The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

July 9, 2024

German chemicals association: Industry past its rock bottom, but export-driven model might be over

By Jonathan Packroff | Euractiv

Est. 3min

0:30 (updated: 7:10)

Content-Type:

Building of industry leader BASF in Ludwigshafen, Germany. [Firn/shutterstock]

Euractiv is part of the Trust Project >>>

Languages: Deutsch

Germany’s chemical industry has overcome its low point, but the previous model of exporting basic chemicals has ended, the sector’s umbrella association VCI said on Monday (8 July).

The group, representing industrial giants such as BASF, Bayer and Fresenius, expects chemical and pharma industry production to climb 3,5% this year and sales to gain 1.5%.

This comes after two years of faltering production – with an aggregate 15% slide between 2021 and 2023.

However, production was still 11% below the “pre-crisis level”, said VCI president Markus Steilemann while presenting the sector’s half-year results in Berlin on Monday, referring to the energy crisis that was triggered by the full-scale invasion of Russia in Ukraine in February 2022.

The recovery was particularly strong in the production of inorganic basic chemicals – such as hydrogen, chlorine and sulphuric acid, which saw a year-on-year increase of 12% in the first six months of 2024.

Similarly, the production of petrochemicals – i.e. chemicals based on oil and gas – saw an increase of 8.5%.

“Energy prices are back at a more tolerable level,” said Steilemann, “and at the same time it has to be said that we still do not have competitive industrial prices for the basic chemicals industry in Germany due to the overall international energy price situation,” he added.

The combination of relatively high electricity prices and high prices for oil and gas derivates, needed as feedstock for some products, “continues to put products manufactured in Germany at a competitive disadvantage,” he said.

In terms of exports, therefore, many basic chemicals produced in Germany are “no longer competitive,” he said.

Hundreds of closures

Steilemann said he believed that “what Germany actually did very successfully in the chemicals sector for many decades up to 2016/2017 – the basic chemicals export model – has come to the end of its life for Germany”.

In 2023, Germany’s biggest chemical company, BASF, made headlines by closing one of its ammonia production sites in Ludwigshafen. The site, which is currently for sale, is only one of numerous examples.

“To our knowledge, around 300 companies in the chemical industry actually ceased operations last year,” Steilemann said, noting,g however, that this would also include small firms such as laboratories.

Nevertheless, he said, “Those who recklessly assumed that production would return 1:1 after the energy crisis were wrong.”

“Unfortunately, for many companies, what’s gone is gone.”

Shift away from prescriptive regulation?

From the next European Commission, Steilemann joined the ranks of many stakeholders calling for the Green Deal to be complemented by an Industrial Deal.

“We need to put a business plan behind this transformation because, so far, it has led to more rules, more regulation – very fine-grained regulation,” he said.

He said the chemical industry alone was affected by 43 laws adopted over the last legislative term. He said this would lead to up to 600 additional regulations, such as implementing acts or national implementation, parts of which are still outstanding.

“In this respect, no matter what approach the new Commission takes, we will initially see a knock-on effect from the legislation of the last Commission,” he said.

German chemicals association: Industry past its rock bottom, but export-driven model might be over

July 8, 2024

Hurricane Beryl shutters Texas coastal shipping lanes

Ports in Houston, Corpus Christi, Galveston, Freeport and Texas City halt operations

· Monday, July 08, 2024

Texas ports along the Gulf Coast closed operations and vessel traffic before Hurricane Beryl made landfall in southeast Texas at 4:30 a.m. Monday CDT as a Category 1 storm packing 94 mph winds, heavy rainfall and the potential for life-threatening storm surges.

Ports in Houston, Corpus Christi, Galveston, Freeport and Texas City were shuttered Sunday morning after the Coast Guard declared condition “Zulu,” according to Reuters.

Under port condition Zulu, all vessel movement and cargo operations are restricted.

“Due to the expected weather, all Port Houston facilities will be closed,” port officials said on X.

They said they would provide an update by noon Monday about Tuesday operations.

Texas ports are major shipping hubs for crude oil, gasoline, liquefied natural gas, steel, automotive goods and chemicals, as well as a variety of consumer commodities.

Rainfall totals in the Houston metro area over the past 24 hours range from 5 to 8 inches. Storm surges of 3 to 7 feet have been reported in parts of the middle and upper Texas coasts.

It’s unclear when the Coast Guard will lift condition Zulu and allow the ports to resume regular operations.

The storm has already caused power outages to more than 1 million homes and businesses in the Houston area, according to The Associated Press. Houston and other parts of southeast Texas have flood warnings in effect until Monday night.

Hurricane Beryl’s track shifted eastward over the past 48 hours, with the storm making landfall in the coastal town of Matagorda, about 95 miles south of Houston. The storm had been predicted to make landfall near or south of Corpus Christi and travel north through Laredo, San Antonio and Austin.

The storm’s path was expected to track through east Texas on Monday and then up toward Shreveport, Louisiana, and Arkansas into Tuesday.

July 8, 2024

Tempur Sealy International, Inc. (TPX) Special Call Transcript

Jul. 08, 2024 9:10 AM ETTempur Sealy International, Inc. (TPX) Stock

Tempur Sealy International, Inc. (NYSE:TPX) Special Call July 8, 2024 8:00 AM ET

Company Participants

Aubrey Moore – Investor Relations

Scott Thompson – Chairman, President & Chief Executive Officer

Scott Thompson

Thank you, Aubrey. Good morning, everyone. And thank you for joining us on our call today. As we announced last week, the FTC has initiated litigation to challenge the combination of Tempur Sealy and Mattress Firm. We felt that sharing a bit more information would be beneficial, not just for investors, but also for our employees and Mattress Firm’s employees who drive the company’s successes. We’re working hard to properly and timely communicate a consistent message to all interested parties.

So, I’d like to take a moment to share some remarks on the current situation, but as I’m sure you’ll understand, as this acquisition is being challenged in court, the company’s commentary is limited. We’ve received some questions via email and we’ll address them as appropriate towards the end of the call. Additionally, we are in a quiet period regarding market conditions and earnings, so I’ll not be able to comment on those topics. We expect to report second-quarter earnings in the coming weeks.

Turning to the topic of the call today, we’ve been working constructively with the FTC to secure regulatory approval for this transaction for over a year. Since complying with the agency’s second request on November 17, 2023, we have voluntarily granted the FTC six extensions of time to complete its review. The FTC has a key role as a regulatory body, and we appreciate their extensive effort to understand the industry and the transaction. While we spent more time in FTC staff review than we planned, we felt it was appropriate given their important job. We are disappointed by the FTC’s position, but have always believed this transaction is consistent with the law, and in the current regulatory environment, we’re prepared for this step.

The bedding industry is highly competitive, offering consumers a diverse selection of products, brands, price points, and purchasing channels. Brick-and-mortar retailers and direct-to-consumer bedding brands sell millions of bedding products online each year. In fact, we believe e-commerce, which includes mattresses at all price points, is the fastest growing channel in our industry. Our own websites provide clear proof point of the ability to sell high-end bedding online. Additionally, there are thousands of brick-and-mortar stores across the United States where consumers can purchase bedding products, only a small fraction of which are operated by Mattress Firm. A quick Google Search or even driving down the street presents numerous bedding distribution options. We remain confident that our combination will unlock incremental benefits for all stakeholders.

In particular, we are confident that the combination will drive exceptional benefits to consumers. Mattress Firm’s strong retail presence complements Tempur Sealy’s manufacturing capability, which facilitates more targeted innovation, improves the customer experience, and ensures high quality, durable products. Additionally, we expect to achieve cost synergies by leveraging our global scale and vertically integrated infrastructure to drive efficiencies through logistics, product lifecycle management, manufacturing optimization, and sourcing initiatives. All of these factors allow us to further execute on Tempur Sealy’s mission to improve sleep of more people’s lives through sleep.

We manufacture 100% of our mattresses we sell domestically in the United States. Let me reread that for you. We manufacture 100% of our mattresses we sell domestically in the United States. Supporting thousands of jobs across 38 states and territories, we disagree with the FTC’s statement that the transaction may harm the U.S. workforce. We’ve had extensive discussions about this transaction with our labor unions representing our employees, and the majority of the unions submitted letters to support the transaction reflecting their belief that the transaction will benefit their members and not adversely impact workers of other bedding companies that they represent. None of the unions representing our employees have expressed opposition to the transaction.

Let me be clear from the start. We have planned for and publicly stated that we see Mattress Firm as a multi-branded bedding retailer. They’ve been a valued retail partner for more than 35 years, and we know one of their many strengths is their diverse offering, which includes leading brands and complementary private label products, providing a broad range of innovative consumer solutions. We are committed to maintaining a curated, comprehensive, and diversified product assortment that is core to their business success and inherent in the intrinsic value of Mattress Firm that we are paying over $4 billion to acquire. Keeping Mattress Firm in multi-brand retail is consistent with how we operate the multi-branded bedding retailers we have acquired in Europe.

In our prior retail acquisitions in the international market, both our brand and others have flourished. Further confirming our intention to run Mattress Firm consistent with its current multi-branded strategy, we also, underscoring the — excuse me, left startup. Furthermore confirming our intention to run Mattress Firm consistent with its current multi-branded strategy, and also underscoring the absence of any possible theory of competitive harm as part of this transaction, we have committed: one, to make a substantial divestiture of stores and supporting infrastructure to rapidly growing US mattress retailer; two, to maintain floor slots at Mattress Firm for third-party brands; and third, to take additional actions. Our slot commitment ensures a portion of the floor will be reserved for the best non-Tempur Sealy products in the market. We’ve successfully engaged with numerous Mattress Firm suppliers on post-merger supply agreements and have executed several, including one with a supplier who does not currently supply Mattress Firm. We’re confident in our pro-competitive rationale of this transaction and look forward to presenting the many benefits of the combination.

We believe that a successful litigation process can be completed in the coming months, which would allow us to close the transaction in late 2024 or early 2025. As I mentioned previously, relative to our original expectations, the timeline has elongated a bit as we worked constructively with the FTC. Lastly, [forward] (ph) to all the Tempur Sealy and Mattress Firm employees who every day provide customers with great products and services. Despite the elongated regulatory process, nothing has dissuaded us from wanting to come together and to continue to succeed. Thank you for your patience and ongoing support for the combination.

Now, let me touch on a couple of questions we’ve heard. What is the process from here? We’re still evaluating the lawsuit to better understand the next steps for our case. Hearing dates had not yet been set, but we expect these to proceed in the next few months.

What is the probability of success? We believe we have a very strong case based on the facts and law. How do you think about your litigation strategy? We’ll try the case in court, not in the public. So I’ll have to pass on all strategy-related questions and the array of what-if scenarios. Good news is, we expect the process to be relatively short to get to judgment. There are numerous questions about competitors’ financial viability with or without this transaction. All I can say is, we have no comment on competitors’ financial conditions.

What court and judge is assigned to the case? The case has been filed in the United States Southern District Court of Texas and assigned to Judge Charles Eskridge. What is plan B for the company if there’s no transaction with Mattress Firm? As we’ve said in the past, the company is deleveraging. And without the transaction, the company will have a low leverage ratio. Without this transaction, we expect to follow our historic process for allocating capital to maximize risk-adjusted returns, which I would expect would result in a material fair repurchase. This will be determined by Tempur Sealy’s Board of Directors.

That concludes our remarks at this time. Thank you for your interest in this transaction and support for the team and our Board of Directors. Operator, that ends the call today.

Operator

Thank you. This does conclude today’s Tempur Sealy International Business Update Call. Thank you for your participation. You may disconnect at any time.

July 8, 2024

China’s Rapid Renewables Rollout Hits Grid Limits

by Tyler Durden

Monday, Jul 08, 2024 – 02:45 AM

By John Kemp, senior energy analyst at Reuters

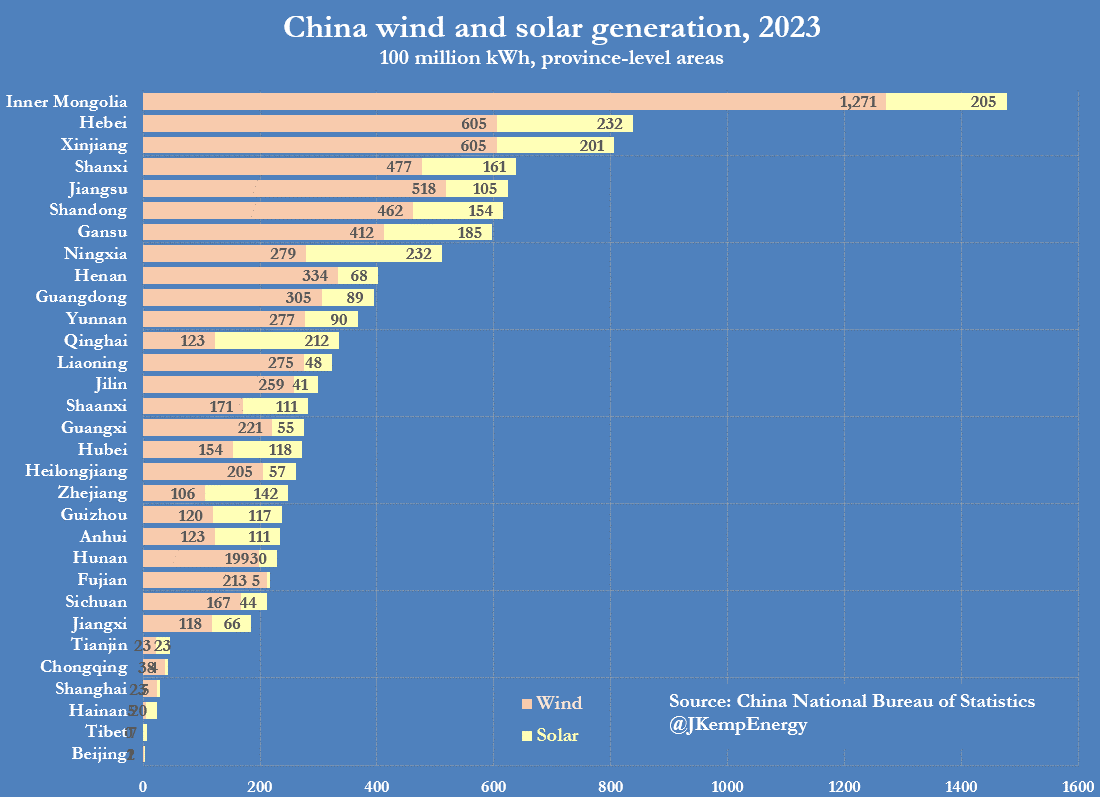

China’s record-breaking deployment of wind and solar capacity has worsened regional power imbalances, forcing the country to idle increasing amounts of renewable generation when it overwhelms local consumption.

New government regulations aim to reduce the amount of renewable generation that has to be abandoned by increasing long-distance transmission links and better coordinating generation plans across provinces.

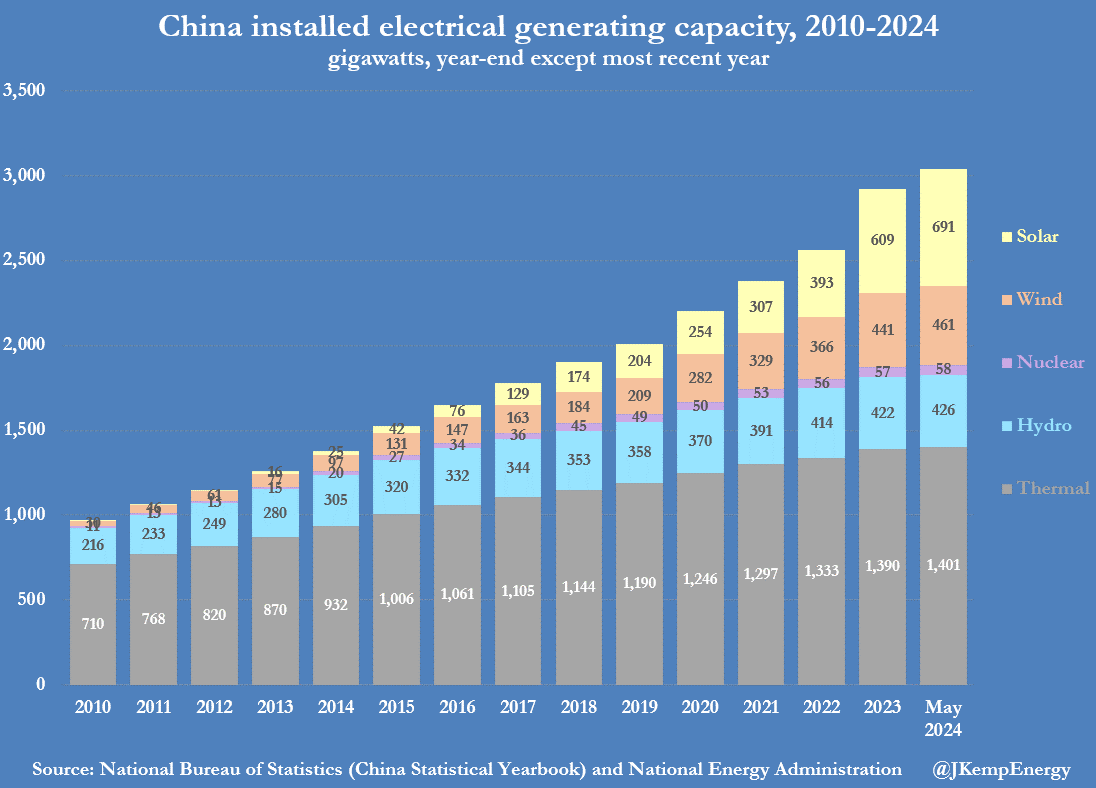

Since the end of 2018, China’s total generating capacity has increased by 1.137 billion kilowatts (kW), compound annual growth of 9%, according to data from the National Bureau of statistics (NBS).

Thermal capacity, mainly from coal-fired plants but some from gas-fired generators, rose by 257 million kW or 4% per year (“China statistical yearbook”, NBS, 2023).

Most capacity additions, however, have come from what the government calls “new energy sources” – wind farms (277 million kW, 19% per year) and solar generators (517 million kW, 29% per year). Increased penetration of intermittent renewables is making it harder to manage a nationwide transmission system that was already struggling with large regional imbalances between generation and load.

The solution to variable wind and solar output is to smooth out fluctuations across a larger number of generators spread over much larger areas of the country, which will require more transmission and better scheduling.

Long-Distance Transmission

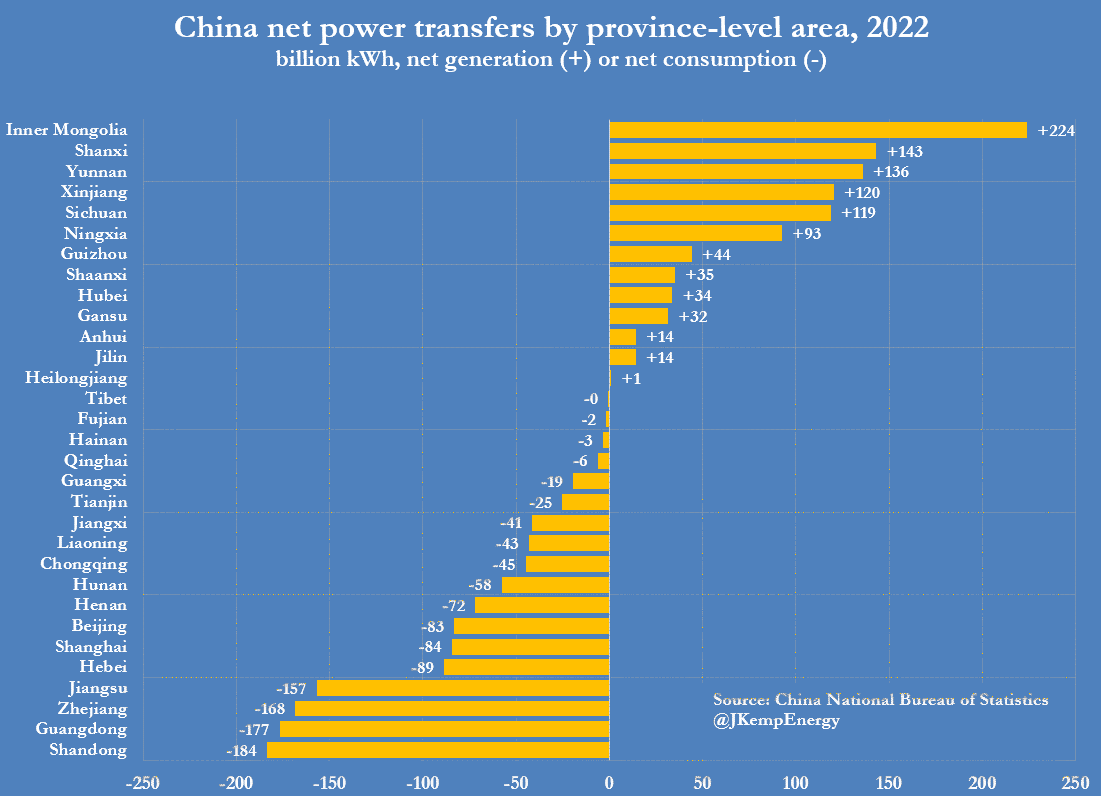

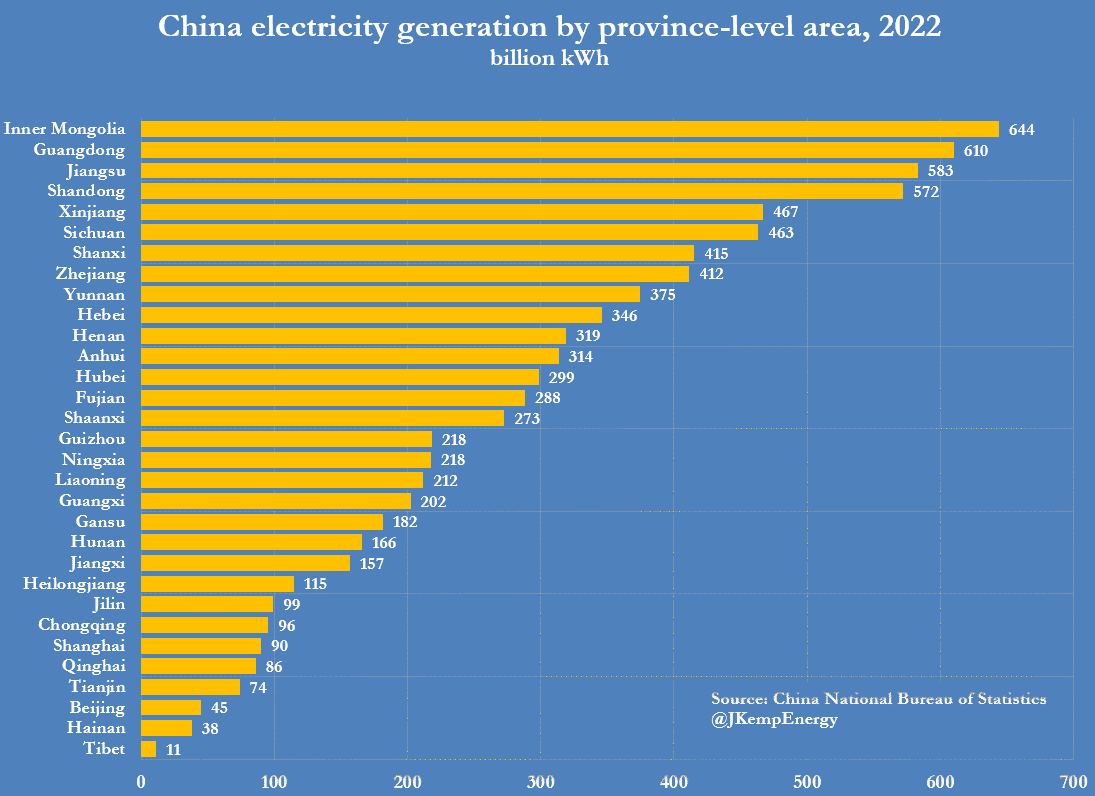

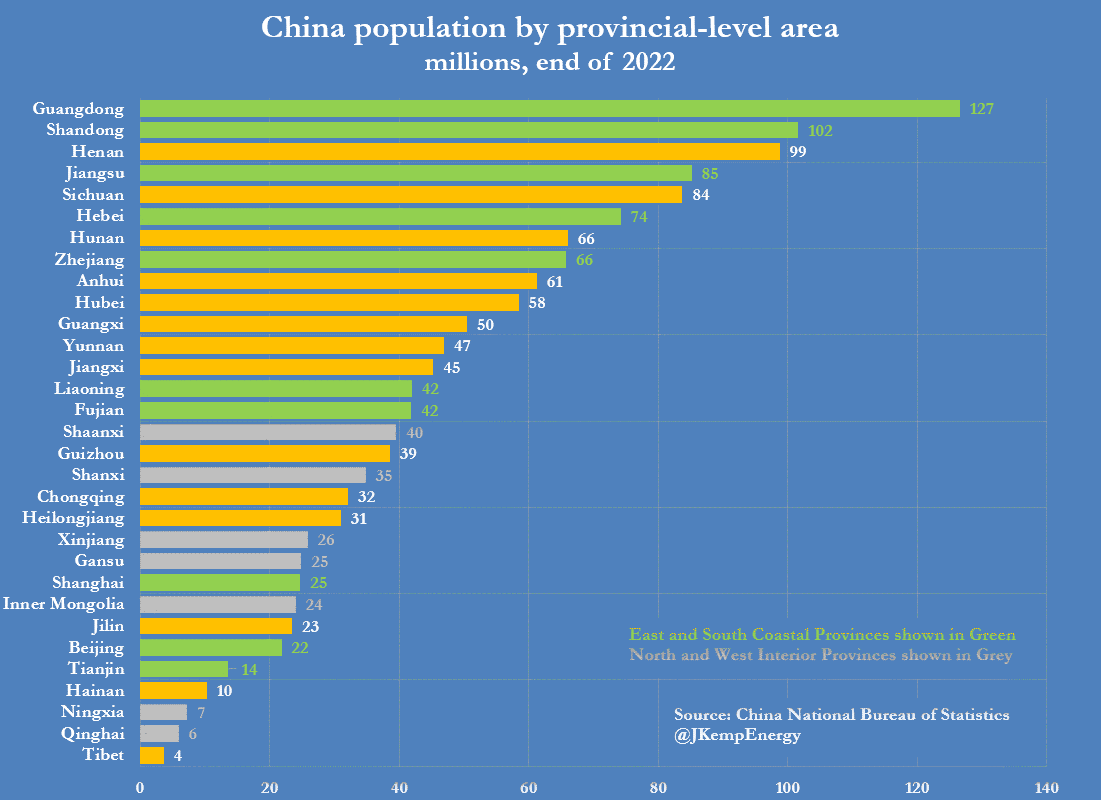

For decades, the country has been characterized by massive west-to-east electricity transfers from interior areas with surplus generation to the massive load centres on the east and south coasts. Ten provincial-level areas in the east and south (Liaoning, Hebei, Beijing, Tianjin, Shandong, Jiangsu, Shanghai, Zhejiang, Fujian and Guangdong) accounted for 50% of national consumption but only 40% of generation in 2022.

By contrast, six remote and sparsely populated northern and western areas (Inner Mongolia, Xinjiang, Shanxi, Shaanxi, Gansu and Ningxia) accounted for 18% of consumption but 25% of generation.

Chartbook: China regional electricity transfers

In response, China’s State Grid Corporation has constructed a network of ultra-high voltage transmission lines to move power thousands of kilometres from surplus areas in the west and north to deficit areas in the east and south.

In the process, China has become the world leader in ultra-high voltage transmission to move electricity over long distances while minimising line losses and is exporting its expertise around the world.

Inner Asia’s Energy Abundance

China’s northern and western areas are some of the least populated and poorest parts of the country, but rich in energy resources, traditionally coal but now increasingly gas and renewables.

The north and west contains the country’s most important coal deposits and has become a major centre of pit-head generation, with some electricity used locally by heavy industry, and the rest transmitted east and south.

Inner Mongolia, Shanxi, Shaanxi and Xinjiang alone accounted for 81% of coal mine production and 25% of all thermal generation in 2022, according to data from the NBS.

In a quirk of fate, the arid and windswept northern and western plains and deserts are also the best sites for giant wind farms and solar parks.

Inner Mongolia, Shanxi, Shaanxi and Xinjiang together with neighbouring Gansu, Ningxia and Qinghai accounted for 42% of all wind and solar generation last year.

But the addition of so much wind and solar generation in a region already saturated with coal-fired power threatens to overwhelm the transmission system.

During peak periods of wind and solar generation, there is not enough population and industry in these areas to absorb all the output, and not enough long-distance transmission capacity to move the surplus east and south.

More Transmission And Planning

In 2016, the national utilisation rate for new energy sources fell to a record low of 84%, prompting the central government to launch a “Clean Energy Absorption Action Plan” to reduce the waste of renewable resources. The plan focused on improvements in local distribution, long-distance inter-provincial transmission, and energy trading to reduce the curtailment of new energy generation.

By 2023, the utilisation rate for wind power had climbed to a remarkable 97.3% and solar had reached 98%, according to the state-run news agency Xinhua.

With rapid deployment of renewable capacity, however, the problem of abandonment is re-emerging, with wind utilisation down to 96.1% and solar down to 96% in the first five months of 2024. Sliding utilisation has prompted an alert from the National New Energy Consumption Monitoring and Early Warning Center (“Solving the pain points and difficulties of new energy consumption”, Xinhua, July 1, 2024).

The response is likely to be similar, with renewed emphasis on integrating renewables at local level and more transmission capacity to move surplus power across provincial boundaries. In the last two years, central government policy statements have repeatedly focused on the need for better coordination of transmission and generation between provinces.

Creating A Truly National System

In a sign of the importance attached to the issue, the Communist Party’s Politburo held a group study session on new energy technology and energy security on February 29, 2024. The session, bringing together top central and regional leaders, included a discussion on boosting “the grid’s capacity capability to integrate, distribute and regulate clean energy.”

President Xi Jinping stressed need for “coordinated development of the energy sector” (“Xi stresses high-quality development of new energy”, CPC International Department, March 2, 2024).

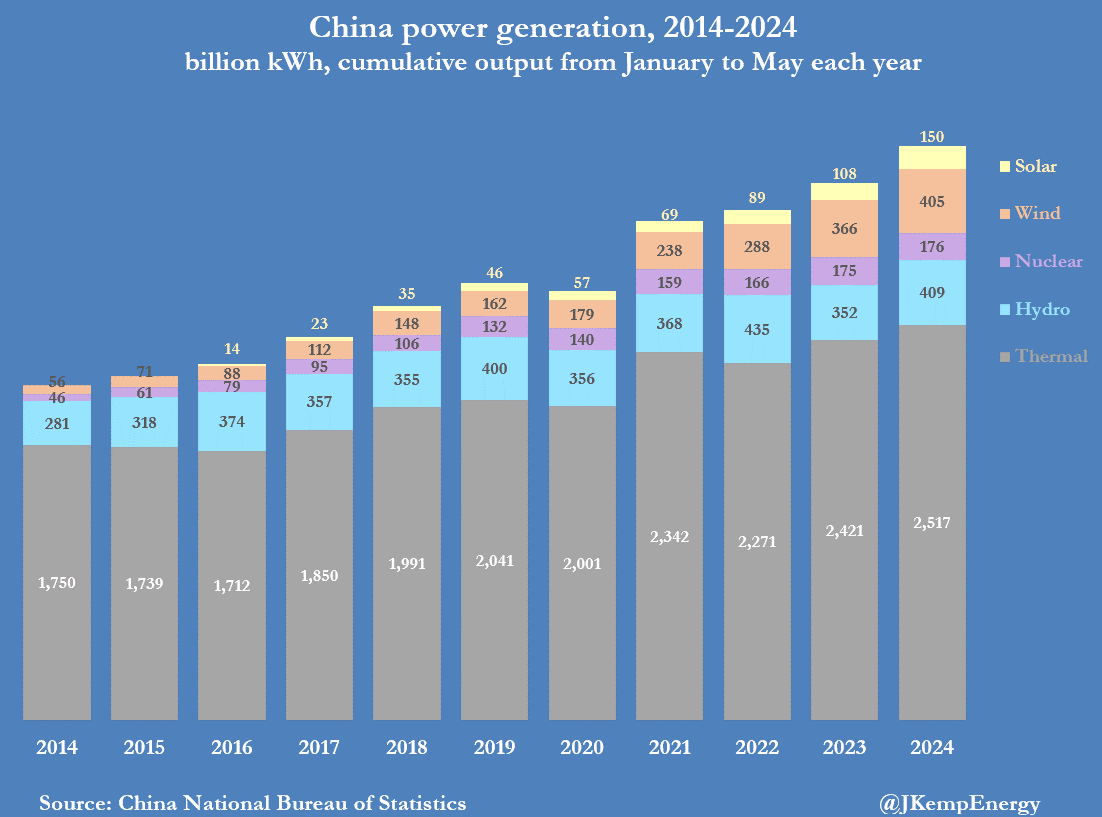

In many ways, China’s long-distance ultra-high voltage transmission system is an extraordinary engineering achievement, likely to be copied in other parts of the world as more and more renewables are connected to grids. It has enabled a remarkable penetration of intermittent renewables, as well as hydroelectric generation, into the national power system while maintaining or improving reliability. As a result, wind and solar producers supplied 15% of all generation in the first five months of 2024, up from 7% in the same period in 2019.

In some ways, however, China is still struggling to forge a truly integrated nationwide system from fragmented provincial-level utilities that pursue their own priorities. If government plans to achieve even higher renewables penetration are to be achieved, there will have to be much closer links and more coordination between different types of generators and across far wider areas.

https://www.zerohedge.com/markets/chinas-rapid-renewables-rollout-hits-grid-limits

July 3, 2024

BASF Pulls Plug on Potential Chile Investments Amid Lithium Rout

Wilfried Eckl-Dorna and James Attwood, Bloomberg News

(Bloomberg) — German chemicals giant BASF SE has abandoned plans to invest in lithium mining assets in Chile as a slowdown in electric-vehicle adoption worldwide drags down battery metal prices.

BASF withdrew from initial talks with Wealth Minerals Ltd., the Vancouver-based firm that has exploration projects in Chile, the German company said in an email to Bloomberg Tuesday.

A potential arrangement had included possible funding and offtake if Wealth obtained production contracts in Chile. BASF also was exploring the possibility of building a plant in Chile to turn lithium into the cathode that goes into electric-vehicle batteries.

“No collaboration between BASF and Wealth Materials materialized in the end,” BASF wrote. The company didn’t give a reason for ending the talks or mention the proposed cathode plant.

The withdrawal follows BASF’s announcement last week that it scrapped plans for a $2.6 billion nickel-cobalt refinery in Indonesia. Slowing EV sales growth has pushed down prices of key inputs, with lithium at three-year lows after surging to a record in late 2022. BASF now plans to bolster raw-materials supply for European operations via a new battery recycling plant in Germany, due to start operations later this year.

While the German company’s involvement in Chile was at a very early stage, it’s withdrawal is a blow to European authorities’ push for companies to secure deals with key battery metals suppliers.

It’s also a setback for Wealth as it grapples with a strategy being implemented in Chile to open new areas to lithium extraction. One of the company’s projects is in an area deemed of strategic importance, meaning it would have to take on a state-owned company as a majority partner.

Wealth Chief Executive Officer Henk van Alphen declined to comment on BASF’s exit. He said implementation of the government’s lithium strategy has been slow though progress is being made. Authorities next week are scheduled to announce details of firms interested in new contracts in nonstrategic salt flats.