Epoxy

November 2, 2021

DuPont Portfolio Changes

DuPont Announces Strategic Actions to Enhance Portfolio for Near and Long-term Value Creation

Provided by PR Newswire Nov 2, 2021 5:59 AM EDT DuPont Announces Strategic Actions to Enhance Portfolio for Near and Long-term Value Creation

DuPont Announces Strategic Actions to Enhance Portfolio for Near and Long-term Value Creation

– Acquisition of Rogers Corporation will expand DuPont’s leadership position in advanced materials for high-growth secular end-markets, including electric vehicles, advanced driver assistance systems (ADAS), 5G telecommunications and clean energy

– Announces intent to divest a substantial portion of the industry leading Mobility & Materials segment

– Combined actions will strengthen DuPont’s positions in high-growth, high-margin markets with a focus on electronics, water, protection, industrial technologies and next generation automotive; accelerates top-line growth, strengthens operating EBITDA margins and significantly improves cross-cycle earnings stability

– Combined actions will make DuPont a faster growing, higher margin business, while maintaining a conservative balance sheet and substantial capability for future growth

PR Newswire

WILMINGTON, Del., Nov. 2, 2021

WILMINGTON, Del., Nov. 2, 2021 /PRNewswire/ — DuPont (NYSE: DD) today announced a series of actions advancing its strategy as a premier multi-industrial company focused on market-leading high-growth, high-margin businesses with complementary technology and financial characteristics.

DuPont has entered into a definitive agreement to acquire Rogers Corporation (“Rogers”) (NYSE: ROG)(1) for $5.2 billion. Rogers is a global leader in engineered materials and components, with unmatched application engineering expertise and leading positions in markets where its advanced technology solutions offer competitive advantages. Its value-added products include high-frequency circuit materials, ceramic substrates for power semiconductor devices, and high-performance foams which go into a variety of highly specialized end-markets where the company has strong, enduring customer relationships. The transaction is expected to close in the second quarter of 2022, subject to customary closing conditions, including approval by Rogers shareholders and receipt of applicable regulatory approvals.

As part of its ongoing transformation, DuPont also announced that it intends to divest a substantial portion of its Mobility & Materials segment(2).

“With today’s announcements, we are sharpening our focus on high-growth, high-value opportunities in sectors with steady long-term secular growth trends where our global innovation leadership enables a competitive advantage,” said Ed Breen, Executive Chairman and Chief Executive Officer of DuPont. “Moving forward, our portfolio will be centered on key pillars – electronics, water, protection, industrial technologies and next generation automotive. We are committed to investing in each of these pillars organically and through strategic acquisitions to maximize our capabilities in areas that enable our customers to grow by delivering next generation technologies and sustainable high value-added solutions. These strategic steps are expected to create tremendous opportunities for DuPont and Rogers employees and unlock significant value for shareholders.”

By focusing the portfolio on high-growth, high-margin businesses closely tied to secular growth areas, the combined transactions are expected to substantially improve DuPont’s top-line growth, operating EBITDA margins and cross-cycle earnings stability, putting us in line with best-in-class multi-industrial peers.

Acquisition of Rogers Corporation

Rogers designs, develops, manufactures and sells high-performance and high-reliability engineered materials and components through its Advanced Electronics Solutions (AES) and Elastomeric Material Solutions (EMS) segments. Headquartered in Chandler, Arizona, Rogers has a workforce of more than 3,500 employees with a global network of 14 manufacturing sites in North America, Europe, and Asia and 2021 expected revenues of approximately $950 million.

Breen continued, “Building on our recent acquisition of Laird Performance Materials, the acquisition of Rogers further cements our position as the leading electronic solutions provider in the industry. We are building an unmatched portfolio that is ideally positioned to capitalize on rapid demand acceleration in high-growth markets, including electric vehicles, ADAS, 5G telecommunications and clean energy. With industry-leading positions in each of its product categories, a proven history of application engineering excellence and deep customer relationships, Rogers is highly complementary to and aligned strategically with our existing Electronics & Industrial business and is expected to deliver compelling returns over the near and long-term.”

“DuPont is a natural fit for Rogers, as a leading advanced materials solutions provider,” said Bruce D. Hoechner, Rogers’ President and CEO. “DuPont is a proven leader in advanced specialty materials, and Rogers will benefit from DuPont’s global reach and strong technical and commercial depth. Like DuPont, Rogers’ success is built upon a dedicated team of people committed to excellence and technology leadership to solve our customers’ most complex application challenges. This combination will create an exciting next chapter for Rogers’ customers, employees and partners.”

DuPont expects to realize approximately $115 million in pre-tax run-rate cost synergies by the end of 2023. The cost synergies associated with both the Laird Performance Materials acquisition and the intended Rogers acquisition represent approximately 6% of the combined revenue, including DuPont Interconnect Solutions. The estimated one-time cost to achieve these synergies is approximately $75 million. DuPont expects the deal to be accretive to its top-line growth, operating EBITDA, free cash flow, and adjusted EPS upon closing. The enterprise value multiple of the transaction is approximately 19x estimated fiscal 2022 EBITDA on a stand-alone basis and approximately 14x including cost synergies.

DuPont has committed financing in place for the acquisition of Rogers. DuPont plans on using a portion of the proceeds from the planned divestiture of a substantial portion of the Mobility & Materials segment to repay all acquisition financing related to Rogers and pursue additional growth opportunities in its remaining key pillars as part of its balanced capital deployment plan.

Intent to Divest Substantial Portion of Mobility & Materials Segment

DuPont intends to divest a substantial portion of its Mobility & Materials segment. The Mobility & Materials segment is comprised of category-defining businesses with longstanding market-leading positions and differentiated products, technologies and capabilities to win with customers and outperform competitors. The businesses within the Mobility & Materials segment that are in-scope for intended divestiture are predominantly those in the Engineering Polymers and Performance Resins lines of business as well as the Company’s stake in the DuPont Teijin Films joint venture. The in-scope product lines include, but are not limited to, well known and respected brands such as Zytel®, Delrin®, Hytrel®, Crastin®, Vamac® and TEDLAR®. Combined, these businesses represent approximately $4.2 billion in revenue and about $1.0 billion of operating EBITDA based on full year 2021 estimates.

“Finding an ownership model that appropriately values the leadership positions and deep customer value proposition of the in-scope Mobility & Materials portfolio will position the business for continued success, leveraging its unmatched combination of products, technologies, and operating expertise for the benefits of its employees and customers,” said Breen. “Through unprecedented challenges in the past 18 months, these teams have proven that their unwavering commitment to deliver for their customers, employees and partners has generated solid results and I am confident they are well equipped to expand their leadership positions under new ownership.”

November 1, 2021

October Propylene Settles Down 9c/lb

Chemical grade is $0.735/lb

November 1, 2021

October Propylene Settles Down 9c/lb

Chemical grade is $0.735/lb

October 29, 2021

US Steel Discusses Automotive Builds

Surprising Disclosure From US Steel Suggests Chip Shortage Is Finally Over

by Tyler DurdenFriday, Oct 29, 2021 – 02:54 PM

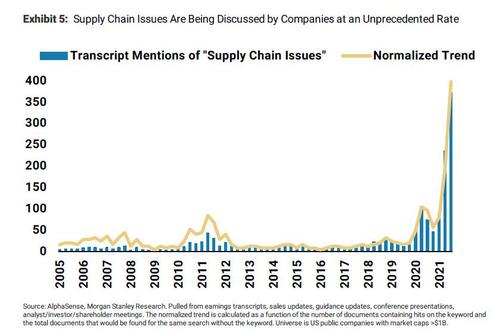

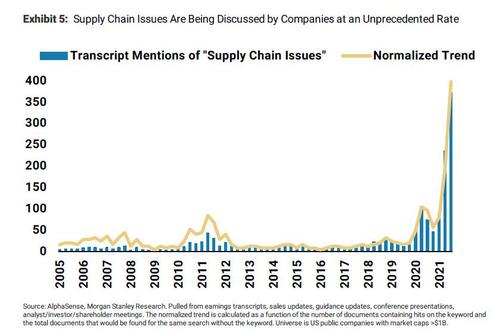

Earlier this week, Morgan Stanley showed that more than inflation, more than concerns about the historic labor crisis, definitely more than covid, one thing has preoccupied the minds of most management teams this quarter: “supply chain issues“, a topic which has seen an explosion of mentions on Q3 earnings calls.

But while by now everyone is aware that the global supply-chain shock is truly historic and getting worse by the day, with used car prices rising sharply again and over 30 million tons of cargo waiting outside US ports ahead of the holiday season, few have considered what realistically could normalize these frayed supply chains.

To address this topic, we discussed a research report from Goldman Sachs in which the bank’s economists listed what they viewed as the three key drivers of supply chain normalization and their most likely timing:

- improved chip supply driven by post-Delta factory restarts (4Q21) and eventually by expanded production capacity (2H22 and 2023);

- improved US labor supply (4Q21 and 1H22); and

- the wind-down of US port congestion (2H22).

While some viewed Goldman’s forecast for a Q4 improvement in chip supply chains – a critical factor for renormalizing auto production – as overly optimistic a little noticed comment in today’s US Steel conference call suggests that Goldman may have been spot on.

Earlier today, US Steel jumped as much as 15%, its biggest gain since March 8, after the company announced a stock buyback, a hike in dividends and third-quarter EPS that beat analyst expectations. But it’s what US Steel CEO David Burritt said toward the end of the prepared remarks in its conference call that was most surprising.

Discussing the demand picture heading into Q4 and the new year, Burritt said that he was “delighted to hear from multiple auto customers, who are foreshadowing that the trough of the chip shortage could be behind us. They’re beginning to add to the fourth quarter and first quarter build schedules, and indicating to us, increasing usage rates, starting as early as next week.“

No surprise that former JPMorgan news aggregation maven and current publisher of VitalKnowledge Media, Adam Crisafulli, called US Steel’s observation “the most important (macro) comment from any earnings call this morning.”

While it isn’t clear what specific macro economic shift may have catalyzed this improvement: after all, West Coast port logjams are about the worst they have ever been, if US Steel’s channel checks are accurate and automakers are indeed ramping up production, then one of the biggest supply chain bottlenecks may indeed now be behind us (even if there is still along way to go before the bigger picture renormalizes).

https://www.zerohedge.com/markets/surprising-disclosure-us-steel-suggests-chip-shortage-finally-over

October 29, 2021

US Steel Discusses Automotive Builds

Surprising Disclosure From US Steel Suggests Chip Shortage Is Finally Over

by Tyler DurdenFriday, Oct 29, 2021 – 02:54 PM

Earlier this week, Morgan Stanley showed that more than inflation, more than concerns about the historic labor crisis, definitely more than covid, one thing has preoccupied the minds of most management teams this quarter: “supply chain issues“, a topic which has seen an explosion of mentions on Q3 earnings calls.

But while by now everyone is aware that the global supply-chain shock is truly historic and getting worse by the day, with used car prices rising sharply again and over 30 million tons of cargo waiting outside US ports ahead of the holiday season, few have considered what realistically could normalize these frayed supply chains.

To address this topic, we discussed a research report from Goldman Sachs in which the bank’s economists listed what they viewed as the three key drivers of supply chain normalization and their most likely timing:

- improved chip supply driven by post-Delta factory restarts (4Q21) and eventually by expanded production capacity (2H22 and 2023);

- improved US labor supply (4Q21 and 1H22); and

- the wind-down of US port congestion (2H22).

While some viewed Goldman’s forecast for a Q4 improvement in chip supply chains – a critical factor for renormalizing auto production – as overly optimistic a little noticed comment in today’s US Steel conference call suggests that Goldman may have been spot on.

Earlier today, US Steel jumped as much as 15%, its biggest gain since March 8, after the company announced a stock buyback, a hike in dividends and third-quarter EPS that beat analyst expectations. But it’s what US Steel CEO David Burritt said toward the end of the prepared remarks in its conference call that was most surprising.

Discussing the demand picture heading into Q4 and the new year, Burritt said that he was “delighted to hear from multiple auto customers, who are foreshadowing that the trough of the chip shortage could be behind us. They’re beginning to add to the fourth quarter and first quarter build schedules, and indicating to us, increasing usage rates, starting as early as next week.“

No surprise that former JPMorgan news aggregation maven and current publisher of VitalKnowledge Media, Adam Crisafulli, called US Steel’s observation “the most important (macro) comment from any earnings call this morning.”

While it isn’t clear what specific macro economic shift may have catalyzed this improvement: after all, West Coast port logjams are about the worst they have ever been, if US Steel’s channel checks are accurate and automakers are indeed ramping up production, then one of the biggest supply chain bottlenecks may indeed now be behind us (even if there is still along way to go before the bigger picture renormalizes).

https://www.zerohedge.com/markets/surprising-disclosure-us-steel-suggests-chip-shortage-finally-over