Pricing and Markets

September 29, 2021

Covestro Update

Covestro raises investment in sustainable growth

Investor Conference 2021: transformation toward a successful future

- Sustainability trends boost demand at Covestro

- New world-scale MDI plant: investment resumed

- EUR 1 billion for circular economy projects over ten years

- Mid-cycle EBITDA to rise to EUR 2.8 billion in 2024

- Expansion of sustainable portfolio: 45 products based on alternative raw materials already commercialized

Covestro is laying the groundwork for sustainable growth in the future. As part of its new “Sustainable Future” strategy, the Group is continuing to focus on the circular economy and the structurally increasing demand for sustainable solutions. Political initiatives to reduce greenhouse gases, such as in China, Europe and the United States, are driving demand, especially in the fields of energy-efficient construction and electromobility.

In this context, Covestro expects global demand growth for the rigid foam precursor MDI and the flexible foam precursor TDI to increase to 6 percent per year until 2025. For MDI in particular, demand is meeting an already high utilization of industry-wide capacities. At its Investor Conference this year, the Group announced that it would resume the investment project for the construction of a world-scale MDI plant, which was temporarily suspended at the beginning of 2020. Covestro plans to deploy the energy efficient AdiP technology, which is already used at its Brunsbuettel site in Germany. The technology can reduce steam by up to 40 percent and electricity by 25 percent per ton of product in an MDI plant, cutting CO2 emissions by up to 35 percent. The company is exploring building the new world-scale MDI plant in either the United States or China. A final decision is expected to be taken after the current project stage. Commissioning of the plant is planned for 2026.

“There is growing demand for sustainable solutions worldwide and that offers us significant additional market potential. Our high-tech plastics already enable sustainable innovations in many industries,” stated Dr. Markus Steilemann, CEO of Covestro. “On our path to becoming fully circular, we are increasing our capital spending selectively and are enabling our customers to become more sustainable with tailored solutions.”

Expansion of production capacities

Covestro aims to generate sustainable growth and in the future will align investments and acquisitions even more consistently to the aspects of profitability and sustainability.

“We’re now in very good economic shape. But we must not be content,” said Dr. Thomas Toepfer, CFO of Covestro. “In order to achieve our ambitious objectives and become fully circular, we are planning targeted capex spending of around EUR 1 billion on circular economy projects over the next ten years.”

In addition, organic growth will continue to play a central role. Covestro will invest around EUR 800 million in 2021 but capital expenditure is to raise substantial in subsequent years. Capital expenditure thus grows on average at or slightly above the level of depreciation and amortization. In the “Performance Materials” segment, the planned construction of the new world-scale MDI plant will significantly increase capital expenditures, particularly in the years 2024 to 2026. To meet the growth in demand for TDI as well, Covestro will expand its production capacities for TDI at the German site in Dormagen as early as 2023 through debottlenecking.

The Group is also investing in the “Solutions and Specialties” segment. Around EUR 300 million will be invested in additional capacities in the Coatings & Adhesives entity by 2025 to enable further growth. Covestro is expanding its compounding capacities for the global production of its highly differentiated polycarbonate. Future plans will focus entirely on this growth market in the area of polycarbonates. The company also sees growing demand for its Specialty Films products, particularly in the medical sector and for holographic films. To meet this demand, Covestro is investing around EUR 200 million in additional capacities by 2025.

Substantial increase in mid-cycle EBITDA up to 2024

Under its new strategy, Covestro reorganized its business into the two segments “Solutions and Specialties” and “Performance Materials” in July 2021. As part of that, the Group gave more entrepreneurial responsibility to the business entities and integrated all operational activities throughout the value chain that are critical to success directly into these new entities. As a result, it can better address the requirements of the specific markets and customers’ individual needs. In both segments, the Group expects an increase in core volumes sold by 2025. This is also expected to impact earnings: Whereas margins in the Performance Materials segment are highly supply-and-demand-driven, margins in the Solutions and Specialties segment are to be raised to 17 percent by 2024.

On the basis of the organizational realignment, the successful integration of the “Resins & Functional Materials” business acquired from DSM in April 2021, and sustainability-driven growth in demand, Covestro expects mid-cycle EBITDA to rise from its current level of EUR 2.2 billion to EUR 2.8 billion in 2024.

At the same time, the new Group structure offers significant efficiency potential that Covestro will leverage by 2023. The goal is to create the right basis for the long-term corporate development. As already announced, the company is currently reviewing all activities and processes worldwide to ascertain whether they fit with its vision and strategy. Overall, fixed costs in 2023 are to remain at the 2020 level.

Expansion of the sustainable product portfolio

On its path to becoming fully circular, Covestro is continuing its unwavering commitment to future technologies and constantly increasing its sustainable product portfolio. For example, the company has already successfully commercialized around 45 products based on alternative raw materials and is pressing ahead with almost 90 associated research products.

Key milestones on this path were achieved in 2021. The company now offers mass-balanced sustainable products from three sites (Antwerp in Belgium, Shanghai in China, and Krefeld-Uerdingen in Germany) that have been awarded ISCC Plus certification. This “International Sustainability and Carbon Certification” means Covestro can offer its customers high-performance plastic polycarbonate and the rigid foam precursor MDI both made from alternative raw materials in the same good quality as fossil-based counterparts. Covestro is thereby helping its customers reduce their carbon footprint.

https://www.covestro.com/investors/news/covestro-raises-investment-in-sustainable-growth/

September 29, 2021

Covestro Update

Covestro raises investment in sustainable growth

Investor Conference 2021: transformation toward a successful future

- Sustainability trends boost demand at Covestro

- New world-scale MDI plant: investment resumed

- EUR 1 billion for circular economy projects over ten years

- Mid-cycle EBITDA to rise to EUR 2.8 billion in 2024

- Expansion of sustainable portfolio: 45 products based on alternative raw materials already commercialized

Covestro is laying the groundwork for sustainable growth in the future. As part of its new “Sustainable Future” strategy, the Group is continuing to focus on the circular economy and the structurally increasing demand for sustainable solutions. Political initiatives to reduce greenhouse gases, such as in China, Europe and the United States, are driving demand, especially in the fields of energy-efficient construction and electromobility.

In this context, Covestro expects global demand growth for the rigid foam precursor MDI and the flexible foam precursor TDI to increase to 6 percent per year until 2025. For MDI in particular, demand is meeting an already high utilization of industry-wide capacities. At its Investor Conference this year, the Group announced that it would resume the investment project for the construction of a world-scale MDI plant, which was temporarily suspended at the beginning of 2020. Covestro plans to deploy the energy efficient AdiP technology, which is already used at its Brunsbuettel site in Germany. The technology can reduce steam by up to 40 percent and electricity by 25 percent per ton of product in an MDI plant, cutting CO2 emissions by up to 35 percent. The company is exploring building the new world-scale MDI plant in either the United States or China. A final decision is expected to be taken after the current project stage. Commissioning of the plant is planned for 2026.

“There is growing demand for sustainable solutions worldwide and that offers us significant additional market potential. Our high-tech plastics already enable sustainable innovations in many industries,” stated Dr. Markus Steilemann, CEO of Covestro. “On our path to becoming fully circular, we are increasing our capital spending selectively and are enabling our customers to become more sustainable with tailored solutions.”

Expansion of production capacities

Covestro aims to generate sustainable growth and in the future will align investments and acquisitions even more consistently to the aspects of profitability and sustainability.

“We’re now in very good economic shape. But we must not be content,” said Dr. Thomas Toepfer, CFO of Covestro. “In order to achieve our ambitious objectives and become fully circular, we are planning targeted capex spending of around EUR 1 billion on circular economy projects over the next ten years.”

In addition, organic growth will continue to play a central role. Covestro will invest around EUR 800 million in 2021 but capital expenditure is to raise substantial in subsequent years. Capital expenditure thus grows on average at or slightly above the level of depreciation and amortization. In the “Performance Materials” segment, the planned construction of the new world-scale MDI plant will significantly increase capital expenditures, particularly in the years 2024 to 2026. To meet the growth in demand for TDI as well, Covestro will expand its production capacities for TDI at the German site in Dormagen as early as 2023 through debottlenecking.

The Group is also investing in the “Solutions and Specialties” segment. Around EUR 300 million will be invested in additional capacities in the Coatings & Adhesives entity by 2025 to enable further growth. Covestro is expanding its compounding capacities for the global production of its highly differentiated polycarbonate. Future plans will focus entirely on this growth market in the area of polycarbonates. The company also sees growing demand for its Specialty Films products, particularly in the medical sector and for holographic films. To meet this demand, Covestro is investing around EUR 200 million in additional capacities by 2025.

Substantial increase in mid-cycle EBITDA up to 2024

Under its new strategy, Covestro reorganized its business into the two segments “Solutions and Specialties” and “Performance Materials” in July 2021. As part of that, the Group gave more entrepreneurial responsibility to the business entities and integrated all operational activities throughout the value chain that are critical to success directly into these new entities. As a result, it can better address the requirements of the specific markets and customers’ individual needs. In both segments, the Group expects an increase in core volumes sold by 2025. This is also expected to impact earnings: Whereas margins in the Performance Materials segment are highly supply-and-demand-driven, margins in the Solutions and Specialties segment are to be raised to 17 percent by 2024.

On the basis of the organizational realignment, the successful integration of the “Resins & Functional Materials” business acquired from DSM in April 2021, and sustainability-driven growth in demand, Covestro expects mid-cycle EBITDA to rise from its current level of EUR 2.2 billion to EUR 2.8 billion in 2024.

At the same time, the new Group structure offers significant efficiency potential that Covestro will leverage by 2023. The goal is to create the right basis for the long-term corporate development. As already announced, the company is currently reviewing all activities and processes worldwide to ascertain whether they fit with its vision and strategy. Overall, fixed costs in 2023 are to remain at the 2020 level.

Expansion of the sustainable product portfolio

On its path to becoming fully circular, Covestro is continuing its unwavering commitment to future technologies and constantly increasing its sustainable product portfolio. For example, the company has already successfully commercialized around 45 products based on alternative raw materials and is pressing ahead with almost 90 associated research products.

Key milestones on this path were achieved in 2021. The company now offers mass-balanced sustainable products from three sites (Antwerp in Belgium, Shanghai in China, and Krefeld-Uerdingen in Germany) that have been awarded ISCC Plus certification. This “International Sustainability and Carbon Certification” means Covestro can offer its customers high-performance plastic polycarbonate and the rigid foam precursor MDI both made from alternative raw materials in the same good quality as fossil-based counterparts. Covestro is thereby helping its customers reduce their carbon footprint.

https://www.covestro.com/investors/news/covestro-raises-investment-in-sustainable-growth/

September 22, 2021

Huntsman MDI Surcharge in Europe

Huntsman Implements Natural Gas Surcharge on MDI Sales in Europe

Download as PDF September 22, 2021 12:00am EDT

THE WOODLANDS, Texas, Sept. 22, 2021 /PRNewswire/ — Huntsman Corporation (NYSE: HUN) announced today that it was implementing a natural gas surcharge of Euros 125 per tonne on all sales of MDI in Europe, Africa, the Middle East and India, in response to the unfortunate and unprecedented natural gas price increases in the region. The surcharge will be effective 1st October 2021 and is in addition to any previously announced MDI price increases.

European natural gas prices have risen to record levels in recent months driven by the combination of structural changes in European energy sources and generation. The unprecedented cost of natural gas, already more than three times historic levels and continuing to rise, has adversely affected the energy inputs, intermediates, and multiple feedstock costs incurred in Huntsman’s MDI production.

Tony Hankins, President of Huntsman’s Polyurethanes division, said: “Huntsman is already working with its customers to manage the impact of the surcharge, which was necessary to respond to the unexpected and unprecedented increase in our production costs.”

About Huntsman:

Huntsman Corporation is a publicly traded global manufacturer and marketer of differentiated and specialty chemicals with 2020 revenues of approximately $6 billion. Our chemical products number in the thousands and are sold worldwide to manufacturers serving a broad and diverse range of consumer and industrial end markets. We operate more than 70 manufacturing, R&D and operations facilities in approximately 30 countries and employ approximately 9,000 associates within our four distinct business divisions. For more information about Huntsman, please visit the company’s website at www.huntsman.com.

September 22, 2021

Huntsman MDI Surcharge in Europe

Huntsman Implements Natural Gas Surcharge on MDI Sales in Europe

Download as PDF September 22, 2021 12:00am EDT

THE WOODLANDS, Texas, Sept. 22, 2021 /PRNewswire/ — Huntsman Corporation (NYSE: HUN) announced today that it was implementing a natural gas surcharge of Euros 125 per tonne on all sales of MDI in Europe, Africa, the Middle East and India, in response to the unfortunate and unprecedented natural gas price increases in the region. The surcharge will be effective 1st October 2021 and is in addition to any previously announced MDI price increases.

European natural gas prices have risen to record levels in recent months driven by the combination of structural changes in European energy sources and generation. The unprecedented cost of natural gas, already more than three times historic levels and continuing to rise, has adversely affected the energy inputs, intermediates, and multiple feedstock costs incurred in Huntsman’s MDI production.

Tony Hankins, President of Huntsman’s Polyurethanes division, said: “Huntsman is already working with its customers to manage the impact of the surcharge, which was necessary to respond to the unexpected and unprecedented increase in our production costs.”

About Huntsman:

Huntsman Corporation is a publicly traded global manufacturer and marketer of differentiated and specialty chemicals with 2020 revenues of approximately $6 billion. Our chemical products number in the thousands and are sold worldwide to manufacturers serving a broad and diverse range of consumer and industrial end markets. We operate more than 70 manufacturing, R&D and operations facilities in approximately 30 countries and employ approximately 9,000 associates within our four distinct business divisions. For more information about Huntsman, please visit the company’s website at www.huntsman.com.

September 6, 2021

Chlorine Overview

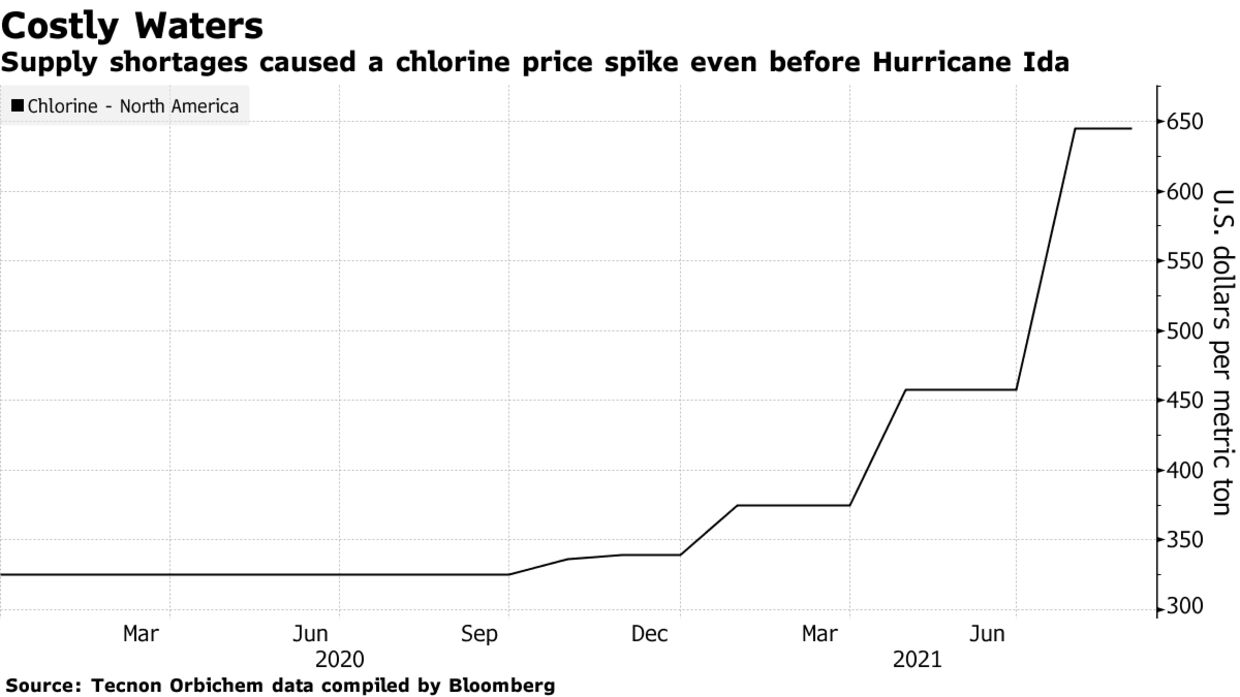

Ida Disrupts Chlorine Production, Raising Risk of Higher Prices

By Kevin Crowley August 30, 2021, 5:29 PM EDT Updated on August 30, 2021, 6:06 PM EDT

- Westlake, Formosa shut down facilities ahead of storm

- Chlorine was already in short supply after February’s freeze

Hurricane Ida’s landfall on the U.S. Gulf Coast caused production outages in the heart of the country’s chlorine manufacturing industry.

Chlorine was already in short supply after a deep freeze in February knocked facilities offline for weeks. Now, widespread power outages around Baton Rouge, Louisiana may increase prices further, according to Robert Stier, a senior petrochemicals analyst at S&P Global Platts.

“Chlorine is going to get really tight” because of the industry’s concentration in the Louisiana area, he said.

READ: Ida’s Aftermath Raises Environmental Fears in ‘Cancer Alley’ (1)

Westlake Chemical Corp. shut two Louisiana facilities that make chlorine over the weekend. An assessment of the storm’s impact may take several days, the company said. Formosa Plastics also closed a plant in Baton Rouge, according to ICIS, a data provider.

Chlorine manufacturers also tend to make PVC, a key building material used in pipes, siding and other construction materials. Gulf Coast contracts for PVC were already trading at record highs before the storm, according to ICIS.