The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

March 31, 2021

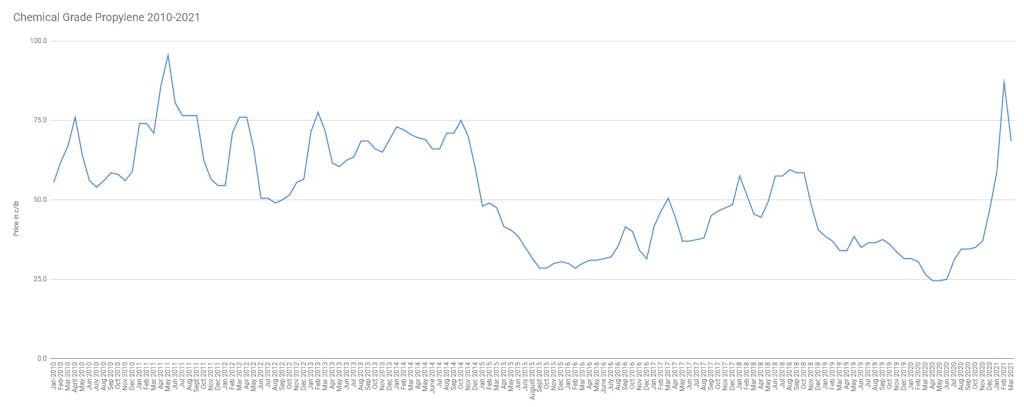

Chemical grade now at $0.685/lb . . .

March 30, 2021

March 30, 2021

Subject: Propylene Oxide & Derivatives – Force Majeure Event

Dear Valued Customer,

Per the previous letter dated February 16, 2021, Lyondell Chemical Company declared a force majeure

event for all products within our Americas Propylene Oxide & Derivatives Portfolio – Propylene Oxide,

Propylene-Glycols, Allyl Alcohol, Butanediol & Derivatives, Propylene-Series Glycol Ethers and

Propylene-Specialties Glycol Ethers, effective February 16, 2021.

In a letter dated February 25, 2021, Lyondell Chemical Company announced a sales allocation for

Propylene Glycol, effective March 1, 2021. For the foreseeable future, Lyondell Chemical Company is

updating the previously announced sales allocation for Propylene Glycol, as outlined below. Allocation

volumes have been determined based on customer’s average monthly purchases for the previous 6 months

(August 2020 – January 2021). This allocation will be effective April 1, 2021.

Product Allocation

Mono-Propylene Glycol Industrial Grade (PGI) 90%

Mono-Propylene Glycol USP/EP Grade (PG USP/EP) 90%

Di-Propylene Glycol Industrial Grade (DPGI) 100%

Di-Propylene Glycol Fragrance Grade (DPGF) 100%

Tri-Propylene Glycol (TPG) 80%

Tri-Propylene Glycol Acrylate Grade (TPGA) 80%

Please note that during the period of allocation, customers will not be permitted to borrow ahead of their

monthly amounts and unused portions of monthly amounts cannot be added to any subsequent month’s

amounts. Additionally, allocations are subject to third party carrier availability and other logistical

infrastructure limitations, including, but not limited to, railcar, tank truck, barge/vessel, terminal and port

availability, and production status of our manufacturing facilities, any of which may impact Product

availability, delivery dates, and order fulfillment. The duration of the force majeure event cannot be

determined at this time and the percentage of allocation may change as new information becomes

available.

As always, your account manager is available to address any questions or concerns you may have

regarding this force majeure event. We value the trust you place in Lyondell Chemical Company as a

supplier and we apologize for the inconvenience this may cause you.

Thank you for your understanding and patience.

March 30, 2021

March 30, 2021

Subject: Propylene Oxide & Derivatives – Force Majeure Event

Dear Valued Customer,

Per the previous letter dated February 16, 2021, Lyondell Chemical Company declared a force majeure

event for all products within our Americas Propylene Oxide & Derivatives Portfolio – Propylene Oxide,

Propylene-Glycols, Allyl Alcohol, Butanediol & Derivatives, Propylene-Series Glycol Ethers and

Propylene-Specialties Glycol Ethers, effective February 16, 2021.

In a letter dated February 25, 2021, Lyondell Chemical Company announced a sales allocation for

Propylene Glycol, effective March 1, 2021. For the foreseeable future, Lyondell Chemical Company is

updating the previously announced sales allocation for Propylene Glycol, as outlined below. Allocation

volumes have been determined based on customer’s average monthly purchases for the previous 6 months

(August 2020 – January 2021). This allocation will be effective April 1, 2021.

Product Allocation

Mono-Propylene Glycol Industrial Grade (PGI) 90%

Mono-Propylene Glycol USP/EP Grade (PG USP/EP) 90%

Di-Propylene Glycol Industrial Grade (DPGI) 100%

Di-Propylene Glycol Fragrance Grade (DPGF) 100%

Tri-Propylene Glycol (TPG) 80%

Tri-Propylene Glycol Acrylate Grade (TPGA) 80%

Please note that during the period of allocation, customers will not be permitted to borrow ahead of their

monthly amounts and unused portions of monthly amounts cannot be added to any subsequent month’s

amounts. Additionally, allocations are subject to third party carrier availability and other logistical

infrastructure limitations, including, but not limited to, railcar, tank truck, barge/vessel, terminal and port

availability, and production status of our manufacturing facilities, any of which may impact Product

availability, delivery dates, and order fulfillment. The duration of the force majeure event cannot be

determined at this time and the percentage of allocation may change as new information becomes

available.

As always, your account manager is available to address any questions or concerns you may have

regarding this force majeure event. We value the trust you place in Lyondell Chemical Company as a

supplier and we apologize for the inconvenience this may cause you.

Thank you for your understanding and patience.

March 29, 2021

Sadara agrees with lenders to reprofile its debt

Ajel News 3 hrs ago

Sadara Chemical Company (Sadara) has signed an agreement with agency creditors and commercial lenders to restructure Sadara’s debt. The restructured debt repayment has been better aligned to match Sadara’s expected future cash flow generation. This agreement became effective March 25, 2021.

Key provisions of the agreement include a debt maturity extension from 2029 to 2038; a principal grace period through 2026, and new guarantees issued by the Sadara’s sponsors; Saudi Arabian Oil Company’s (Saudi Aramco); and The Dow Chemical Company’s (Dow).

Global manufacturing cost curve

Following the successful reprofiling, Sadara will also benefit from longer-term structural operating and feedstock improvements; further enhancing its cracker’s flexibility and improving Sadara’s position on the global manufacturing cost curve.

Sadara has also received the agreement of its shareholders — Saudi Aramco and Dow — to start the transition of the marketing rights of Sadara’s finished products to levels more consistent with each partner’s equity ownership.

This transition is part of the partnership’s original plan and will gradually increase over the next five years.

The acceleration of the marketing rights of Saudi Aramco will be taken over by the Saudi Basic Industries Corporation (SABIC). All parties agreed on this and these rights will relate to several specific products; which include a range of polyethylene, chemicals and polyurethane.

“Sadara’s debt reprofiling is an essential move that positions us well for the long term in both local and global markets.

“The company marked many milestones and achievements in various areas as a world-class organization since it reached full operations, reflecting our continuous commitment to our shareholders and stakeholders,” said Dr. Faisal Al-Faqeer, Sadara’s chief executive officer.

He added: “The transition of our marketing rights to these global industry leaders is part of the shareholders’ actions to improve Sadara’s operating results, as the marketers will leverage their marketing and sales expertise to ensure that Sadara’s world-class assets, technologies and products reach their full potential.

“This will further benefit our shareholders and lenders as well as current customers.”

Sadara’s Chief Financial Officer Alejandro Farre noted, “This transaction is yet another critical milestone for Sadara and a demonstration of the strong support from shareholders and lenders to provide the company with the long-term sustainable capital structure to enable its continued success.”

https://www.msn.com/en-ae/money/news/sadara-agrees-with-lenders-to-reprofile-its-debt/ar-BB1f56Ee

Sadara markets in the Middle East today, and Dow in the rest of the world. Sadara will no longer market products, but they will be sold by Sabic. Aramco (Sabic parent) owns 65% of the JV and Dow owns 35% of the JV. This is the amount of volume that will be marketed by each of the two companies in the future, starting this summer.

March 29, 2021

Sadara agrees with lenders to reprofile its debt

Ajel News 3 hrs ago

Sadara Chemical Company (Sadara) has signed an agreement with agency creditors and commercial lenders to restructure Sadara’s debt. The restructured debt repayment has been better aligned to match Sadara’s expected future cash flow generation. This agreement became effective March 25, 2021.

Key provisions of the agreement include a debt maturity extension from 2029 to 2038; a principal grace period through 2026, and new guarantees issued by the Sadara’s sponsors; Saudi Arabian Oil Company’s (Saudi Aramco); and The Dow Chemical Company’s (Dow).

Global manufacturing cost curve

Following the successful reprofiling, Sadara will also benefit from longer-term structural operating and feedstock improvements; further enhancing its cracker’s flexibility and improving Sadara’s position on the global manufacturing cost curve.

Sadara has also received the agreement of its shareholders — Saudi Aramco and Dow — to start the transition of the marketing rights of Sadara’s finished products to levels more consistent with each partner’s equity ownership.

This transition is part of the partnership’s original plan and will gradually increase over the next five years.

The acceleration of the marketing rights of Saudi Aramco will be taken over by the Saudi Basic Industries Corporation (SABIC). All parties agreed on this and these rights will relate to several specific products; which include a range of polyethylene, chemicals and polyurethane.

“Sadara’s debt reprofiling is an essential move that positions us well for the long term in both local and global markets.

“The company marked many milestones and achievements in various areas as a world-class organization since it reached full operations, reflecting our continuous commitment to our shareholders and stakeholders,” said Dr. Faisal Al-Faqeer, Sadara’s chief executive officer.

He added: “The transition of our marketing rights to these global industry leaders is part of the shareholders’ actions to improve Sadara’s operating results, as the marketers will leverage their marketing and sales expertise to ensure that Sadara’s world-class assets, technologies and products reach their full potential.

“This will further benefit our shareholders and lenders as well as current customers.”

Sadara’s Chief Financial Officer Alejandro Farre noted, “This transaction is yet another critical milestone for Sadara and a demonstration of the strong support from shareholders and lenders to provide the company with the long-term sustainable capital structure to enable its continued success.”

https://www.msn.com/en-ae/money/news/sadara-agrees-with-lenders-to-reprofile-its-debt/ar-BB1f56Ee

Sadara markets in the Middle East today, and Dow in the rest of the world. Sadara will no longer market products, but they will be sold by Sabic. Aramco (Sabic parent) owns 65% of the JV and Dow owns 35% of the JV. This is the amount of volume that will be marketed by each of the two companies in the future, starting this summer.