Company News

April 24, 2024

POSM Unit in Europe Back Onstream

Europe styrene output to rise as force majeures lifting in H2 April

A force majeure was declared on polyolefins in March at LyondellBasell’s and Covestro’s jointly-owned propylene oxide styrene monomer (POSM) plant in Maasvlakte, the Netherlands. The POSM plant had been taken offline in mid-December as a preventative measure and came back online in second half February. A spokesperson for LyondellBasell confirmed OPIS Tuesday that the “unit at Maasvlakte is up and running.”

LyondellBasell’s site at Maasvlakte produces 680,000 metric tons/year of styrene, the largest styrene manufacturing unit in Europe, and 313,000 mt/year of propylene oxide, according to data from Chemical Market Analytics (CMA) by OPIS, a Dow Jones company. TotalEnergies produces 600,000 mt/year styrene at Gonfreville, the second largest European production site, CMA data showed.

April 18, 2024

Trade Action on Epoxy Resin

Olin Among U.S. Epoxy Resin Producers Filing Trade Cases Against Five Countries

News provided by Olin Corporation

Apr 03, 2024, 16:05 ET

CLAYTON, Mo., April 3, 2024 /PRNewswire/ — Olin Corporation (NYSE: OLN) today announced the filing of antidumping and countervailing duty petitions against five countries related to certain epoxy resins, as part of the U.S. Epoxy Resin Producers Ad Hoc Coalition. The petitions charge that unfairly traded imports of certain epoxy resins from China, India, South Korea, Taiwan, and Thailand are causing material injury to the domestic epoxy resin industry. The petitions further charge that significant subsidies have been provided to the foreign producers by the governments of China, India, South Korea, and Taiwan. The U.S. producers in the Coalition, including Olin, produce epoxy resins, an essential component for which there are no practical substitutes, for various customer applications, including critical U.S. industries such as Aerospace, Automotive, Defense, Electrical Transmission, Semiconductors, and Wind Energy. Having domestically produced epoxy resins is vital to ensuring that the U.S. manufacturing industry is capable of meeting domestic preference requirements contained in important U.S. legislation like The Inflation Reduction Act (IRA), the Bipartisan Infrastructure Law, and the CHIPS and Science Act. The availability of domestic epoxy production is also important to ensure U.S. industry has supply chain resiliency.

“We have been facing a significant volume of what we believe are unfairly dumped and subsidized imports of epoxy resin into this country,” said Florian Kohl, President, Olin Epoxy. “These unfairly traded imports have seriously impacted pricing in the U.S. market, which has resulted in a significant negative effect on our production, sales, and earnings. Without relief under U.S. law, unfairly traded imports will undermine the sustainability of U.S. producers and the welfare of their workers and local communities.”

The petitions were filed today with the U.S. Department of Commerce (“Commerce Department”) and the U.S. International Trade Commission (“USITC”). The five countries covered by the antidumping petitions and the dumping margins alleged by the domestic industry are as follows:

| COUNTRY | DUMPING MARGINS ALLEGED |

| China | 264.87% – 351.97% |

| India | 11.43% – 17.50% |

| South Korea | 30.01% – 69.42% |

| Taiwan | 87.19% – 136.02% |

| Thailand | 163.94% – 205.63% |

The petitions also allege that the foreign producers benefit from numerous countervailable subsidies. The petitions were filed in response to large volumes of low-priced imports of epoxy resins from the subject countries over the past three years that have injured the domestic epoxy resin producers.

The petitions allege that producers in the subject countries have injured the U.S. epoxy resin producers by selling their products at unfairly low prices that significantly undercut the prices of U.S. producers. As a result, imports of epoxy resins have captured an increasing share of the U.S. market at the direct expense of the U.S. industry. The price declines that U.S. producers have suffered are likely to continue if duties are not imposed to level the playing field.

Antidumping duties are intended to offset the amount by which a product is sold at less than fair value, or “dumped,” in the United States. The margin of dumping is calculated by the Commerce Department. Estimated duties in the amount of the dumping are collected from importers at the time of importation. Countervailing duties are intended to offset unfair subsidies that are provided by foreign governments and benefit the production of a particular good. The USITC, an independent agency, will determine whether the domestic industry is materially injured or threatened with material injury by reason of the unfairly traded imports.

OLIN COMPANY DESCRIPTION

Olin Corporation is a leading vertically integrated global manufacturer and distributor of chemical products and a leading U.S. manufacturer of ammunition. The chemical products produced include chlorine, caustic soda, vinyls, epoxies, chlorinated organics, bleach, hydrogen, and hydrochloric acid. Winchester’s principal manufacturing facilities produce and distribute sporting ammunition, law enforcement ammunition, reloading components, small caliber military ammunition and components, industrial cartridges, and clay targets.

April 18, 2024

The Story of Ashley Furniture

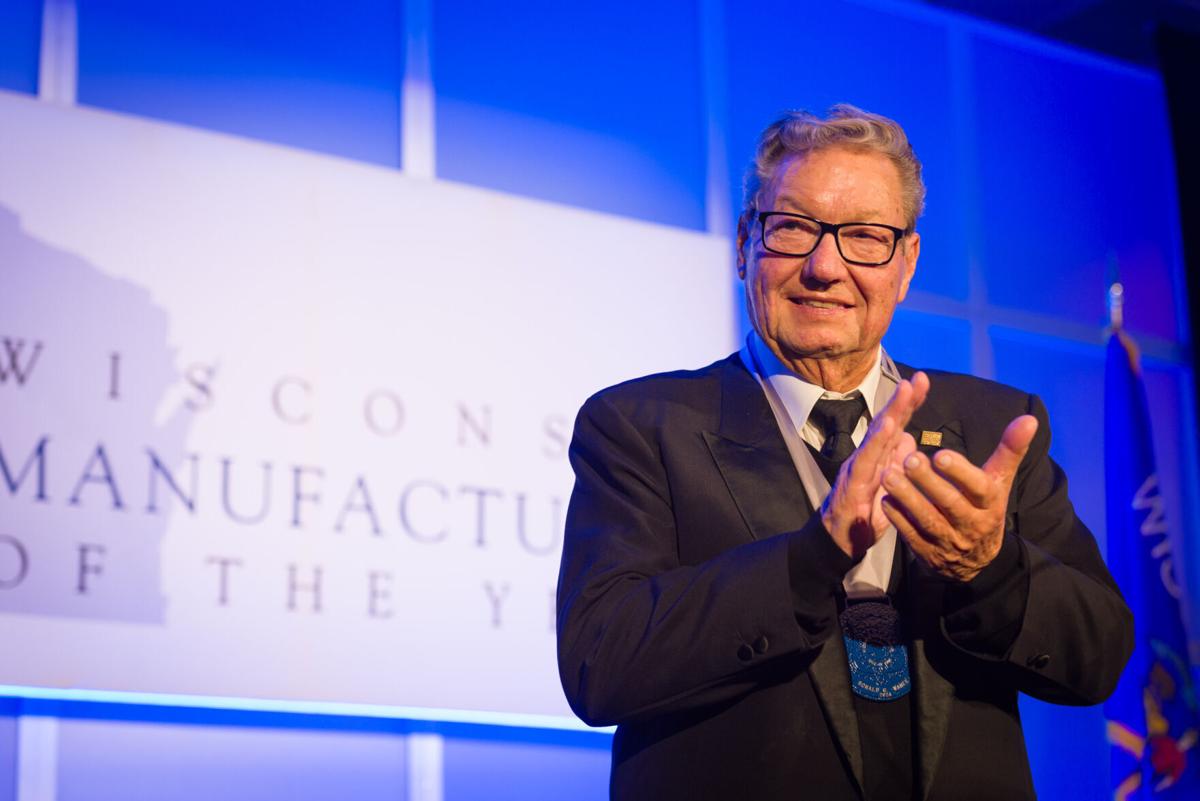

Ashley Furniture founder Ron Wanek first Wisconsin Manufacturing Hall of Fame inductee in 50 years

- RACHEL MERGEN

- Apr 5, 2024

RACHEL MERGEN

All his life, Ashley Furniture Industries founder and chairman Ron Wanek wanted to work in manufacturing.

Now, he is on an exclusive list of those who have made a lasting impact on the sector in Wisconsin.

In February, the Arcadia businessman was inducted into the Wisconsin Manufacturers & Commerce’s Manufacturing Hall of Fame. He was the first inductee added to the Hall of Fame since 1970.

“Wisconsin is a manufacturing state. It’s No. 2 in the United States as far as manufacturing jobs per capita,” Wanek said. “So what I’m saying is there’s a lot of manufacturers in Wisconsin, so I’m very honored.”

He said he did not expect to hear the Hall of Fame was set to expand.

“I was even more surprised when I found out I was the winner of it,” Wanek said.

Manufacturing family

Wanek was raised on a farm without indoor plumbing or electric lights near Lewiston, Minnesota.

“Manufacturing was always something that I wanted to do,” Wanek said.

A number of family members worked in manufacturing in Winona, Minnesota, he said. Eventually, he did too, starting with a job at Winona Industries in 1961.

Fast growth

He was able to learn and thrived at Winona Industries until he discovered an opportunity in 1970 to begin manufacturing occasional tables in Arcadia.

From there, he built Ashley Furniture Industries into the world’s largest manufacturer of home furnishings.

“That’s an impressive legacy for a company that only started 54 years ago,” Wisconsin Manufacturers & Commerce CEO Kurt Bauer said.

Bauer said Ashley Furniture has served as a huge employer and major economic engine in the western part of the state, helping other companies thrive through its supply chain.

The company has about 1,200 stores around the world, Wanek said.

Staying ahead

To stay strong, the company has made many changes through the years.

“We’ve had to constantly rebirth our organization,” Wanek said.

He said the company has implemented major changes to the way it operates 19 times. A big driver of those changes is the company’s mission to keep up with new technology.

Wanek said artificial intelligence and robotics currently are a focus for Ashley Furniture, along with making jobs easier for workers and remaining competitive.

Manufacturing in the US

Ashley Furniture also does all it can to keep its workforce in Wisconsin and the United States, Wanek said.

Philanthropy is also a priority for the Wanek family and Ashley Furniture, with over $45 million in donations since 2017 to science, technology, engineering and mathematics programs throughout the country.

Wanek said supporting diabetes and heart research programs has been a focus, along with planting trees throughout the country.

Wanek joins an impressive list of Hall of Fame inductees, including La Crosse native Reuben Trane, who founded Trane with his father, James.

Family-owned Ashley Furniture continues to grow far beyond its area home

Perfect fit for Hall of Fame

Bauer said Wanek matched the criteria for a rebooted Hall of Fame perfectly.

The Hall of Fame originally was started as the Industrial Hall of Fame in 1958 by the organization’s predecessor, the Wisconsin Manufacturers Association.

Wisconsin Manufacturers & Commerce — which was created when the Manufacturers Association and the Wisconsin State Chamber of Commerce merged — wanted to bring back the Hall of Fame to honor Wisconsin as a manufacturing state, Bauer said.

“We just thought it made sense to honor the history of manufacturing and the fact that it continues in the state of Wisconsin,” he said.

The newly restarted Hall of Fame’s criteria, Bauer said, includes a person’s economic impact, leadership, civic engagement, community philanthropy and enduring legacy.

“Mr. Wanek was at the top of the list in every one of those categories,” Bauer said.

April 18, 2024

New PO Capacity in China

Will Lihuayi Weiyuan Chemical’s New 300ktpa PO Facility Drive Market Prices Downwards?

PUdaily | Updated: April 18, 2024

Lihuayi Weiyuan Chemical Co., Ltd. has recently commenced production of its 300ktpa PO facility, with products passing inspection and now being sold externally. As a crucial extension of the company’s supply chain, the facility uses propylene and hydrogen produced from its propane dehydrogenation unit as raw materials. It maximizes the mutual supply and utilization of raw materials, products, and energy, representing another step in the company’s target of “building, extending, supplementing, and strengthening supply chain”. By enhancing the integrated utilization of materials and heat energy between units, it enables the extension of the industrial chain, further strengthening the chain’s resilience and enhancing the company’s competitiveness.

The start of this large-scale facility by Lihuayi Weiyuan Chemical undoubtedly breaks the current stalemate in Chinese PO market. On April 16, the prevailing offers of PO in Shandong and North China markets stood around CNY 9,050-9,100/tonne EXW in bulk in cash. Those in East China were CNY 9,400-9,500/tonne DEL in bulk in cash. Lihuayi Weiyuan Chemical is offering an ex-factory price of CNY 9,050/tonne, effective from April 16.

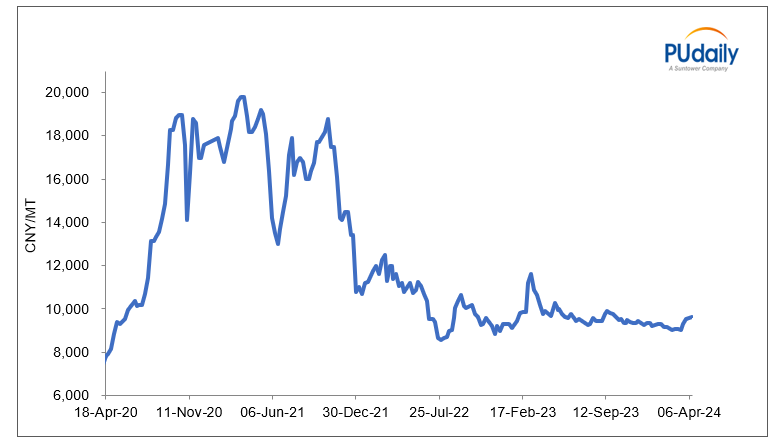

With continuously expanding capacity, China’s PO market is gradually becoming saturated. The additional 300ktpa capacity brought by Lihuayi Weiyuan Chemical further intensifies competition, putting downward pressure on the PO market. Chinese PO prices reached high levels in early 2020, peaking several times at CNY 20,000/tonne. The price increase was largely attributed to China’s growing domestic demand, the expansion of “dual-control” policy and power restrictions, facility maintenance in peripheral countries like Saudi Arabia and Singapore, and force majeure for polyether polyols and PO in the U.S. By the latter half of 2021, China’s downturn in the real estate sector caused PO prices to decline continuously to around CNY 9,000/tonne. The real estate industry, the largest downstream sector for the chemical industry, contributes a significant consumption share. The prosperity or downturn of the real estate sector directly and significantly impacts certain important chemical products. Factors such as the real estate downturn, slower macroeconomic growth, and sluggish industrial activity exert pressure on the PO industry chain.

In 2023, China’s PO capacity reached 6.1mtpa, marking a new high in recent years, according to PUdaily. Lihuayi Weiyuan Chemical’s new 300ktpa PO facility will further aggravate market competition and drive prices downwards.

Figure 2: China PO Price Trend 2022-2024

In general, Lihuayi Weiyuan Chemical’s new 300ktpa PO facility has had a short-term impact on market prices. However, in the long run, it will propel technological advancements and industrial upgrades, injecting new momentum for sustainable industry development. This development serves as a reminder that businesses must innovate continuously and enhance core competencies to secure a strong position in the increasingly competitive market.

April 17, 2024

Latest on Adnoc Covestro Dialogue

Covestro takeover by oil group Adnoc still up in the air

April 17, 2024 at 01:02 pm

Share

LEVERKUSEN (dpa-AFX) – Talks on a possible takeover of the chemicals group Covestro by Abu Dhabi National Oil (Adnoc) continue to drag on. “We are conducting these talks in a constructive and open-minded manner in accordance with our obligations under stock corporation law – and in the interests of our company, our shareholders and all other stakeholders,” said Covestro CEO Markus Steilemann on Wednesday at the Annual General Meeting of the DAX-listed company from Leverkusen. Key points relating to the talks with the oil company from the United Arab Emirates thus remain open.

Speculation about a deal arose almost a year ago. It was only in September that Covestro announced that it was in talks with Adnoc. After several rumored increases in the offer, an informal offer of just over EUR 60 per share has been in the air for some time. The Bloomberg news agency reported on this sum in February, citing people familiar with the matter. In total, this would be more than 11.3 billion euros.

Covestro shares initially benefited from speculation about interest from the golf group. In June 2023, its price jumped by around a quarter to around 50 euros. The bottom line is that not much has happened since then. Investors are concerned that the share price will fall again significantly if negotiations with the state-owned company fail, despite the recent slight improvement in the outlook for the chemical industry./mis/stw/jha/