The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

August 18, 2021

Covestro AG (CVVTF) CEO Markus Steilemann on Q2 2021 Results – Earnings Call Transcript

Aug. 08, 2021 11:20 AM ETCovestro AG (CVVTF), COVTY1 Like

Covestro AG (OTCPK:CVVTF) Q2 2021 Earnings Conference Call August 6, 2021 9:00 AM ET

Company Participants

Ronald Köhler – Investor Relations

Markus Steilemann – Chief Executive Officer

Thomas Toepfer – Chief Financial Officer

Markus Steilemann

Thank you, Ronald, and a very warm welcome to everyone on the phone from my side. Good day and good morning. The second quarter 2021 performance was well above previous year. Like in the first quarter, the prior year impacted by the coronavirus pandemic, hence we have a low basis for comparison.

The trend of a dynamic demand recovery and increasing product margins that started in 2020 in the second half is however continuing. We see strong earnings momentum to this day and well into the third quarter. In total the second quarter core volumes were 35% above previous year. The EBITDA of €817 million is in line with the second quarter guidance of €730 to €870 million and as pre-announced on July the 12th. We also have seen a very strong free operating cash flow of €374 million. After closing of the RFM acquisition on April 1, this business is now fully consolidated for the first time in Covestro numbers. We also further raised our earnings guidance for full-year 2021 as announced on July 12th.

With that we turn to the next page. The core volumes increased strongly against an exceptionally weak prior year, with peak of pandemic’s impact in Europe, North America, and parts of Asia. While demand rebound continued dynamically, the current quarter’s growth potential was limited by constrained product availability.

Let’s take a look at volume development by regions. On low comparable figures, strong volume rebound of 48% year on year in Europe. The actual volume growth was limited by constrained polyols availability. We see a similar picture in North America. Strong underlying demand growth of almost 38% year on year. The actual volume growth was also here limited by the constrained feedstock supply. The volume rebound in Asia Pacific came in at 22% year on year. In China, as you might remember, the first quarter 2020 had been a pandemic-related trough and the second quarter 2020 had already seen a demand recovery.

Now, let’s take a view on the volumes by an industry perspective. The ranking is by kilotons sold to specific industries. So we start with furniture, which was up 20% year-on-year driven by demand in Europe and North America. Construction was up 13% year on year globally driven by good demand in Europe as well as Asia Pacific, while North America growth was limited by supply constraints of MDI and polyols. In the automotive and transportation sector, we saw strong demand growth in all regions, plus 88% year on year.

Divers industries, here we also saw a strong increase of 55% year on year as the total RFM volumes have been allocated for first consolidation. Underlying volumes here grew at 14% year on year.

Let’s now turn on the next page and look at the first segment polyurethanes. The core volume growth of 27.8% year on year was driven by dynamic rebound of demand from all key customer industries compared to a week prior year. Based on preliminary industry data, MDI, as well as TDI industry demand, grew strongly, double-digit rates in Q1 and Q2 versus prior year and single-digit rates above pre-pandemic levels of 2019. Of all Covestro segments, however, PUR was most burdened by constrained product availability, mainly in the United States and Europe. Limited feedstock supply remained a key constraint for us to produce sufficient products to meet very strong underlying customer demand.

In the U.S. we meanwhile lifted force majeure for polyols on June 1, for TDI on July 1 as well as for some MDI grades on July 14. For MDI in Europe we declared force majeure on July 2 due to an unforeseen production issue beyond our control in Brunsbuttel, Germany. This is expected to last several weeks and to burden group core volume growth by several percentage points in the third quarter. Compared to prior year, EBITDA increased mainly due to a strong positive pricing delta in all three product groups. EBITDA margins of 24.6% are still well below historic peaks of 32.7%, which happened in the first quarter of 2018.

Christian Faitz

Yes. Thank you very much. Good afternoon, Markus, Thomas, Ronald, and everybody else on the call. Congrats on the results. Two questions from my side as a start. First of all, can you please share with us some more details on the Brunsbuttel force majeure? When could you envisage a restart there? And then second question, assuming that your cash flow generation continues as envisaged for the year and even beyond, can you remind us on your priorities on your uses of cash? In that context, what is your current thinking around the MDI plant in the U.S.? Thank you.

Thomas Toepfer

Now on your question on MDI, also nothing new to report. We will take a decision on that as we always said in the second half of the year. We’re currently in the second half, so you should expect the decision to be taken rather towards the end of this year, and we will then decide if and when to continue the MDI-500 investment. So I think that would be my comments on the use of cash, Christian. And then maybe over to Markus for the Brunsbuttel question.

Markus Steilemann

Yes. Christian, this is Markus. Good to hear you. So on Brunsbuttel, the restart actually has just happened. However, we have to realize that volumes will stay constrained simply due to the low inventory levels and also additionally planned and required maintenance shutdowns in August. Therefore, the loss of volumes will continue for some time compared to normal operations and will burden our Q3 in terms of volume growth compared to previous year’s level. Again, a very strong comparison basis by several percentage points on a group level. However, all in all, let’s say, all these developments have been somewhat baked into the full-year guidance.

Daniel Chung

Thanks. Hi Markus, Thomas, Ronald. Just a couple from my end. And the first is, it’d be great to get your views on what you’re seeing at your customers in terms of their inventory levels, and maybe you can touch on your assumptions on whether we’re expecting potentially a big phase of customer restocking into the end of the year or maybe this might roll into the next. And then secondly, could you comment or even quantify the type of lead times your customers are experiencing and how that’s developed and maybe you can translate that to your order books going into this coming quarter? Thanks

Markus Steilemann

Well, Daniel thanks for the question. I would like to take the first one and maybe then Thomas takes the second one. So overall, we see since mid of last year actually this growing momentum of customer demand and also with all the developments that we have just outlined to you a couple of minutes ago. That means, yes, we see that there is customers who try to maybe order more, some customers even panicking and try to stock material. However, they simply do not get their hands on the material. So given that some customers try to do that, given that they have not made so many let’s say positive experiences or were not simply able to get their hands around material, we think that current demand patterns are really reflecting the true demand that is out there. Or to put it better, we are still not able to supply all the demand that is out there, and that is also let’s say continuing well into the third quarter as we have outlined, because that is the main driver for the current momentum, this very strong demand across all of our industries and also across regions.

So having said that, we do not see that restocking or stock building plays a major role in the current overall trading environment. Whether this will change actually towards year-end, a big question mark because at least from our perspective and from today’s perspective, as far as we can let’s say see through our order books, the demand is still strong, the supply is still subdued, and from that perspective, it is very difficult to judge what will happen towards year end. The only region where we see let’s say a little bit more normalization in terms of supply and demand is in China. And therefore, we expect that in China, let’s say this tight situation at one point in time will normalize. So I hope that helps.

And with that, I would like to hand over to Thomas.

Thomas Toepfer

Yes. Maybe, Daniel to your second question; if I got it correctly, it was about the lead times of our customers. So the lead times that we’re seeing on average across all the products is about six to eight weeks and that is also the visibility that we have in terms of our sales and EBITDA development. Now that number is pretty much unchanged or has been unchanged over the last quarters, and therefore nothing really big has changed also in terms of our visibility. The only thing that is maybe worth highlighting is the automotive industry where I think we can clearly see and say that we are sold out until the end both for Europe but also for the U.S.

Markus Steilemann

Now switching gears towards your statement around let’s say this assumed MDI-500 investment. I don’t know where actually you have caught let’s say that statement, but it’s very important to look at the MDI investment from a very general perspective, what opportunities do we have in very general terms. And that is not only related to the MDI investment. We have already opportunity to partially get access to renewable raw materials in the market. It could be used as a complete drop-in for, and when I mean complete, I mean in terms of specification, a complete drop-in for petrochemical-based raw materials. However, the availability of those raw materials is still rather limited. So we’re talking about a very, very low let’s say below 1% range that we would be able to currently actually get access to in the raw materials market. However, that availability is increasing, at least we’re expecting this availability to increase over the next years, and that would be then regardless of if we would build a new plant on MDI or we would just use it as a drop-in solution of sustainable raw materials for our existing plants, to be clear on that one.

And the second bit is, the second let’s say the different side of the same coin on renewable raw materials is renewable energy, and we need also renewable energy supply to make our overall operations more sustainable. And here we’re looking currently into each and every opportunity in different regions with the different let’s say characteristics of the respective energy supply markets. And I have to tell you it is not easy. It’s not necessarily only a matter of supply but also in terms of risk exposure and so on and so forth. So long story short, on renewable raw materials, no, it is not that. In case we would invest, and once again Thomas alluded to that, in MDI, this is not 100% based on renewable materials. And we have still the opportunity to go for new renewable materials in existing plants. However, the availability is still the limiting factor. And the second bit is we’re also looking into renewable energy for our entire operations, but that is also planned and we’re very diligently currently working on. But so far, no large update on that one.

August 18, 2021

Covestro AG (CVVTF) CEO Markus Steilemann on Q2 2021 Results – Earnings Call Transcript

Aug. 08, 2021 11:20 AM ETCovestro AG (CVVTF), COVTY1 Like

Covestro AG (OTCPK:CVVTF) Q2 2021 Earnings Conference Call August 6, 2021 9:00 AM ET

Company Participants

Ronald Köhler – Investor Relations

Markus Steilemann – Chief Executive Officer

Thomas Toepfer – Chief Financial Officer

Markus Steilemann

Thank you, Ronald, and a very warm welcome to everyone on the phone from my side. Good day and good morning. The second quarter 2021 performance was well above previous year. Like in the first quarter, the prior year impacted by the coronavirus pandemic, hence we have a low basis for comparison.

The trend of a dynamic demand recovery and increasing product margins that started in 2020 in the second half is however continuing. We see strong earnings momentum to this day and well into the third quarter. In total the second quarter core volumes were 35% above previous year. The EBITDA of €817 million is in line with the second quarter guidance of €730 to €870 million and as pre-announced on July the 12th. We also have seen a very strong free operating cash flow of €374 million. After closing of the RFM acquisition on April 1, this business is now fully consolidated for the first time in Covestro numbers. We also further raised our earnings guidance for full-year 2021 as announced on July 12th.

With that we turn to the next page. The core volumes increased strongly against an exceptionally weak prior year, with peak of pandemic’s impact in Europe, North America, and parts of Asia. While demand rebound continued dynamically, the current quarter’s growth potential was limited by constrained product availability.

Let’s take a look at volume development by regions. On low comparable figures, strong volume rebound of 48% year on year in Europe. The actual volume growth was limited by constrained polyols availability. We see a similar picture in North America. Strong underlying demand growth of almost 38% year on year. The actual volume growth was also here limited by the constrained feedstock supply. The volume rebound in Asia Pacific came in at 22% year on year. In China, as you might remember, the first quarter 2020 had been a pandemic-related trough and the second quarter 2020 had already seen a demand recovery.

Now, let’s take a view on the volumes by an industry perspective. The ranking is by kilotons sold to specific industries. So we start with furniture, which was up 20% year-on-year driven by demand in Europe and North America. Construction was up 13% year on year globally driven by good demand in Europe as well as Asia Pacific, while North America growth was limited by supply constraints of MDI and polyols. In the automotive and transportation sector, we saw strong demand growth in all regions, plus 88% year on year.

Divers industries, here we also saw a strong increase of 55% year on year as the total RFM volumes have been allocated for first consolidation. Underlying volumes here grew at 14% year on year.

Let’s now turn on the next page and look at the first segment polyurethanes. The core volume growth of 27.8% year on year was driven by dynamic rebound of demand from all key customer industries compared to a week prior year. Based on preliminary industry data, MDI, as well as TDI industry demand, grew strongly, double-digit rates in Q1 and Q2 versus prior year and single-digit rates above pre-pandemic levels of 2019. Of all Covestro segments, however, PUR was most burdened by constrained product availability, mainly in the United States and Europe. Limited feedstock supply remained a key constraint for us to produce sufficient products to meet very strong underlying customer demand.

In the U.S. we meanwhile lifted force majeure for polyols on June 1, for TDI on July 1 as well as for some MDI grades on July 14. For MDI in Europe we declared force majeure on July 2 due to an unforeseen production issue beyond our control in Brunsbuttel, Germany. This is expected to last several weeks and to burden group core volume growth by several percentage points in the third quarter. Compared to prior year, EBITDA increased mainly due to a strong positive pricing delta in all three product groups. EBITDA margins of 24.6% are still well below historic peaks of 32.7%, which happened in the first quarter of 2018.

Christian Faitz

Yes. Thank you very much. Good afternoon, Markus, Thomas, Ronald, and everybody else on the call. Congrats on the results. Two questions from my side as a start. First of all, can you please share with us some more details on the Brunsbuttel force majeure? When could you envisage a restart there? And then second question, assuming that your cash flow generation continues as envisaged for the year and even beyond, can you remind us on your priorities on your uses of cash? In that context, what is your current thinking around the MDI plant in the U.S.? Thank you.

Thomas Toepfer

Now on your question on MDI, also nothing new to report. We will take a decision on that as we always said in the second half of the year. We’re currently in the second half, so you should expect the decision to be taken rather towards the end of this year, and we will then decide if and when to continue the MDI-500 investment. So I think that would be my comments on the use of cash, Christian. And then maybe over to Markus for the Brunsbuttel question.

Markus Steilemann

Yes. Christian, this is Markus. Good to hear you. So on Brunsbuttel, the restart actually has just happened. However, we have to realize that volumes will stay constrained simply due to the low inventory levels and also additionally planned and required maintenance shutdowns in August. Therefore, the loss of volumes will continue for some time compared to normal operations and will burden our Q3 in terms of volume growth compared to previous year’s level. Again, a very strong comparison basis by several percentage points on a group level. However, all in all, let’s say, all these developments have been somewhat baked into the full-year guidance.

Daniel Chung

Thanks. Hi Markus, Thomas, Ronald. Just a couple from my end. And the first is, it’d be great to get your views on what you’re seeing at your customers in terms of their inventory levels, and maybe you can touch on your assumptions on whether we’re expecting potentially a big phase of customer restocking into the end of the year or maybe this might roll into the next. And then secondly, could you comment or even quantify the type of lead times your customers are experiencing and how that’s developed and maybe you can translate that to your order books going into this coming quarter? Thanks

Markus Steilemann

Well, Daniel thanks for the question. I would like to take the first one and maybe then Thomas takes the second one. So overall, we see since mid of last year actually this growing momentum of customer demand and also with all the developments that we have just outlined to you a couple of minutes ago. That means, yes, we see that there is customers who try to maybe order more, some customers even panicking and try to stock material. However, they simply do not get their hands on the material. So given that some customers try to do that, given that they have not made so many let’s say positive experiences or were not simply able to get their hands around material, we think that current demand patterns are really reflecting the true demand that is out there. Or to put it better, we are still not able to supply all the demand that is out there, and that is also let’s say continuing well into the third quarter as we have outlined, because that is the main driver for the current momentum, this very strong demand across all of our industries and also across regions.

So having said that, we do not see that restocking or stock building plays a major role in the current overall trading environment. Whether this will change actually towards year-end, a big question mark because at least from our perspective and from today’s perspective, as far as we can let’s say see through our order books, the demand is still strong, the supply is still subdued, and from that perspective, it is very difficult to judge what will happen towards year end. The only region where we see let’s say a little bit more normalization in terms of supply and demand is in China. And therefore, we expect that in China, let’s say this tight situation at one point in time will normalize. So I hope that helps.

And with that, I would like to hand over to Thomas.

Thomas Toepfer

Yes. Maybe, Daniel to your second question; if I got it correctly, it was about the lead times of our customers. So the lead times that we’re seeing on average across all the products is about six to eight weeks and that is also the visibility that we have in terms of our sales and EBITDA development. Now that number is pretty much unchanged or has been unchanged over the last quarters, and therefore nothing really big has changed also in terms of our visibility. The only thing that is maybe worth highlighting is the automotive industry where I think we can clearly see and say that we are sold out until the end both for Europe but also for the U.S.

Markus Steilemann

Now switching gears towards your statement around let’s say this assumed MDI-500 investment. I don’t know where actually you have caught let’s say that statement, but it’s very important to look at the MDI investment from a very general perspective, what opportunities do we have in very general terms. And that is not only related to the MDI investment. We have already opportunity to partially get access to renewable raw materials in the market. It could be used as a complete drop-in for, and when I mean complete, I mean in terms of specification, a complete drop-in for petrochemical-based raw materials. However, the availability of those raw materials is still rather limited. So we’re talking about a very, very low let’s say below 1% range that we would be able to currently actually get access to in the raw materials market. However, that availability is increasing, at least we’re expecting this availability to increase over the next years, and that would be then regardless of if we would build a new plant on MDI or we would just use it as a drop-in solution of sustainable raw materials for our existing plants, to be clear on that one.

And the second bit is, the second let’s say the different side of the same coin on renewable raw materials is renewable energy, and we need also renewable energy supply to make our overall operations more sustainable. And here we’re looking currently into each and every opportunity in different regions with the different let’s say characteristics of the respective energy supply markets. And I have to tell you it is not easy. It’s not necessarily only a matter of supply but also in terms of risk exposure and so on and so forth. So long story short, on renewable raw materials, no, it is not that. In case we would invest, and once again Thomas alluded to that, in MDI, this is not 100% based on renewable materials. And we have still the opportunity to go for new renewable materials in existing plants. However, the availability is still the limiting factor. And the second bit is we’re also looking into renewable energy for our entire operations, but that is also planned and we’re very diligently currently working on. But so far, no large update on that one.

August 17, 2021

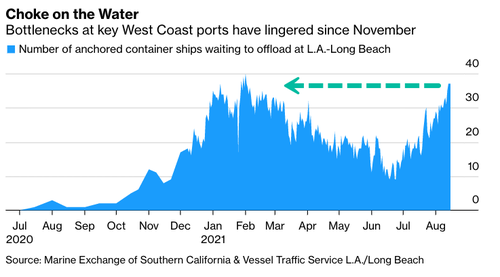

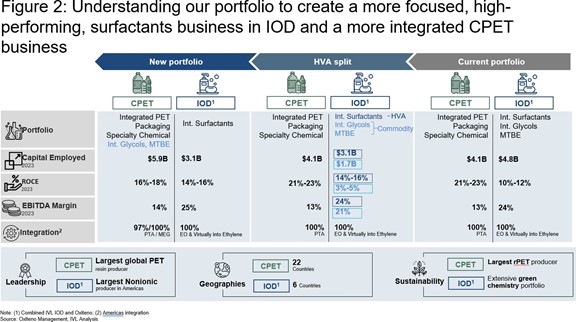

Vessel Congestion At LA Ports Soars As More Ships Join Queue

by Tyler DurdenTuesday, Aug 17, 2021 – 05:45 AM

Vessel congestion outside the busiest US gateway for trade with Asia is clogged with the most inbound container vessels in nearly six months.

Bloomberg data shows the number of containerships queuing off the coast of Los Angeles has reached 37 on Sunday evening, that’s three less than the all-time-high observed on Feb. 1.

On Sunday, the average waits for berth space, a designated location in a port used for mooring vessels when vessels are not at sea, was 6.2 days, compared with 5.7 in late June. That number topped eight days in April.

Readers may recall the collapse of the trans-pacific supply chains has been among the main reasons for soaring consumer goods prices. It’s also hardly a secret that the most vulnerable section of supply chains are West Coast ports where congestion remains off the charts.

The transpacific trade routes have experienced significant port delays in China in recent weeks because COVID outbreaks are shutting down terminals.

We’ve discussed the latest meltdown down of the trans-pacific supply chains in “Supply-Chains Brace For Collapse: Port Of LA Fears Repeat Of “Shipping Nightmare” As China Locks Down” and “Shippers Frantic After China’s Busiest Port Shuts Container Terminal Due To Covid.”

Goldman Sachs has explicitly warned that “port closures or stricter control measures at ports could also put further upward pressure on shipping costs, which are already very high.”

But as new data suggest, shipping congestion at the ports of Los Angeles and Long Beach is worsening and could even surpass levels seen earlier this year. The timing of this bottleneck is ahead of back-to-school and the holiday season when importers ramp up shipments of goods from Asia.

https://www.zerohedge.com/markets/vessel-congestion-la-ports-soars-more-ships-join-queue

August 17, 2021

Vessel Congestion At LA Ports Soars As More Ships Join Queue

by Tyler DurdenTuesday, Aug 17, 2021 – 05:45 AM

Vessel congestion outside the busiest US gateway for trade with Asia is clogged with the most inbound container vessels in nearly six months.

Bloomberg data shows the number of containerships queuing off the coast of Los Angeles has reached 37 on Sunday evening, that’s three less than the all-time-high observed on Feb. 1.

On Sunday, the average waits for berth space, a designated location in a port used for mooring vessels when vessels are not at sea, was 6.2 days, compared with 5.7 in late June. That number topped eight days in April.

Readers may recall the collapse of the trans-pacific supply chains has been among the main reasons for soaring consumer goods prices. It’s also hardly a secret that the most vulnerable section of supply chains are West Coast ports where congestion remains off the charts.

The transpacific trade routes have experienced significant port delays in China in recent weeks because COVID outbreaks are shutting down terminals.

We’ve discussed the latest meltdown down of the trans-pacific supply chains in “Supply-Chains Brace For Collapse: Port Of LA Fears Repeat Of “Shipping Nightmare” As China Locks Down” and “Shippers Frantic After China’s Busiest Port Shuts Container Terminal Due To Covid.”

Goldman Sachs has explicitly warned that “port closures or stricter control measures at ports could also put further upward pressure on shipping costs, which are already very high.”

But as new data suggest, shipping congestion at the ports of Los Angeles and Long Beach is worsening and could even surpass levels seen earlier this year. The timing of this bottleneck is ahead of back-to-school and the holiday season when importers ramp up shipments of goods from Asia.

https://www.zerohedge.com/markets/vessel-congestion-la-ports-soars-more-ships-join-queue

August 16, 2021

Indorama Ventures agrees to buy Brazil-based Oxiteno to create a unique portfolio in high-value surfactants

16 August 2021

Bangkok, Thailand – 16 August 2021 – Indorama Ventures Public Company Limited (IVL), a global chemicals producer, today announced it agreed to acquire Brazil-based Oxiteno S.A. Indústria e Comércio, a subsidiary of Ultrapar Participações S.A. The acquisition gives IVL a unique portfolio in high-value surfactants and significantly extends its existing Integrated Oxides and Derivatives (IOD) business.

Oxiteno is a leading integrated surfactants producer, catering to highly attractive end-use markets in LATAM. The acquisition brings an excellent management team, world-class expertise in green chemistry innovation, strong customer relationships in Brazil, Uruguay and Mexico, and substantial growth potential in attractive end markets, including the U.S. through a new facility in Pasadena, Texas. Oxiteno has a strong commitment to environmental governance, and its focus on lowering greenhouse gas emissions will also enhance IVL’s ESG credentials.

Through the acquisition, IVL will assume a unique market position in technologies catering to niche, IP-rich and value-added applications in home & personal care, agrochemicals, coatings and oil & gas markets. The surfactants market has seen consistent growth over the last decade, driven by trends in population growth, urbanization and increasing hygiene awareness amid the Covid-19 pandemic.

With 11 manufacturing plants, customers in 4 continents, and an experienced management team, Oxiteno will complement IOD’s footprint in the U.S and Latin America, while its 5 research and technology centers will add to IVL’s innovation credentials in green chemistry. The extended footprint has potential to drive expansion in Europe and Asia by leveraging on IVOX’s surfactants business in Australia and India and IVL’s global presence in 34 countries. IVL expects to realize synergies of US$100 million by 2025 through portfolio adjustments, asset optimization and operational excellence.

IVL will purchase Oxiteno for US$1.3 billion (subject to adjustments at closing), with a deferred payment of $150 million in 2024. The transaction is subject to customary conditions to closing, including approval of relevant regulatory authorities. The transaction is expected to close in Q1 2022 and will be earnings accretive immediately. Financing is secured through deferred payment, using existing extra cash on our balance sheet, free cash flow generated from existing businesses, short term loans against working capital and the balance as long-term debt.

Oxiteno and Indorama Ventures both have family-business origins and share a similar mindset, which positions people as a key business differentiator and values innovation and investments in an increasingly diversified and efficient portfolio.

Mr Aloke Lohia, IVL Group CEO, said, “This acquisition is a natural fit for us. We have a solid track record of continuously driving value for shareholders through successfully integrating 50 acquisitions over the past 20 years. With Oxiteno, we are creating a global leader in surfactants. By bringing our companies together, we are strengthening our customer value proposition, our market reach, and our experienced team. Like us, Oxiteno grew as a family enterprise with an entrepreneurial mindset. The combination of our teams is unmatched in our industry, and we look forward welcoming them to our family.”

Frederico Curado, CEO of Ultra Group, said, “It is important to ensure that Oxiteno will benefit from integrating the new majority shareholder into the business, which is strategically positioned to lead the company through its growth path.”

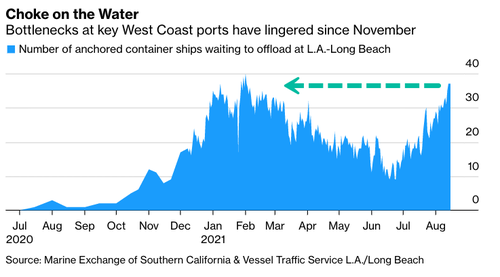

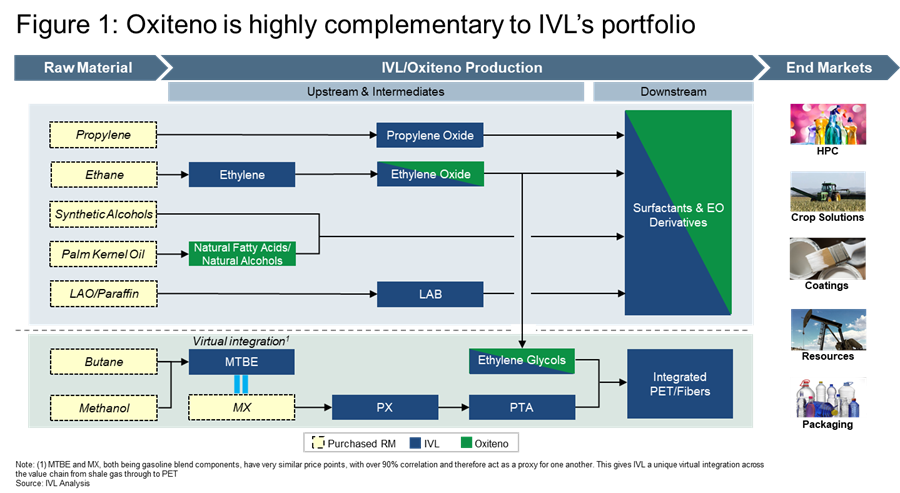

Oxiteno’s HVA growth portfolio complements IVL’s existing IOD business

Oxiteno’s innovation-led HVA offering is a significant complement to IVL’s growth platform (Figure 1), and a key driver of IVL’s EBITDA projection over the next two years, which is 15% above the company’s forecast in January 2021. Together with IVL’s world-class assets, which were acquired from U.S.-based Huntsman in 2020 (Spindletop transaction), the acquisition of Oxiteno will lead IVL’s newest IOD business segment as a major high-margin growth driver alongside its traditional PET commodities business, creating a stronger and more resilient hybrid platform.

The linkages between IOD, Oxiteno’s high-performing surfactants, and the Combined PET businesses through their crude oil, shale and oleo feedstocks gives IVL integration benefits across the value chain, which is key to the company’s sustainable business model as the world’s largest producer of PET resin and a large geographic footprint in non-ionic surfactants in the Americas (Figure 2).

Oxiteno’s green chemistry innovation credentials also strengthen IVL’s ambitious sustainability objectives as a leader in PET circularity and bio-ingredients. Brazil is home to the largest inventory of ethanol, used to produce bio-ethylene to enhance EOD and PET sustainability. Today, IVL is the largest producer of resin used in recycled PET bottles and aims to recycle a minimum of 750,000 metric tons of PET globally by 2025, investing up to US$1.5 billion to achieve this goal.

Mr D K Agarwal, Chief Executive Officer of Combined PET, IOD and Fibers Business, said, “The combination of Oxiteno and IVL’s existing Integrated Oxides & Derivatives business is highly complementary. It gives us a presence in the high-growth Latin American markets, and we also become a more reliable supplier to our global customers, especially in Europe and the US. It will drive sustainable long-term value creation by accelerating our expansion in downstream chemicals, increasing our exposure to high-quality markets, and adding to our R&D and sustainability credentials. The portfolio will accelerate revenue and EBITDA growth, and deliver cost synergies.”

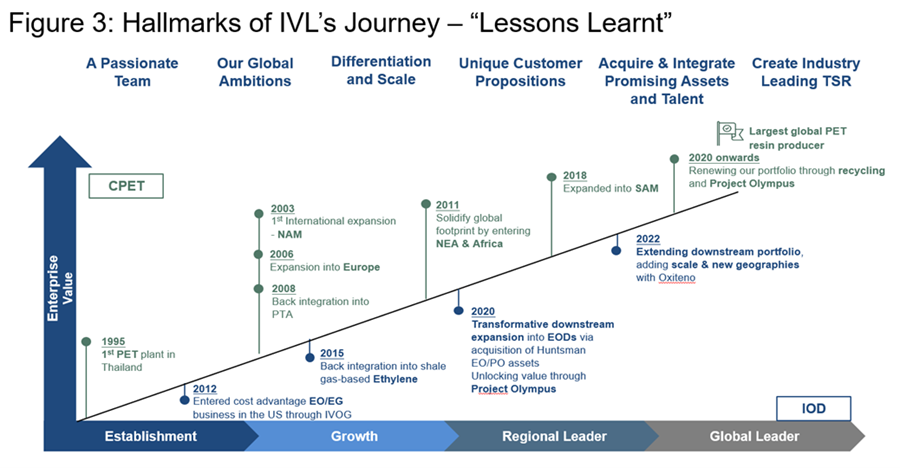

Driving enterprise growth through a proven strategy

IVL has built a strong global platform based on some 50 successful acquisitions over 20 years, and is embarking on a program of continuous improvement through its 5 strategic priorities of costs transformation, asset optimization, adjacency growth, circularity, and organization excellence. These include significant investments in transformation, savings, and efficiency projects, which are driving expansion in IOD, strengthening its Fibers business segment, and enhancing value in its traditional Combined PET segment.

Mr Aloke Lohia, IVL Group CEO, added, “Since 2014 I have been very clear about our strategy of making big bets on HVA and innovation-led products that help us build global leadership positions. From our first PET plant in 1995, we have grown to our current global leadership position through a sound track record of acquiring and integrating new assets and teams that give us scale and differentiate us in the marketplace. This, and our focus on sustainable and circular models, our transformation and efficiency programs, and our ability to grow organically and from acquisitions, will continue to drive enterprise value.” (Figure 3)