Pricing and Markets

September 30, 2020

Tight PO Wreaking Havoc on Polyol Pricing in Middle East

High polyol prices depress Middle East TDI demand

Author: Prateek Pillai

2020/09/30

SINGAPORE (ICIS)–The unceasing rise of polyol prices in the Middle East along with scarce availability of cargoes has dampened demand for toluene diisocyanate (TDI) in the region.

With polyol supply expected to remain tight up to the end of the year, TDI demand is likely to be negatively affected for the foreseeable future.

TDI and polyols (both the POP and the conventional variety) are used in combination to manufacture polyurethane (PU) foams which have multiple applications, including for mattresses, furniture and automobile seat covers.

Due to the months-long rise in prices of upstream propylene oxide (PO) in China, polyol producers have had to increase their quotes.

Average prices of 10-13.5% polyether polyol (POP) reaching $2,430/tonne CFR Middle East and those of conventional polyols at $2,405/tonne CFR Middle East – their highest levels in more than five years.

The non-stop rise of upstream PO prices has trimmed the margins of polyol producers. This has made it difficult for them to ramp up production to meet demand, which has picked up markedly since lockdown restrictions were relaxed in the region during the summer.

Polyol supply to the Middle East is currently very limited with many buyers unable to procure cargoes that they need. This extremely tight supply situation has, in turn, caused polyol prices to spike.

Buyers now find themselves in a situation where either the record high polyol prices have made it prohibitively expensive to buy cargoes; or the limited supply makes any procurement difficult.

Since the primary application of both TDI and polyols is in the manufacturing of PU foams, the tight supply conditions prevalent in the polyol market has cooled buying interest in TDI too.

It does not make sense to buy TDI when polyol was not available, a downstream buyer said.

The reluctance to buy new TDI cargoes has also halted the rise of TDI prices in the region, which had been on a continuous upswing since July.

With most market players expecting the polyol market to be marked by tight supply for the remainder of the year, unless TDI prices begin to decline, demand for the product is likely to continue weakening.

Focus article by Prateek Pillai

September 30, 2020

Tight PO Wreaking Havoc on Polyol Pricing in Middle East

High polyol prices depress Middle East TDI demand

Author: Prateek Pillai

2020/09/30

SINGAPORE (ICIS)–The unceasing rise of polyol prices in the Middle East along with scarce availability of cargoes has dampened demand for toluene diisocyanate (TDI) in the region.

With polyol supply expected to remain tight up to the end of the year, TDI demand is likely to be negatively affected for the foreseeable future.

TDI and polyols (both the POP and the conventional variety) are used in combination to manufacture polyurethane (PU) foams which have multiple applications, including for mattresses, furniture and automobile seat covers.

Due to the months-long rise in prices of upstream propylene oxide (PO) in China, polyol producers have had to increase their quotes.

Average prices of 10-13.5% polyether polyol (POP) reaching $2,430/tonne CFR Middle East and those of conventional polyols at $2,405/tonne CFR Middle East – their highest levels in more than five years.

The non-stop rise of upstream PO prices has trimmed the margins of polyol producers. This has made it difficult for them to ramp up production to meet demand, which has picked up markedly since lockdown restrictions were relaxed in the region during the summer.

Polyol supply to the Middle East is currently very limited with many buyers unable to procure cargoes that they need. This extremely tight supply situation has, in turn, caused polyol prices to spike.

Buyers now find themselves in a situation where either the record high polyol prices have made it prohibitively expensive to buy cargoes; or the limited supply makes any procurement difficult.

Since the primary application of both TDI and polyols is in the manufacturing of PU foams, the tight supply conditions prevalent in the polyol market has cooled buying interest in TDI too.

It does not make sense to buy TDI when polyol was not available, a downstream buyer said.

The reluctance to buy new TDI cargoes has also halted the rise of TDI prices in the region, which had been on a continuous upswing since July.

With most market players expecting the polyol market to be marked by tight supply for the remainder of the year, unless TDI prices begin to decline, demand for the product is likely to continue weakening.

Focus article by Prateek Pillai

September 29, 2020

Monomers Overview

US Ethylene & Propylene Supply Chain Rebounds After a Shaky Few Months

Posted by Kathy Hall on Sep 29, 2020 10:00:00 AM Find me on: LinkedIn

Our last blogpost in early April ended on a deeply uncertain note. Lockdowns in the US had just begun a few weeks earlier. COVID-19 was still gripping Europe and Asia and was just ramping up in South America. Consumer demand was a huge unknown for many manufacturing sectors and oil prices went negative at the end of March. The stability of the entire petrochemical supply chain was called into question.

I personally recall saying to a friend, “We could be in this lockdown until Memorial Day.”

And here we are in late September. Many of us in the US have gotten used to Lockdown Life and much of the rest of the world has been re-opening (and in some cases, re-closing). Consumer demand has re-appeared in many sectors. Energy markets have stabilized.

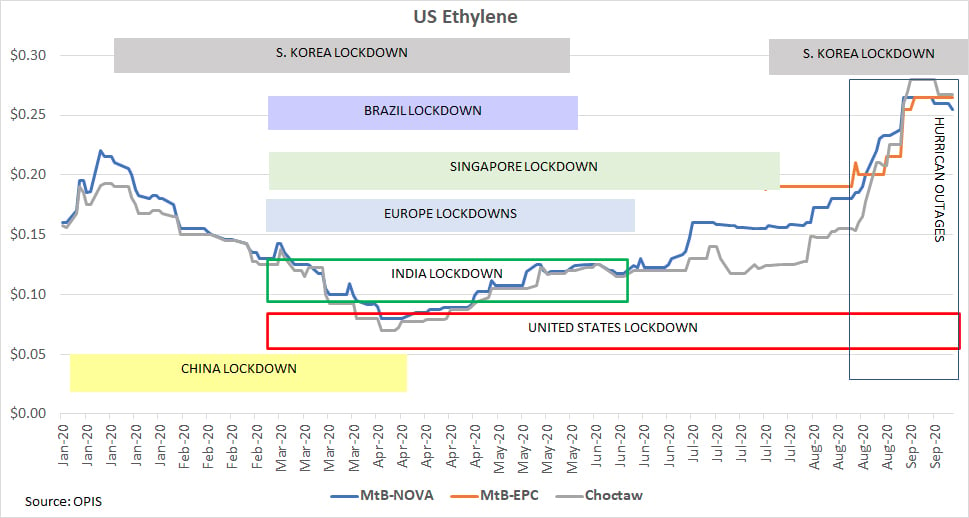

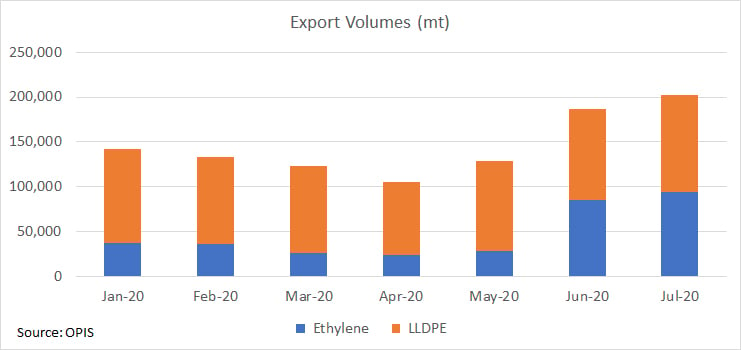

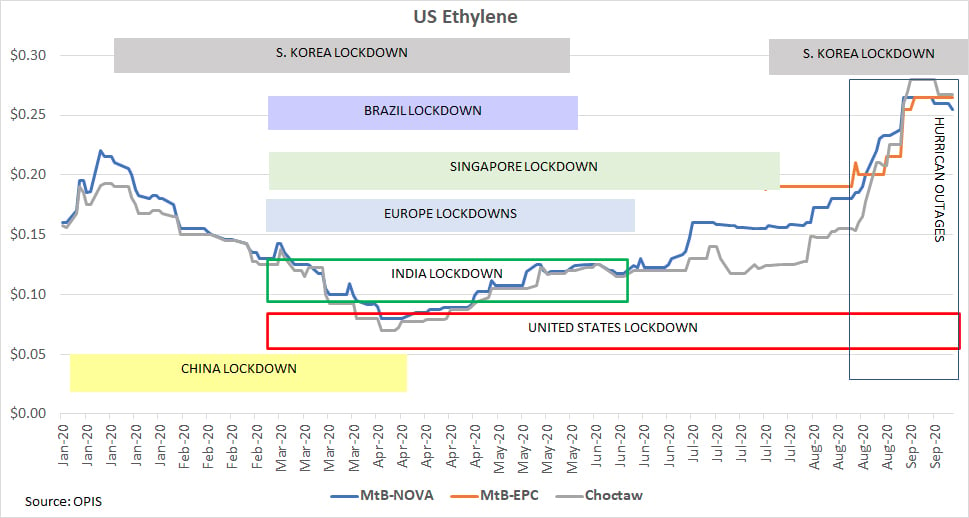

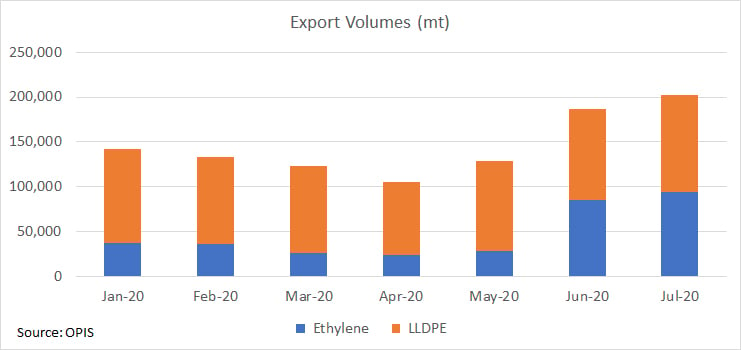

Also of note in early April was the emergence of a new ethylene market as the Enterprise storage hub at Mont Belvieu, Texas opened and a slew of new spot trades began occurring at the new location. The hub lined up with Enterprise’s other massive commitment to the ethylene market – its export terminal on the Houston Ship Channel. Prior to this terminal’s opening, the US ethylene market was largely contained to the local Texas and Louisiana markets. Ethylene exports were rare and limited to the controls of one terminal owned by Targa and operated by Mitsubishi. The Enterprise terminal sent its first cargo in December of 2019. By April, it had loaded a handful of cargoes, averaging 2-3 per month. Cargo volumes ranged between roughly 10 million and 25 million pounds each. In June, Enterprise announced that it expected to load 175 million pounds during that month.

This is a massive pattern shift for this market, opening a demand channel not seen before and establishing ethylene’s value at the Enterprise hub as unique to other locations.

Ethylene prices at the Mont Belvieu hub operated by NOVA had hit an all-time low of 8 cents per pound in early April. Prices at the Enterprise hub were close to these levels, exhibiting a premium of less than a penny. By June, this premium was 2 cents and by July it was 4 cents.

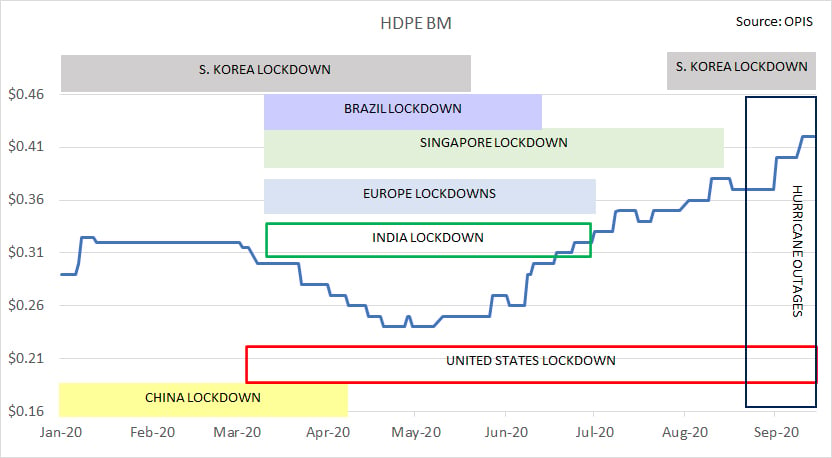

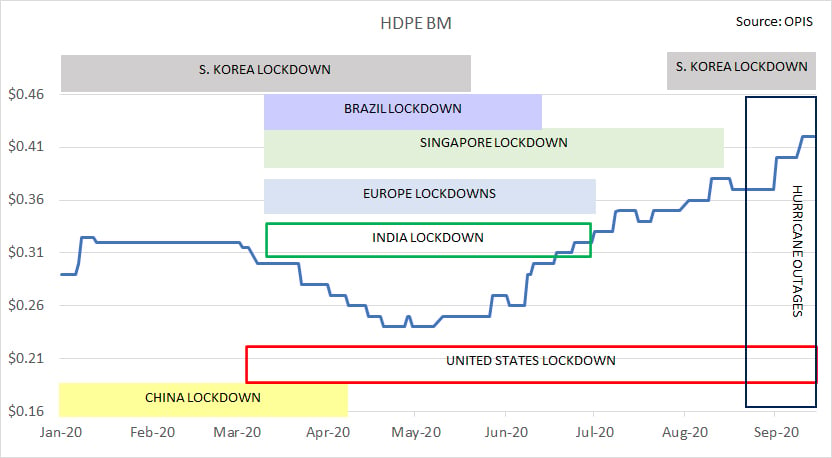

Demand for US ethylene in Europe and Asia dovetailed with the return of demand in those regions for US plastics, leading to a rebound in prices throughout the supply chain. Polyethylene export prices (for high density blow mold grade) rose from 25 cents per pound in April to 35 cents in July, while PVC export prices moved from 25 cents to 33 cents. Ethylene at the NOVA hub rose from its aforementioned historic 8-cent low to 15 cents and ethylene at the Enterprise hub rallied to 19 cents. Upstream feedstock prices were also buoyed by this demand and ethane prices rose from 10 cents per gallon in April to 20 cents in July, an equivalent of 6.7 cents per pound. Not bad for an integrated plastics producer.

In the US market, demand has been fractured during this pandemic. Plastic grades serving the automotive industry, for example, have suffered, while demand from the medical device sector has soared. Food packaging demand from restaurants has flagged while food packaging demand from grocery stores has surged. Few of us are buying new clothes but more of us are buying everything online and it’s delivered to us swaddled in polyethylene.

Elsewhere in the world, the appetite for US ethylene is increasing, but so far not at the expense of global demand for US polyethylene.

As more economies rebound, prices throughout the manufacturing supply chain have continued to rise. By the end of August, HDPE export prices rose to 37 cents and PVC export prices were 40 cents. Ethylene at both Mont Belvieu hubs converged in mid-August to 20 cents while ethylene at the Choctaw hub in Louisiana trailed 2-3 cents below that level.

However, the ravages of hurricane season in the US Gulf also ran through the supply chain as Hurricane Laura took out a handful of petrochemical sites in Lake Charles and Port Arthur at the end of August. This pushed prompt pricing to 26.5 cents at the NOVA hub, 25.5 cents at the Enterprise hub and 26 cents at the Choctaw hub. Plastics pricing was also up, with HDPE fetching up to 42 cents and PVC exports seen at a robust 48 cents. The knocks were taken by ethane, as the production losses dampened feedstock demand and prompt ethane fell back to 18 cents per gallon. On a cents per pound basis (which correlates better to ethylene), this was a mere 6 cents. At this writing, ethylene at the NOVA hub was trading at 25.75 cents and its forward curve was firmly backward, indicating strength in the prompt months. Ethane, however, remained stuck at 18 cents per gallon (roughly 6 cents per pound) and its forward curve was in a contango shape, as the prompt months were the weakest prices. HDPE, meanwhile, was unmoved and supported at that 42 cent level. For an integrated producer, that ethane-HDPE spread of nearly 36 cents per pound leaves one sitting pretty.

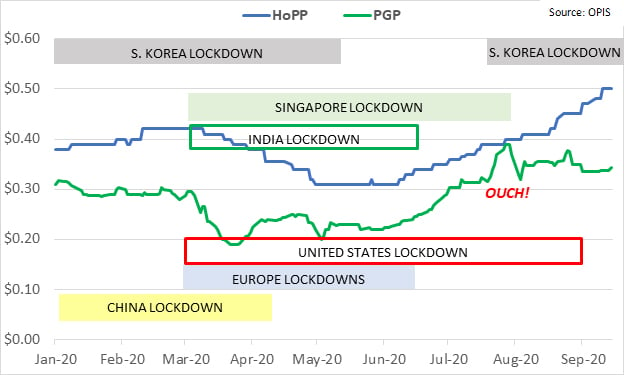

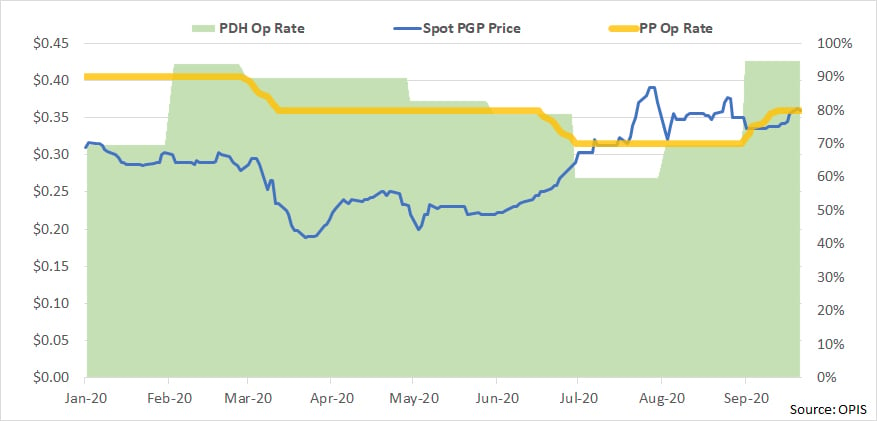

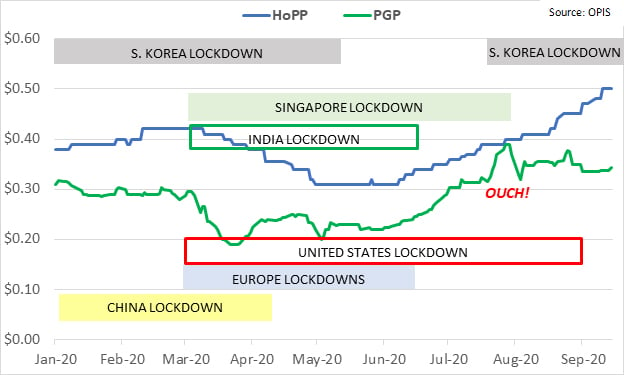

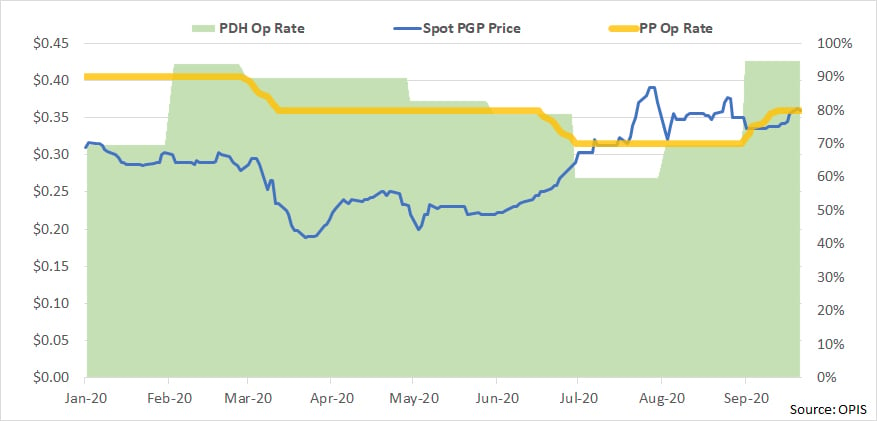

The story for the propylene chain has been somewhat different. Propylene and polypropylene capacity in the US is about one-third the size of ethylene/polyethylene, and plant operating issues cause deeper shockwaves as a result. And unlike ethane, whose sole use is to make ethylene, propane’s fundamentals are more diverse than chemical and plastics demand, as propane is also a popular heating fuel and also finds seasonable demand from the agriculture sector as a crop drying agent.

On the demand side, polypropylene’s strong reliance on the automobile industry caused spot prices to start to crumble shortly after US lockdowns began, and PP producers had reduced plant operating rates to 80% by April. Homopolymer injection grade polypropylene spent most of 1Q 2020 at 40 cents per pound, at a time when propylene monomer prices were 30 cents and margins were slim. When PP began sliding towards the 35-cent level, production was further curtailed — but even that was not enough to prop up this market.

Prompt PP prices reached 30 cents in May and plant operating rates were reduced to 70%. Propylene operating rates in May were about 90%, and with the loss of so much resin production, propylene prices slipped to 20 cents per pound. In June, unplanned outages at polypropylene and propylene plants lifted values in both markets and the first reports of improved demand for polypropylene within the US emerged. The outages in both markets continued throughout July. By the start of August, propylene prices reached their high for the year so far at 39 cents. Unfortunately for polypropylene producers, their own prices were 40 cents at the time.

By the time Hurricane Laura came ashore and swept through the Texas/Louisiana border area, three polypropylene producers had declared force majeure and prices spiked to 50 cents. As pockets of demand returned, polypropylene plants that were operating were still well below 100% rates and supply availability has been extremely limited in September. Against this backdrop, propylene prices, however, drifted to 35 cents as the storm did not disturb any significant production and the PP operating issues muted local demand.

And how was propane affected by all of this? It ignored the drama and has been hovering in the 45-50 cents per gallon range the whole time. On a cents per pound basis (which correlates better with propylene), this range was a tight 10.2-11.8 cents – pretty nice for propylene producers even at their lowest price moments.

As we cruise into the fourth quarter, many of the world’s markets appeared to be settling back into pre-pandemic conditions, with a few exceptions. South Korea re-entered lockdown in late August and at this writing, India is proposing returning to lockdown at the end of September. As the situation continues in the US, the country’s NGL, petrochemical & plastics markets adjust to the “new normal” of local pandemic demand trends but are also more dependent upon the health of the markets in Europe and Asia than usual.

Watch this space and we’ll be back in December to wrap up the year for these crucial markets!

http://blog.opisnet.com/us-ethylene-propylene-supply-chain-rebounds-after-a-shaky-few-months

September 29, 2020

Monomers Overview

US Ethylene & Propylene Supply Chain Rebounds After a Shaky Few Months

Posted by Kathy Hall on Sep 29, 2020 10:00:00 AM Find me on: LinkedIn

Our last blogpost in early April ended on a deeply uncertain note. Lockdowns in the US had just begun a few weeks earlier. COVID-19 was still gripping Europe and Asia and was just ramping up in South America. Consumer demand was a huge unknown for many manufacturing sectors and oil prices went negative at the end of March. The stability of the entire petrochemical supply chain was called into question.

I personally recall saying to a friend, “We could be in this lockdown until Memorial Day.”

And here we are in late September. Many of us in the US have gotten used to Lockdown Life and much of the rest of the world has been re-opening (and in some cases, re-closing). Consumer demand has re-appeared in many sectors. Energy markets have stabilized.

Also of note in early April was the emergence of a new ethylene market as the Enterprise storage hub at Mont Belvieu, Texas opened and a slew of new spot trades began occurring at the new location. The hub lined up with Enterprise’s other massive commitment to the ethylene market – its export terminal on the Houston Ship Channel. Prior to this terminal’s opening, the US ethylene market was largely contained to the local Texas and Louisiana markets. Ethylene exports were rare and limited to the controls of one terminal owned by Targa and operated by Mitsubishi. The Enterprise terminal sent its first cargo in December of 2019. By April, it had loaded a handful of cargoes, averaging 2-3 per month. Cargo volumes ranged between roughly 10 million and 25 million pounds each. In June, Enterprise announced that it expected to load 175 million pounds during that month.

This is a massive pattern shift for this market, opening a demand channel not seen before and establishing ethylene’s value at the Enterprise hub as unique to other locations.

Ethylene prices at the Mont Belvieu hub operated by NOVA had hit an all-time low of 8 cents per pound in early April. Prices at the Enterprise hub were close to these levels, exhibiting a premium of less than a penny. By June, this premium was 2 cents and by July it was 4 cents.

Demand for US ethylene in Europe and Asia dovetailed with the return of demand in those regions for US plastics, leading to a rebound in prices throughout the supply chain. Polyethylene export prices (for high density blow mold grade) rose from 25 cents per pound in April to 35 cents in July, while PVC export prices moved from 25 cents to 33 cents. Ethylene at the NOVA hub rose from its aforementioned historic 8-cent low to 15 cents and ethylene at the Enterprise hub rallied to 19 cents. Upstream feedstock prices were also buoyed by this demand and ethane prices rose from 10 cents per gallon in April to 20 cents in July, an equivalent of 6.7 cents per pound. Not bad for an integrated plastics producer.

In the US market, demand has been fractured during this pandemic. Plastic grades serving the automotive industry, for example, have suffered, while demand from the medical device sector has soared. Food packaging demand from restaurants has flagged while food packaging demand from grocery stores has surged. Few of us are buying new clothes but more of us are buying everything online and it’s delivered to us swaddled in polyethylene.

Elsewhere in the world, the appetite for US ethylene is increasing, but so far not at the expense of global demand for US polyethylene.

As more economies rebound, prices throughout the manufacturing supply chain have continued to rise. By the end of August, HDPE export prices rose to 37 cents and PVC export prices were 40 cents. Ethylene at both Mont Belvieu hubs converged in mid-August to 20 cents while ethylene at the Choctaw hub in Louisiana trailed 2-3 cents below that level.

However, the ravages of hurricane season in the US Gulf also ran through the supply chain as Hurricane Laura took out a handful of petrochemical sites in Lake Charles and Port Arthur at the end of August. This pushed prompt pricing to 26.5 cents at the NOVA hub, 25.5 cents at the Enterprise hub and 26 cents at the Choctaw hub. Plastics pricing was also up, with HDPE fetching up to 42 cents and PVC exports seen at a robust 48 cents. The knocks were taken by ethane, as the production losses dampened feedstock demand and prompt ethane fell back to 18 cents per gallon. On a cents per pound basis (which correlates better to ethylene), this was a mere 6 cents. At this writing, ethylene at the NOVA hub was trading at 25.75 cents and its forward curve was firmly backward, indicating strength in the prompt months. Ethane, however, remained stuck at 18 cents per gallon (roughly 6 cents per pound) and its forward curve was in a contango shape, as the prompt months were the weakest prices. HDPE, meanwhile, was unmoved and supported at that 42 cent level. For an integrated producer, that ethane-HDPE spread of nearly 36 cents per pound leaves one sitting pretty.

The story for the propylene chain has been somewhat different. Propylene and polypropylene capacity in the US is about one-third the size of ethylene/polyethylene, and plant operating issues cause deeper shockwaves as a result. And unlike ethane, whose sole use is to make ethylene, propane’s fundamentals are more diverse than chemical and plastics demand, as propane is also a popular heating fuel and also finds seasonable demand from the agriculture sector as a crop drying agent.

On the demand side, polypropylene’s strong reliance on the automobile industry caused spot prices to start to crumble shortly after US lockdowns began, and PP producers had reduced plant operating rates to 80% by April. Homopolymer injection grade polypropylene spent most of 1Q 2020 at 40 cents per pound, at a time when propylene monomer prices were 30 cents and margins were slim. When PP began sliding towards the 35-cent level, production was further curtailed — but even that was not enough to prop up this market.

Prompt PP prices reached 30 cents in May and plant operating rates were reduced to 70%. Propylene operating rates in May were about 90%, and with the loss of so much resin production, propylene prices slipped to 20 cents per pound. In June, unplanned outages at polypropylene and propylene plants lifted values in both markets and the first reports of improved demand for polypropylene within the US emerged. The outages in both markets continued throughout July. By the start of August, propylene prices reached their high for the year so far at 39 cents. Unfortunately for polypropylene producers, their own prices were 40 cents at the time.

By the time Hurricane Laura came ashore and swept through the Texas/Louisiana border area, three polypropylene producers had declared force majeure and prices spiked to 50 cents. As pockets of demand returned, polypropylene plants that were operating were still well below 100% rates and supply availability has been extremely limited in September. Against this backdrop, propylene prices, however, drifted to 35 cents as the storm did not disturb any significant production and the PP operating issues muted local demand.

And how was propane affected by all of this? It ignored the drama and has been hovering in the 45-50 cents per gallon range the whole time. On a cents per pound basis (which correlates better with propylene), this range was a tight 10.2-11.8 cents – pretty nice for propylene producers even at their lowest price moments.

As we cruise into the fourth quarter, many of the world’s markets appeared to be settling back into pre-pandemic conditions, with a few exceptions. South Korea re-entered lockdown in late August and at this writing, India is proposing returning to lockdown at the end of September. As the situation continues in the US, the country’s NGL, petrochemical & plastics markets adjust to the “new normal” of local pandemic demand trends but are also more dependent upon the health of the markets in Europe and Asia than usual.

Watch this space and we’ll be back in December to wrap up the year for these crucial markets!

http://blog.opisnet.com/us-ethylene-propylene-supply-chain-rebounds-after-a-shaky-few-months

September 29, 2020

Propylene Flat for September

$0.345/lb for Chemical Grade Propylene