- Sales grow to €15.6 billion (plus 8%), largely driven by higher sales prices in all segments (plus 6%) as well as higher volumes (plus 2%)

- EBIT before special items of €1.5 billion (minus 14%), mainly due to lower contribution from Chemicals segment

- Net income of €1.2 billion (minus 10%)

2018 outlook adjusted following signing of agreement to merge Wintershall and DEA:

- Slight sales growth

- Slight decrease in EBIT before special items

- Considerable decline in EBIT

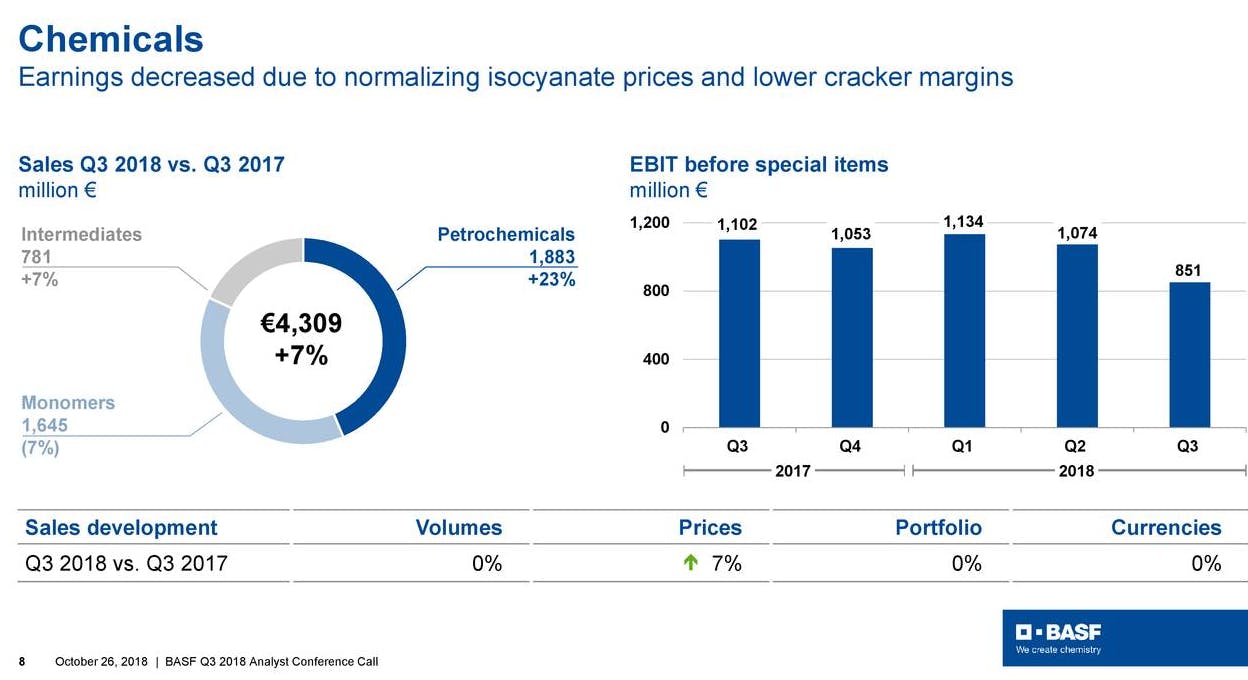

In the third quarter of 2018, BASF Group sales rose by 8% year on year to reach €15.6 billion. This was primarily attributable to higher sales prices in all segments. Volumes growth and the acquisition of the Bayer businesses in August 2018 also contributed to the sales increase. Negative currency effects had an offsetting impact. Income from operations (EBIT) before special items declined by €232 million to €1.5 billion, mainly due to the significantly lower contribution from the Chemicals segment. EBIT before special items also decreased considerably in the Functional Materials & Solutions and Agricultural Solutions segments, but fell only slightly in the Performance Products segment. This was partially offset by improved earnings in Other.

Special items in EBIT totaled minus €75 million in the third quarter of 2018, compared with €122 million in the prior-year quarter. In addition to the integration costs incurred in connection with the acquisition of significant businesses and assets from Bayer, expenses for restructuring measures and other charges also contributed here. The prior-year quarter included special income in the Performance Products segment from the transfer of BASF’s leather chemicals business to the Stahl group. Compared to the third quarter of 2017, EBIT therefore declined by €429 million to €1.4 billion. Income from operations before depreciation, amortization and special items (EBITDA before special items) decreased by €254 million to €2.3 billion and EBITDA by €465 million to €2.2 billion.

At the presentation of BASF Group’s quarterly figures, Chairman of the Board of Executive Directors Dr. Martin Brudermüller and Chief Financial Officer Dr. Hans-Ulrich Engel pointed to some of the special factors in the third quarter: “We completed the acquisition of significant businesses and assets from Bayer and reached an agreement on the merger of Wintershall and DEA,” said Brudermüller. After the transaction agreement between BASF and LetterOne was signed, it was necessary to adjust the financial reporting retroactively as of January 1, 2018. The prior-year figures were also restated accordingly.

The low water level in the Rhine River had an impact on business. “Throughout the entire third quarter, we had to struggle with this, which led to production cutbacks and higher transportation costs,” said Brudermüller. And the reporting period is being compared to the BASF Group’s very strong third quarter of 2017, when the business climate was considerably more favorable in comparison. Brudermüller said: “The challenges in the macroeconomic environment are growing. You can see this in our third-quarter 2018 results.”

Outlook for the full year 2018

Growth in industrial production fell short of expectations in the third quarter of 2018, primarily due to developments in the automotive industry in September in particular. The introduction of new emission standards had an impact in Europe. The effects of the trade conflict between the United States and China are also showing. This is leading to a slowdown in economic growth in Asia in particular, mainly in China.

BASF therefore adjusted its assessment of the global economic environment in 2018 as follows (forecast from the BASF Half-Year Financial Report 2018 in parentheses):

- Growth in gross domestic product: 3.0% (3.0%)

- Growth in industrial production: 3.1% (3.2%)

- Growth in chemical production: 3.1% (3.4%)

- Average euro/dollar exchange rate of $1.20 per euro ($1.20 per euro)

- Average Brent blend oil price for the year of $70 per barrel ($70 per barrel)

The signing of the definitive transaction agreement on the merger of Wintershall and DEA reduces the BASF Group’s sales and EBIT by the contribution of its oil and gas activities – retroactively as of January 1, 2018, and with the prior-year figures restated – due to their presentation as discontinued operations.

As a result of this, the BASF Group’s forecast for the full year 2018 made in the 2017 report was adjusted at the end of September (previous forecast from the BASF Report 2017 in parentheses):

- Slight sales growth (slight growth)

- Slight decrease in EBIT before special items (slight increase)

- Considerable decline in EBIT (slight decline)

https://www.basf.com/en/company/news-and-media/news-releases/2018/10/p-18-343.html