The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

January 13, 2021

Polycoat Products acquires ChemCo Systems

Highlights

• Brings together ChemCo’s high performance epoxies used in construction

and transportation with Polycoat’s leadership capabilities in industrial,

commercial and residential polyurethanes, polyureas and polyaspartic

technologies.

• Positions Polycoat and ChemCo for domestic and international growth in

polymer solutions for infrastructure applications.

• The combination will focus on tomorrow’s needs for innovative and

sustainable products used in new construction and to extend the lifecycles

of existing buildings, structures and facilities.

Santa Fe Springs, CA and Redwood City, CA, December 29, 2020–American Polymers Corp., dba Polycoat Products, a California company, has acquired ChemCo Systems, Inc. (“ChemCo”), an international leader in high performance construction epoxies. ChemCo will continue to expand

on its current growth opportunities with best-in-class products as an independent subsidiary of Polycoat.

“Acquiring ChemCo is very exciting for Polycoat,” said Ashish Dhuldhoya, Executive Vice President of Polycoat Products. “The addition of ChemCo to our family will expand our ability to provide advanced materials and solutions oriented new products to support the needs of our global

infrastructure partners and customers.”

“The owners of ChemCo unanimously agree that this acquisition is the right strategic direction for ChemCo and will better enable the organization to focus on its core mission of providing superior epoxy construction chemicals worldwide,” said ChemCo Vice President, John Bors.

About ChemCo

ChemCo’s industry leading construction polymer based adhesives (including epoxy injection), grouts and coatings are used on a variety of projectsincluding: Industrial and Commercial (Boeing,

Louisiana Pacific, GE, Sysco, Costco), Public Works (Bureau of Reclamation, the Washington Monument, Department of Energy, U.S. Navy and Air Force installations), Airports (>50 major airports including Hong Kong, Taoyuan Int’l, San Francisco, Sky Harbor, Los Angeles, Denver

and Seattle), Utilities (Con Ed, Arizona Power, PG&E), Sports Stadiums (Fenway Park, Dodger Stadium, Wrigley Field), and Institutional (Oschner Hospital, Holy Name Cathedral).

ChemCo is a world performance leader in modified asphalt performance with its Epoxy Asphalt product, now in its 10th generation. Epoxy Asphalt is used in the most challenging pavement applications forstrategic roads, long span bridges and open graded permeable pavements. Installed

applications have lasted over 50 years with minimal maintenance.

ChemCo has commercialized a unique insulating product developed in collaboration with a DOE laboratory called InsulPOX to serve LNG terminal facilities as well as cryogenic applications as an insulating polymer concrete (IPC) used as secondary containment in trenches and sumps. The

U.S. Navy has specified InsulPOX for use in a new LNG terminal (under construction) to feed a self-sufficient power plant.

ChemCo’s existing staff and management headed by John Bors and Ralph Eisenhut will be reinforced with additional resources and personnel from its new parent, Polycoat. Together with their industry partners and customers, Polycoat and ChemCo expect to deliver transformative

solutions and rapid new product development for global infrastructure applications.

About Polycoat

Polycoat Products was founded in 1979 in El Monte, CA. Manufacturing operations were expanded to Santa Fe Springs, CA with initial product offerings in vehicular and pedestrian deck and fluid-applied below grade waterproofing. Polycoat’s products include tire fill polyurethanes

(PU), polyureas for pickup truck bedliners and industrial coatings, hot and ambient temperature cast PU elastomers, PU prepols, PU adhesives, epoxy decorative flooring, PU spray foam insulation for roofing and walls, recreational and sporting PU binders, and highway and infrastructure polymer solutions.

Polycoat remains a family-owned business with 1 million square feet of manufacturing and R&D space across the United States. Polycoat’s products are renowned for their innovative chemistry, highest quality and responsive technical staff. Polycoat facilities are distinguished for their ISO

9001:2015 quality certifications.

The transaction closed on December 28, 2020. Financial terms of the acquisition were not disclosed.

January 13, 2021

Polycoat Products acquires ChemCo Systems

Highlights

• Brings together ChemCo’s high performance epoxies used in construction

and transportation with Polycoat’s leadership capabilities in industrial,

commercial and residential polyurethanes, polyureas and polyaspartic

technologies.

• Positions Polycoat and ChemCo for domestic and international growth in

polymer solutions for infrastructure applications.

• The combination will focus on tomorrow’s needs for innovative and

sustainable products used in new construction and to extend the lifecycles

of existing buildings, structures and facilities.

Santa Fe Springs, CA and Redwood City, CA, December 29, 2020–American Polymers Corp., dba Polycoat Products, a California company, has acquired ChemCo Systems, Inc. (“ChemCo”), an international leader in high performance construction epoxies. ChemCo will continue to expand

on its current growth opportunities with best-in-class products as an independent subsidiary of Polycoat.

“Acquiring ChemCo is very exciting for Polycoat,” said Ashish Dhuldhoya, Executive Vice President of Polycoat Products. “The addition of ChemCo to our family will expand our ability to provide advanced materials and solutions oriented new products to support the needs of our global

infrastructure partners and customers.”

“The owners of ChemCo unanimously agree that this acquisition is the right strategic direction for ChemCo and will better enable the organization to focus on its core mission of providing superior epoxy construction chemicals worldwide,” said ChemCo Vice President, John Bors.

About ChemCo

ChemCo’s industry leading construction polymer based adhesives (including epoxy injection), grouts and coatings are used on a variety of projectsincluding: Industrial and Commercial (Boeing,

Louisiana Pacific, GE, Sysco, Costco), Public Works (Bureau of Reclamation, the Washington Monument, Department of Energy, U.S. Navy and Air Force installations), Airports (>50 major airports including Hong Kong, Taoyuan Int’l, San Francisco, Sky Harbor, Los Angeles, Denver

and Seattle), Utilities (Con Ed, Arizona Power, PG&E), Sports Stadiums (Fenway Park, Dodger Stadium, Wrigley Field), and Institutional (Oschner Hospital, Holy Name Cathedral).

ChemCo is a world performance leader in modified asphalt performance with its Epoxy Asphalt product, now in its 10th generation. Epoxy Asphalt is used in the most challenging pavement applications forstrategic roads, long span bridges and open graded permeable pavements. Installed

applications have lasted over 50 years with minimal maintenance.

ChemCo has commercialized a unique insulating product developed in collaboration with a DOE laboratory called InsulPOX to serve LNG terminal facilities as well as cryogenic applications as an insulating polymer concrete (IPC) used as secondary containment in trenches and sumps. The

U.S. Navy has specified InsulPOX for use in a new LNG terminal (under construction) to feed a self-sufficient power plant.

ChemCo’s existing staff and management headed by John Bors and Ralph Eisenhut will be reinforced with additional resources and personnel from its new parent, Polycoat. Together with their industry partners and customers, Polycoat and ChemCo expect to deliver transformative

solutions and rapid new product development for global infrastructure applications.

About Polycoat

Polycoat Products was founded in 1979 in El Monte, CA. Manufacturing operations were expanded to Santa Fe Springs, CA with initial product offerings in vehicular and pedestrian deck and fluid-applied below grade waterproofing. Polycoat’s products include tire fill polyurethanes

(PU), polyureas for pickup truck bedliners and industrial coatings, hot and ambient temperature cast PU elastomers, PU prepols, PU adhesives, epoxy decorative flooring, PU spray foam insulation for roofing and walls, recreational and sporting PU binders, and highway and infrastructure polymer solutions.

Polycoat remains a family-owned business with 1 million square feet of manufacturing and R&D space across the United States. Polycoat’s products are renowned for their innovative chemistry, highest quality and responsive technical staff. Polycoat facilities are distinguished for their ISO

9001:2015 quality certifications.

The transaction closed on December 28, 2020. Financial terms of the acquisition were not disclosed.

January 13, 2021

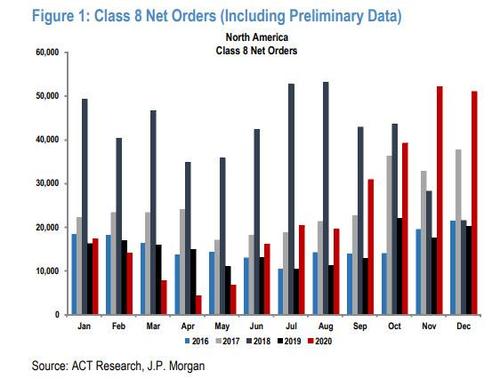

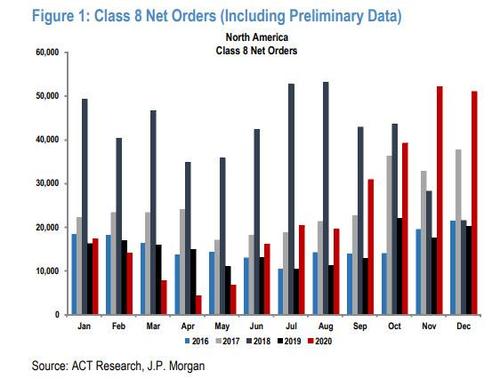

December Class 8 Truck Orders Are The Fourth Highest In History

by Tyler DurdenWednesday, Jan 13, 2021 – 5:35

Class 8 truck net new orders in December were the fourth highest in history at 50,900 units, down 2% MoM but up 153% YoY. Seasonally adjusted orders in the month came in at 39,500 units (474,000 SAAR), down 18% MoM. Orders were up 139% YoY to 142,000 units in Q4 (the second best quarter on record) and up 54% to 278,400 units in 2020.

As Alan Adler at Freightwaves writes, the surge in bookings reflects continued demand for consumer goods, an awakening of the manufacturing sector and robust fleet profits from tight freight capacity. A driver shortage is worsened by closed driving schools. Other drivers are sidelined because they failed drug tests. All of these factor into higher per-mile freight rates.

“As we at ACT [Research] can often be heard saying, ‘When carriers make money, they buy trucks,’” ACT President and senior analyst Kenny Vieth told FreightWaves.

The order strength in the last four months of the year made up for a stagnant order book in April and May, when the first wave of the coronavirus shuttered truck manufacturing plants and disrupted supply chains. But a V-shaped recovery took hold in late summer and plants laid on overtime to make up for delayed orders.

“Looking to 2021, with freight-intensive economic sectors like manufacturing coming on strong, and driver recruitment continuing to lag, carrier profitability should continue to accelerate, which bodes well for new vehicle demand,” Vieth said.

In a Thursday note from JPMorgan, the largest US commercial bank said it expects production of ~250,000 units in 2021 (up 17% YoY) and ~258,000 units in 2022 (up 3% YoY).

Should the economy fall victim to the worsening impact of the pandemic, fleets can cancel or retime orders. Order placements assure carriers of being assigned a build slot for their new trucks. As production backlogs grow, so does the time between order and delivery.

“Although we believe the tailwinds of still-strong consumer buying, likely to be boosted further by new stimulus checks, and inventory restocking will remain powerful in 1H21, a successful vaccine rollout and reopening of economies is likely to drive an aggressive shift in consumer dollars back to services,” Evercore ISI said in an investor note Thursday.

That could occur just as new trucks being ordered now are ready for delivery.

“To get two back-to-back order months over 50,000 is a stellar accomplishment, after previously seeing orders crater to under 5,000 units in April,” said Don Ake, vice president of commercial vehicles at FTR Transportation Intelligence. “Now, 2021 has the potential to be an incredible recovery year.”

Orders for new dry vans and refrigerated trailers mirror the surge in the tractor orders that pull them. Flatbed orders are recovering more slowly. The September-November booking total amounted to the second-best three months in industry history. “The backlog is filled into Q4,” Dave Giesen, vice president of sales at Stoughton Trailers, told FreightWaves in December. “We will wait for the supply chain to catch up before we continue quoting as this is a long way out.”

Meanwhile, December demand for Class 5-7 trucks recorded its second-best ever volume at 35,100 units. Medium-duty orders rose 28% over November and 73% compared to last December.

“There is a symbiotic relationship between heavy-duty freight rates and medium-duty demand,” Vieth said. “Clearly, the shift in consumer spending from experiences to goods has been good for the providers of local trucking services as e-commerce has grown by leaps and bounds during the pandemic.”

https://www.zerohedge.com/markets/december-class-8-truck-orders-are-fourth-highest-history

January 13, 2021

December Class 8 Truck Orders Are The Fourth Highest In History

by Tyler DurdenWednesday, Jan 13, 2021 – 5:35

Class 8 truck net new orders in December were the fourth highest in history at 50,900 units, down 2% MoM but up 153% YoY. Seasonally adjusted orders in the month came in at 39,500 units (474,000 SAAR), down 18% MoM. Orders were up 139% YoY to 142,000 units in Q4 (the second best quarter on record) and up 54% to 278,400 units in 2020.

As Alan Adler at Freightwaves writes, the surge in bookings reflects continued demand for consumer goods, an awakening of the manufacturing sector and robust fleet profits from tight freight capacity. A driver shortage is worsened by closed driving schools. Other drivers are sidelined because they failed drug tests. All of these factor into higher per-mile freight rates.

“As we at ACT [Research] can often be heard saying, ‘When carriers make money, they buy trucks,’” ACT President and senior analyst Kenny Vieth told FreightWaves.

The order strength in the last four months of the year made up for a stagnant order book in April and May, when the first wave of the coronavirus shuttered truck manufacturing plants and disrupted supply chains. But a V-shaped recovery took hold in late summer and plants laid on overtime to make up for delayed orders.

“Looking to 2021, with freight-intensive economic sectors like manufacturing coming on strong, and driver recruitment continuing to lag, carrier profitability should continue to accelerate, which bodes well for new vehicle demand,” Vieth said.

In a Thursday note from JPMorgan, the largest US commercial bank said it expects production of ~250,000 units in 2021 (up 17% YoY) and ~258,000 units in 2022 (up 3% YoY).

Should the economy fall victim to the worsening impact of the pandemic, fleets can cancel or retime orders. Order placements assure carriers of being assigned a build slot for their new trucks. As production backlogs grow, so does the time between order and delivery.

“Although we believe the tailwinds of still-strong consumer buying, likely to be boosted further by new stimulus checks, and inventory restocking will remain powerful in 1H21, a successful vaccine rollout and reopening of economies is likely to drive an aggressive shift in consumer dollars back to services,” Evercore ISI said in an investor note Thursday.

That could occur just as new trucks being ordered now are ready for delivery.

“To get two back-to-back order months over 50,000 is a stellar accomplishment, after previously seeing orders crater to under 5,000 units in April,” said Don Ake, vice president of commercial vehicles at FTR Transportation Intelligence. “Now, 2021 has the potential to be an incredible recovery year.”

Orders for new dry vans and refrigerated trailers mirror the surge in the tractor orders that pull them. Flatbed orders are recovering more slowly. The September-November booking total amounted to the second-best three months in industry history. “The backlog is filled into Q4,” Dave Giesen, vice president of sales at Stoughton Trailers, told FreightWaves in December. “We will wait for the supply chain to catch up before we continue quoting as this is a long way out.”

Meanwhile, December demand for Class 5-7 trucks recorded its second-best ever volume at 35,100 units. Medium-duty orders rose 28% over November and 73% compared to last December.

“There is a symbiotic relationship between heavy-duty freight rates and medium-duty demand,” Vieth said. “Clearly, the shift in consumer spending from experiences to goods has been good for the providers of local trucking services as e-commerce has grown by leaps and bounds during the pandemic.”

https://www.zerohedge.com/markets/december-class-8-truck-orders-are-fourth-highest-history

January 13, 2021

Asian propylene-naphtha spread crunches to 4-month low on naphtha upswing

Highlights

Naphtha prices rise on robust demand, crude uptick

Propylene prices weaken as buyers retreat

- Author

- Wanda Wang Melvin Yeo

- Editor

- Wendy Wells

Singapore — Asian naphtha prices strengthening to an almost 12-month high as propylene prices weaken has narrowed the propylene-naphtha spread to a four-month low, S&P Global Platts data showed Jan. 13.

The spread between FOB Korea propylene and naphtha C+F Japan cargo assessments narrowed $7.75/mt day on day to $424.25/mt at the Jan. 12 Asian close. The spread was lower on Sept. 4, 2020, at $420/mt, Platts data showed.

The typical breakeven level for propylene production is around $250/mt, and the Asian propylene-naphtha spread has remained above this level since Jan. 9, 2020, Platts data showed.

Feedstock naphtha, used by steam crackers to produce propylene has been on a crude-driven price uptrend, which pushed benchmark naphtha C+F Japan cargo up $7.75/mt day on day to $525.75/mt at the Asian close Jan. 12, a level last higher on Jan. 24, 2020, at $531.75/mt, Platts data showed.

Crude prices have firmed in response to the recent production cut by Saudi Arabia, vaccine rollouts and stimulus hopes.

Front month March Brent crude futures were assessed at $55.98/b at the Asian close Jan. 12, up $2.05/b week on week, Platts data showed. Front month Brent crude at the Asian close had averaged $50.11/b in December and $43.62/b in November, Platts data showed.

In addition, naphtha demand is robust as petrochemical makers are keen to run their naphtha-fed steam crackers at full or close to full capacity on positive olefin margins. Moreover, winter demand has boosted LPG to a premium to naphtha, making it uneconomical as an alternative cracker feedstock, sources said.

PROPYLENE UNDER PRESSURE

Propylene prices have been weighed down by thin trading activity, the availability of cheaper domestic cargoes in China, and weakness in polypropylene, sources said.

The CFR China propylene price was assessed steady day on day at $975/mt Jan. 12 and down $40/mt month on month, while the FOB Korea marker was unchanged day on day at $950/mt and down $20/mt month on month, Platts data showed.

Chinese buyers were putting import spot purchases on hold as they were expecting prices to soften when South Korean majors YNCC and LG Chemical restart cracker operations later this week. Weaker downstream polypropylene futures were also impacting their buying interest.

The planned restarts of naphtha-fed steam crackers in January and February are slated to increase propylene supply, sources said.

China’s Fujian Meide is also expected to produce on-spec propylene from its new PDH plant in Fujian province this month, and this is expected to add further pressure on import prices, sources said.