The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

April 12, 2021

Eager furniture buyers face long delays because of supply chain issues, shortage of chemical used to make cushion foam

Updated 5:30 AM; Today 5:30 AM

By Cameron Fields, cleveland.com

CLEVELAND, Ohio — The winter storms and power outages that hit Texas and Louisiana happened about two months ago. But their economic impact, particularly for the furniture industry, is still being felt greatly around the country, including in Northeast Ohio.

Texas and Louisiana house the plants that produce toluene diisocyanate (TDI), one of two main chemicals used to make furniture foam.

Because of the storms’ impact, those plants had to shut down their manufacturing process for several weeks, said John Ferrato, president of Wayside Furniture in Akron. The backup in producing TDI is one of the reasons customers have had 3-6 month wait times for furniture to arrive in store showrooms.

Furniture stores in Northeast Ohio have been managing increased demand since last May, when they re-opened after the state-ordered COVID-19 business shutdown.

“People because they couldn’t travel, they couldn’t go out to restaurants, so they’re spending their money on anything to do with the home,” Ferrato said. “So you have huge increases in demand, but then you have a decrease in production capacity, it’s a perfect storm for the whole industry.”

Furniture industry veterans Mike Dewey and Larry Weisman, who own Dewey Furniture in Vermilion and Sheraton Furniture in Willoughby, respectively, have never seen demand for furniture at this level.

A third-generation furniture retailer, Dewey has owned his store for 30 years, and he hopes people continue to put money into their homes after the pandemic. Weisman’s family started the business 60 years ago, and he’s been there 40 years.

“This has been outrageous,” Weisman said. “I mean thank God, it’s been fantastic, but never seen anything close to this.”

As a steady volume of customers purchase furniture, Ferrato and other store leaders have had to make sure they’re transparent with folks about wait times. Ferrato said 3-6 month waits are the most common, but some factories are quoting 8-9 month wait times for product.

These longer wait times, though, are for furniture that is coming on special order, meaning it’s something different than what Ferrato has in stock. Ferrato said if someone came to his store, probably about 80% of what’s on his floor could be picked up that same day or be delivered in a week.

“It’s just that if you see it, and if it’s in blue and you want it in brown, instead of our normal six to 10 weeks, we’re telling you three to six months,” Ferrato said.

At Fish Furniture, 95% of its business consists of products coming on special order, said owner Dan Geller. Geller said most customers know that unless they’re buying a floor sample, they’ll have to wait. Fish Furniture has offered customers loaner furniture to use until their pieces come in.

“Consumers, you can get what you want, and there’s plenty of merchants in Cleveland to do it, but you just have to realize you’re going to wait longer than normal,” Geller said.

Geller said he knows the TDI backup will be resolved within the next 3-4 months because the plants are moving from two shifts to three and will have the workers.

The TDI backup isn’t the only wrinkle in the tangled supply chain, though. A lack of truck drivers and warehouse workers has contributed to the delays as well. Ferrato said the driver shortage had been happening for several years before COVID, but with the recent shortage in warehouse workers, that’s created a deeper problem.

“Even if you have a truck available, if you don’t have somebody in the warehouse to drive a picker to go pull the goods out of the racks and then load them on the trucks, that’s another issue,” Ferrato said.

Containers and boats to ship product from overseas are also in short supply because of the huge amount of demand. Ferrato said product could be sitting in a factory overseas for months because it can’t get onto a ship.

But then when it does get onto a ship and reaches Los Angeles ports or the East Coast, docks are overrun and boats “could literally sit out on the water for weeks on end,” Ferrato said. Some of the backup at the docks is also caused by a lack of workers there.

“You could actually look at a live video outside of Los Angeles any time you want and you’ll see up to 30 boats basically driving around the Pacific Ocean waiting to get a dock appointment because there’s just so much coming in,” Ferrato said.

Geller and other furniture owners think the current demand will continue into the next few months, around the summer or early fall when most people will likely be vaccinated and want to return to going on vacations and eating out. They’ll be spending money on other things again, and furniture sales should return to what stores typically deal with.

But the supply chain issues could cause problems for the furniture industry for an extended period of time. Geller thinks it will take another year for the supply chain to return to normal. Weisman agrees and is hoping next year things will be back to normal.

He advises that if someone wants a special order piece of furniture for Christmas, that they make the order by May.

“I think the supply chain is so burnt out that it may take months for the furniture industry to get out of this thing,” Weisman said.

April 12, 2021

Eager furniture buyers face long delays because of supply chain issues, shortage of chemical used to make cushion foam

Updated 5:30 AM; Today 5:30 AM

By Cameron Fields, cleveland.com

CLEVELAND, Ohio — The winter storms and power outages that hit Texas and Louisiana happened about two months ago. But their economic impact, particularly for the furniture industry, is still being felt greatly around the country, including in Northeast Ohio.

Texas and Louisiana house the plants that produce toluene diisocyanate (TDI), one of two main chemicals used to make furniture foam.

Because of the storms’ impact, those plants had to shut down their manufacturing process for several weeks, said John Ferrato, president of Wayside Furniture in Akron. The backup in producing TDI is one of the reasons customers have had 3-6 month wait times for furniture to arrive in store showrooms.

Furniture stores in Northeast Ohio have been managing increased demand since last May, when they re-opened after the state-ordered COVID-19 business shutdown.

“People because they couldn’t travel, they couldn’t go out to restaurants, so they’re spending their money on anything to do with the home,” Ferrato said. “So you have huge increases in demand, but then you have a decrease in production capacity, it’s a perfect storm for the whole industry.”

Furniture industry veterans Mike Dewey and Larry Weisman, who own Dewey Furniture in Vermilion and Sheraton Furniture in Willoughby, respectively, have never seen demand for furniture at this level.

A third-generation furniture retailer, Dewey has owned his store for 30 years, and he hopes people continue to put money into their homes after the pandemic. Weisman’s family started the business 60 years ago, and he’s been there 40 years.

“This has been outrageous,” Weisman said. “I mean thank God, it’s been fantastic, but never seen anything close to this.”

As a steady volume of customers purchase furniture, Ferrato and other store leaders have had to make sure they’re transparent with folks about wait times. Ferrato said 3-6 month waits are the most common, but some factories are quoting 8-9 month wait times for product.

These longer wait times, though, are for furniture that is coming on special order, meaning it’s something different than what Ferrato has in stock. Ferrato said if someone came to his store, probably about 80% of what’s on his floor could be picked up that same day or be delivered in a week.

“It’s just that if you see it, and if it’s in blue and you want it in brown, instead of our normal six to 10 weeks, we’re telling you three to six months,” Ferrato said.

At Fish Furniture, 95% of its business consists of products coming on special order, said owner Dan Geller. Geller said most customers know that unless they’re buying a floor sample, they’ll have to wait. Fish Furniture has offered customers loaner furniture to use until their pieces come in.

“Consumers, you can get what you want, and there’s plenty of merchants in Cleveland to do it, but you just have to realize you’re going to wait longer than normal,” Geller said.

Geller said he knows the TDI backup will be resolved within the next 3-4 months because the plants are moving from two shifts to three and will have the workers.

The TDI backup isn’t the only wrinkle in the tangled supply chain, though. A lack of truck drivers and warehouse workers has contributed to the delays as well. Ferrato said the driver shortage had been happening for several years before COVID, but with the recent shortage in warehouse workers, that’s created a deeper problem.

“Even if you have a truck available, if you don’t have somebody in the warehouse to drive a picker to go pull the goods out of the racks and then load them on the trucks, that’s another issue,” Ferrato said.

Containers and boats to ship product from overseas are also in short supply because of the huge amount of demand. Ferrato said product could be sitting in a factory overseas for months because it can’t get onto a ship.

But then when it does get onto a ship and reaches Los Angeles ports or the East Coast, docks are overrun and boats “could literally sit out on the water for weeks on end,” Ferrato said. Some of the backup at the docks is also caused by a lack of workers there.

“You could actually look at a live video outside of Los Angeles any time you want and you’ll see up to 30 boats basically driving around the Pacific Ocean waiting to get a dock appointment because there’s just so much coming in,” Ferrato said.

Geller and other furniture owners think the current demand will continue into the next few months, around the summer or early fall when most people will likely be vaccinated and want to return to going on vacations and eating out. They’ll be spending money on other things again, and furniture sales should return to what stores typically deal with.

But the supply chain issues could cause problems for the furniture industry for an extended period of time. Geller thinks it will take another year for the supply chain to return to normal. Weisman agrees and is hoping next year things will be back to normal.

He advises that if someone wants a special order piece of furniture for Christmas, that they make the order by May.

“I think the supply chain is so burnt out that it may take months for the furniture industry to get out of this thing,” Weisman said.

April 12, 2021

This Could Be The Hottest Summer Ever… For Freight

by Tyler DurdenSunday, Apr 11, 2021 – 03:00 PM

By Zach Strickland of FreightWaves,

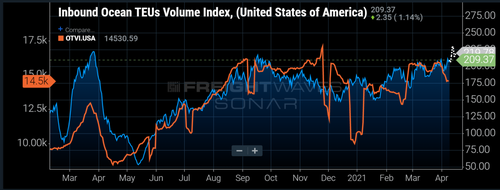

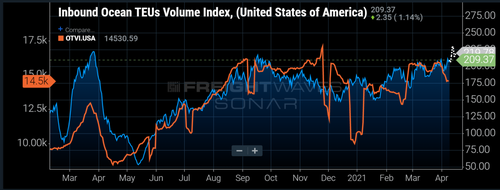

The Inbound Ocean TEU Volume Index (IOTI), which measures maritime bookings for twenty-foot equivalent units for U.S. imports, is set to hit an all-time high this week. The IOTI starts in January 2019 but covers one of the most active periods in maritime shipping thanks to the pandemic. With imports being tied more closely than ever to surface freight volumes and transportation demand, this could be a signal of an extremely active summer for domestic surface transportation providers.

Import booking activity measures freight that will hit the U.S. two to six weeks in advance and has been connected to surface transportation volumes over the past year. After a quicker-than-anticipated recovery in consumer spending on durable goods last spring, shippers found themselves low on inventory and began placing orders at a record pace last May.

Whereas the connection between truckload and import volumes has not always been this close, the urgency of the past year has closed the gap between the time the freight is on the ship to the time it moves on a truck.

With many shippers caught off guard by changing consumer behaviors, there was no budget or plan for what occurred in most of 2020. Companies have found themselves playing catch-up most of the year, and the recent surge in consumer spending thanks to a new stimulus bill and continued quarantine this winter has not helped them recover.

The IOTI shows bookings up to a week in advance, meaning it is measuring freight that is being requested to leave their ports of origin over the next seven days. The spike in bookings over the next week is on the heels of a longer-running increase that began in late January.

Bookings do not necessarily translate to freight being moved, as the maritime providers do not necessarily accept the request, similar to domestic truckload, but it is a sign that shippers are becoming increasingly active in trying to secure capacity on the water. Looking at the Van Outbound Tender Volume Index (VOTVI), there are similar moments when shippers appear to spam their providers just to increase the odds of success.

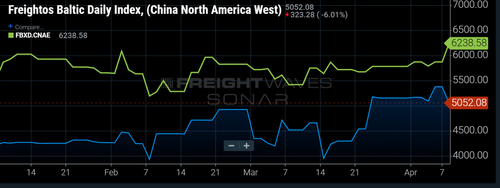

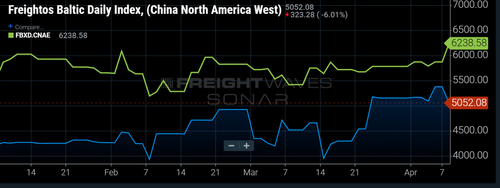

This type of activity keeps upward pressure on rates as little to no gains in total available capacity are occurring, essentially bidding up the price. The Freightos Baltic Daily Indices that measure the average spot price for shipping a forty-foot equivalent unit across the water from China to North America’s East and West coasts continue to hit all-time highs.

The East Coast rate broke $6,000 for the first time this week as shippers are booking more loads to the eastern half of the U.S., attempting to bypass the port congestion in Southern California. This is another sign that freight volumes will continue to flood the U.S. in the coming weeks. It is also a sign that shipping patterns are changing, which will potentially put more pressure on carrier networks as more freight enters in areas they are unaccustomed to servicing at volume.

The Houston and Savannah, Georgia, markets have both seen trucking volumes surge over the past month and capacity tighten to record levels — tender rejection rates hit all-time highs in both markets over the past two weeks.

Most carriers have focused on getting trucks to Southern California to take advantage of high mileage, high-paying loads that keep utilization numbers high and margins wide. Houston and Savannah tend to have lower-mileage and smaller-margin loads thanks to regional density of carriers and destinations.

There is already enough freight to keep carriers busy on the West Coast and it is very difficult to alter networks quickly. With more freight on the way, this summer may be the hottest (market) on record.

April 12, 2021

This Could Be The Hottest Summer Ever… For Freight

by Tyler DurdenSunday, Apr 11, 2021 – 03:00 PM

By Zach Strickland of FreightWaves,

The Inbound Ocean TEU Volume Index (IOTI), which measures maritime bookings for twenty-foot equivalent units for U.S. imports, is set to hit an all-time high this week. The IOTI starts in January 2019 but covers one of the most active periods in maritime shipping thanks to the pandemic. With imports being tied more closely than ever to surface freight volumes and transportation demand, this could be a signal of an extremely active summer for domestic surface transportation providers.

Import booking activity measures freight that will hit the U.S. two to six weeks in advance and has been connected to surface transportation volumes over the past year. After a quicker-than-anticipated recovery in consumer spending on durable goods last spring, shippers found themselves low on inventory and began placing orders at a record pace last May.

Whereas the connection between truckload and import volumes has not always been this close, the urgency of the past year has closed the gap between the time the freight is on the ship to the time it moves on a truck.

With many shippers caught off guard by changing consumer behaviors, there was no budget or plan for what occurred in most of 2020. Companies have found themselves playing catch-up most of the year, and the recent surge in consumer spending thanks to a new stimulus bill and continued quarantine this winter has not helped them recover.

The IOTI shows bookings up to a week in advance, meaning it is measuring freight that is being requested to leave their ports of origin over the next seven days. The spike in bookings over the next week is on the heels of a longer-running increase that began in late January.

Bookings do not necessarily translate to freight being moved, as the maritime providers do not necessarily accept the request, similar to domestic truckload, but it is a sign that shippers are becoming increasingly active in trying to secure capacity on the water. Looking at the Van Outbound Tender Volume Index (VOTVI), there are similar moments when shippers appear to spam their providers just to increase the odds of success.

This type of activity keeps upward pressure on rates as little to no gains in total available capacity are occurring, essentially bidding up the price. The Freightos Baltic Daily Indices that measure the average spot price for shipping a forty-foot equivalent unit across the water from China to North America’s East and West coasts continue to hit all-time highs.

The East Coast rate broke $6,000 for the first time this week as shippers are booking more loads to the eastern half of the U.S., attempting to bypass the port congestion in Southern California. This is another sign that freight volumes will continue to flood the U.S. in the coming weeks. It is also a sign that shipping patterns are changing, which will potentially put more pressure on carrier networks as more freight enters in areas they are unaccustomed to servicing at volume.

The Houston and Savannah, Georgia, markets have both seen trucking volumes surge over the past month and capacity tighten to record levels — tender rejection rates hit all-time highs in both markets over the past two weeks.

Most carriers have focused on getting trucks to Southern California to take advantage of high mileage, high-paying loads that keep utilization numbers high and margins wide. Houston and Savannah tend to have lower-mileage and smaller-margin loads thanks to regional density of carriers and destinations.

There is already enough freight to keep carriers busy on the West Coast and it is very difficult to alter networks quickly. With more freight on the way, this summer may be the hottest (market) on record.

April 10, 2021

Producer Prices Blow Out

by Wolf Richter • Apr 9, 2021 •

And companies have been reporting that they’re able to pass on those surging costs. So here we go with inflation.

By Wolf Richter for WOLF STREET.

Inflation that producers are experiencing is now blowing out. The surging input costs and the ability to pass on those higher input costs that have been reported by company executives as part of the services PMIs and manufacturing PMIs, and that owners of small businesses have told me about for months, have now solidly fired up the Producer Price Index for final demand, which in March jumped by 1.0% from February – double the rate that economists polled by Reuters had forecast – after having jumped 0.5% in February, and 1.3% in January. The PPI has now taken off, after hovering in fairly benign territory last year.

Compared to March last year, the PPI jumped by 4.2%, the sharpest year-over-year increase since 2011, according to the Bureau of Labor Statistics today. Note the surge over the past three months (data via YCharts):

The “Base Effect” that I discussed yesterday can be blamed for only a portion of the year-over-year increase. A big part of the base effect is going to come in April.

The PPI hit a high in January 2020 with an index value of 119.2. In February and March last year, it dropped 0.5% from the prior month, and in April it plunged 1.1% to an index value of 116.7, driven by the collapse in fuel prices. And that was it in terms of declines. It has been rising ever since (data via YCharts):

What might April look like? Today’s index value at 123.1 is already 5.5% higher than that of April last year. If the PPI rises 0.5% in April from today’s level, it would make for a 6% year-over-year increase, the highest since the index was started in November 2009. And this would include the full brunt of the base effect.

The index for prices of goods soared 1.7% in March from February, the biggest increase since the data series was started in 2009. Energy costs jumped 5.9% for the month. Within that, gasoline prices jumped 8.8%.

The index for prices of services jumped 0.7%, the third month in a row of increases. These services include wholesaling of machinery and vehicles, which soared 6.7% in March from February, confirming the giant jumps in wholesale prices for used vehicles that I reported on March 27 based on weekly auction data.

Excluding prices of foods, energy, and trade services, the index jumped 0.6% for the month and was up 3.1% year-over-year.

So here we go with inflation pressures building up in the pipeline. The producer price index measures inflation for companies – input cost increases. And these companies are now reporting in the PMIs that they’re able to pass on those price increases, ultimately to consumers.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.