The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

April 29, 2019

A “Nightmare Come True”: Amazon Launches Freight Brokerage, Slashes Prices By 30%

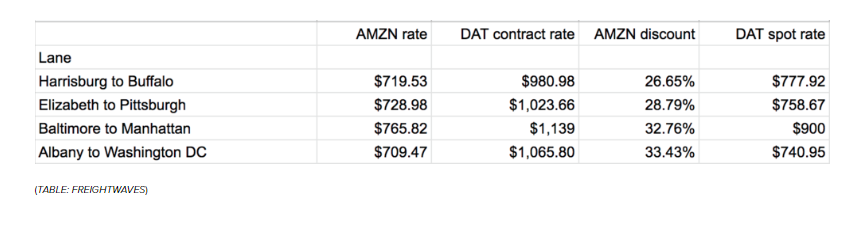

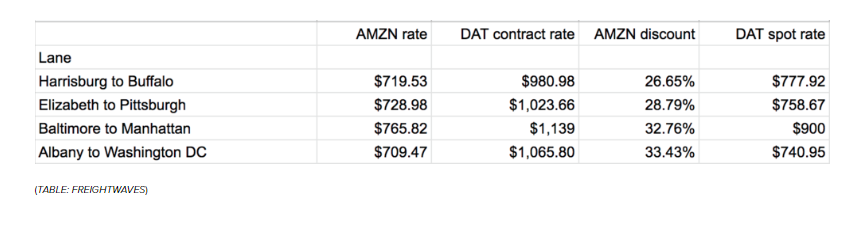

In what is being called a “nightmare come true” for freight brokers and carriers, Amazon did what it traditionally does every time it enters a new market, and took its own digital freight brokerage platform live while undercutting prevailing market prices by 26% to 33% in the latest deflationary race to the pricing bottom in order to grab market share, according to FreightWaves.

Late last week, Morgan Stanley equities analyst Brian Nowak had predicted this was going to happen, stating: “We see AMZN’s 1-day Prime shipping raising consumer expectations and increasing the cost to compete in e-commerce. Over the long term, we also see this as a Trojan horse for Amazon to grow its next disruptive business… a third party logistics network.”

Amazon already has an extensive network of trucking carriers as it moves an enormous amount of freight across the country. Having their own third-party logistics network was just an obvious next step for the behemoth of a company that relies so much on shipping. The benefits are plentiful for Amazon: they get to hedge against the volatile price of trucking capacity and they get to expand their infrastructure, while turning part of their costs into revenue. Amazon is already a top 10 international freight forwarder for Asian ocean freight inbound to North America.

Amazon explained the company’s strategy by stating: “The advantages that then come from disintermediation and the monetization of those capabilities are secondary to the immediate need of self-preservation, but then serve to feed very critical needs of Amazon’s ability to continue to succeed. This innovation and growth then manifests as continuously evolving towards the ability to sell everything and anything that is or can be sold. That’s the true Amazon flywheel: disintermediate to survive; monetize to fund innovation; innovate to grow; disintermediate to survive…”

Amazon’s entry into freight brokerage is an attempt to re-accelerate its top line, which has slowed from 30% annually three years ago to less than 15% this year. The company is trying to not allow trucking capacity to constrain its growth and, for now, it is coming in at price points that are far below market prices. This indicates that Amazon is not trying to realize enormous gross margins at first. The company’s new portal is intended for those who want Amazon‘s rates for full truckload dry van freight in Connecticut, Maryland, New Jersey, New York, and Pennsylvania. Based on these rates, the company is essentially a “free, marginless brokerage”.

Eventually, down the road, the company will monetize this. But for right now, the company is focused on deploying a massive amount of capital to rapidly scale up its network on thin margins to get started. Prices will eventually creep up once Amazon has penetrated the market (read obliterated the competition), not unlike Amazon’s original business model decades ago.

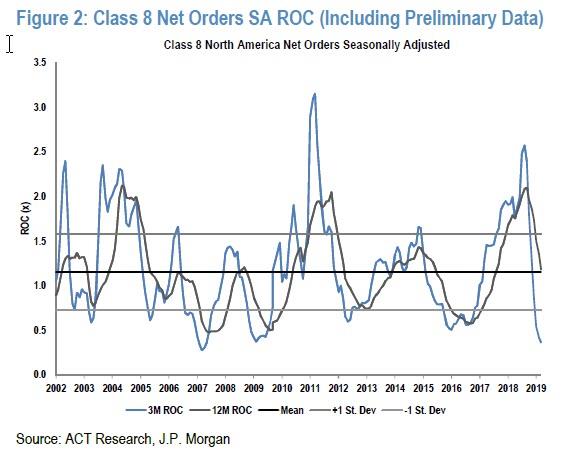

Amazon’s new business will surely result in even more carnage in the Class 8 “heavy duty” order industry, where as we reported a few weeks ago, order for Class 8 trucks collapsed an astounding 66%, which decline is attributed to a 300,000+ vehicle backlog potentially prompting fleets to halt purchases in the near term, however it is also likely that concerns about the economic slowdown are also playing a major part in the latest collapse. Specifically, March Class 8 net orders were just 15,700 units (16,000 SA; 192,000 SAAR), down 66% YoY from 49,600 a year ago and down 6.7% sequentially.

“March marks the fourth consecutive month of orders meaningfully below the current rate of build,” said Steve Tam, vice president of ACT. During that four-month period, Class 8 orders have been booked at a 194,000 seasonally adjusted annual rate, or SAAR. This is down significantly from 489,000 SAAR for the same period a year earlier, Tam said.

And it’s only going to get worse now that Amazon is taking over. The company spent $7.3 billion on transportation in the first quarter of 2019, which is lumped together with sortation and delivery costs in its “shipping cost” line item. Amazon’s shipping costs for the year, annualized, are approximately $87.6 billion and FreightWaves predicts that it could be years before investors start asking about margins on this business.

Building out this network could also allow Amazon to “blowout retail peak season”. By sacrificing margins up front, the company will have capacity locked up to move record breaking volumes during the holiday season. This is also another step Amazon is taking to try and get a leg up against competitors like Walmart. We just reported hours ago that Walmart was looking to get into one day shipping without a membership fee to compete with Amazon. Now, it looks as though Amazon has volleyed that ball right back into Walmart’s court.

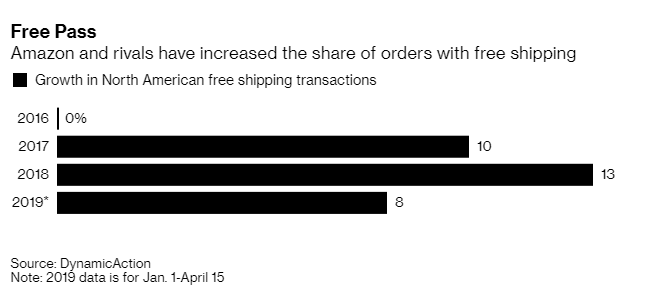

Walmart has offered free two-day shipping on orders of $35 or more since early 2017, which helped it keep up with Amazon. And while Amazon still accounts for about half of all e-commerce spending in the United States, this $35 threshold has also been taken on by other retailers, like Target, to help offset the cost of delivery.

Total retail transactions with free shipping were up 13% in North America last year and were up 8% through April 15 of this year. Amazon Prime now charges customers monthly and annual fees, amounting to about $119 in the US for a year. Prime customers get shipping discounts and free two day delivery on most items.

April 29, 2019

A “Nightmare Come True”: Amazon Launches Freight Brokerage, Slashes Prices By 30%

In what is being called a “nightmare come true” for freight brokers and carriers, Amazon did what it traditionally does every time it enters a new market, and took its own digital freight brokerage platform live while undercutting prevailing market prices by 26% to 33% in the latest deflationary race to the pricing bottom in order to grab market share, according to FreightWaves.

Late last week, Morgan Stanley equities analyst Brian Nowak had predicted this was going to happen, stating: “We see AMZN’s 1-day Prime shipping raising consumer expectations and increasing the cost to compete in e-commerce. Over the long term, we also see this as a Trojan horse for Amazon to grow its next disruptive business… a third party logistics network.”

Amazon already has an extensive network of trucking carriers as it moves an enormous amount of freight across the country. Having their own third-party logistics network was just an obvious next step for the behemoth of a company that relies so much on shipping. The benefits are plentiful for Amazon: they get to hedge against the volatile price of trucking capacity and they get to expand their infrastructure, while turning part of their costs into revenue. Amazon is already a top 10 international freight forwarder for Asian ocean freight inbound to North America.

Amazon explained the company’s strategy by stating: “The advantages that then come from disintermediation and the monetization of those capabilities are secondary to the immediate need of self-preservation, but then serve to feed very critical needs of Amazon’s ability to continue to succeed. This innovation and growth then manifests as continuously evolving towards the ability to sell everything and anything that is or can be sold. That’s the true Amazon flywheel: disintermediate to survive; monetize to fund innovation; innovate to grow; disintermediate to survive…”

Amazon’s entry into freight brokerage is an attempt to re-accelerate its top line, which has slowed from 30% annually three years ago to less than 15% this year. The company is trying to not allow trucking capacity to constrain its growth and, for now, it is coming in at price points that are far below market prices. This indicates that Amazon is not trying to realize enormous gross margins at first. The company’s new portal is intended for those who want Amazon‘s rates for full truckload dry van freight in Connecticut, Maryland, New Jersey, New York, and Pennsylvania. Based on these rates, the company is essentially a “free, marginless brokerage”.

Eventually, down the road, the company will monetize this. But for right now, the company is focused on deploying a massive amount of capital to rapidly scale up its network on thin margins to get started. Prices will eventually creep up once Amazon has penetrated the market (read obliterated the competition), not unlike Amazon’s original business model decades ago.

Amazon’s new business will surely result in even more carnage in the Class 8 “heavy duty” order industry, where as we reported a few weeks ago, order for Class 8 trucks collapsed an astounding 66%, which decline is attributed to a 300,000+ vehicle backlog potentially prompting fleets to halt purchases in the near term, however it is also likely that concerns about the economic slowdown are also playing a major part in the latest collapse. Specifically, March Class 8 net orders were just 15,700 units (16,000 SA; 192,000 SAAR), down 66% YoY from 49,600 a year ago and down 6.7% sequentially.

“March marks the fourth consecutive month of orders meaningfully below the current rate of build,” said Steve Tam, vice president of ACT. During that four-month period, Class 8 orders have been booked at a 194,000 seasonally adjusted annual rate, or SAAR. This is down significantly from 489,000 SAAR for the same period a year earlier, Tam said.

And it’s only going to get worse now that Amazon is taking over. The company spent $7.3 billion on transportation in the first quarter of 2019, which is lumped together with sortation and delivery costs in its “shipping cost” line item. Amazon’s shipping costs for the year, annualized, are approximately $87.6 billion and FreightWaves predicts that it could be years before investors start asking about margins on this business.

Building out this network could also allow Amazon to “blowout retail peak season”. By sacrificing margins up front, the company will have capacity locked up to move record breaking volumes during the holiday season. This is also another step Amazon is taking to try and get a leg up against competitors like Walmart. We just reported hours ago that Walmart was looking to get into one day shipping without a membership fee to compete with Amazon. Now, it looks as though Amazon has volleyed that ball right back into Walmart’s court.

Walmart has offered free two-day shipping on orders of $35 or more since early 2017, which helped it keep up with Amazon. And while Amazon still accounts for about half of all e-commerce spending in the United States, this $35 threshold has also been taken on by other retailers, like Target, to help offset the cost of delivery.

Total retail transactions with free shipping were up 13% in North America last year and were up 8% through April 15 of this year. Amazon Prime now charges customers monthly and annual fees, amounting to about $119 in the US for a year. Prime customers get shipping discounts and free two day delivery on most items.

April 29, 2019

Results influenced by challenging environment as expected

Covestro confirms full year guidance after first quarter

Core volumes slightly down (–1.8%)

Group sales around EUR 3.2 billion (–16.0%)EBITDA at EUR 442 million in line with expectations (–58.4%)

Net income of EUR 179 million below previous year (–72.2%)

Free operating cash flow at minus EUR 45 millionGuidance for fiscal 2019 confirmed

As expected, higher competitive pressure influenced the first quarter 2019 results of DAX-listed Covestro. Despite an overall solid demand, core volumes decreased slightly by 1.8%, mainly due to lower volumes in the Polycarbonates segment. A marked drop in selling prices led to a reduction in Group sales by 16.0% to EUR 3.2 billion. The Group’s EBITDA at EUR 442 million (–58.4%), a contrast to the exceptionally positive prior-year results, was in line with the forecast. As a result, net income also fell to EUR 179 million (–72.2%). At minus EUR 45 million, free operating cash flow (FOCF) was negativecompared with the previous year (EUR 364 million) due to reduced cash flows from operating activities and increased investments. Although on the whole significantly below the outstanding resultsof the prior year’s quarter, results remain in the expected range and Covestro confirms targets set for the year as a whole.

“The first quarter was in line with our guidance and confirms our subdued expectations for the full year,” explains CEO Dr. Markus Steilemann. “It is therefore even more important to now set the right course for our future growth with investments and efforts to improve efficiency. After all, demand for our innovative and sustainable materials remains intact.”

Covestro confirms targets for fiscal year 2019Dr. Thomas Toepfer, CFO of Covestro,compares the results of the first quarter against the same period in 2018: “The prior-year quarter was influenced by exceptionally high margins in a number of product groups. In line with our expectations, our results therefore fell below those of the same period of last year. In anticipation of continued challenging environment influencing results throughout the year, we are especially focusing on efficient production and processes and targeted investments.”

Consistent with this focus, Covestro raised its stake to 80% in the joint venture DIC Covestro Polymer in Japan effective April 1, 2019, expanding its promising global thermoplastic polyurethanes business. Covestro plans total investments of over EUR 900 million this year to refurbish and expand its production plants and extend into growth areas such as specialty films. Efficiency measuresare expected to deliver cost savings of EUR 350 million per year over the medium term.For fiscal2019, Covestro continues to project core volume growth to be in the low-to mid-single-digit percentage range. FOCF is expected to be between EUR 300 million and EUR 700 million, with ROCE between 8% and 13%. EBITDA for the fiscal year is forecast to be between EUR 1.5 billion and EUR 2.0 billion, with the second quarter EBITDA expected to be around the level of first quarter 2019.Strategic initiatives making headway.

Strategic initiatives to advance digitalization and innovation made progress in the first quarter. The new digital B2B trading platform Asellion was successfully launched at the end of March, enabling Covestro customers to order products online and do business around the clock and with just a few clicks at the link covestro.asellion.com.

Covestro has also joined forces with the US-based biotechnology company Genomatica to research and develop high-performance materials on the basis of renewable raw materials. This collaboration aims to reduce the use of fossil-based resources such as crude oil through the use of sustainable raw materials instead.Sales and earnings growth in Coatings, Adhesives, Specialties segment.

Core volumes in the Polyurethanes segment remained largely stable (–0.2%) in the first quarter of 2019. Sales in this segment declined by 24.3% to EUR 1,476 million due to lower selling prices, with all three regions posting lower sales. EBITDA fell to EUR157 million (–75.4%) due to lower margins.

Driven by weaker demand from the automotive industry, core volumes in the Polycarbonates segment decreased by 6.3%. Sales in this segment declined by 16.7%toEUR 860million, due also to lower selling prices. With falling margins and stable raw material prices, EBITDA declined to EUR 155 million (–48.8%).

In the Coatings, Adhesives, Specialties segment, core volumes saw virtually no change versus the prior-year quarter (–0.1%). Sales in this segment increased by 5.9% to EUR 627 million, boosted by increased selling prices on average and exchange rate movements. EBITDA rose 7.4% to EUR 146 million.

https://news.covestro.com/news.nsf/id/B6AAF2E730B71136C12583E800488AAE/%24File/2019-064E.pdf?open&mod=29.04.2019_07:21:54

April 29, 2019

Results influenced by challenging environment as expected

Covestro confirms full year guidance after first quarter

Core volumes slightly down (–1.8%)

Group sales around EUR 3.2 billion (–16.0%)EBITDA at EUR 442 million in line with expectations (–58.4%)

Net income of EUR 179 million below previous year (–72.2%)

Free operating cash flow at minus EUR 45 millionGuidance for fiscal 2019 confirmed

As expected, higher competitive pressure influenced the first quarter 2019 results of DAX-listed Covestro. Despite an overall solid demand, core volumes decreased slightly by 1.8%, mainly due to lower volumes in the Polycarbonates segment. A marked drop in selling prices led to a reduction in Group sales by 16.0% to EUR 3.2 billion. The Group’s EBITDA at EUR 442 million (–58.4%), a contrast to the exceptionally positive prior-year results, was in line with the forecast. As a result, net income also fell to EUR 179 million (–72.2%). At minus EUR 45 million, free operating cash flow (FOCF) was negativecompared with the previous year (EUR 364 million) due to reduced cash flows from operating activities and increased investments. Although on the whole significantly below the outstanding resultsof the prior year’s quarter, results remain in the expected range and Covestro confirms targets set for the year as a whole.

“The first quarter was in line with our guidance and confirms our subdued expectations for the full year,” explains CEO Dr. Markus Steilemann. “It is therefore even more important to now set the right course for our future growth with investments and efforts to improve efficiency. After all, demand for our innovative and sustainable materials remains intact.”

Covestro confirms targets for fiscal year 2019Dr. Thomas Toepfer, CFO of Covestro,compares the results of the first quarter against the same period in 2018: “The prior-year quarter was influenced by exceptionally high margins in a number of product groups. In line with our expectations, our results therefore fell below those of the same period of last year. In anticipation of continued challenging environment influencing results throughout the year, we are especially focusing on efficient production and processes and targeted investments.”

Consistent with this focus, Covestro raised its stake to 80% in the joint venture DIC Covestro Polymer in Japan effective April 1, 2019, expanding its promising global thermoplastic polyurethanes business. Covestro plans total investments of over EUR 900 million this year to refurbish and expand its production plants and extend into growth areas such as specialty films. Efficiency measuresare expected to deliver cost savings of EUR 350 million per year over the medium term.For fiscal2019, Covestro continues to project core volume growth to be in the low-to mid-single-digit percentage range. FOCF is expected to be between EUR 300 million and EUR 700 million, with ROCE between 8% and 13%. EBITDA for the fiscal year is forecast to be between EUR 1.5 billion and EUR 2.0 billion, with the second quarter EBITDA expected to be around the level of first quarter 2019.Strategic initiatives making headway.

Strategic initiatives to advance digitalization and innovation made progress in the first quarter. The new digital B2B trading platform Asellion was successfully launched at the end of March, enabling Covestro customers to order products online and do business around the clock and with just a few clicks at the link covestro.asellion.com.

Covestro has also joined forces with the US-based biotechnology company Genomatica to research and develop high-performance materials on the basis of renewable raw materials. This collaboration aims to reduce the use of fossil-based resources such as crude oil through the use of sustainable raw materials instead.Sales and earnings growth in Coatings, Adhesives, Specialties segment.

Core volumes in the Polyurethanes segment remained largely stable (–0.2%) in the first quarter of 2019. Sales in this segment declined by 24.3% to EUR 1,476 million due to lower selling prices, with all three regions posting lower sales. EBITDA fell to EUR157 million (–75.4%) due to lower margins.

Driven by weaker demand from the automotive industry, core volumes in the Polycarbonates segment decreased by 6.3%. Sales in this segment declined by 16.7%toEUR 860million, due also to lower selling prices. With falling margins and stable raw material prices, EBITDA declined to EUR 155 million (–48.8%).

In the Coatings, Adhesives, Specialties segment, core volumes saw virtually no change versus the prior-year quarter (–0.1%). Sales in this segment increased by 5.9% to EUR 627 million, boosted by increased selling prices on average and exchange rate movements. EBITDA rose 7.4% to EUR 146 million.

https://news.covestro.com/news.nsf/id/B6AAF2E730B71136C12583E800488AAE/%24File/2019-064E.pdf?open&mod=29.04.2019_07:21:54

April 29, 2019

|

| Press Release of Recticel – 29 April 2019 |

Trading update for 1st quarter 2019

Olivier Chapelle (CEO): “As previously announced, our net sales have decreased in 1Q2019 due to a combination of adverse Automotive and Comfort markets affecting the volumes, and of selling price erosion in the Flexible Foams and Insulation segments as a consequence of falling MDI and TDI raw material prices.

The evolution of our order books points towards progressive volume and net sales increases, and we remain focused on the execution of our innovation and growth plans, among which the ramp-up of our new Insulation factory in Finland.

In parallel of executing our announced industrial footprint reduction in Germany, the Group continues to implement operating cost reductions.

While the process has become more challenging over the last 8 months due to the rapidly changing Automotive market conditions, the Group continues to actively pursue the divestment of its Automotive Interiors division.” OUTLOOK In a highly volatile economic and geopolitical environment, we are well positioned to adapt quickly to changing market conditions, and we remain focused on the execution of our plans. Having anticipated an adverse market environment in the first half of 2019, we expect an improvement in the second half of the year, and confirm our guidance of a 2019 Adjusted EBITDA above the level of 2018 on a like-for-like basis. |