The Urethane Blog

Everchem Updates

VOLUME XXI

September 14, 2023

Everchem’s exclusive Closers Only Club is reserved for only the highest caliber brass-baller salesmen in the chemical industry. Watch the hype video and be introduced to the top of the league: — read more

April 17, 2024

Covestro takeover by oil group Adnoc still up in the air

April 17, 2024 at 01:02 pm

Share

LEVERKUSEN (dpa-AFX) – Talks on a possible takeover of the chemicals group Covestro by Abu Dhabi National Oil (Adnoc) continue to drag on. “We are conducting these talks in a constructive and open-minded manner in accordance with our obligations under stock corporation law – and in the interests of our company, our shareholders and all other stakeholders,” said Covestro CEO Markus Steilemann on Wednesday at the Annual General Meeting of the DAX-listed company from Leverkusen. Key points relating to the talks with the oil company from the United Arab Emirates thus remain open.

Speculation about a deal arose almost a year ago. It was only in September that Covestro announced that it was in talks with Adnoc. After several rumored increases in the offer, an informal offer of just over EUR 60 per share has been in the air for some time. The Bloomberg news agency reported on this sum in February, citing people familiar with the matter. In total, this would be more than 11.3 billion euros.

Covestro shares initially benefited from speculation about interest from the golf group. In June 2023, its price jumped by around a quarter to around 50 euros. The bottom line is that not much has happened since then. Investors are concerned that the share price will fall again significantly if negotiations with the state-owned company fail, despite the recent slight improvement in the outlook for the chemical industry./mis/stw/jha/

April 16, 2024

Korean petrochemical industry on alert as naphtha price soars

0

|

| [Graphics by Song Ji-yoon] |

| <이미지를 클릭하시면 크게 보실 수 있습니다> |

South Korea’s petrochemical industry is closely monitoring the developments in the Middle East as the price of petrochemical raw materials could soar further on intensifying tension.

According to the Ministry of Trade, Industry and Energy on Monday, the price of naphtha stood at $717 per ton as of April 5, up 8.3 percent from February.

Naphtha is a key raw material that accounts for a significant portion of the cost of petrochemical products.

The Korean petrochemical industry uses naphtha generated during the oil refining process to produce basic products such as ethylene and propylene.

For ethylene, about 80 percent of the selling price is used to procure naphtha.

The recent upward trend in oil prices has been blamed for the rise in naphtha prices.

According to the Korea International Trade Association, prices of the country’s benchmark Dubai crude reached $90.48 per barrel, marking the highest level since October 2023.

Prices rose by 11.3 percent from the average price of $81.3 in the first quarter of 2024.

Dubai crude oil prices are projected to rise to more than $100 per barrel if the Israel-Hamas conflict escalates.

The Strait of Hormuz, which Iran could blockade, is also a major export route for Saudi Arabia, which accounted for 31 percent of Korea‘s crude oil imports in 2023.

The petrochemical industry is concerned that rising costs will hurt profitability.

“In a supply-driven market, we can pass on cost increases to selling prices to maintain profitability,” said an industry insider. “But now it is the other way around. We are in a situation of oversupply. Any increase in production costs will immediately lead to a deterioration in profitability.”

China has ramped up its production capacity to become self-sufficient in petrochemical products, contributing to a global oversupply of more than 13 million tons over the past three years.

Global production gained 23.2 million tons from 2021 to 2023 while demand added only 10.21 million tons.

이 기사의 카테고리는 언론사의 분류를 따릅니다.

http://news.zumst.com/articles/90048175

April 5, 2024

LyondellBasell declares FM on PO and Styrene and Covestro on polyether polyols in Europe . . .

Styrol: Covestro und LyondellBasell erklären Force Majeure

03.04.2024

Ausfall in Maasvlakte: Covestro und LyondellBasell haben Force Majeure auf Styrol und Propylenoxid erklärt (Foto: LyondellBasell)

Ausfall in Maasvlakte: Covestro und LyondellBasell haben Force Majeure auf Styrol und Propylenoxid erklärt (Foto: LyondellBasell)

Ein offenbar technisches Problem hat am 27. März 2024 zum Stillstand der großen Kombi-Anlage zur Produktion von Styrol und Propylenoxid im niederländischen Maasvlakte geführt.

In der Folge erklärte mit Covestro (Leverkusen) zumindest einer der beiden Joint-Venture-Partner Force Majeure auf Styrolprodukte und Polyether-Polyole in der Region EMEA. Das bestätigte ein Sprecher auf Nachfrage von KI. Eine Sprecherin von LyondellBasell (LYB, Houston, Texas / USA) als dem zweiten Unternehmen wollte zu dem Vorfall keine Stellung nehmen.

Man könne die fehlenden Mengen auch mit Zukäufen bei Wettbewerbern nicht kompensieren, teilte Covestro mit. Wie lange der Ausfall dauern wird, scheint noch unklar. Das Unternehmen nannte einen „unvorhersehbaren Schaden“ als Grund für die Störung, verwies aber für weitere Details an LyondellBasell als Betreiber der JV-Anlage.

April 4, 2024

Arsenal Completes Sale of Seal For Life to Henkel

PR Newswire

Thu, Apr 4, 2024, 8:45 AM EDT3 min read

NEW YORK, April 4, 2024 /PRNewswire/ — Arsenal Capital Partners (“Arsenal”), a private equity firm that specializes in investments in industrial and healthcare companies, announced today it has sold its portfolio company, Seal For Life Industries LLC (“Seal For Life”), to Henkel AG & Co. KGaA (“Henkel”), a publicly traded German manufacturer of industrial and consumer products. The terms of the transaction were not disclosed.

Seal For Life is a specialized supplier of protective coating and sealing solutions for a broad variety of infrastructure markets such as renewable energy, oil & gas, and water. The company employs more than 650 people and has a global production network. Seal For Life offers innovative coating and sealing products such as heat-shrink sleeves, visco-elastic coatings, epoxy & urethane coatings, fire protection, insulation, and sound dampening coatings. The performance and application capabilities of these solutions, marketed under different industry-leading brands including STOPAQ®, CANUSA®, COVALENCE®, and LIFELAST®, are pioneering in the protection and retrofitting of a wide variety of customer infrastructure assets, including onshore and offshore pipelines, jetty piles, storage tanks, valves, flanges, and high- performance industrial flooring.

Arsenal completed its investment in Seal For Life in 2019 and through seven strategic acquisitions, built a global platform in innovative coating and sealing solutions for both existing and new build infrastructure assets. The company’s leading brands and technologies play a critical role in extending the asset life of aging infrastructure with a focus on sustainable materials. During Arsenal’s ownership, Seal For Life significantly invested in technology development and innovation as well as expanded its end market exposure with novel solutions into applications such as district energy and renewable applications for wind and solar infrastructure protection.

Sal Gagliardo, an Operating Partner of Arsenal, said, “We are delighted with the growth achieved during our ownership, with Seal For Life’s sales more than doubling and strengthening of the company’s global market position. Seal For Life’s team, led by Jeff Oravitz, achieved strong organic growth, completed and integrated complementary acquisitions, and created a best-in-class technology platform in the infrastructure coatings sector. We want to thank Jeff and the Seal For Life team for their efforts and leadership that drove to this successful outcome.”

Jeff Oravitz, CEO of Seal For Life, stated, “Arsenal has enabled the transformation of Seal For Life into a unique platform of coatings solutions. The firm brought significant expertise in technologies and applications that drove a focus on where the markets are going and how we can address the long-term trends. We are grateful to the Arsenal team for their partnership and support over the last five years and are excited for the growth opportunities as we join the Henkel organization.”

Roy Seroussi, an Investment Partner of Arsenal, commented, “Arsenal’s close collaboration with Jeff and the team and the success of the Seal For Life platform further strengthens Arsenal’s position as a leading investor and company builder in the coatings, adhesives, sealants, and elastomers sector. We wish the Seal For Life team and Henkel the very best in their future success.”

Arsenal is an active investor in the coatings, adhesives, sealants, and elastomers sector, with current investments including Applied Adhesives, ATP Tapes, Fenzi Group, Meridian Adhesives Group, Polycorp, and Polytek, and with several prior investments in this sector.

J.P. Morgan Securities LLC acted as financial advisor to Seal For Life and Kirkland & Ellis LLP served as legal counsel.

About Arsenal Capital Partners

Arsenal Capital Partners is a leading private equity firm that specializes in investments in industrial growth and healthcare companies. Since its inception in 2000, Arsenal has raised institutional equity investment funds totaling over $10 billion, completed more than 290 platform and add-on acquisitions, and achieved more than 35 realizations. The firm works with management teams to build strategically important companies with leading market positions, high growth, and high value-add. For more information, visit www.arsenalcapital.com.

https://finance.yahoo.com/news/arsenal-completes-sale-seal-life-124500648.html

April 2, 2024

The Rise and Fall of 3M’s Floppy Disk

The high-profile creator of magnetic media gave it up nearly three decades ago

8 hours ago

10 min read

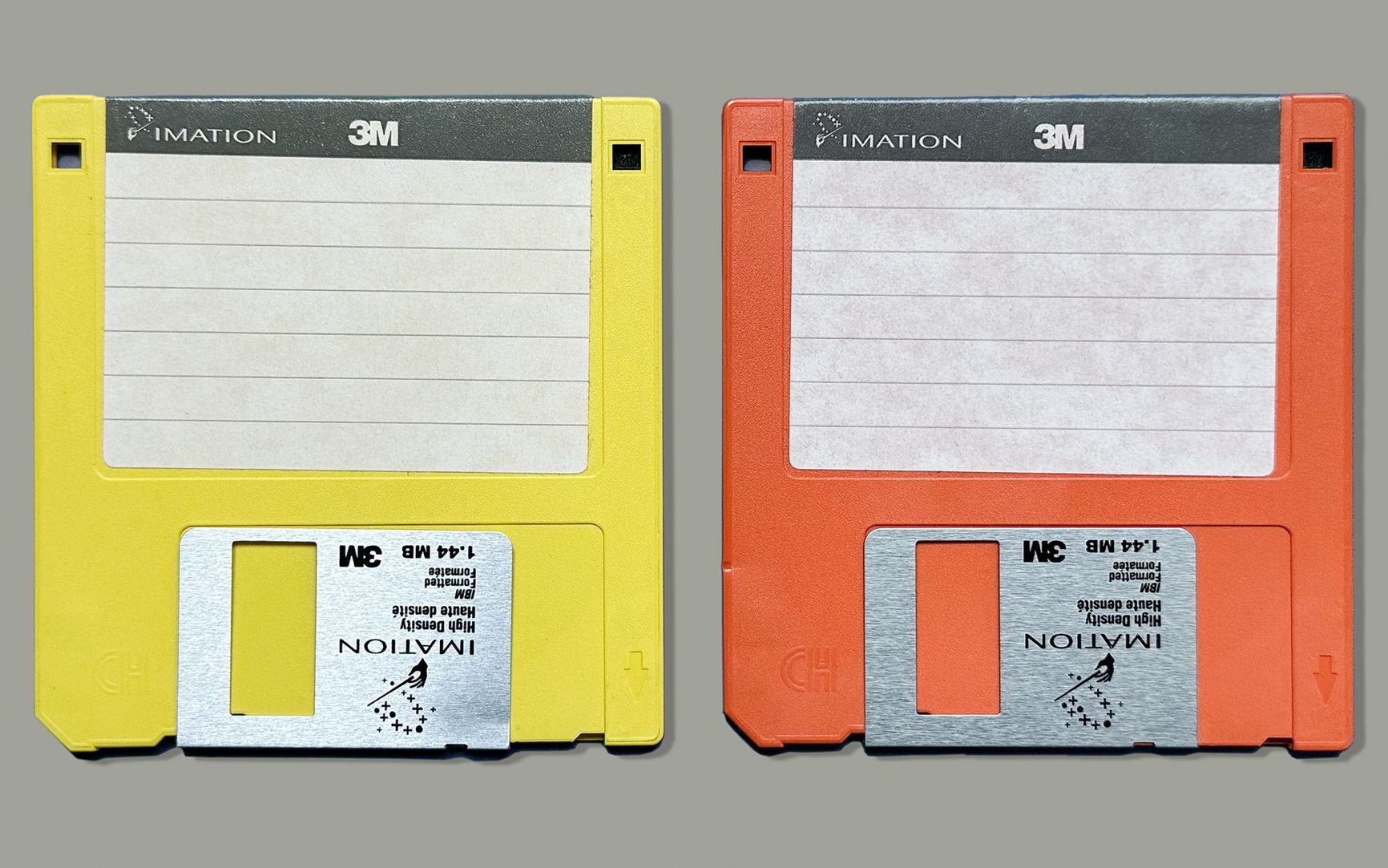

3M’s floppies were not unique, but they were emblematic of an early computing era.

IEEE Spectrum

3m floppycomputer historyaudio tapemasking tape

A version of this post originally appeared onTedium, Ernie Smith’s newsletter, which hunts for the end of the long tail.

If you ask the average person what the company 3M does, odds are if they have a few gray hairs hanging out on their scalp, they might say that the company makes floppy disks. Now, this was once true, but if you look on 3M’s own website, you will see no mention of this legacy—it’s a firm that sells abrasive materials, adhesive tapes, filters, films, personal protective equipment, and medical equipment. (Younger people, if they recognize 3M, it’s probably because of Post-it notes, or more recently its N95 masks)

Floppies have had a surprisingly long life—in January 2024, Japan announced it will no longer require floppy-disk copies of government submissions. But 3M got out of the data-storage business about 28 years ago, when it transferred its floppy disk manufacturing to a spin-off called Imation. Imation is still around, under the name Glassbridge Enterprises, but with a much smaller profile.

3M’s spin-off, Imation, continued producing floppy disks after 3M itself left the business. IEEE Spectrum

Even with that said, those gray-hairs will frequently claim that of the many makers of floppies out there, 3M made the best ones. Given that, I was curious to figure out exactly why 3M became the most memorable brand in data storage during the formative days of computing, and why it abandoned the product.

How 3M Became a Key Innovator in the Production of Magnetic Data Storage

Now, to be clear, 3M did not invent magnetic storage—that was done by Austro-German engineer Fritz Pfleumer, in 1928. He created audio tape, a recording medium that started as broad strips of paper coated with iron-powder granules, and eventually moved to less-fragile cellulose acetate with help from what would become another big name in floppy disks, BASF. At first, the innovation didn’t spread outside of Germany because of World War II.

Nor was 3M the first company to popularize magnetic media— that was Ampex, which commercialized the tape recorder in the late 1940s. That was the point when magnetic tape turned into a major innovation in the world of music—one that, famously, Bing Crosby got to first because he gave financial support to Ampex. Incidentally, Ampex’s later spinoff, Memorex, represented Silicon Valley’s first true startup.

“Of all the businesses 3M has shed over its 100 years, the two seminal decisions that people point to as most significant involved the sale of 3M’s Duplicating Products business to Harris Corporation in Atlanta, Georgia, and the spin-off of 3M’s data-storage and imaging-systems businesses in 1996 creating a new company called Imation in Oakdale, Minnesota…”

Before World War II, one company did attempt to manufacture a tape recorder in the U.S. based on Pfluemer’s magnetic-tape invention. That firm, the Brush Development Co., had developed a device called the Soundmirror, produced by a Hungarian inventor named Semi J. Begun, who was likely something of a competitor to Pfleumer: Also a German, he had moved to the United States and developed a steel-based magnetic tape. The invention was used by the U.S. military during the war, and the company revisited the idea immediately after. But, it needed someone to manufacture magnetic tape for it to use.

As author David Morton noted in his 2006 book Sound Recording: The Life Story of a Technology, 3M was one of the best-suited companies on the market to help Brush out. That’s because the groundbreaking work that the company had done to develop pressure-sensitive adhesive tape was an essential element of making magnetic tape effective.

3M’s adhesive-tape technology transferred readily to magnetic tape. 3M

Strangely enough, Richard Gurley Drew, the inventor of much of 3M’s tape technology, was a musician—he played banjo in a local orchestra—when he took a job with the company. He probably didn’t realize he was inventing a key element of 20th-century recording technology when he observed that auto body shops needed a way to “mask off” areas of vehicles that were being whittled down with sandpaper, but his observation would prove useful to the invention of masking tape.

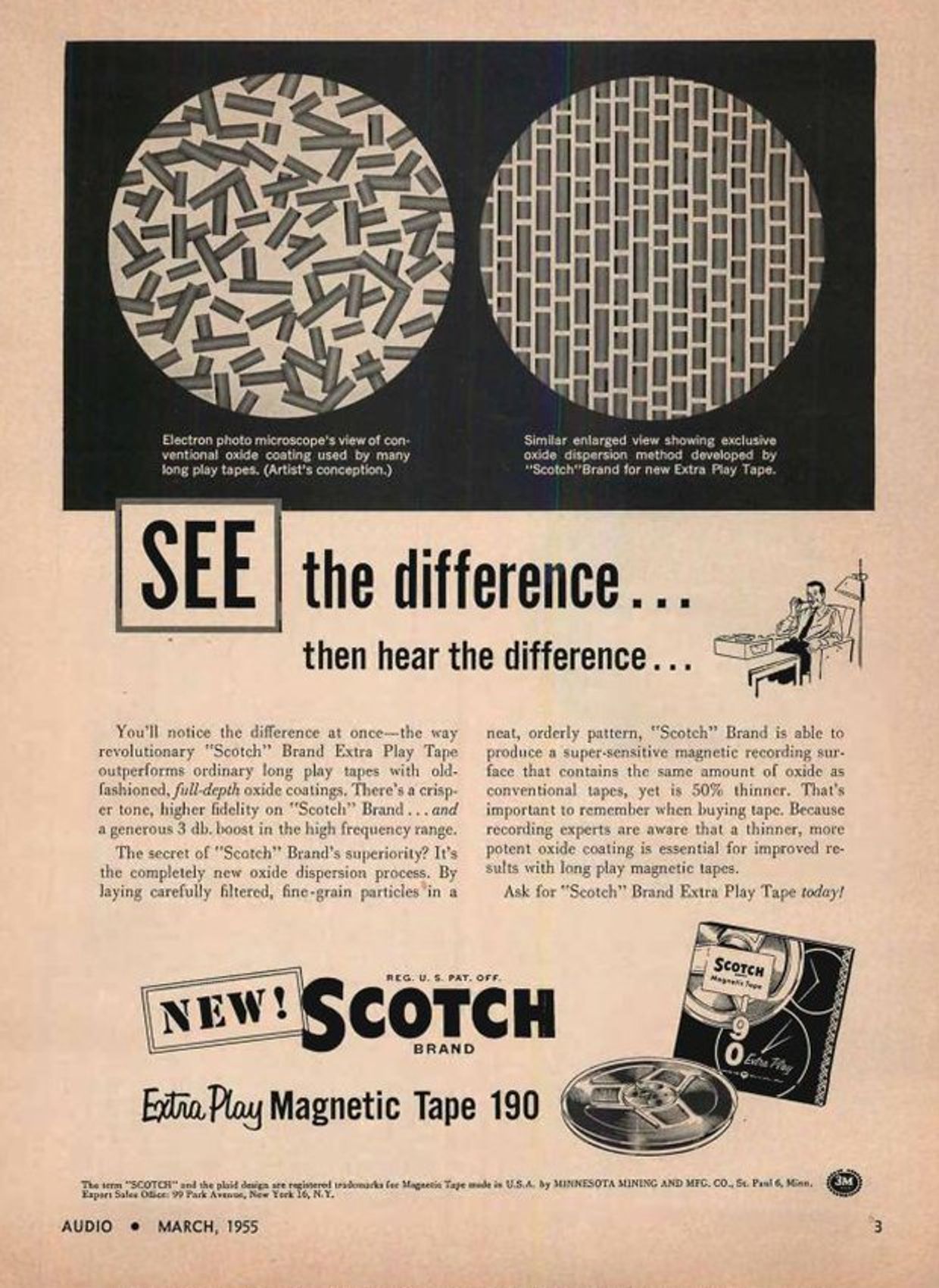

In the mid-1950s, 3M advertised its Scotch audio reel-to-reel tape.Audio Magazine/Internet Archive/Scotch

In the mid-1950s, 3M advertised its Scotch audio reel-to-reel tape.Audio Magazine/Internet Archive/Scotch

As Smithsonian Magazine notes, the formulation he developed, combining cabinetmaker’s glue with glycerin, proved to be just the right level of easy-to-remove adhesive that it became an out-and-out phenomenon. You might know his invention, developed in 1925, as Scotch Tape.

In 1930, he followed it up with another invention that was even more amazing—tape made from cellophane, which by its nature was totally transparent. Another 3M employee developed the tape dispenser, and the two inventions reshaped offices the world over.

So, when Brush looked to others to produce its recording medium, 3M was well positioned to help out due to magnetic tape’s similarity with its Scotch Tape. Brush eventually moved to other manufacturers, like Dupont. But the experience led 3M to continue developing metal-oxide tape technology, leading to the creation of the Scotch 111 reel-to-reel tape, which was one of the most popular types used in recording studios throughout the 1950s, according to the Museum of Magnetic Sound Recording.

I admittedly have long had a fascination with these reel-to-reel tapes. A number of years ago, back when I lived in Milwaukee, I found a couple of blank reel-to-reel tapes created by 3M using the Scotch name. I bought them from a junk store, and maybe paid $2 for them. They managed to follow me through three states and five cities, and now sit on my intentionally organized pile of junk. Based on my analysis of the container and the logotype it uses, they date to the mid-1960s or earlier. (No, I have not tried to record on them.)

I’ve owned this blank Scotch 150 reel-to-reel tape for nearly 20 years. It is 50 to 60 years old. Ernie Smith

For years, 3M’s reel-to-reels had one of the strongest reputations in the music industry; they were built to be of superhigh quality. But you might be wondering, how did 3M make the leap from reel-to-reel tape to floppies? It feels like just as strange a leap as a masking tape company developing reel-to-reel audio tape.

But, again, it happened.

How 3M’s Tapes Went From Music to Data

3M didn’t develop the floppy disk drive, either. IBM did, and Shugart Associates further improved it by making it small enough for regular users.

3M manufactured a signature 5.25-inch floppy disk. IEEE Spectrum

But 3M, much as with mechanical tape, was well positioned to improve on it, leveraging its skills with mechanical media in the budding computing industry. In a way, 3M came to media manufacturing from the opposite direction than its disk-selling competitor Memorex did. Memorex started with computers and gradually came to develop and improve tape-based technology, which eventually evolved into floppy disks. On the other hand, 3M started with the raw materials and the manufacturing processes, and combined those into computing’s greatest commodity item, the floppy disk.

3M got into the floppy disk market around the fall of 1973. It was not the only manufacturer of disks out there—some names from this era include Verbatim, Control Data, Dysan, and BASF. Most of these companies started with computing technology—for example, Dysan worked closely with Shugart Associates on the 5.25-inch floppy. But 3M wasn’t alone in starting with the raw materials. BASF, a German chemical manufacturer, has a somewhat similar corporate history and logo design to fellow thick-Helvetica enthusiast 3M. (Though 3M obviously never associated with the Nazis during World War II, so there’s that.)

3M branched out beyond standard floppy disks with a variety of magnetic-tape storage media.ComputerWorld/Google Books/3M

3M branched out beyond standard floppy disks with a variety of magnetic-tape storage media.ComputerWorld/Google Books/3M

3M didn’t rest on its laurels with the floppy disk either, and tried to push the technology further, most notably with Floptical disk technology, which Jim Adkisson, who helped create the 5.25-inch floppy at Shugart Associates, developed in the 1980s. A partnership of 3M, Maxell, and Iomega created the Floptical disk, which could hold 20 megabytes of data on something that looked a lot like a 3.5-inch floppy. Unfortunately the floptical disk flopped, losing out to products like Iomega’s iconic Zip drives.

3M also worked in more specialized media, developing high-capacity optical disks that fit into standard floppy and optical disk mechanisms, as well as high-end tape drives intended for the server room rather than your cassette player.

In many ways, 3M was out front on one of the most important elements of computing and was making huge profits from it. But by the end of 1995, those days were done. What changed?

https://www.youtube.com/embed/bOHKgENMcGQ?rel=03M advertised its floppy disk as more reliable than the competition in no uncertain terms.

What Led 3M to Kick a Multibillion-Dollar Business to the Curb

By 1995, 3M’s magnetic-media arm had evolved into a US $2.3 billion business, according to Time, which made it a significant chunk of 3M’s overall offering.

But at that time, high technology— especially consumer technology—was starting to look like a bad bet for legacy companies. This was around the same period that AT&T, still smarting from misadventures like the EO Personal Communicator, spun off Bell Labs as Lucent Technologies.

3M’s story, in its own words, suggests a similar crisis of culture. In A Century of Innovation, a book published by the company in 2002, around the time of its 100-year anniversary, the company compared the creation of the spin-off, which it called “the most wrenching decision in its history,” to that of its determination eight years earlier to sell its Duplicating Products Division, which sold copying machines:

Of all the businesses 3M has shed over its 100 years, the two seminal decisions that people point to as most significant involved the sale of 3M’s Duplicating Products business to Harris Corporation in Atlanta, Georgia, and the spin-off of 3M’s data-storage and imaging-systems businesses in 1996 creating a new company called Imation in Oakdale, Minnesota, near 3M headquarters. The two decisions have several elements in common—both involved businesses that 3M created and, in fact, ranked number one in the marketplace for decades. They were “homegrown” businesses—largely created within 3M and commercialized and built with the energy of many internal sponsors and champions. The businesses were risky because the products were based on pioneering technologies. They not only changed the basis of competition; they also created all new, global industries. The businesses were highly profitable for decades, and they represented a significant share of the company’s total annual revenues. They also produced many of 3M’s next generation of leaders.

So what happened? Essentially, despite the company’s success working in industrial and professional settings, doing things for consumers like producing videotapes, floppy disks, and cassettes meant moving out of its comfort zone. These products, initially developed for businesses, grew so popular that they suddenly needed to be available at every big-box store and drugstore alike, and, Post-its aside, retail was not a fit for the kind of company 3M was.

But more significantly, other companies were simply better at undercutting, and per the corporate biography, that required some tough decisions to be made:

While it sold its products for little or no profit, its competition sold their products for even less. Even though the consumer business had huge growth potential, 3M had little experience with a low-cost, low-profit-margin model.

The markings were clear—exit this business, even though 3M invented it. To stay in the “dog fight” meant 3M had to invest enormous amounts of money in order to remain the low-cost producer, with no assurance that profit margins ever would improve. “Exiting it was the right decision,” [former senior vice president Al] Huber said.

Seeing what came after, it’s hard to disagree. While floppies were still a significant medium in the mid-1990s, it was obvious that they would not be enough capacity for the next generation of data hoarders. It would only be a couple of years before Apple would put the first dagger in the heart of the floppy disk with the iMac, breaking with tradition by releasing a personal computer in 1998 with no built-in floppy disk drive.

https://www.youtube.com/embed/3qkQi3zZVhg?rel=0Imation carried on a floppy-disk ad campaign through the late 1990s.

That was a harbinger of what was to come. Within a decade of the decision, floppy drives, compact cassettes, and videotapes—the three key elements of 3M’s move into consumer-driven magnetic media—had fallen by the wayside. Imation, still active today, is owned by O-Jin Corp., a Korean technology company that basically bought it for the its trademarked name.

Five Unusual Types of Products 3M Developed Over the Years

Bondo: While not developed under 3M’s roof, the Bondo brand of automotive body filler, essentially a putty designed to fill in holes and cover visual imperfections, has been owned by 3M since at least 2007. Much like Post-its and Scotch Tape, it has become a generic term for the product line it serves.

Petrifilm: You know petri dishes, the containers used to allow bacteria to grow in a lab? Yep, 3M came up with a better version of them, in the form of Petrifilm, an easy-to-deploy platelike product developed by the company’s food-safety department in 1984. The technology has become hugely important in testing for potential food-safety concerns.

Tartan track: You know how Astroturf is commonly used in sports stadiums as a replacement for grass? Tartan track is sort of the track-and-field version of Astroturf , originally designed for horse tracks. One strange element of the Tartan track story is the fact that the original formulation used mercury, making it much more dangerous than it needed to be. (This kind of problem would later be a theme for 3M, a major chemical manufacturer.)

The typodont: This weirdly named device, associated with dentistry, is essentially a plastic model of the mouth and teeth, intended to make it easier to explain what is happening in a person’s mouth. While 3M didn’t invent the typodont, which has existed since the late 19th century, it is one of the 60,000 products the company makes.

Wind-vortex generators: In 2016, 3M developed a technology to help wind turbines generate airflow more optimally to ensure they work better, in partnership with Smartblade. It’s essentially a piece of carefully placed, high-quality plastic that, when placed correctly, increases energy production on turbines by 2 to 3 percent—a boost that adds up.

Much like its one-time competitor Memorex, Imation is a technology ghost kitchen. Its former corporate parent 3M, meanwhile, has a market cap of $51.33 billion at the time of this writing.

3M’s Magnetic Legacy

In a lot of ways, I think 3M’s persisting deep association with computing, despite the fact that the company left the field decades ago, comes down to the fact that it had a very recognizable logo design during its computer heyday.

My first experience with 3M was seeing its bright red logo on floppy disks used in classrooms with Apple IIe computers in the late 1980s and early ’90s. 3M was instantly recognizable among those responsible for creating the disks we needed to load up Number Munchers and Commander Keen, and as a result, its name is forever imprinted into the brains of retro-tech nerds the world over. It is a memory that gives me warm feelings.

But 3M, for a number of reasons, is not a company that carries a lot of goodwill with younger generations. For example, the company is closely associated with the manufacturing of a variety of chemicals, including PFOS (Perfluorooctane sulfonate), a key ingredient in Scotchguard and other water-resistant materials. It’s one of many PFAS (perfluoroalkyl and polyfluoroalkyl) substances that are believed to be harmful to humans.

The floppy disks that I and other elder millennials associate with a company that was essential to our youthful computing experience are long gone, shuttled away as a non-core business for a giant corporation that is best described as an amalgamation of non-core businesses loosely held together by a logo and backing in chemistry and raw materials.