The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

April 21, 2023

Good News on Inflation

Dan North | April 2023

The Consumer Price Index (CPI) rose only 0.1% m/m in March, below expectations of 0.2%. Perhaps more importantly, the y/y rate fell a full 1% from 6.0% in February to 5.0% in March, the lowest since May of 2021. After stripping out volatile food and energy prices, the core rate rose 0.4% m/m putting the y/y rate at 5.6%. However, that’s just above last month’s 5.5% which was the lowest since the peak last September of 6.5%.

On a mm/m basis, gasoline fell the most, dropping -4.6%, while air fares rose a steep 4.0%. The y/y patterns were the same as gasoline fell -17% while airfares gained 18%.

The Producer Price Index (PPI), which measures the prices that producers receive for their goods and services, delivered very happy news. On a m/m basis, PPI plummeted a dramatic -0.5%, blowing past expectations of 0.0%. It was the biggest decline since just after the pandemic started in April of 2020. The results on a y/y basis were even more startling, nosediving from 4.9% in February to 2.7% in March. That’s a breathtaking descent in one month. Furthermore, over the course of the past year, the PPI has fallen a gigantic 9% from 11.7% last March. Progress is being made.

The core rate (Final Demand Less Foods, Energy, and Trade Services) also delivered inspiration, as the y/y rate fell from 4.8% to 3.7% Looking at the individual industries on a m/m basis, prices in the energy industry fell -6.4%, driven by a huge -11.7% drop in gasoline prices. Energy also had the largest decline on a y/y basis at -7.2% while construction gained an outsized 15.6% over the year.

The sharp decline in the PPI y/y is significant because. As shown in the chart below the PPI tends to lead the CPI, suggesting that CPI is likely to continue falling as well.

https://www.allianz-trade.com/en_US/insights/good-news-on-inflation.html

April 18, 2023

“The Recovery Is On Track”: China Economy Rebounds Strongly With 4.5% GDP Jump In Q1

by Tyler Durden

Tuesday, Apr 18, 2023 – 05:58 AM

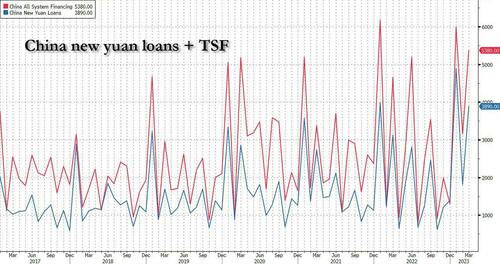

Last week, when discussing the latest record – for the month of March – Chinese credit injection which saw a massive 5.4 trillion yuan in Total Social Financing, beating estimates by almost CNY 1 trillion…

… and sparking a surge in China’s all-important Credit Impulse…

… we said that China’s delayed “liftoff was imminent”, and that “the 2008 deja vu meter just went off the charts, because while the US is about to sink into a recession with commercial real estate set to fall all off a cliff, it is once again China that is – willingly or otherwise – set to serve as the world’s growth dynamo at a time when the entire developed world is about to max out at the same time. This is precisely what happened in 2008 when China unleashed the biggest credit expansion in modern history, sparking not only historic growth spree but also an exponential debt increase that sent China’s debt to over 300% of GDP.”

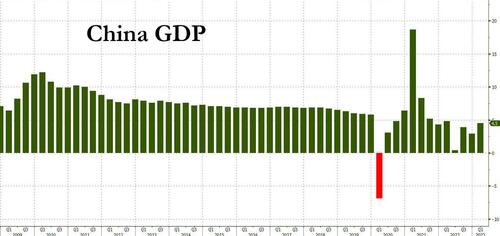

Since then, we have seen China report stellar trade data with both exports and imports sharply higher than expected, more solid real estate prints as housing prices have clearly rebounded from two years of decline, and most importantly, overnight China’s Q1 GDP also surprised to the upside, rising at a 4.5% annual clip in the first quarter – the strongest quarter for the Chinese economy since Q1 2022 – as strong growth in exports and infrastructure investment as well as a rebound in retail consumption and property prices drove a recovery in the world’s second-largest economy.

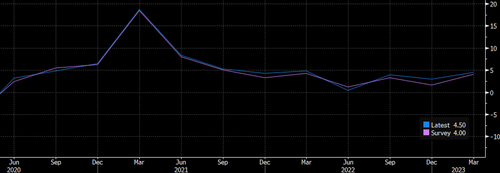

The official figure, which exceeded analyst expectations of a 4% rise and was the third consecutive beat of the median forecast…

… followed efforts by Chinese leader Xi Jinping’s government to restore business confidence damaged by pandemic controls last year and abrupt policy changes.

That said, the Q1 growth rate was just short of the government’s recently upgraded full-year target of 5%, held back by a nationwide Covid-19 outbreak at the start of this year, but economists expect it to pick up pace as the year progresses.

Xi, who formally embarked on an unprecedented third term as China’s president last month, is keen to revive economic growth following China’s shocking reversal of its covid-zero policy. Last year, GDP expanded just 3%, missing the official target of 5.5% which was already the lowest in decades.

“Definitely, the recovery’s on track,” said Tao Wang, UBS chief China economist. “The momentum at the beginning of the year was stronger than expected.”

Echoing what we said last week, the FT writes that “China’s rebound is crucial to global economic growth this year as developed nations grapple with persistently high inflation, rising interest rates and sluggish expansion in the wake of the pandemic and Russia’s full-scale invasion of Ukraine.”

“The national economy showed a steady recovery and made a good start,” China’s National Bureau of Statistics said. But the agency cautioned the situation was “complex and volatile, inadequate domestic demand remains prominent and the foundation for economic recovery is not solid yet”.

Curiously, while Chinese commodities markets rallied following Tuesday’s data release, equities failed to hold on to early gains. That’s because the data may have snuffed out recent hopes that bad news is good news and would lead to more stimulus. As Bloomberg reports Sofia Horta e Costa writes, “It’s clear markets are setting a high bar for China’s economy. So China data beats estimates yet again, but hardly anything moves in local assets. What’s going on?”

In March I wrote about how some traders were betting on a consumption-driven recovery, and others believed more stimulus would be forthcoming. You were either in one camp or the other. The issue for markets right now is that the macro picture is falling somewhere in the middle. Yes, the data is good — in some ways much better than expected — but not good enough for bulls to make a compelling case for a reopening boom in the economy.

The rebound is fragile, with pockets of weakness including the property market and factories. It’s also uneven: consumers may be spending more but they’re mainly focused on restaurants and jewelry. And the central bank is erring on the cautious side of stimulus. The bar is increasingly getting higher for any meaningful market reaction. We either need a blowout set of data across the board or more action from Beijing.

Indeed, while the Chinese data has been strong so far, it is certainly not blowout, at least not yet.

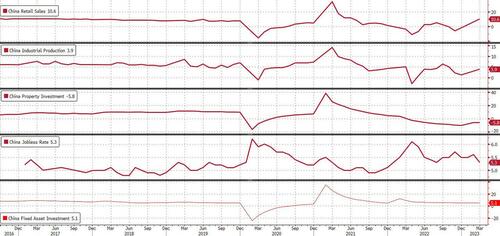

China abandoned zero-Covid restrictions in December amid popular opposition to the rolling lockdowns that paralyzed cities across the country for most of the year. The easing unleashed pent-up demand in the retail sector, where sales rose 5.8% year on year in the first quarter and 10.6% in March, both coming in well above expectations. But the base of comparison with last year was low, given that Shanghai started a months-long lockdown in late February 2022.

Premier Li Qiang, Xi’s new number two, signalled at China’s rubber-stamp parliament last month that the government would relax a crackdown on business that has wiped billions of dollars from property developers and internet platforms.

Elsewhere, manufacturing investment rose 7% year on year in the first quarter and industrial output gained 3%. Exports showed strong growth, up 8.4% in the first quarter, and state-led infrastructure investment climbed 8.8%, while overall fixed asset investment rose 5.1%, a modest miss to expectations. Private investment was weak, up just 0.6 %, suggesting a decline in March. The jobless rate fell to 5.3% in March from 5.6% in February, but youth unemployment hit the second-highest mark on record, at 19.6%.

At the same time, while home prices may be rising, housing sector woes persisted: the property sector’s woes continued, with new housing starts tumbling 19.2% year on year in the first quarter. Home sales by area declined 1.8% but sales by value rose 4.1%, pointing to a nascent recovery in prices. Indeed, in March, new home prices rose at their fastest pace in 21 months.

Following the news, Citigroup economists upgraded their forecast for 2023 GDP growth to 6.1% from 5.7% previously after strong data Tuesday. “Consumption recovery continued to be divergent across sectors, with services outperforming,” economists led by Xiangrong Yu wrote in a Tuesday research note. “Normalization in savings and improvement in employment” has provided “potential upside”

The property sector also improved steadily in March compared to the first two months of the year, especially for sales. The growth pickup “perhaps further lowers the necessity of stimulus,” the economists wrote, adding that they “don’t expect anything major” in the upcoming April Politburo meeting. This year could be a “window of opportunities for policymakers to address structural issues, such as weak private confidence, youth unemployment and local government debt.”

Other economists also said momentum would pick up in the second quarter, helped by the low base effect, but warned that consumption and property might struggle to maintain strong growth, while exports could be threatened by weaker developed markets.

Xi’s administration also remained hamstrung by a lack of credibility after hobbling the private sector, experts said.

Keyu Jin, a professor at the London School of Economics and author of The New China Playbook, said the biggest obstacle was the gap in private sector demand, both in consumption and investment.

“It will take time for confidence to come back to the Chinese economy,” she said, although what she really meant is that it would take a lot of new debt and credit. And as we showed last week, Beijing is already injecting record amounts of it as it prepares to become the world’s growth pillar now that the US is set to slide into recession.

https://www.zerohedge.com/markets/recovery-track-china-economy-rebounds-strongly-45-gdp-jump-q1

April 18, 2023

Wanhua Chemical’s operating income at 41.939 billion Yuan and net profit at 4.053 billion Yuan in Q1 2023 Save Print

Text size

| On April 14, Wanhua Chemical (600309) released the first quarter report of 2023, which showed that the operating income in the first quarter of 2023 was 41939325956.05 yuan, an increase of 0.37% over the same period of last year. The net profit belonging to shareholders of listed companies was 4053161512.31 yuan, down 24.58% on the year. The net cash flow generated by operating activities during the reporting period was 4166884642.68 yuan and the total assets were 237793786466.24 yuan. During the reporting period, the company’s operating income in the first quarter of 2023 was 41939325956.05 yuan, an increase of 0.37% over the same period of last year; the net profit belonging to shareholders of listed companies was 4053161512.31 yuan, down 24.58% year on year, mainly due to the decline in product prices and the reduction of gross profit. Wanhua Chemical is mainly engaged in polyurethane business, petrochemical business and fine chemicals and new materials business. |

https://www.ccfgroup.com/newscenter/newsview.php?Class_ID=600000&Info_ID=2023041830002

April 18, 2023

On February 24, 2023, Huntsman held a ribbon-cutting ceremony.

“…It’s the best investment you could possibly make.” – Peter Huntsman

“We are excited to open our newest location in Costa Rica. We welcome talent, experience, and fresh ideas from employees at all stages of their careers, from interns to seasoned professionals. In return, we offer you the opportunity to become an integral part of a dynamic, industry-leading company, where safety and ethics always come first.”

“..Service-oriented jobs in accounting, human resources, purchasing, automation, continuous improvement, financial planning and analysis, treasury, credit and communications…” – Costa Rica site leader, Mauricio Gonzalez

April 16, 2023

Business deindustrialization

Covestro boss calls for master plan for Germany

As of: 12:59 a.m | Reading time: 2 minutes

Quelle: Getty Images

High energy prices are a burden for chemical companies. Covestro boss Markus Steilemann, who is also president of the chemical industry, sees the industry as being unduly burdened. He is worried about job cuts in the manufacturing industry.

Dhe boss of the chemical company Covestro, Markus Steilemann, warns of Germany’s economic decline. “De-industrialization has already started,” Steilemann told WELT AM SONNTAG in an interview.

Steilemann, who is also President of the industry association VCI, cited the high energy prices as the main reason. “We need a master plan for Germany, and we need it urgently,” he demands. As a possible measure, Steilemann named a cheaper electricity price for industry.

Germany is still a leader in many research fields such as biotechnology. “But we are in the process of losing this lead to the USA, Great Britain and China.” The main culprits are the high energy prices, but also a real “law tsunami” with which the government is really slowing down companies.

There is no way around the government’s planned conversion to a climate-neutral future. “But instead of setting the right incentives for a country that is poor in raw materials but hungry for energy, the federal government loses itself in regulation mania,” says Steilemann.

At the same time, the industry is being unduly burdened by electricity prices, which are very high by international standards. “This puts Germany’s business model, as one of the leading export nations, at risk. There are already first signs: I’m watching with concern how massive jobs are currently being cut in Germany – and not just in the manufacturing industry,” he said.

Despite the difficult outlook this year, the CEO ruled out redundancies for Covestro: “Since we have made long-term provisions, we don’t need any quick-fix measures. I have made it clear that we will rule out redundancies for operational reasons, and that’s how it’s going to stay.”