The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

June 15, 2023

Carpenter Co., one of the world’s largest producers of comfort products, is pleased to announce that it has completed the acquisition of Recticel N.V.’s Engineered Foams Division, which includes the former Foam Partner and Otto Bock operations. The acquisition creates the world’s largest vertically integrated manufacturer of polyurethane foams and specialty polymer products.

Recticel, a Belgian company with origins tracing back to 1778, comprises people, offices and production facilities in Europe, Asia, Africa and North America. The transaction allows Carpenter to expand its geographic footprint, explore new product lines and add new capabilities to the industry leader.

Brad Beauchamp, CEO of Carpenter Co., expressed, “We are very excited to welcome the employees of Recticel, Foam Partner and Otto Bock into Carpenter. We believe that combining these great businesses with ours will result in the best flexible foam company throughout all market segments and geographic locations. We believe that this acquisition will bring additional innovations in polyurethane foam beyond our industry leading materials like Serene® foam, Hybrid TheraGel™ memory foam and others. Recticel is also known for their leadership in sustainability and recycling of foam materials and we expect that to pair very well with our own developments on those issues that are facing the industry.”

Both Carpenter and Recticel have demonstrated a commitment to innovation, sustainability and continuous improvement. United together, the combined organization will work towards a shared purpose: to enhance the quality of life for everyone through its products and services.

June 14, 2023

PPI Plunges More Than Expected – Lowest Since Dec 2020

by Tyler Durden

Wednesday, Jun 14, 2023 – 08:36 AM

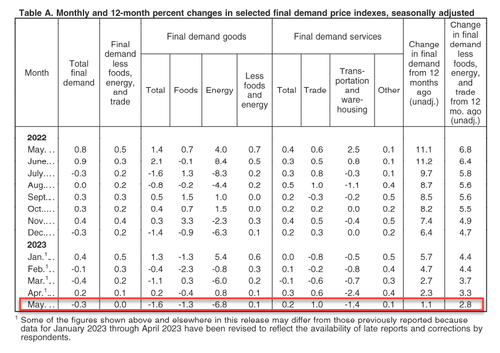

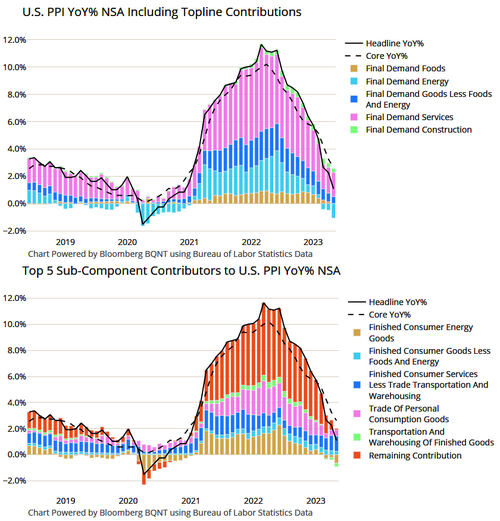

After a mixed picture from CPI data yesterday (headline down big, core still sticky, supercore rising), PPI was expected to continue to decline in data this morning for May, and it did bigly… Headline PPI fell 0.3% MoM in May (way more than the 0.1% drop expected), which dragged the YoY PPI to just 1.1%. That is the lowest since Dec 2020…

Source: Bloomberg

Under the hood, Goods PPI tumbled 1.6% while Services rose just 0.2%…

Sixty percent of the May decline in the index for final demand goods can be traced to a 13.8-percent drop in prices for gasoline.

The indexes for diesel fuel, chicken eggs, jet fuel, fresh and dry vegetables, and iron and steel scrap also fell. Conversely, prices for tobacco products advanced 1.7 percent. The indexes for electric power and for beverages and beverage materials also increased.

Over 40 percent of the May increase in prices for final demand services can be attributed to margins for automobiles and automobile parts retailing, which rose 4.2 percent.

The indexes for fuels and lubricants retailing; apparel, footwear, and accessories retailing; securities brokerage, dealing, investment advice, and related services; machinery and vehicle wholesaling; and food wholesaling also advanced. Conversely, prices for truck transportation of freight fell 2.1 percent. The indexes for portfolio management and for health, beauty, and optical goods retailing also decreased.

Core PPI was unchanged MoM, dragging the YoY change to +2.8% – the lowest since Feb 2021…

Source: Bloomberg

The pipeline for PPI is also increasingly deflationary as prices for intermediate demand goods plunge…

Source: Bloomberg

Finally, M2 suggests this re-acceleration of the deflationary impulse in PPI is set to continue aggressively…

Source: Bloomberg

The question is – does The Fed care about PPI? Or just its latest SuperCore CPI as an inflation ‘signal’?

Finally, we note the following trend – is this the new economy?

Drink more, drive less?

https://www.zerohedge.com/personal-finance/ppi-plunges-more-expected-lowest-dec-2020

June 14, 2023

Recticel becomes a pure insulation player after completing the divestment of its Engineered Foams activities on 12 and 13 June 2023

Regulated information, Brussels, 14/06/2023 — 06:59 CET, 14.06.2023

- Changes in transaction perimeter: Recticel keeps The Soundcoat Company Inc. (USA – acoustic and thermal insulation) and its 33% participation in Orsa Foam S.p.A. (Italy)

- Recticel Ltd. (UK Comfort Foams) sold to GIL Investments Ltd.

- Revised Enterprise Value of EUR 454.1 million

- Cash proceeds of EUR 427.0 million

- Reduction of IFRS16 lease debt by EUR 23.9 million, and reduction of other provisions and liabilities by EUR 30.6 million

- The transaction represents a 7.5 x multiple on the average 2021 and 2022 Adjusted EBITDA pertaining to the divested perimeter

Recticel signed a binding agreement (see press release dd. 07 December 2021) to sell its Engineered Foams activities to US-based Carpenter Co., subject to customary closing conditions, including anti-trust clearance. Carpenter and Recticel received such clearance from the UK Competition & Markets Authority (CMA) on 12 April 2023, and have subsequently signed the divestment of the two UK Comfort foam facilities (remedies meeting CMA requirements) to GIL Investments Ltd. on 17 April 2023 (see press release dd. 28 April 2023). All conditions precedent being met, Carpenter Co. and Recticel could progress to closing the main transaction.