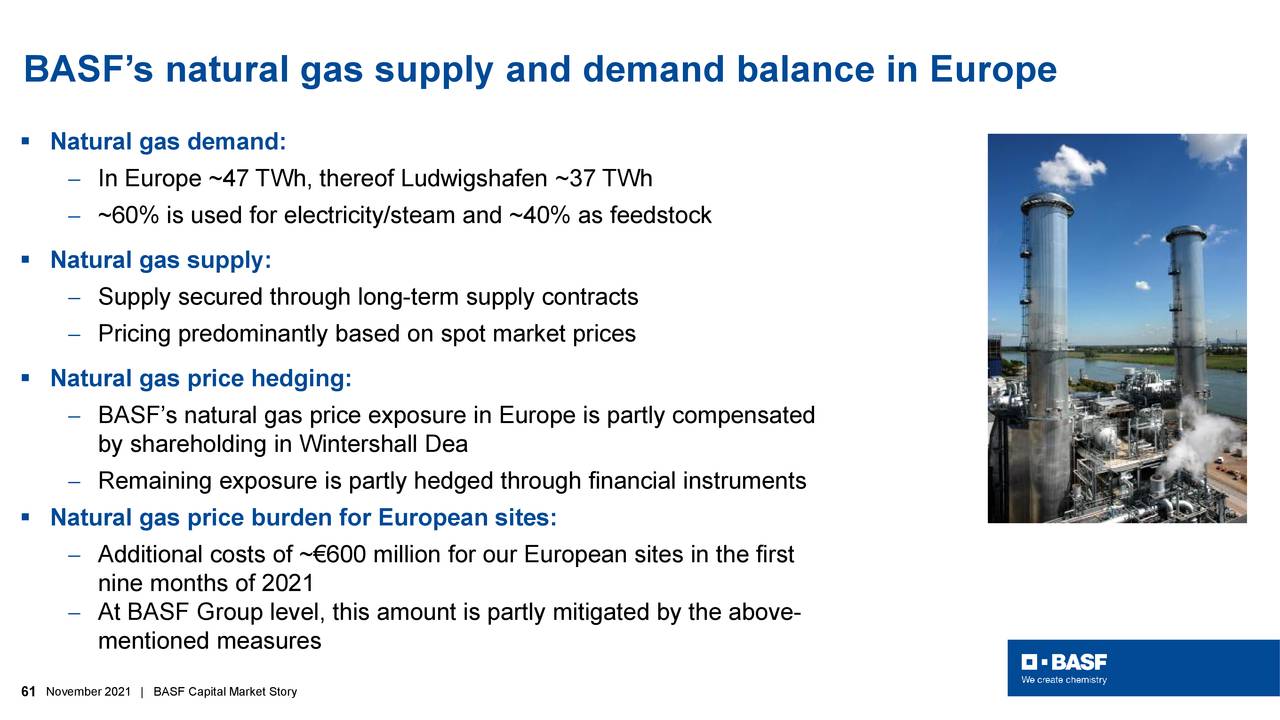

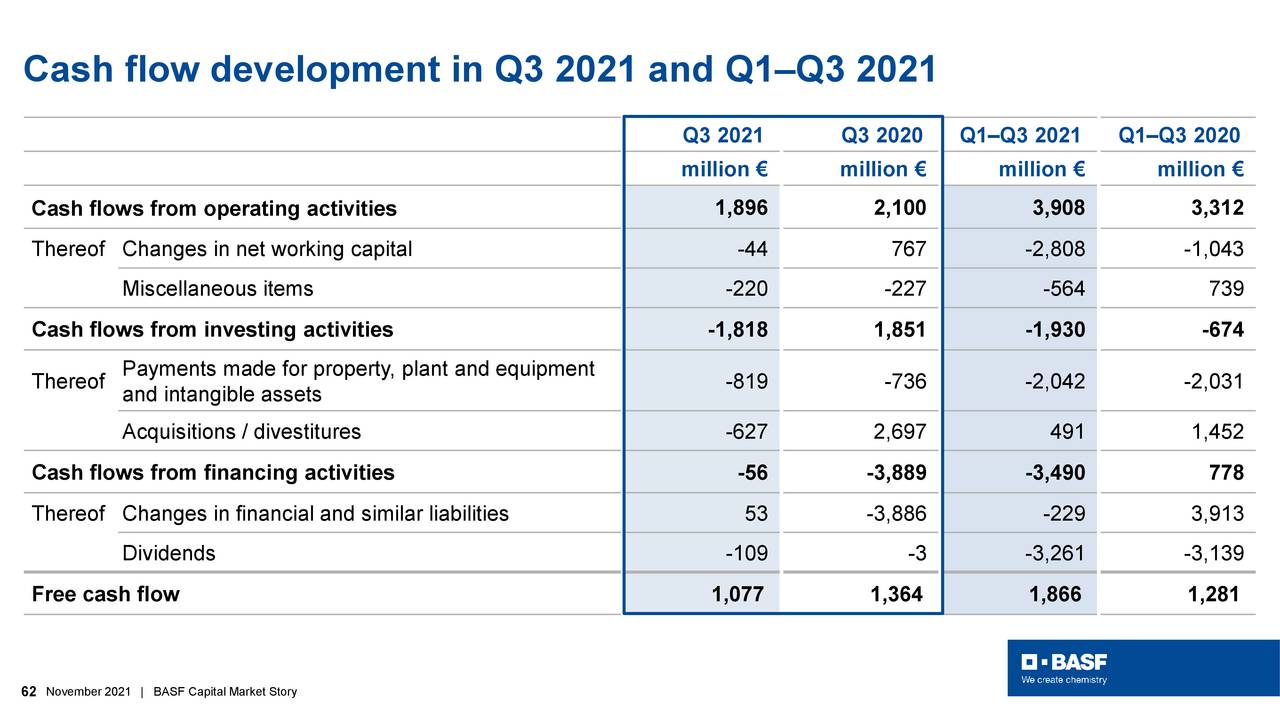

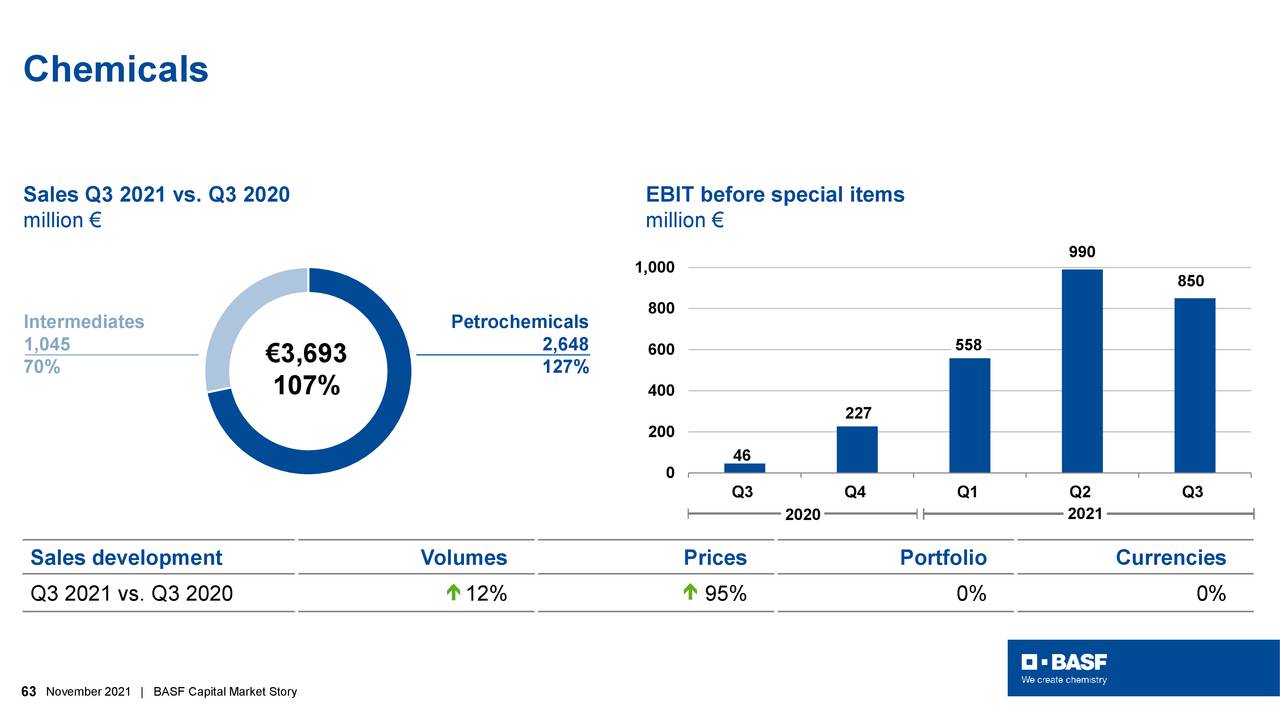

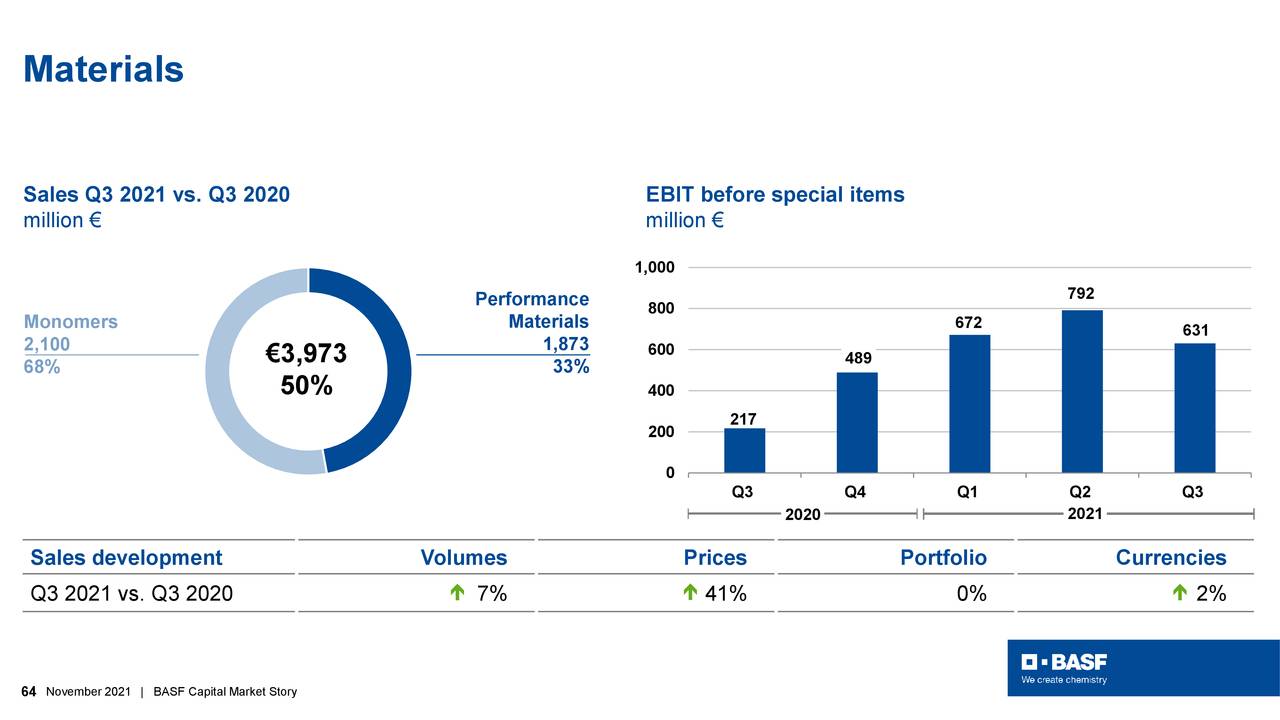

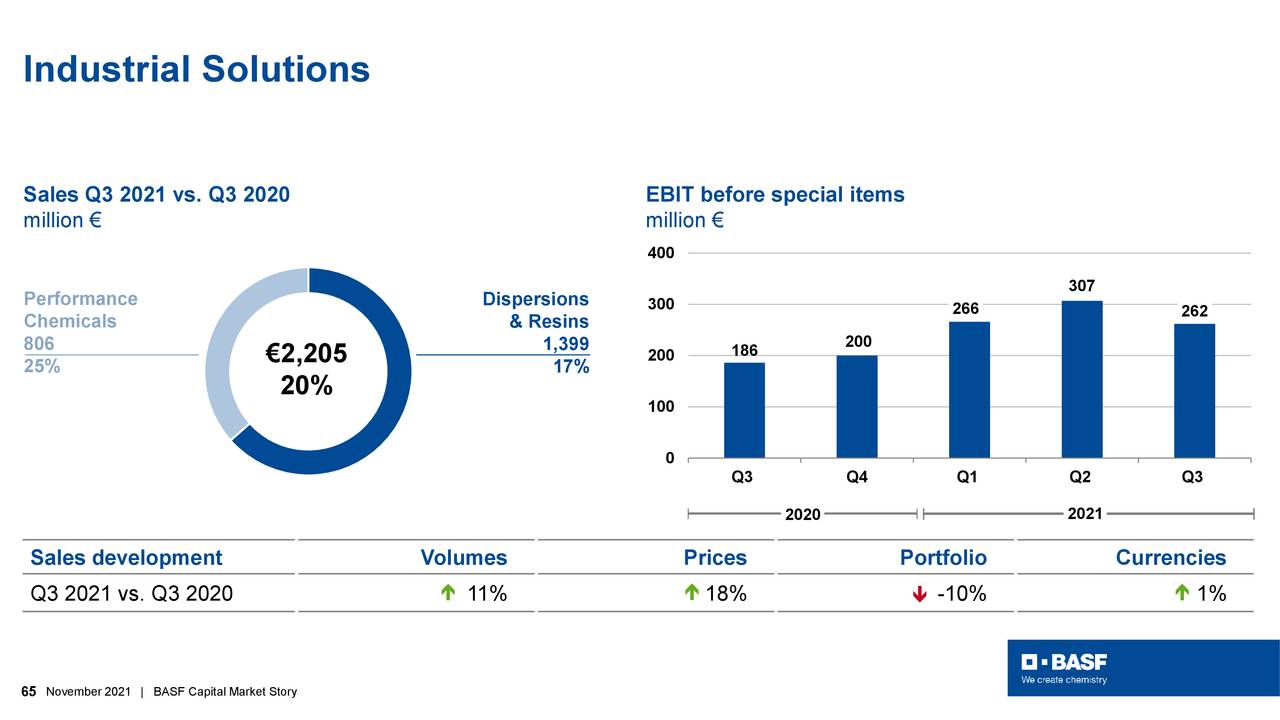

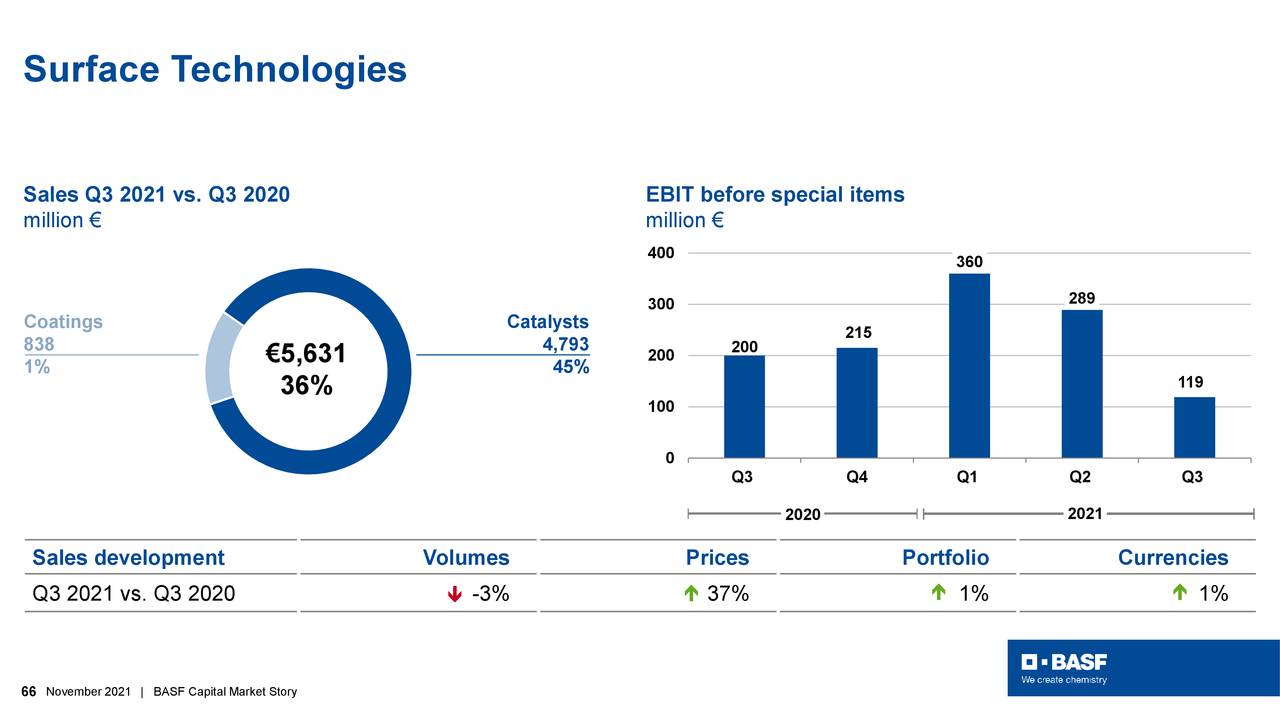

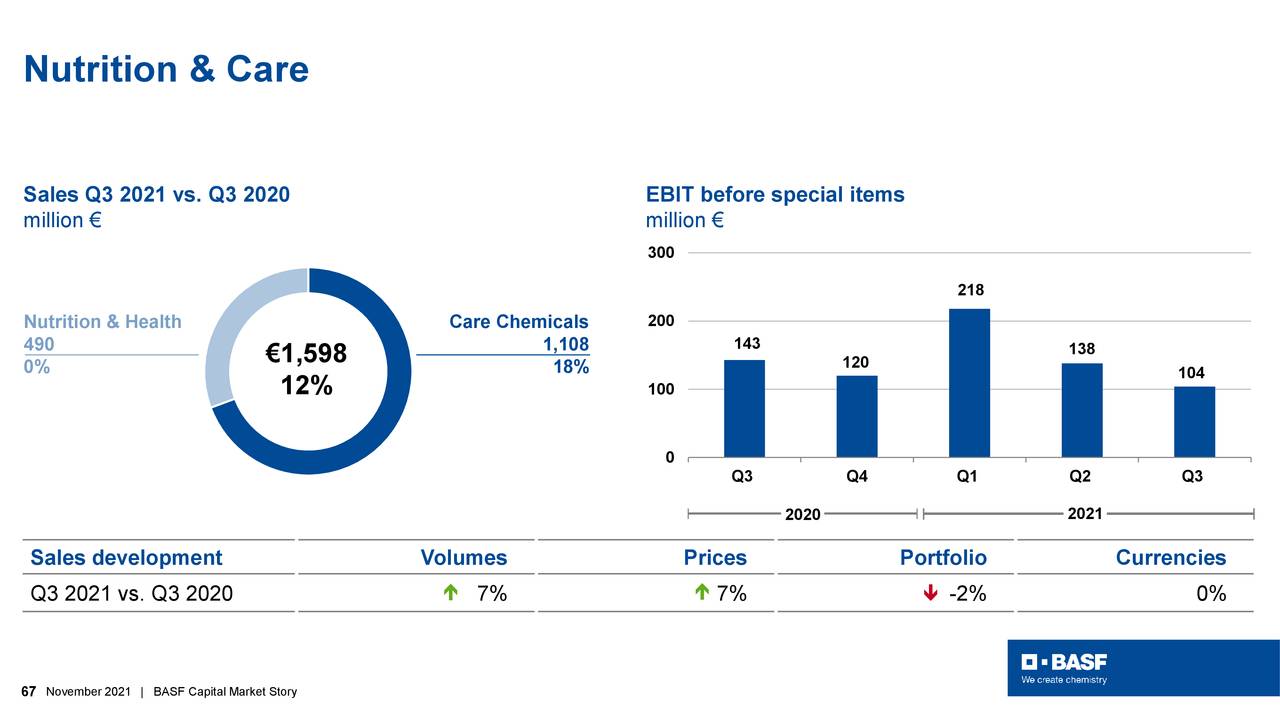

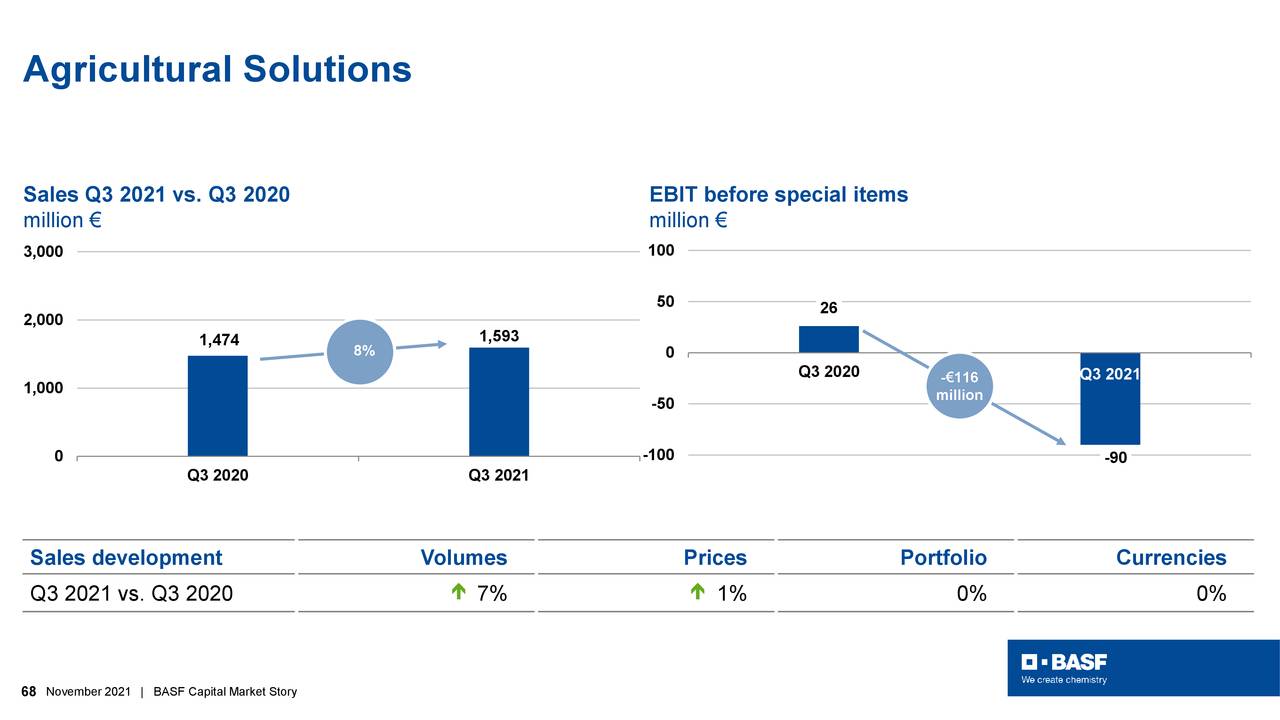

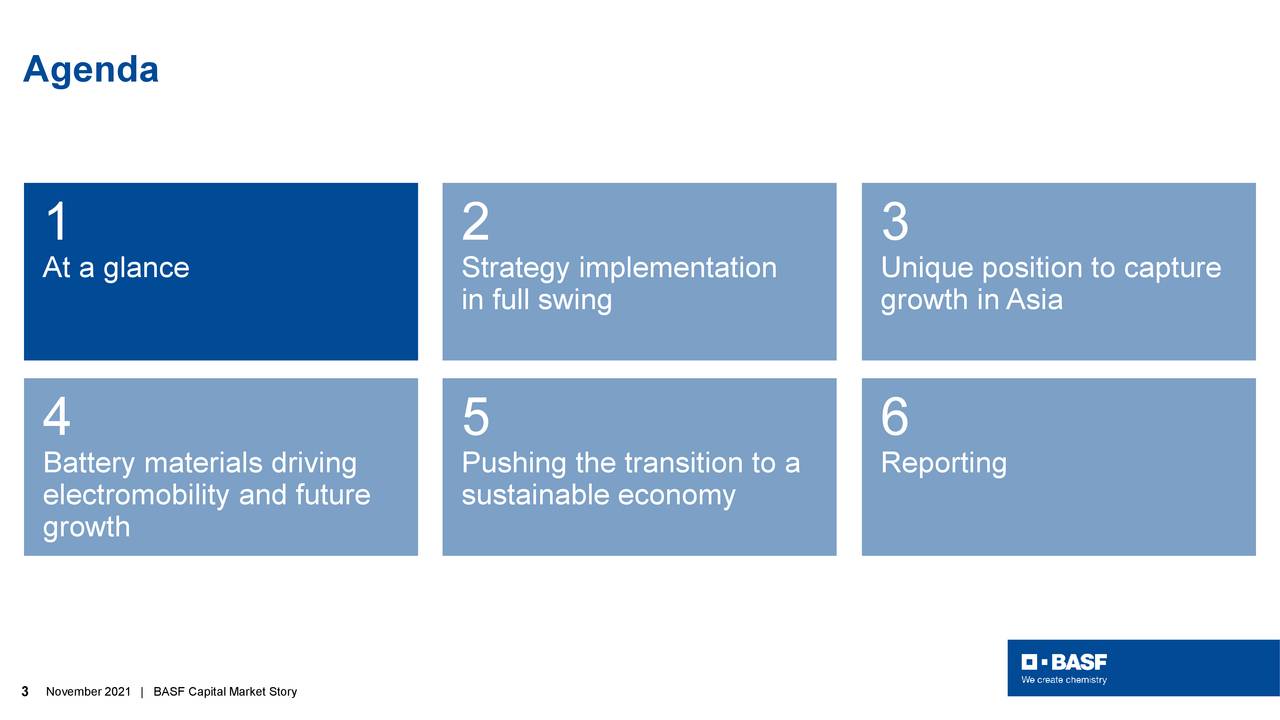

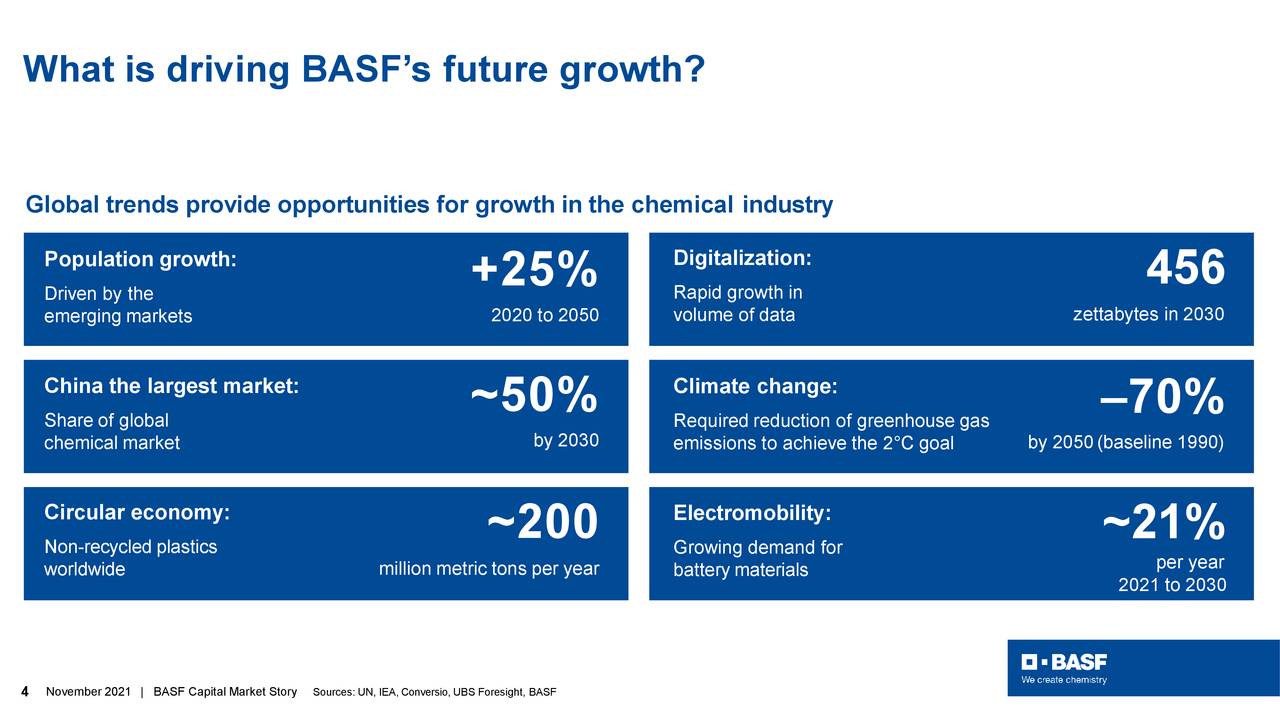

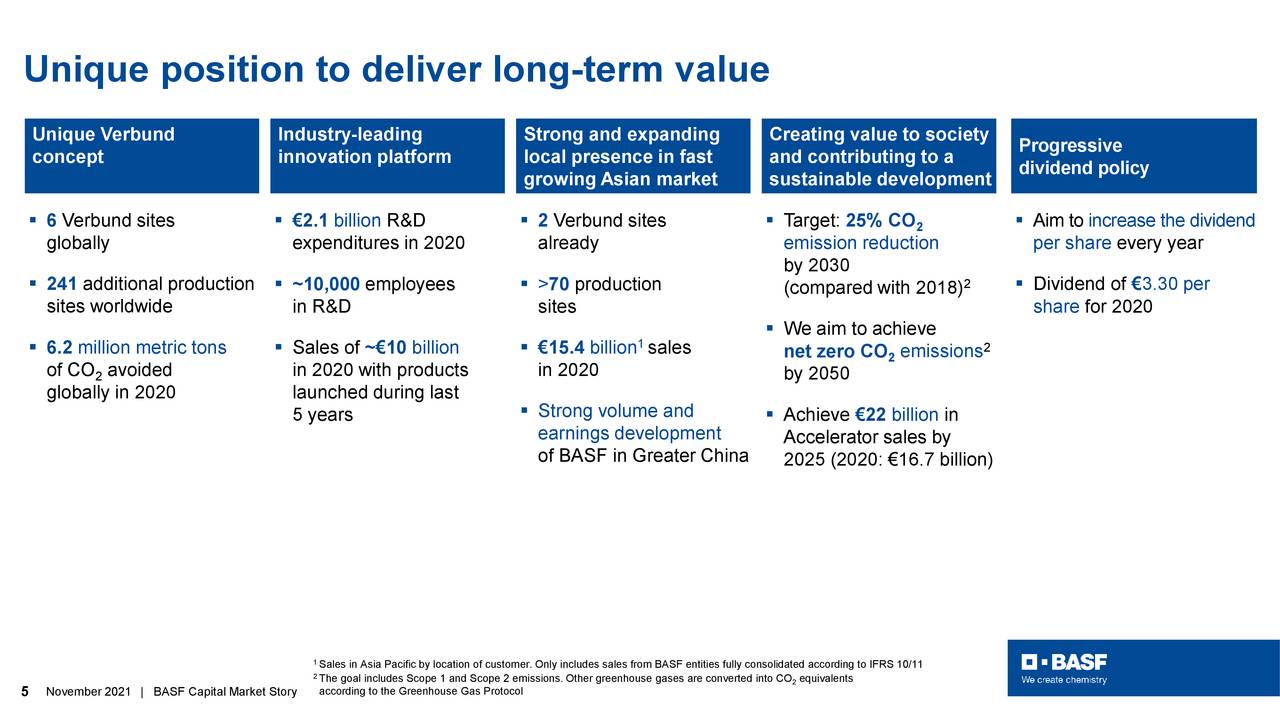

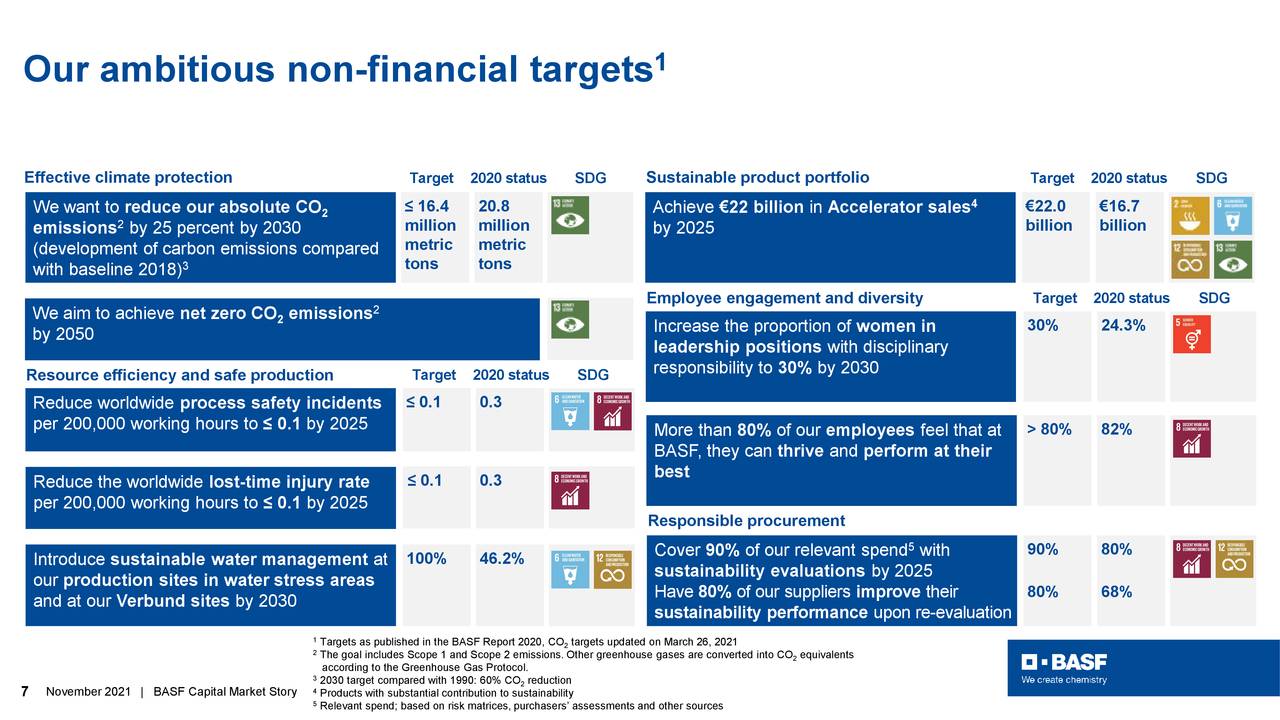

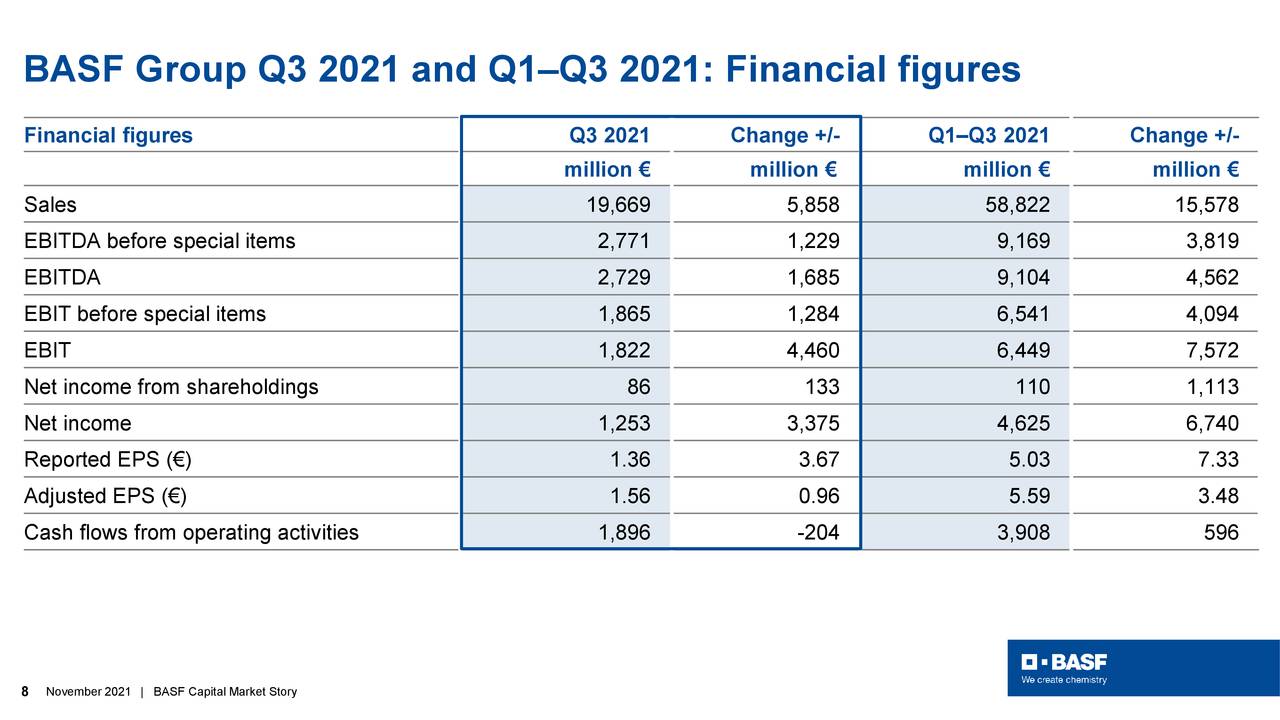

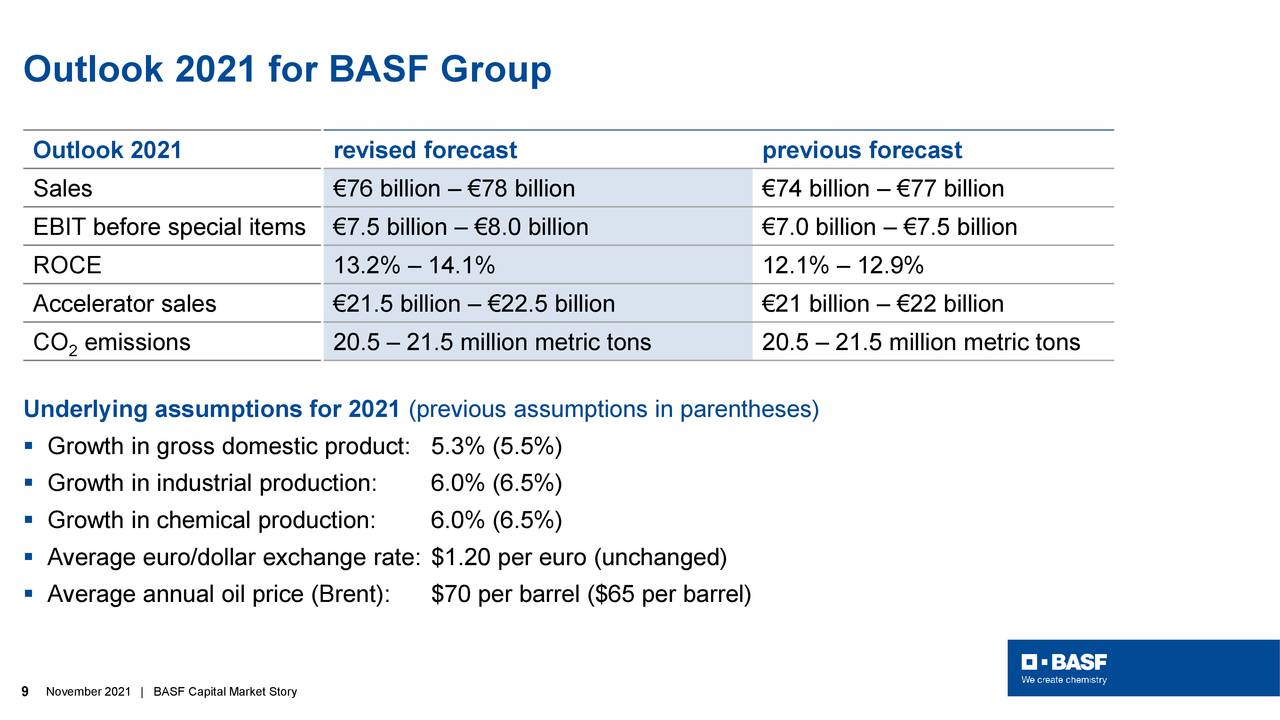

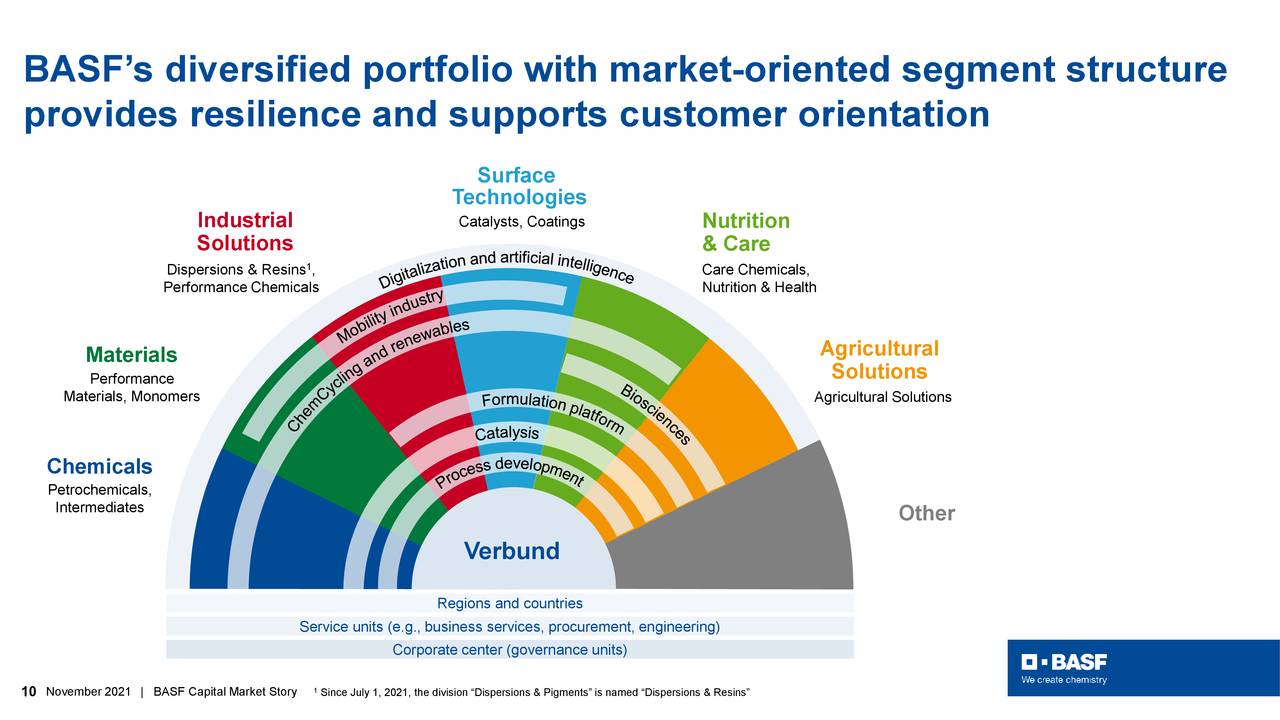

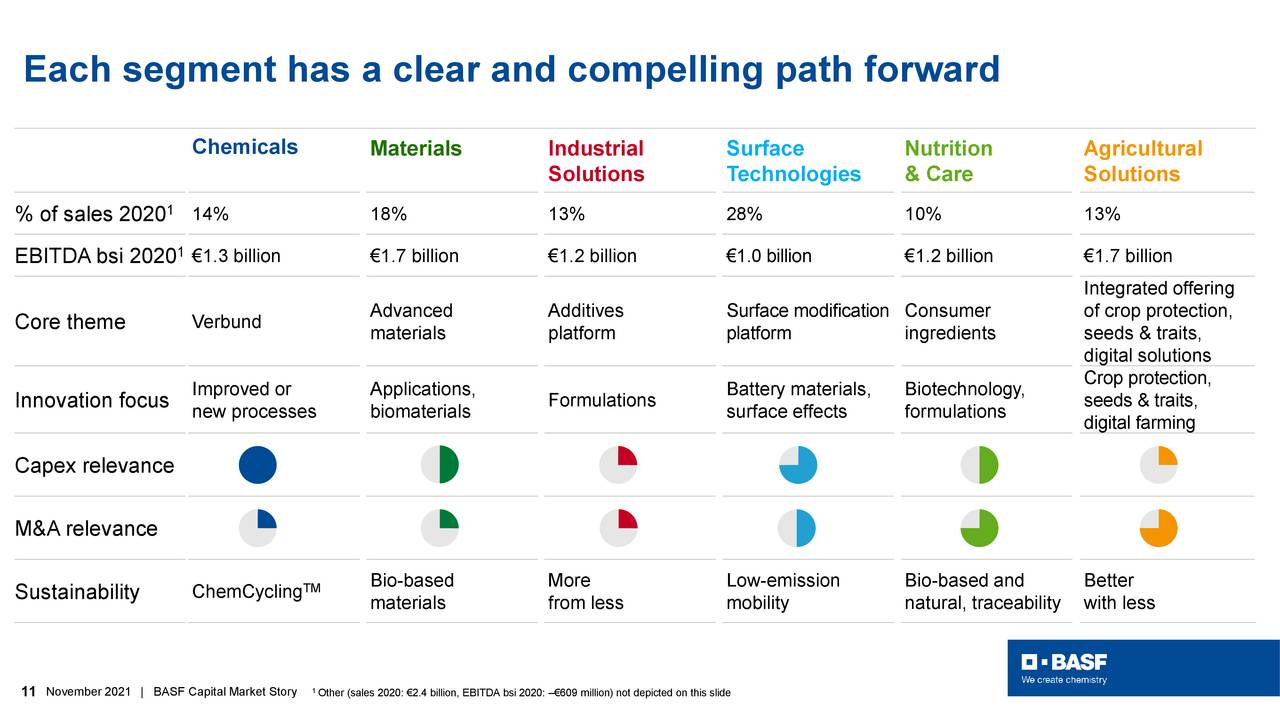

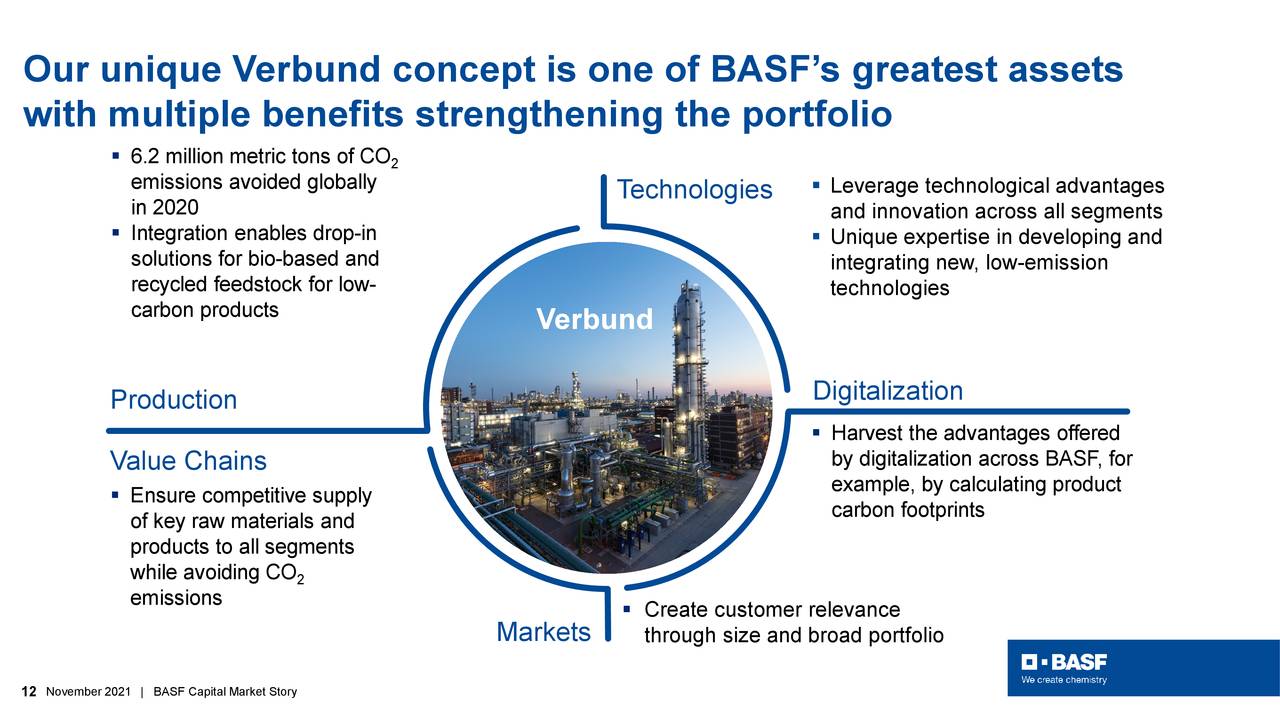

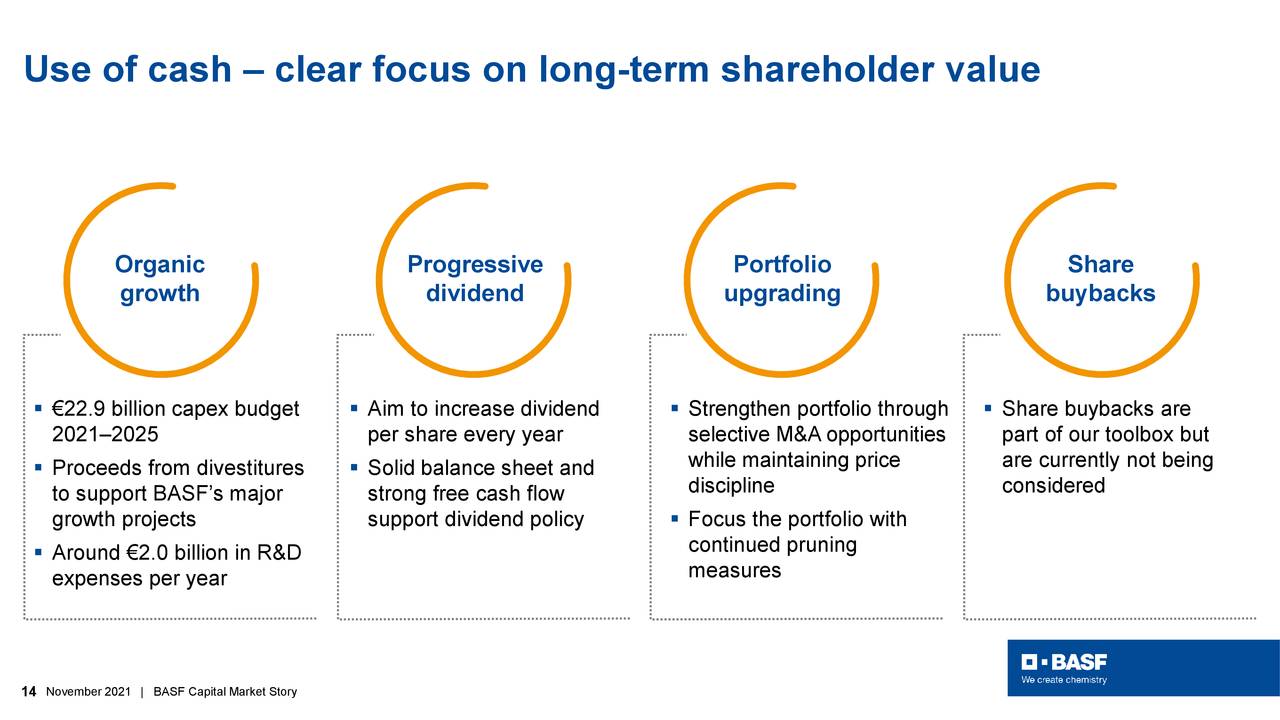

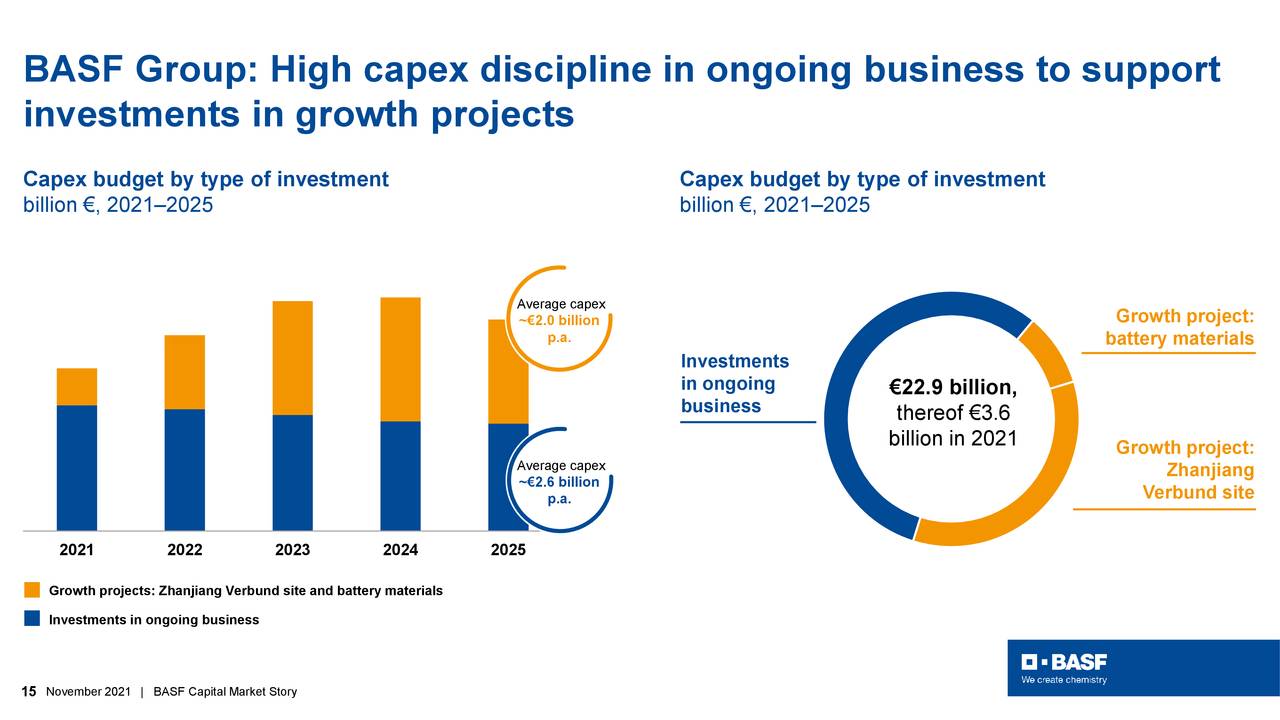

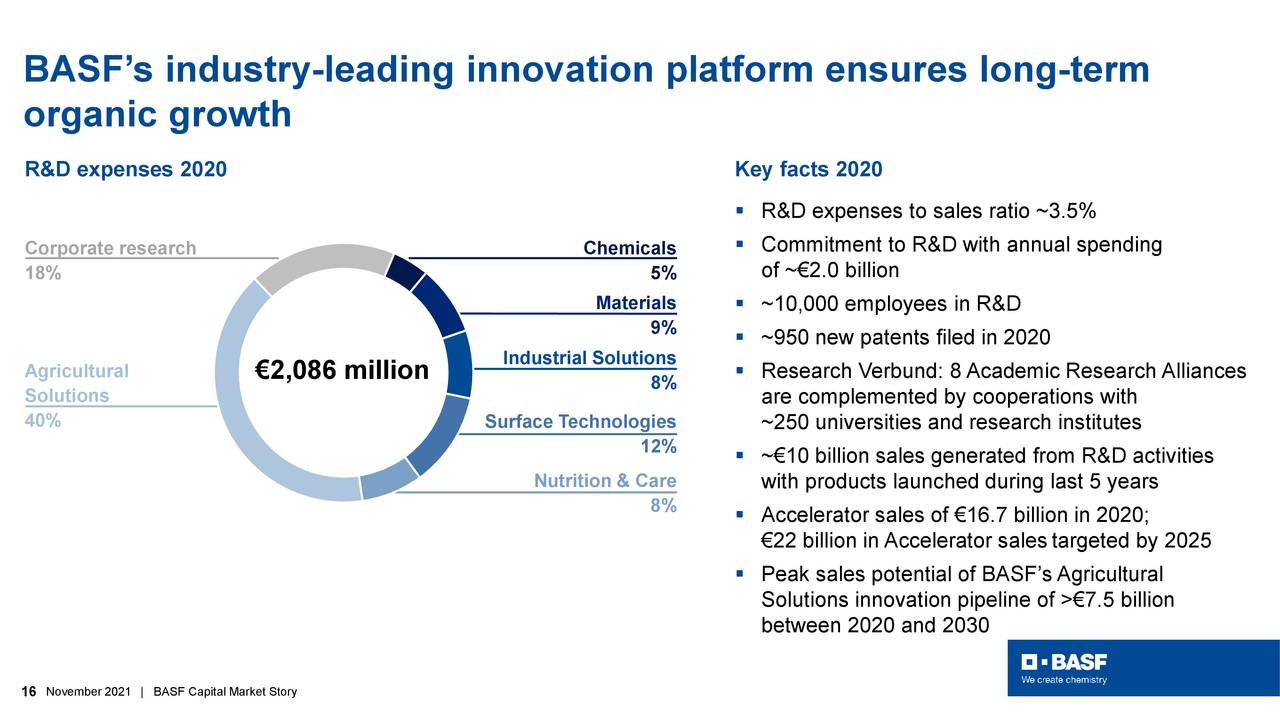

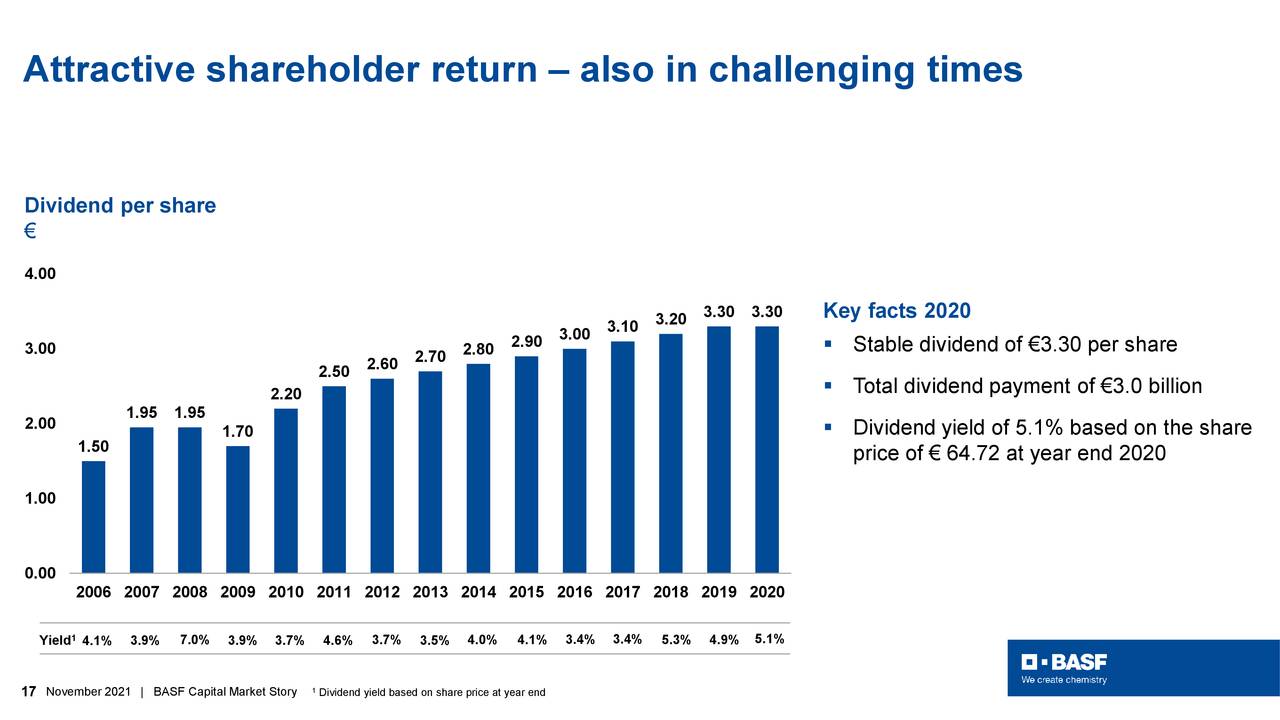

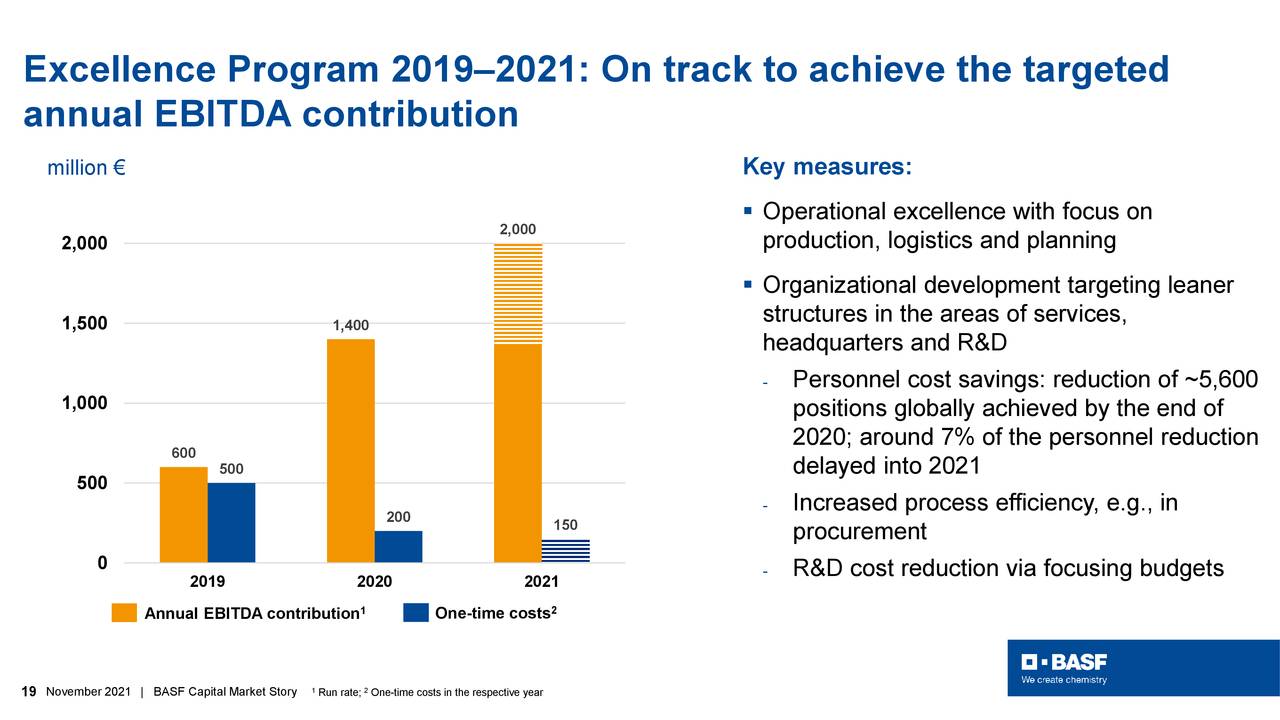

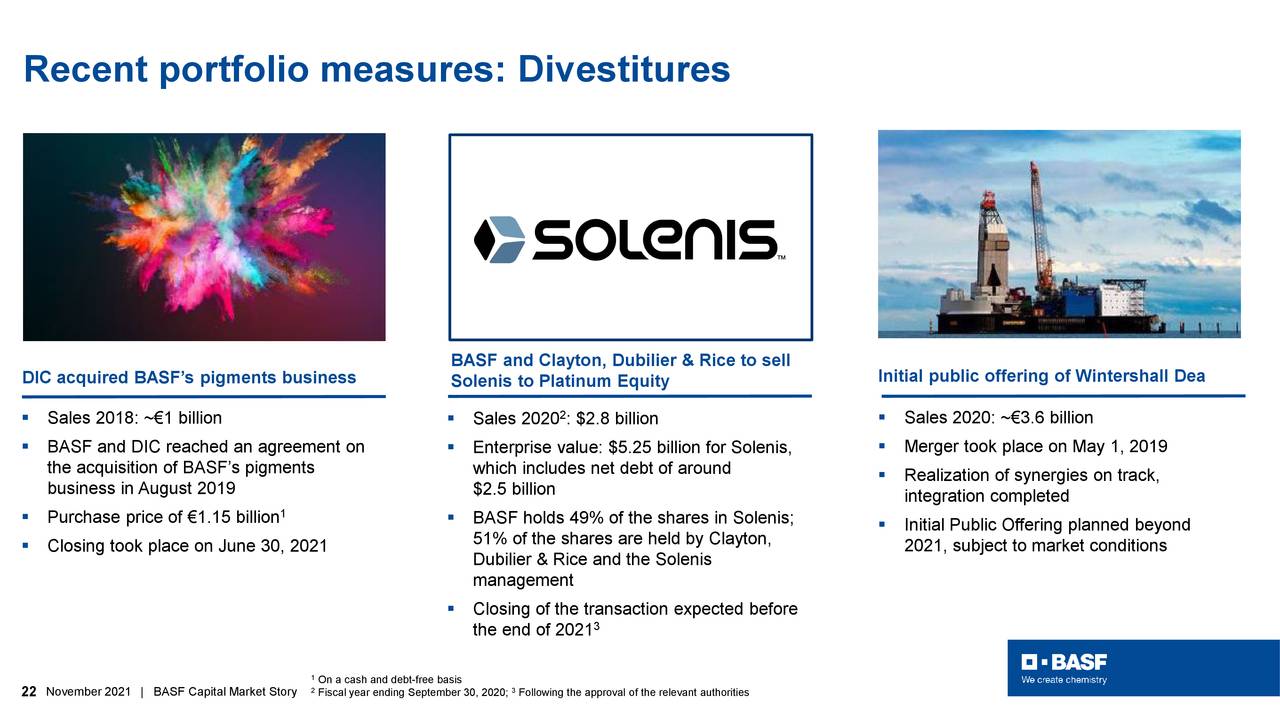

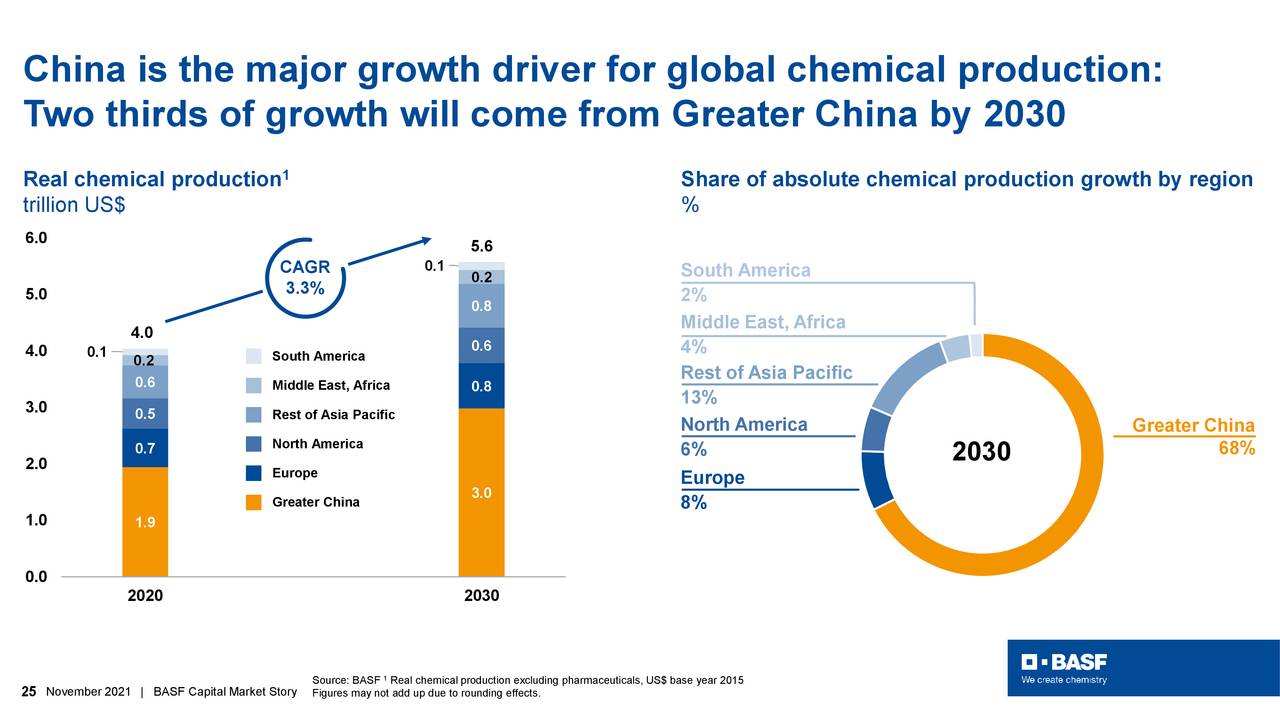

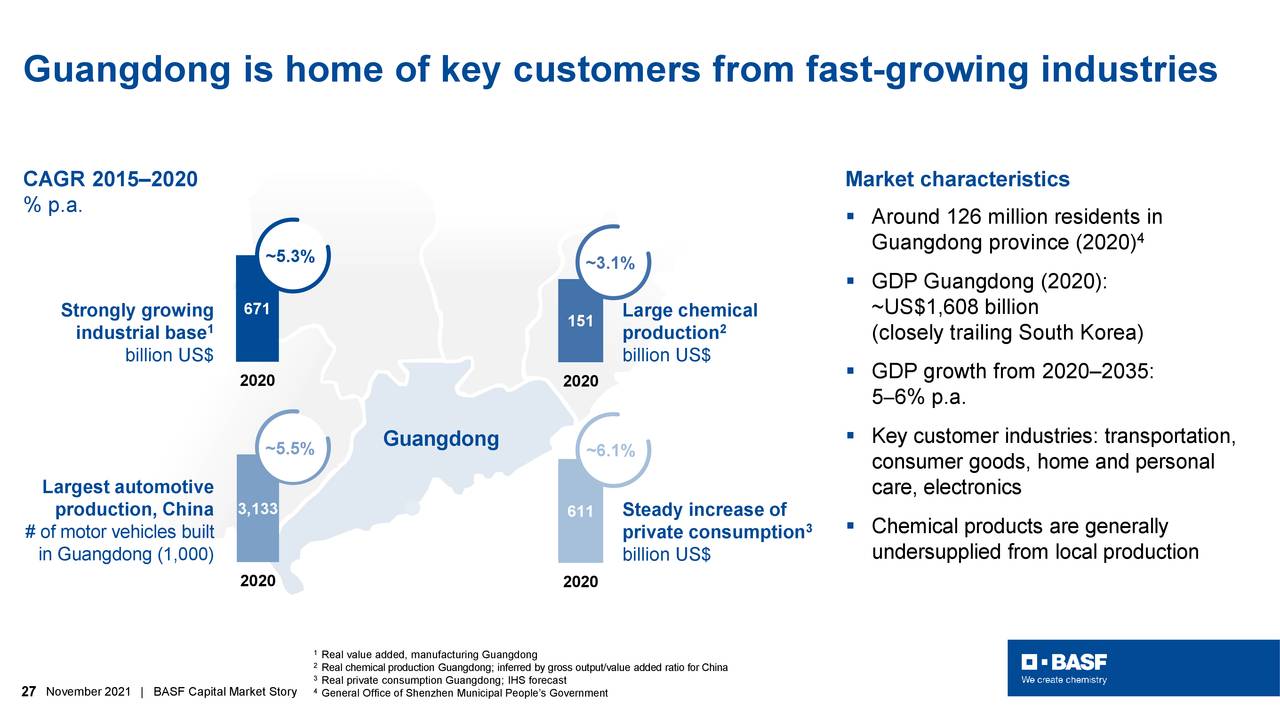

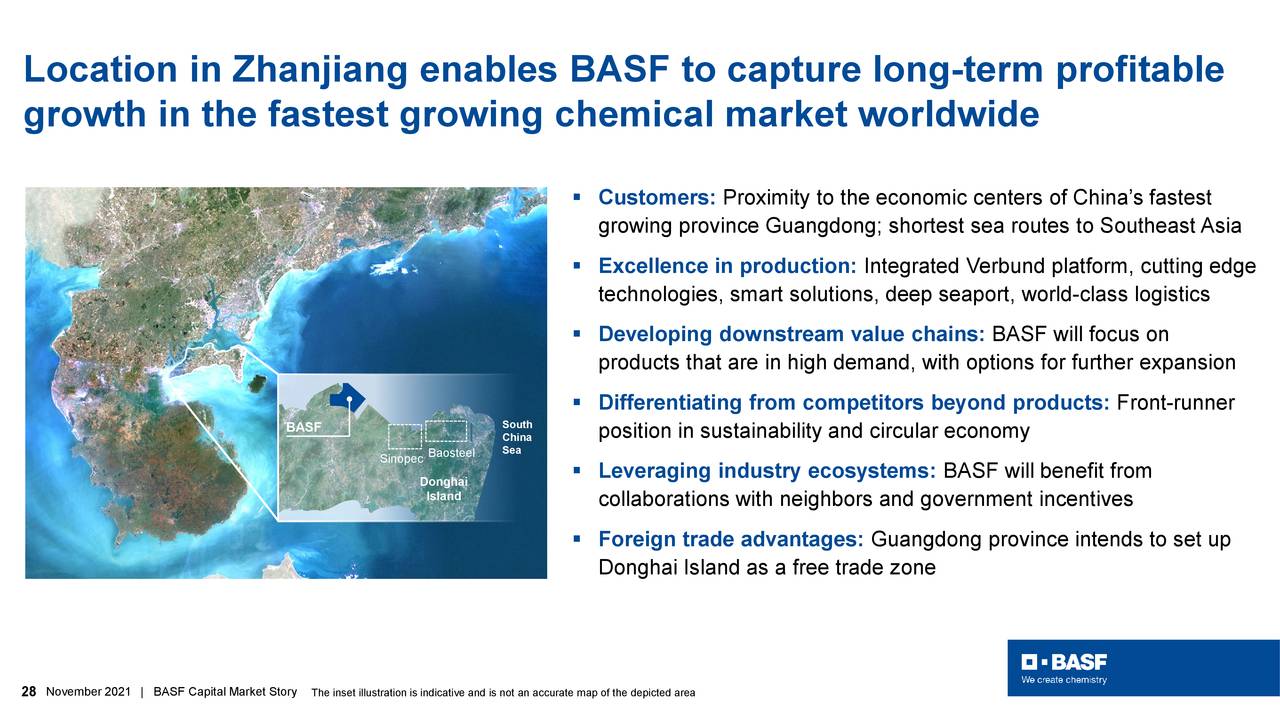

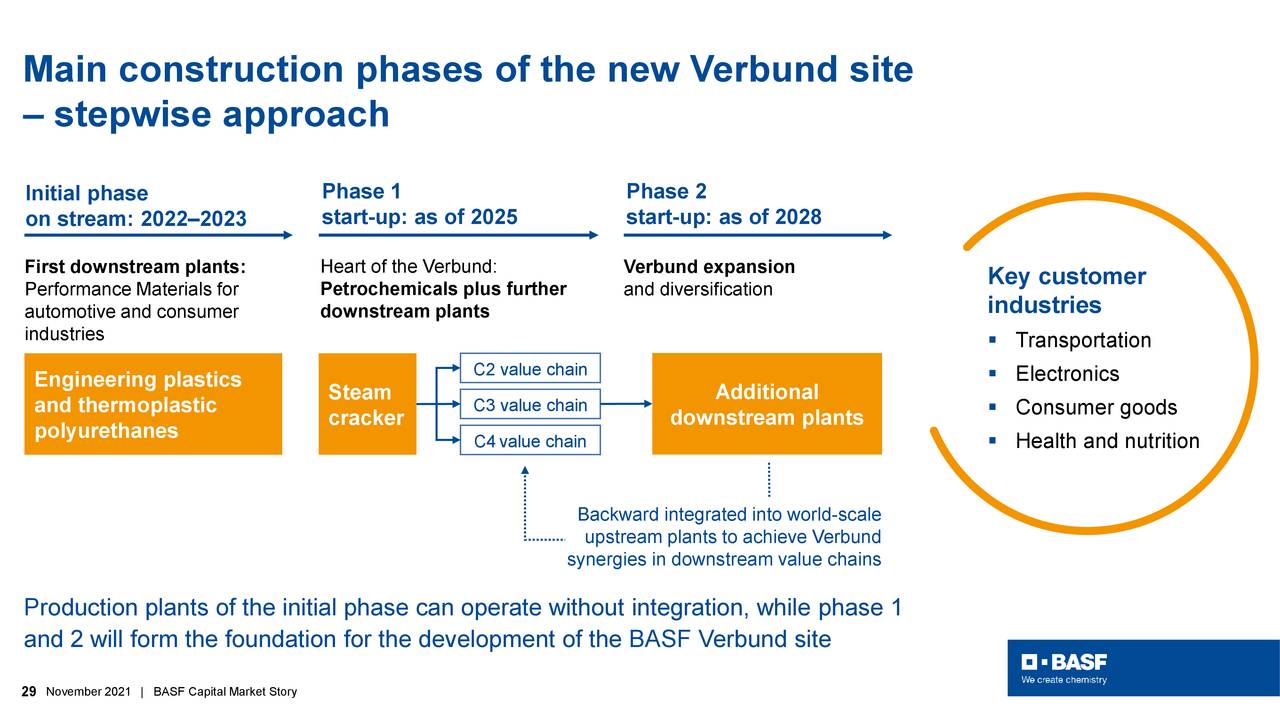

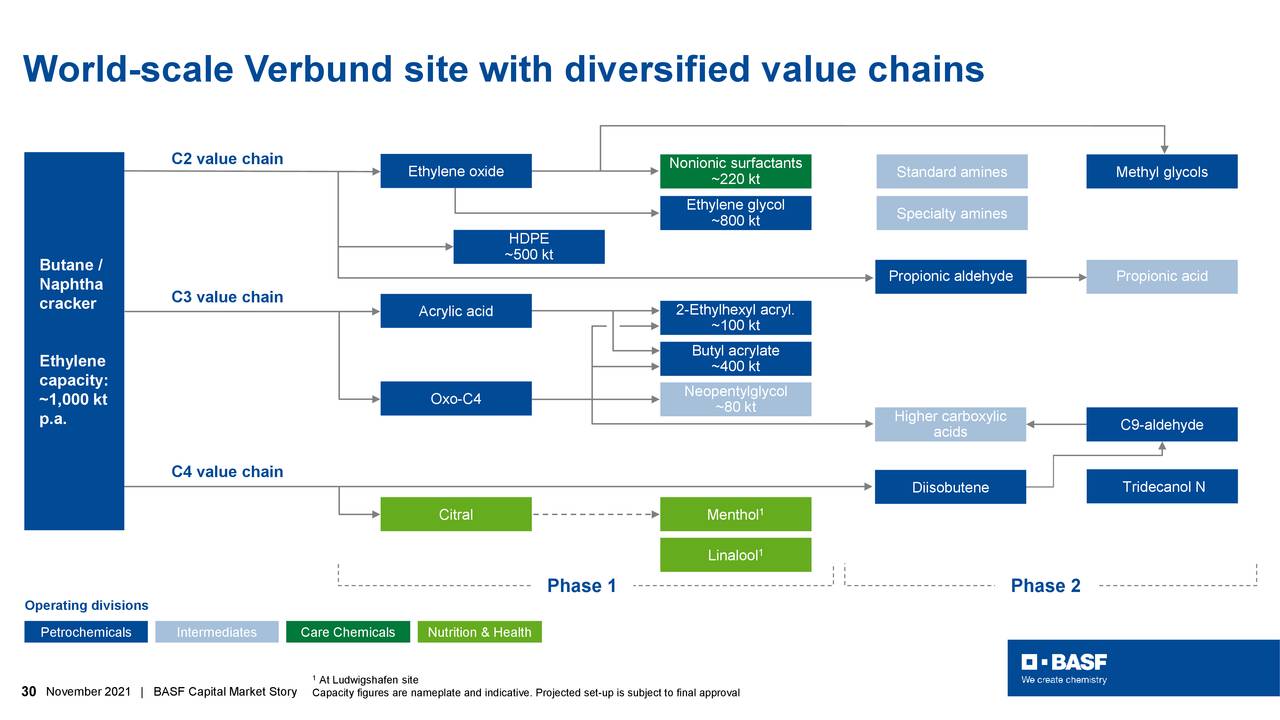

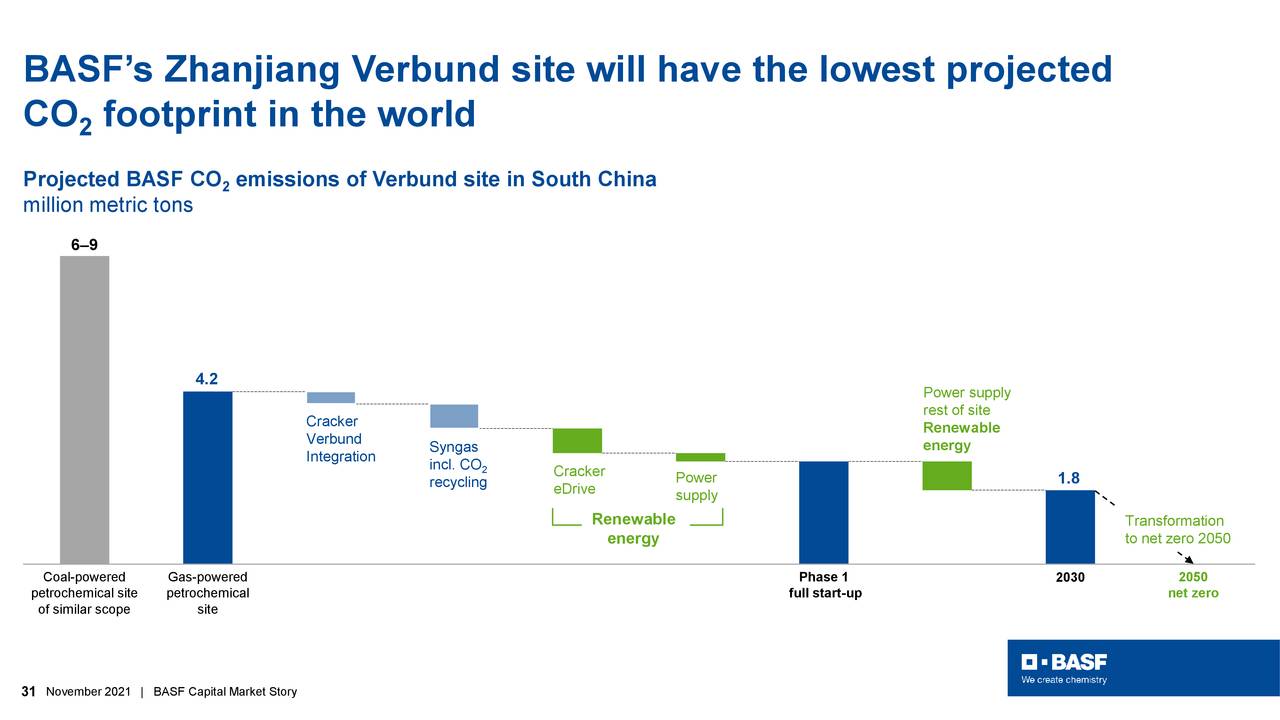

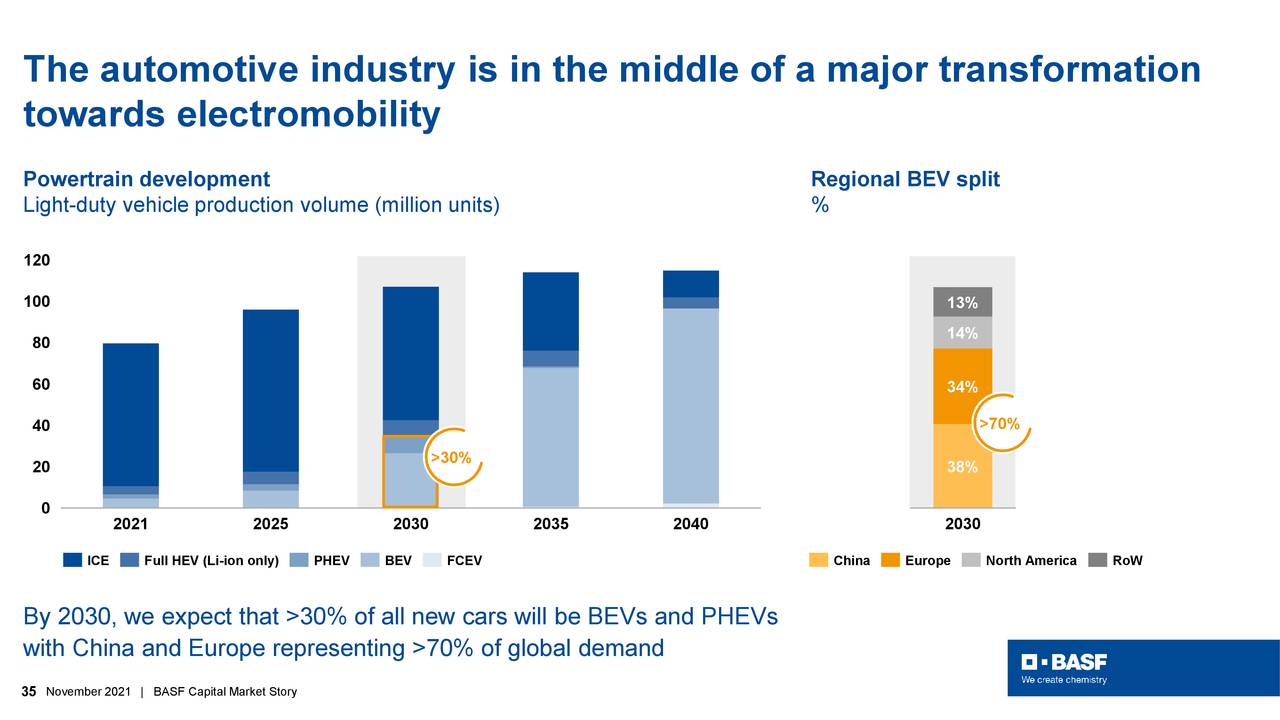

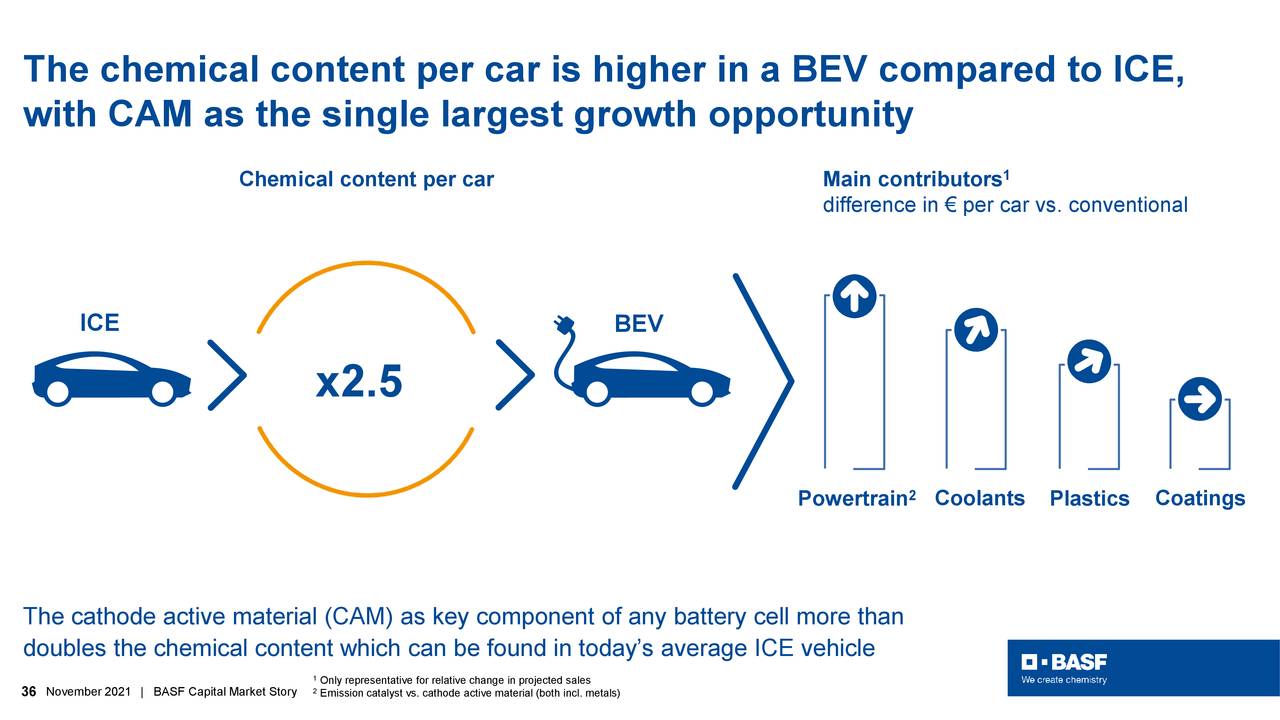

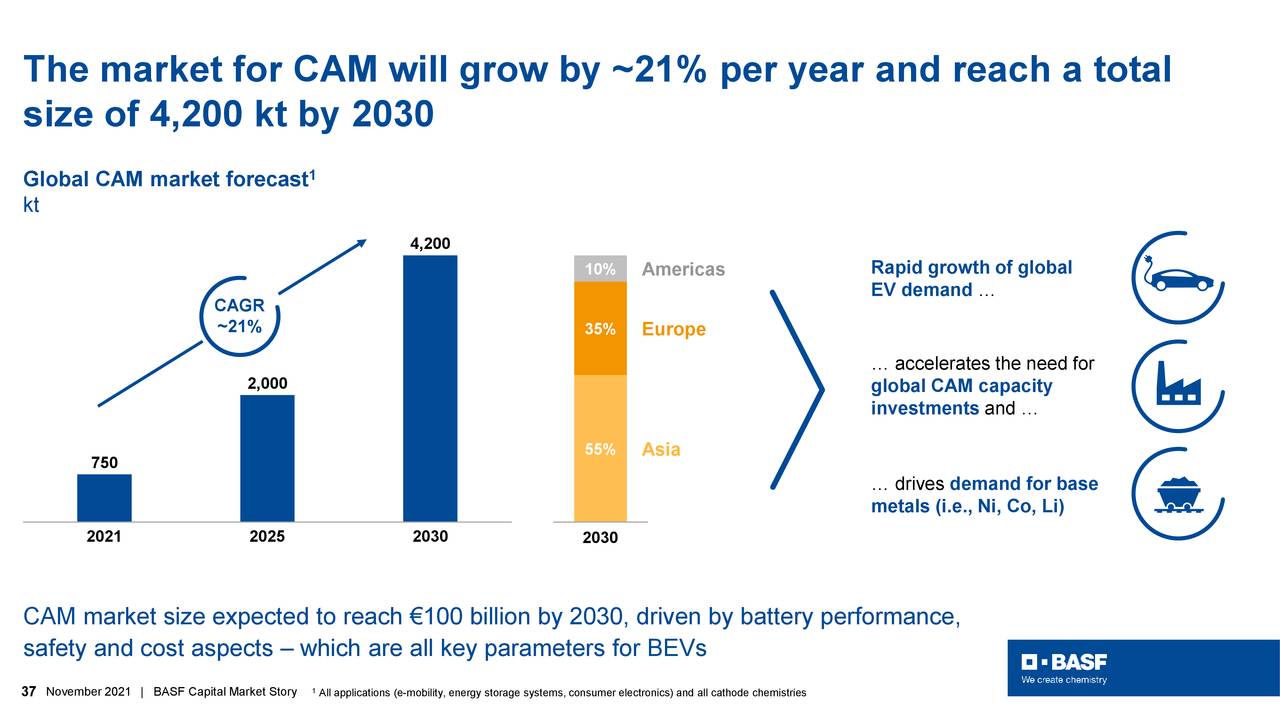

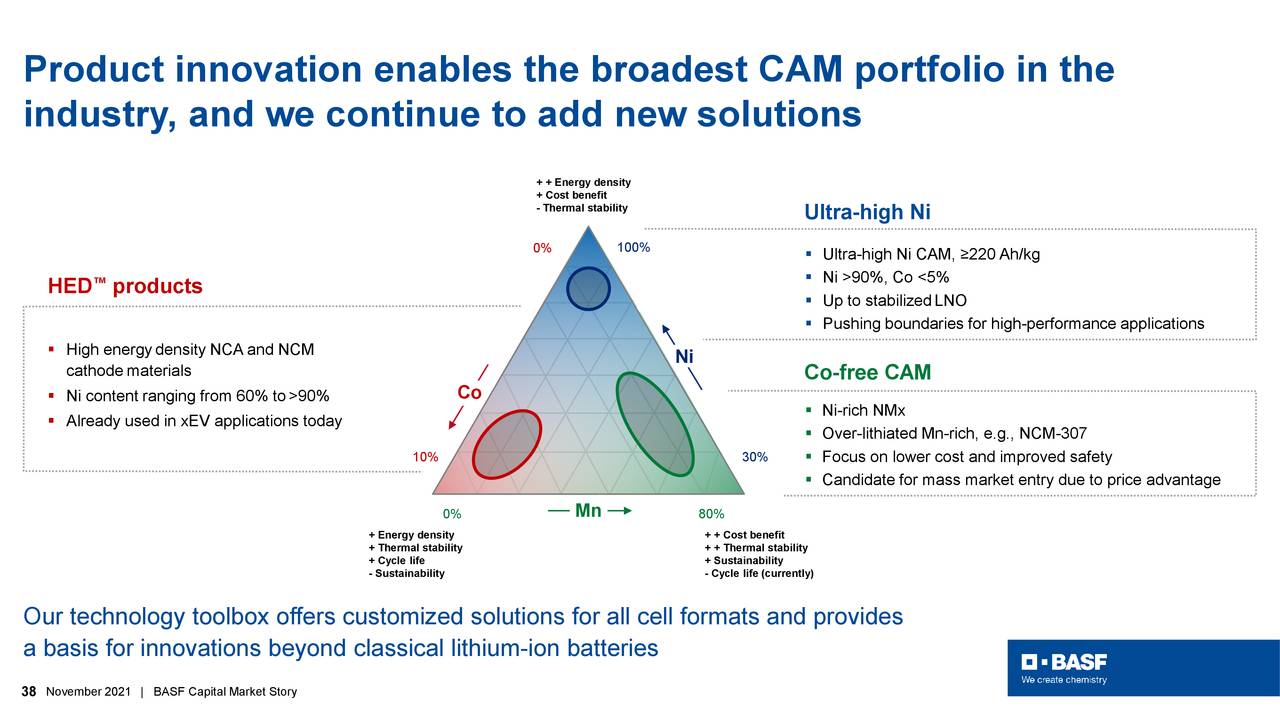

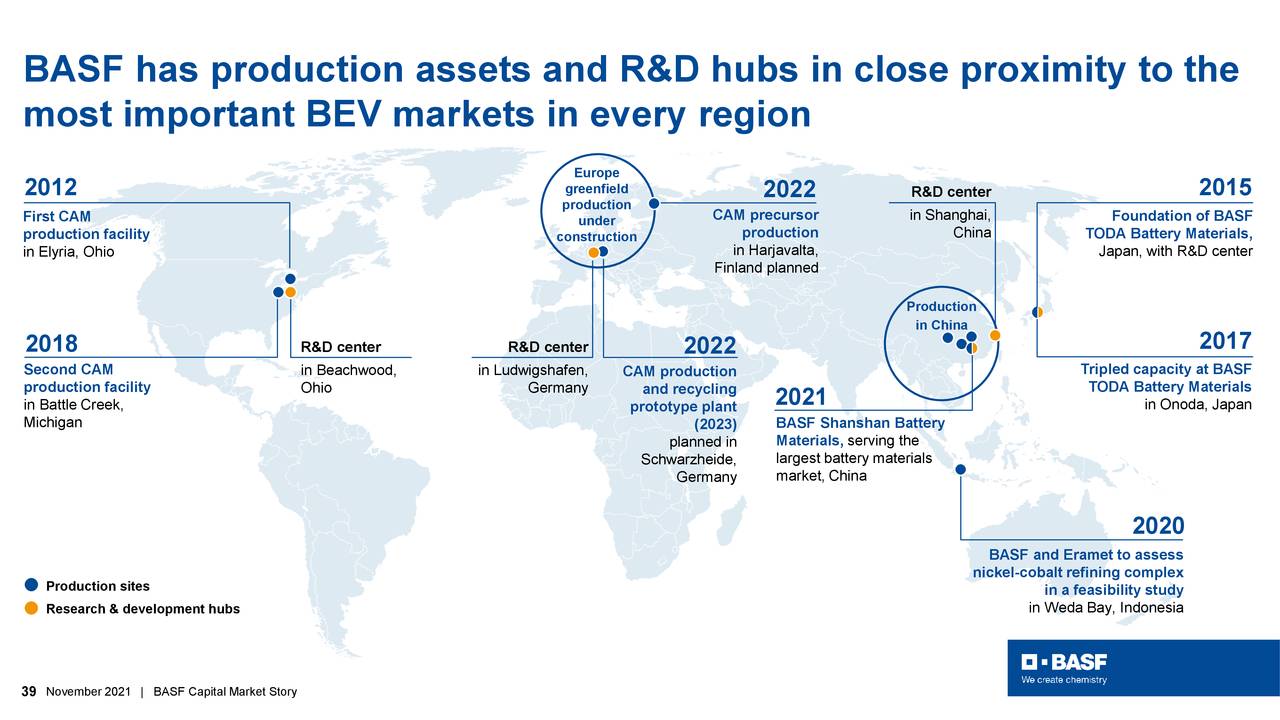

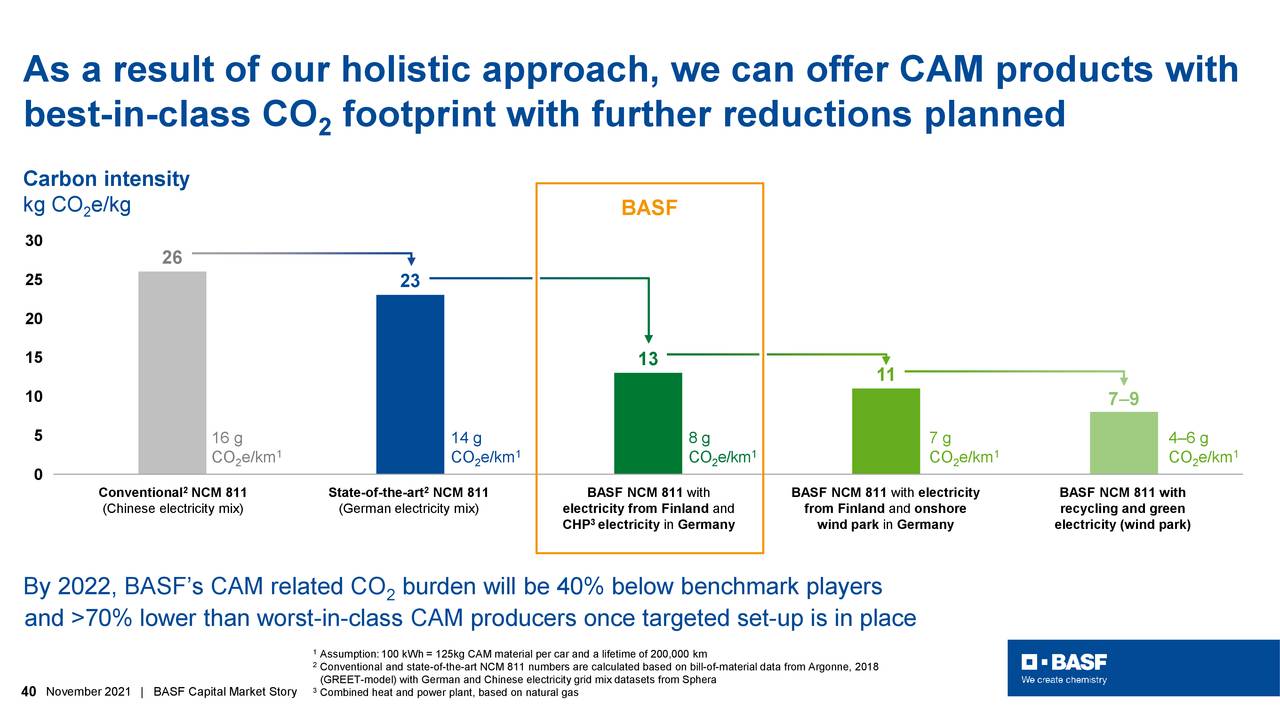

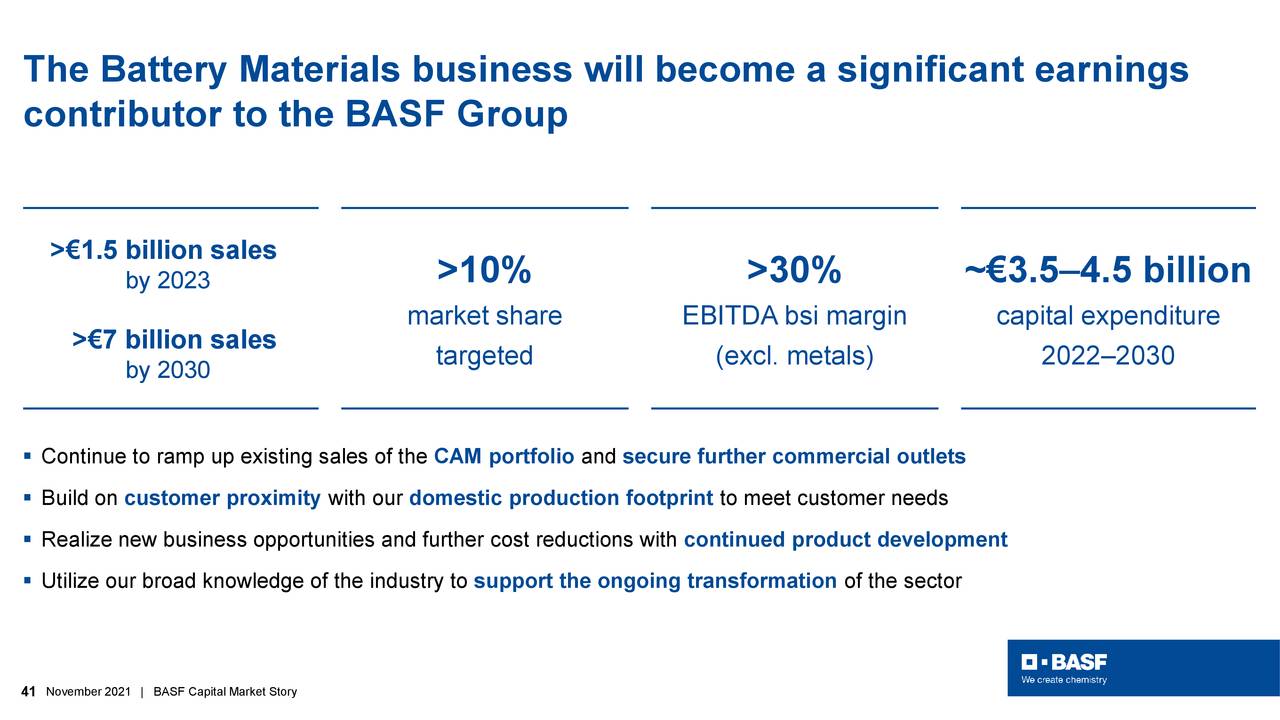

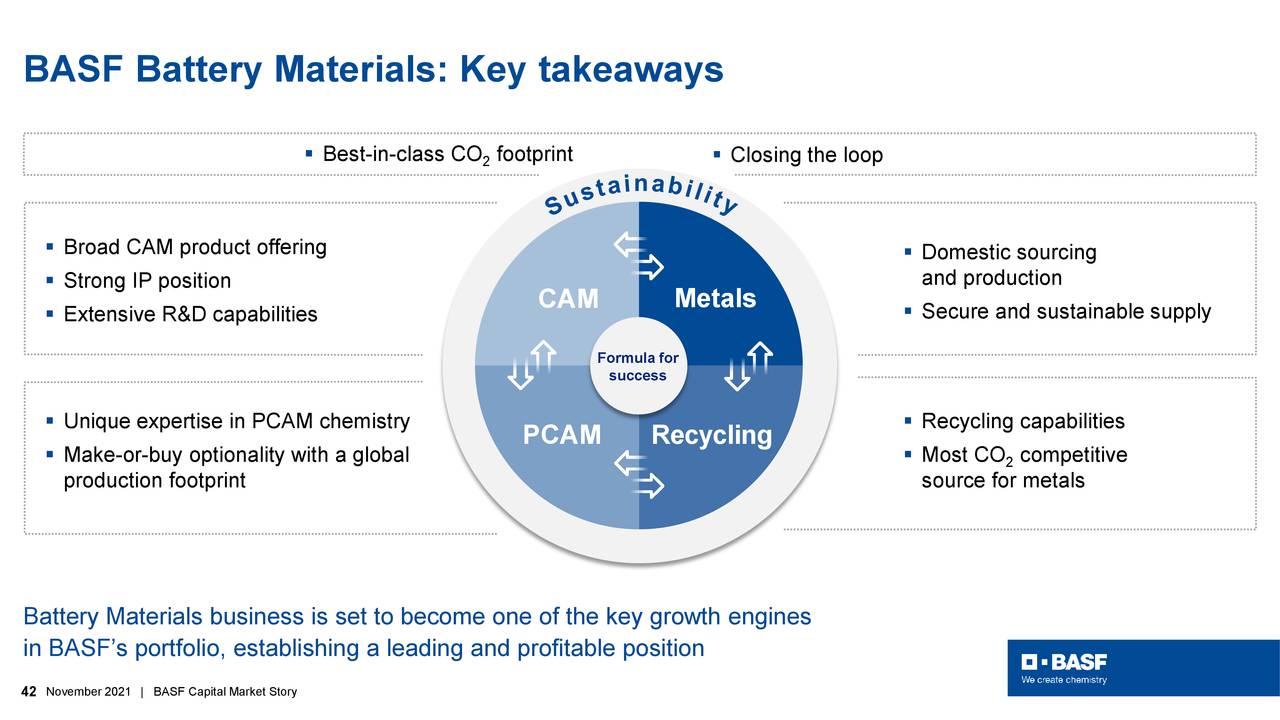

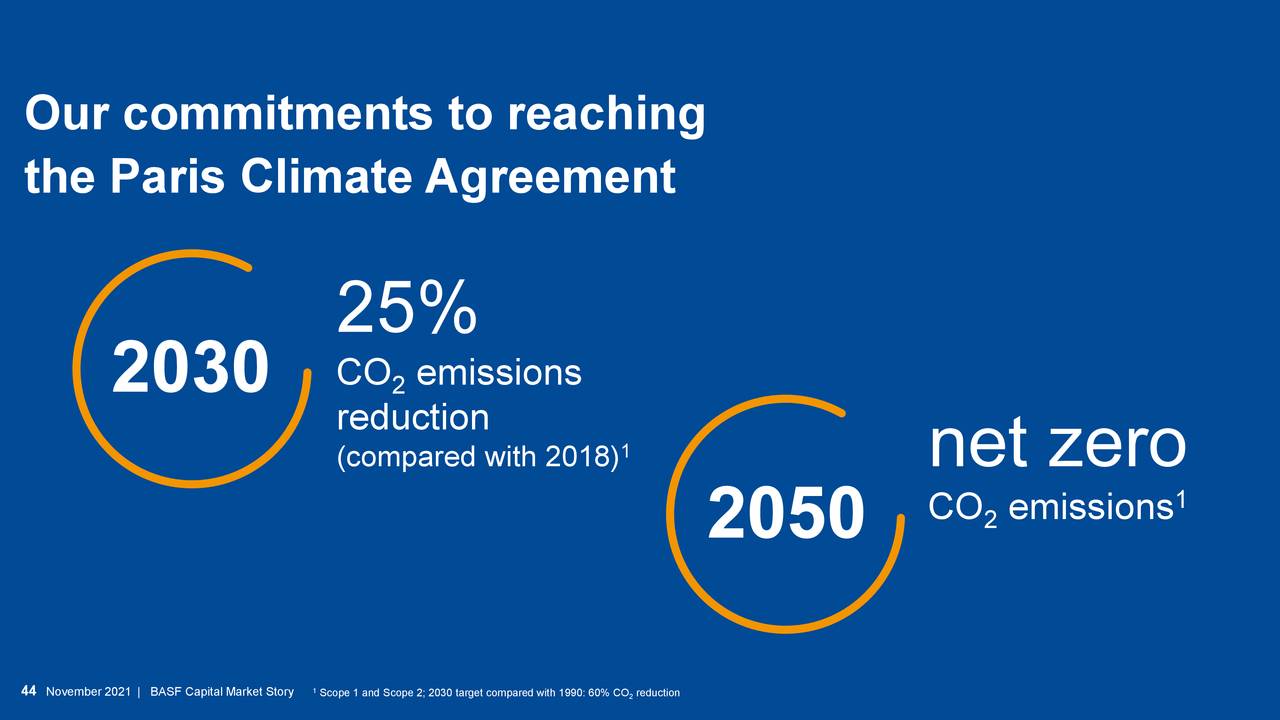

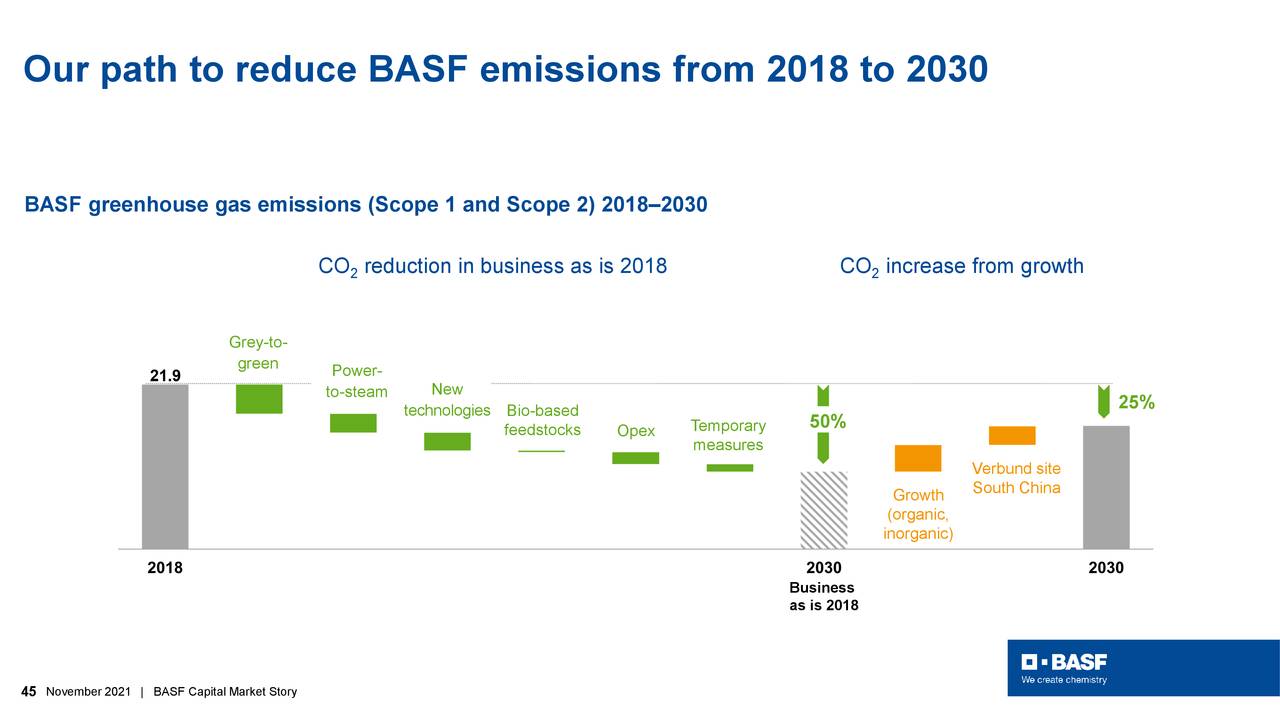

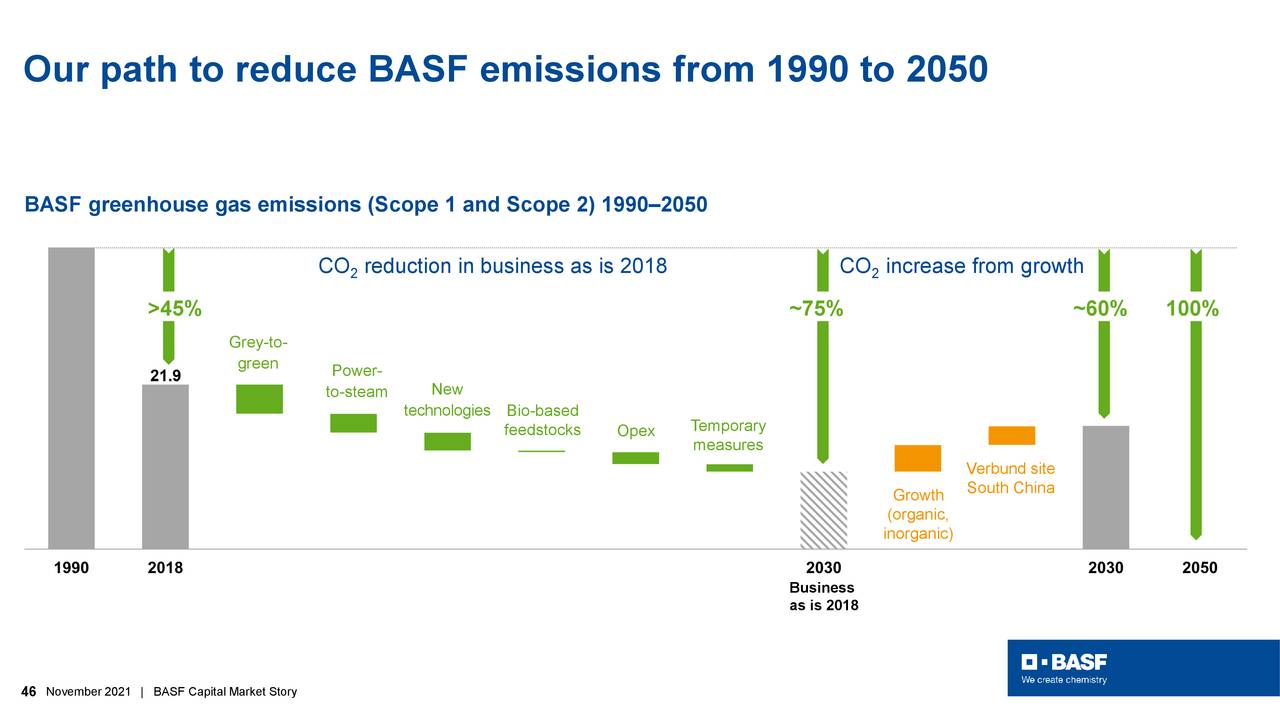

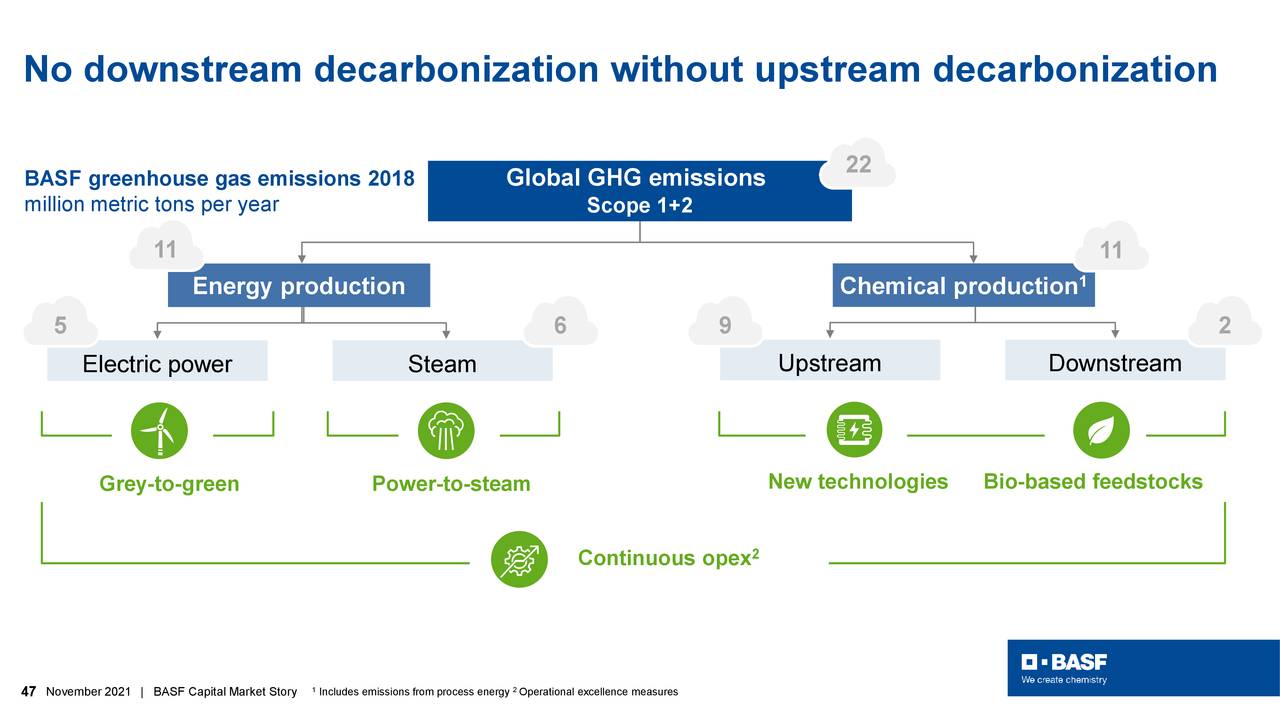

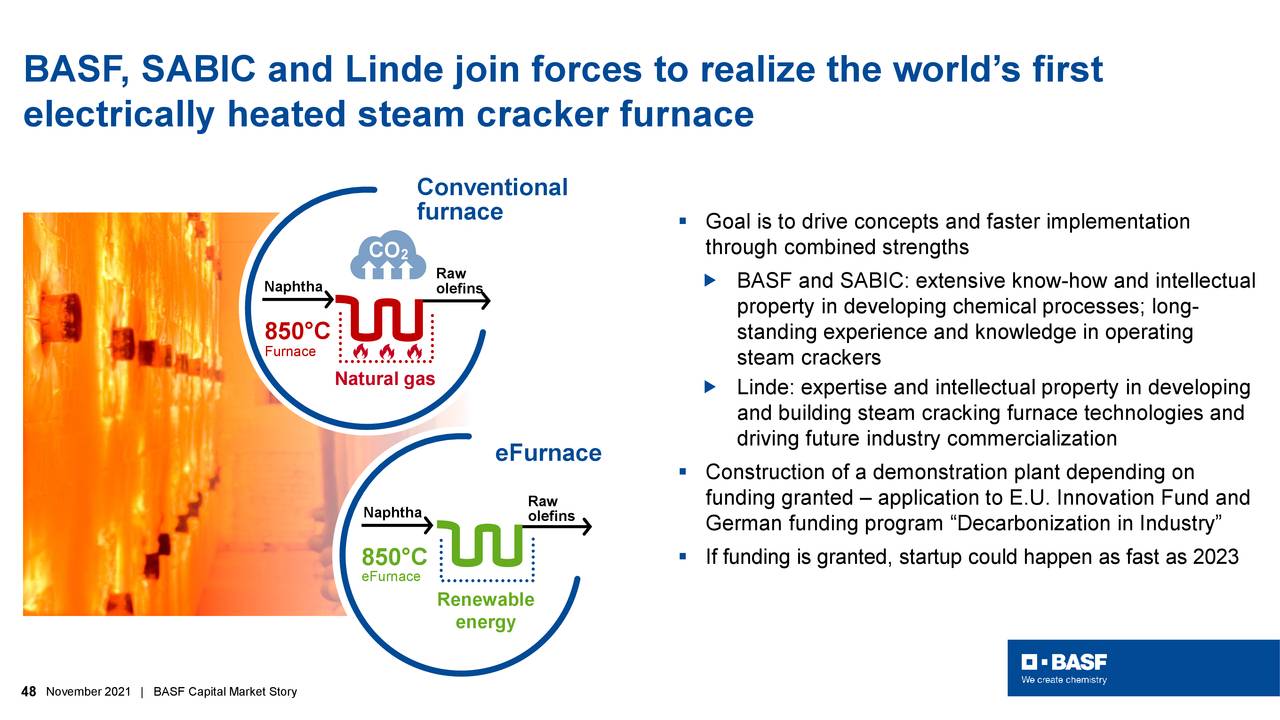

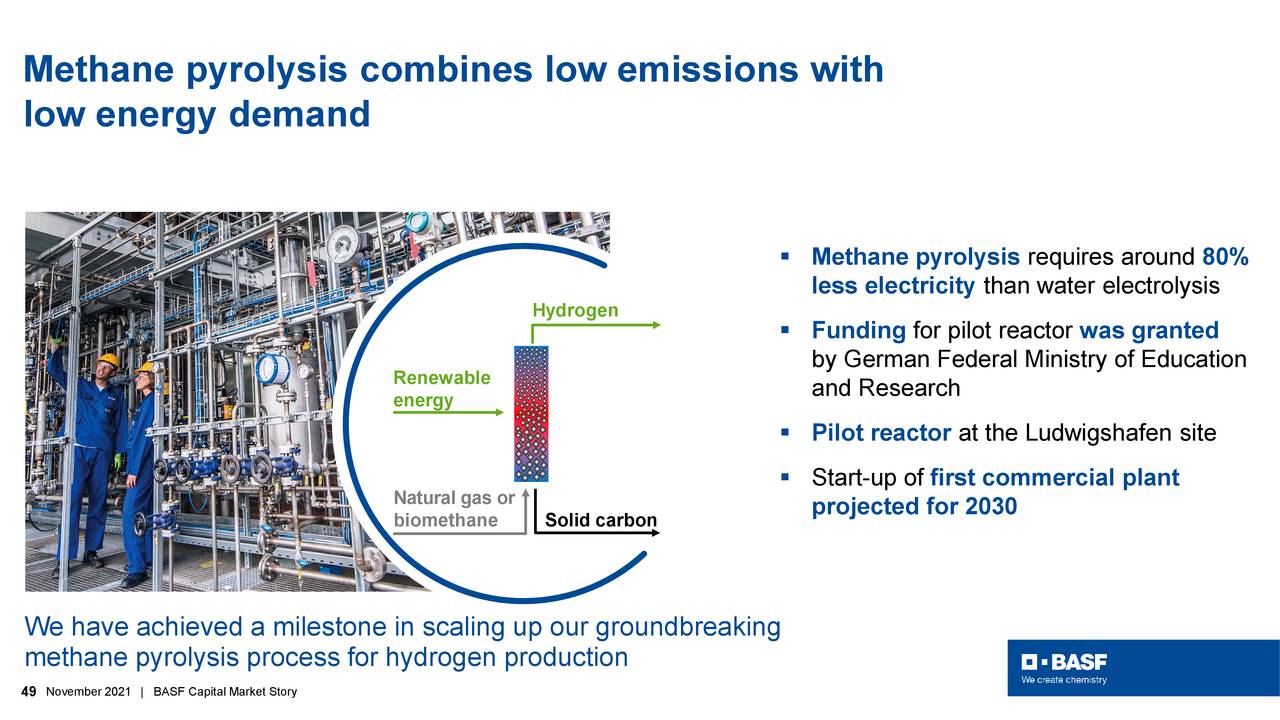

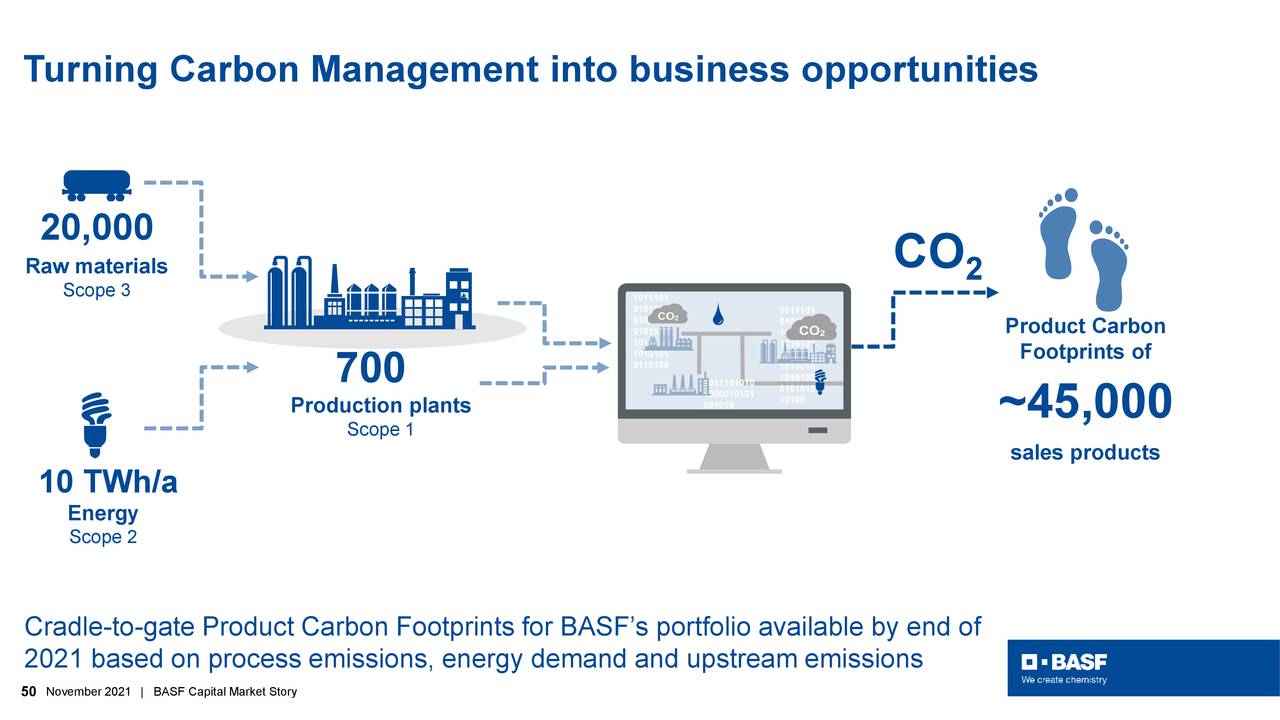

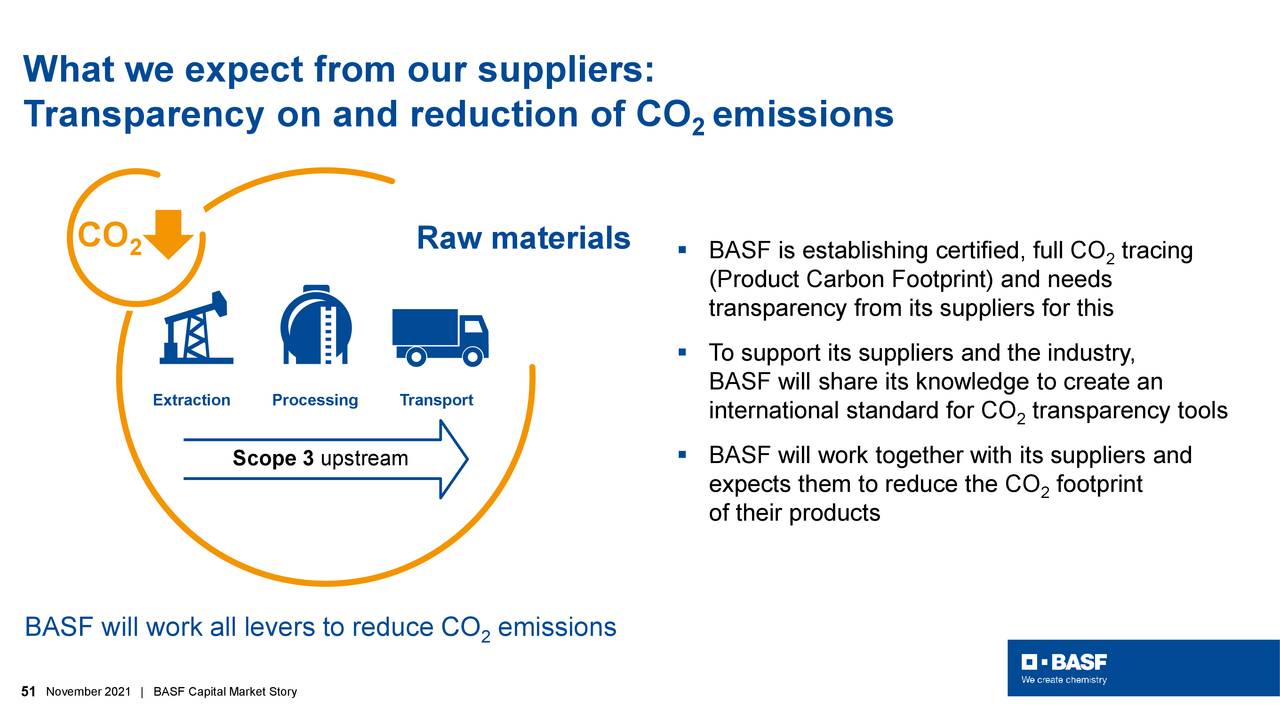

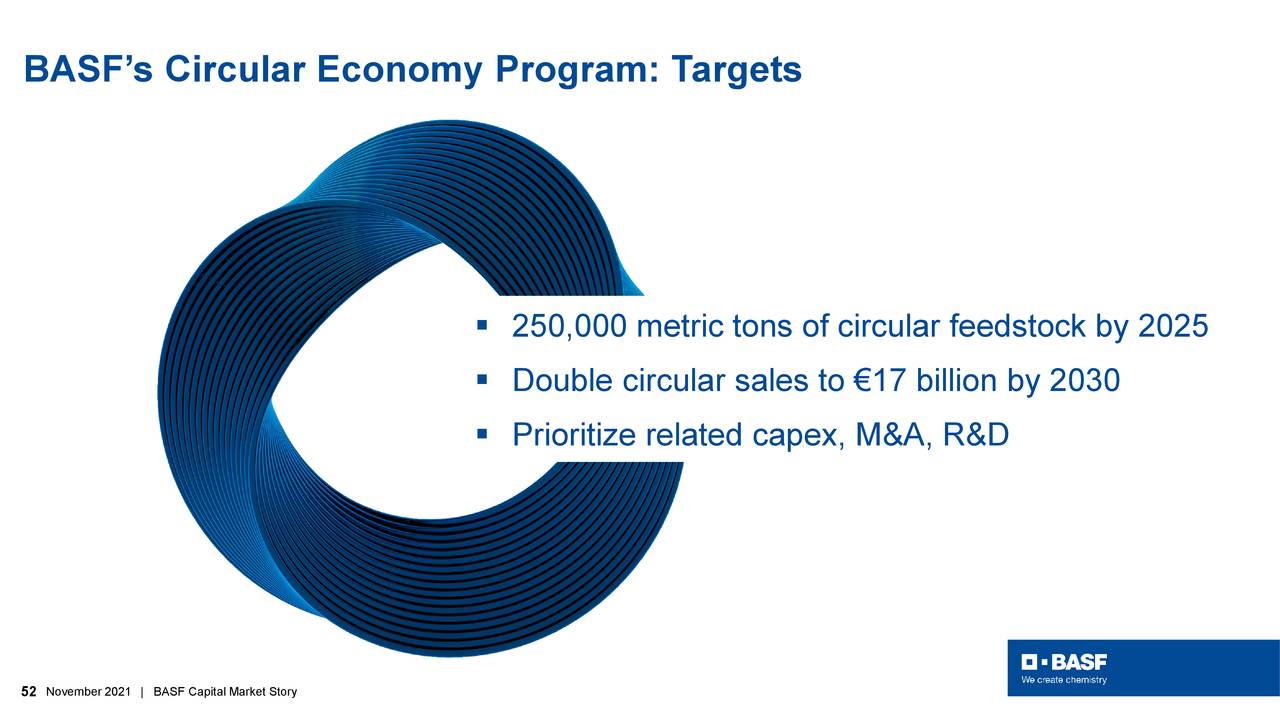

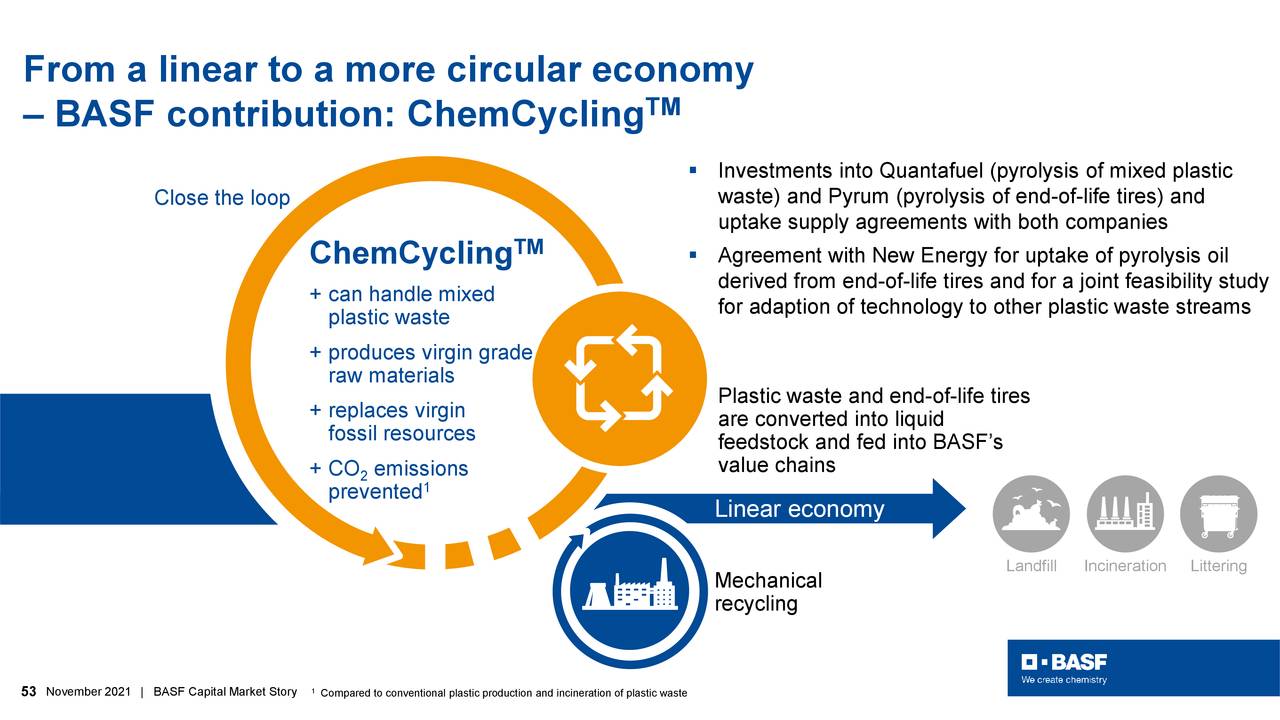

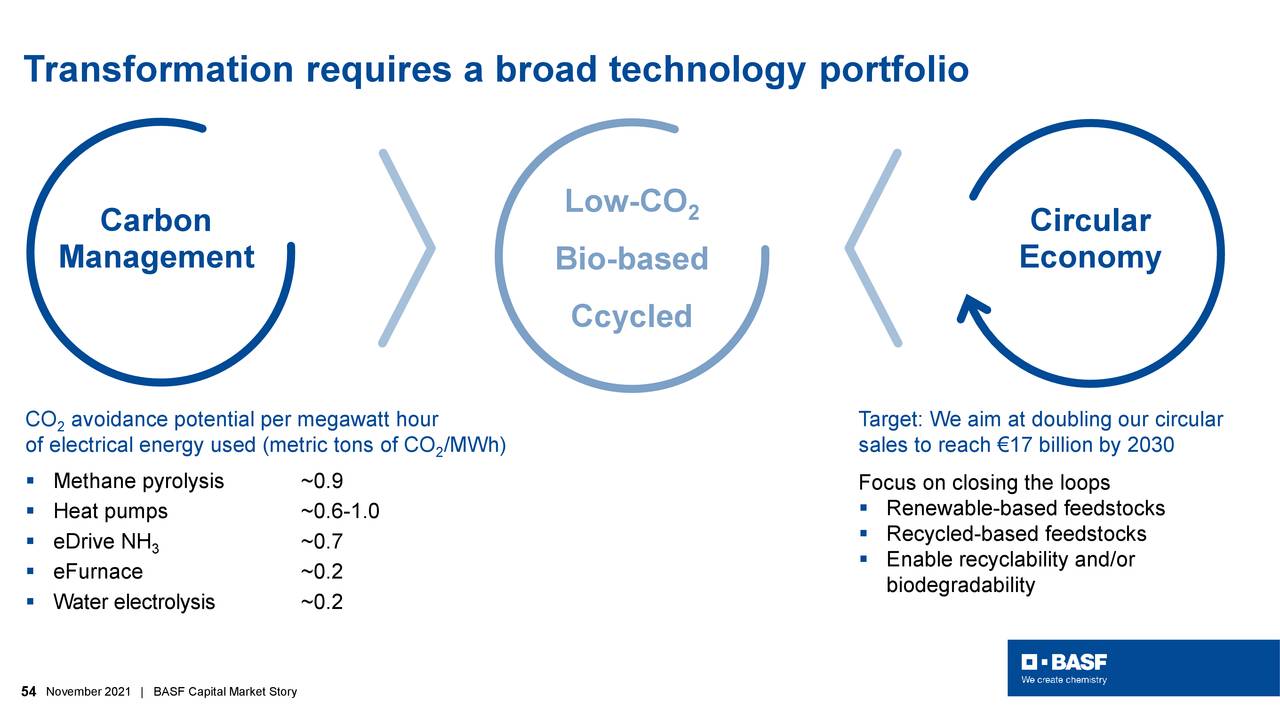

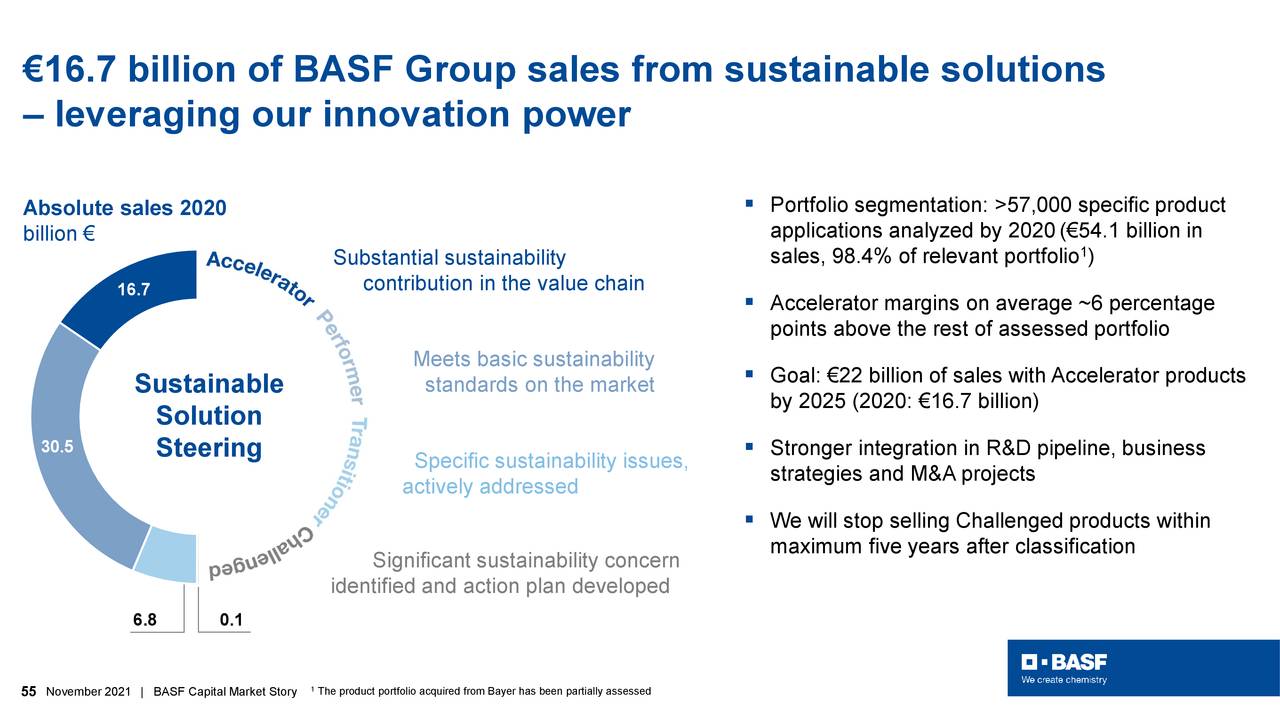

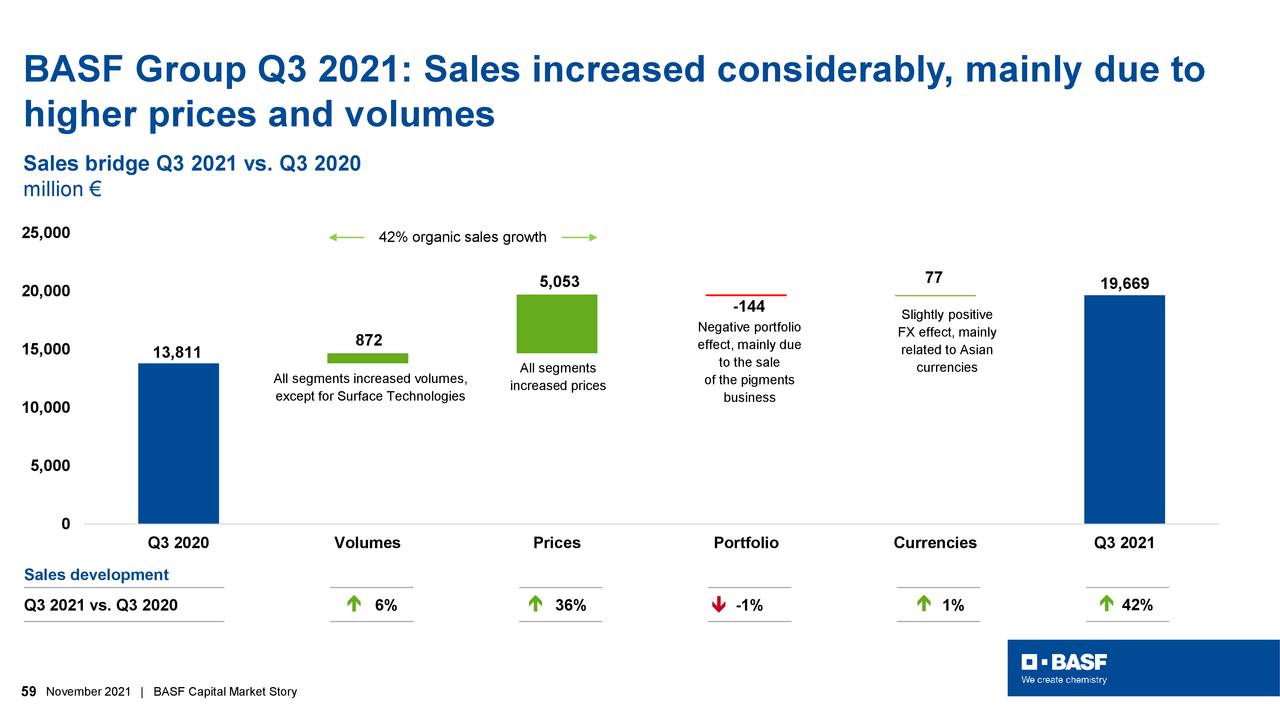

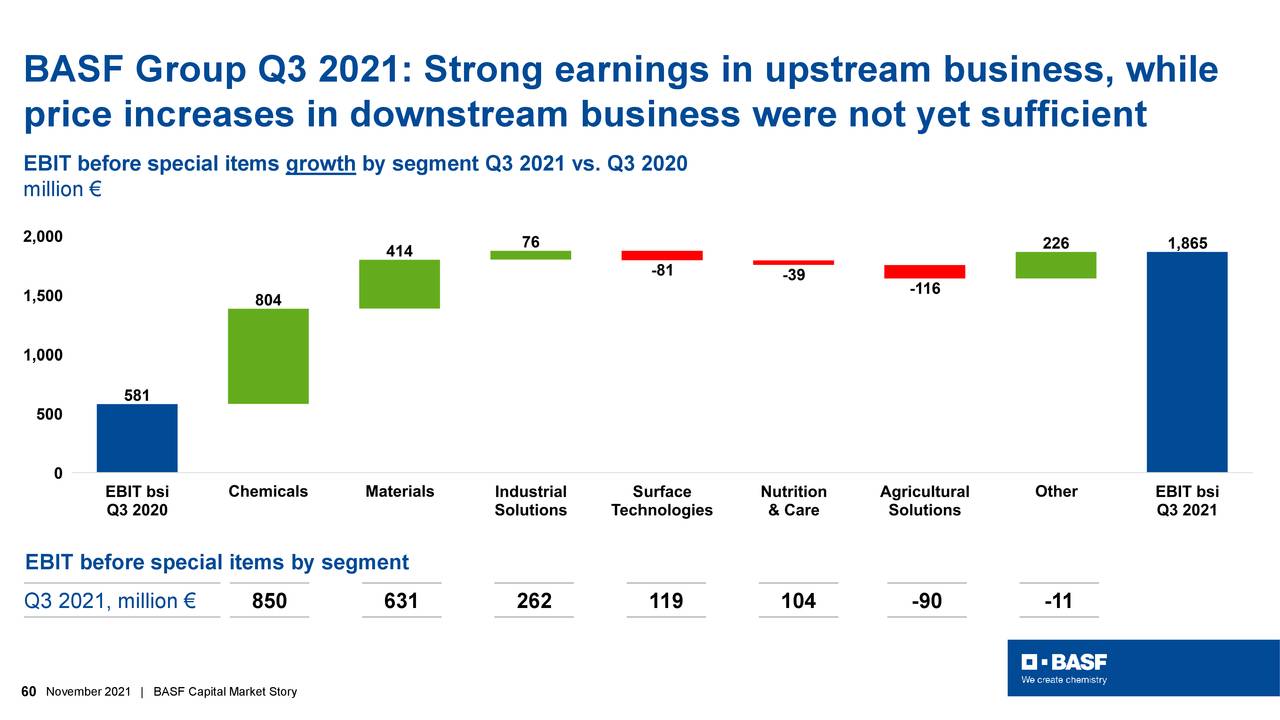

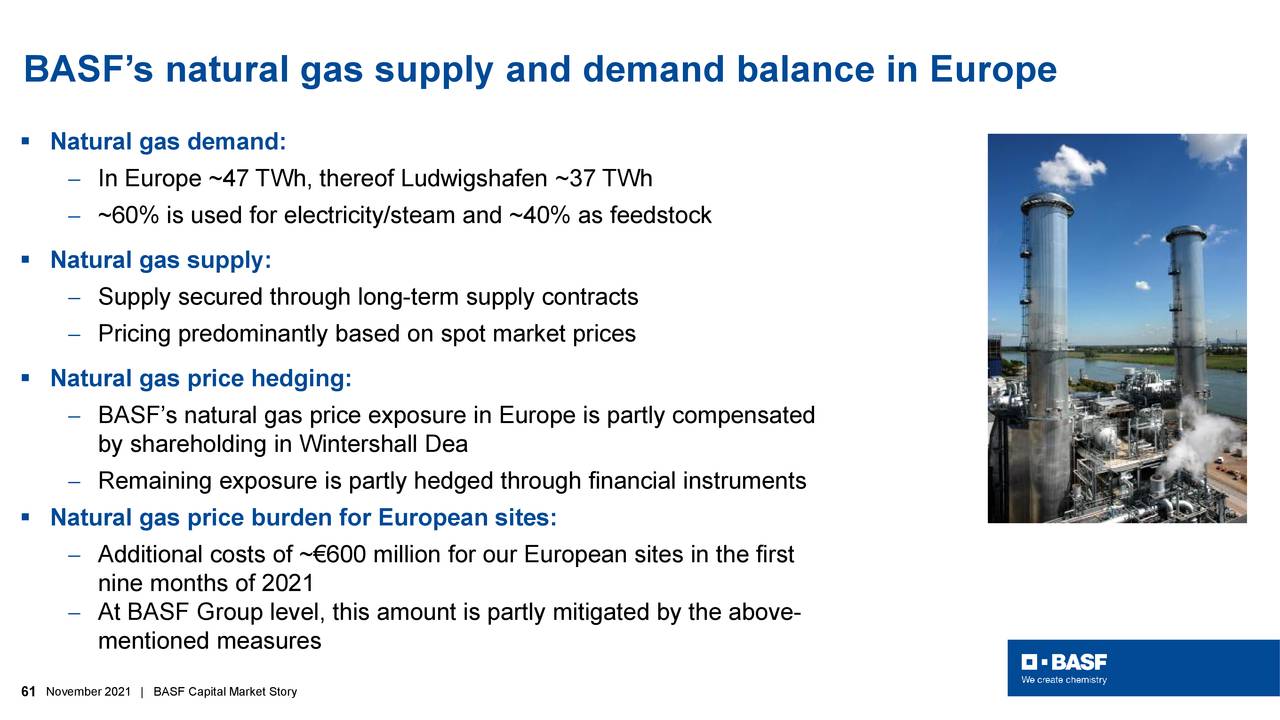

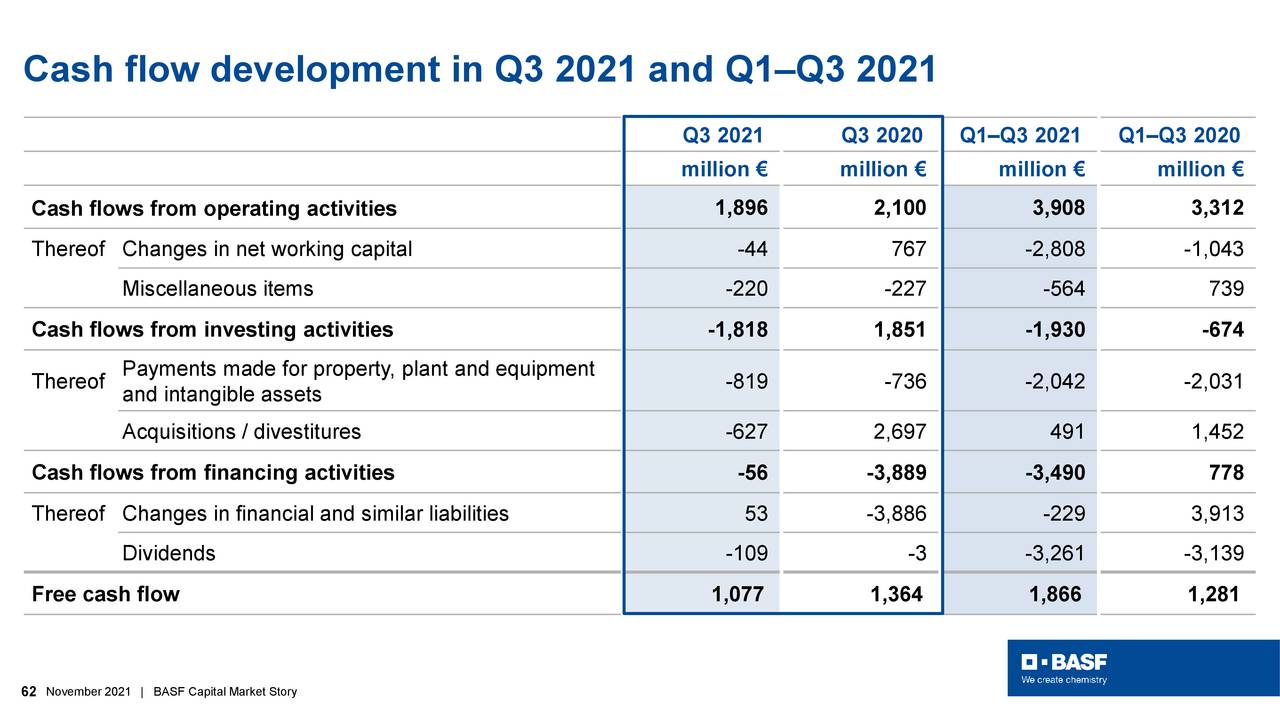

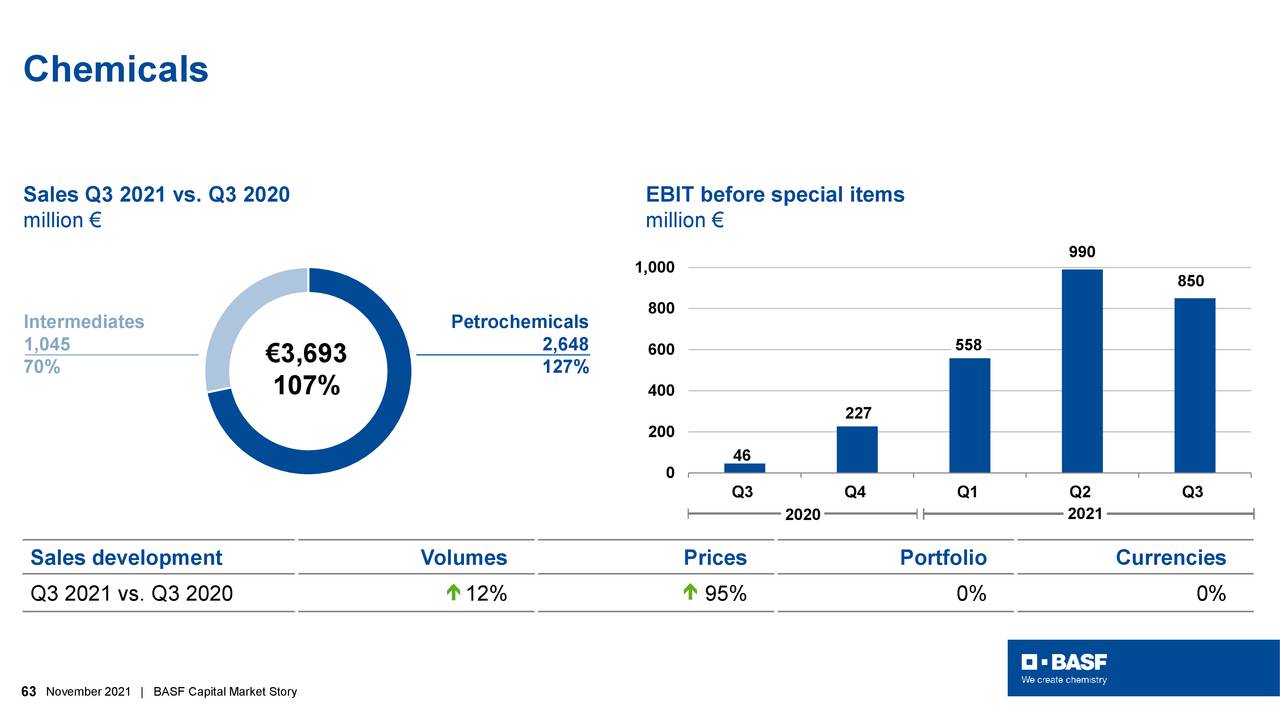

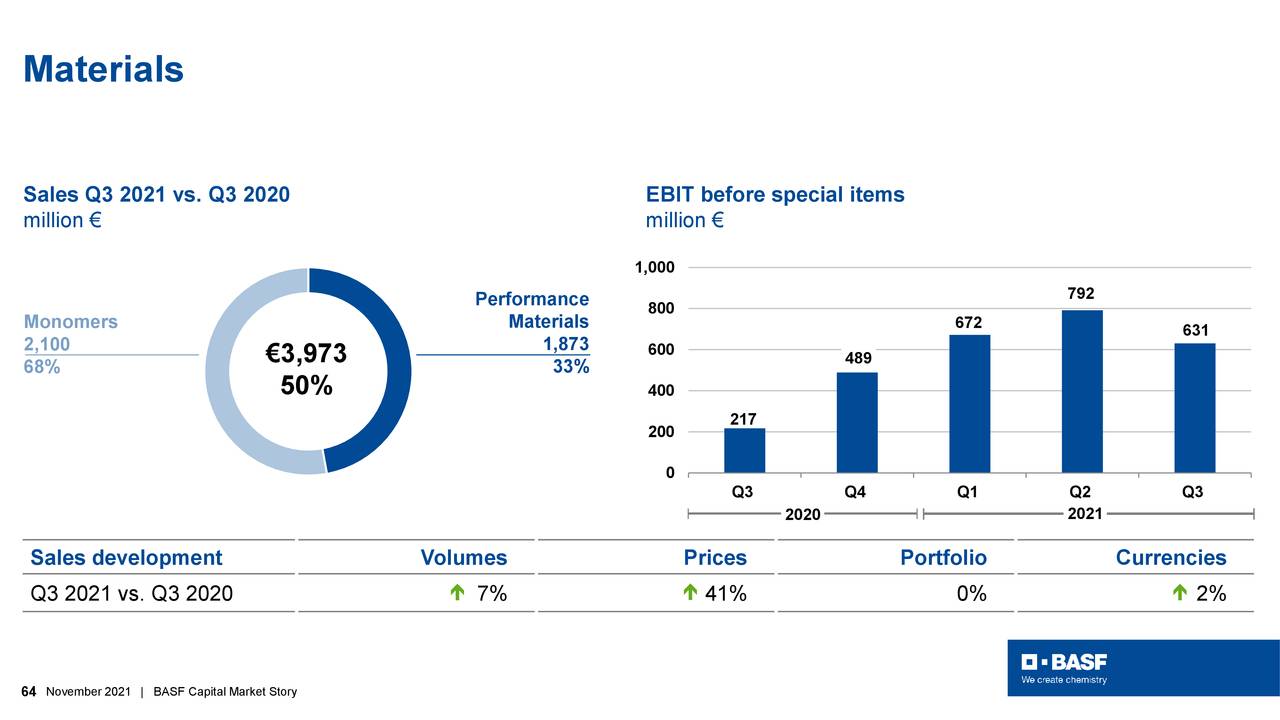

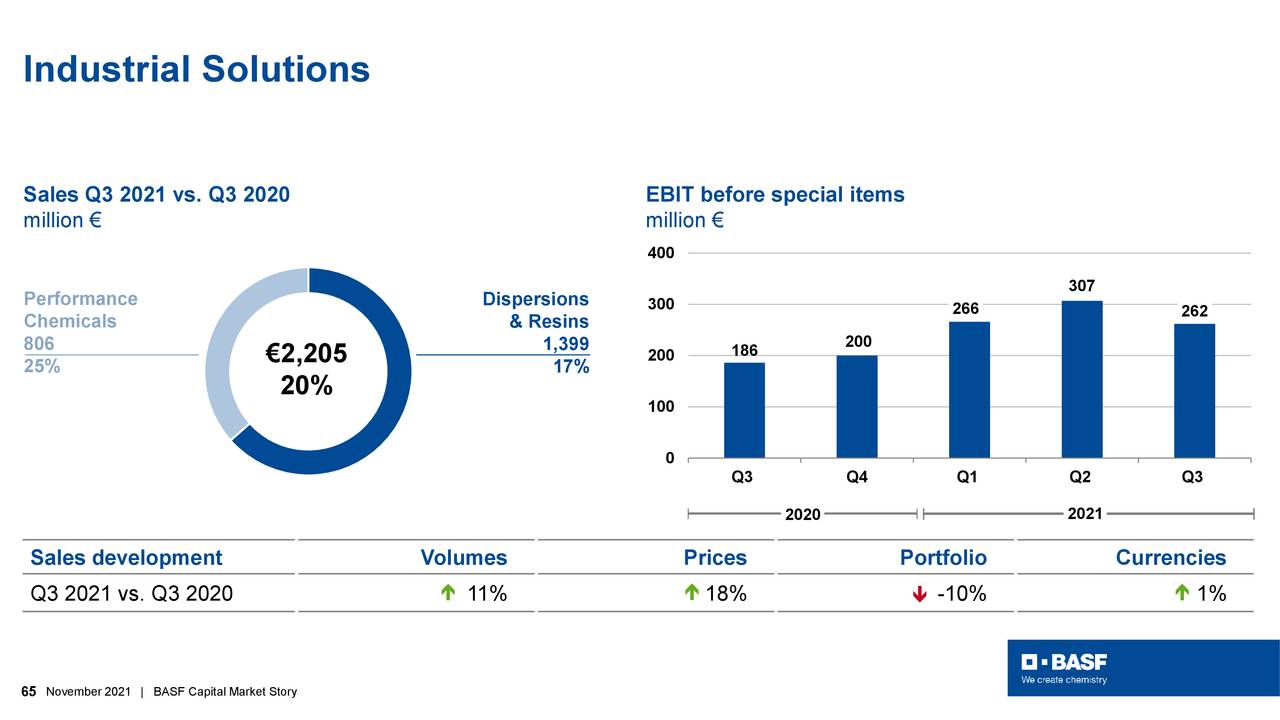

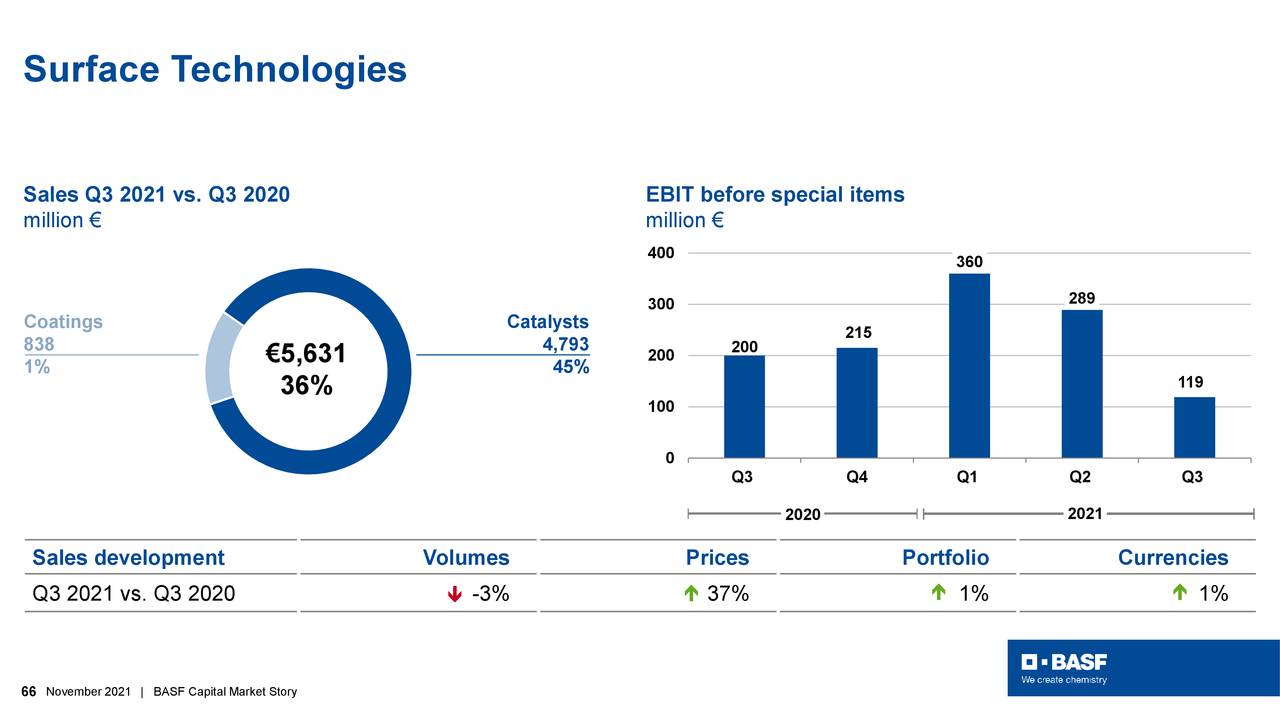

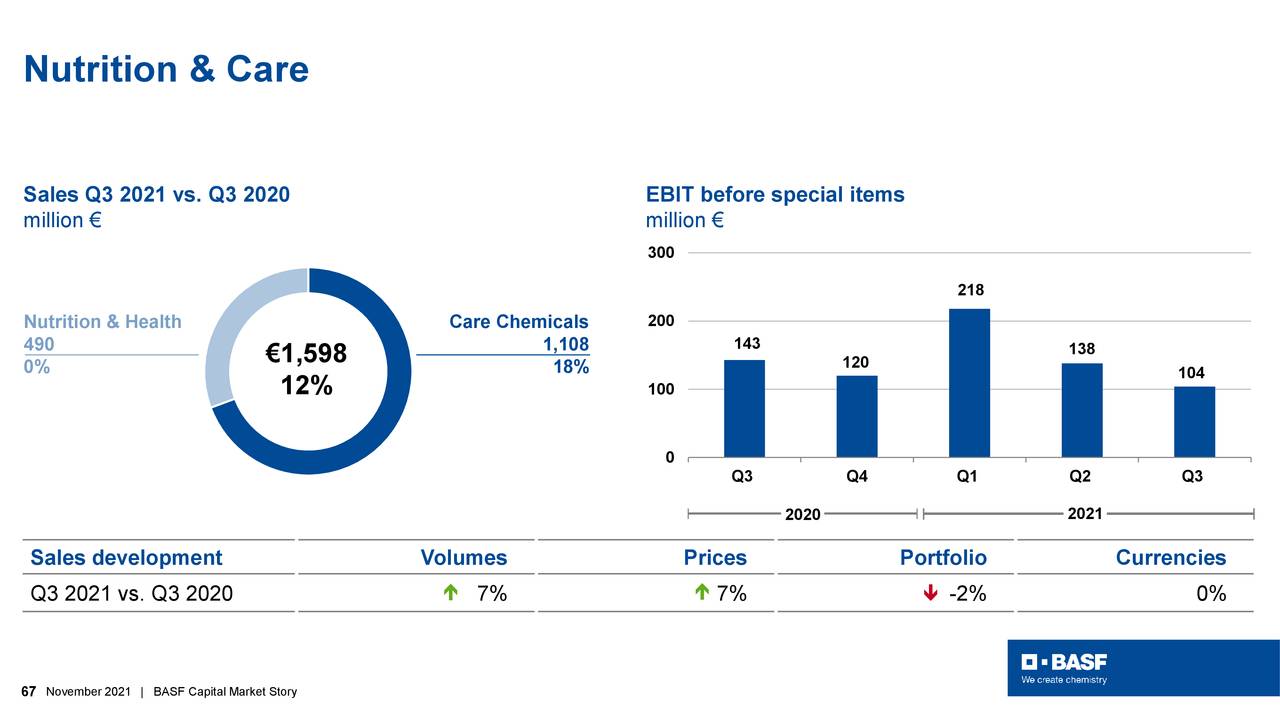

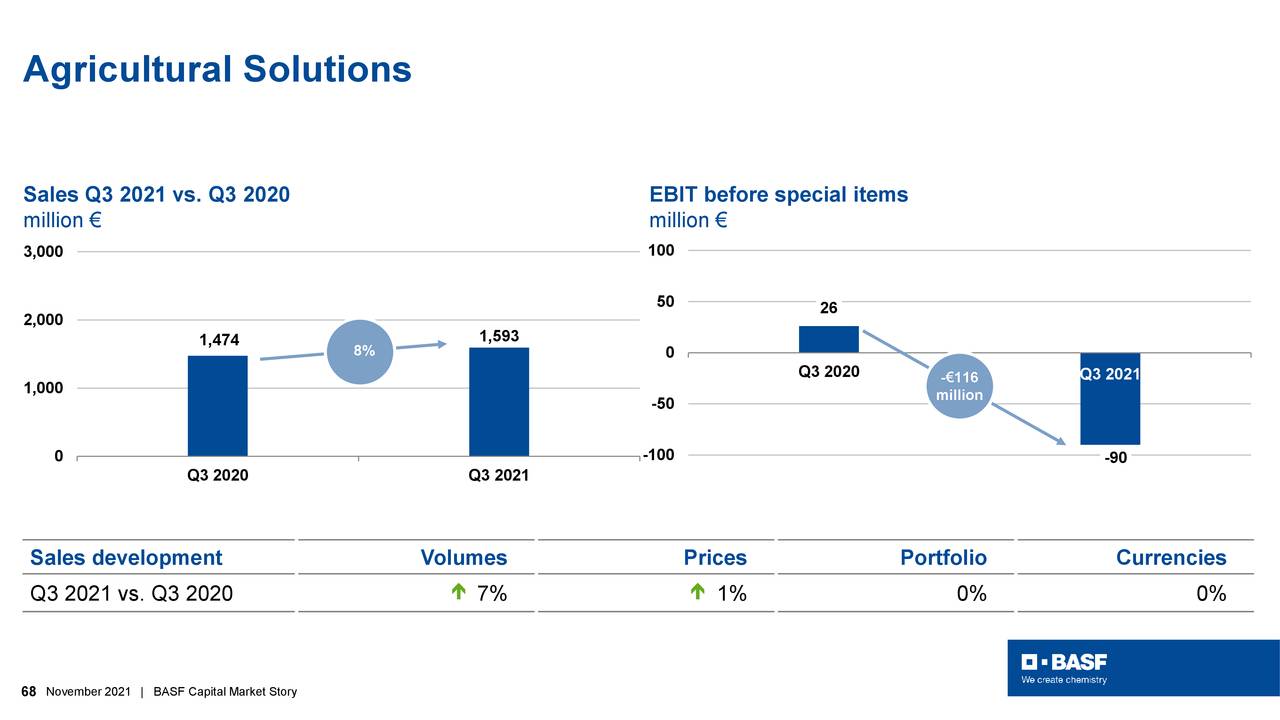

BASF (BASFY) Investor Presentation – Slideshow

Dec. 02, 2021 4:57 PM ETBASF SE (BASFY), BFFAF

The following slide deck was published by BASF SE in conjunction with this event.

169

December 2, 2021

Interesting Presentation

BASF (BASFY) Investor Presentation – Slideshow

Dec. 02, 2021 4:57 PM ETBASF SE (BASFY), BFFAF

The following slide deck was published by BASF SE in conjunction with this event.

169