Pricing and Markets

February 28, 2023

European Benzene

European Benzene Pressure Continues to Mount, Phenol Prices are on the Rise, MDI Producer Idles Unit

- 22-Feb-2023 3:18 PM

- Journalist: Robert Hume

Hamburg (Germany): In the European market, the continuous increase in Benzene prices has made headlines, and producers have failed to face the heat of the rising prices. In the latest turn of events, Huntsman Corporation announced the idling of one of their Methylene Diphenyl Diisocyanate (MDI) plants in Rotterdam. The company announced that the unfeasible economics and sluggish demand drove the announcement.

Earlier, Huntsman Corporation has already idled one of their MDI units in Geismar, Louisiana.

In Europe, Benzene prices have increased by more than 50% since the beginning of the year, and the mounting pressure of rising prices has been more than evident.

Benzene forms a critical intermediate to several fundamental petrochemicals, MDI, Phenol, Cyclohexanone, and many others. MDI goes into Polyurethane production; while Cyclohexanone is a crucial part of Polyamide value chains and Phenolic Resins, Caprolactam is an important source of the demand for Phenol.

The incessant rise in Benzene prices has disrupted the economics of several downstream value chains. The high energy price pressure and firm cost support have translated into rising Cumene prices. Furthermore, the unbearable pressure of the Benzene prices has translated not only on the direct downstream but also on their derivatives; the sharp rise in Phenol has been a case in point.

Europe has been facing a double whammy, rising cost pressure and weak downstream demand, which has made the producers swallow a tough pill. The producers have become the shock absorbers between the soaring energy prices and the ultimate consumers. Huntsman has stated that they won’t be carrying on being the shock absorbers anymore.

Huntsman Corporation has implemented energy surcharges since the sharp climb in energy prices; however, the impact of energy surcharges has been limited at the very most. Thus the idling of production units comes as the last resort for the MDI producer to stay afloat.

China has eased covid restrictions and increased in demand since the conclusion of the Lunar New Year holidays, suggesting the changing market dynamics after the 2022 debacle. The improving economics in China also bodes well for the global economy as China forms a crucial production house as well as a key end-use market for several products that the Western market exports heavily.

February 14, 2023

China TDI Price Forecast for 2023

China TDI Price Forecast for 2023

PUdaily | Updated: February 14, 2023

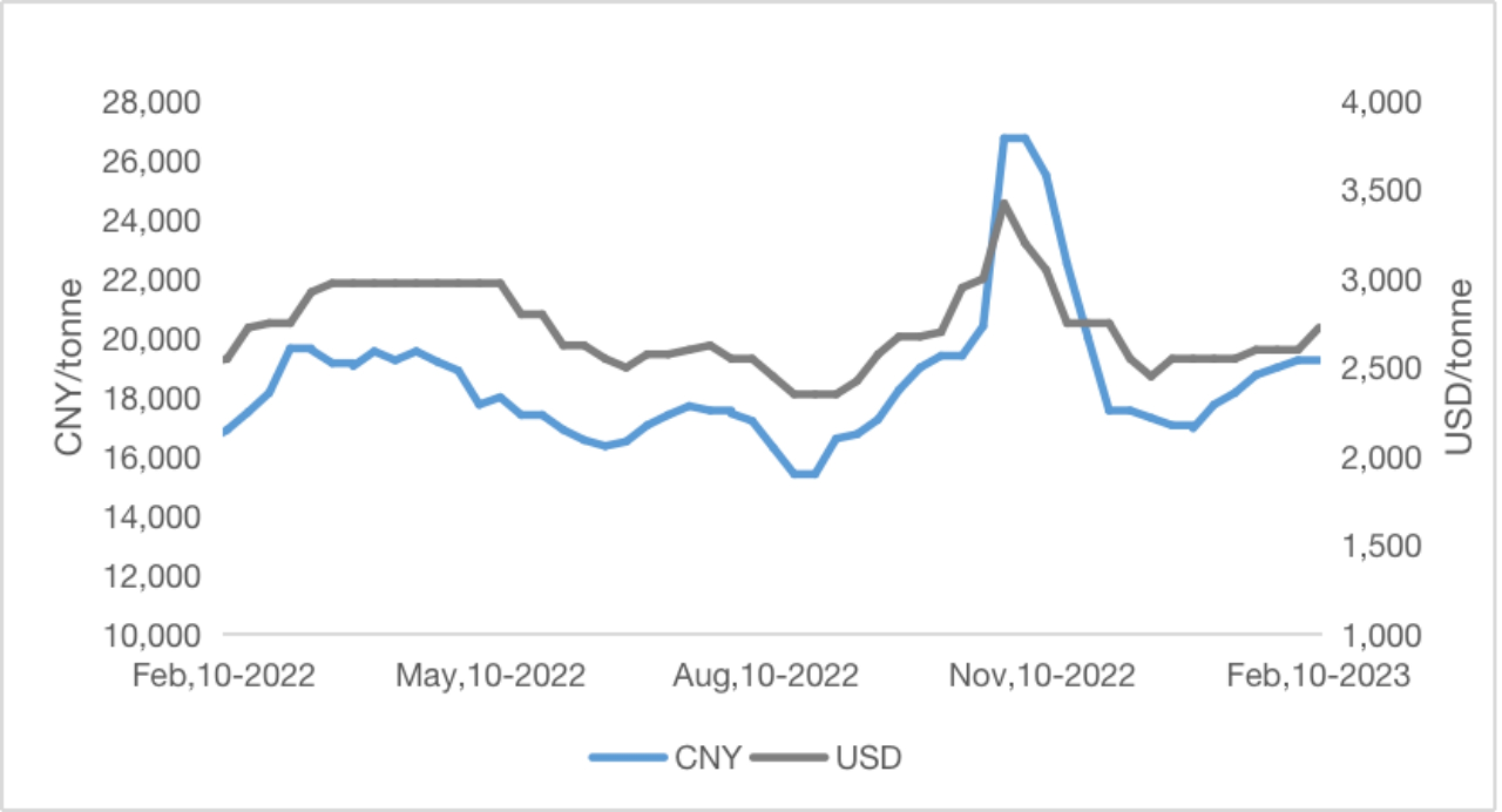

After returning from the Spring Festival holiday in 2023, the already high TDI price not only did not fall, but began another round of rapid rise: Covestro and BASF guidance prices increased sharply, and the market rumored that Wanhua Chemical will permanently close the old TDI production plant in Fujian on February 1. At the end of January, the market price rose rapidly to 20500~21000 CNY/tonne. However, after the Lantern Festival, the downstream industry basically resumed work, and was cautious in the face of high prices, and just needed procurement. Subsequently, as the trading continued to be light, some traders began to waver, driven by the low-price shipment of the profit order, some chose to let the profit shipment, the market price loosened slightly, the quotation range converged significantly, and the market price returned to around 20200~20600 CNY/tonne.

Table 1 Price influencing factors and forecast of China TDI market in2023

For the subsequent price trend, Pudaily combined the raw material side, supply side and demand side information to predict the TDI market price for the whole year of 2023:

Table 1 :Influencing Factors & Forecast for China TDI Market Price in 2023

| Influencing Factor | Impact on TDI Price | |

| Feedstock | It is projected that the impact of Russia-Ukraine conflict and OPEC’s oil output cuts would continue, and global crude oil prices would fluctuate at high levels in 2023. | – |

| Supply | It’s expected that Gansu Yinguang’s new 150kT facility would resume production in February 2023, and Wanhua Chemical’s new 250kT facility in Fujian would be put into production in June 2023. | ↓↓↓ |

| Demand | Domestic demand: Under China’s principle of “houses for living in, not speculation”, the demand in the main downstream industry of TDI – upholstered furniture- is unlikely to increase significantly. However, in view of the liberalization of anti-epidemic measures, demand may recover somewhat under the government’s initiatives to stimulate consumption. | ↑ |

| External demand: As many foreign TDI facilities are outmoded, their overall supply capacity is declining, thereby widening the gap between supply and demand. Meanwhile, Chinese TDI suppliers and traders have paid more attention to exports in recent years, especially after China has lifted registration system for foreign trade authorization. China’s TDI exports are expected to maintain year-on-year growth in 2023. | ↑ | |

| Comprehensive Prediction | In 2023, China’s TDI market is expected to open high and move downward, with weak fluctuations. The demand in China is projected to revive in 2023, with a slight year-on-year increase. However, owing to the increase of 300kT TDI supply capacity, and the low possibility of substantial growth of Chinese and global economy, especially the demand in the upholstered furniture industry, Chinese TDI market is forecasted to be oversupplied, and prices may open high and decline weakly in 2023. TDI prices in China would move between CNY 14,000/tonne and CNY 20,000/tonne. |

NOTE: “↑” represents positive, “↓” represents negative, and “-” represents neutral. The more the number of arrows, the greater impact the influencing factor is likely to have.

On the whole, it is expected that China’s TDI price will open high and low in 2023, which will be weak and volatile. In summary, demand is expected to recover in 2023, with a slight year-on-year increase. However, due to the supply-side production capacity will increase by 300,000 tons, and the substantial growth of China and the global economy in 2023, especially the possibility of a substantial increase in demand in the upholstered furniture industry, the overall TDI market in 2023 has a high probability of supply exceeding demand, and the price may open high and go low, weak and volatile, and the expected operating range: 14,000 yuan / ton ~ 22,000 yuan / ton.

February 1, 2023

Propylene Jumps 11c/lb in January

Chemical grade propylene moved up to $0.415/lb . . .

December 22, 2022

December Chemical Grade Propylene

Falls 1c/lb to $0.305/lb

December 22, 2022

December Chemical Grade Propylene

Falls 1c/lb to $0.305/lb