The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

April 15, 2021

Mideast petrochemical supply mixed; demand slows amid Ramadan

Author: Felicia Loo

2021/04/15

SINGAPORE (ICIS)–Petrochemical supply conditions are mixed in the Middle East, with trade limited for some products while cargo availability is tight when it comes to base oils, polyols and polystyrene in the first week of Ramadan.

The bulk of the region’s polyethylene (PE) and polypropylene (PP) business for April in the Middle East has been completed before the Muslim fasting month started on 12 April.

Demand is set to taper off due to shorter working hours in place in most Middle Eastern countries during Ramadan, which will end with the Eid ul-Fitr holiday.

Markets across the region are generally expected to pick up pace around mid-May.

In the East Mediterranean market, demand remains restricted with purchases being done on a need-to basis amid a sharp resurgence in coronavirus cases in Jordan and Lebanon.

With regards to polyethylene terephthalate (PET), imports Asian cargoes into the Middle East have slowed down.

Sellers were mostly looking to sell June or later deliveries, but buyers hesitate to commit on purchases amid recent price softening.

Downstream consumption in the Gulf Cooperation Council (GCC) may not experience the usual boost during the Eid holidays after Ramadan this year since big gatherings are restricted amid the pandemic.

PET bottle grade resins are typically used in bottle and sheet packaging applications

For isocyanates, trade is limited for polymeric methylene diphenyl diisocyanate (PMDI) and toluene diisocyanate (TDI) in the region.

Demand is slow and there have been few enquiries, also due to soft macroeconomic conditions.

Buyers are cautious, adopting a wait-and-see stance on the market, with a pick-up in consumption expected in mid-May while supply remains modest amid an outage at a regional facility.

For PMDI, supply from European suppliers is tight which coincides with slow demand in the GCC.

In the base oils market, supply is tight in the Middle East, with Group I supply not expected to improve soon.

Iranian producers may continue to float small-volume export tenders for the grade.

Over the last two weeks, Iranian producers have issued export sales tenders totalling just under 10,000 tonnes of Group I SN500 product, less than half the estimated monthly requirement of the UAE market.

In addition, Group II and III spot supply is expected to remain short.

There are minimal known turnarounds among base oils producers in the Middle East through the second quarter, but spot supply is likely to remain challenged as many producers have had to reduce output in part due to lower feedstock availability.

For 10-13.5% polyether polyols (POP), most customers in the Middle East have assumed a wait-and-see stance on the market this week amid tight supply in northeast Asia.

Less supply is available to the Middle East as most cargoes from northeast Asia had previously been sold to the US and Europe.

GCC polyols supply is seen to be limited due to unexpected upstream issues at a regional facility.

Meanwhile, polystyrene (PS) buyers in the Middle East reported a shortage of supply from a major regional producer, preventing it from making offers to some customers.

Spot availability was also hard to come by from other suppliers in Asia and Europe.

Focus article by Felicia Loo and Veena Pathare

April 15, 2021

Mideast petrochemical supply mixed; demand slows amid Ramadan

Author: Felicia Loo

2021/04/15

SINGAPORE (ICIS)–Petrochemical supply conditions are mixed in the Middle East, with trade limited for some products while cargo availability is tight when it comes to base oils, polyols and polystyrene in the first week of Ramadan.

The bulk of the region’s polyethylene (PE) and polypropylene (PP) business for April in the Middle East has been completed before the Muslim fasting month started on 12 April.

Demand is set to taper off due to shorter working hours in place in most Middle Eastern countries during Ramadan, which will end with the Eid ul-Fitr holiday.

Markets across the region are generally expected to pick up pace around mid-May.

In the East Mediterranean market, demand remains restricted with purchases being done on a need-to basis amid a sharp resurgence in coronavirus cases in Jordan and Lebanon.

With regards to polyethylene terephthalate (PET), imports Asian cargoes into the Middle East have slowed down.

Sellers were mostly looking to sell June or later deliveries, but buyers hesitate to commit on purchases amid recent price softening.

Downstream consumption in the Gulf Cooperation Council (GCC) may not experience the usual boost during the Eid holidays after Ramadan this year since big gatherings are restricted amid the pandemic.

PET bottle grade resins are typically used in bottle and sheet packaging applications

For isocyanates, trade is limited for polymeric methylene diphenyl diisocyanate (PMDI) and toluene diisocyanate (TDI) in the region.

Demand is slow and there have been few enquiries, also due to soft macroeconomic conditions.

Buyers are cautious, adopting a wait-and-see stance on the market, with a pick-up in consumption expected in mid-May while supply remains modest amid an outage at a regional facility.

For PMDI, supply from European suppliers is tight which coincides with slow demand in the GCC.

In the base oils market, supply is tight in the Middle East, with Group I supply not expected to improve soon.

Iranian producers may continue to float small-volume export tenders for the grade.

Over the last two weeks, Iranian producers have issued export sales tenders totalling just under 10,000 tonnes of Group I SN500 product, less than half the estimated monthly requirement of the UAE market.

In addition, Group II and III spot supply is expected to remain short.

There are minimal known turnarounds among base oils producers in the Middle East through the second quarter, but spot supply is likely to remain challenged as many producers have had to reduce output in part due to lower feedstock availability.

For 10-13.5% polyether polyols (POP), most customers in the Middle East have assumed a wait-and-see stance on the market this week amid tight supply in northeast Asia.

Less supply is available to the Middle East as most cargoes from northeast Asia had previously been sold to the US and Europe.

GCC polyols supply is seen to be limited due to unexpected upstream issues at a regional facility.

Meanwhile, polystyrene (PS) buyers in the Middle East reported a shortage of supply from a major regional producer, preventing it from making offers to some customers.

Spot availability was also hard to come by from other suppliers in Asia and Europe.

Focus article by Felicia Loo and Veena Pathare

April 14, 2021

“Unprecedented Demand”: RV Sales Hit Record In February, On Pace For Blowout 2021

by Tyler DurdenWednesday, Apr 14, 2021 – 11:05 AM

With median prices for both existing and new homes at all time highs, and soaring at a record annualized rate of almost 20%…

… increasingly more Americans find themselves priced out of homeownership and, unwilling to rent shoeboxes in those liberal bicoastal, record tax incubators, are instead opting to not purchase expensive (and stationary) homes altogether, and are picking a far cheaper (and mobile) option.

According to the RV Industry Association (RVIA), an industry association trade group that monitors the RV industry, manufacturers are shipping a record number of new units to dealer lots across the county that are being snapped up almost as soon as they arrive.

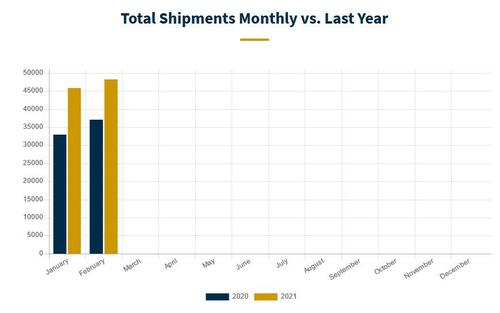

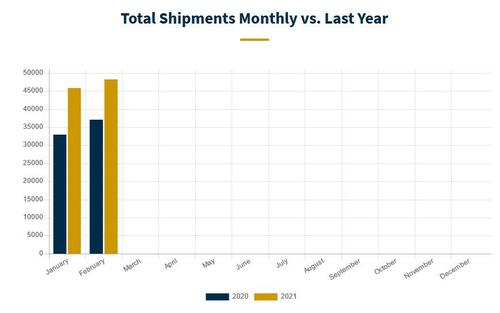

A February survey of manufacturers showed total RV shipments for the month topping out at 48,286 units, an increase of 30.1% compared to the same period last year, making February 2021 the best February on record.

“As people begin to think about their spring and summer vacations, RV trips continue to be the preferred way to travel for millions of Americans,” said RV Industry Association President & CEO Craig Kirby. “As evident in this month’s record shipment report, RV manufacturers and suppliers are committed to meeting the demand from new consumers as well as those looking to upgrade their existing RVs. According to the report, the industry remains on track to build more RVs in 2021 than in any previous year.”

It’s part of a continuing trend the RVIA has been watching closely: “We’re on quite a streak right now,” said Monika Geraci, a RVIA analyst and spokesperson. “November and December were record-breaking months, too.”

According to the recent study commissioned by RVIA, RV wholesale shipments appear to be headed to their highest levels in 2021. Those projections show total RV shipments ranging between 523,000 units and 543,000 units for the coming year, representing a 23% increase over the 2020 year-end total of 430,412 units. It suggests a 5% gain over the record high of 504,600 units shipped in 2017.

“RV shipments in 2021 are forecast to reach record highs as the industry continues its over 40 years of long-term growth,” said Kirby. “We expect consumers to continue to turn to RVs not only because they allow people to recreate responsibly, but also because RVs allow people the freedom to live a fun, active outdoor lifestyle.”

Those numbers surprised even RV insiders, who said they thought 2020 would be a down year.

“A year ago when RV plants shut down for nearly two months, who would have thought we would be talking about record-breaking shipments less than a year later?” said Jeff Rutherford, president and CEO of Airxcel Inc. and RV Industry Association chairman. “The fact that 2021 is projected to be the best year ever for RV shipments speaks to the strengths of our industry and the incredible appeal of the RV lifestyle.”

One factor helping drive the stronger demand for RVs seems to be that they have found a new audience with younger customers. Studies show that 18- to 34-year-olds now make up 22% of the market of new RV buyers, a significant increase.

That study also found RV ownership has increased over 62% in the last 20 years, and now a record 11.2 million American households own RVs. Those numbers are split almost equally between those over and under the age of 55. Additionally, the study found 9.6 million households intend to buy an RV within the next five years. And of that, 84% of Millennials and Gen Zers who own RVs plan to buy another RV within the next five years, and 78% of them saying they want to buy a brand-new model.

According to the report, usage for RV owners remains steady at 20 days a year, while people who say they now intend to buy an RV also say they plan to use their new units for an average of 25 days per year. This increase is thought to be the result of changing attitudes toward working remotely and distance learning. Both give families more ability to be away from home, but still working, than in the past.

Nearly a third of the respondents in the study are “first-time owners,” underscoring the growth of the industry in the past decade. Ownership is spread widely not only across age levels, but also across genders.

In 2017, the industry’s best year to date, manufacturers built and moved just over half a million new units to dealer lots around the county, but those numbers pale when placed against the anticipated growth expected throughout this year.

“It looks like a significant increase over our best year ever,” Geraci said. “And that’s because many people are still looking forward to taking that RV trip they dreamed of. There’s really continued customer demand. Inventory on dealer lots continues to be at historic lows because of the demand by consumers. Based on those two factors alone, it should be a really strong year for the industry.”

Demand for new RVs was strong before the pandemic and stronger still during and after. Geraci said RVIA has been watching demand steadily grow over the last decade.

“If we look back 13 months ago, the RV numbers were really strong. They were up over 2019. So even pre-pandemic, people were looking at RVs. Add the pandemic on top of that, where you had people who had maybe thought about RVing suddenly jumping in,” she said.

While large segments of the travel industry suffered due to the pandemic, it appears that people’s appetite to travel failed to decrease, making RVs a great alternative. Geraci said an RV allows people bring along their own bedroom, kitchen and bathroom, giving most the travel solution they were looking for.

RVs became hot in 2020 when more traditional travel and vacation plans, including air travel, cruising and hotel stays, were crushed by the pandemic. Instead, Americans opted to snap up RVs and hit the road as a safer alternative for their time off.

“It’s easy to social distance in an RV,” she said.

Traditional trailers, units that are pulled behind a truck, still dominate the industry and account for the lion’s share of all sales. But demand for fifth wheels, vans and motorhomes are all up by as much as 20%.

April 14, 2021

“Unprecedented Demand”: RV Sales Hit Record In February, On Pace For Blowout 2021

by Tyler DurdenWednesday, Apr 14, 2021 – 11:05 AM

With median prices for both existing and new homes at all time highs, and soaring at a record annualized rate of almost 20%…

… increasingly more Americans find themselves priced out of homeownership and, unwilling to rent shoeboxes in those liberal bicoastal, record tax incubators, are instead opting to not purchase expensive (and stationary) homes altogether, and are picking a far cheaper (and mobile) option.

According to the RV Industry Association (RVIA), an industry association trade group that monitors the RV industry, manufacturers are shipping a record number of new units to dealer lots across the county that are being snapped up almost as soon as they arrive.

A February survey of manufacturers showed total RV shipments for the month topping out at 48,286 units, an increase of 30.1% compared to the same period last year, making February 2021 the best February on record.

“As people begin to think about their spring and summer vacations, RV trips continue to be the preferred way to travel for millions of Americans,” said RV Industry Association President & CEO Craig Kirby. “As evident in this month’s record shipment report, RV manufacturers and suppliers are committed to meeting the demand from new consumers as well as those looking to upgrade their existing RVs. According to the report, the industry remains on track to build more RVs in 2021 than in any previous year.”

It’s part of a continuing trend the RVIA has been watching closely: “We’re on quite a streak right now,” said Monika Geraci, a RVIA analyst and spokesperson. “November and December were record-breaking months, too.”

According to the recent study commissioned by RVIA, RV wholesale shipments appear to be headed to their highest levels in 2021. Those projections show total RV shipments ranging between 523,000 units and 543,000 units for the coming year, representing a 23% increase over the 2020 year-end total of 430,412 units. It suggests a 5% gain over the record high of 504,600 units shipped in 2017.

“RV shipments in 2021 are forecast to reach record highs as the industry continues its over 40 years of long-term growth,” said Kirby. “We expect consumers to continue to turn to RVs not only because they allow people to recreate responsibly, but also because RVs allow people the freedom to live a fun, active outdoor lifestyle.”

Those numbers surprised even RV insiders, who said they thought 2020 would be a down year.

“A year ago when RV plants shut down for nearly two months, who would have thought we would be talking about record-breaking shipments less than a year later?” said Jeff Rutherford, president and CEO of Airxcel Inc. and RV Industry Association chairman. “The fact that 2021 is projected to be the best year ever for RV shipments speaks to the strengths of our industry and the incredible appeal of the RV lifestyle.”

One factor helping drive the stronger demand for RVs seems to be that they have found a new audience with younger customers. Studies show that 18- to 34-year-olds now make up 22% of the market of new RV buyers, a significant increase.

That study also found RV ownership has increased over 62% in the last 20 years, and now a record 11.2 million American households own RVs. Those numbers are split almost equally between those over and under the age of 55. Additionally, the study found 9.6 million households intend to buy an RV within the next five years. And of that, 84% of Millennials and Gen Zers who own RVs plan to buy another RV within the next five years, and 78% of them saying they want to buy a brand-new model.

According to the report, usage for RV owners remains steady at 20 days a year, while people who say they now intend to buy an RV also say they plan to use their new units for an average of 25 days per year. This increase is thought to be the result of changing attitudes toward working remotely and distance learning. Both give families more ability to be away from home, but still working, than in the past.

Nearly a third of the respondents in the study are “first-time owners,” underscoring the growth of the industry in the past decade. Ownership is spread widely not only across age levels, but also across genders.

In 2017, the industry’s best year to date, manufacturers built and moved just over half a million new units to dealer lots around the county, but those numbers pale when placed against the anticipated growth expected throughout this year.

“It looks like a significant increase over our best year ever,” Geraci said. “And that’s because many people are still looking forward to taking that RV trip they dreamed of. There’s really continued customer demand. Inventory on dealer lots continues to be at historic lows because of the demand by consumers. Based on those two factors alone, it should be a really strong year for the industry.”

Demand for new RVs was strong before the pandemic and stronger still during and after. Geraci said RVIA has been watching demand steadily grow over the last decade.

“If we look back 13 months ago, the RV numbers were really strong. They were up over 2019. So even pre-pandemic, people were looking at RVs. Add the pandemic on top of that, where you had people who had maybe thought about RVing suddenly jumping in,” she said.

While large segments of the travel industry suffered due to the pandemic, it appears that people’s appetite to travel failed to decrease, making RVs a great alternative. Geraci said an RV allows people bring along their own bedroom, kitchen and bathroom, giving most the travel solution they were looking for.

RVs became hot in 2020 when more traditional travel and vacation plans, including air travel, cruising and hotel stays, were crushed by the pandemic. Instead, Americans opted to snap up RVs and hit the road as a safer alternative for their time off.

“It’s easy to social distance in an RV,” she said.

Traditional trailers, units that are pulled behind a truck, still dominate the industry and account for the lion’s share of all sales. But demand for fifth wheels, vans and motorhomes are all up by as much as 20%.

April 14, 2021

Shipping Container Rates Expected To Remain Elevated Through Year

by Tyler DurdenWednesday, Apr 14, 2021 – 02:45 AM

Bad news for US importers searching for cheap shipping container rates, that is, rates are as up much as 50% than one year ago. Increasing shipping costs are crimping margins of importers that will ultimately have to be passed onto consumers.

Take, for example, the Asia to North American trade line last week was approximately $2,500 to $3,000 for a 40-foot container, about a 25% to 50% increase than the previous year, George Griffiths, an editor on the global container freight-pricing team at S&P Global Platts, told Bloomberg. Shipping costs create massive headaches for US importers, he said, adding that, the logistical issues they are facing today are extreme.

Hapag-Lloyd CEO Rolf Habben Jansen said container prices are likely to remain elevated through the second half of the year. “I don’t see any signs around the corner that demand is falling off a cliff,” he said.

Meanwhile, Oakland and Long Beach, California ports, both reported record imports for March – on a seasonal basis, usually quiet months for containerized inflows. But no thanks to Jay Powell and Janet Yellen’s historical experiment: unleashing trillions of dollars in helicopter money into consumer pockets has created the largest ever pull forward in history where Americans are using their stimulus checks to purchase goods from Asia.

… and it doesn’t come as any surprise the annual trade deficit for goods came in at an all-time high in January, increasing $3.4 billion to a record $221.1 billion. In another sign of the massive trade imbalance, there is a shortage of shipping containers to bring things into the US.

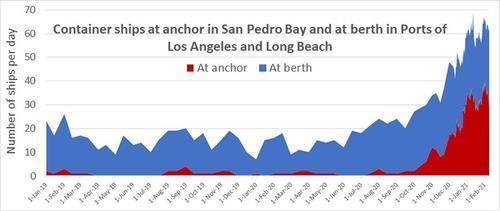

The congestion is so bad at the US West Coast port that the port’s head told importers to expedite container pickup to alleviate congestion last month. Los Angeles and Long Beach ports are locked in traffic jams of vessels waiting to offload cargo as trillions of dollars in stimulus result in one-sided trade with Asia.

“The container dwell time is much higher than it was pre-pandemic,” Port of Los Angeles Executive Director Gene Seroka told CNBC, referring to the duration a container spends at the port.

Data compiled by Marine Exchange of Southern California shows a massive congestion crisis of moored container ships waiting to unload their cargo.

All these supply chain challenges are feeding concerns of inflation could be around the corner. The US producer prices jumped more than forecasted last month, and the March CPI is expected to be released Tuesday.

The four core trade lines worldwide (data provided by Freightos) show prices per 40-foot container began to increase rapidly during the summer of 2000.

It’s unlikely shipping container rates will decline anytime soon as the Biden administration continues to hand out free money to US consumers who turn around and purchase products that are not manufactured in the US.

https://www.zerohedge.com/commodities/shipping-container-rates-expected-remain-elevated-through-year