The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

May 11, 2023

Upholstered Furniture Market Situation & Trends

PUdaily | Updated: May 9, 2023

Upholstered furniture refers to furniture added with padding, foam, fabric and other materials. This involves sofas, upholstered beds, mattresses, nightstands, coffee tables and other relative products. Among them, mattresses and sofas are the two main types of upholstered furniture. The industrialization of upholstered furniture began in Europe in the early 20th century. Global upholstered furniture industry has greatly increased its production capacity thanks to continuously advanced manufacturing technologies, and the market demand has also kept growing.

As the upholstered furniture industry is labor-intensive, developed countries are continuing to transfer their manufacturing to developing countries, which have low labor costs and sufficient raw materials. The main upholstered furniture manufacturing countries currently include China, U.S., Poland, India, Italy, and Germany.

China has become one of major producers and consumers of upholstered furniture. China’s modern upholstered furniture industry began in the early 1980s. In recent years, through introduction of advanced furniture design technology and processing technology from abroad, and on the basis of fully leveraging the advantages of raw material resources and labor costs, China’s upholstered furniture industry has developed rapidly. At present, China’s upholstered furniture output value makes up 46.4% of the world, contributing about 30.7% of the global upholstered furniture consumption.

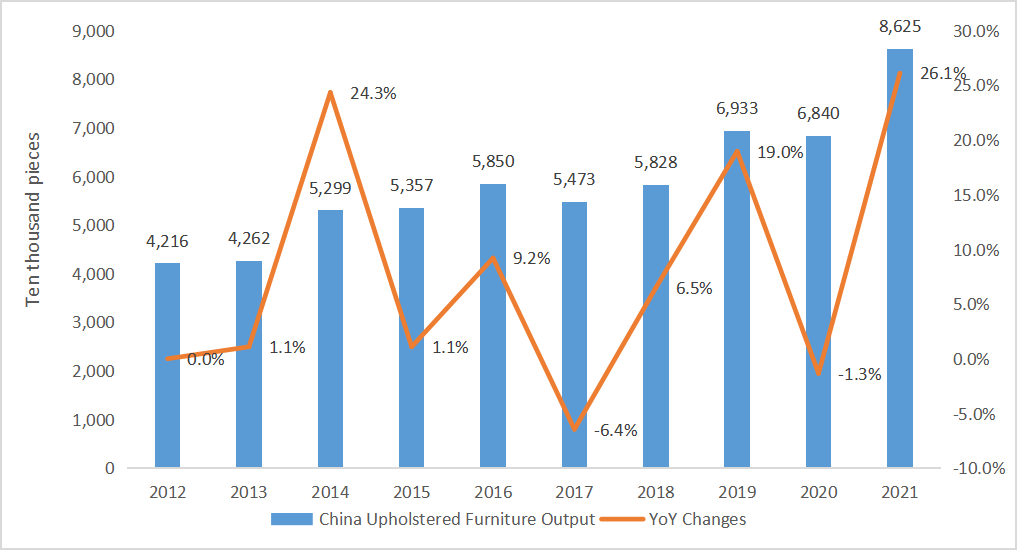

Figure 1 China Upholstered Furniture Outputs & YoY Changes, 2012-2021

The upholstered furniture industry has a long industrial chain that spans agriculture, manufacturing, and retail industries. Its upstream industries mainly include leather, wood, foam, and other raw material industries. Downstream manufacturers mainly sell products to end consumers through channels such as dealers, ODMs, and direct-sale stores. Leather is mainly used for the outer surface of upholstered furniture, primarily natural cowhide. Wood is mainly used for the main structure of upholstered furniture, and the development of forest planting directly affects the wood supply and procurement costs of the upholstered furniture industry. Foam, namely polyurethane foam, is a typical cushioning material mainly used for cushions, armrests, backrests, etc., to improve the softness and comfort of upholstered furniture. It is made from polyurethane through processes such as foaming, hot pressing, and cutting, and is a derivative product in the petrochemical processing industry. Therefore, its price is greatly affected by fluctuations in oil prices. Downstream manufacturers of upholstered furniture mainly sell products to end users through direct-sale stores, dealers, etc., and factors such as household income and real estate industry development drive consumer demand.

Commodity prices have risen sharply since 2021. The low added value and high cost of the upholstered furniture industry have been greatly affected by rising raw material prices. Meanwhile, under the policy of “housing is for living, not for speculation”, the prosperity of the real estate industry has significantly declined, which also brings obvious suppression on the demand for upholstered furniture. Under the dual impact of rising costs and weakening demand, the overall profit margin of the upholstered furniture industry has significantly decreased. Especially for small and micro manufacturers that rely on price advantages, their survival space has been squeezed.

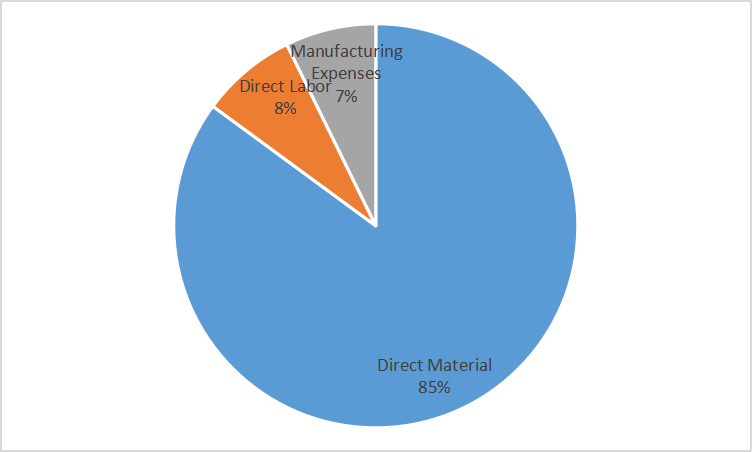

Figure 2 Cost Structure of a Mattress Manufacturer

In the future, China’s upholstered furniture industry could follow two important directions:

1) A boom in established market:

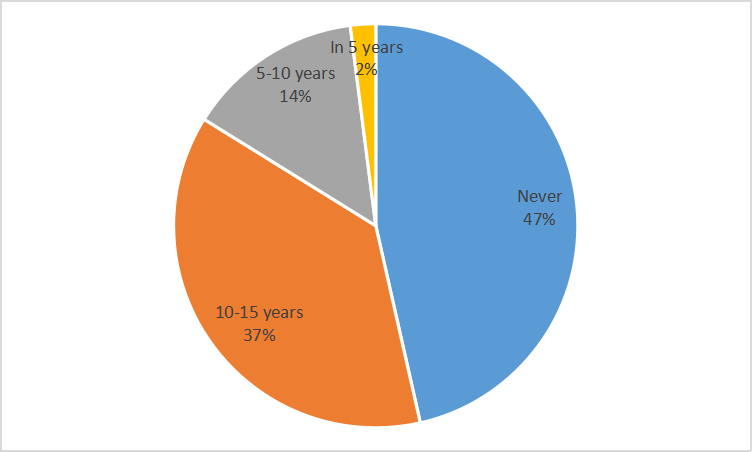

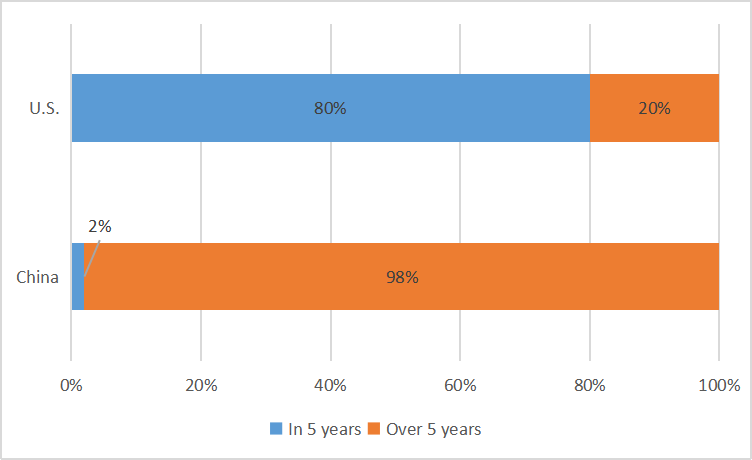

A few decades ago, spring mattresses were popularized in China. For a spring mattress, the lifespan of spring is usually 10-20 years, and that of filler and fabric is about 5-10 years. At present, the frequency of mattress replacement in China is much lower than that in U.S. 37% of Chinese consumers replace mattresses in 10-15 years, while 47% of consumers have never changed them, which are mostly under serviceability limit state. We believe that increasingly frequent mattress replacement and higher requirements for comfort level of beddings may boost the demand for mattresses.

Figure 3 Mattress Replacement Frequency in China

Figure 4 Comparison of Mattress Replacement Frequency in China and U.S.

2) Rising industrial concentration:

At present, China’s sofa industry is fragmented. CR4 (the concentration ratio of the top four manufacturers) in China was only 30% in 2021, with Man Wah holding the largest market share (about 12%); the concentration of U.S. sofa industry was higher, with CR4 reaching 51% and CR10 reaching 79% in 2017, and the market share of top manufacturers la-z-boy/Ashley/Man Wah reached 21%/11%/10% respectively.

In terms of the mattress industry, the U.S. market is dominated by a few top brands, while Chinese mattress market is inundated with small and medium-sized manufacturers.

The top 5 brands in U.S., (CR5), Sealy, Simmons, Serta, Tempur-Pedic and Sleep Number, together occupied 69.40% of the mattress market. CR3 and CR8 in China’s mattress market are only 11.43% and 18.66%. The market share of top three brands – Sleemon, Serta and DeRucci – is 4.38%, 3.88% and 3.17% respectively.

With the improvement of residents’ consumption levels and the broad demand for mattress replacement, top manufacturers with advantages in brand, channels, and services are expected to usher in a significant growth in the next few years.

May 10, 2023

Headline CPI Dips To 2-Year Low; Shelter Costs Roll Over

by Tyler Durden

Wednesday, May 10, 2023 – 08:39 AM

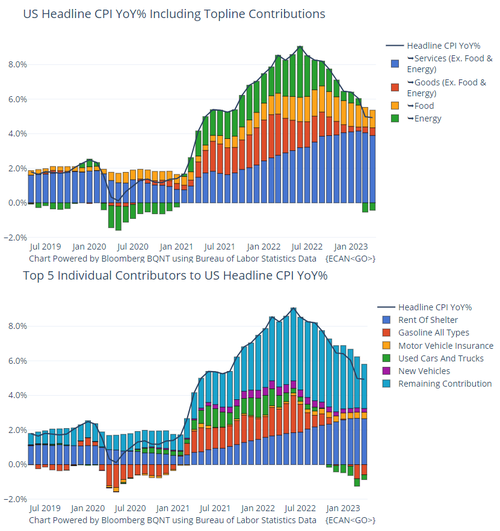

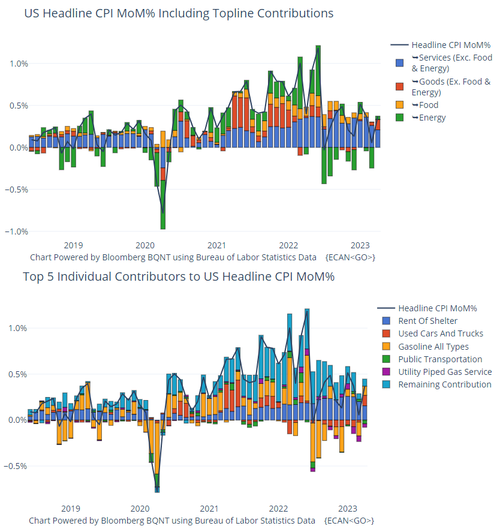

Another month, another inflation print to jawbone over. The Fed’s new favorite signal from The BLS is Core Services CPI Ex-Shelter, and this morning’s print is ‘good’ news with the YoY growth at the slowest since May 2022….

Source: Bloomberg

Headline CPI was expected to accelerate in April (+0.4% MoM exp), and met expectations with the drop in YoY CPI slowing dramatically (though the 4.9% print was slightly cooler than the 5.0% YoY exp)…

Source: Bloomberg

The all items index increased 4.9 percent for the 12 months ending April; this was the smallest 12-month increase since the period ending April 2021.

Energy (and Gasoline) was the main drivers to the downside while Shelter costs remain high…

The headline print is below pretty much all the major f0orecast:

- 5.1% – Goldman Sachs

- 5.1% – Citigroup

- 5.1% – JP Morgan Chase

- 5.1% – Morgan Stanley

- 5.0% – Barclays

- 5.0% – Bank of America

- 5.0% – Credit Suisse

- 5.0% – Bloomberg Economics

- 5.0% – HSBC

- 5.0% – UBS

- 5.0% – Wells Fargo

Core CPI was also expected to rise by 0.4% MoM in April, and met that expectation with YoY up 5.2% – very sticky.

The energy index decreased 5.1 percent for the 12 months ending April, and the food index increased 7.7 percent over the last year.

Source: Bloomberg

The index for all items less food and energy rose 0.4 percent in April, as it did in March.

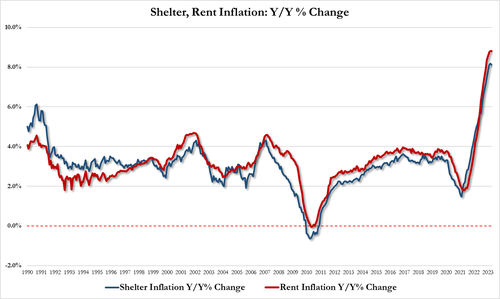

- The shelter index increased 0.4 percent over the month after rising 0.6 percent in March.

- The index for rent rose 0.6 percent in April, and the index for owners’ equivalent rent rose 0.5 percent over the month.

- The index for lodging away from home decreased 3.0 percent in April after rising in each of the previous four months.

The shelter index was the largest factor in the monthly increase in the index for all items less food and energy… as we noted last month, the shelter index has now topped out…

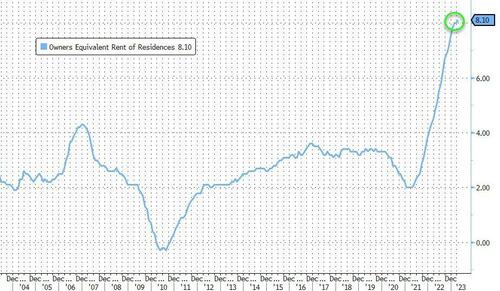

But, just to add some confusion to the pot, Owners Equivalent Rent rose 8.1% YoY – a new record high…

Among the other indexes that rose in April was the index for used cars and trucks, which increased 4.4 percent, and the index for motor vehicle insurance which increased 1.4 percent. The indexes for recreation, household furnishings and operations, personal care, apparel, and education also increased in April.

Several indexes declined in April, led by the airline fares index which fell 2.6 percent over the month after rising in February and March.

- The index for new vehicles declined 0.2 percent and the index for communication decreased 0.1 percent in April.

- The medical care index was unchanged in April, after falling 0.3 percent the previous month.

- The index for hospital services rose 0.5 percent over the month, after a 0.4-percent decline in March.

- The prescription drugs index increased 0.3 percent in April, while the physicians’ services index was unchanged.

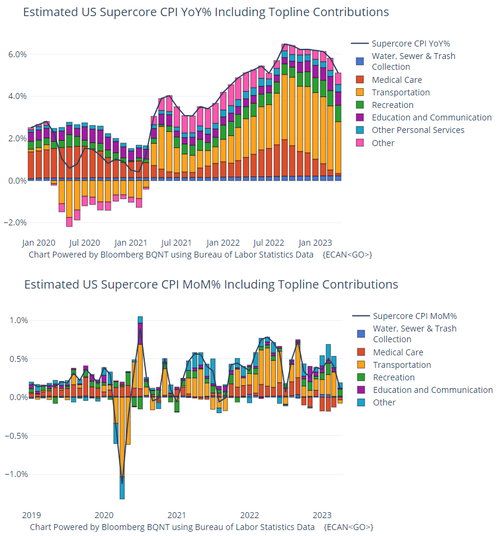

The so-called SuperCore inflation also slowed to 5.0% YoY with Transport and Medical Care costs dropping MoM…

Is M2 signaling that the ‘stickiness’ is over and a tsunami of deflation is about to hit?

Source: Bloomberg

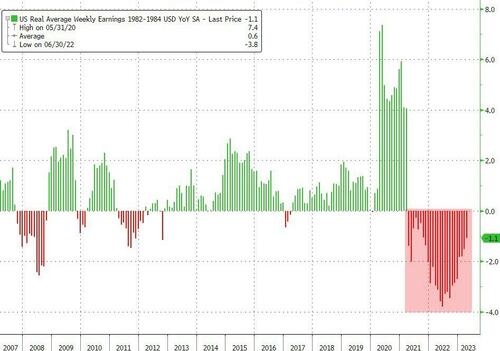

Finally, inflation continues to outpace Americans’ rising wages – for the 25th straight month…

Source: Bloomberg

May 9, 2023

Leading Global Bedding Company Tempur Sealy to Acquire Mattress Firm, the Nation’s Largest Mattress Specialty Retailer

May 09, 2023 6:36 AM ETTempur Sealy International, Inc. (TPX)

– Significantly Expands Consumer Touchpoints and Accelerates U.S. Omni-Channel Strategy

– Simplifies Consumer Purchase Journey and Facilitates Innovation

– Streamlines Operations and Drives Adjusted EPS Accretion

– Tempur Sealy (TPX) to Host Conference Call to Discuss First Quarter 2023 Results and the Transaction at 8:00 a.m. Eastern Time Today, May 9th

LEXINGTON, Ky., May 9, 2023 /PRNewswire/ — Tempur Sealy International, Inc. (NYSE: TPX, “Company” or “Tempur Sealy”) and Mattress Firm Group Inc. (“Mattress Firm”) today announced that Tempur Sealy has signed a definitive agreement to acquire Mattress Firm, the nation’s largest mattress specialty retailer, in a cash and stock transaction valued at approximately $4.0 billion.

The transaction is expected to be funded by approximately $2.7 billion of cash consideration (subject to adjustments, including the repayment of Mattress Firm’s debt and other customary items) and $1.3 billion in stock consideration issued to Mattress Firm shareholders, reflecting the issuance of 34.2 million shares of common stock based on the closing share price of $37.62 as of May 8, 2023. The transaction is currently anticipated to close in the second half of 2024, subject to the satisfaction of customary closing conditions, including applicable regulatory approvals. Following the close of the transaction, Mattress Firm is expected to operate as a separate business unit within the Company.

Founded in 1986, Mattress Firm is the largest mattress specialty retailer in the U.S., operating over 2,300 brick-and-mortar retail locations and a growing e-commerce platform. Mattress Firm’s more than 6,200 highly trained retail sales associates provide personalized service to help consumers choose the ideal bedding products across their robust assortment of market-leading brands.

This combination will complement Tempur Sealy’s extensive product development and manufacturing capabilities with vertically integrated retail. Together, Tempur Sealy and Mattress Firm’s combined global footprint will include approximately 3,000 retail stores, 30 e-commerce platforms, 71 manufacturing facilities, and 4 state-of-the-art R&D facilities worldwide. These combined operations will be supported by more than 21,000 best-in-class employees with a collective focus on providing breakthrough sleep solutions to consumers in over 100 countries.

Tempur Sealy Chairman and CEO Scott Thompson said, “This transaction advances all four of our key long-term initiatives: to develop the highest quality bedding products, promote brands with compelling marketing, optimize our diverse omnichannel distribution platform, and drive EPS growth. Consistent with our M&A strategy, this acquisition will make Tempur Sealy more competitive by bringing us closer to consumers and facilitating continued innovation.”

Thompson concluded, “We are excited by the long-term growth prospects for our global vertically integrated Company. This combination will accelerate our growth trajectory and enhance operating cash flow. Mattress Firm has been a valued retail partner for more than 35 years, and we look forward to welcoming their talented workforce of more than 8,100 employees to the Tempur Sealy family.”

Mattress Firm CEO John Eck said, “We know that every customer has unique needs and wants when it comes to a sleep solution that is perfect for them. As part of Tempur Sealy, our customers will benefit from our combined portfolio of highly recognized brands and products, extensive omni-channel capabilities, industry leading innovation and best-in-class teams. Under Tempur Sealy’s leadership, our combined company will be in a unique position to take advantage of our shared values and complementary capabilities to better address consumers’ needs and drive growth.”

Strategic Rationale

The combination with Mattress Firm is expected to enhance Tempur Sealy’s ability to meet consumers’ needs, expand growth opportunities, and streamline operations.

We expect to leverage the individual strengths of Tempur Sealy and Mattress Firm to realize six strategic benefits through this acquisition.

- Expanding Consumer Touchpoints. Mattress Firm’s and Tempur Sealy’s combined consumer touchpoints will create opportunities to keep pace with consumers’ evolving preferences. Being closer to the U.S. bedding consumer will also broaden opportunities to develop lifetime relationships with consumers.

- Accelerating U.S. Omni-Channel Strategy. Mattress Firm’s more than 2,300 brick-and-mortar retail stores, robust e-commerce capabilities, and sleep education and sleep tracking platforms complement Tempur Sealy’s direct-to-consumer operations, enabling a seamless omni-channel ecosystem that meets the needs of more consumers nationwide.

- Simplifying the Consumer Purchase Journey. This combination facilitates targeted marketing efforts to drive incremental brand awareness through blended advertising and share of voice, and enhance consumer understanding of bedding innovation, including health and wellness benefits. Further, the combination brings together Tempur Sealy’s and Mattress Firm’s highly trained retail sales and customer service teams to expand customer service capabilities, facilitate improved consumer outcomes, and simplify the consumer purchase journey.

- Facilitating Consumer-Centric Innovation. The alignment of new product development and testing will enable a more targeted, end-to-end innovation approach and enhances opportunities to invest in, test, and refine new sleep technologies.

- Streamlining Operations and Enhances Supply Chain Management. Enhanced visibility to consumer demand creates opportunities for more agile and fortified supply chain management. Combined scale and vertically integrated infrastructure across the combined company drives operational efficiencies across logistics, transportation, warehousing, supply chain planning, sourcing, and product development, streamlining the order-to-delivery process for all customers.

- Driving Adjusted EPS Accretion. Tempur Sealy has a strong track record of creating long-term value from highly strategic M&A activities. This acquisition is expected to be accretive to adjusted EPS before synergies in the first year post close. Adjusted for the impact of run-rate synergies, this acquisition is expected to deliver low double digit adjusted EPS accretion.

Cost Synergies

Tempur Sealy expects to begin realizing synergies by the end of year two after closing and to realize at least $100 million in annual run-rate synergies by the end of year four after closing. The Company expects to achieve synergies by leveraging its global scale and vertically integrated infrastructure to drive efficiencies through logistics, product lifecycle management, manufacturing optimization, and sourcing initiatives.

Transaction Overview

Under the terms of the agreement, Tempur Sealy will purchase Mattress Firm for an enterprise value of approximately $4.0 billion. The transaction is expected to be funded by approximately $2.7 billion of cash consideration (subject to adjustments including the repayment of Mattress Firm’s debt and other customary items.) and $1.3 billion in stock consideration issued to Mattress Firm shareholders, reflecting the issuance of approximately 34.2 million shares of Tempur Sealy common stock based on the closing price of $37.62 per share as of May 8, 2023. Following the transaction, Mattress Firm’s and Tempur Sealy’s shareholders will own approximately 16.6% and 83.4% of the combined company, respectively, based on the Company’s shares outstanding at the time of signing. Tempur Sealy expects to expand its existing Board of Directors by appointing two mutually-agreed Mattress Firm directors to the Tempur Sealy Board following the closing of the transaction.

Tempur Sealy plans to fund the cash portion of the transaction using a combination of cash on hand and proceeds from a combination of new secured and unsecured financing, a portion of which will be used to repay Mattress Firm’s outstanding debt. The combined company’s expected net leverage at closing per the Company’s credit agreement after giving effect to the transaction is expected to be between 3.0x and 3.25x adjusted EBITDA. Tempur Sealy expects to return to its net leverage target range of 2.0x to 3.0x adjusted EBITDA in the first 12 months after closing, supported by the increased earnings and free cash flow outlook of the combined company.

Timing and Approvals

The transaction has been approved by the board of directors of Tempur Sealy and Mattress Firm. Mattress Firm shareholders holding more than 80% of Mattress Firm’s outstanding shares have signed voting agreements in support of the transaction. The transaction does not require Tempur Sealy shareholder approval.

The transaction is expected to close in the second half of 2024, subject to the satisfaction of customary closing conditions and applicable regulatory approvals, including receipt of clearance under the Hart-Scott-Rodino Antitrust Improvements Act of 1976.

The Company has received a request for additional information and documentary material from the Federal Trade Commission (“FTC”) in connection with the FTC’s review of the transaction. The Company expects to work cooperatively with the FTC to complete the acquisition.

Impact of Explosion at Luxi Chemical’s Hydrogen Peroxide Plant

PUdaily | Updated: May 6, 2023

On May 1 at 12:20 pm, an explosion occurred at the hydrogen peroxide production area of Luxi Chemical, a subsidiary of Sinochem Holdings. The preliminary investigation found that when recovering the fluid, a large amount of 70% hydrogen peroxide had leaked into the kettle of the hydrogen peroxide device. The impurities in the kettle caused the hydrogen peroxide to decompose, causing overpressure explosions in the kettle that triggered explosions in the adjacent octanol storage tanks and pipeline leaks. Nine workers died, one was injured, and one is still missing.

The trigger for this accident was hydrogen peroxide, which is commonly used in medicine, sterilization, oxygen preparation, oxidants, bleaching agents, and dechlorinators. As a strong oxidiser, it is unstable and prone to decomposition. During decomposition, a large amount of heat is released. If metals, salts, and impurities are mixed in, the decomposition process may be intensified, leading to an explosion.

The HPPO process, which uses hydrogen peroxide as a raw material to directly oxidize propylene into propylene oxide (PO), is a new green technology, and the process patents are mainly held by companies such as Degussa, Uhde, Dow Chemical, and BASF. In China, Sinopec, Dalian Institute of Chemical Physics of the Chinese Academy of Sciences, and East China University of Science and Technology also have independent technologies. The process is relatively simple and does not produce too many byproducts, nor does it cause pollution to the surrounding environment. The produced propylene oxide is the only product allowed for export in China at present.

In the HPPO process, it’s key to ensure the quality of hydrogen peroxide. The most direct impact of the explosion at the hydrogen peroxide production area of Luxi Chemical is twofold:

First, the shutdown and transformation, which means that all devices that do not meet safety and environmental standards are immediately shut down, rectified, and closed within a certain time limit. The company’s current shutdown and associated devices involve hydrogen peroxide, caprolactam/nylon 6, and polyol units, and the resumption time is not decided yet.

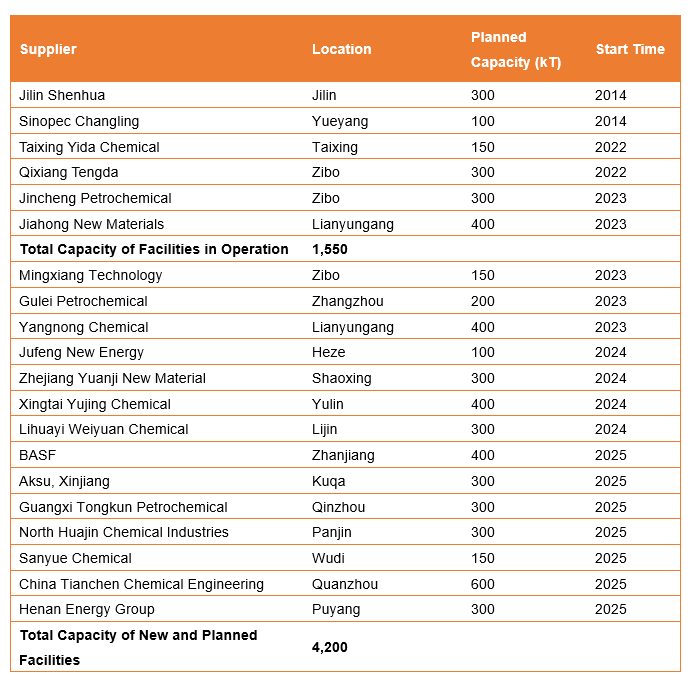

Second, the safety production supervision has been strengthened, and the entry threshold for HPPO process to produce propylene oxide has been raised. In China, the currently operating HPPO facilities include those at Jilin Shenhua and Sinopec Changling, which were put into operation in 2014, Taixing Yida Chemical and Qixiang Tengda, which were put into operation in 2022, and Jincheng Petrochemical and Jiahong New Materials, which were put into operation in 2023. China’s total annual capacity of propylene oxide is presently1.55 million tonnes, and the future new and planned projects will add an annual capacity of 4.2 million tonnes, according to PUdaily.

Moreover, the hydrogen peroxide explosion incident has to some extent delayed the restart of some HPPO process facilities, and the reduction in supply of propylene oxide is one of the reasons for the recent price increase. On May 5, the prevailing offers of propylene oxide in China have risen to CNY 10,000-10,100/tonne from CNY 9,600-9,700/tonne before the May Day holiday, and the uptrend will continue in the short term.

Future impacts include accelerating the relocation and transformation of hazardous chemical production companies in urban areas, increasing efforts to rectify, reduce, shift, and transform chemical companies outside of industrial parks.

May 5, 2023