The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

January 26, 2023

Michigan-based Dow is cutting about 2,000 jobs, or 5% of workforce

Materials science company Dow is cutting about 2,000 jobs, or approximately 5% of its global workforce, as part of an effort to reach $1 billion in cost savings this year.

The Midland, Michigan-based company currently employs approximately 37,800 people.

Dow Inc. will take a charge of $550 million to $725 million in the first quarter. This mostly includes severance and related benefit costs; costs related to exit and disposal activities and asset write-downs and write-offs. Dow did not provide specifics but said it would evaluate assets with a focus on Europe.

The company also reported a fourth-quarter profit of $613 million, or 85 cents per share. Its adjusted profit was 46 cents per share, below the 57 cents per share that analysts surveyed by Zacks Investment Research were calling for.

Revenue totaled $11.86 billion, missing Wall Street’s estimate of $12.03 billion.

“In the fourth quarter, Team Dow continued to proactively navigate slowing global growth, challenging energy markets, and destocking,” Jim Fitterling, chairman and CEO, said in a statement. “In response, we shifted our focus to cash generation in the quarter as we lowered operating rates, implemented cost-savings measures, and prioritized higher-value products where demand remained resilient.

January 25, 2023

2022 Year End Summary: China’s PO Market Review

PUdaily | Updated: January 17, 2023

The pandemic, coupled with tight global supplies of energy and food, impacted consumption and manufacturing activities in China in 2022. But China’s economy is expected to pick up in 2023 as the government efforts to stimulate economy are producing effects, including the shift in pandemic prevention and control policy, which enables the economy to emerge from the negative effects of the COVID-19, the demand to recover and the manufacturing activities to return to normal levels, as well as the development of policies to increase domestic demand, which will help offset the impact of decreased exports. And the low base in 2022 also lays a foundation for the robust economic recovery in 2023. It is expected that China’s economy will grow by over 5% in 2023.

In terms of the PU raw materials market, against the backdrop of global inflation, repeated COVID-19 outbreaks and start-up of new production capacities, in 2022 buyers gained more bargaining power the market supply and demand pattern has turned from up to down, and the PO market shows a trend of falling within a range and fluctuating in a narrow range.

China PO Prices

In 2022, manufacturers in Shandong continued to have the greatest impact on the changes in domestic PO prices. Offers in Shandong and North China averaged about CNY 10,163/tonne EXW in bulk in cash, down 38.3%. And those in East China averaged CNY 10,309/tonne DEL in bulk in cash, down 38.2%.

China PO Capacity & Output

In 2022, Taixing Yida Chemical saw successful trial run of its 150kt/a PO project, and Tianjin Bohai Chemical’s PO/SM plant, with an annual capacity of 200,000 tonnes for PO and 450,000 tons for SM, was also successfully commissioned, thus bringing the national PO capacity to 4.897 million tons per year, up 14% from prior year. Further capacity expansion can be expected as Zhejiang Petroleum and Chemical’s Phase II PO/SM project is under construction and Jiangsu Eastern Shenghong is planning its PO/SM facility project, with an annual capacity of 200,000 tonnes for PO and 450,000 tons for SM. China’s total PO output in 2022 hit a record high of 3.76 million tonnes, up 8.7 percent.

China PO Import & Export

According to the General Administration of Customs of China, China imported 290,000 tonnes of PO for the January-November period, down 26.3% year-on-year and mainly from Thailand and Japan. It exported 9,000 tonnes of PO for the same period, up 268.3% year-over-year and mainly to India and the United States.

In the year, some PO units in Saudi Arabia, Japan and South Korea, Thailand and European countries were shut for routine maintenance or forced to lower their production loads due to energy crisis and cost pressure. On the other hand, as domestic production capacity continued to expand, China’s dependence on imports had been significantly reduced. All this led to shrunk PO imports…

China PO Consumption

In 2022, China’s PO consumption rose by 4.2%. Although PO production increased significantly as new capacities came online, the demand failed to expand as rapidly. The lockdown in East China was lifted in the second quarter, but no significant recovery in demand followed in July. The supply remained ample, though individual manufacturers experienced fluctuations in their production. In 2022, PPG remained the largest consumer of PO, although PPG consumption decreased by 8.3%. It is followed by PG/DMC, propylene glycol ethers, flame retardant TCPP and isopropanolamine…

In 2023, Tianjin No. 3 Petrochemical Plant, Zhejiang Petrochemical &Chemical, Shandong Minxiang Chemical Technology and Shandong Jufeng New Energy Technology are likely to put into operation their new plants. In 2022, PO manufacturers again lowered their production loads in an attempt to boost the market, resulting in an industry operating rate of 55% to 68% excluding plants shut for maintenance. But the effectiveness was quite different than in 2021. The main reason is the fierce competition resulting from more new players entering the market in addition to the sluggish demand. As supply became increasingly ample, buyers gained more bargaining power and the profit margin was squeezed.

January 25, 2023

Southeast Asia MDI Market and Dowmstream Sectors Review 2022

PUdaily | Updated: January 19, 2023

With higher vaccination coverage and loosening pandemic restrictions, most economies in Southeast Asia showed strong recovery momentum in the past year. In December 2022, the Asian Development Bank (ADB) gave out a supplement to its flagship Asian Development Outlook(ADO) 2022, which upgraded growth outlook for 2022 to 5.5% from 5.1% on robust economic performance in Malaysia, the Philippines, Thailand, and Vietnam in the third quarter. The report noted that the strong performance on consumption, exports and tourism in these economies boosted economic growth expectations for 2022.

Southeast Asia MDI Demand 2022

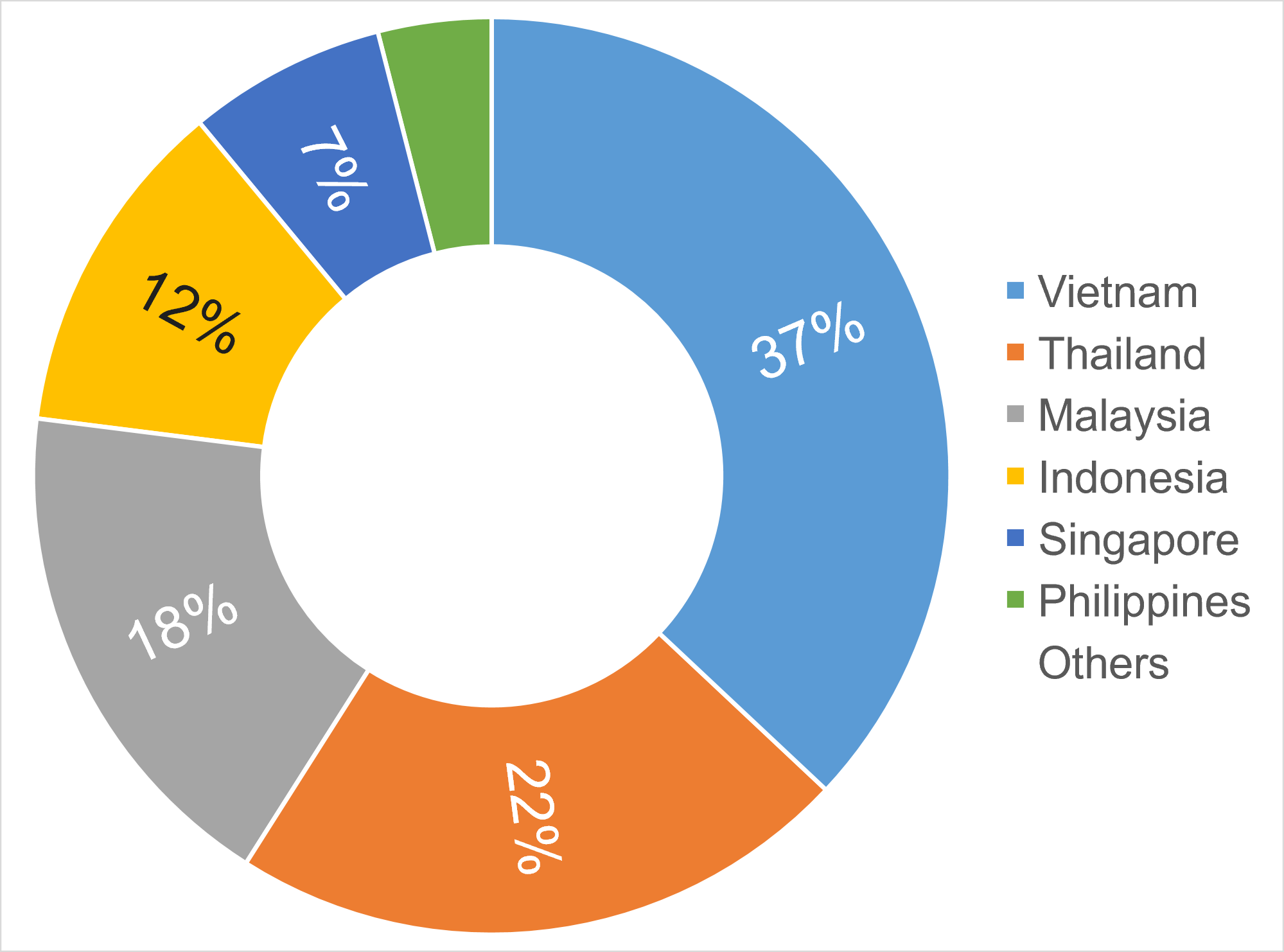

Without any MDI synthesizing facilities, Southeast Asia region mainly imports MDI products from China, Japan, South Korea and even from the Middle East and Europe. The major MDI suppliers include Chinese Wanhua Chemical, Japanese Tosoh, South Korean KMCI and BASF. Moreover, Middle Eastern firm Sadara’s PMDI is sold by Dow and SABIC. The supply of MDI exported from China, Japan and South Korea to Southeast Asia kept stable from 2018 to 2022. It is estimated that the total demand for MDI in Southeast Asia will be about 300kT in 2022, of which the demand for imported goods from China, Japan and South Korea will be around 260kT, basically the same as the previous year. Vietnam, Thailand and Malaysia are the top MDI consumers in Southeast Asia. In 2022, the year-on-year growth rates of MDI consumption in Vietnam and Malaysia were higher than the overall growth level of consumption in Southeast Asia.

Southeast Asian (Estimated) MDI Consumption by Country, 2022 (%)

Southeast Asian Major MDI Downstream Sectors

The main downstream sectors of PMDI in Southeast Asia are insulation panels, refrigerators & freezers, automobiles, etc. And the main downstream sectors of MMDI are PU resin for shoe sole and spandex. Vietnam, Thailand, Indonesia, Malaysia and Singapore are the top MDI consumers and also the major economies in the region. Southeast Asia countries have attracted significant foreign investment in recent years, owing to low costs on land and labor, stable political environment, robust economic development and preferential tariff rates.

Cold Chain Logistics (Insulation Panel): As one of the key strategic regions for global industrial transfer, the development of Southeast Asian countries is attracting much attention, and its cold chain logistics market is expected to grow by more than 12% in 2022-2027. Thailand’s refrigeration capacity totaled 940kT, and the refrigeration capacity of Indonesia and Myanmar was 370kT and 88kT respectively, according to a report of the Economic Research Institute for ASEAN and East Asia (ERIA). Increasing meat consumption is one of the main driving factor for the development of the cold chain industry in Southeast Asian countries. Malaysia’s poultry meat industry is largely self-sufficient, with an annual per capita consumption of nearly 50 kilograms.

Automobile: With a huge population and abundant natural resources, ASEAN is one of the fastest-growing consumer market, which, in turn, will drive the automobile market. From January to November 2022, auto outputs in ASEAN amounted to 4.06 million units, up 27.4% y/y. The top three auto producers are Indonesia, Thailand and Malaysia, contributing about 92.5% of total regional outputs. Thailand, the largest auto production base in Southeast Asia, produced 1.79 million vehicles from January to November 2022, up 16.9% y/y.

Summary:

The overall MDI consumption in Southeast Asia in 2022 kept unchanged compared with the previous year. It’s mainly because Southeast Asian manufacturing PMI is above 50% throughout the year and the demand in MDI downstream sectors didn’t weaken significantly. In addition, thanks to lower labor costs, more foreign-funded enterprises chose to enter the Southeast Asian market. In 2023, MDI consumption and its downstream sectors are projected to see a rise in Southeast Asia.

January 25, 2023

Serta Simmons Files for Bankruptcy Amid Financing Controversy

Amelia Pollard and Luca Casiraghi

Tue, January 24, 2023 at 2:54 PM EST·4 min read

(Bloomberg) — The emergency funding that Serta Simmons Bedding received during the pandemic triggered a blowback that the company is still struggling to recover from.

The mattress manufacturer filed for bankruptcy on Monday, after clashes with lenders including Apollo Global Management Inc. left it with no other options for cutting its debt load while grappling with an economic slowdown that is crimping sales. Serta said the Chapter 11 filing will allow it to continue operating while it fixes its balance sheet, cutting debt to $300 million from $1.9 billion.

When the pandemic was raging in 2020 and the US economy had broadly shut down, Serta Simmons got $200 million of rescue financing to help it stay in business. The funding came from a group of lenders including Eaton Vance and Invesco Ltd., and featured a twist: the firms would be among the first in line to get repaid if the company failed.

Lenders excluded from that financing, including Apollo and Angelo Gordon & Co., responded by suing, arguing that other creditors had violated lending agreements by jumping ahead of them in the line to be repaid. Litigation tied to the transaction is still going on.

The mattress maker, assembled over a decade by private equity firms, faced heavy debt maturities this year. Alongside its Chapter 11 petition, Serta filed a lawsuit asking its bankruptcy judge to bless the 2020 financing that triggered litigation. Settling the fight over that deal is “critical” to the mattress maker’s restructuring, the company said in its lawsuit. The company’s planned deal is backed by a majority of lenders and shareholders.

Plan Details

The Serta litigation was the beginning of a series of clashes between lenders and companies with heavy debt loads that were struggling to navigate the pandemic. Creditors said that companies were pitting lenders against one another to get cheaper funding, and were hurting investors in the process.

Now Serta is trying to fix its financial difficulties with a bankruptcy plan that calls for repaying high-ranking lenders with new debt and stock in the restructured company, court papers show. Holders of more than $830 million of so-called first-lien-second-out debt are slated to get most of the company’s equity.

Loans pushed back in the repayment line in 2020 — more than $860 million of debt — would get a single-digit share of the stock in post-bankruptcy Serta. The plan also calls for paying the company’s continuing vendors in full, as long as they agree to favorable trade terms.

Nearly all of its top unsecured creditors are suppliers, with the top one listed owed more than $17 million, the filings show. The plan requires bankruptcy court approval and could change.

The creditor group has agreed to provide $125 million in the form of an asset-based loan to help the company fund itself in bankruptcy. Serta has also secured a commitment of $125 million in the same form once it exits bankruptcy.

The firm listed assets of $1 billion to $10 billion and liabilities in the same range in its petition. The company’s debt, which stems from a roughly $3 billion leveraged buyout by Advent International in 2012, has hobbled the retailer. Confidential talks over a restructuring plan started late last year, Bloomberg earlier reported.

Serta is working with advisers Weil, Gotshal & Manges, Evercore Group and FTI Consulting, according to the statement. Gibson Dunn & Crutcher and Centerview Partners are advising creditors, while Ropes and Gray are working with Advent.

Joining Forces

The mattress giant’s start can be traced back to the 1870s along the shores of Lake Michigan. There, Simmons first started producing coil spring mattresses, John Linker, the company’s chief financial officer, said in court papers.

The firm grew over the next century until it filed for bankruptcy during the fall-out of the financial crisis. Soon after, the firm combined with competitor Serta to establish the new company, Serta Simmons. In 2018, the company acquired Tuft & Needle, a maker of mattresses that get packaged in boxes and shipped directly to consumers’ homes.

Today, the firm is one of the largest mattress companies in the US, accounting for 19% of annual bedding sales, according to court papers. It operates 21 manufacturing facilities across the US and Canada and sells mattresses at 2,200 independent retailers.

But selling mattresses has grown more difficult, according to Serta. Rising interest rates have weighed on consumer spending, and the company has faced higher raw material costs and supply chain disruptions.

The case is Serta Simmons Bedding LLC, 23-90020, US Bankruptcy Court for the Southern District of Texas.

https://www.yahoo.com/now/mattress-maker-serta-simmons-files-044757930.html

January 24, 2023

Alantra advises Mearthane Products Corp. on a recapitalization by Compass Group Equity Partners

SECTORIndustrials

ServiceM&A

Dec 2022https://www.alantra.com/ib-transaction/mearthane-products-corporation-sell-side-advisory-compass-group-equity-partners/

Sell-side advisory

Boston – Alantra, a leading global investment bank and asset management firm, is pleased to announce that Mearthane Products Corporation (“MPC”), a leader in proprietary, branded urethane-based technology, has been recapitalized by Compass Group Equity Partners (“CGEP”). The deal closed on December 23, 2022, and financial terms were not disclosed.

Founded in North Providence, Rhode Island, in 1965, MPC is a leader in the development and manufacture of polyurethane elastomers with a specific focus on advanced thermoset products for use in high performance applications. With an emphasis on urethane technology, partnership, quality, and community, MPC produces high performance parts including belts, rollers, wheels, seals, and enclosures for diverse end markets such as medical & analytical testing, digital printing, vehicle platforms, and sports & recreation.

“We are very pleased with Alantra’s teamwork and guidance throughout this process,” said Kevin Redmond and Peter Kaczmarek, the shareholders of MPC. “Alantra was a committed advisor from start to finish, and clearly delivered on our objective of finding a partner for the next chapter of growth for MPC.”

Paul Colone, Managing Director & Partner with Alantra, said, “We are very pleased to deliver on the MPC shareholders’ objectives to form a new partnership to support their active pipeline of M&A and organic growth opportunities. We have a very active practice in Specialty Materials and MPC meets the definition in every respect due to their focus on developing technical solutions for high performance applications.”

Alantra Director Jon Tetirick continued, “MPC has found an excellent partner in CGEP and we look forward to following the new owners as they continue to execute on MPC’s M&A add-on strategy in what is sure to be an exciting and rewarding future ahead.”

MPC represents another strong credential supporting Alantra’s expertise with Specialty Materials and Industrials. In addition to Mr. Colone (Boston), and Mr. Tetirick (Boston), the Alantra team advising MPC included Sam Worley (Associate, Boston), and Alif Kanji (Analyst, Boston).

www.alantra.com/what-we-do/investment-banking/transactions/?sector=industrials

Read more here: https://www.cgep.com/news/2023/compass-group-announces-strategic-partnership-with-mearthane-products-corporation