Mergers & Acquisitions

December 17, 2023

Saint-Gobain Streamlining

Saint-Gobain to Sell Majority of UK Foam Insulation Business to Soprema

Published: Dec. 7, 2023 at 1:33 a.m. ET

By David Sachs

Saint-Gobain said it would sell a majority stake in its U.K. foam insulation business to Soprema as part of its disposal plan.

The French construction supplier said late Wednesday that Celotex’s assets will be transferred to a new standalone company, which will be 75% owned by Soprema, a private French waterproofing and insulation firm. Saint-Gobain will retain a 25% minority stake, it said.

The move is part of Saint-Gobain’s streamlining strategy, which includes asset-disposals.

Celotex has two manufacturing facilities in the U.K. and employs 155 people, Saint-Gobain said. The transaction is expected to close early next year.

Financial details were not disclosed.

December 10, 2023

LyondellBasell to Sell EO & Derivatives to INEOS

LyondellBasell Announces Sale of Ethylene Oxide & Derivatives Business and Production Facility to INEOS

HOUSTON, Dec. 8, 2023 /PRNewswire/ — LyondellBasell (LYB) today announced it has entered into an agreement to sell its Ethylene Oxide & Derivatives (EO&D) business along with the production facility located in Bayport, Texas to INEOS Oxide (INEOS).

“This transaction is evidence of our disciplined focus on value creation through the execution of a key pillar of our strategy – growing and upgrading our core,” said Peter Vanacker, LyondellBasell CEO. “Successful execution of this strategic pillar involves making difficult decisions to divest businesses which are not part of our core. We remain proud of the positive cash generation, access to advantaged feedstocks, reliability and highly skilled team that makes up the EO&D business and are excited to have reached an agreement with INEOS to enable the business to continue generating value under different ownership. We look forward to collaborating closely with INEOS on a seamless transition.”

The Ethylene Oxide & Derivatives business in Bayport produces high-quality ethylene oxide and various derivatives. The fully integrated platform with access to cost-advantaged feedstocks and logistics networks has excellent performance and reputation in the market.

Tobias Hannemann, CEO INEOS Oxide said, “We are pleased to announce this strategic acquisition. INEOS is a leading producer in Europe and this significant step expands its Ethylene Oxide & Derivatives business into the US, which is the world’s largest market. It also complements our existing Ethanolamines production facility in Plaquemine, Louisiana.”

The purchase price for the transaction is $700 million. The transaction is expected to close in the second quarter of 2024 following completion of the planned maintenance at the facility and is subject to regulatory and other customary closing conditions. J.P. Morgan acted as financial advisor and King & Spalding acted as legal counsel to LyondellBasell.

https://lyondellbasell.mediaroom.com/index.php?s=43&item=1470

November 15, 2023

Carpenter Signs Agreement to Purchase NCFI’s Consumer Products Division

Carpenter Signs Agreement to Purchase NCFI’s Consumer Products Division

Carpenter Co., the world’s largest vertically integrated manufacturer of polyurethane foams, has signed an agreement to acquire the flexible foam assets of NCFI’s Consumer Products Division. The Division, based in Mount Airy, North Carolina, features scientifically-engineered foams for the furniture, mattress, aircraft, aerospace, marine, medical industries, and several additional market segments.

Brad Beauchamp, CEO of Carpenter Co., said, “We are excited to bring the world class products and people of NCFI to Carpenter. This acquisition will further our integration and growth of the Engineered Foams business that we acquired from Recticel earlier this year. The Mt. Airy location and the diverse set of products made therein will complement our current business portfolio.”

The NCFI Consumer Products Division site in Mount Airy will complement Carpenter’s existing operations in Conover, North Carolina, as well as provide additional capacity to make select foam grades offered by the former Recticel Engineered Foams business. Moreover, NCFI’s commitment to sustainability and innovation supports Carpenter’s vision: to be admired for creating products and delivering solutions that help make the world more comfortable, safer, and healthier.

November 13, 2023

Lanxess to Sell Urethanes Business

Persistently weak demand impacts third quarter

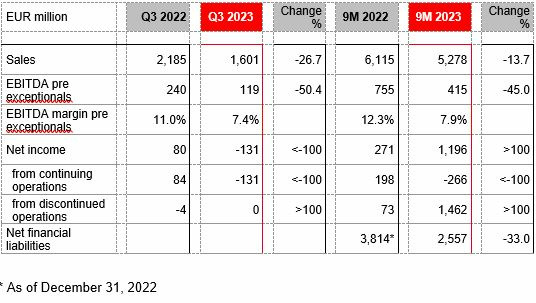

- Sales down 26.7 percent to EUR 1.601 billion in the third quarter of 2023

- EBITDA pre exceptionals down 50.4 percent year-on-year at EUR 119 million

- Further significant reduction of net financial liabilities to EUR 2.557 billion

- Guidance for fiscal year 2023: EBITDA pre exceptionals expected to be between EUR 500 and 550 million

- Board of Management plans dividend reduction to EUR 0.10

- Sale of Urethane Systems business unit initiated

- “FORWARD!” action plan: structural measures to permanently reduce costs by EUR 150 million

CologneNovember 08, 2023

In the third quarter of 2023, LANXESS’ business figures were again influenced by the persistently weak economy. Sales amounted to EUR 1.601 billion, down 26.7 percent on the previous year’s figure of EUR 2.185 million. EBITDA pre exceptionals fell by 50.4 percent from EUR 240 million to EUR 119 million.

The main reasons for this development were the low demand from nearly all industries and customers’ ongoing albeit diminishing inventory reduction. The associated reduction in sales volumes and high idle costs led to declining earnings, especially in the Specialty Additives and Advanced Intermediates segments. The Consumer Protection segment saw only a comparatively moderate earnings decline.

The Group’s EBITDA margin pre exceptionals was 7.4 percent, against 11.0 percent in the prior-year quarter. Net income declined to minus EUR 131 million in the third quarter compared with EUR 80 million in the prior-year quarter.

“The weak demand in the global chemicals industry persists, and we see no signs of recovery for the rest of the year. On the contrary, demand in the fourth quarter to date seems to be even weaker than expected,” said Matthias Zachert, Chairman of the Board of Management at LANXESS AG.

LANXESS had already announced the unexpectedly weak start to the fourth quarter on November 6. Initiated destocking of customers in the agroindustry and a supplier-related production limitation for the Business Unit Flavors & Fragrances at its production site in Botlek (NL) impact results additionally. LANXESS therefore expects EBITDA pre exceptionals for the full year 2023 to be between EUR 500 and 550 million. LANXESS’ previous guidance was EUR 600 to 650 million for EBITDA pre exceptionals for the total year.

Dividend cut and sale of Urethane Systems

Given the weak business development, the Board of Management intends to propose a reduction of the full year 2023 dividend to EUR 0.10. The hereby avoided cash outflow would result in a further reduction of net financial debt. Expected proceeds from the now initiated sale of the Business Unit Urethane Systems would contribute as well.

As the last remaining polymer business at LANXESS, the business unit no longer fits in with the strategic orientation of the Group, which has systematically realigned its portfolio in recent years. The business unit has a global presence with six production sites and employs around 400 staff.

https://lanxess.com/en/Media/Press-Releases/2023/11/Persistently-weak-demand-impacts-third-quarter

October 18, 2023

VPC Announcement

VPC Group Inc.VPC Group Inc. 2,340 followers2,340 followers

VPC Group Acquires Prestige Fabricators in Strategic Expansion into US Markets.

VPC Group, a leader in the production of both foam and fiber materials has successfully acquired the assets of Klaussner’s subsidiary, Prestige Fabricators, as part of Klaussner’s asset liquidation.

This acquisition marks a significant milestone in VPC Group’s growth strategy, enabling them to expand their foam pouring and fabrication footprint beyond its historical origins of Canada, into the US market.

With a strong reputation as a customer centric partner in the bedding and furniture industry, VPC Group is known for its commitment to quality and service and has emerged as the market leader in North America.

The acquisition of Prestige Fabricators reinforces their position in the industry, both in Canada and the United States.

VPC Group currently operates 20 state-of-the-art facilities across North America. This includes foam pouring, foam fabrication and fiber processing facilities.

The addition of Prestige Fabricators and their recent acquisition of Fibrix LLC, clearly demonstrates VPC’s commitment to expanding their product offerings and reach in the North American market.

The acquisition of Prestige Fabricators will expand VPC footprint and strengthen and enhance VPC Group’s capabilities to better serve their customers with a broader range of foam products.

https://www.linkedin.com/feed/update/urn:li:activity:7119717013287038976/