The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

August 13, 2020

Current year-to-date ( YTD ) data is through June 2020.

Imports: Mattresses and other bedding products

Mattresses and other bedding products, the No. 111 import by value totaled $322.55 million for the month of June, $1.84 billion through June of 2020, and $4.29 billion for all of 2019, the latest annual data available, according to U.S. Census Bureau data analyzed by WorldCity. Need more details? Read more

Top Sources

| Rank | Country | YTD |

|---|---|---|

| 1 | China | $850.84 M |

| 2 | Indonesia | $191.79 M |

| 3 | Vietnam | $184.49 M |

| 4 | India | $105.1 M |

| 5 | Mexico | $92.07 M |

| 6 | Malaysia | $82.29 M |

| 7 | Turkey | $60.44 M |

| 8 | Thailand | $51.49 M |

| 9 | Cambodia | $38.47 M |

| 10 | Serbia | $38.32 M |

Top Gateways

| Rank | Port | YTD |

|---|---|---|

| 1 | Port of Los Angeles | $481.32 M |

| 2 | Port of Newark | $212.4 M |

| 3 | Port of Savannah, Ga. | $204.42 M |

| 4 | Port of Long Beach | $165.78 M |

| 5 | Port of Virginia | $108.47 M |

| 6 | Port of Oakland, Calif. | $107.83 M |

| 7 | Port of Charleston | $99.56 M |

| 8 | Port of Tacoma, Wash. | $74.07 M |

| 9 | Port of Houston | $53.06 M |

| 10 | Port of Seattle, Wash. | $51.48 M |

U.S. imports of Mattresses and other bedding products decreased 6.90 percent through June to $1.84 billion

U.S. imports of Mattresses and other bedding products decreased 6.90 percent from $1.97 billion to $1.84 billion through the first six months of 2020 when compared to the same period the previous year, according to WorldCity analysis of the latest U.S. Census Bureau data.

The category ranked 111 through June among the roughly 1,265 import commodity groupings as classified by Census. It ranked No. 114 for the last full year with a total value of $4.29 billion, a $212.11 million, 5.20 percent increase from the 2018 total.

Through June of this year the leading sources were No. 1 China, No. 2 Indonesia, No. 3 Vietnam, No. 4 India and No. 5 Mexico. The leading gateways were No. 1 Port of Los Angeles, No. 2 Port of Newark, No. 3 Port of Savannah, Ga., No. 4 Port of Long Beach and No. 5 Port of Virginia.

In the last previous full year, the leading sources were No. 1 China, No. 2 Mexico, No. 3 India, No. 4 Vietnam and No. 5 Canada. The leading gateways were No. 1 Port of Los Angeles, No. 2 Port of Newark, No. 3 Port of Savannah, Ga., No. 4 Port of Long Beach and No. 5 Port of Oakland, Calif..

Looking at specific airports, seaports and border crossings, the top five through through the first six months of the year were:

Highlights for the top five ports:

- Port of Los Angeles fell 22.15 percent compared to last year to $481.32 million.

- Port of Newark fell 4.55 percent compared to last year to $212.4 million.

- Port of Savannah, Ga. rose 19.52 percent compared to last year to $204.42 million.

- Port of Long Beach rose 35.69 percent compared to last year to $165.78 million.

- Port of Virginia rose 1.92 percent compared to last year to $108.47 million.

There are several hundred airports, seaports and border crossings that handle international trade; they are, in turn, part of the roughly four dozen U.S. Customs districts.

Highlights for the top five foreign markets:

- U.S. imports from No. 1 China decreased $600.28 million, 41.37 percent, (46.3 percent market share).

- U.S. imports from No. 2 Indonesia increased $166.25 million, 650.94 percent, (10.44 percent market share).

- U.S. imports from No. 3 Vietnam increased $125.57 million, 213.14 percent, (10.04 percent market share).

- U.S. imports from No. 4 India decreased $13.57 million, 11.43 percent, (5.72 percent market share).

- U.S. imports from No. 5 Mexico decreased $46.6 million, 33.61 percent, (5.01 percent market share).

All totaled, 77.5 percent of all these Mattresses and other bedding products imports to the United States were shipped from the top five markets through June of this year. That is equal to $1.42 billion of the $1.84 billion total.

All totaled, 63.79 percent of all these Mattresses and other bedding products imports to the United States were shipped to the top five Ports through June of this year. That is equal to $1.17 billion of the $1.84 billion total

August 12, 2020

Toned-down summer furniture market set to start Thursday

- By Dennis Seid Daily Journal

- 6 hrs ago

TUPELO • It’s been seven months since the last major furniture trade show, setting up what should be, under normal circumstances, a pretty good Summer Market at the Tupelo Furniture Market.

But 2020 has been anything but normal.

With the COVID-19 pandemic taking root in March, which led to shutdowns of businesses and schools for weeks, the economy still is trying to recover.

And while there’s been evidence to show consumers are buying again, it will take some time to recover.

So the question confronting the Tupelo Furniture Market, which starts its Summer Market this week, is who will show up?

“It’s shaping up pretty good actually,” said V.M. Cleveland, the chairman of the market. “We’ve had people calling in who haven’t been here in years because their stores are doing well and they can’t get product, so they’re coming here to source their stores.”

Cleveland doesn’t deny that COVID-19 will have an effect on overall attendance, but thinks that the market will perform better than admittedly low expectations.

“We’ve had some last-minute cancellations for various reasons, including some who had a case of coronavirus pop up at their factory,” he said.

Market officials had already consolidated the summer show into just three buildings – four through six – a move that Cleveland had said would happen after the Winter Market in January.

On Tuesday afternoon, with exhibitors getting their show spaces ready, plenty of space was available. Building 6 was about two-thirds filled, and four and five were about half-filled. The market doesn’t officially start until Thursday, so there’s still time for other vendors to arrive.

Affordable Furniture, which has shown at Tupelo since 2005, has a new home in Building 5. But CEO Jim Sneed doesn’t have particularly high expectations for the market.

“We’re going to open on a voluntary basis with our sales reps,” he said. “I have five of 16 reps coming, and we’re not showing anything new. I don’t expect much.”

On the other hand, Dow Canup with Kingston Casual, an outdoor and patio vendor, said this week’s market is the most important one for his company.

“Outdoors is segmented a lot,” Canup said. “High Point and Las Vegas have different looks and their shows aren’t timed well. This show in Tupelo is timed well … January is before the big selling season and August is perfect for those of us who import. So the timing is perfect.”

Kingston also usually shows at an outdoors trade show in Chicago, which is the primary market, but that was cancelled. So the Tupelo market has become all-important.

But business will be a little different, Dow said.

“We have Zoom calls lined up all across the country, from major chain stores to mom-and-pop stores and specialty suppliers,” he said. “We’ve got five full days of Zoom calls lined up. With COVID, it’s just a different year.”

Dow has high expectations for the market, even though only about 60% of his customers who usually come plan to attend in person. Much of the buying will be done through Zoom.

And the outdoors industry has fared well during the pandemic.

“Outdoor has been blessed with the economy as people have stayed home,” he said. “They’re redoing their spaces, and many of our retailers are saying it’s their best year ever. That’s great for us, too. They thought it would be the worst year ever, as they were closed down in the key months. But once the economy opened back up, they just blew through inventory.”

Cleveland hopes that sentiment is shared in the residential home furnishings and accessories market as well. He expects a more business-like approach this market since the usual social gatherings and award ceremonies have been cancelled.

“We’re not going to do any group gatherings, unfortunately,” he said. “We’re not doing to do anything that causes people to congregate in one spot, so no Buyer’s Award, Manufacturer’s Rep Award, no dinners or bands. Hopefully we can bring them back next market.”

Attendees will required to wear masks at the market, and before entering, they’ll have their temperatures taken, Cleveland said. Masks will be provided if attendees don’t have one.

Also, hand sanitizer stations will be located throughout the buildings.

“Social distancing won’t be a problem,” Cleveland said. “We’ve got multiple entrances, wide hallways and even with the smaller market, we still have about 1 million square feet under roof.”

August 12, 2020

Toned-down summer furniture market set to start Thursday

- By Dennis Seid Daily Journal

- 6 hrs ago

TUPELO • It’s been seven months since the last major furniture trade show, setting up what should be, under normal circumstances, a pretty good Summer Market at the Tupelo Furniture Market.

But 2020 has been anything but normal.

With the COVID-19 pandemic taking root in March, which led to shutdowns of businesses and schools for weeks, the economy still is trying to recover.

And while there’s been evidence to show consumers are buying again, it will take some time to recover.

So the question confronting the Tupelo Furniture Market, which starts its Summer Market this week, is who will show up?

“It’s shaping up pretty good actually,” said V.M. Cleveland, the chairman of the market. “We’ve had people calling in who haven’t been here in years because their stores are doing well and they can’t get product, so they’re coming here to source their stores.”

Cleveland doesn’t deny that COVID-19 will have an effect on overall attendance, but thinks that the market will perform better than admittedly low expectations.

“We’ve had some last-minute cancellations for various reasons, including some who had a case of coronavirus pop up at their factory,” he said.

Market officials had already consolidated the summer show into just three buildings – four through six – a move that Cleveland had said would happen after the Winter Market in January.

On Tuesday afternoon, with exhibitors getting their show spaces ready, plenty of space was available. Building 6 was about two-thirds filled, and four and five were about half-filled. The market doesn’t officially start until Thursday, so there’s still time for other vendors to arrive.

Affordable Furniture, which has shown at Tupelo since 2005, has a new home in Building 5. But CEO Jim Sneed doesn’t have particularly high expectations for the market.

“We’re going to open on a voluntary basis with our sales reps,” he said. “I have five of 16 reps coming, and we’re not showing anything new. I don’t expect much.”

On the other hand, Dow Canup with Kingston Casual, an outdoor and patio vendor, said this week’s market is the most important one for his company.

“Outdoors is segmented a lot,” Canup said. “High Point and Las Vegas have different looks and their shows aren’t timed well. This show in Tupelo is timed well … January is before the big selling season and August is perfect for those of us who import. So the timing is perfect.”

Kingston also usually shows at an outdoors trade show in Chicago, which is the primary market, but that was cancelled. So the Tupelo market has become all-important.

But business will be a little different, Dow said.

“We have Zoom calls lined up all across the country, from major chain stores to mom-and-pop stores and specialty suppliers,” he said. “We’ve got five full days of Zoom calls lined up. With COVID, it’s just a different year.”

Dow has high expectations for the market, even though only about 60% of his customers who usually come plan to attend in person. Much of the buying will be done through Zoom.

And the outdoors industry has fared well during the pandemic.

“Outdoor has been blessed with the economy as people have stayed home,” he said. “They’re redoing their spaces, and many of our retailers are saying it’s their best year ever. That’s great for us, too. They thought it would be the worst year ever, as they were closed down in the key months. But once the economy opened back up, they just blew through inventory.”

Cleveland hopes that sentiment is shared in the residential home furnishings and accessories market as well. He expects a more business-like approach this market since the usual social gatherings and award ceremonies have been cancelled.

“We’re not going to do any group gatherings, unfortunately,” he said. “We’re not doing to do anything that causes people to congregate in one spot, so no Buyer’s Award, Manufacturer’s Rep Award, no dinners or bands. Hopefully we can bring them back next market.”

Attendees will required to wear masks at the market, and before entering, they’ll have their temperatures taken, Cleveland said. Masks will be provided if attendees don’t have one.

Also, hand sanitizer stations will be located throughout the buildings.

“Social distancing won’t be a problem,” Cleveland said. “We’ve got multiple entrances, wide hallways and even with the smaller market, we still have about 1 million square feet under roof.”

August 12, 2020

US Consumer Prices Surge As Food & Medical Costs Jump

by Tyler Durden Wed, 08/12/2020 – 08:36

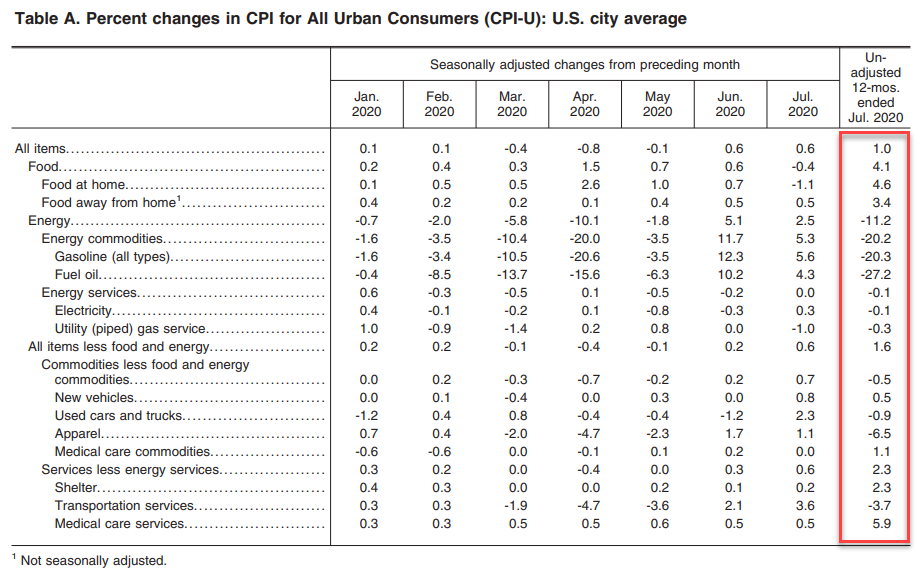

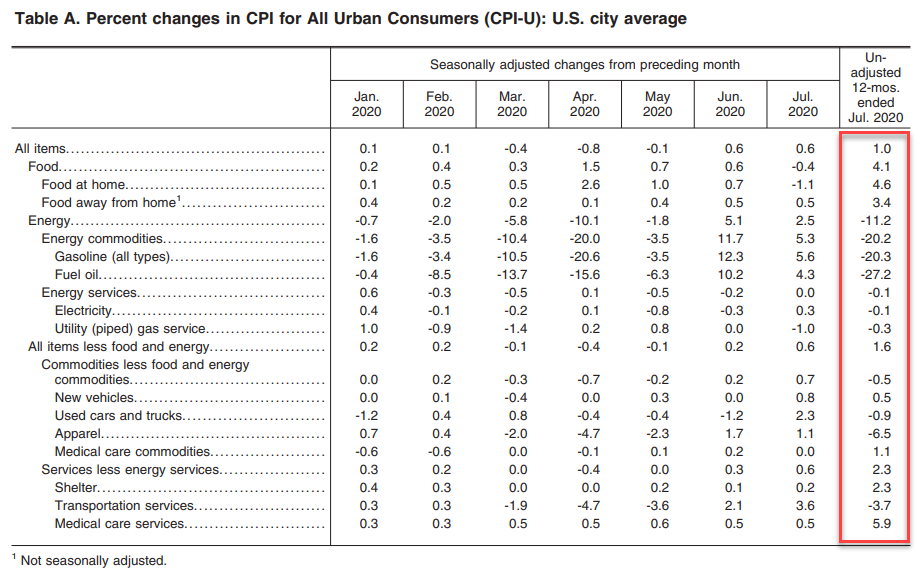

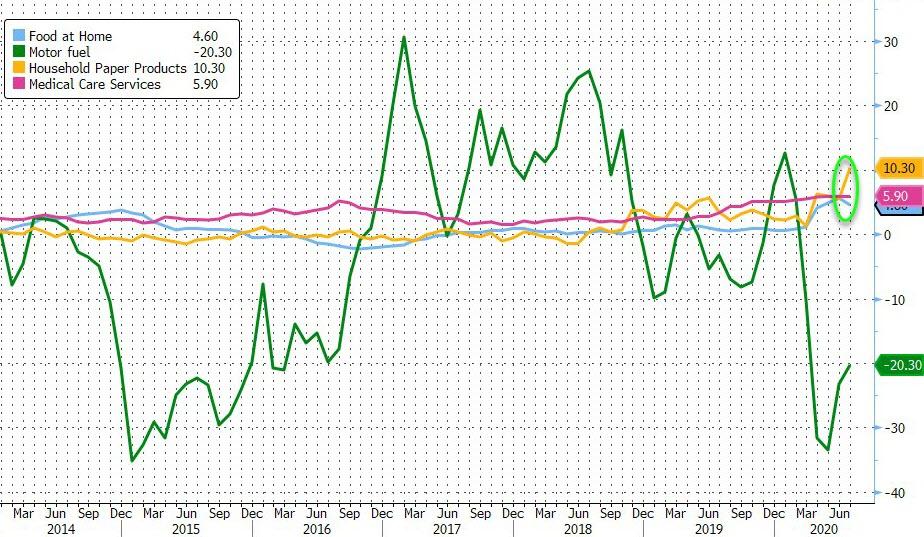

Following yesterday’s hotter-than-expected producer price data (led by a surge in energy costs and day-trading), analysts expected CPI to accelerate modestly YoY in July, but it acelerated significantly (rising 1.6% YoY vs +1.1% expected).

On a month over month basis, the headline CPI rose 0.6% (doubling the expected 0.3% rise)…

Source: Bloomberg

While PPI remains in deflation, Consumer Prices are rising…

Source: Bloomberg

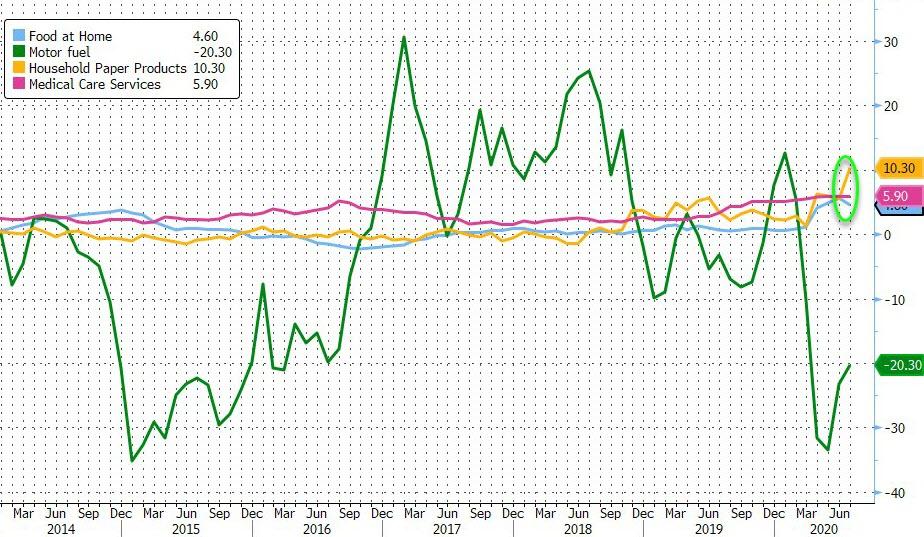

As Food costs continue to surge…

The food at home index increased 4.6 percent over the last 12 months. All six major grocery store food group indexes rose over that span. The index for beef increased 14.2 percent over the last 12 months, contributing to an 8.4-percent increase in the index for meats, poultry, fish, and eggs. The remaining groups rose more modestly, with increases ranging from 2.3 percent (fruits and vegetables) to 5.0 percent (nonalcoholic beverages). The index for food away from home rose 3.4 percent over the last year. The index for limited service meals increased 4.5 percent and the index for full service meals rose 2.9 percent over the last 12 months.

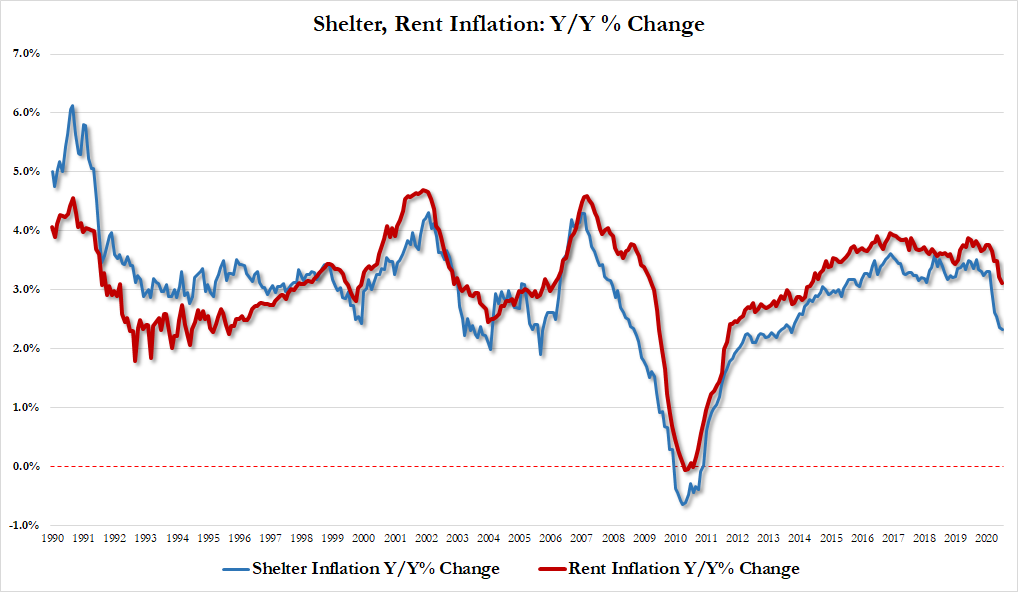

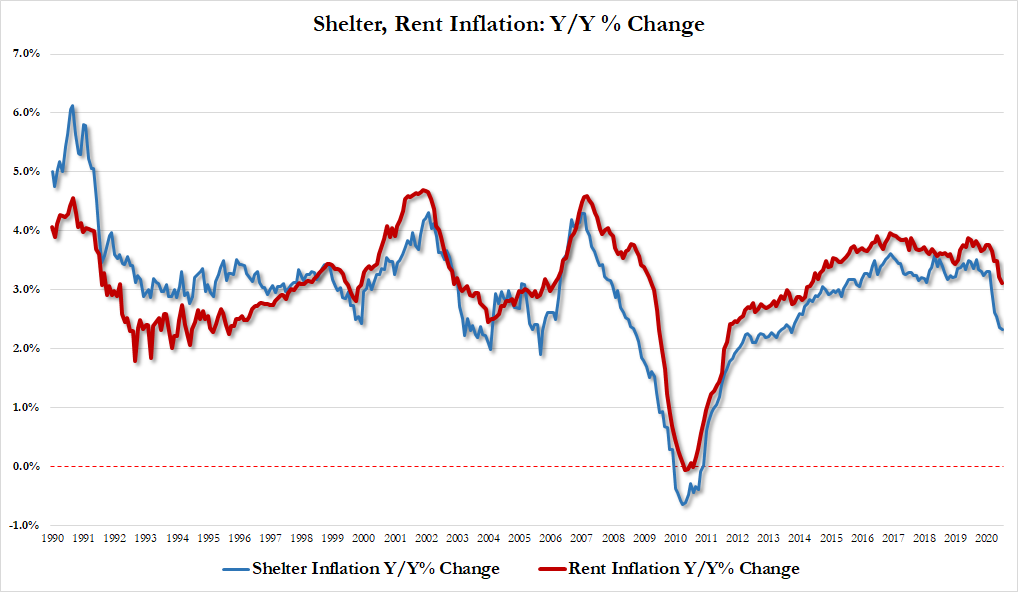

Additionally, medical care services also surged, but on the bright side (for some), rent/shelter inflation is slowing (rent inflation was 3.12% Y/Y, lowest since May 2014 and shelter inflation 2.33% Y/Y, lowest since Oct 2013)…

https://www.zerohedge.com/personal-finance/us-consumer-prices-surge-food-medical-costs-jump

August 12, 2020

US Consumer Prices Surge As Food & Medical Costs Jump

by Tyler Durden Wed, 08/12/2020 – 08:36

Following yesterday’s hotter-than-expected producer price data (led by a surge in energy costs and day-trading), analysts expected CPI to accelerate modestly YoY in July, but it acelerated significantly (rising 1.6% YoY vs +1.1% expected).

On a month over month basis, the headline CPI rose 0.6% (doubling the expected 0.3% rise)…

Source: Bloomberg

While PPI remains in deflation, Consumer Prices are rising…

Source: Bloomberg

As Food costs continue to surge…

The food at home index increased 4.6 percent over the last 12 months. All six major grocery store food group indexes rose over that span. The index for beef increased 14.2 percent over the last 12 months, contributing to an 8.4-percent increase in the index for meats, poultry, fish, and eggs. The remaining groups rose more modestly, with increases ranging from 2.3 percent (fruits and vegetables) to 5.0 percent (nonalcoholic beverages). The index for food away from home rose 3.4 percent over the last year. The index for limited service meals increased 4.5 percent and the index for full service meals rose 2.9 percent over the last 12 months.

Additionally, medical care services also surged, but on the bright side (for some), rent/shelter inflation is slowing (rent inflation was 3.12% Y/Y, lowest since May 2014 and shelter inflation 2.33% Y/Y, lowest since Oct 2013)…

https://www.zerohedge.com/personal-finance/us-consumer-prices-surge-food-medical-costs-jump