The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

August 31, 2023

Recticel Half Year Results 2023

Regulated information, Brussels, 31/08/2023 — 06:59 CET, 31.08.2023

- Net sales decrease from € 287.2 million in 2022 to € 266.1 million (-7.4%) in 2023

- Adjusted EBITDA: from € 31.7 million to € 18.2 million (-42.6%)

- Result of the period (share of the Group): from € 34.6 million to € 2.2 million

- Net cash position: € 142.3 million (31 December 2022: net financial debt of € 250.0 million; 30 June 2022: net financial debt of € 256.2 million)

- Agreement reached on the divestment of the 33% share in Orsa Foam

Sales and profits have been disappointing in the first half of 2023. Recticel is entirely dependent on the European construction markets, which have remained very challenging in most segments and countries during the period. In the residential markets, new build and renovation activities have been seriously impacted by a combination of high inflation and interest rate increases, weighing on disposable income. In the industrial and commercial markets, fewer projects were launched and some have been postponed. These market trends have been observed in most European countries, with the notable exception of France, which has remained quite dynamic.

As a consequence of these subdued markets, our volumes have been lower year-on-year by more than 15%, in a context of substantial competition leading to price deflation and pressure on margins.

After the closing of the Engineered Foams divestment to Carpenter on 12 and 13 June 2023, and the subsequent € 142.3 million net cash position, several acquisition opportunities are being pursued and progressing well, which will enhance our market and segment positions in Europe.

OUTLOOK

Input costs of chemicals, steel, and to a lesser extent mineral wool have decreased, which should create the conditions for volume growth going forward. Although still volatile, we see improvements in the demand, particularly in Insulated Panels.

In this context, we expect our full year 2023 Adjusted EBITDA to reach between € 40 and 45 million.

https://www.recticel.com/recticel-half-year-results-2023.html

August 31, 2023

European Auto Sales Rose 17% In July, Marking 12th Consecutive Month Of Gains

by Tyler Durden

Thursday, Aug 31, 2023 – 04:15 AM

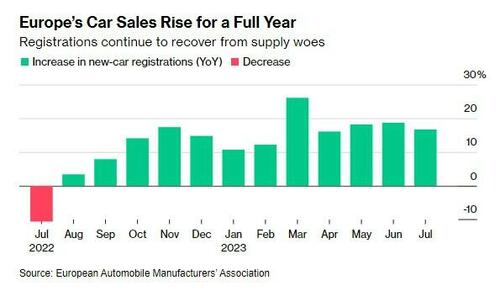

European vehicle sales are going to be on watch heading into the back half of the week after automobile sales in Europe rose for the 12th consecutive month in July, Bloomberg reported this morning.

Germany, France and Spain all saw double digit growth for the month, the report says. In sum, registrations of new cars were up 17% to 1.02 million vehicles, the report says, citing data from the European Automobile Manufacturers’ Association.

Volkswagen sold the most passenger cars in the region with 280,294 registrations, up 19% from a year prior. Buyers in Germany saw the biggest YOY rise, with 48,682 cars sold in July, up 69% from 2022.

Battery electric cars led the charge across Europe, rising 62%, at the same time sales of diesel models fell 9%.

As we have reported, Tesla’s Model Y was the best selling vehicle in Europe in the first half of the year, but manufacturers like Volkswagen AG, Stellantis NV and BMW AG are setting up to challenge the EV maker’s dominance with new model releases in the second half of the year.

Several of these models are expected to debut at next week’s IAA car show in Munich, Bloomberg wrote.

After battling through endless supply chain challenges and dealing with a semiconductor shortage as a result of the pandemic, automakers are finally seeing operations resemble a return to normal in 2023.

However, new challenges for the industry include a worldwide rising cost of living and higher borrowing costs, with Central Banks hiking interest rates far higher than during the pandemic.

https://www.zerohedge.com/markets/european-auto-sales-rise-17-july

August 31, 2023

Recticel announces the departure of Olivier Chapelle as CEO and appoints Jan Vergote as new CEO

Occasional information, Brussels, 31/08/2023 — 06:50 CET, 31.08.2023

After the finalisation of the transformation of Recticel in a pure insulation player, the Board of Directors and Olivier Chapelle have agreed that after 13 years at the helm of Recticel, the timing was ideal to pass the torch to a new CEO, who would lead the next phase of expansion of the Company. Olivier Chapelle and the Board of Directors have aligned on a handover, to begin on 1 September 2023, with Jan Vergote who succeeds him. Jan Vergote will resign from all his operational functions at Baltisse Group.

Johnny Thijs, Chairman: “In the name of the Board of Directors, I wish to thank Olivier Chapelle wholeheartedly for having successfully transformed Recticel under difficult circumstances. The company can now fully focus on its next phase of expansion as a pure insulation player. The successor of Olivier, Jan Vergote, has accumulated a lot of experience as Managing Director and CEO in several European and international companies, active in the construction industry. He brings the experience needed to realize our ambitious growth targets.”

August 30, 2023

Cheniere and BASF sign long-term LNG sale and purchase agreement

MOSCOW (MRC) — Cheniere Energy Inc, announced that Cheniere’s subsidiary, Cheniere Marketing LLC, has entered into a long-term liquefied natural gas sale and purchase agreement with BASF, said the FT.

Under the SPA, BASF has agreed to purchase up to approximately 0.8 million tonnes per annum of LNG from Cheniere Marketing on a free-on-board basis for a purchase price indexed to the Henry Hub price, plus a fixed liquefaction fee. Deliveries will commence in mid-2026 and, subject to a positive Final Investment Decision with respect to the first train of the Sabine Pass Liquefaction Expansion Project in Louisiana, will increase to approximately 0.8 mtpa upon the start of commercial operations of Train Seven. The term of the SPA extends through 2043.

“We are pleased to enter into this long-term relationship with BASF, a global leader in the chemical industry,” said Anatol Feygin, Cheniere’s Executive Vice President and Chief Commercial Officer. “This SPA demonstrates the critical role US natural gas plays in providing long-term secure, sustainable and affordable energy for Europe. With this agreement, we are supporting the objectives of one of Europe’s key industrial end-use consumers to ensure stability of its supply chain.”

“By establishing our own dedicated LNG supply chain with Cheniere, we are diversifying our energy and raw materials portfolio at a time of critical changes in the European gas market, which is marked by increased demand and volatile prices for LNG,” said Dr. Dirk Elvermann, BASF’s Chief Financial Officer. “While we are reducing our dependence on fossil fuels to reach our goal of net zero CO2 emissions by 2050, this agreement will ensure reliable supply of natural gas at competitive terms.”

The SPL Expansion Project is being developed for up to approximately 20 mtpa of total LNG capacity. In May 2023, certain subsidiaries of Cheniere Energy Partners, L.P. (NYSE American: CQP) entered the pre-filing review process with respect to the SPL Expansion Project with the Federal Energy Regulatory Commission under the National Environmental Policy Act.

We remind, BASF, Huntsman and their Chinese partners in the joint venture Shanghai Lianheng Isocyanate Co (SLIC) complete the planned separation of their joint MDI production in Caojing. The two MDI (diphenylmethane diisocyanate) plants at the Caojing site in China will be operated independently by the two companies in the future. Huntsman, together with Shanghai Chlor-Alkali Chemical, and BASF, together with Shanghai Hua Yi (Group company) and Sinopec Shanghai Gaoqiao Petrochemical, will each take over one of the MDI plants.

https://www.mrchub.com/news/409100-cheniere-and-basf-sign-long-term-lng-sale-and-purchase-agreement

August 29, 2023

China PMDI Imports and Exports in July 2023

PUdaily | Updated: August 29, 2023

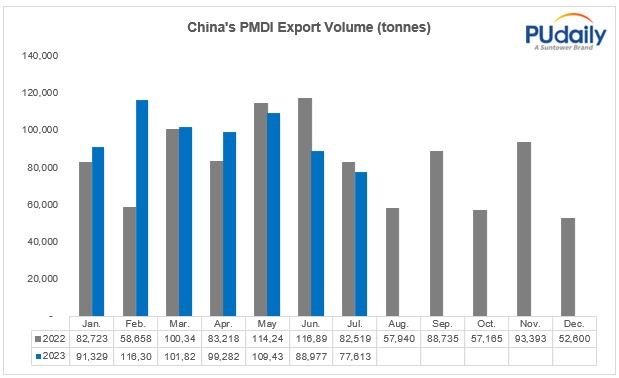

PMDI Export

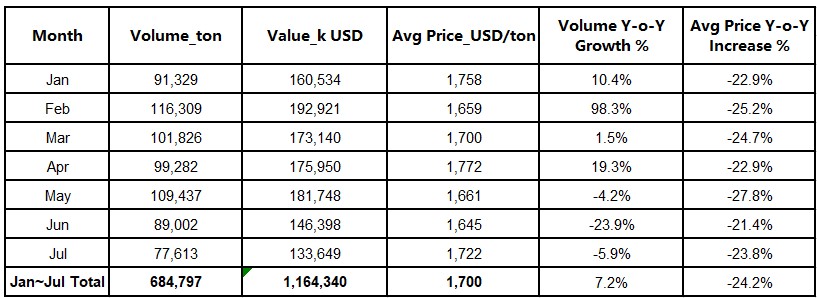

China’s PMDI exports totaled 77.6 thousand tonnes in July 2023, experiencing a month-on-month decrease of 12.8% and a year-on-year decrease of 5.9%, according to the latest data from China Customs. From January to July 2023, China’s cumulative exports of PMDI reached 684.8 thousand tonnes, which showed a year-on-year increase of 7.2% compared to the same period last year.

The average exporting price of PMDI in this July was USD 1,722/tonne, which represents a year-on-year decrease of 23.8%, but increased by 4.7% from the price in this June.

China PMDI Export Volume, Value & Avgerage Exporting Price from January to July 2023

By region, the United States was the largest destination for China’s PMDI exports from this January to July. The cumulative export volume of PMDI from China to the United States during this period reached 162 thousand tonnes, with a year-on-year growth of 2.8% but a month-on-month decrease of 31.6%. Besides, during the same period, the total volume of PMDI imported from China to countries of Belt and Road Initiative (BRI) reached 287 thousand tonnes, showing a year-on-year growth of 34.5%. (Note: As of January 6, 2023, China had signed over 200 cooperation documents with 151 countries and 32 international organizations under the BRI framework. BRI countries are important markets for China’s export trade.)

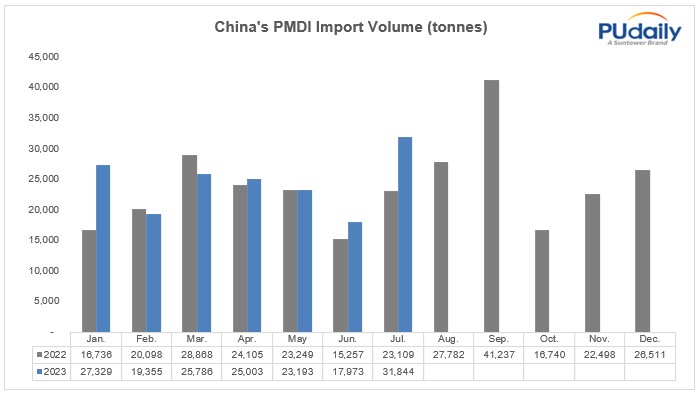

PMDI Import

China’s imports of PMDI (including crude MDI) totaled 31.8 thousand tonnes in July 2023, showing a month-on-month growth of 77.2% and a year-on-year growth of 37.8%. The month-on-month growth was mainly due to the recovery of imports from Saudi Arabia and Japan, reaching the normal levels seen in previous months. From January to July 2023, the cumulative imports of PMDI in China reached 170.6 thousand tonnes, representing a year-on-year increase of 12.6% compared to the same period last year.

In July, China imported 13.3 thousand tonnes of PMDI from Saudi Arabia, which has returned to normal levels. Imports of PMDI and crude MDI from Japan reached 9 thousand tonnes, showing a month-on-month growth of 89.0%. This increase was mainly due to the completion of maintenance at Tosoh Japan, resulting in the recovery of supply. However, during the same period, China imported 7 thousand tonnes of PMDI from South Korea, experiencing a month-on-month decrease of 8.3%.