The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

October 1, 2023

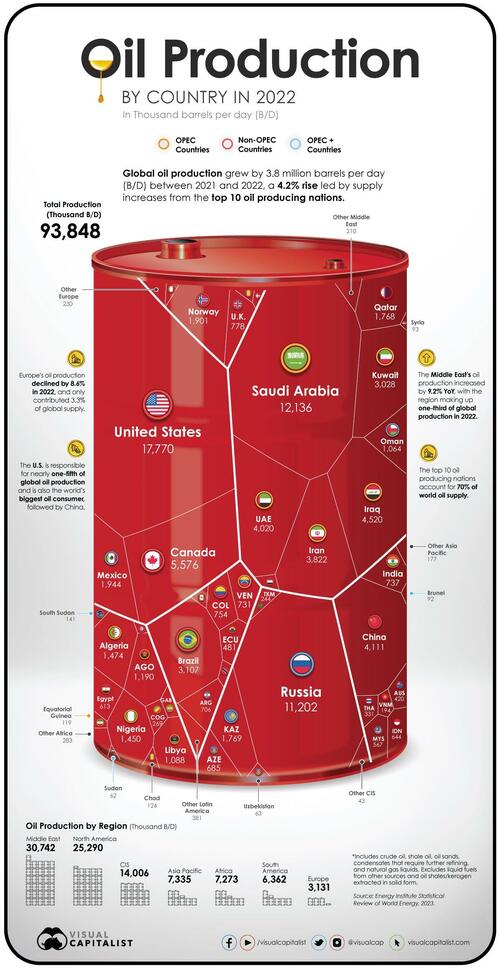

These Are The World’s Largest Oil Producers

by Tyler Durden

Saturday, Sep 30, 2023 – 07:35 AM

In 2022 oil prices peaked at more than $100 per barrel, hitting an eight-year high, after a full year of turmoil in the energy markets in the wake of the Russian invasion of Ukraine.

Oil companies doubled their profits and the economies of the biggest oil producers in the world got a major boost.

But which countries are responsible for most of the world’s oil supply? Using data from the Statistical Review of World Energy by the Energy Institute, Visual Capitalist’s Pallavi Rao and Christina Kostandi visualized and ranked the world’s biggest oil producers.

Ranked: Oil Production By Country, in 2022

The U.S. has been the world’s biggest oil producer since 2018 and continued its dominance in 2022 by producing close to 18 million barrels per day (B/D). This accounted for nearly one-fifth of the world’s oil supply.

Almost three-fourths of the country’s oil production is centered around five states: Texas, New Mexico, North Dakota, Alaska, and Colorado.

We rank the other major oil producers in the world below.

| Rank | Country | 2022 Production (Thousand B/D) | YoY Change | Share of World Supply |

|---|---|---|---|---|

| 1 | 🇺🇸 U.S. | 17,770 | +6.5% | 18.9% |

| 2 | 🇸🇦 Saudi Arabia | 12,136 | +10.8% | 12.9% |

| 3 | 🇷🇺 Russia | 11,202 | +1.8% | 11.9% |

| 4 | 🇨🇦 Canada | 5,576 | +3.0% | 5.9% |

| 5 | 🇮🇶 Iraq | 4,520 | +10.2% | 4.8% |

| 6 | 🇨🇳 China | 4,111 | +2.9% | 4.4% |

| 7 | 🇦🇪 UAE | 4,020 | +10.4% | 4.3% |

| 8 | 🇮🇷 Iran | 3,822 | +4.6% | 4.1% |

| 9 | 🇧🇷 Brazil | 3,107 | +3.9% | 3.3% |

| 10 | 🇰🇼 Kuwait | 3,028 | +12.0% | 3.2% |

| 11 | 🇲🇽 Mexico | 1,944 | +0.9% | 2.1% |

| 12 | 🇳🇴 Norway | 1,901 | -6.3% | 2.0% |

| 13 | 🇰🇿 Kazakhstan | 1,769 | -2.0% | 1.9% |

| 14 | 🇶🇦 Qatar | 1,768 | +1.8% | 1.9% |

| 15 | 🇩🇿 Algeria | 1,474 | +8.9% | 1.6% |

| 16 | 🇳🇬 Nigeria | 1,450 | -11.2% | 1.5% |

| 17 | 🇦🇴 Angola | 1,190 | +1.1% | 1.3% |

| 18 | 🇱🇾 Libya | 1,088 | -14.3% | 1.2% |

| 19 | 🇴🇲 Oman | 1,064 | +9.6% | 1.1% |

| 20 | 🇬🇧 UK | 778 | -11.0% | 0.8% |

| 21 | 🇨🇴 Colombia | 754 | +2.4% | 0.8% |

| 22 | 🇮🇳 India | 737 | -3.8% | 0.8% |

| 23 | 🇻🇪 Venezuela | 731 | +8.1% | 0.8% |

| 24 | 🇦🇷 Argentina | 706 | +12.4% | 0.8% |

| 25 | 🇦🇿 Azerbaijan | 685 | -5.6% | 0.7% |

| 26 | 🇮🇩 Indonesia | 644 | -6.9% | 0.7% |

| 27 | 🇪🇬 Egypt | 613 | +0.8% | 0.7% |

| 28 | 🇲🇾 Malaysia | 567 | -1.7% | 0.6% |

| 29 | 🇪🇨 Ecuador | 481 | +1.7% | 0.5% |

| 30 | 🇦🇺 Australia | 420 | -5.2% | 0.4% |

| 31 | 🇹🇭 Thailand | 331 | -17.5% | 0.4% |

| 32 | 🇨🇩 Congo | 269 | -1.7% | 0.3% |

| 33 | 🇹🇲 Turkmenistan | 244 | +1.0% | 0.3% |

| 34 | 🇻🇳 Vietnam | 194 | -1.2% | 0.2% |

| 35 | 🇬🇦 Gabon | 191 | +5.4% | 0.2% |

| 36 | 🇸🇸 South Sudan | 141 | -7.6% | 0.2% |

| 37 | 🇵🇪 Peru | 128 | +0.5% | 0.1% |

| 38 | 🇹🇩 Chad | 124 | +6.2% | 0.1% |

| 39 | 🇬🇶 Equatorial Guinea | 119 | -9.2% | 0.1% |

| 40 | 🇸🇾 Syria | 93 | -2.7% | 0.1% |

| 41 | 🇮🇹 Italy | 92 | -7.9% | 0.1% |

| 42 | 🇧🇳 Brunei | 92 | -13.8% | 0.1% |

| 43 | 🇾🇪 Yemen | 81 | -2.4% | 0.1% |

| 44 | 🇹🇹 Trinidad & Tobago | 74 | -3.6% | 0.1% |

| 45 | 🇷🇴 Romania | 65 | -6.2% | 0.1% |

| 46 | 🇩🇰 Denmark | 65 | -1.6% | 0.1% |

| 47 | 🇺🇿 Uzbekistan | 63 | -0.9% | 0.1% |

| 48 | 🇸🇩 Sudan | 62 | -3.3% | 0.1% |

| 49 | 🇹🇳 Tunisia | 40 | -12.9% | 0.0% |

| 50 | Other CIS | 43 | +4.4% | 0.0% |

| 51 | Other Middle East | 210 | +1.2% | 0.2% |

| 52 | Other Africa | 283 | -3.4% | 0.3% |

| 53 | Other Europe | 230 | -20.5% | 0.2% |

| 54 | Other Asia Pacific | 177 | -10.6% | 0.2% |

| 55 | Other S. & Cent. America | 381 | +68.5% | 0.4% |

| Total World | 93,848 | +4.2% | 100.0% |

Behind America’s considerable lead in oil production, Saudi Arabia (ranked 2nd) produced 12 million B/D, accounting for about 13% of global supply.

Russia came in third with 11 million B/D in 2022. Together, these top three oil producing behemoths, along with Canada (4th) and Iraq (5th), make up more than half of the entire world’s oil supply.

Meanwhile, the top 10 oil producers, including those ranked 6th to 10th—China, UAE, Iran, Brazil, and Kuwait—are responsible for more than 70% of the world’s oil production.

Notably, all top 10 oil giants increased their production between 2021–2022, and as a result, global output rose 4.2% year-on-year.

Major Oil Producing Regions in 2022

The Middle East accounts for one-third of global oil production and North America makes up almost another one-third of production. The Commonwealth of Independent States—an organization of post-Soviet Union countries—is another major regional producer of oil, with a 15% share of world production.

| Region | 2022 Production (Thousand B/D) | YoY Change | Share of World Supply |

|---|---|---|---|

| Middle East | 30,743 | +9.2% | 32.8% |

| North America | 25,290 | +5.3% | 27.0% |

| CIS | 14,006 | +0.9% | 14.9% |

| Africa | 7,043 | -3.5% | 7.5% |

| Asia Pacific | 7,273 | -1.4% | 7.8% |

| South & Central America | 6,361 | 7.2% | 6.8% |

| Europe | 3,131 | -8.6% | 3.3% |

What’s starkly apparent in the data however is Europe’s declining share of oil production, now at 3% of the world’s supply. In the last 20 years the EU’s oil output has dropped by more than 50% due to a variety of factors, including stricter environmental regulations and a shift to natural gas.

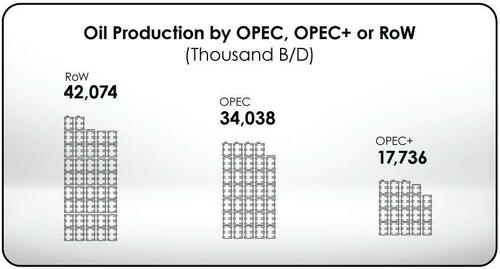

Another lens to look at regional production is through OPEC members, which control about 35% of the world’s oil output and about 70% of the world’s oil reserves.

When taking into account the group of 10 oil exporting countries OPEC has relationships with, known as OPEC+, the share of oil production increases to more than half of the world’s supply.

Oil’s Big Balancing Act

Since it’s the very lifeblood of the modern economy, the countries that control significant amounts of oil production also reap immense political and economic benefits. Entire regions have been catapulted into prosperity and wars have been fought over the control of the resource.

At the same time, the ongoing effort to pivot to renewable energy is pushing many major oil exporters to diversify their economies. A notable example is Saudi Arabia, whose sovereign wealth fund has invested in companies like Uber and WeWork.

However, the world still needs oil, as it supplies nearly one-third of global energy demand.

https://www.zerohedge.com/energy/these-are-worlds-largest-oil-producers

September 28, 2023

Shepherd’s Exclusive Partnership with Everchem

As a leading global metal chemistry manufacturer, Shepherd relies on key partnerships to help boost product awareness and sales. Everchem is one such partner, deserving not only recognition but gratitude for its commitment to marketing Shepherd’s BiCAT polyurethane catalyst product line to customers in need of catalysts for polyurethanes, spray foam, coatings and more.

Everchem is an exclusive partner for Shepherd’s BiCAT® polyurethane catalyst product line in United States and Canada. The partnership provides downstream customers with access to the broad range of BiCAT® products, an array of packaging options, closer-to-market customer service, and an unmatched level of expertise within the polyurethane market that only Everchem provides.

At its core, Everchem is a sales, marketing, and technology driven company that operates within the North American marketplace. Its core markets served include urethanes, epoxy, UV curing, and industrial chemical raw materials. Everchem prides itself on providing invaluable market intel and superior service which creates mutual benefit and value to customers and suppliers alike. The company’s lean business model and strong supplier relationships increase its responsiveness to customer needs with lower costs and less bureaucracy than many larger organizations can offer.

The Future of BiCAT Polyurethane Catalysts is Bright

Shepherd is considered a market leader when it comes to current and next-generation polyurethane catalysts. It was the first to develop hydrolytically stable bismuth carboxylate chemistry for use in HFO blowing agents, which reduces VOC’s and improves curing rates amongst other enhancements. This technological breakthrough earned Shepherd the 2016 CPI (The Center for The Polyurethanes Industry) Polyurethane Innovation Award.

Shepherd has experienced healthy growth in the sales of its BiCAT® product line through Everchem since our partnership was announced in September 2019. Through this arrangement, BiCAT® products are finding new markets, new customers, and new applications which only enhance the historically strong Shepherd brand.

Our Shared Philosophy

The mutually shared philosophy upon which Everchem and Shepherd respectively and collectively do business is a strategic difference maker when it comes to serving customers. We work together on a platform of transparency, which has yielded fantastic results for both companies since the inception of the partnership.

Everchem a wonderful steward of the Shepherd brand and our confidence in their capability and reliability is second to none. The future only provides additional opportunity for further strengthening of this relationship between the two companies.

If you’re in the market for BiCAT polyurethane catalysts, we’d love to work with you. Please contact us online or by calling 513-731-1110.

www.shepchem.com/news

September 28, 2023

Trucking sees ‘green shoot’ in August

But capacity growth in private fleets could slow recovery, ACT says

· Wednesday, September 27, 2023

FreightWaves

Trucking sees ‘green shoot’ in August

4 min

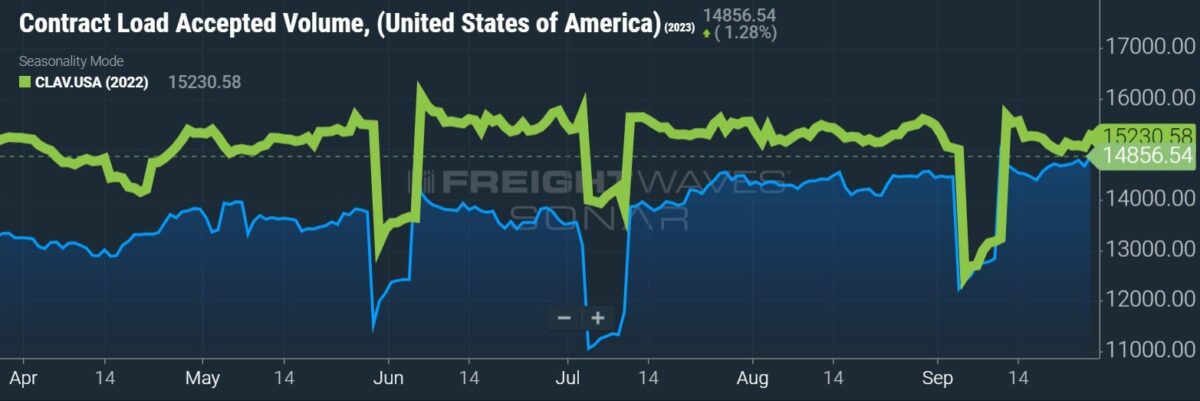

A Wednesday report from ACT Research showed the trucking cycle may be “approaching [a] turning point.” All five components of ACT’s For-Hire Trucking Index showed improvement from a carrier’s perspective during August, with volumes logging a large turnaround.

ACT’s volume index jumped 12.3 percentage points to 54.4 on a seasonally adjusted basis from July to August.

A reading above 50 indicates growth while one below 50 implies contraction. The report was quick to caution that the measure is one of breadth, with a large number of fleets seeing an increase but not necessarily a pronounced one.

“So, we wouldn’t suggest this means the freight downturn is over, but it is a considerable ‘green shoot’ that suggests the retail inventory destock is playing out,” said Tim Denoyer, vice president and senior analyst at ACT.

August produced the highest reading for the volume index since early 2022 and a level well above the mid-30s to mid-40s readings displayed throughout the spring. Inventory levels approaching a better balance and a reduction in import declines to the West Coast were cited as contributors.

“Additionally, consumers remain a surprising economic upside, even in the face of sustained high, if moderating, inflation, and are reverting to more goods spending after the service spending boom coming out of the pandemic,” Denoyer said. “Though, still-high inflation and decreasing savings are headwinds to future consumer spending.”

ACT’s capacity index was in modest contraction territory for a second straight month at 48.9. The data set was down one point seasonally adjusted from July.

Those surveyed included mostly large, for-hire fleets. However, the report noted that Class 8 tractor sales remain near all-time highs, which is indicative of capacity being added by private fleets as well as small carriers buying secondhand equipment from larger fleets.

With better volumes and a modest contraction in capacity, the supply-demand balance index jumped 13.4 points to 55.6 in August on a seasonally adjusted comparison. This was the first reading above 50 in 18 months.

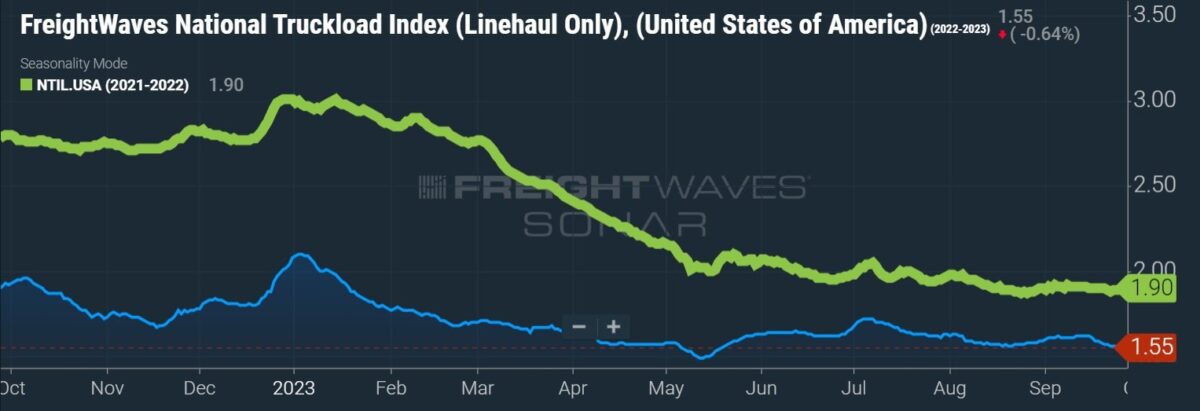

Truck pricing remained under pressure during the month at 39.3. The report noted a “less worse” trend as the index improved 2 points from July and continued to improve from the record low of 30.5 in April. ACT expects a soft pricing environment to linger in the near term.

“Though growth in private fleets may be delaying the recovery in rates, the trucking market appears to be past the nadir, and the improved supply/demand balance this month suggests more less worse results to come,” Denoyer said.

Other findings from the report showed fleet productivity (measured as miles per tractor) increased 6.1 points seasonally adjusted to 53.6 in August. However, 56.4% of survey respondents said they would be buying new equipment in the next three months, which could weigh on the metric. Buying intentions were roughly 7 points below the prior-year level as many of the big, for-hire fleets have largely caught up on their replacement cycles, which were extended during the pandemic.

“We expect fleet ordering intentions to subdue as contract rates are under severe pressure and pent-up demand is fading following capacity constraints the last two years,” Denoyer said.

The driver availability index remained elevated at 59.5 during August. The loosening in the driver labor market was in part credited to spot-market-dependent operators leaving for more stable working conditions at larger fleets.

“Driver availability also remains extraordinarily good for the diverse group of for-hire fleets in our survey,” Denoyer said. “In our view, this probably isn’t enough yet to turn the tide in the spot market, but the market rebalancing is progressing and this should be a good leading indicator of better times ahead.”

September 28, 2023

Frequent Explosion Accidents: What are the Dangers of Hydrogen Peroxide?

PUdaily | Updated: September 21, 2023

Following the explosion occurred at the hydrogen peroxide production area of Luxi Chemical, a subsidiary of Sinochem Holdings, on May 1, which resulted in 9 deaths, 1 injury, and 1 person missing, another explosion occurred in the hydrogen peroxide workshop at Risun Chemical on September 14. It is the second major hydrogen peroxide accident that has occurred within China in 2023.

Why is hydrogen peroxide so dangerous?

Electrolysis, anthraquinone (AQ), isopropanol oxidation, electrochemical cathode reduction of oxygen, and auto-oxidation (AO) are commonly used in the production of hydrogen peroxide. The AQ method is currently the most mature method, and over 99% of hydrogen peroxide plants in China use this technology. The AQ process for hydrogen peroxide production has a high hazard coefficient. It involves using hazardous raw materials and going through hazardous processes to produce a hazardous product.

The first reaction in the production process of hydrogen peroxide, namely hydrogenation, is a hazardous chemical process that is subject to strict regulation. It has the following hazardous characteristics: (a) The reactants have explosiveness, and the explosion limit of hydrogen gas is 4-75%, making it highly flammable and explosive. (b) Hydrogenation is an exothermic reaction, and when hydrogen gas comes into contact with steel under high temperature and pressure, carbon molecules in the steel can react with hydrogen gas to form hydrocarbons, reducing the strength of the steel equipment and causing hydrogen embrittlement. (c) The regeneration and activation of catalysts can easily cause explosions. (d) The exhaust gas from the hydrogenation reaction contains unreacted hydrogen gas and other impurities, which can easily cause ignition or explosion during discharge. The second reaction in the hydrogen peroxide production – oxidation – is also a hazardous chemical process that is subject to strict regulation. It’s hazardous because that the peroxidation process has a strong risk of decomposition and explosion due to the presence of peroxide groups (-O-O-).

Hydrogen peroxide is currently an important raw material for the production of propylene oxide. The concentration of hydrogen peroxide products in China is mainly 27.5%. However, in recent years, there has been an increasing demand for high concentration products (>50%), as the use of high concentration hydrogen peroxide can effectively improve the production efficiency and product quality. The HPPO process often uses hydrogen peroxide with a concentration of 50% to 70%.

Currently, the key players in China’s HPPO-based propylene oxide industry are Jilin Shenhua and Sinopec Changling. In 2011, Jilin Shenhua introduced HPPO technology from Degussa and Uhde, with an investment of CNY 2.5 billion, and built the first and largest HPPO plant in China with a scheduled capacity of 300 ktpa. The plant started operations in July 2014. In 2013, Sinopec planned to adopt independently developed HPPO technology and invested about CNY 1.28 billion to build a 100 ktpa industrial plant at the company’s Changling Branch. The plant was completed in July 2014, and successful trial operation was conducted on December 6 of the same year. This marked Sinopec as the third company in the world to own the patent for producing propylene oxide using hydrogen peroxide technology, breaking the monopoly of foreign countries on this technology.

In addition to the aforementioned two producers, Taixing Yida Chemical (independent R&D), Qixiang Tengda (authorized by Evonik and ThyssenKrupp Uhde), Jincheng Petrochemical (independently developed by China Tianchen Engineering), and Jiahong New Material (using the process owned by China Catalyst Holding Co., Ltd) have also successfully operated their HPPO facilities in recent years. The current production capacity of HPPO (Hydrogen Peroxide to Propylene Oxide) plants in China has reached 1.55 mtpa.

However, the current stability of HPPO facilities is poor, with frequent shutdowns and maintenance issues. Although there are many newly completed or planned HPPO projects, there are still significant uncertainties and obstacles. The main reasons are as follows:

1) Inadequate hydrogen peroxide supply: Due to its unstable and highly explosive nature, hydrogen peroxide cannot be transported over long distances. It has a limited sales radius (300-500 km). Currently, hydrogen peroxide production in China is mainly concentrated in East China (63%), North China (6%), and Central China (14%), primarily located in chemical-intensive provinces such as Shandong, Hubei, Jiangsu, and Zhejiang. Southwest (4%), northwest (2%), and northeast (6%) regions have minimal production capacity, resulting in an imbalance between production layout and market size. On one hand, in some areas with concentrated downstream industries, there is a supply shortage of hydrogen peroxide, resulting in high transportation costs. On the other hand, some regions have excessive production facilities, with capacity far exceeding demand. Therefore, the issue of hydrogen peroxide supply needs to be addressed. The construction of new hydrogen peroxide plants requires sufficient hydrogen resources and faces difficulties in approval due to the classification of hydrogen peroxide as a hazardous chemical.

2) The production requires high-concentration hydrogen peroxide, while the preparation of high-concentration hydrogen peroxide presents certain difficulties. Currently, in Jilin Shenhua’s plant, the required 70% hydrogen peroxide is supplied by Evonik. The high cost leads to poor profitability of the plant.

3) In the HPPO process, hydrogen peroxide has high activity and can produce some aldehyde impurities during the production process, which can have an impact on downstream production.

September 28, 2023

Quadrant Performance Materials Names Geoff Stephenson as Vice President of Sales

McKinney, TX, September 27, 2023 –(PR.com)– Quadrant Performance Materials (QPM), a global leader in high-performance materials, is thrilled to announce the appointment of Mr. Geoff Stephenson as its new Vice President of Sales. In this strategic leadership role, Mr. Stephenson will drive the company’s sales efforts and strengthen its spray foam insulation market position across key industries.

Geoff Stephenson brings over 15 years of sales and management experience in the spray foam materials and manufacturing sector. He has a proven track record of delivering growth and driving revenue in competitive markets. Prior to joining Quadrant Performance Materials, Mr. Stephenson held executive sales positions at Henry Roofing and Foam where he consistently exceeded sales targets and enhanced customer relationships.

In his new role, Mr. Stephenson will be responsible for leading the sales team, developing, and executing sales strategies, and identifying new opportunities for Quadrant Performance Materials’ innovative product portfolio. His industry expertise and leadership will play a pivotal role in strengthening customer partnerships and expanding the company’s market share.

“We are delighted to welcome Geoff Stephenson to our executive team,” said QPM President & CEO Robert Jamieson. “His extensive experience, strategic vision, and customer-centric approach align perfectly with our company’s values and objectives. We look forward to his leadership as we continue to innovate and deliver cutting-edge solutions to our customers.”

Geoff Stephenson expressed his excitement about the new role, stating, “I am honored to join Quadrant Performance Materials, a company known for its commitment to quality and innovation. I am eager to work with the talented sales team and contribute to the company’s growth trajectory by delivering value to our customers.”

For more information on the line of spray foam products, please visit www.QuadrantPM.com or call 972-542-0072.