The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

September 7, 2021

08/31/2021 – PRESS RELEASE

Arkema acquires Ashland’s performance adhesives

An agreement was signed today for the acquisition of Ashland’s Performance Adhesives business, a first-class leader in high performance adhesives for industrial applications in the United States with a unique and innovative product portfolio. This project is perfectly aligned with the Group’s ambition to become a pure Specialty Materials player by 2024.

- An agreement was signed today for the acquisition of Ashland’s Performance Adhesives business, a first-class leader in high performance adhesives for industrial applications in the United States with a unique and innovative product portfolio

- This project perfectly aligns with the Group’s ambition to become a pure Specialty Materials player by 2024 and focus its development on sustainable and high performance solutions

- This key step supports Bostik’s strong long term growth ambition and now allows it to aim for an EBITDA margin above 17% in 2024

- Sales of approximately US$360 million (1) in 2021 with an EBITDA margin above 25% (1) and 330 employees.

- The offer was made on the basis of a US$ 1,650 million enterprise value, i.e. 15x the estimated 2021 EBITDA (1) after taking into account the tax benefits linked to the structure of the transaction

- Significant pre-tax synergies, estimated at 12.5% of sales, enabling to reduce the EV/EBITDA multiple to 8.7 by 2026

- Strongly value-creative deal for Arkema’s shareholders, with an accretive impact on net earnings per share in the first year, and a €1 per share accretion by 2026

“We are very happy and proud of this move. In a context of strong earnings growth following the recent divestment of PMMA and the start of the strategic review of Fluorogases, the acquisition of Ashland’s adhesives business is a fantastic opportunity to reinforce the Group’s presence in the US and to accelerate Bostik’s growth.

With an excellent business which holds leading positions in many high-growth segments and a high level of profitability, this project fully aligns with the Group’s targeted acquisition strategy. Ashland’s adhesives will constitute a new technological platform for our adhesives and the synergies are particularly high given the geographical and application complementarities with Bostik and our Coating Solutions platform.

The cultures of the teams are very close, focused on customer centricity and sustainable innovation. We look forward to welcoming Ashland’s high-caliber management team and to partner together for this highly value creative deal.”, stated Thierry Le Hénaff, the Group’s Chairman and Chief Executive Officer.

A major step in Bostik’s strong long term growth ambition

With estimated sales of around US$ 360 million (1) and an estimated EBITDA at a very high level of around US$95 million (1) in 2021, Ashland offers a portfolio of high performance adhesive solutions in high-value-added industrial applications.

With its large range of key technologies and well-known brands, Ashland Performance Adhesives is a key player in pressure-sensitive adhesives in the United States, operating in high-growth applications, in particular in decorative, protection, and signage films for automotive and buildings. Combined with Bostik’s and the Coating Solutions segment’s sustainable and high performance solutions, its range will represent one of the most complete offering in the pressure sensitive adhesives sector.

Ashland also holds significant positions in structural adhesives in the United States, in particular in segments such as wood bonding for construction, composites and transportation. This will allow Bostik to complement its positions and to benefit from fast-growing demand driven by major sustainable trends.

Ashland also holds significant positions in structural adhesives in the United States, in particular in segments such as wood bonding for construction, composites and transportation. This will allow Bostik to complement its positions and to benefit from fast-growing demand driven by major sustainable trends.

Finally, Ashland Performance Adhesives offers a wide range of adhesives for flexible packaging, addressing growing demand for more sustainable products. Thanks to Ashland’s positioning in North America, Bostik will complete its geographic presence in flexible lamination, becoming one of the world’s key players in this sector.

Ashland’s Performance Adhesives business, which employs approximately 330 people and operates 6 production plants, mainly in North America, has enjoyed sustained growth in recent years and has significant growth potential in Europe and Asia. Combined with Arkema’s global positioning, the excellent technological, geographic and commercial complementarities of this acquisition will enable Bostik to expand its offering and position itself as a major player in high performance industrial adhesives.

This acquisition also allows to upgrade the 2024 profitability target for Arkema’s Adhesive Solutions segment, which now aims for an EBITDA margin above 17%, among the very best in the industry, with sales of over €3 billion.

(1) Including pro forma adjustments

A strongly value-creative project, perfectly in line with Arkema’s 2024 ambition

This project offers significant pre-tax synergies estimated at over US$ 45 million, which will be progressively implemented over the next 5 years. They will focus on the commercial development of globalized solutions in high-growth segments, procurement synergies through our acrylics business and industrial optimizations.

Given these synergies and the anticipated growth over the next few years, the enterprise value/EBITDA multiple will be reduced to 8.7 times in 2026 after taking account of the tax benefits linked to the structure of the transaction, which are estimated at more than US$200 million.

This deal will be financed fully in cash, and the level of net debt including hybrid bonds on closing will remain tightly controlled at 1.9x the 2021 pro forma EBITDA (2), in line with the Group’s objective to maintain this ratio below 2.

Furthermore, this business represents a high EBITDA-to-cash conversion rate, above the Group’s long-term targets, given the tight control of working capital and limited capital intensity.

Within the first year of integration this deal will have an accretive impact on net earnings per share and the accretive impact will reach €1 per share by 2026.

This proposed acquisition is fully in line with the Group’s strategy and ambition to become a pure Specialty Materials player by 2024 generating sales of at least €10 billion with an EBITDA margin of around 17% and improved resilience. It is a major step in strengthening Arkema’s Adhesive Solutions segment.

The project is subject to the approval of the antitrust authorities in the countries concerned. Relevant legal information and consultation process involving employee representative bodies will be performed before closing.

(2) Estimated 2021 Group EBITDA integrating the full year impact of M&A operations already announced in 2021

September 7, 2021

08/31/2021 – PRESS RELEASE

Arkema acquires Ashland’s performance adhesives

An agreement was signed today for the acquisition of Ashland’s Performance Adhesives business, a first-class leader in high performance adhesives for industrial applications in the United States with a unique and innovative product portfolio. This project is perfectly aligned with the Group’s ambition to become a pure Specialty Materials player by 2024.

- An agreement was signed today for the acquisition of Ashland’s Performance Adhesives business, a first-class leader in high performance adhesives for industrial applications in the United States with a unique and innovative product portfolio

- This project perfectly aligns with the Group’s ambition to become a pure Specialty Materials player by 2024 and focus its development on sustainable and high performance solutions

- This key step supports Bostik’s strong long term growth ambition and now allows it to aim for an EBITDA margin above 17% in 2024

- Sales of approximately US$360 million (1) in 2021 with an EBITDA margin above 25% (1) and 330 employees.

- The offer was made on the basis of a US$ 1,650 million enterprise value, i.e. 15x the estimated 2021 EBITDA (1) after taking into account the tax benefits linked to the structure of the transaction

- Significant pre-tax synergies, estimated at 12.5% of sales, enabling to reduce the EV/EBITDA multiple to 8.7 by 2026

- Strongly value-creative deal for Arkema’s shareholders, with an accretive impact on net earnings per share in the first year, and a €1 per share accretion by 2026

“We are very happy and proud of this move. In a context of strong earnings growth following the recent divestment of PMMA and the start of the strategic review of Fluorogases, the acquisition of Ashland’s adhesives business is a fantastic opportunity to reinforce the Group’s presence in the US and to accelerate Bostik’s growth.

With an excellent business which holds leading positions in many high-growth segments and a high level of profitability, this project fully aligns with the Group’s targeted acquisition strategy. Ashland’s adhesives will constitute a new technological platform for our adhesives and the synergies are particularly high given the geographical and application complementarities with Bostik and our Coating Solutions platform.

The cultures of the teams are very close, focused on customer centricity and sustainable innovation. We look forward to welcoming Ashland’s high-caliber management team and to partner together for this highly value creative deal.”, stated Thierry Le Hénaff, the Group’s Chairman and Chief Executive Officer.

A major step in Bostik’s strong long term growth ambition

With estimated sales of around US$ 360 million (1) and an estimated EBITDA at a very high level of around US$95 million (1) in 2021, Ashland offers a portfolio of high performance adhesive solutions in high-value-added industrial applications.

With its large range of key technologies and well-known brands, Ashland Performance Adhesives is a key player in pressure-sensitive adhesives in the United States, operating in high-growth applications, in particular in decorative, protection, and signage films for automotive and buildings. Combined with Bostik’s and the Coating Solutions segment’s sustainable and high performance solutions, its range will represent one of the most complete offering in the pressure sensitive adhesives sector.

Ashland also holds significant positions in structural adhesives in the United States, in particular in segments such as wood bonding for construction, composites and transportation. This will allow Bostik to complement its positions and to benefit from fast-growing demand driven by major sustainable trends.

Ashland also holds significant positions in structural adhesives in the United States, in particular in segments such as wood bonding for construction, composites and transportation. This will allow Bostik to complement its positions and to benefit from fast-growing demand driven by major sustainable trends.

Finally, Ashland Performance Adhesives offers a wide range of adhesives for flexible packaging, addressing growing demand for more sustainable products. Thanks to Ashland’s positioning in North America, Bostik will complete its geographic presence in flexible lamination, becoming one of the world’s key players in this sector.

Ashland’s Performance Adhesives business, which employs approximately 330 people and operates 6 production plants, mainly in North America, has enjoyed sustained growth in recent years and has significant growth potential in Europe and Asia. Combined with Arkema’s global positioning, the excellent technological, geographic and commercial complementarities of this acquisition will enable Bostik to expand its offering and position itself as a major player in high performance industrial adhesives.

This acquisition also allows to upgrade the 2024 profitability target for Arkema’s Adhesive Solutions segment, which now aims for an EBITDA margin above 17%, among the very best in the industry, with sales of over €3 billion.

(1) Including pro forma adjustments

A strongly value-creative project, perfectly in line with Arkema’s 2024 ambition

This project offers significant pre-tax synergies estimated at over US$ 45 million, which will be progressively implemented over the next 5 years. They will focus on the commercial development of globalized solutions in high-growth segments, procurement synergies through our acrylics business and industrial optimizations.

Given these synergies and the anticipated growth over the next few years, the enterprise value/EBITDA multiple will be reduced to 8.7 times in 2026 after taking account of the tax benefits linked to the structure of the transaction, which are estimated at more than US$200 million.

This deal will be financed fully in cash, and the level of net debt including hybrid bonds on closing will remain tightly controlled at 1.9x the 2021 pro forma EBITDA (2), in line with the Group’s objective to maintain this ratio below 2.

Furthermore, this business represents a high EBITDA-to-cash conversion rate, above the Group’s long-term targets, given the tight control of working capital and limited capital intensity.

Within the first year of integration this deal will have an accretive impact on net earnings per share and the accretive impact will reach €1 per share by 2026.

This proposed acquisition is fully in line with the Group’s strategy and ambition to become a pure Specialty Materials player by 2024 generating sales of at least €10 billion with an EBITDA margin of around 17% and improved resilience. It is a major step in strengthening Arkema’s Adhesive Solutions segment.

The project is subject to the approval of the antitrust authorities in the countries concerned. Relevant legal information and consultation process involving employee representative bodies will be performed before closing.

(2) Estimated 2021 Group EBITDA integrating the full year impact of M&A operations already announced in 2021

September 6, 2021

Azelis to Raise $1 Billion in Biggest Belgian IPO Since 2007

Kat Van HoofMon, September 6, 2021, 5:50 AM·2 min read

(Bloomberg) — Specialty-chemical and food-ingredient distributor Azelis SA plans to raise 880 million euros ($1.04 billion) in an initial public offering on Euronext Brussels in what could be the biggest stock-market listing in Belgium in 14 years.

Existing shareholders will also sell stock in the deal, the company said in a statement Monday. The IPO could value Azelis at about 5 billion euros ($6 billion), Bloomberg News reported in June.

Proceeds from the offering will be used to ease the company’s debt burden while providing firepower for acquisitions.

“Azelis has been and will continue to be a consolidator among specialty-chemicals and food-ingredient suppliers,” Chief Executive Officer Hans Joachim Mueller said in a phone interview.

The offering is set to be the biggest initial share sale in Brussels since metals supplier Nyrstar NV’s listing in 2007, according to data compiled by Bloomberg.

Azelis is part of a wave of companies expected to go public this fall in Europe. Cybersecurity provider Exclusive Networks said Friday it will list in Paris, while French private equity firm Antin Infrastructure Partners SA also said it’s working on an IPO. Goldman Sachs Group Inc.’s Petershill unit announced Monday it plans to list a new investment vehicle in London.

“Given the level of maturity of the company, it feels right to list now,” Muller said, noting that the business grew during the pandemic. Azelis’s adjusted earnings rose by 16% in 2020 from the year before, according to the statement.

Based in Antwerp, Belgium, Azelis distributes specialty chemicals used in everything from animal nutrition to industrial cleaning. The company has about 2,800 employees in 56 countries, according to the statement.

Swedish buyout firm EQT AB acquired Azelis in 2018 from Apax Partners for an undisclosed amount. Canada’s PSP Investments was a co-investor in the deal.

Goldman Sachs Group Inc. and JPMorgan Chase & Co. are joint global coordinators, with bookrunners Barclays Plc, BNP Paribas SA, HSBC Holdings Plc and ING Bank NV on the IPO. Cooperatieve Rabobank and Landesbank Baden-Wuerttemberg are co-lead managers, while Lazard Ltd. is Azelis’s financial adviser.

(Adds CEO comments in fourth paragraph.)

https://finance.yahoo.com/news/chemicals-firm-azelis-seeks-raise-072504580.html

September 6, 2021

Azelis to Raise $1 Billion in Biggest Belgian IPO Since 2007

Kat Van HoofMon, September 6, 2021, 5:50 AM·2 min read

(Bloomberg) — Specialty-chemical and food-ingredient distributor Azelis SA plans to raise 880 million euros ($1.04 billion) in an initial public offering on Euronext Brussels in what could be the biggest stock-market listing in Belgium in 14 years.

Existing shareholders will also sell stock in the deal, the company said in a statement Monday. The IPO could value Azelis at about 5 billion euros ($6 billion), Bloomberg News reported in June.

Proceeds from the offering will be used to ease the company’s debt burden while providing firepower for acquisitions.

“Azelis has been and will continue to be a consolidator among specialty-chemicals and food-ingredient suppliers,” Chief Executive Officer Hans Joachim Mueller said in a phone interview.

The offering is set to be the biggest initial share sale in Brussels since metals supplier Nyrstar NV’s listing in 2007, according to data compiled by Bloomberg.

Azelis is part of a wave of companies expected to go public this fall in Europe. Cybersecurity provider Exclusive Networks said Friday it will list in Paris, while French private equity firm Antin Infrastructure Partners SA also said it’s working on an IPO. Goldman Sachs Group Inc.’s Petershill unit announced Monday it plans to list a new investment vehicle in London.

“Given the level of maturity of the company, it feels right to list now,” Muller said, noting that the business grew during the pandemic. Azelis’s adjusted earnings rose by 16% in 2020 from the year before, according to the statement.

Based in Antwerp, Belgium, Azelis distributes specialty chemicals used in everything from animal nutrition to industrial cleaning. The company has about 2,800 employees in 56 countries, according to the statement.

Swedish buyout firm EQT AB acquired Azelis in 2018 from Apax Partners for an undisclosed amount. Canada’s PSP Investments was a co-investor in the deal.

Goldman Sachs Group Inc. and JPMorgan Chase & Co. are joint global coordinators, with bookrunners Barclays Plc, BNP Paribas SA, HSBC Holdings Plc and ING Bank NV on the IPO. Cooperatieve Rabobank and Landesbank Baden-Wuerttemberg are co-lead managers, while Lazard Ltd. is Azelis’s financial adviser.

(Adds CEO comments in fourth paragraph.)

https://finance.yahoo.com/news/chemicals-firm-azelis-seeks-raise-072504580.html

September 6, 2021

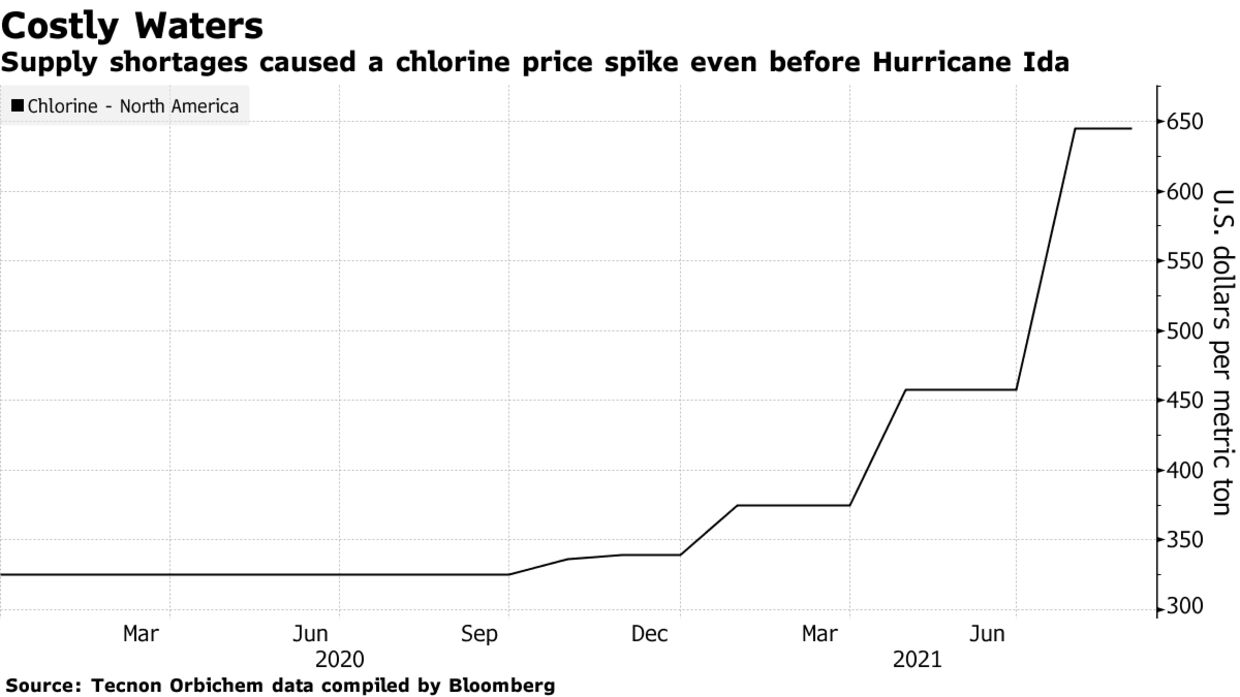

Ida Disrupts Chlorine Production, Raising Risk of Higher Prices

By Kevin Crowley August 30, 2021, 5:29 PM EDT Updated on August 30, 2021, 6:06 PM EDT

- Westlake, Formosa shut down facilities ahead of storm

- Chlorine was already in short supply after February’s freeze

Hurricane Ida’s landfall on the U.S. Gulf Coast caused production outages in the heart of the country’s chlorine manufacturing industry.

Chlorine was already in short supply after a deep freeze in February knocked facilities offline for weeks. Now, widespread power outages around Baton Rouge, Louisiana may increase prices further, according to Robert Stier, a senior petrochemicals analyst at S&P Global Platts.

“Chlorine is going to get really tight” because of the industry’s concentration in the Louisiana area, he said.

READ: Ida’s Aftermath Raises Environmental Fears in ‘Cancer Alley’ (1)

Westlake Chemical Corp. shut two Louisiana facilities that make chlorine over the weekend. An assessment of the storm’s impact may take several days, the company said. Formosa Plastics also closed a plant in Baton Rouge, according to ICIS, a data provider.

Chlorine manufacturers also tend to make PVC, a key building material used in pipes, siding and other construction materials. Gulf Coast contracts for PVC were already trading at record highs before the storm, according to ICIS.