The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

July 9, 2020

Covestro AG: Preliminary EBITDA of EUR 124 million in Q2 2020 is above market expectation

In the course of preparing the half-year financial report 2020 for the Covestro Group, preliminary Q2 key financial data deviate from capital market expectations, based on the average values of latest consensus estimates of financial analysts, published by Vara Research on July 8, 2020.

Therefore, Covestro provides already today the following Q2 pre-release of the Group half-year financial report 2020:

• Preliminary sales amount to EUR 2,156 million in Q2’20. Consensus expects this number to be EUR 2,223 million.

• Preliminary volume effect in sales amounts to -22% in Q2’20. Consensus expects this number to be -22.5%.

• Preliminary EBITDA amounts to EUR 124 million in Q2’20. Consensus expects this number to be EUR 80 million.

• Preliminary net income amounts to around EUR -60 million in Q2’20. Consensus expects this number to be EUR -107 million.

The entire half-year financial report 2020 will be published on July 23, 2020.

July 9, 2020

Covestro AG: Preliminary EBITDA of EUR 124 million in Q2 2020 is above market expectation

In the course of preparing the half-year financial report 2020 for the Covestro Group, preliminary Q2 key financial data deviate from capital market expectations, based on the average values of latest consensus estimates of financial analysts, published by Vara Research on July 8, 2020.

Therefore, Covestro provides already today the following Q2 pre-release of the Group half-year financial report 2020:

• Preliminary sales amount to EUR 2,156 million in Q2’20. Consensus expects this number to be EUR 2,223 million.

• Preliminary volume effect in sales amounts to -22% in Q2’20. Consensus expects this number to be -22.5%.

• Preliminary EBITDA amounts to EUR 124 million in Q2’20. Consensus expects this number to be EUR 80 million.

• Preliminary net income amounts to around EUR -60 million in Q2’20. Consensus expects this number to be EUR -107 million.

The entire half-year financial report 2020 will be published on July 23, 2020.

July 9, 2020

Press Release of Recticel – 09 July 2020 Update on COVID-19 impact – Business recovering after April low point

Olivier Chapelle (Chief Executive Officer): “After the low activity point of April, our sales progressively rebounded in May and further accelerated in June, which combined with the current strength of our orderbooks, gives me confidence that we are now emerging from this extraordinary crisis. In the second half of 2020, the topline of our retained businesses is expected to be back at the level of the second half of 2019, provided that no second wave of coronavirus cases occurs.”

July 9, 2020

Press Release of Recticel – 09 July 2020 Update on COVID-19 impact – Business recovering after April low point

Olivier Chapelle (Chief Executive Officer): “After the low activity point of April, our sales progressively rebounded in May and further accelerated in June, which combined with the current strength of our orderbooks, gives me confidence that we are now emerging from this extraordinary crisis. In the second half of 2020, the topline of our retained businesses is expected to be back at the level of the second half of 2019, provided that no second wave of coronavirus cases occurs.”

July 7, 2020

US Trucking Volumes Soar 45% YoY Ahead Of July 4th Holidays

by Tyler Durden Tue, 07/07/2020 – 14:55

Authored by Seth Holm via FreightWaves.com,

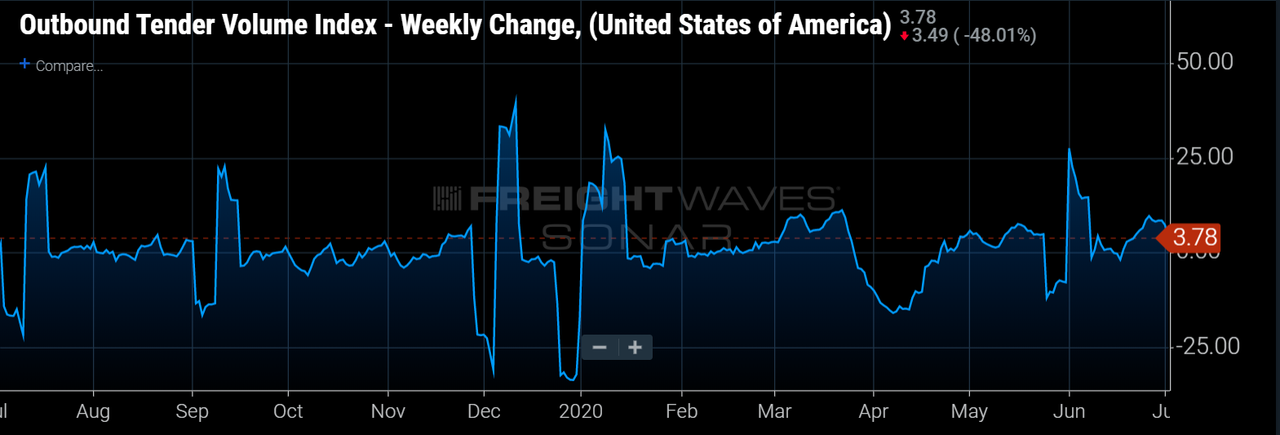

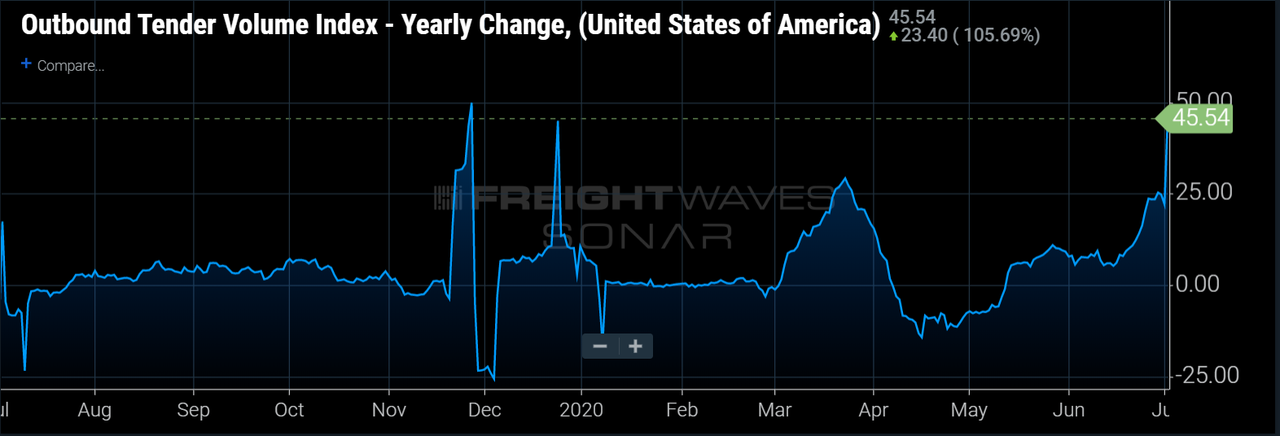

Volumes have continued to burst all around the country this week. Carriers are rejecting loads at rates only seen during the March panic-buying spree buildup. Spot rates have been bid up above 2019 levels in many markets around the country, but it is unlikely that this trend continues given there is typically a significant drop-off in outbound volume after the Fourth. However, volumes are so high currently that even a significant decline could still keep OTVI above 2018/2019 comparables.

Outbound tender volumes continued to gush in many regions around the country this week. The Outbound Tender Volume Index (OTVI) is now almost at 13,000 for only the second time in its three-year history, with the first coming just three months ago during the March panic-induced buying spree.

The current volume of freight flowing in the U.S. cannot be overstated — besides the March demand spike, there has not been freight demand like this in recent history. 2018 was considered a banner year for freight volume and OTVI currently sits more than 14% above the 2018 high point.

There is typically a surge in volumes leading up to Independence Day as shippers try to clear as much inventory as possible before the close of the second quarter. After a lost April and depressed May, we believe shippers are particularly focused on pushing freight to paint the second quarter as rosy as possible. Independence Day often marks the beginning of the midsummer slowdown that drags on throughout July and August before picking up at the edge of autumn. If 2020 is to follow historical patterns, we should expect this extremely high volume level to last only a few more days. That said, 2020 has followed very few historical patterns, so there is a great deal of uncertainty about where demand will be in the third quarter.

It appears highly unlikely for volumes to continue in this range after the Fourth. In each of the past two years, OTVI has averaged roughly 10,200. A major retraction in tender volumes would need to take place for the index to average similar levels as the previous two years.

On the positive side, nine of the 15 of the major freight markets FreightWaves tracks were positive on a week-over-week basis. This ratio has been consistently high in recent weeks. The markets with the largest gains this week in OTVI.USA were Laredo, Texas (11.33%), Los Angeles (8.57%) and Dallas (6.93%). The markets with the largest declines this week in OTVI.USA were Cleveland (-10.68%), Memphis (-2.63%) and Indianapolis (-2.42%).

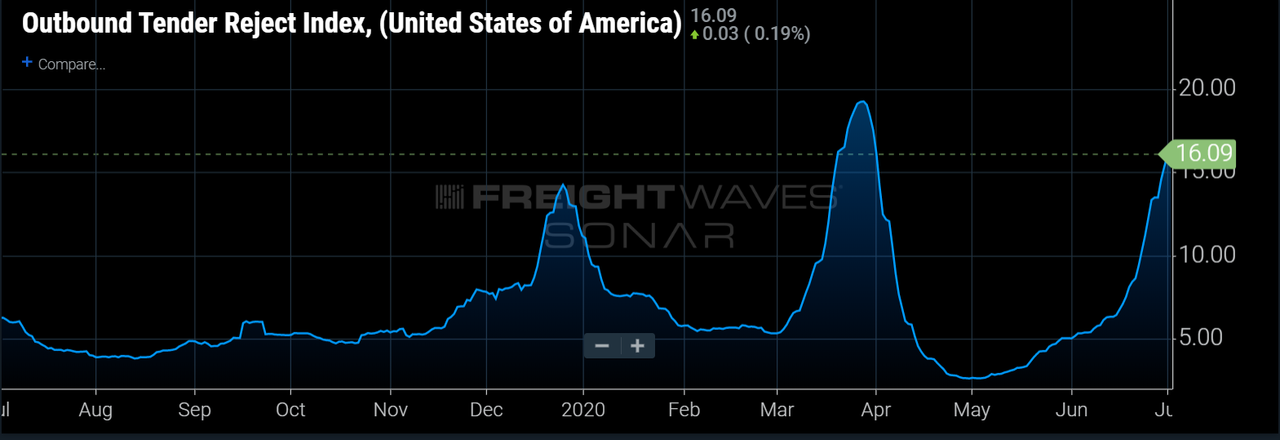

Tender rejections continue to soar with volumes, now at 16%

Carriers continued for a second week rejecting loads at a much higher rate this week that at any time since the panic-buying spree. The Outbound Tender Rejection Index (OTRI) jumped an additional 500 bps over the past week after running up more than 400 bps last week. The last two weeks have been among the more volatile weeks for OTRI in its three-year history.

We wrote during late May and early June that we believed capacity had been slow to adjust to the volume levels, but last week that changed. Volumes have remained elevated since Memorial Day, but carriers have been slow to reject freight. This was likely an attempt to make up for those “lost” months of April and May.

Much like volumes, tender rejections tend to trend higher in the week(s) leading up to a national holiday. However, this spike is unlike those of any leading up to a summer holiday in the past few years. This change in rejections may not only stem from holiday disruption, but also from carriers looking for other opportunities in this time of freight abundance. This level of tender rejections indicates upward pressure on rates and carriers have begun to test the waters.