The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

July 7, 2020

US Trucking Volumes Soar 45% YoY Ahead Of July 4th Holidays

by Tyler Durden Tue, 07/07/2020 – 14:55

Authored by Seth Holm via FreightWaves.com,

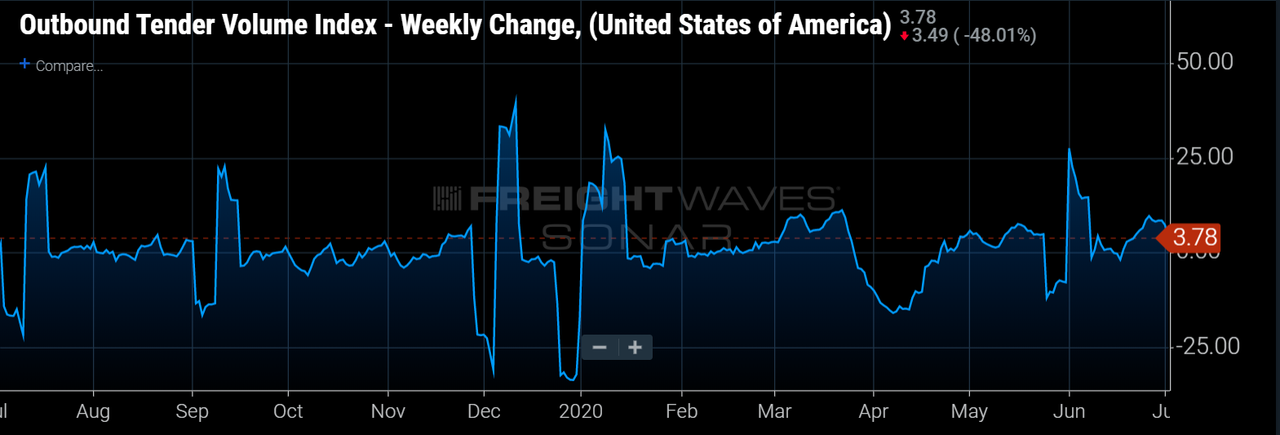

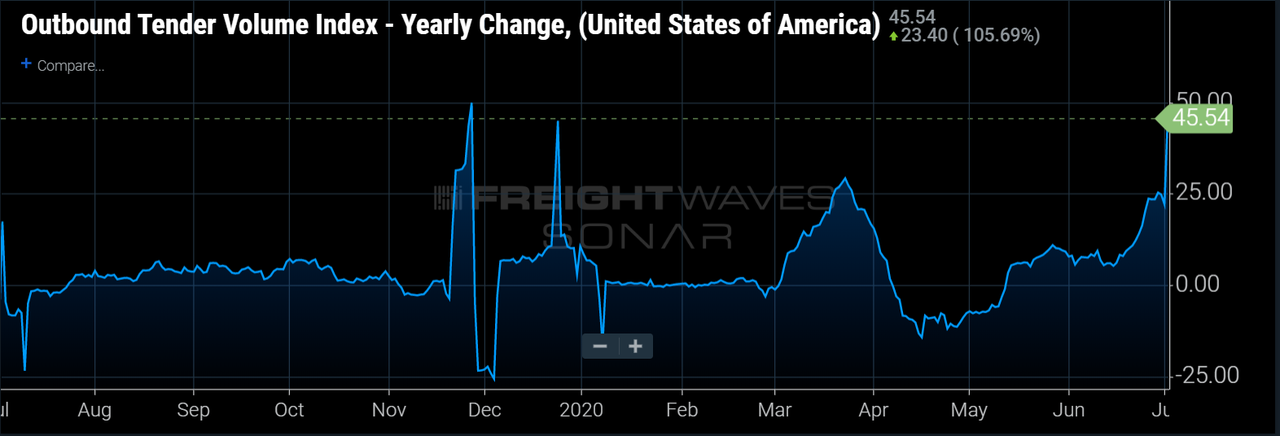

Volumes have continued to burst all around the country this week. Carriers are rejecting loads at rates only seen during the March panic-buying spree buildup. Spot rates have been bid up above 2019 levels in many markets around the country, but it is unlikely that this trend continues given there is typically a significant drop-off in outbound volume after the Fourth. However, volumes are so high currently that even a significant decline could still keep OTVI above 2018/2019 comparables.

Outbound tender volumes continued to gush in many regions around the country this week. The Outbound Tender Volume Index (OTVI) is now almost at 13,000 for only the second time in its three-year history, with the first coming just three months ago during the March panic-induced buying spree.

The current volume of freight flowing in the U.S. cannot be overstated — besides the March demand spike, there has not been freight demand like this in recent history. 2018 was considered a banner year for freight volume and OTVI currently sits more than 14% above the 2018 high point.

There is typically a surge in volumes leading up to Independence Day as shippers try to clear as much inventory as possible before the close of the second quarter. After a lost April and depressed May, we believe shippers are particularly focused on pushing freight to paint the second quarter as rosy as possible. Independence Day often marks the beginning of the midsummer slowdown that drags on throughout July and August before picking up at the edge of autumn. If 2020 is to follow historical patterns, we should expect this extremely high volume level to last only a few more days. That said, 2020 has followed very few historical patterns, so there is a great deal of uncertainty about where demand will be in the third quarter.

It appears highly unlikely for volumes to continue in this range after the Fourth. In each of the past two years, OTVI has averaged roughly 10,200. A major retraction in tender volumes would need to take place for the index to average similar levels as the previous two years.

On the positive side, nine of the 15 of the major freight markets FreightWaves tracks were positive on a week-over-week basis. This ratio has been consistently high in recent weeks. The markets with the largest gains this week in OTVI.USA were Laredo, Texas (11.33%), Los Angeles (8.57%) and Dallas (6.93%). The markets with the largest declines this week in OTVI.USA were Cleveland (-10.68%), Memphis (-2.63%) and Indianapolis (-2.42%).

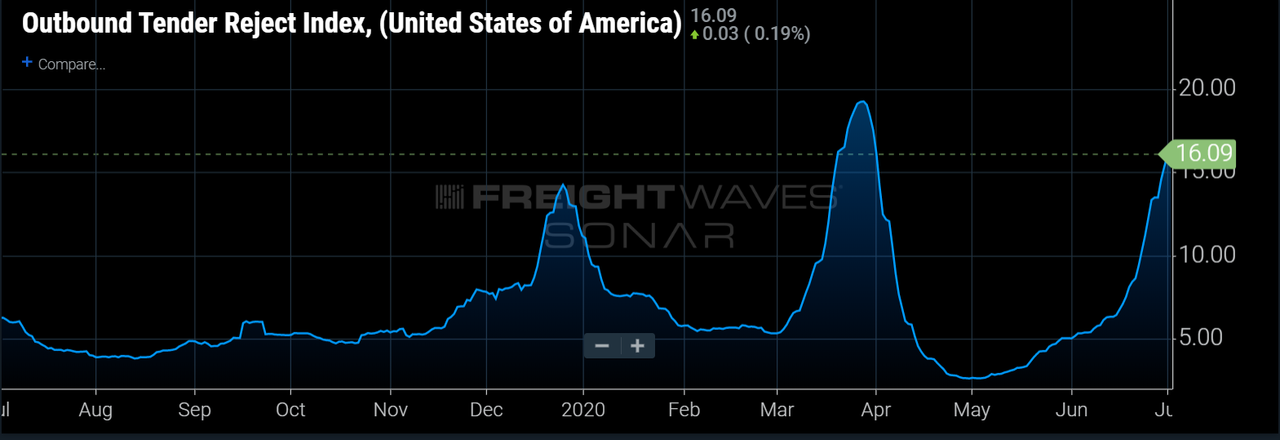

Tender rejections continue to soar with volumes, now at 16%

Carriers continued for a second week rejecting loads at a much higher rate this week that at any time since the panic-buying spree. The Outbound Tender Rejection Index (OTRI) jumped an additional 500 bps over the past week after running up more than 400 bps last week. The last two weeks have been among the more volatile weeks for OTRI in its three-year history.

We wrote during late May and early June that we believed capacity had been slow to adjust to the volume levels, but last week that changed. Volumes have remained elevated since Memorial Day, but carriers have been slow to reject freight. This was likely an attempt to make up for those “lost” months of April and May.

Much like volumes, tender rejections tend to trend higher in the week(s) leading up to a national holiday. However, this spike is unlike those of any leading up to a summer holiday in the past few years. This change in rejections may not only stem from holiday disruption, but also from carriers looking for other opportunities in this time of freight abundance. This level of tender rejections indicates upward pressure on rates and carriers have begun to test the waters.

July 7, 2020

ACC: Spray Foam Coalition responds to California DTSC’s notice on SPF Abridged AA Report

The California Department of Toxic Substances Control (DTSC) on 30 June 2020 issued a “notice of deficiency” on the Abridged Alternative Analysis Report on Two-component Low- and High-pressure Spray Polyurethane Foam Systems Containing Unreacted Methylene Diphenyl Diisocyanates (MDI).

The American Chemistry Council (ACC) issued the following statement in response, which may be attributed to Lee Salamone, Senior Director, ACC Center for the Polyurethanes Industry (CPI).

“ACC is disappointed by DTSC’s decision to issue a ‘notice of deficiency’ on the Abridged Alternative Analysis Report (the Report). The Report concludes that there are no technically or economically feasible alternatives to spray polyurethane foam (SPF) systems containing unreacted MDI — a position that the industry has maintained since this process started in 2014. It is important to note that a ‘notice of deficiency’ represents another step in the regulatory process and is not a final decision on the safety of SPF or on the Report. Accordingly, the ACC Spray Foam Coalition (SFC) will coordinate with regulated entities as they revise their company-specific reports and resubmit for consideration. Californians can continue to rely on SPF to meet their energy efficiency needs.

“Health and safety are top priorities for the SPF industry. SPF insulation is well-studied and is subject to robust regulatory controls and stewardship programs. It is an effective and proven building material with a 40-year track record of success when installed by a trained professional contractor.

“SPF insulation offers exceptional thermal insulation and air sealing performance. California is a leader in climate policy and should promote SPF as one solution to climate change. Using SPF to insulate and air seal buildings can help California meet its energy efficiency and climate change goals, as well as move the state forward on its strategic plan for zero net energy buildings.”

July 7, 2020

ACC: Spray Foam Coalition responds to California DTSC’s notice on SPF Abridged AA Report

The California Department of Toxic Substances Control (DTSC) on 30 June 2020 issued a “notice of deficiency” on the Abridged Alternative Analysis Report on Two-component Low- and High-pressure Spray Polyurethane Foam Systems Containing Unreacted Methylene Diphenyl Diisocyanates (MDI).

The American Chemistry Council (ACC) issued the following statement in response, which may be attributed to Lee Salamone, Senior Director, ACC Center for the Polyurethanes Industry (CPI).

“ACC is disappointed by DTSC’s decision to issue a ‘notice of deficiency’ on the Abridged Alternative Analysis Report (the Report). The Report concludes that there are no technically or economically feasible alternatives to spray polyurethane foam (SPF) systems containing unreacted MDI — a position that the industry has maintained since this process started in 2014. It is important to note that a ‘notice of deficiency’ represents another step in the regulatory process and is not a final decision on the safety of SPF or on the Report. Accordingly, the ACC Spray Foam Coalition (SFC) will coordinate with regulated entities as they revise their company-specific reports and resubmit for consideration. Californians can continue to rely on SPF to meet their energy efficiency needs.

“Health and safety are top priorities for the SPF industry. SPF insulation is well-studied and is subject to robust regulatory controls and stewardship programs. It is an effective and proven building material with a 40-year track record of success when installed by a trained professional contractor.

“SPF insulation offers exceptional thermal insulation and air sealing performance. California is a leader in climate policy and should promote SPF as one solution to climate change. Using SPF to insulate and air seal buildings can help California meet its energy efficiency and climate change goals, as well as move the state forward on its strategic plan for zero net energy buildings.”

July 7, 2020

BASF advances chemical polyurethane recycling

by Craig Bettenhausen

July 4, 2020 | APPEARED IN VOLUME 98, ISSUE 26

Credit: BASF BASF plans to convert polyurethane foam mattresses back into the polyol (brown bottle, left) from which they’re made.

Credit: BASF BASF plans to convert polyurethane foam mattresses back into the polyol (brown bottle, left) from which they’re made.

In a lab in Brandenburg, Germany, BASF researchers are turning polyurethane mattress foam back into its polyol starting materials. It’s easy to sort mattresses out of waste streams but not to recycle them. That combination makes mattresses an attractive target for BASF’s drive toward circular supply chains, says technical project manager Arno Volkmann. The firm expects to have pilot quantities of recycled polyol later this year. BASF says it is also working to recover diisocyanate, the other major foam component.

July 7, 2020

BASF advances chemical polyurethane recycling

by Craig Bettenhausen

July 4, 2020 | APPEARED IN VOLUME 98, ISSUE 26

Credit: BASF BASF plans to convert polyurethane foam mattresses back into the polyol (brown bottle, left) from which they’re made.

Credit: BASF BASF plans to convert polyurethane foam mattresses back into the polyol (brown bottle, left) from which they’re made.

In a lab in Brandenburg, Germany, BASF researchers are turning polyurethane mattress foam back into its polyol starting materials. It’s easy to sort mattresses out of waste streams but not to recycle them. That combination makes mattresses an attractive target for BASF’s drive toward circular supply chains, says technical project manager Arno Volkmann. The firm expects to have pilot quantities of recycled polyol later this year. BASF says it is also working to recover diisocyanate, the other major foam component.