Current Affairs

June 4, 2022

Lumber Prices

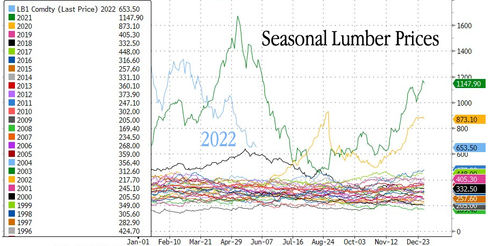

Lumber Prices Crash 50% As Fed Tightens

by Tyler DurdenFriday, Jun 03, 2022 – 08:40 PM

Lumber prices have been halved since the Federal Reserve embarked on its most aggressive interest rate tightening campaign in decades as the pandemic boom in housing slows.

Lumber contracts trading on the CME crashed to $653 per thousand board feet, down 51% from a high in late February of $1,336. The decline in wood prices occurred about two weeks before the Fed began hiking interest rates in mid-March.

The Fed is expected to continue raising rates this summer. Interest rate probabilities show the Fed could hike by 50bps at three of the next FOMC meetings to suppress consumption and get inflation under control ahead of the midterm elections. However, that’s going to be a challenging task, which may cause a hard landing in the economy.

Fed Chair Jerome Powell’s pursuit of finding the neutral rate has already unleashed a rate shock in the housing market, with the 30-year fixed-rate mortgage shooting up more than 200bps this year, from 320 bps to 557 bps. This has crushed activity for refinancing houses (remodeling) and sent mortgage applications (home construction) plunging, a sign the housing market is cooling.

Signs of a slowdown in construction are already materializing: “Buyers don’t have the same mentality of having to go out and buy 10 when they only need five,” Ash Boeckholt, co-founder and chief revenue officer at online wood-products marketplace MaterialsXchange, told WSJ.

A monthly survey from John Burns Real Estate Consulting of building-products dealers shows only 12% had tight lumber inventories in April, down 61% from last year. Lumber is a leading indicator and suggests higher prices and soaring interest rates have helped fix shortages that were stoked during the pandemic lockdowns of easy money and robust demand for housing.

Lumber is still double the price of the three-decade trend of $359. Matthew Saunders, who leads John Burns Real Estate Consulting, said that prices are expected to stay above pre-pandemic levels despite improving supply chains and falling demand for wood.

“We believe that they will trade above long-term averages for the balance of the year. However, in the short term, lumber is down more than 50% from the most recent peak. The market is trying to determine where the new price equilibrium compared to slowing demand and increased supply,” Josh Goodman, vice president of inventory and purchasing at Sherwood Lumber, told GlobeSt.com.

Another sign lumber demand is declining is directly from one of the largest wood producers in North America, Canfor Corp, who reduced operating schedules at sawmills in Western Canada. Since March, Canfor has operated sawmills at 80% of production capacity.

On the retail side, traders and analysts have noticed slumping demand for lumber at Home Depot and Lowe’s as consumers shift away from home-improvement projects to spending money on vacations.

The Fed will frontload interest rate hikes this summer which could pressure lumber prices even lower. Perhaps, if some readers have been waiting to build a deck or fence and didn’t want to pay crazy COVID prices, now could be the time to build (despite paying high labor costs).

https://www.zerohedge.com/commodities/lumber-prices-crash-50-fed-tightens

June 1, 2022

Memorial Day Mattress Update

Slowing sales for mattress retailers ‘on par with Great Recession’ – Wedbush

Jun. 01, 2022 3:25 PM ETPurple Innovation, Inc. (PRPL), SNBR, TPXBy: Kevin P. Curran, SA News Editor7 Comments

Lagging sales for mattress retailers over the Memorial Day holiday point to a rough rest of the year, according to Wedbush analyst Seth Basham.

In a research note authored on Wednesday, the analyst reported that recent sales checks came back negative while demand generally continues to wane. Basham added that advertisement and promotional activity did not pay off as many of the retailers had hoped.

“Our analysis found incremental promotional intensity with outsized discounting on the low-end and in the Direct-to-Consumer Bed-In-Box (BiB) channel while Tempur-Pedic (TPX-O) increased its promotional intensity on lower-end mattress and base bundles,” he wrote in a research note on Wednesday. “As sales trends for this key period often set the tone for the entire summer season, the soft performance over the Memorial Weekend suggests continued sharp [mid-single digit to high-single digit] unit declines through the summer in the absence of incremental discounting to spur demand—this level of unit decline is on par with the Great Recession.”

On top of that bearish comparison, Basham noted that increased commodity costs and supply chain problems present only added issues for these retail chains as they are likely forced into further promotional activity and price cuts due to waning demand. In particular, his team expects increased clearance-type sales around the July 4 and Labor Day holidays.

“In sum, it appears to be too early for a turn in fundamentals or mattress industry stocks,” he concluded.

June 1, 2022

Memorial Day Mattress Update

Slowing sales for mattress retailers ‘on par with Great Recession’ – Wedbush

Jun. 01, 2022 3:25 PM ETPurple Innovation, Inc. (PRPL), SNBR, TPXBy: Kevin P. Curran, SA News Editor7 Comments

Lagging sales for mattress retailers over the Memorial Day holiday point to a rough rest of the year, according to Wedbush analyst Seth Basham.

In a research note authored on Wednesday, the analyst reported that recent sales checks came back negative while demand generally continues to wane. Basham added that advertisement and promotional activity did not pay off as many of the retailers had hoped.

“Our analysis found incremental promotional intensity with outsized discounting on the low-end and in the Direct-to-Consumer Bed-In-Box (BiB) channel while Tempur-Pedic (TPX-O) increased its promotional intensity on lower-end mattress and base bundles,” he wrote in a research note on Wednesday. “As sales trends for this key period often set the tone for the entire summer season, the soft performance over the Memorial Weekend suggests continued sharp [mid-single digit to high-single digit] unit declines through the summer in the absence of incremental discounting to spur demand—this level of unit decline is on par with the Great Recession.”

On top of that bearish comparison, Basham noted that increased commodity costs and supply chain problems present only added issues for these retail chains as they are likely forced into further promotional activity and price cuts due to waning demand. In particular, his team expects increased clearance-type sales around the July 4 and Labor Day holidays.

“In sum, it appears to be too early for a turn in fundamentals or mattress industry stocks,” he concluded.

May 31, 2022

Lockdown Lifted

Shanghai Is Finally Lifting Its COVID Lockdown

by Tyler DurdenTuesday, May 31, 2022 – 06:00 PM

After another two months of misery and lockdowns, Shanghai is finally starting to lift its Covid restrictions (again).

Authorities in the Chinese city have started “dismantling fences around housing compounds and ripping police tape off public squares and buildings”, according to a report published on Tuesday by Reuters.

On Monday night, residents were being allowed out of their compounds for the first time in two months, the report says. Despite the lockdowns starting to come to an end, “there was a sense of wariness and anxiety among residents,” Reuters reported.

Joseph Mak, who works in education, commented: “I feel a little nervous. It’s hard to believe it’s actually happening.”

Not only has the recent bout of lockdowns triggered public protests and anger in the city of more than 25 million people, it also threw another sizeable wrench into the global supply chain at a time when the world could least afford it.

Shanghai government spokeswoman Yin Xin told reporters this week: “This is a day that we dreamed of for a very long time. Everyone has sacrificed a lot. This day has been hard-won, and we need to cherish and protect it, and welcome back the Shanghai we are familiar with and missed.”

Despite the lockdowns being lifted, residents will still have to test every 72 hours to take public transportation and those who test positive will still be subjected to China’s “normal” quarantine procedures.

Shanghai brought COVID under control at “very significant personal and economic cost”, commented Julian MacCormac, chair of the British Chamber in China. He continued: “What has materially changed to ensure that this will not happen again? That’s where the uncertainty lies.”

Todd Pearson, managing director of Camel Hospitality Group added: “I’m hopeful that they will rush things along to restart the economy. I just hope it’s not at the cost of more outbreaks. I’m not sure many businesses or the people could handle much more.”

Qu Weiguo, a professor at the Fudan University school of foreign languages even wrote online: “The Shanghai government needs to make a public apology in order to obtain the understanding and support of the people of Shanghai and repair the damaged relationship between the government and the people.”

https://www.zerohedge.com/markets/shanghai-finally-lifting-its-covid-lockdown

May 31, 2022

Lockdown Lifted

Shanghai Is Finally Lifting Its COVID Lockdown

by Tyler DurdenTuesday, May 31, 2022 – 06:00 PM

After another two months of misery and lockdowns, Shanghai is finally starting to lift its Covid restrictions (again).

Authorities in the Chinese city have started “dismantling fences around housing compounds and ripping police tape off public squares and buildings”, according to a report published on Tuesday by Reuters.

On Monday night, residents were being allowed out of their compounds for the first time in two months, the report says. Despite the lockdowns starting to come to an end, “there was a sense of wariness and anxiety among residents,” Reuters reported.

Joseph Mak, who works in education, commented: “I feel a little nervous. It’s hard to believe it’s actually happening.”

Not only has the recent bout of lockdowns triggered public protests and anger in the city of more than 25 million people, it also threw another sizeable wrench into the global supply chain at a time when the world could least afford it.

Shanghai government spokeswoman Yin Xin told reporters this week: “This is a day that we dreamed of for a very long time. Everyone has sacrificed a lot. This day has been hard-won, and we need to cherish and protect it, and welcome back the Shanghai we are familiar with and missed.”

Despite the lockdowns being lifted, residents will still have to test every 72 hours to take public transportation and those who test positive will still be subjected to China’s “normal” quarantine procedures.

Shanghai brought COVID under control at “very significant personal and economic cost”, commented Julian MacCormac, chair of the British Chamber in China. He continued: “What has materially changed to ensure that this will not happen again? That’s where the uncertainty lies.”

Todd Pearson, managing director of Camel Hospitality Group added: “I’m hopeful that they will rush things along to restart the economy. I just hope it’s not at the cost of more outbreaks. I’m not sure many businesses or the people could handle much more.”

Qu Weiguo, a professor at the Fudan University school of foreign languages even wrote online: “The Shanghai government needs to make a public apology in order to obtain the understanding and support of the people of Shanghai and repair the damaged relationship between the government and the people.”

https://www.zerohedge.com/markets/shanghai-finally-lifting-its-covid-lockdown