The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

October 6, 2020

Dry Bulk Shipping Rates Just Hit A New 2020 High

by Tyler Durden Tue, 10/06/2020 – 13:25

By Greg Miller, senior editor at FreightWaves,

More ocean shipping signals are flashing green. First came a recovery in the container sector, driven by surging U.S. consumer demand. Now comes a rebound in dry bulk, the world’s largest freight market in terms of volume.

Rates for large bulkers known as Capesizes — ships carrying iron ore and coal that have a capacity of around 180,000 deadweight tons (DWT) — just hit year-to-date highs, driven primarily by industrial demand.

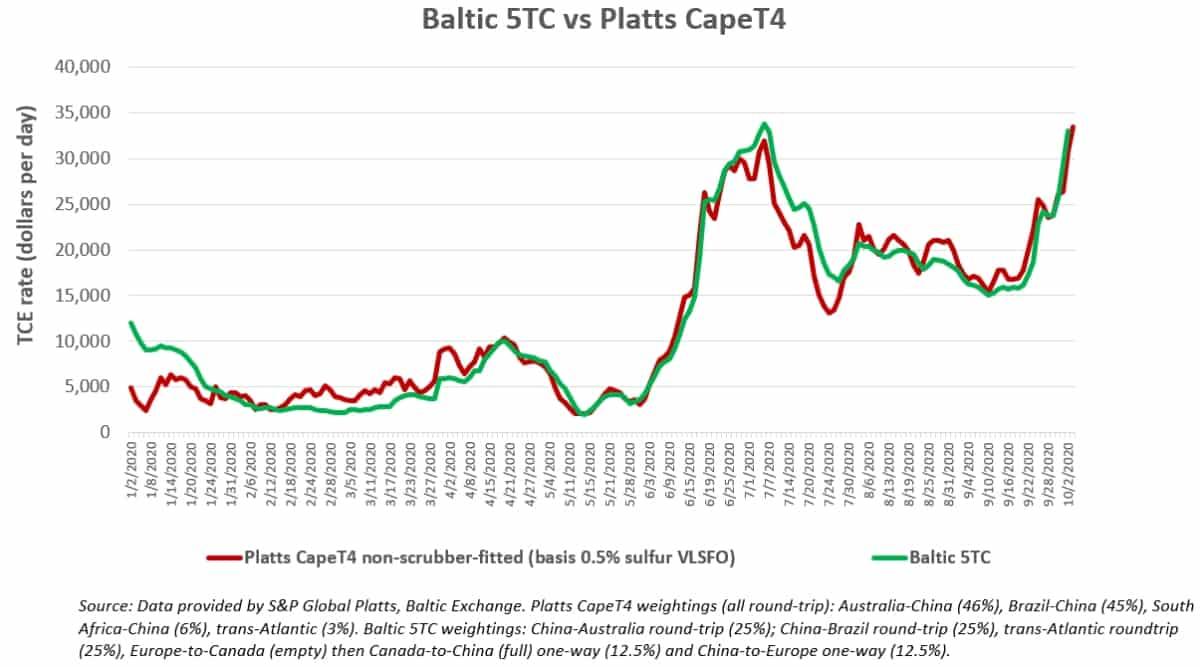

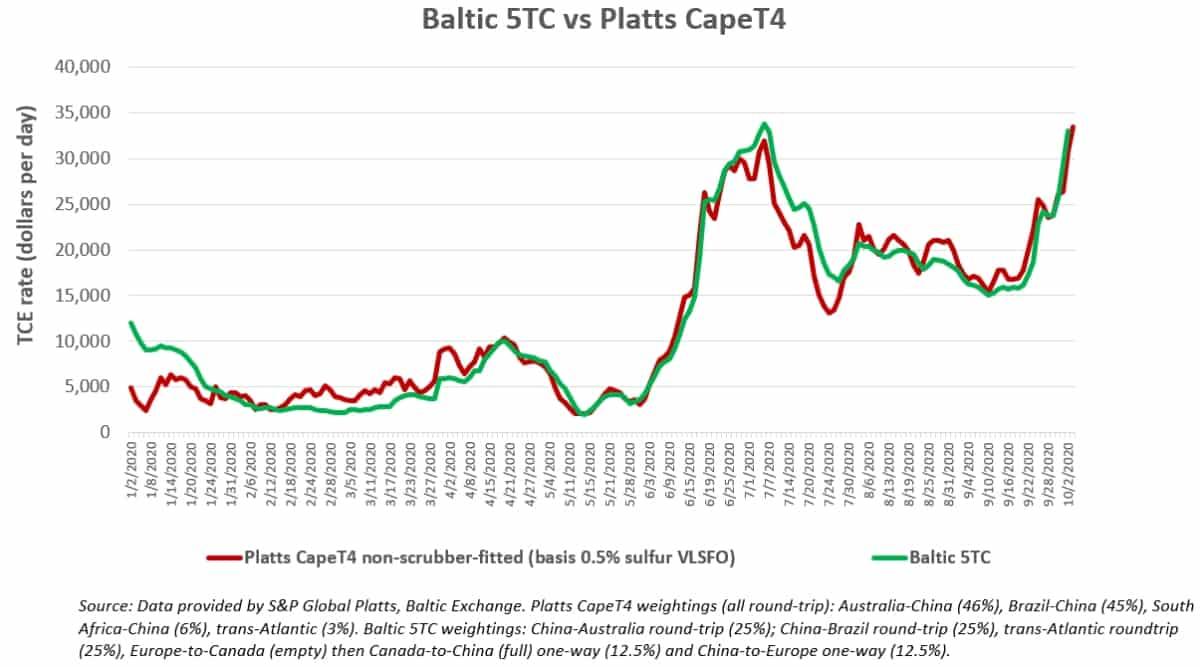

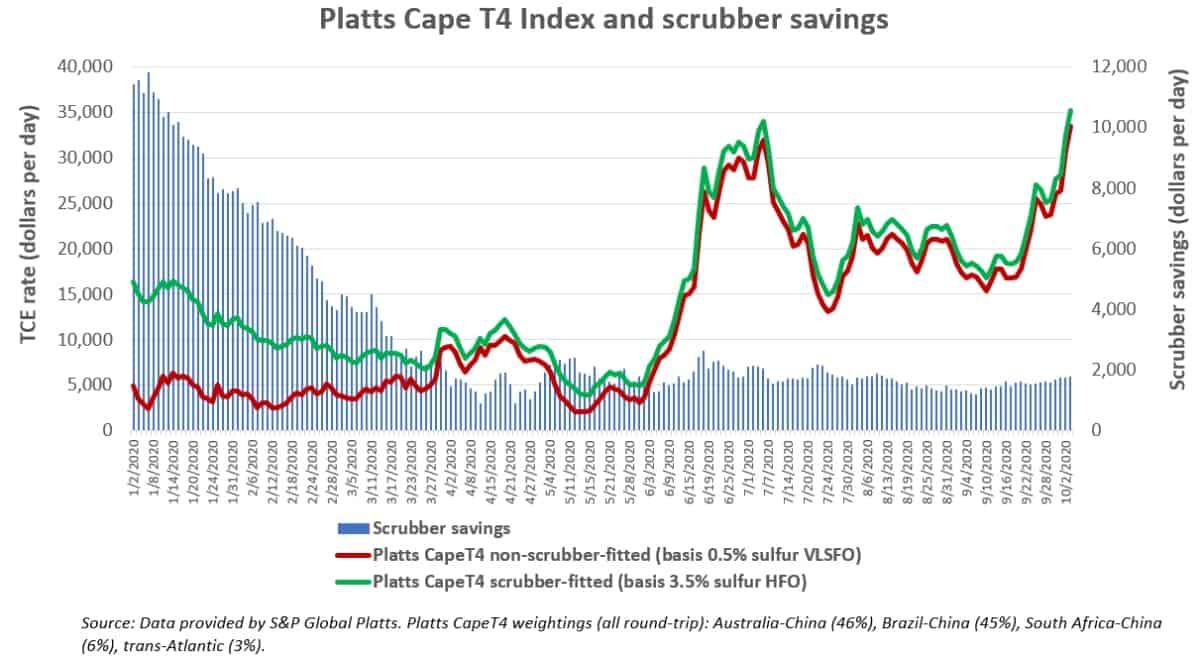

The Baltic Exchange’s 5TC index assessed Monday’s time-charter equivalent (TCE) rates for Capesizes burning 0.5% sulfur fuel at $34,293 per day. That’s up a whopping 127% month-on-month, marking the highest daily average since Sept. 23, 2019, and a year-on-year rise of 45%. Similarly, the Platts CapeT4 index assessed Monday’s rates for Capesizes burning 0.5% sulfur fuel at $33,438 per day.

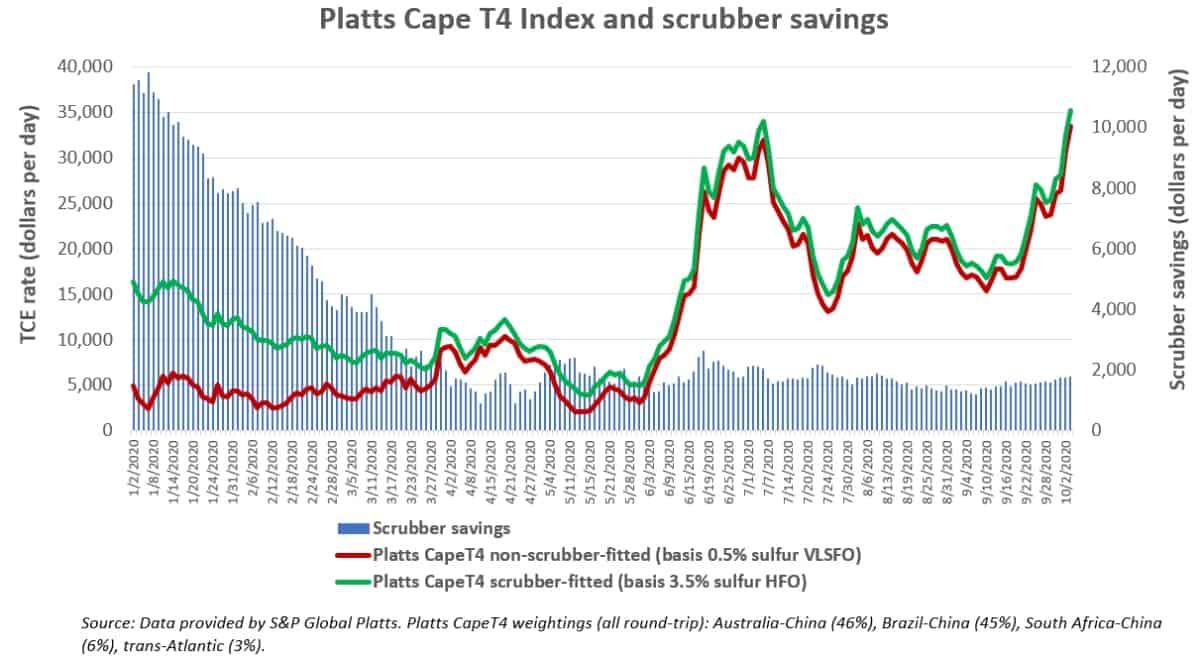

Platts also assesses rates for Capes that use exhaust-gas scrubbers and burn 3.5% sulfur heavy fuel oil. Due to much-slimmer-than-expected fuel spreads in the wake of the coronavirus, scrubber-equipped Capes currently save just under $1,800 per day. That brought scrubber Capes’ TCE rate to $35,253 per day.

Capesize rate drivers

Capesize rates are largely driven by iron ore volumes from Australia and Brazil and the extent that exports from those two sources match up (or not) with vessel tonnage positioned in the Atlantic and Pacific basins.

“The Cape index has been very strong on a lack of tonnage in the Atlantic,” Nick Ristic, lead dry cargo analyst at Braemar ACM Shipbroking, told FreightWaves. “Brazilian charterers have been extremely busy over the last couple of weeks covering October volumes, while shipments have jumped. Daily shipments from Brazil over the past seven days averaged 1.25 million [metric] tons per day, up 18% over the previous 10 days.”Brazilian iron-ore operations (Photo: Vale)

And it’s not all about Brazil and the country’s giant iron-ore miner, Vale (NYSE: VALE). According to Clarksons Platou Securities analyst Frode Mørkedal, “During the July-September period a good amount of Australian cargoes were removed from the market due to normal seasonal maintenance on the part of the large iron ore miners. But higher volumes have now returned to the market.”

Regardless of whether the iron ore is coming from Brazil or Australia, the demand driver is Chinese steel production. “Iron-ore demand from China continues to boom,” affirmed S&P Global Platts.

Sub-Cape vessel classes

Rates for smaller bulkers — which unlike Capes have high exposure to grain transport — have yet to follow the Capes’ lead.

The rates for Panamaxes (60,000-95,000 DWT) are only $12,400 per day, down 17% year-on-year, according to Clarksons. Rates for Supramaxes (45,000-60,000 DWT) are $10,900 per day, down 19% year-on-year.

Asked about the smaller bulker classes, Ristic told FreightWaves, “We are fairly positive on grain trades in the fourth quarter. U.S. soybean volumes are picking up, Brazilian corn shipments remain strong and Ukrainian corn exports are about to kick off.”

On the downside, “seriously depressed coal volumes globally are keeping some pressure on Panamax earnings.”

On the upside, Capesize strength should trickle down. “If high Cape rates are sustained, Panamaxes will naturally follow as Cape stems will start to be split,” said Ristic. A “stem” is a shipper’s quantity of cargo. Shippers will split a Capesize cargo into two Panamax cargoes if it’s cheaper to do so.

S&P Global Platts reported Monday that charterers are already starting to split Atlantic Basin Capesize cargoes into smaller stems.

Dry bulk stocks to bounce?

Shipping stock performance has diverged over the past three months. Tanker stocks have languished near their year-to-date lows, battered by storage-destocking headwinds. In contrast, container-ship leasing stocks have risen sharply over recent weeks, playing catch-up with already recovered charter rates. Will dry bulk stocks now bounce as rates rise?

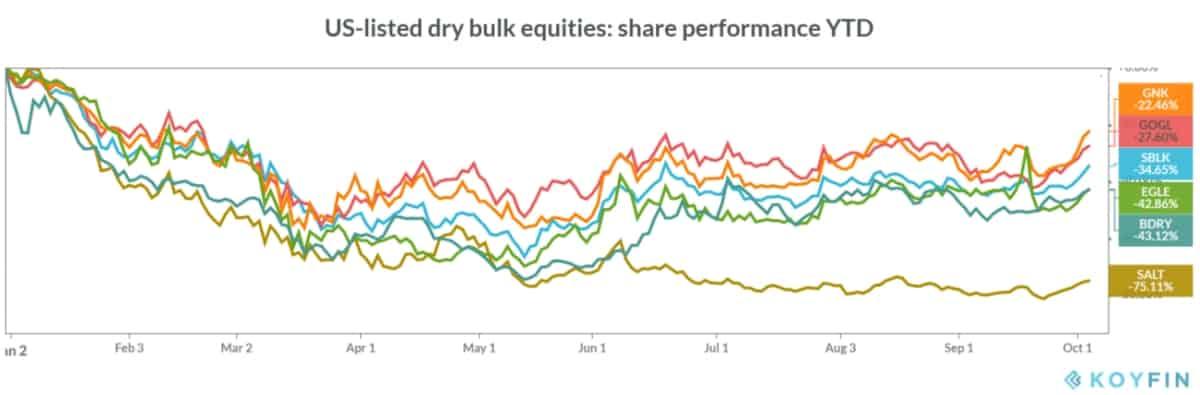

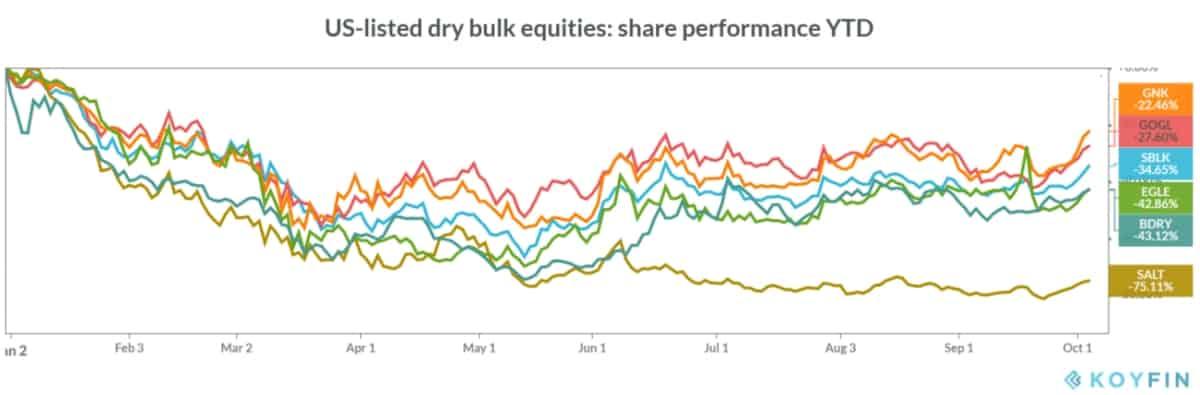

Stocks with high Capesize exposure include Star Bulk, Golden Ocean and Genco Shipping & Trading. Dry bulk stocks with high exposure to smaller asset classes include Scorpio Bulkers and Eagle Bulk. In addition, the Breakwave Dry Bulk Shipping Exchange Traded Fund buys freight futures to offer investors more direct exposure to rates.

These equities have been rising over the past week, however, with one exception they are still down 22%-43% year-to-date. (The outlier is Scorpio Bulkers, which is doing far worse: down 75%.)

When will rates retreat?

The problem for dry bulk stocks is that rates will almost certainly retreat in the months ahead. Is fleeting rate strength is enough to entice investors? “Some seem to be wondering how much more juice is left in the cherry [but] don’t be Boo-Boo Bear. There’s more juice. We promise!” wrote a broker at Barry Rogliano Salles.

Looking at the forward curve, Cape futures for the month of October rose to $28,553 per day on Monday — a positive sign. That said, December futures fell to $18,672 per day.

As Ristic explained, “Fourth-quarter FFAs [futures] are lower than current earnings and it’s extremely unlikely for these levels to be sustained for months at a time. The longer the current spike is sustained, futures will continue to rally. But if rates start to rapidly fall, the sell-off will likely be even more aggressive than the rally.”

Breakwave Advisors argued in a new blog post that it’s not about where rates peak, it’s about the average. In the past decade, Capesize rates peaked at $42,000 per day in 2013. “It will not be surprising to surpass such levels soon,” Breakwave predicted, acknowledging that rates would then inevitably correct.

Instead of dismissing the current situation as “another short-term spike,” Breakwave advised investors to focus on freight cost relative to the price of a cargo of iron ore or another dry commodity. Looked at this way, the freight cost percentage is now at a seven-year low relative to the cargo price.

Breakwave maintained that this creates room for the freight cost to rise, as the percentage of freight cost relative to the cargo price could revert higher. This could benefit rates over time. And for investors, the average rate over time is what to watch, not press headlines like Monday’s on new highs

https://www.zerohedge.com/commodities/dry-bulk-shipping-rates-hust-hit-new-2020-high

October 6, 2020

Dry Bulk Shipping Rates Just Hit A New 2020 High

by Tyler Durden Tue, 10/06/2020 – 13:25

By Greg Miller, senior editor at FreightWaves,

More ocean shipping signals are flashing green. First came a recovery in the container sector, driven by surging U.S. consumer demand. Now comes a rebound in dry bulk, the world’s largest freight market in terms of volume.

Rates for large bulkers known as Capesizes — ships carrying iron ore and coal that have a capacity of around 180,000 deadweight tons (DWT) — just hit year-to-date highs, driven primarily by industrial demand.

The Baltic Exchange’s 5TC index assessed Monday’s time-charter equivalent (TCE) rates for Capesizes burning 0.5% sulfur fuel at $34,293 per day. That’s up a whopping 127% month-on-month, marking the highest daily average since Sept. 23, 2019, and a year-on-year rise of 45%. Similarly, the Platts CapeT4 index assessed Monday’s rates for Capesizes burning 0.5% sulfur fuel at $33,438 per day.

Platts also assesses rates for Capes that use exhaust-gas scrubbers and burn 3.5% sulfur heavy fuel oil. Due to much-slimmer-than-expected fuel spreads in the wake of the coronavirus, scrubber-equipped Capes currently save just under $1,800 per day. That brought scrubber Capes’ TCE rate to $35,253 per day.

Capesize rate drivers

Capesize rates are largely driven by iron ore volumes from Australia and Brazil and the extent that exports from those two sources match up (or not) with vessel tonnage positioned in the Atlantic and Pacific basins.

“The Cape index has been very strong on a lack of tonnage in the Atlantic,” Nick Ristic, lead dry cargo analyst at Braemar ACM Shipbroking, told FreightWaves. “Brazilian charterers have been extremely busy over the last couple of weeks covering October volumes, while shipments have jumped. Daily shipments from Brazil over the past seven days averaged 1.25 million [metric] tons per day, up 18% over the previous 10 days.”Brazilian iron-ore operations (Photo: Vale)

And it’s not all about Brazil and the country’s giant iron-ore miner, Vale (NYSE: VALE). According to Clarksons Platou Securities analyst Frode Mørkedal, “During the July-September period a good amount of Australian cargoes were removed from the market due to normal seasonal maintenance on the part of the large iron ore miners. But higher volumes have now returned to the market.”

Regardless of whether the iron ore is coming from Brazil or Australia, the demand driver is Chinese steel production. “Iron-ore demand from China continues to boom,” affirmed S&P Global Platts.

Sub-Cape vessel classes

Rates for smaller bulkers — which unlike Capes have high exposure to grain transport — have yet to follow the Capes’ lead.

The rates for Panamaxes (60,000-95,000 DWT) are only $12,400 per day, down 17% year-on-year, according to Clarksons. Rates for Supramaxes (45,000-60,000 DWT) are $10,900 per day, down 19% year-on-year.

Asked about the smaller bulker classes, Ristic told FreightWaves, “We are fairly positive on grain trades in the fourth quarter. U.S. soybean volumes are picking up, Brazilian corn shipments remain strong and Ukrainian corn exports are about to kick off.”

On the downside, “seriously depressed coal volumes globally are keeping some pressure on Panamax earnings.”

On the upside, Capesize strength should trickle down. “If high Cape rates are sustained, Panamaxes will naturally follow as Cape stems will start to be split,” said Ristic. A “stem” is a shipper’s quantity of cargo. Shippers will split a Capesize cargo into two Panamax cargoes if it’s cheaper to do so.

S&P Global Platts reported Monday that charterers are already starting to split Atlantic Basin Capesize cargoes into smaller stems.

Dry bulk stocks to bounce?

Shipping stock performance has diverged over the past three months. Tanker stocks have languished near their year-to-date lows, battered by storage-destocking headwinds. In contrast, container-ship leasing stocks have risen sharply over recent weeks, playing catch-up with already recovered charter rates. Will dry bulk stocks now bounce as rates rise?

Stocks with high Capesize exposure include Star Bulk, Golden Ocean and Genco Shipping & Trading. Dry bulk stocks with high exposure to smaller asset classes include Scorpio Bulkers and Eagle Bulk. In addition, the Breakwave Dry Bulk Shipping Exchange Traded Fund buys freight futures to offer investors more direct exposure to rates.

These equities have been rising over the past week, however, with one exception they are still down 22%-43% year-to-date. (The outlier is Scorpio Bulkers, which is doing far worse: down 75%.)

When will rates retreat?

The problem for dry bulk stocks is that rates will almost certainly retreat in the months ahead. Is fleeting rate strength is enough to entice investors? “Some seem to be wondering how much more juice is left in the cherry [but] don’t be Boo-Boo Bear. There’s more juice. We promise!” wrote a broker at Barry Rogliano Salles.

Looking at the forward curve, Cape futures for the month of October rose to $28,553 per day on Monday — a positive sign. That said, December futures fell to $18,672 per day.

As Ristic explained, “Fourth-quarter FFAs [futures] are lower than current earnings and it’s extremely unlikely for these levels to be sustained for months at a time. The longer the current spike is sustained, futures will continue to rally. But if rates start to rapidly fall, the sell-off will likely be even more aggressive than the rally.”

Breakwave Advisors argued in a new blog post that it’s not about where rates peak, it’s about the average. In the past decade, Capesize rates peaked at $42,000 per day in 2013. “It will not be surprising to surpass such levels soon,” Breakwave predicted, acknowledging that rates would then inevitably correct.

Instead of dismissing the current situation as “another short-term spike,” Breakwave advised investors to focus on freight cost relative to the price of a cargo of iron ore or another dry commodity. Looked at this way, the freight cost percentage is now at a seven-year low relative to the cargo price.

Breakwave maintained that this creates room for the freight cost to rise, as the percentage of freight cost relative to the cargo price could revert higher. This could benefit rates over time. And for investors, the average rate over time is what to watch, not press headlines like Monday’s on new highs

https://www.zerohedge.com/commodities/dry-bulk-shipping-rates-hust-hit-new-2020-high

October 6, 2020

China September chemicals buoyed by firm demand, supply pressure

Author: Yvonne Shi

2020/10/06

SINGAPORE (ICIS)–China’s chemical markets in September were generally buoyed up by firm demand due to pre-holiday restocking and tight supply for some products.

Twenty of the 33 petrochemicals tracked by the ICIS China team had price increases in September from August, eight of which rose by more than 10% with the strongest growth logged by propylene oxide (PO) at 37%.

Thirteen products posted price declines, five of which had more than a 5% slump.

PO is included in the 17 products that comprise the ICIS China Petrochemical Index.

The others are methanol, purified terephthalic acid (PTA), polypropylene (PP), polyethylene (PE), monoethylene glycol (MEG), mixed xylene, benzene, toluene, acetic acid, styrene, phenol, acrylonitrile, acetone, n-butanol, 2-ethylhexanol (2-EH) and acrylic esters.

The index spiked in early September, with some narrow fluctuations noted until some weakness set in toward the end of the month.

Spot prices of PO, methyl methacrylate (MMA), n-butanol and bisphenol-A (BPA) rose on the back of healthy demand; while those of butadiene (BD), vinyl acetate monomer (VAM) and acetic acid increased largely due to tight availability of supply.

External market conditions have had some influence on products such as acetic acid and VAM, as well as BD.

China’s exports of acetic acid and VAM were strong in September, while imports of BD was curtailed by tight regional supply.

Unplanned domestic plant shutdowns have tightened supply of some products in September, but market players are generally concerned about a possible oversupply when four integrated petrochemical complexes in the country start up toward the fourth quarter.

Some of the key downstream plants of Zhongke Refinery and Petrochemical and Sinochem Quanzhou, including PE, PP and MEG came on stream in end-September, with commercial production expected in October.

In terms of demand, pre-holiday restocking was a bright spot for September, providing a short-term support for some products like MMA.

MMA demand was up by about 15% from normal levels in September before waning, closer to the October holidays.

The Chinese markets are closed for the Mid-Autumn and National Day celebrations on 1-8 October.

In the fourth quarter, peak domestic travel during the long holiday, as well as consumption-boosting events such as the Double Eleven (11 November) and year-end promotions should help buoy up demand for petrochemicals.

Economic data in September were encouraging, with the manufacturing purchasing managers’ index (PMI) on its seventh month of expansion.

China’s retail sales in September also posted growth for the first time this year, led by communication equipment, cosmetics, and goods related to sports and entertainment as well as cultural and office supplies.

September retail sales inched up by 0.5% year on year, from a 1.1% contraction in August.

China’s total consumption of goods and services in the two weeks to 27 September increased by 7.4%, based on data from a third-party payment platform.

Seasonal demand with the onset of winter should help the apparel and textiles sector but this is not expected to be as strong as in the previous years.

Textile raw materials PTA and MEG had the steepest price falls in September.

For methyl tertiary butyl ether (MTBE), xylene and mixed aromatics, blending demand will be constrained by weaker consumption of downstream gasoline at the end of the summer season.

An expected improvement in construction and agricultural farming activity should boost diesel consumption.

Market players are hopeful of more stimulus policies as consumption, although improving, is far from pre-pandemic levels.

Analysis by Yvonne Shi

October 6, 2020

China September chemicals buoyed by firm demand, supply pressure

Author: Yvonne Shi

2020/10/06

SINGAPORE (ICIS)–China’s chemical markets in September were generally buoyed up by firm demand due to pre-holiday restocking and tight supply for some products.

Twenty of the 33 petrochemicals tracked by the ICIS China team had price increases in September from August, eight of which rose by more than 10% with the strongest growth logged by propylene oxide (PO) at 37%.

Thirteen products posted price declines, five of which had more than a 5% slump.

PO is included in the 17 products that comprise the ICIS China Petrochemical Index.

The others are methanol, purified terephthalic acid (PTA), polypropylene (PP), polyethylene (PE), monoethylene glycol (MEG), mixed xylene, benzene, toluene, acetic acid, styrene, phenol, acrylonitrile, acetone, n-butanol, 2-ethylhexanol (2-EH) and acrylic esters.

The index spiked in early September, with some narrow fluctuations noted until some weakness set in toward the end of the month.

Spot prices of PO, methyl methacrylate (MMA), n-butanol and bisphenol-A (BPA) rose on the back of healthy demand; while those of butadiene (BD), vinyl acetate monomer (VAM) and acetic acid increased largely due to tight availability of supply.

External market conditions have had some influence on products such as acetic acid and VAM, as well as BD.

China’s exports of acetic acid and VAM were strong in September, while imports of BD was curtailed by tight regional supply.

Unplanned domestic plant shutdowns have tightened supply of some products in September, but market players are generally concerned about a possible oversupply when four integrated petrochemical complexes in the country start up toward the fourth quarter.

Some of the key downstream plants of Zhongke Refinery and Petrochemical and Sinochem Quanzhou, including PE, PP and MEG came on stream in end-September, with commercial production expected in October.

In terms of demand, pre-holiday restocking was a bright spot for September, providing a short-term support for some products like MMA.

MMA demand was up by about 15% from normal levels in September before waning, closer to the October holidays.

The Chinese markets are closed for the Mid-Autumn and National Day celebrations on 1-8 October.

In the fourth quarter, peak domestic travel during the long holiday, as well as consumption-boosting events such as the Double Eleven (11 November) and year-end promotions should help buoy up demand for petrochemicals.

Economic data in September were encouraging, with the manufacturing purchasing managers’ index (PMI) on its seventh month of expansion.

China’s retail sales in September also posted growth for the first time this year, led by communication equipment, cosmetics, and goods related to sports and entertainment as well as cultural and office supplies.

September retail sales inched up by 0.5% year on year, from a 1.1% contraction in August.

China’s total consumption of goods and services in the two weeks to 27 September increased by 7.4%, based on data from a third-party payment platform.

Seasonal demand with the onset of winter should help the apparel and textiles sector but this is not expected to be as strong as in the previous years.

Textile raw materials PTA and MEG had the steepest price falls in September.

For methyl tertiary butyl ether (MTBE), xylene and mixed aromatics, blending demand will be constrained by weaker consumption of downstream gasoline at the end of the summer season.

An expected improvement in construction and agricultural farming activity should boost diesel consumption.

Market players are hopeful of more stimulus policies as consumption, although improving, is far from pre-pandemic levels.

Analysis by Yvonne Shi

October 5, 2020

NACD Weighs In On the Chemicals and Coatings Markets

October 5, 2020 Eric Byer

The National Association of Chemical Distributors (NACD) is an international association based in Arlington, Virginia, with a membership comprising nearly 430 chemical distribution companies and their supply chain partners. NACD members represent more than 85 percent of the chemical distribution capacity in the nation and generate 93 percent of the industry’s gross revenue.

The organization’s members, operating in nearly every U.S. state through approximately 3,400 facilities, are responsible for more than 26,000 direct jobs in the U.S. Collectively, the distribution industry is responsible for almost 137,000 direct and indirect jobs. Chemical distributors in the U.S. are predominantly small regional businesses, many of which are family owned and multigenerational – on average having 30 employees and operating under extremely low margins.

PCI recently talked to Eric R. Byer, President and CEO of NACD, about the effect the global pandemic has had on chemical distributors, the outlook for the coatings market, and current legislation that the NACD is actively involved in to protect the chemicals industry.

PCI: How has the COVID-19 pandemic affected chemical distributors specifically, and what have they done to respond?

Byer: Fortunately, the chemical distribution industry has, by and large, fared much better than other sectors of the U.S. economy due to our essential link in commercial and industrial supply chains, and our ability to distribute much-needed products to combat the Coronavirus, like sterilizers needed for medical equipment, cleansers consumers use in their homes, hand sanitizer, and even personal protective equipment for first responders.

Nevertheless, like most of the world, the U.S. economy and the chemical distribution industry have not been immune to the ill effects COVID-19 has flung upon the globe. In terms of the broader United States, Gross Domestic Product fell five percent in the first quarter of 2020, and some estimate it fell by as much as 35 percent in the second quarter. Unless there is a dramatic improvement in growth over the remaining two quarters of the year, it is very likely the U.S. economy will have contracted for the first time since 2009.

The U.S. chemical sector has been able to weather the health and economic crisis better, but it still has had its share of troubles. Since February, employment has been down 2.1 percent – a fraction of what other industries like entertainment and hospitality have faced, but still concerning given the number of high-skilled jobs the industry needs to perform well. Chemical production is down 12 percent from this time last year, but the good news is shipments are up 2.3 percent in the last five months. And again, since February, prices are down 5.6 percent. However, wages have been holding steady, meaning that profit margins have been absorbing most of the price drop.

Most of the major industries that are users of chemicals have seen a large drop-off in demand. One particularly bright spot for chemical distributors has been the sale of isopropyl alcohol (IPA). Beginning in March, demand surged for IPA both here in the United States and globally due to its use in hand sanitizers and cleaning agents. Many NACD members store IPA as a “rainy day fund” of sorts, and have been able to draw upon those reserves to boost their sales when demand for other products has fallen off. Prices for IPA spiked across the globe to historically high levels this spring, and while they remain historically high, they are starting to come down slowly from their peak levels. This increase in demand and prices has been a key lifeline for NACD members that have been able to tap into that product market during the COVID-19 crisis.

Chemical distributors were deemed essential businesses during the pandemic and able to continue doing business serving their customers in paints, coatings and many other industries. They continued to take the safety and security of their operations, their employees, and their communities seriously – thanks to NACD Responsible Distribution®, NACD’s mandatory third-party-verified environmental, health, safety and security program. Throughout this entire health crisis, NACD members have taken steps to limit the spread of COVID-19 within their ranks. Most have allowed front office employees to work remotely when possible. For staff that are needed onsite, companies have instituted social distancing practices and daily temperature checks, restricted visitors from entering their facilities, provided PPE to workers, and undergone daily facility cleanings, among other strategies.

PCI: Have the partnerships between distributors and their principals been a benefit to the industries they serve throughout the pandemic? If so, how?

Byer: We saw many examples of the benefit of the close relationship between chemical distributors, their suppliers and their customers. Many were able to help each other obtain access to critical PPE when it wasn’t available from their regular providers. Additionally, many chemical distributors were able to become essential suppliers of hand sanitizer in volume to those companies who needed it for their operations and employees, as well as keeping product moving through the supply chain to keep customers’ businesses up and operating during the pandemic.

PCI: How has “virtual” business and learning been a factor throughout the pandemic?

Byer: Until recently, chemical producers and distributors have been slower to adopt to new opportunities posed by digital tools and technologies than some other industries such as banking and manufacturing that have streamlined operations and improve productivity as a result of digitalization.

However, opinions are changing, and chemical distributors are becoming far more aware of the benefits of investing and innovating in the digital space, especially in light of the COVID-19 pandemic. There are several platforms in the marketplace that have helped distributors launch their own branded e-commerce portals and supplement existing sales channels.

Shifting demographics are also driving change. A significant proportion of those working in the chemical industry are expected to retire in the next five years, and the younger generation entering the workforce are bringing with them a better understanding of how these new technologies work. Many of these systems offer distributors and manufacturers/customers with a closed B-to-B network offering a simple-to-use, secure way to buy and sell chemicals.

Beyond these sales platforms, chemical distributors have been engaging in many on-line webinars, workshops and conferences through NACD to continue to invest in their employees and meet their training and compliance needs. The Association’s online training platform, NACD U, offers the industry over 200 courses on safety, security, operations and Responsible Distribution at low cost.

PCI: What is your outlook for the coatings industry in the short and long term?

Byer: The paint and coatings industry is one of the key customers for NACD members. Based on data from the Bureau of Economic Analysis (BEA), more than $27.00 of every $100 of paints and coatings produced in the United States consists of chemicals like industrial gases, basic organic/inorganic chemicals, and resins used by paint manufacturers in their production process. This figure compares with the 20.6 percent of the overall cost of paints and coatings going to wages and benefits for company workers.

Considering that about $40.3 billion worth of paints and coatings were produced in the United States last year, this is a very important segment for the chemical distribution industry, with over $11.2 billion worth of chemical products purchases.

Paint and coatings sales have been relatively flat over the past few years. According to the Bureau of Economic Analysis, paint and coatings manufacturers’ sales are up by just 5.8 percent, for a compound annual growth rate of 0.3 percent per year, which is well below the 2.2 percent growth in the overall economy during the same period.

Interestingly, the growth in paint and coatings sales has not kept pace with new home sales, a major market for such products. Back in 1997, overall paint sales were equivalent to 6.8 percent of the value of every new home sold in America. This does not mean that each home used this much paint, but overall sales for all markets equaled 6.8 percent of the value of every new house. A similar ratio continued up until the recession when it fell to about 4.6 percent, a level that is up to just about 5 percent today (Figure 1). Comparing overall paint sales to overall construction spending, the trend is even more dramatic, and paint as a percent of construction spending has fallen by 26.9 percent.

What this means is that the housing and construction market is less important for paint and coatings sales than it was prior to the 2006/07 recession. According to the American Coatings Association, the largest drivers impacting the coatings industry overall are the rising needs in the construction and automotive sectors, with the architectural segment alone accounting for about half of the market. The trends therefore, are problematic, and may be a big reason why paint and coating sales have not kept up with overall economic activity.

In order to keep up sales, paint and coatings manufacturers will need to develop new markets outside of automotive (which is likely to be impacted by tariffs in the near term) and construction. Again, according to the American Coatings Association, the industrial and specialty purpose segments have contributed to the growth of the paint and coatings market, with demand for products like marine, antimicrobial and corrosion resistant coatings all increasing in recent years.

PCI: What is some of the current legislation that the NACD is actively involved in to protect the chemicals industry?

Byer: As NACD set out our priorities at the beginning of this year, we were hopeful but acknowledged what would likely be a challenging environment in a presidential election year. Then the Coronavirus pandemic hit and turned everything upside down for the chemical distribution industry, our country and the world, and we immediately pivoted to supporting our members through this extraordinary time. NACD established an online Coronavirus Resource Center to keep the industry up to date on the latest developments. We worked closely with the Administration to ensure that chemical distributors were allowed to continue their important work as essential businesses, and we developed guidance for accessing the Paycheck Protection Program (PPP) for those who needed it to weather the pandemic. NACD continues to work to encourage common-sense approaches to taxation and forgiveness of PPP loan dollars.

Fortunately, Congress has also continued its work on important issues beyond COVID-19. Most notably for our industry is reauthorization of the U.S. Department of Homeland Security’s Chemical Facility Anti-Terrorism Standards (CFATS) program, which after several small extensions was reauthorized in July for a three-year period. This program is critical to securing our nation’s chemical facilities against potential acts of terrorism.

Another important issue for the chemical distribution and paint and coatings industry is recent action to designate per- and polyfluoroalkyl substances (PFAS) as hazardous substances. The U.S. Environmental Protection Agency (EPA) already requires comprehensive toxicity testing be conducted on all PFAS under the Toxic Substances Control Act (TSCA) – a move the effectively bars the manufacturing of PFAS of concern. Our industries must be constantly vigilant against efforts to group very different chemicals under a single regulatory umbrella, and we at NACD will continue to closely follow and thoughtfully weigh in on this issue.

Trade is also front and center. Last year, NACD successfully petitioned the Trump administration to exempt hundreds of chemical products from the Section 301 tariffs on imported goods, but the tariffs continue to have an adverse impact on our industry and others. NACD supports the Generalized System of Preferences (GSP) and the Miscellaneous Tariff Bill (MTB) – two programs that effectively reduce the tariff rates on thousands of goods that either cannot be sourced domestically or otherwise would put U.S. businesses at a global disadvantage because of higher import duties – and both require action in 2020. The GSP, which helps the world’s developing countries increase and diversify their trade with the U.S while significantly reducing tariffs on imported raw materials used by chemical distributors and others, must be reauthorized before the end of this year. We’ll be working tirelessly to ensure it remains a priority.

https://www.pcimag.com/articles/107930-nacd-weighs-in-on-the-chemicals-and-coatings-markets