The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

March 25, 2021

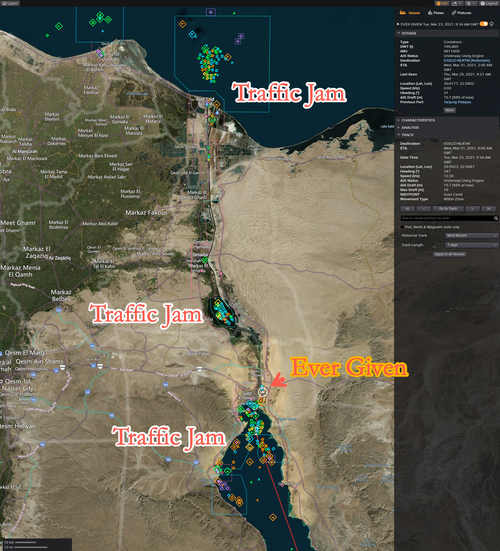

“Might Take Weeks” – Suez Canal Still Closed As “Enormous Beached Whale” Ship Remains Stuck

by Tyler DurdenThursday, Mar 25, 2021 – 06:35 AM

Update (0956ET): Daily Mail’s deputy political editor John Stevens tweets the British government “stands ready” to support operations to free the containership blocking the Suez Canal.

Boris Johnson’s spokesman:

“We are ready to provide any assistance that we can but have not been asked yet.”

* * *

Update (0942 ET): The massive containership blocking the Suez Canal remains stuck in place and unable to refloat on Thursday. Each day the canal is blocked, it halts about $9.6 billion of traffic through the world’s most important shipping lane.

The Suez Canal Authority’s knock-on effects on closing the 120-mile long canal will likely cause shipping traffic jams at both entrances of the canal, delayed shipments, supply chain disruptions, rising prices of certain commodities, and may push up freight rates. https://platform.twitter.com/embed/Tweet.html?dnt=false&embedId=twitter-widget-0&frame=false&hideCard=false&hideThread=false&id=1375080625942724608&lang=en&origin=https%3A%2F%2Fwww.zerohedge.com%2Fenergy%2Fmight-take-weeks-suez-canal-still-closed-enormous-beached-whale-ship-remains-stuck&siteScreenName=zerohedge&theme=light&widgetsVersion=e1ffbdb%3A1614796141937&width=550px

* * *

The Suez Canal Authority (SCA) reported Thursday it had suspended traffic along the 120-mile long canal while eight tugboats worked to free a massive containership, according to Reuters.

SCA’s statement said thirteen vessels had sailed south along the canal on Wednesday and were waiting in the canal’s lakes until the containership was refloated. On either side of the canal’s entrances, dozens of ships are piling up as the world’s most crucial shipping lane grinds to a halt.

The container ship called the Ever Given, owned by Evergreen Marine Corp., “could be stuck in the canal for weeks,” according to the firm working to dislodge the vessel.

Peter Berdowski, CEO of Dutch company Boskalis which has been tasked to dislodge Ever Given, was quoted by the Daily Mail as saying:

“We can’t exclude it might take weeks, depending on the situation. It’s an enormous weight on the sand. We might have to work with a combination of reducing the weight by removing containers, oil and water from the ship, tug boats, and dredging of sand.”

Berdowski compared the 1,312ft-long, 175ft-wide, 200,000-ton vessel to an “enormous beached whale” as he suggested offloading cargo might be one solution to refloat the ship.

A source familiar with the matter told Bloomberg that Ever Given is “lodged approximately 5 meters into the canal’s bank, hindering efforts to re-float it fully.”

As many as 50 vessels pass through the canal on a given day, which means upwards of 150 vessels could be waiting to transit the canal. By now, some vessels have opted for alternative routes.

NYMEX WTI crude oil futures are down 2% in the overnight session and don’t seem to care about the canal’s continued shuttering. Perhaps, oil traders are refocusing on virus troubles in Europe, hindering demand.

But as we must note, if the SCA were to release a statement indicating a prolonged shutdown of the canal, crude prices would likely continue to rise. This is because 12% of global trade and 8% of liquefied natgas traverse the canal and nearly one million oil barrels each day.

On top of global supply chains already stretched thin due to the virus pandemic, the world’s most important shipping lane is paralyzed.

March 25, 2021

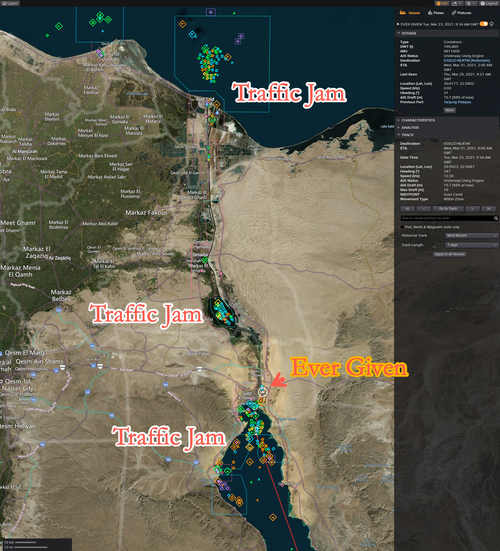

“Might Take Weeks” – Suez Canal Still Closed As “Enormous Beached Whale” Ship Remains Stuck

by Tyler DurdenThursday, Mar 25, 2021 – 06:35 AM

Update (0956ET): Daily Mail’s deputy political editor John Stevens tweets the British government “stands ready” to support operations to free the containership blocking the Suez Canal.

Boris Johnson’s spokesman:

“We are ready to provide any assistance that we can but have not been asked yet.”

* * *

Update (0942 ET): The massive containership blocking the Suez Canal remains stuck in place and unable to refloat on Thursday. Each day the canal is blocked, it halts about $9.6 billion of traffic through the world’s most important shipping lane.

The Suez Canal Authority’s knock-on effects on closing the 120-mile long canal will likely cause shipping traffic jams at both entrances of the canal, delayed shipments, supply chain disruptions, rising prices of certain commodities, and may push up freight rates. https://platform.twitter.com/embed/Tweet.html?dnt=false&embedId=twitter-widget-0&frame=false&hideCard=false&hideThread=false&id=1375080625942724608&lang=en&origin=https%3A%2F%2Fwww.zerohedge.com%2Fenergy%2Fmight-take-weeks-suez-canal-still-closed-enormous-beached-whale-ship-remains-stuck&siteScreenName=zerohedge&theme=light&widgetsVersion=e1ffbdb%3A1614796141937&width=550px

* * *

The Suez Canal Authority (SCA) reported Thursday it had suspended traffic along the 120-mile long canal while eight tugboats worked to free a massive containership, according to Reuters.

SCA’s statement said thirteen vessels had sailed south along the canal on Wednesday and were waiting in the canal’s lakes until the containership was refloated. On either side of the canal’s entrances, dozens of ships are piling up as the world’s most crucial shipping lane grinds to a halt.

The container ship called the Ever Given, owned by Evergreen Marine Corp., “could be stuck in the canal for weeks,” according to the firm working to dislodge the vessel.

Peter Berdowski, CEO of Dutch company Boskalis which has been tasked to dislodge Ever Given, was quoted by the Daily Mail as saying:

“We can’t exclude it might take weeks, depending on the situation. It’s an enormous weight on the sand. We might have to work with a combination of reducing the weight by removing containers, oil and water from the ship, tug boats, and dredging of sand.”

Berdowski compared the 1,312ft-long, 175ft-wide, 200,000-ton vessel to an “enormous beached whale” as he suggested offloading cargo might be one solution to refloat the ship.

A source familiar with the matter told Bloomberg that Ever Given is “lodged approximately 5 meters into the canal’s bank, hindering efforts to re-float it fully.”

As many as 50 vessels pass through the canal on a given day, which means upwards of 150 vessels could be waiting to transit the canal. By now, some vessels have opted for alternative routes.

NYMEX WTI crude oil futures are down 2% in the overnight session and don’t seem to care about the canal’s continued shuttering. Perhaps, oil traders are refocusing on virus troubles in Europe, hindering demand.

But as we must note, if the SCA were to release a statement indicating a prolonged shutdown of the canal, crude prices would likely continue to rise. This is because 12% of global trade and 8% of liquefied natgas traverse the canal and nearly one million oil barrels each day.

On top of global supply chains already stretched thin due to the virus pandemic, the world’s most important shipping lane is paralyzed.

March 24, 2021

Covestro and ENGIE sign supply agreement for green power in Belgium

| 45% of Covestro Antwerp’s electricity demand covered by renewable energy Capacity of almost 40 megawatts from new onshore wind turbines |

Covestro will be covering almost half of its future electricity demand in Belgium from wind energy. The company concluded a Power Purchase Agreement (PPA) with ENGIE, the largest producer of renewable energy in the country. From April 1, 2021, the energy provider is going to supply around 45% of the electricity demand of Covestro in Antwerp from 15 wind turbines in four newly constructed onshore wind farms.The new agreement, known as a Corporate PPA, covers a capacity of 39 megawatts. This equals the energy supply for about 30,000 private households and reduces Covestro’s carbon footprint in Belgium by more than 38,500t of CO₂, which is equivalent to the emissions of almost 20,000 cars per year.More energy efficient productionProduction in the chemical industry is traditionally energy-intensive. Covestro sees this as an incentive to take responsibility and minimise both energy demand and CO2emissions from production plants and processes. With its various innovative process technologies and a licensed energy management system, Covestro has already significantly increased energy efficiency and reduced emissions from its production. The company has set itself the goal to halve its specific carbon dioxide emissions by 2025, compared to 2005. In addition and in line with its new vision, Covestro wants to obtain most of the remaining energy from wind power.”The new supply agreement is a milestone in the conversion of our production to the use of renewable energies,” says Georg Wagner, Managing Director at Covestro in Antwerp. “Wind energy, together with the use of sustainable raw materials and innovative recycling technologies, are important steps towards realising our vision of becoming fully circular and achieving the climate goals of the European Green Deal. We are pleased to have found a partner in ENGIE to take this next step, with which we support our customers and the corresponding value chains to produce more sustainably.”  Largest supplier of renewable energies in Belgium Vincent Verbeke, Head of ENGIE Global Energy Management in Belgium, says: “Being the largest renewable energy producer in Belgium, ENGIE acts to accelerate the transition towards a carbon-neutral world, by supporting its clients in reaching their sustainability goals. We are proud to help Covestro meet their environmental goals and to facilitate their consumption of onshore wind energy. This contract also illustrates ENGIE’s strong ambition to increase renewables’ development in Belgium.” Covestro already signed a major industrial customer supply contract with energy provider Ørsted to cover a significant proportion of the electricity requirements of the German sites for a long-time period as from 2025. The current contract with ENGIE will make Antwerp the first Covestro production site powered almost half by wind energy. At its Antwerp site, Covestro produces the high-performance plastic polycarbonate, which is used in car headlights, electrical and electronic components, LED lights, medical technology and many other applications. It also produces polyethers and the important industrial chemical aniline. The latter is eventually processed into methylene diphenyl diisocyanate (MDI), a raw material for rigid polyurethane foam, which has proven to be an efficient insulator for buildings and in the cold chain. |

March 24, 2021

Covestro and ENGIE sign supply agreement for green power in Belgium

| 45% of Covestro Antwerp’s electricity demand covered by renewable energy Capacity of almost 40 megawatts from new onshore wind turbines |

Covestro will be covering almost half of its future electricity demand in Belgium from wind energy. The company concluded a Power Purchase Agreement (PPA) with ENGIE, the largest producer of renewable energy in the country. From April 1, 2021, the energy provider is going to supply around 45% of the electricity demand of Covestro in Antwerp from 15 wind turbines in four newly constructed onshore wind farms.The new agreement, known as a Corporate PPA, covers a capacity of 39 megawatts. This equals the energy supply for about 30,000 private households and reduces Covestro’s carbon footprint in Belgium by more than 38,500t of CO₂, which is equivalent to the emissions of almost 20,000 cars per year.More energy efficient productionProduction in the chemical industry is traditionally energy-intensive. Covestro sees this as an incentive to take responsibility and minimise both energy demand and CO2emissions from production plants and processes. With its various innovative process technologies and a licensed energy management system, Covestro has already significantly increased energy efficiency and reduced emissions from its production. The company has set itself the goal to halve its specific carbon dioxide emissions by 2025, compared to 2005. In addition and in line with its new vision, Covestro wants to obtain most of the remaining energy from wind power.”The new supply agreement is a milestone in the conversion of our production to the use of renewable energies,” says Georg Wagner, Managing Director at Covestro in Antwerp. “Wind energy, together with the use of sustainable raw materials and innovative recycling technologies, are important steps towards realising our vision of becoming fully circular and achieving the climate goals of the European Green Deal. We are pleased to have found a partner in ENGIE to take this next step, with which we support our customers and the corresponding value chains to produce more sustainably.”  Largest supplier of renewable energies in Belgium Vincent Verbeke, Head of ENGIE Global Energy Management in Belgium, says: “Being the largest renewable energy producer in Belgium, ENGIE acts to accelerate the transition towards a carbon-neutral world, by supporting its clients in reaching their sustainability goals. We are proud to help Covestro meet their environmental goals and to facilitate their consumption of onshore wind energy. This contract also illustrates ENGIE’s strong ambition to increase renewables’ development in Belgium.” Covestro already signed a major industrial customer supply contract with energy provider Ørsted to cover a significant proportion of the electricity requirements of the German sites for a long-time period as from 2025. The current contract with ENGIE will make Antwerp the first Covestro production site powered almost half by wind energy. At its Antwerp site, Covestro produces the high-performance plastic polycarbonate, which is used in car headlights, electrical and electronic components, LED lights, medical technology and many other applications. It also produces polyethers and the important industrial chemical aniline. The latter is eventually processed into methylene diphenyl diisocyanate (MDI), a raw material for rigid polyurethane foam, which has proven to be an efficient insulator for buildings and in the cold chain. |

March 24, 2021

Soft North American contract furniture market drags Herman Miller sales lower

BY Jayson Bussa Thursday, March 18, 2021 01:37pm

ZEELAND — Office furniture maker Herman Miller Inc. continues to feel the sting as office workers stay home because of the COVID-19 pandemic.

In reporting its 2021 fiscal year results for its third quarter that ended Feb. 27, the company said it generated $590.5 million in sales for the three-month period, down 11.3 percent from the same time last year.

Herman Miller (Nasdaq: MLHR) reported $566.1 million in new orders, a 13.1-percent decrease from a year ago. The company attributed the falloff to demand pressures in the North American contract furniture market, where sales were off 35 percent and orders dipped 38 percent.

However, the company pointed to growing vaccination efforts, a drop in hospitalization rates and the fact that many of its clients are preparing to return to the office as reasons for optimism in the segment.

Herman Miller’s international contract segment held steady for the most part, with net sales up 1 percent and order volumes down 5 percent.

“Our global footprint also provides reasons for optimism,” the company said in a statement. “In regions where the impact of the pandemic has already lessened, our customers are resuming their workplace investments, giving us confidence that we will see similar rebounds in other regions as the pandemic retreats.”

The company reported quarterly earnings of $43.3 million, or 70 cents per diluted share, which compared to earnings of $37.3 million, or 64 cents per diluted share, a year ago.

Herman Miller also reined in operating expenses, which were down $13.9 million from last year, excluding restructuring expenses.

As a result of cost reductions and a planned price increase, the company also said it reinstated employer retirement contributions, which it had suspended for the first three quarters of its 2021 fiscal year.

As has been the case with other contract furniture manufacturers, Herman Miller said its retail segment has been strong. Retail sales shot up by 63 percent compared to last year, while order growth accelerated 81 percent. The company reported that these increases were spread fairly evenly across Design Within Reach and Hay, both brands owned by Herman Miller, and other Herman Miller retail brands.

Continued demand for home office furniture was the driver in that growth, with order growth in the category exceeding 326 percent, according to Herman Miller’s report.

Through the first nine months of its 2021 fiscal year, Herman Miller generated $1.84 billion in sales, down 8.3 percent from the previous year. Net earnings through three quarters were up 3.4 percent at $169.5 million.

In its outlook, Herman Miller said it was “encouraged by positive signs in each of our businesses,” but cited ongoing uncertainty about global demand and the pace of recovery.

“From a demand perspective, our contract sales funnel is pointing to increased demand in the back half of calendar 2021. From a cost perspective, like other industries, we are experiencing commodity pressures, especially associated with steel prices,” the company said in a statement. “We are ready to capitalize on the increased demand expected as the global contract market begins to recover. We believe that recovery, along with our expectation for sustained momentum in our Retail business and our global, multi-channel distribution model, puts us in a strong position to drive growth in our business as we reach the other side of the global pandemic.”