The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

October 12, 2023

Shell’s Singapore Petrochemical Unit Puts Out Fire; Styrene Impact Likely — OPIS Update

Provided by Dow Jones

Oct 11, 2023 9:39 AM EDT

Singapore’s Shell Jurong Island (SJI) has extinguished a fire that broke out at one of its petrochemical unit manufacturing site on Jurong Island, according to market sources.

The fire occurred at around 3:00 hours Singapore time on Oct.10 and was extinguished with no reported casualties, according to the source.

Market sources said that the fire would most likely impact Shell’s styrene monomer (SM) production.

“The specific impact of the styrene plant is still being evaluated by Shell. We will have to wait and see how serious the damages are,” said a China-based SM broker.

A Shell spokesperson confirmed the incident and said no injuries were reported.

“Our emergency response team is currently monitoring the situation closely. Safety is a key priority to Shell,” the spokesperson said.

At its site, SJI can produce a total of 1,040 million metric ton (mt) per year of SM and 490,000 mt/year propylene oxide (PO) between its two POSM lines, according to its website.

Operations at Shell’s cracker on the same site do not appear to have been disrupted, sources said.

“Besides PO and SM, there should be no disruption to the other chemical production,” added the SM broker.

This content was created by Oil Price Information Service, which is operated by Dow Jones & Co. OPIS is run independently from Dow Jones Newswires and The Wall Street Journal.

–Reporting by Hazel Kumari, hkumari@opisnet.com; Editing by Hanwei Wu, hwu@opisnet.com

October 11, 2023

Tempur Sealy Announces Refinancing of Credit Facilities

Oct. 11, 2023 6:45 AM ETTempur Sealy International, Inc. (TPX)

LEXINGTON, Ky., Oct. 11, 2023 /PRNewswire/ — Tempur Sealy International (TPX), Inc. announced today that it has successfully completed the closing of its $1.65 billion senior secured credit facilities, which include a $1.15 billion revolving credit facility and a $500 million term loan facility.

The proceeds of the senior secured credit facilities will be used to refinance Tempur Sealy’s existing credit facilities and, in the case of the revolving credit facility, for general corporate purposes. The senior secured credit facilities have an accordion feature that permits incremental borrowings of up to $850 million and potentially substantially more subject to compliance with a specified secured leverage ratio and certain other conditions.

Tempur Sealy Chairman and CEO Scott Thompson said, “We are very pleased with the refinancing of our credit facilities. With this refinancing, we have meaningfully extended our debt maturities, improved our financial flexibility, and increased our potential total senior credit funding while maintaining our current cost of funds in what is clearly a tight commercial banking market.”

Thompson added, “We appreciate the strong support from the 13 market-leading lenders who participated in the financing of these facilities. The transaction was substantially over-subscribed, evidencing support for our strategic vision.”

Additional details regarding the refinanced credit facilities are available in Tempur Sealy’s Current Report on Form 8-K filed today with the Securities and Exchange Commission.

October 10, 2023

China PMDI Import & Export in August 2023

PUdaily | Updated: October 5, 2023

PMDI Export

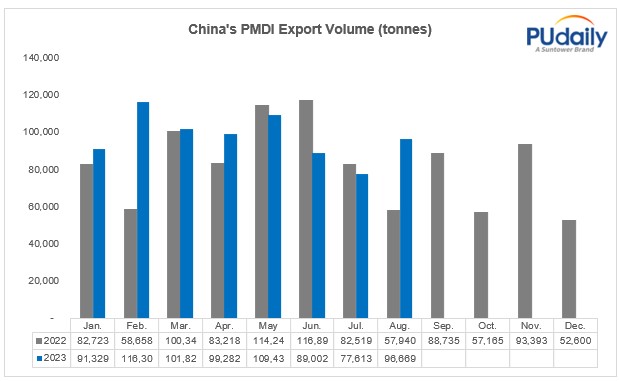

According to China customs data, in August 2023, China’s polymeric MDI exports were 96,700 tons, down 12.8% from the previous month and up 24.6% year-on-year. From January to August 2023, China’s polymeric MDI accumulated exports of 781,500 tons, compared with January to August last year, an increase of 12.2%.

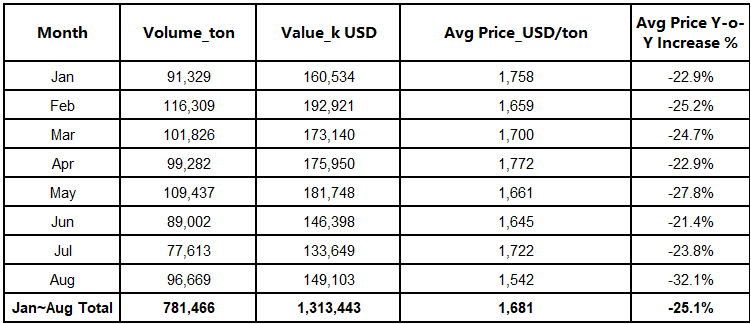

Average export price:

The average export price of polymeric MDI in August was US $1,542/ton, down 32.1% year-on-year, the decline widened.

Table: China’s polymeric MDI export volume and average export price from January to August 2023

From January to August, the United States was the largest export destination of China’s polymeric MDI, and the cumulative PMDI export volume from China to the United States was 184 thousand tons, an increase of 8.4%. In August, PMDI export from China to the United States were 22.5 thousand tons, up 77.3% year-on-year and up 22.6% month-on-month. Secondly, the main destinations of China’s polymeric MDI from January to August are Russia, the Netherlands, Belgium and Turkey.

PMDI Import

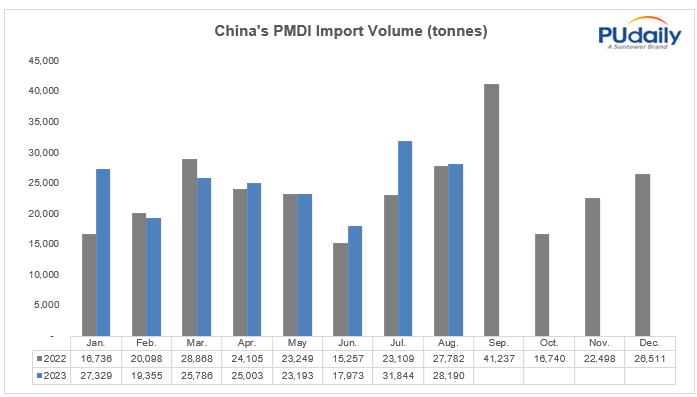

According to China customs data, in August 2023, China’s polymeric MDI (including crude MDI) imports of 28.2 thousand tons, down 11.5% month-on-month, an increase of 66.8%. From January to August 2023, China’s aggregate MDI cumulative imports of 199 thousand tons, compared with January to August last year, an increase of 10.9%.

In August, China imported 8,238 tons of polymeric MDI from the Netherlands and 7,004 tons of polymeric MDI from Saudi Arabia. The polymeric MDI and crude MDI imported from Japan was 6,885 tons, and the 200 ktpa MDI facility of Tosoh Japan has shut down for maintenance from early September, so their supply to China market was tight again.

October 9, 2023

Chemical Deal Results

| Seller | Buyer | Business | Date |

|---|---|---|---|

| Belle Chemical | Arclin | methylamines and derivatives | 3rd Quarter 2023 |

| Eastman | Ineos | Texas City TX site (acetic acid) – $490v | 3rd Quarter 2023 |

| M. Holland | Interfacial (Nagase) | 3D Printing Group | 3rd Quarter 2023 |

| Tredegar | Oben Group | Terphane flexible packaging films – $152s/$116v | 3rd Quarter 2023 |

| LRBG Chemicals | Bakelite Synthetics | liquid phenolic resins, amino resins and amino spray-dried powdered resins | 3rd Quarter 2023 |

| M. Holland | Ravago | distribution of thermoplastic resins and ancillary materials (acquisition of majority stake) – $1,500s | 3rd Quarter 2023 |

| DuPont | TJC | 80.1% stake in Delrin acetal homopolymer business – $1,800v | 3rd Quarter 2023 |

| Advanced Color Technologies | Techmer | color and additive compounds | 3rd Quarter 2023 |

| Specialty Products International | Everchem | technologies for polyurethane foams and elastomers | 3rd Quarter 2023 |

| Chase Corporation | KKR | acquisition of whole company (adhesives, sealants, additives, industrial tapes, corrosion protection and waterproofing) – $326s/$1,300v | 3rd Quarter 2023 |

| Seller | Buyer | Business | Date |

|---|---|---|---|

| Thiessen Team USA | Sika | shotcrete and grouting products for the mining industr3 | 3rd Quarter 2023 |

You can tell M&A is slow this quarter!

http://www.chemicaldeals.com/Results.aspx?searchtext=&quarter=3rd+Quarter+2023

October 9, 2023

Abu Dhabi’s Adnoc bets on global expansion

Energy major seeks opportunities in renewables, LNG and others

By Reuters

Published: Mon 9 Oct 2023, 8:13 PM

The UAE is refashioning state-owned Abu Dhabi National Oil Company (Adnoc) in the image of an international oil major by stepping up its global expansion and finding new revenue streams.

As part of this strategy, Adnoc told Reuters it was actively pursuing select opportunities in the areas of renewable energy, gas, petrochemicals and liquefied natural gas (LNG).

Two people with knowledge of the matter said the company was on the hunt for LNG assets in Africa and was considering buying Galp’s 10 per cent stake in a multi-billion-dollar natural gas project in the Rovuma basin off the coast of Mozambique.

Adnoc has already bought a stake in an Azerbaijani gas field, has put in an offer with BP for a stake in Israeli gas producer NewMed Energy , has opened takeover talks with German plastics maker Covestro and is looking to create a $20 billion chemicals giant with Austria’s OMV.

The state-owned company also told Reuters it was investing in energy trading. “As part of our international growth strategy, we are focused on expanding our presence in renewables, gas, LNG and chemicals, and are actively pursuing select opportunities, while also investing in and growing our trading capabilities,” an Adnoc spokesperson said in response to written questions.

Adnoc has two trading arms, both set up in 2020: Adnoc Trading, which is focused on crude oil, and Adnoc Global Trading, a joint venture with Italy’s Eni and OMV which is more focused on refined products.

While Adnoc’s deal-making dates back to 2017 when it listed its fuel distribution unit, the pace of change accelerated after a board meeting in November. The board brought forward to 2027 plans to up production capacity to 5 million barrels per day and also approved a five-year business plan and capital spending of $150 billion. “The thinking is to move away from a traditional state oil firm model to more like an IOC (international oil company),” a source with knowledge of the matter said.

The transformation at Adnoc is similar to ongoing changes at state-owned energy giants in Saudi Arabia and Qatar.

The national energy champions – Adnoc, Saudia Arabia’s Aramco and QatarEnergy – drive their economies but were traditionally focused on oil and gas production at home.

Now, as the transition to renewable energy accelerates, the timeline is shortening for the national oil companies (NOCs) to monetise their reserves and they are also doubling-down on opportunities further afield.

To propel its changes, Adnoc has hired more than 3,370 staff, including 28 senior managers, so far this year from companies such as global energy firms, trading houses, banks and consultancies, according to data on employment network LinkedIn.

LinkedIn data shows Adnoc’s headcount is up 13 per cent this year, and by a quarter over the past two years, to about 32,750. The actual number, however, which Adnoc has never disclosed, is now over 40,000, one person familiar with the matter said. “As we continue to grow our business, we are creating exciting opportunities for our talented workforce as we accelerate the transformation, decarbonisation of and future-proof our company,” the Adnoc spokesperson said in response to questions about hiring.

Michele Fiorentino, who was chief investment officer from 2017-2020, confirmed to Reuters that he recently returned to Adnoc from US oil services firm Baker Hughes as executive vice president for low carbon solutions and business development.

Other recent hires include Bart Cornelissen, who left Deloitte to become Adnoc’s senior vice president for group strategy and portfolio last month, according to LinkedIn.

Michael Hafner, a long-time investment banker in the energy sector – most recently at Greenhill & Co and previously at Deutsche Bank and UBS – also joined Adnoc last month as a senior adviser to the executive office for business development.

Other senior managers have recently been hired from Western firms including Morgan Stanley, HSBC, Natixis , Litasco, Borealis, TotalEnergies, Shell and Eni, according to LinkedIn.

Recent senior hires for Adnoc’s trading arms include alumni of Gunvor, Litasco, Shell and TotalEnergies, the employment network showed.

The UAE firm was looking to buy energy trader Gunvor Group last year but talks fell apart because Adnoc wanted a controlling stake and Gunvor’s shareholder only wanted to cede a minority, sources familiar with the matter have said.

“Adnoc wants to expand in Europe, whether it was through Gunvor or organically,” a source with knowledge of the matter said. “Now that the Gunvor deal is off the table, it will focus on organic growth.”

https://www.khaleejtimes.com/business/abu-dhabis-adnoc-bets-on-global-expansion