The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

September 14, 2023

September 12, 2023

Locked Items, Self-Checkouts & Disappearing Staff: Rising Theft And Slowing Sales Eat Away At Retail

by Tyler Durden

Tuesday, Sep 12, 2023 – 07:45 PM

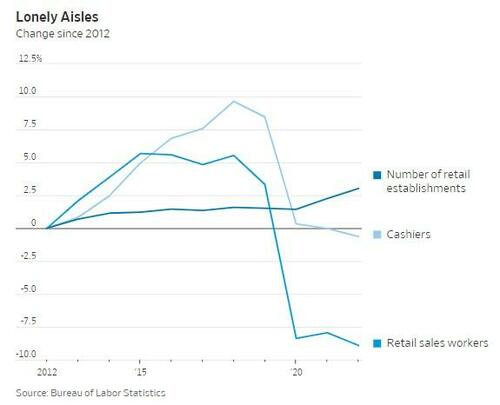

Across the retail industry, a trend is emerging: less employees, more self-checkouts and more items locked up behind safety doors.

The cause? Slowing sales and rising theft are eating into profits, according to the Wall Street Journal, who wrote this week that the “countermeasures” being used by retailers to fight theft and other shrink could make in-person shopping “even more miserable than it already is”.

In addition to having to deal with normalized looting across the country thanks to Democratic DAs, retailers also are dealing with “the steepest annual wage growth since the 1980s,” the report says. Average wages in the sector have now risen to about $20.54 per hour, the report says.

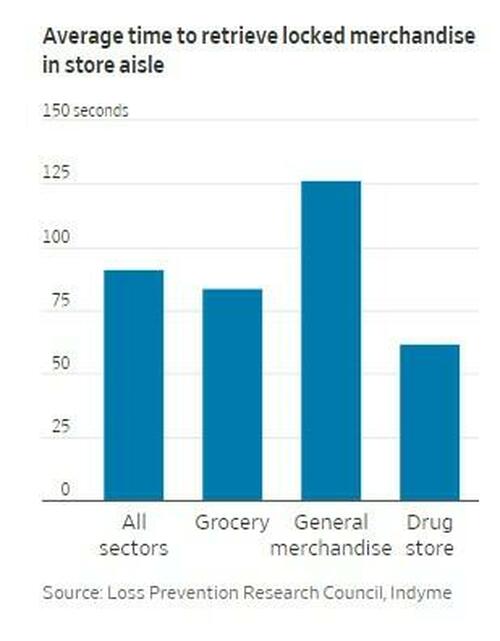

Remember that the next time some cashier wearing Airpods sighs when you ask them to take a stick of deodorant out of its alarmed hiding spot.

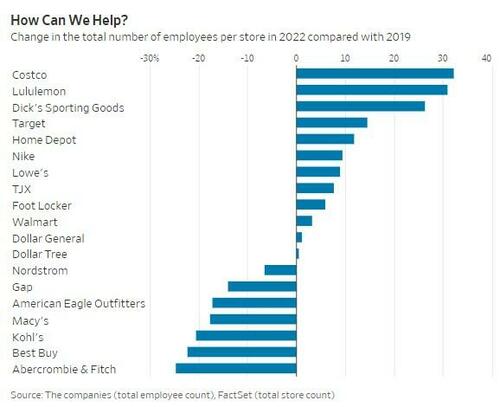

And so as a result, retailers have cut head cut and have not returned to their pre-pandemic staffing levels. Retail sales workers fell 12% from 2019 to 2022 and stores like Macy’s and Kohl’s have lost as many as 20% of their staff. Gap and Best Buy cut their staff by 25% and 22%, respectively. Only a handful of companies like Lululemon, Nike, T.J. Maxx and Costco have raised their employee headcounts.

Lorraine Hutchinson, retail-sector equity analyst at Bank of America says that the employees that are in stores now spend their time filling online orders.

Shrink remains a key concern with retailers like Ulta now locking up 50% of its fragrances at stores. The practice has become so widespread that it is now a talking point on almost all retailer earnings calls.

David Bassuk, global leader of the retail practice at AlixPartners, commented: “Unfortunately, we’re facing a situation where shrink is a CEO topic. It used to be a store-manager topic.”

Neil Saunders, managing director of research firm GlobalData confirmed that retailers like Dollar General are seeing poorer performance due to a lower in-store employee footprint. He said that Macy’s poor results were due to an “incredibly sloppy attitude to retail” and called their staffing a “complete breakdown”. Dollar General has said they need to “further elevate the in-store experience and better serve its customers.”

Best Buy has been a positive example of the “new” retail: despite employing 35,000 fewer individuals in 2022 compared to 2019, the company has surpassed Wall Street’s revenue expectations in eight out of the last ten quarters. By emphasizing cross-training, they’ve enabled their workers to perform multiple roles, from customer service to online order processing.

Moreover, in their recent earnings report, Best Buy indicated that automated virtual agents are handling 40% of customer inquiries without human intervention

Buck the trend and increase customer service for better results!

September 12, 2023

WTI Breaks Out To New Nov Highs After OPEC Data Shows Huge Supply Shortfall

by Tyler Durden

Tuesday, Sep 12, 2023 – 08:23 AM

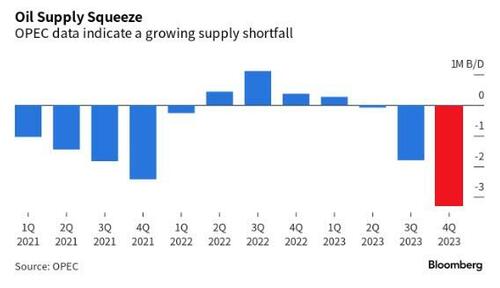

Oil prices had been coiling for a few days ahead of this data and are breaking out now after OPEC reports that global oil markets face a supply shortfall of more than 3 million barrels a day next quarter – potentially the biggest deficit in more than a decade.

If realized, it could be the biggest inventory drawdown since at least 2007, according to a Bloomberg analysis of figures published by OPEC’s Vienna-based secretariat.

OPEC’s 13 members have pumped an average of 27.4 million barrels a day so far this quarter, or roughly 1.8 million less than it believes consumers needed, according to the report.

WTI pushed above $88 on the news, its highest since Nov 2022…

As Bloomberg reports, The kingdom’s hawkish strategy, aided by export reductions from fellow OPEC+ member Russia, threatens to bring renewed inflationary pressures to a fragile global economy.

Diesel prices have surged in Europe, while American airlines are warning passengers to brace for increased costs.

It could even become a political issue for President Biden as he prepares for next year’s reelection campaign, with national gasoline prices nearing the sensitive threshold of $4 a gallon.

Editor’s Note: PS: What happens to inventories when customers expect increases?

September 12, 2023

Foam industry firming up

Around 200 companies have entered the polyurethane foam industry of Bangladesh over the past 30 years. Photo: Collected

The market for polyurethane foam is growing in Bangladesh as the material is being increasingly used for making upholstered furniture as well as packaging and insulation, according to industry insiders.

For example, the automotive industry is contributing to the increased use as many car seats and door panels now incorporate foam fillings, they said.

As such, around 200 companies have entered the polyurethane foam industry over the past 30 years.

Besides, big companies like EuroAsia, Pran-RFL, Swan, Karmo, Bengal, Apex, Expo Group, Akhter, HomeTex, Hatil, and Classical Home have already established a firm grip on the market.

Pran-RFL Group entered the market in 2016 under the brand name “Comfy”.

The company produces several polyurethane foam products of varying density that have different uses.

These include soft and supper soft foam for mattresses and pillows, rigid foam for fridge insulation, flexible foam for footwear, and high-density foam for car accessories such as seats and panelling.

Kamruzzaman Kamal, director of marketing at Pran-RFL Group, said his company has grabbed about 15 percent of the market for foam products over the past seven years.

According to him, they have invested at least Tk 100 crore so far only for the manufacturing segment.

Kamal believes the business has potential for more branded companies to enter as demand has been increasing by about 10 percent annually for the past three decades.

Echoing the same, Shubhrajit Sarker, head of corporate at Euroasia, said the market for foam products is currently worth around Tk 360 crore annually.

Having entered the foam making business in 2015, Euroasia has grabbed a substantial share of the market since then by delivering quality products and after-sales service.

“By virtue of our quality and commitment, Euroasia has won the minds of customers as an authentic brand in Bangladesh,” Sarker added.

Referring to their market analysis, he said the overall demand for foam is worth Tk 30 crore per month.

Besides, the sector has so far created at least 1.5 lakh opportunities for direct and indirect employment.

But other than making furniture and footwear, foam is also used for packaging and insulation.

“So, the growth of e-commerce and subsequent rise in shipping of fragile products has further boosted the demand for foam packaging materials,” he said.

Furthermore, the construction industry in Bangladesh has witnessed a surge in foam usage for thermal insulation purposes, Hossain added.

Ali Hossain, general manager of Swan Foam, a leading foam manufacturer, said they have been in the business for more than 30 years and never compromised on quality.

According to him, there is no market data regarding the foam segment even though the material’s usage has been increasing in making furniture and other purposes.

Foam usage was once furniture centric but now, it is used in cars, fridges, footwear and more.

Also, the demand in rural areas has increased in line with the peoples’ growing purchasing power.

And while around 200 companies are currently involved with the business as it requires little investment, the quality of products made by most manufacturers is considerably limited, he added.

Selim H Rahman, chairman and managing director of Hatil, said they set up a foam production unit as a backward linkage industry so that they can ensure good quality materials in their furniture products.

However, this means that none of the foam produced at their unit is sold in the market.

According to him, the usage of foam is multidimensional, so the market is growing in line with the country’s economy.

Also, different sectors develop silently when a country’s economy develops like that of Bangladesh, which is not understood by the common people, Rahman added.

Quazi Anwarul Haque, proprietor of M/S RR Enterprise in the Baitul Mukarram area, said the foam making sector is unorganised as the market is still dominated by informal traders.

https://www.thedailystar.net/business/economy/news/foam-industry-firming-3401586

September 11, 2023

UAW Begins Negotiations With Detroit Automakers, Admits ‘Things Moving Slowly’ As Deadline Looms

by Tyler Durden

Monday, Sep 11, 2023 – 01:55 PM

Update (1355ET):

After United Auto Workers rejected all three offers from Detroit’s “Big Three” automakers – General Motors, Ford, and Stellantis, the producer of Chrysler – last week, the union said they’re now ready to negotiate.

As quoted by Bloomberg, UAW President Shawn Fain stated, “We are ready to negotiate in Detroit 24/7, just as we have been for the past seven weeks since we gave them our Members Demands.”

Fain continued, “Despite receiving no response for over a month, when the CEOs are ready to make a serious offer, we’ll be there, day or night.”

Bloomberg said UAW officials already met with the automakers on Monday. The union boss said, “Things are moving but they’re moving very slow, and we’ve got a long way to go in four days.”

Thursday is the deadline for a new four-year labor agreement for approximately 146,000 workers. A strike will follow shortly after that if a labor deal is not agreed upon.

Members are preparing for a strike.

* * *

The pro-union Biden administration has been very confident United Auto Workers won’t strike against Detroit’s “Big Three” automakers – General Motors, Ford, and Stellantis, the producer of Chrysler – and a deal will be struck before Thursday. Even though Bank of America Securities warned clients, a “strike is almost guaranteed.”

Earlier this month, Biden was vacationing at his beach house in liberal white-elitest Rehoboth Beach when he said, “I’m not worried about a strike. I don’t think it’s going to happen.”

As the Thursday deadline looms, one which UAW’s current contract with the automakers expires, Deputy Treasury Secretary Wally Adeyemo reaffirmed Biden’s stance that there will be no strike.

Adeyemo told CNBC this morning that UAW leaders and automakers are well-positioned to hammer out a new four-year labor agreement for approximately 146,000 workers before the deadline.

He said both sides want to reach a new labor contract because it’s in their best economic interests, adding, “They’re well positioned to cut this deal, that’s what we expect them to do.”

However, John Murphy, a senior auto analyst at Bank of America Securities, warned clients last week that a strike was “almost guaranteed.”

Murphy expects negotiations will result in a 25-30% increase in labor costs over the next four years with “sizable cash signing bonuses and adjustments to other benefits” once contracts are finalized.

He said the word on the street is “UAW may offer a counter-proposal to the OEM offers shortly” but warned, “We continue to believe a strike is very likely after the Master Agreement expires next Thursday, September 14.”

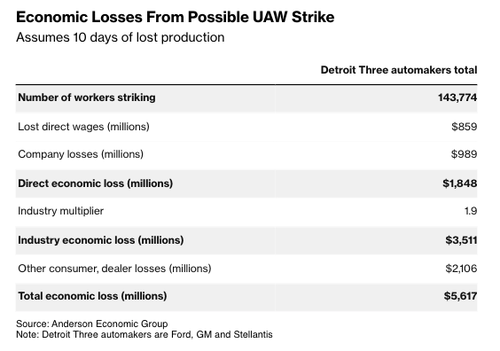

Bloomberg cited new data from economic consultancy Anderson Economic Group that showed just ten days of strikes at General Motors, Ford, and Stellantis factories could reduce US gross domestic product by $5.6 billion and quickly spiral Michigan’s economy into a recession.

“If we were to have a long strike in 2023, the state of Michigan and parts of the Midwest would go into a recession,” said Patrick Anderson, chief executive officer of Anderson Economic.

Anderson said, “When GM workers went on strike in 2019, you saw gross state product drop in Michigan in the fourth quarter, while in the rest of the country it was largely unaffected. That won’t be the case this time if the UAW goes through on its threat to strike all three companies.”

Here’s Anderson Economic’s economic loss forecast for a ten-day strike:

Any such labor action could be bad news for car buyers as it would cause some models to soar in price due to scarcity issues. However, the walkout could send key commodity prices lower, especially hot-rolled steel.

Charlie Chesbrough, senior economist at Cox Automotive, said major automakers have about 58 days’ worth of inventory. He said, “I don’t know that a couple of weeks would have a noticeable impact in the marketplace.”

Chesbrough said it would be a different story if the strike “goes on for a couple of months,” indicating supply chain snarls as ones experienced during Covid could reemerge.

What became evident last week is that the labor contract offers from all three automakers to UAW fell significantly short of the union leader’s demands. UAW President Shawn Fain described GM’s labor contract proposal as “insulting.”

The only issue with unions demanding higher wages, and some even succeeding, such as UPS Teamsters locking in a handsome contract for their delivery drivers, comes when the Federal Reserve is trying to cool inflation. And if unions get what they want, this will make the Fed’s job even harder.