The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

September 8, 2021

Huntsman Announces Update on the Hurricane Ida Impact to its Operations

Download as PDF September 07, 2021 7:30pm EDT

THE WOODLANDS, Texas, Sept. 7, 2021 /PRNewswire/ — Huntsman Corporation (NYSE: HUN) today disclosed that Hurricane Ida caused no significant damage to its Geismar, Louisiana manufacturing facility. The Geismar facility manufactures products for Huntsman’s Polyurethanes and Performance Products divisions and all units were shutdown orderly and safely before Hurricane Ida made landfall. Site personnel are currently preparing the production units for restart. The precise timing of the restart of each unit is dependent on the availability of utilities and the ability of other third-party suppliers to restart their respective operations. Currently, the Company’s best estimate is that production comes back online slowly this coming weekend with an increase in rates next week. Under this timeline, the Company currently anticipates that the estimated impact from Hurricane Ida to third quarter 2021 EBITDA will be offset by strength in the broader Performance Products division and the European and Asian MDI markets.

About Huntsman:

Huntsman Corporation is a publicly traded global manufacturer and marketer of differentiated and specialty chemicals with 2020 revenues of approximately $6 billion. Our chemical products number in the thousands and are sold worldwide to manufacturers serving a broad and diverse range of consumer and industrial end markets. We operate more than 70 manufacturing, R&D and operations facilities in approximately 30 countries and employ approximately 9,000 associates within our four distinct business divisions. For more information about Huntsman, please visit the company’s website at www.huntsman.com.

September 8, 2021

Huntsman Announces Update on the Hurricane Ida Impact to its Operations

Download as PDF September 07, 2021 7:30pm EDT

THE WOODLANDS, Texas, Sept. 7, 2021 /PRNewswire/ — Huntsman Corporation (NYSE: HUN) today disclosed that Hurricane Ida caused no significant damage to its Geismar, Louisiana manufacturing facility. The Geismar facility manufactures products for Huntsman’s Polyurethanes and Performance Products divisions and all units were shutdown orderly and safely before Hurricane Ida made landfall. Site personnel are currently preparing the production units for restart. The precise timing of the restart of each unit is dependent on the availability of utilities and the ability of other third-party suppliers to restart their respective operations. Currently, the Company’s best estimate is that production comes back online slowly this coming weekend with an increase in rates next week. Under this timeline, the Company currently anticipates that the estimated impact from Hurricane Ida to third quarter 2021 EBITDA will be offset by strength in the broader Performance Products division and the European and Asian MDI markets.

About Huntsman:

Huntsman Corporation is a publicly traded global manufacturer and marketer of differentiated and specialty chemicals with 2020 revenues of approximately $6 billion. Our chemical products number in the thousands and are sold worldwide to manufacturers serving a broad and diverse range of consumer and industrial end markets. We operate more than 70 manufacturing, R&D and operations facilities in approximately 30 countries and employ approximately 9,000 associates within our four distinct business divisions. For more information about Huntsman, please visit the company’s website at www.huntsman.com.

September 7, 2021

Top US Port Head Warns Shipping Logjams To Continue Through “Summer 2022”

by Tyler DurdenTuesday, Sep 07, 2021 – 10:50 AM

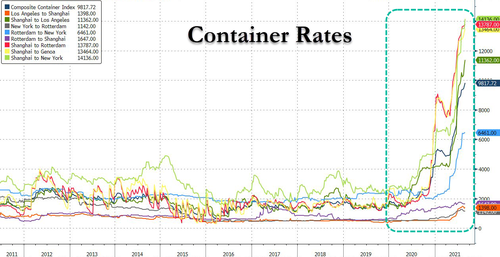

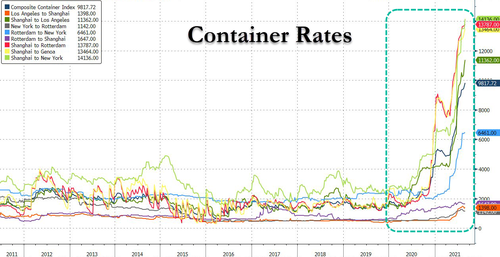

Containerized shipping has become the ugly story of the chaotic supply chain facing U.S. importers and Chinese exporters. Hopes are quickly fading that trans-pacific supply chains will normalize this year or even in 2022.

According to the Wall Street Journal’s Paul Berger, who spoke with industry experts, trans-pacific supply chains will remain swamped through at least the summer of 2022.

Port leaders, such as Mario Cordero, executive director at the Port of Long Beach, California, warned:

“I don’t see substantial mitigation with regard to the congestion that the major container ports are experiencing,” Cordero said. “Many people believe it’s going to continue through the summer of 2022.”

The latest data from Marine Exchange of Southern California & Vessel Traffic Service of Los Angeles and Long Beach ports shows container ship congestion is worsening. This comes as U.S. importers are ordering products from Asia ahead of the holiday season.

In three recent notes, “Vessel Congestion At LA Ports Soars As More Ships Join Queue” and “U.S. West Coast Port Congestion At Record High Amid Transpacific Trade Route Disruptions” and “California Congestion Nears New High, East Coast Gridlock Worsens,” we highlight the latest build-up of vessels, now reaches new heights.

Figures from last week showed 44 container ships were moored at a berth space outside Los Angeles and Long Beach ports, surpassing the record of 40 set in early February. Average wait times are on the rise, from 6.2 in mid-August to 7.6 days earlier this month.

Data from the Global Port Tracker report produced by Hackett Associates for the National Retail Federation showed that U.S. ports handled 2.37 million imported containers in August, the most on record, dating back to 2002 when records began.

The National Retail Federation expects 25.9 million containers will enter the U.S. in 2021, surpassing 2020’s record-setting 22 million.

And it’s not just bottlenecks at ports that are disrupting the global supply chain, Bob Biesterfield, chief executive of C.H. Robinson Worldwide Inc., one of the largest freight brokers in the U.S., warned of a labor shortage of port workers, truck drivers, and warehouse workers that are adding to shipping delays.

Biesterfield believes that global supply chain issues aren’t going to be “fixed in the next four to five months in accordance with the Lunar New Year.”

There’s also a global shipping container shortage that Goldman Sachs continues to warn about which has pressured shipping costs higher.

Sam Ruda, port director at the Port Authority of New York and New Jersey, warned that congestion at U.S. ports might end when the pandemic diminishes. However, Dr. Anthony Fauci and peers at the FDA and CDC (most notably CDC Director Dr. Rochelle Walensky) have recently warned about a new mu variant which may indicate that virus continues to evolve.

It appears ocean freight won’t normalize anytime soon – maybe not until the end of 2022.

But-but-but supply chains disruptions pushing inflation higher were only supposed to be “transitory” – the Federal Reserve continues to lose whatever credibility it has left.

September 7, 2021

Top US Port Head Warns Shipping Logjams To Continue Through “Summer 2022”

by Tyler DurdenTuesday, Sep 07, 2021 – 10:50 AM

Containerized shipping has become the ugly story of the chaotic supply chain facing U.S. importers and Chinese exporters. Hopes are quickly fading that trans-pacific supply chains will normalize this year or even in 2022.

According to the Wall Street Journal’s Paul Berger, who spoke with industry experts, trans-pacific supply chains will remain swamped through at least the summer of 2022.

Port leaders, such as Mario Cordero, executive director at the Port of Long Beach, California, warned:

“I don’t see substantial mitigation with regard to the congestion that the major container ports are experiencing,” Cordero said. “Many people believe it’s going to continue through the summer of 2022.”

The latest data from Marine Exchange of Southern California & Vessel Traffic Service of Los Angeles and Long Beach ports shows container ship congestion is worsening. This comes as U.S. importers are ordering products from Asia ahead of the holiday season.

In three recent notes, “Vessel Congestion At LA Ports Soars As More Ships Join Queue” and “U.S. West Coast Port Congestion At Record High Amid Transpacific Trade Route Disruptions” and “California Congestion Nears New High, East Coast Gridlock Worsens,” we highlight the latest build-up of vessels, now reaches new heights.

Figures from last week showed 44 container ships were moored at a berth space outside Los Angeles and Long Beach ports, surpassing the record of 40 set in early February. Average wait times are on the rise, from 6.2 in mid-August to 7.6 days earlier this month.

Data from the Global Port Tracker report produced by Hackett Associates for the National Retail Federation showed that U.S. ports handled 2.37 million imported containers in August, the most on record, dating back to 2002 when records began.

The National Retail Federation expects 25.9 million containers will enter the U.S. in 2021, surpassing 2020’s record-setting 22 million.

And it’s not just bottlenecks at ports that are disrupting the global supply chain, Bob Biesterfield, chief executive of C.H. Robinson Worldwide Inc., one of the largest freight brokers in the U.S., warned of a labor shortage of port workers, truck drivers, and warehouse workers that are adding to shipping delays.

Biesterfield believes that global supply chain issues aren’t going to be “fixed in the next four to five months in accordance with the Lunar New Year.”

There’s also a global shipping container shortage that Goldman Sachs continues to warn about which has pressured shipping costs higher.

Sam Ruda, port director at the Port Authority of New York and New Jersey, warned that congestion at U.S. ports might end when the pandemic diminishes. However, Dr. Anthony Fauci and peers at the FDA and CDC (most notably CDC Director Dr. Rochelle Walensky) have recently warned about a new mu variant which may indicate that virus continues to evolve.

It appears ocean freight won’t normalize anytime soon – maybe not until the end of 2022.

But-but-but supply chains disruptions pushing inflation higher were only supposed to be “transitory” – the Federal Reserve continues to lose whatever credibility it has left.

September 7, 2021

08/31/2021 – PRESS RELEASE

Arkema acquires Ashland’s performance adhesives

An agreement was signed today for the acquisition of Ashland’s Performance Adhesives business, a first-class leader in high performance adhesives for industrial applications in the United States with a unique and innovative product portfolio. This project is perfectly aligned with the Group’s ambition to become a pure Specialty Materials player by 2024.

- An agreement was signed today for the acquisition of Ashland’s Performance Adhesives business, a first-class leader in high performance adhesives for industrial applications in the United States with a unique and innovative product portfolio

- This project perfectly aligns with the Group’s ambition to become a pure Specialty Materials player by 2024 and focus its development on sustainable and high performance solutions

- This key step supports Bostik’s strong long term growth ambition and now allows it to aim for an EBITDA margin above 17% in 2024

- Sales of approximately US$360 million (1) in 2021 with an EBITDA margin above 25% (1) and 330 employees.

- The offer was made on the basis of a US$ 1,650 million enterprise value, i.e. 15x the estimated 2021 EBITDA (1) after taking into account the tax benefits linked to the structure of the transaction

- Significant pre-tax synergies, estimated at 12.5% of sales, enabling to reduce the EV/EBITDA multiple to 8.7 by 2026

- Strongly value-creative deal for Arkema’s shareholders, with an accretive impact on net earnings per share in the first year, and a €1 per share accretion by 2026

“We are very happy and proud of this move. In a context of strong earnings growth following the recent divestment of PMMA and the start of the strategic review of Fluorogases, the acquisition of Ashland’s adhesives business is a fantastic opportunity to reinforce the Group’s presence in the US and to accelerate Bostik’s growth.

With an excellent business which holds leading positions in many high-growth segments and a high level of profitability, this project fully aligns with the Group’s targeted acquisition strategy. Ashland’s adhesives will constitute a new technological platform for our adhesives and the synergies are particularly high given the geographical and application complementarities with Bostik and our Coating Solutions platform.

The cultures of the teams are very close, focused on customer centricity and sustainable innovation. We look forward to welcoming Ashland’s high-caliber management team and to partner together for this highly value creative deal.”, stated Thierry Le Hénaff, the Group’s Chairman and Chief Executive Officer.

A major step in Bostik’s strong long term growth ambition

With estimated sales of around US$ 360 million (1) and an estimated EBITDA at a very high level of around US$95 million (1) in 2021, Ashland offers a portfolio of high performance adhesive solutions in high-value-added industrial applications.

With its large range of key technologies and well-known brands, Ashland Performance Adhesives is a key player in pressure-sensitive adhesives in the United States, operating in high-growth applications, in particular in decorative, protection, and signage films for automotive and buildings. Combined with Bostik’s and the Coating Solutions segment’s sustainable and high performance solutions, its range will represent one of the most complete offering in the pressure sensitive adhesives sector.

Ashland also holds significant positions in structural adhesives in the United States, in particular in segments such as wood bonding for construction, composites and transportation. This will allow Bostik to complement its positions and to benefit from fast-growing demand driven by major sustainable trends.

Ashland also holds significant positions in structural adhesives in the United States, in particular in segments such as wood bonding for construction, composites and transportation. This will allow Bostik to complement its positions and to benefit from fast-growing demand driven by major sustainable trends.

Finally, Ashland Performance Adhesives offers a wide range of adhesives for flexible packaging, addressing growing demand for more sustainable products. Thanks to Ashland’s positioning in North America, Bostik will complete its geographic presence in flexible lamination, becoming one of the world’s key players in this sector.

Ashland’s Performance Adhesives business, which employs approximately 330 people and operates 6 production plants, mainly in North America, has enjoyed sustained growth in recent years and has significant growth potential in Europe and Asia. Combined with Arkema’s global positioning, the excellent technological, geographic and commercial complementarities of this acquisition will enable Bostik to expand its offering and position itself as a major player in high performance industrial adhesives.

This acquisition also allows to upgrade the 2024 profitability target for Arkema’s Adhesive Solutions segment, which now aims for an EBITDA margin above 17%, among the very best in the industry, with sales of over €3 billion.

(1) Including pro forma adjustments

A strongly value-creative project, perfectly in line with Arkema’s 2024 ambition

This project offers significant pre-tax synergies estimated at over US$ 45 million, which will be progressively implemented over the next 5 years. They will focus on the commercial development of globalized solutions in high-growth segments, procurement synergies through our acrylics business and industrial optimizations.

Given these synergies and the anticipated growth over the next few years, the enterprise value/EBITDA multiple will be reduced to 8.7 times in 2026 after taking account of the tax benefits linked to the structure of the transaction, which are estimated at more than US$200 million.

This deal will be financed fully in cash, and the level of net debt including hybrid bonds on closing will remain tightly controlled at 1.9x the 2021 pro forma EBITDA (2), in line with the Group’s objective to maintain this ratio below 2.

Furthermore, this business represents a high EBITDA-to-cash conversion rate, above the Group’s long-term targets, given the tight control of working capital and limited capital intensity.

Within the first year of integration this deal will have an accretive impact on net earnings per share and the accretive impact will reach €1 per share by 2026.

This proposed acquisition is fully in line with the Group’s strategy and ambition to become a pure Specialty Materials player by 2024 generating sales of at least €10 billion with an EBITDA margin of around 17% and improved resilience. It is a major step in strengthening Arkema’s Adhesive Solutions segment.

The project is subject to the approval of the antitrust authorities in the countries concerned. Relevant legal information and consultation process involving employee representative bodies will be performed before closing.

(2) Estimated 2021 Group EBITDA integrating the full year impact of M&A operations already announced in 2021