Company News

June 7, 2022

More on Inventories

Target Crashes After Cutting Profit Outlook For 2nd Time In Three Weeks Due To Excess Inventory

by Tyler DurdenTuesday, Jun 07, 2022 – 07:23 AM

Just two weeks ago, Target dropped the most since 1987’s Black Monday after the retailer warned profits would come in well below expectation due to soaring inflation eating into profit margins and would also impact revenue growth. Fast forward to today when Target issued another profit warning, just as we expected now that we have entered the prime of guidance cut season

… because the retailer will need to cancel orders or offer discounts to clear out unwanted goods, the latest sign of the sudden mismatch between supply and demand inside America’s stores.

In this morning’s profit warning, Target warned that operating profit will amount to just 2% of sales in the current quarter, well below its May 18 prediction that the gauge would be in a wide range around 5.3%. Target still sees operating margin rising to about 6% in the second half of the year, but that number will be cut too in time.

In addition, the company will offload excess inventory and adjust some prices “to address the impact of unusually high transportation and fuel costs.” Target is also seeking to get a handle on supply-chain disruptions by adding “incremental holding capacity near U.S. ports,” which will give it greater flexibility.

“We’ve had some additional time after earnings to really evaluate the overall operating environment,” said Target Chief Executive Brian Cornell in an interview with the WSJ. That includes watching consumer behavior as they face high rates of inflation, he said, and seeing many other retailers talk about high inventory levels during their earnings presentations. “We have to be decisive and get out in front of this to make sure this doesn’t linger through the back half of the year.”

“Excess inventory doesn’t usually age well,” Chief Financial Officer Michael Fiddelke told Bloomberg. “We want to make sure that we’re being aggressive to right-size our inventory now.” He said this would help improve shoppers’ experience while boosting value for shareholders.

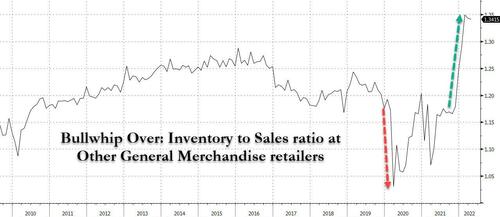

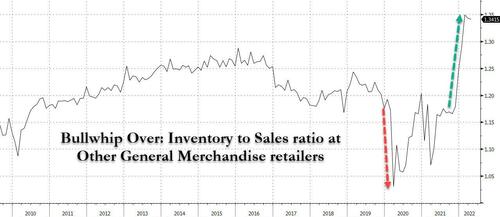

Of course, none of this should be news to regular Zero Hedge readers because just three weeks ago we wrote “Bullwhip Effect Ends With A Bang: Why Prices Are About To Fall Off A Cliff” in which we showed the dramatic surge in the inventory-to-sales ratio at General Merchandise retailers, and predicted that as they have no choice but to liquidate excess inventory, prices – and profit margins – are set to crater.

Big retailers benefited over the past two years from the pandemic rush to buy patio furniture, laptops and home décor, as shoppers were buoyed by savings and government stimulus checks. Now many of those same stores are grappling with a swift reversal of buying behavior with consumers spending less on goods in favor of services and necessities such as food and fuel.

The measures show Target’s struggle to adjust to rapid shifts in demand amid stubborn inflation that’s forced consumer spending into less-profitable staple goods and away from discretionary categories such as electronics and home products. That’s left Target and its big-box rivals with more merchandise that consumers don’t want, complicating their effort to maintain their market-share gains of the pandemic while keeping investors happy.

As Bloomberg adds, retailers have to account for many consumers’ sudden price sensitivity, while balancing their own surging operating costs from fuel, labor and other expenses. Meanwhile, the lessons of the pandemic, when shoppers hoarded goods, are still fresh, and companies are wary of being caught without enough merchandise to sell.

But holding on to larger quantities of products is expensive, and if they fail to move, markdowns further hurt profitability while benefiting bargain-hunting shoppers. Inventories have soared at retailers from Gap Inc. to Costco Wholesale Corp. Last week, Walmart Inc. said it would need “another couple quarters” to work through its bloated inventory. Given the industry overhang, Target decided since its earnings report to take “a decisive set of actions,” Fiddelke said.

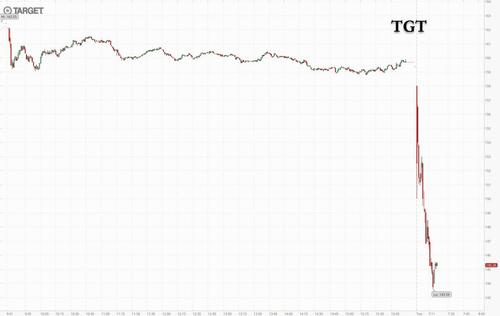

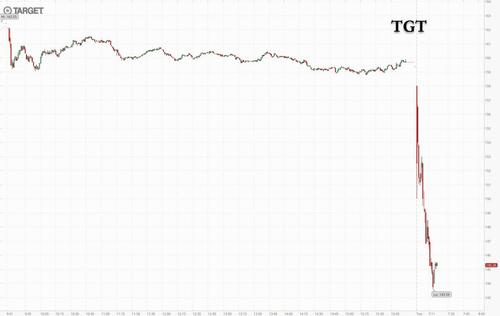

Needless to say, the market was not happy, although it certainly was surprised despite our explicit warning that this was coming. On May 13, Target shares plunged the most since 1987 after the release of its first-quarter results, which included the more pessimistic profit outlook and an increase in product inventories. The following week, the stock sank to the lowest since September 2020 before recording meager gains since then. In all, Target has fallen 31% so far this year. And this morning, the stock is plunging another 10%,

Target was not alone as the market realize that we were right all along, and peer retailers such as Walmart and Costco all fell premarket after Target’ margin guidance cut. WMT was down as much as 4.3% ahead of the bell, COST -2.9%, while TGT shares sank as much as 10%, Kroger -1.3%, Macy’s -3%, and so on as traders realize that the US is about to be hit with a historic liquidation wave as retailers rush to dump tens of billions in excess inventory.

June 7, 2022

More on Inventories

Target Crashes After Cutting Profit Outlook For 2nd Time In Three Weeks Due To Excess Inventory

by Tyler DurdenTuesday, Jun 07, 2022 – 07:23 AM

Just two weeks ago, Target dropped the most since 1987’s Black Monday after the retailer warned profits would come in well below expectation due to soaring inflation eating into profit margins and would also impact revenue growth. Fast forward to today when Target issued another profit warning, just as we expected now that we have entered the prime of guidance cut season

… because the retailer will need to cancel orders or offer discounts to clear out unwanted goods, the latest sign of the sudden mismatch between supply and demand inside America’s stores.

In this morning’s profit warning, Target warned that operating profit will amount to just 2% of sales in the current quarter, well below its May 18 prediction that the gauge would be in a wide range around 5.3%. Target still sees operating margin rising to about 6% in the second half of the year, but that number will be cut too in time.

In addition, the company will offload excess inventory and adjust some prices “to address the impact of unusually high transportation and fuel costs.” Target is also seeking to get a handle on supply-chain disruptions by adding “incremental holding capacity near U.S. ports,” which will give it greater flexibility.

“We’ve had some additional time after earnings to really evaluate the overall operating environment,” said Target Chief Executive Brian Cornell in an interview with the WSJ. That includes watching consumer behavior as they face high rates of inflation, he said, and seeing many other retailers talk about high inventory levels during their earnings presentations. “We have to be decisive and get out in front of this to make sure this doesn’t linger through the back half of the year.”

“Excess inventory doesn’t usually age well,” Chief Financial Officer Michael Fiddelke told Bloomberg. “We want to make sure that we’re being aggressive to right-size our inventory now.” He said this would help improve shoppers’ experience while boosting value for shareholders.

Of course, none of this should be news to regular Zero Hedge readers because just three weeks ago we wrote “Bullwhip Effect Ends With A Bang: Why Prices Are About To Fall Off A Cliff” in which we showed the dramatic surge in the inventory-to-sales ratio at General Merchandise retailers, and predicted that as they have no choice but to liquidate excess inventory, prices – and profit margins – are set to crater.

Big retailers benefited over the past two years from the pandemic rush to buy patio furniture, laptops and home décor, as shoppers were buoyed by savings and government stimulus checks. Now many of those same stores are grappling with a swift reversal of buying behavior with consumers spending less on goods in favor of services and necessities such as food and fuel.

The measures show Target’s struggle to adjust to rapid shifts in demand amid stubborn inflation that’s forced consumer spending into less-profitable staple goods and away from discretionary categories such as electronics and home products. That’s left Target and its big-box rivals with more merchandise that consumers don’t want, complicating their effort to maintain their market-share gains of the pandemic while keeping investors happy.

As Bloomberg adds, retailers have to account for many consumers’ sudden price sensitivity, while balancing their own surging operating costs from fuel, labor and other expenses. Meanwhile, the lessons of the pandemic, when shoppers hoarded goods, are still fresh, and companies are wary of being caught without enough merchandise to sell.

But holding on to larger quantities of products is expensive, and if they fail to move, markdowns further hurt profitability while benefiting bargain-hunting shoppers. Inventories have soared at retailers from Gap Inc. to Costco Wholesale Corp. Last week, Walmart Inc. said it would need “another couple quarters” to work through its bloated inventory. Given the industry overhang, Target decided since its earnings report to take “a decisive set of actions,” Fiddelke said.

Needless to say, the market was not happy, although it certainly was surprised despite our explicit warning that this was coming. On May 13, Target shares plunged the most since 1987 after the release of its first-quarter results, which included the more pessimistic profit outlook and an increase in product inventories. The following week, the stock sank to the lowest since September 2020 before recording meager gains since then. In all, Target has fallen 31% so far this year. And this morning, the stock is plunging another 10%,

Target was not alone as the market realize that we were right all along, and peer retailers such as Walmart and Costco all fell premarket after Target’ margin guidance cut. WMT was down as much as 4.3% ahead of the bell, COST -2.9%, while TGT shares sank as much as 10%, Kroger -1.3%, Macy’s -3%, and so on as traders realize that the US is about to be hit with a historic liquidation wave as retailers rush to dump tens of billions in excess inventory.

June 7, 2022

Azelis M&A Focus

Azelis Strengthens Executive Leadership to Support Group’s Growth Strategy

June 7, 2022 by admin

ANTWERP, Belgium–(WORK TEL)–Regulatory Information:

Azelis (Brussels:AZE), a number one world innovation providers supplier within the specialty chemical substances and meals elements business, introduced the appointment of Laurent Nataf as Head of Mergers and Acquisitions (M&A), a brand new strategic perform on the group’s Government Committee. Sertaç Sürür, who was appointed as the brand new CEO and President of Azelis Asia Pacific, joined the Government Committee in his new place, growing the manager management of Azelis to 6 members.

As a part of Azelis’ technique to speed up development, Laurent Nataf, at the moment the CEO and President of Azelis Asia Pacific, will assume the function of Chief M&A Officer efficient September 1, 2022. The creation of this new function on the Government Committee displays the continued significance of the Group’s M&A program to enhance its natural development growth in strengthening its footprint and market management. Laurent will additional develop and drive Azelis’ world M&A method consistent with the group’s bold development plans and also will oversee post-acquisition integration applications. Laurent will leverage his management abilities and enterprise growth expertise by main the acquisition of 17 firms for Azelis in Asia Pacific. Below Laurent’s management, the group’s Asia Pacific enterprise grew from 8% to over 15% of group income, increasing Azelis’ footprint to incorporate 12 nations within the area.

Sertaç Sürür, who’s at the moment the Common Supervisor of Azelis Turkey, will take over the management of the Asia Pacific area from Laurent Nataf. Since becoming a member of in 2015, Sertaç has taken on numerous native and regional management roles, driving the group’s Turkey enterprise to develop into a number one specialty chemical substances distributor within the home market, rising from 2% to roughly 6% of Azelis’ EMEA income. Previous to becoming a member of Azelis, Sertaç held numerous business and administration management positions at world industrial and chemical distribution and manufacturing firms, together with DSM and Ravago.

Laurent and Sertaç, as members of the Government Board, will report back to the Group CEO,Dr. Hans Joachim Muller. They may quickly start to transition into their new roles to make sure a easy and seamless handover.

Dennis Verhaert, present Group M&A Director, will tackle a brand new function at Azelis, particulars of which shall be introduced quickly.

Azelis CEO Dr. Remark by Hans Joachim Müller:

“I’m happy to announce to the management of the group these strategic appointments that mark the following stage in our evolution to develop into the reference innovation service supplier within the specialty chemical substances and meals elements distribution market. Including M&A performance to the Government Committee is a logical step given our technique to enhance natural development with acquisitions to strengthen our facet worth chain and world footprint.

I wish to thank Dennis for his contribution to the event of a powerful M&A group that has supported the group’s speedy development over the previous 4 years. Laurent and Sertaç have a formidable monitor document of growing enterprise for the group and I’ve full confidence that they are going to proceed to efficiently fulfill their new roles.”

About Azelles

Azelis is a number one world innovation service supplier within the specialty chemical substances and meals elements business, with greater than 3,000 staff positioned in additional than 50 nations worldwide. Every of our educated groups of business, market and technical specialists is devoted to a selected market inside Life Sciences and Industrial Chemical compounds. We provide greater than 51,000 prospects a lateral complementary product worth chain, backed by roughly 2,300 key relationships, producing turnover of €2.8 billion (2021). Azelis Group NV is listed on Euronext Brussels with the code AZE.

Throughout our intensive community of greater than 60 software labs, our award-winning workers help within the growth of formulations and supply technical steerage for purchasers all through the product growth course of. We mix a world market attain with an area footprint to offer a dependable, built-in and distinctive digital service to native prospects and enticing job alternatives for principals. With an EcoVadis Platinum ranking, Azelis is a frontrunner in sustainability. We imagine in establishing and nurturing stable, sincere and clear relationships with our staff and companions.

Affect via concepts. Innovation via formulation.

www.azelis.com

https://webringnet.com/azelis-strengthens-executive-leadership-to-support-groups-growth-strategy/

June 7, 2022

Azelis M&A Focus

Azelis Strengthens Executive Leadership to Support Group’s Growth Strategy

June 7, 2022 by admin

ANTWERP, Belgium–(WORK TEL)–Regulatory Information:

Azelis (Brussels:AZE), a number one world innovation providers supplier within the specialty chemical substances and meals elements business, introduced the appointment of Laurent Nataf as Head of Mergers and Acquisitions (M&A), a brand new strategic perform on the group’s Government Committee. Sertaç Sürür, who was appointed as the brand new CEO and President of Azelis Asia Pacific, joined the Government Committee in his new place, growing the manager management of Azelis to 6 members.

As a part of Azelis’ technique to speed up development, Laurent Nataf, at the moment the CEO and President of Azelis Asia Pacific, will assume the function of Chief M&A Officer efficient September 1, 2022. The creation of this new function on the Government Committee displays the continued significance of the Group’s M&A program to enhance its natural development growth in strengthening its footprint and market management. Laurent will additional develop and drive Azelis’ world M&A method consistent with the group’s bold development plans and also will oversee post-acquisition integration applications. Laurent will leverage his management abilities and enterprise growth expertise by main the acquisition of 17 firms for Azelis in Asia Pacific. Below Laurent’s management, the group’s Asia Pacific enterprise grew from 8% to over 15% of group income, increasing Azelis’ footprint to incorporate 12 nations within the area.

Sertaç Sürür, who’s at the moment the Common Supervisor of Azelis Turkey, will take over the management of the Asia Pacific area from Laurent Nataf. Since becoming a member of in 2015, Sertaç has taken on numerous native and regional management roles, driving the group’s Turkey enterprise to develop into a number one specialty chemical substances distributor within the home market, rising from 2% to roughly 6% of Azelis’ EMEA income. Previous to becoming a member of Azelis, Sertaç held numerous business and administration management positions at world industrial and chemical distribution and manufacturing firms, together with DSM and Ravago.

Laurent and Sertaç, as members of the Government Board, will report back to the Group CEO,Dr. Hans Joachim Muller. They may quickly start to transition into their new roles to make sure a easy and seamless handover.

Dennis Verhaert, present Group M&A Director, will tackle a brand new function at Azelis, particulars of which shall be introduced quickly.

Azelis CEO Dr. Remark by Hans Joachim Müller:

“I’m happy to announce to the management of the group these strategic appointments that mark the following stage in our evolution to develop into the reference innovation service supplier within the specialty chemical substances and meals elements distribution market. Including M&A performance to the Government Committee is a logical step given our technique to enhance natural development with acquisitions to strengthen our facet worth chain and world footprint.

I wish to thank Dennis for his contribution to the event of a powerful M&A group that has supported the group’s speedy development over the previous 4 years. Laurent and Sertaç have a formidable monitor document of growing enterprise for the group and I’ve full confidence that they are going to proceed to efficiently fulfill their new roles.”

About Azelles

Azelis is a number one world innovation service supplier within the specialty chemical substances and meals elements business, with greater than 3,000 staff positioned in additional than 50 nations worldwide. Every of our educated groups of business, market and technical specialists is devoted to a selected market inside Life Sciences and Industrial Chemical compounds. We provide greater than 51,000 prospects a lateral complementary product worth chain, backed by roughly 2,300 key relationships, producing turnover of €2.8 billion (2021). Azelis Group NV is listed on Euronext Brussels with the code AZE.

Throughout our intensive community of greater than 60 software labs, our award-winning workers help within the growth of formulations and supply technical steerage for purchasers all through the product growth course of. We mix a world market attain with an area footprint to offer a dependable, built-in and distinctive digital service to native prospects and enticing job alternatives for principals. With an EcoVadis Platinum ranking, Azelis is a frontrunner in sustainability. We imagine in establishing and nurturing stable, sincere and clear relationships with our staff and companions.

Affect via concepts. Innovation via formulation.

www.azelis.com

https://webringnet.com/azelis-strengthens-executive-leadership-to-support-groups-growth-strategy/

May 31, 2022

Applied Adhesives Makes Another Acquisition

Arsenal’s APPLIED Adhesives

Acquires Alliance Adhesives

MINNETONKA, Minn., May 25, 2022 – APPLIED Adhesives, a premier custom adhesive solutions provider in North America, today announced that it has completed its acquisition of Alliance Adhesives, a regional supplier of adhesives and dispensing equipment solutions located in Oldsmar, FL. This acquisition strengthens the Company’s commitment to providing industry-leading products, technical expertise, and superior service to its customers.

“Alliance’s dedication to providing an exceptional customer experience is in direct alignment with Applied’s commitment to relentless customer focus, demonstrating an ideal cultural fit,” said John Feriancek, President and CEO of APPLIED Adhesives. “We are pleased to welcome Alliance Adhesives to APPLIED Adhesives and look forward to providing their customers with the outstanding service and innovative solutions they have come to expect.”

“Alliance always has the mindset that we are an extension of our customers’ business by supporting their needs to drive their success. Our relationship with our customers is our number one priority. We have them to thank for who we are today,” said David Rittenhouse, President of Alliance Adhesives. “Applied shares those same values and mindset. We feel the support that Applied brings to the table and their passion for relentless customer focus makes this a win for everyone.”

About APPLIED Adhesives

APPLIED Adhesives, founded in 1971, is a premier custom adhesive solutions provider in North America. The company is a value-added distributor of hot melt, water-based, and reactive adhesives as well as dispensing equipment. APPLIED Adhesives serves as a critical supply chain partner to leading adhesive manufacturers and formulators by offering reach and high service levels to an expansive customer base. For more information, please visit appliedadhesives.com or follow us on LinkedIn.

About Alliance Adhesives

Located in Oldsmar, FL, Alliance Adhesives is a regional, family-owned manufacturer and distributor of industrial adhesives. For 20 years, customers have depended on Alliance for cost-effective solutions for their adhesives needs. Alliance serves customers of all types including small- and medium-sized businesses, large enterprises, agricultural, educational institutions, government agencies, and consumers. For more information, please visit Allianceadhesives.com

About Arsenal Capital Partners

Arsenal is a leading private equity firm that specializes in investments in middle-market industrial growth and healthcare companies. Since its inception in 2000, Arsenal has raised institutional equity investment funds of more than $10 billion, has completed more than 250 platform and add-on investments, and achieved more than 30 realizations. Arsenal invests in industry sectors in which the firm has significant prior knowledge and experience. The firm works with management teams to build strategically important companies with leading market positions, high growth, and high value-add. Visit www.arsenalcapital.com for more information.