Current Affairs

September 20, 2021

Natural Gas Issues

The pier at Dominion’s Cove Point liquefied natural gas (LNG) plant on Maryland’s Chesapeake Bay on Feb. 5, 2014. (Timothy Gardner/File Photo/Reuters) Economy

Trade Group Urges Department of Energy to Place Restrictions on US Natural Gas Exports

By Katabella Roberts September 20, 2021 Updated: September 20, 2021 biggersmallerPrint

A manufacturers trade group has called on the Department of Energy (DOE) to order U.S. liquefied natural gas (LNG) producers to reduce exports, amid fears of potential supply shortages this winter.

In a letter to U.S. Energy Secretary Jennifer Granholm (pdf) on Sept. 17, Industrial Energy Consumers of America (IECA), a trade group representing chemical, food, and materials manufacturers, asked the Department of Energy to take “immediate action” and restrict exports of LNG until U.S. inventories increase.

“We urge you to take immediate action under the Natural Gas Act (NGA) to prevent a supply crisis and price spikes for consumers this winter by requiring LNG exporters to reduce export rates in order to allow U.S. inventories to reach the 5-year average storage levels,” the letter reads.

“U.S. consumers, the health of the economy, and national security should take priority over LNG export profits,” IECA added.

The industrial organization also requested that the DOE place a hold on all existing, pending, and prefiling export authorizations for new LNG export plants in the lower 48 states of the United States.

IECA called for a “review of whether these facilities are in the public interest under the NGA,” adding, “We are certain that they are not.”

Natural gas prices have risen more than 35 percent in the past month amid lower supplies and a surge in demand as pandemic-hit economies around the world reopen, prompting fears that there is simply not enough gas stored up for the winter if temperatures were to be particularly cold in the northern hemisphere.

Meanwhile, growing international demand for U.S. exports of LNG have also added to a price increase for natural gas, which is used for heating and generating electricity, as well as the processing of chemicals, fertilizers, paper, and glass, among other commodities.

IECA said U.S. prices would have to increase to $10 per MMBtu to provide incentive to fulfill domestic natural gas demand, noting that such prices could lead to “destruction” to manufacturing demand.

“Many manufacturers can no longer compete in the market at those prices. In 2008, we saw thousands of manufacturing facilities shut down because they were no longer profitable,” it added.

According to the Energy Information Administration, the level of gas in U.S. storage is 7.4 percent below the five-year average and 16.8 percent below the level at this time last year.

“To increase storage inventories to the five-year average by November, the U.S. would have to inject more than 90 billion cubic feet (Bcf) each week, a rate that is more than 40 percent higher than the five-year average weekly buildup rate. The EIA supply data makes clear that increased production will not be forthcoming,” IECA wrote.

Despite the call from IECA, immediate changes to the NGA, the framework to provide regulatory control over the interstate sale and transportation of natural gas, is unlikely.

Katabella Roberts

September 20, 2021

Natural Gas Issues

The pier at Dominion’s Cove Point liquefied natural gas (LNG) plant on Maryland’s Chesapeake Bay on Feb. 5, 2014. (Timothy Gardner/File Photo/Reuters) Economy

Trade Group Urges Department of Energy to Place Restrictions on US Natural Gas Exports

By Katabella Roberts September 20, 2021 Updated: September 20, 2021 biggersmallerPrint

A manufacturers trade group has called on the Department of Energy (DOE) to order U.S. liquefied natural gas (LNG) producers to reduce exports, amid fears of potential supply shortages this winter.

In a letter to U.S. Energy Secretary Jennifer Granholm (pdf) on Sept. 17, Industrial Energy Consumers of America (IECA), a trade group representing chemical, food, and materials manufacturers, asked the Department of Energy to take “immediate action” and restrict exports of LNG until U.S. inventories increase.

“We urge you to take immediate action under the Natural Gas Act (NGA) to prevent a supply crisis and price spikes for consumers this winter by requiring LNG exporters to reduce export rates in order to allow U.S. inventories to reach the 5-year average storage levels,” the letter reads.

“U.S. consumers, the health of the economy, and national security should take priority over LNG export profits,” IECA added.

The industrial organization also requested that the DOE place a hold on all existing, pending, and prefiling export authorizations for new LNG export plants in the lower 48 states of the United States.

IECA called for a “review of whether these facilities are in the public interest under the NGA,” adding, “We are certain that they are not.”

Natural gas prices have risen more than 35 percent in the past month amid lower supplies and a surge in demand as pandemic-hit economies around the world reopen, prompting fears that there is simply not enough gas stored up for the winter if temperatures were to be particularly cold in the northern hemisphere.

Meanwhile, growing international demand for U.S. exports of LNG have also added to a price increase for natural gas, which is used for heating and generating electricity, as well as the processing of chemicals, fertilizers, paper, and glass, among other commodities.

IECA said U.S. prices would have to increase to $10 per MMBtu to provide incentive to fulfill domestic natural gas demand, noting that such prices could lead to “destruction” to manufacturing demand.

“Many manufacturers can no longer compete in the market at those prices. In 2008, we saw thousands of manufacturing facilities shut down because they were no longer profitable,” it added.

According to the Energy Information Administration, the level of gas in U.S. storage is 7.4 percent below the five-year average and 16.8 percent below the level at this time last year.

“To increase storage inventories to the five-year average by November, the U.S. would have to inject more than 90 billion cubic feet (Bcf) each week, a rate that is more than 40 percent higher than the five-year average weekly buildup rate. The EIA supply data makes clear that increased production will not be forthcoming,” IECA wrote.

Despite the call from IECA, immediate changes to the NGA, the framework to provide regulatory control over the interstate sale and transportation of natural gas, is unlikely.

Katabella Roberts

September 19, 2021

Have Spot Rates Peaked?

Shipping Lines Think Spot Rates Have Peaked

By Ann Koh September 14, 2021, 3:58 AM EDT

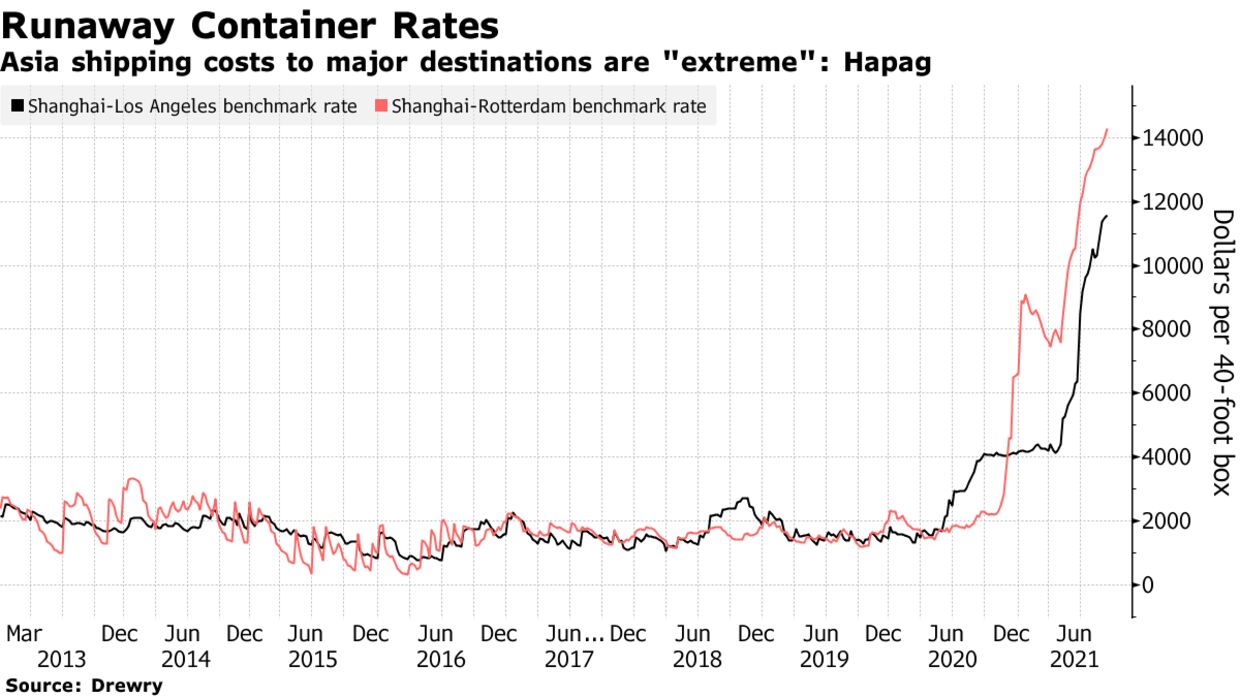

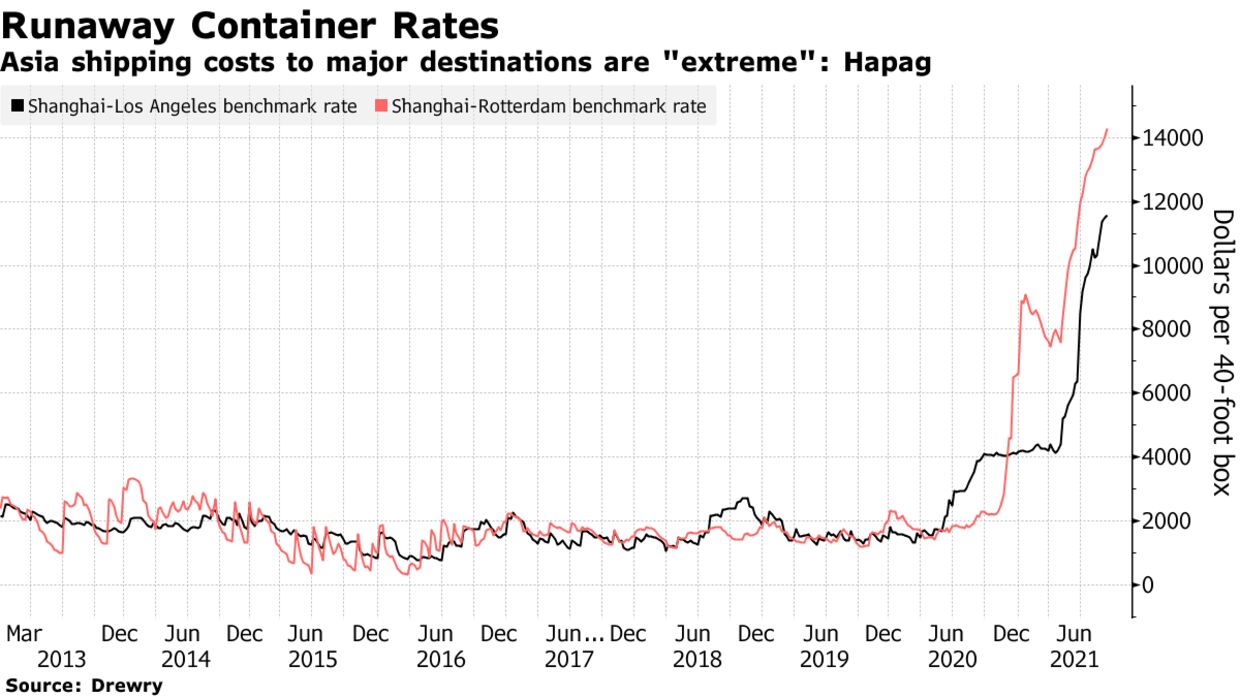

- Hapag-Lloyd halts spot rate hikes for Asia-Europe and U.S.

- Extreme freight rates on these routes are peaking, Hapag says

1:21

One of the world’s biggest shipping lines has decided to stop increasing spot freight rates on routes out of Asia to Europe and the U.S. as it sees an end to the rally that has seen prices hit records.

Hapag-LLoyd AG thinks spot rates have peaked and further increases are “not necessary,” according to Nils Haupt, the Hamburg-based company’s head of corporate communications. The move comes after French rival CMA CGM SA last week froze rates, saying it was prioritizing long-term relationships following a rally that has seen some spot rates jump more than sixfold in the past year.

The price gains came as the economic recovery coincided with reduced shipping capacity, putting inflationary pressure on manufacturers in Asia already grappling with higher commodity and electricity prices. While the historic rally led maritime regulators in the U.S., China and Europe to meet virtually last week to discuss the impact on snarled global supply chains, Hapag-LLoyd’s decision “was not requested by governments or regulators,” Haupt said.

While many shipping lines have taken advantage of rising spot prices, the rally is expected to “come to an end at some point,” said Jim Bureau, chief executive officer of logistics digital platform provider JAGGAER.

“The supply chain is extremely fragile right now,” he said. “How much more cost can carriers practically take on without increasing financial risk on both buyer and supplier?”

September 19, 2021

Have Spot Rates Peaked?

Shipping Lines Think Spot Rates Have Peaked

By Ann Koh September 14, 2021, 3:58 AM EDT

- Hapag-Lloyd halts spot rate hikes for Asia-Europe and U.S.

- Extreme freight rates on these routes are peaking, Hapag says

1:21

One of the world’s biggest shipping lines has decided to stop increasing spot freight rates on routes out of Asia to Europe and the U.S. as it sees an end to the rally that has seen prices hit records.

Hapag-LLoyd AG thinks spot rates have peaked and further increases are “not necessary,” according to Nils Haupt, the Hamburg-based company’s head of corporate communications. The move comes after French rival CMA CGM SA last week froze rates, saying it was prioritizing long-term relationships following a rally that has seen some spot rates jump more than sixfold in the past year.

The price gains came as the economic recovery coincided with reduced shipping capacity, putting inflationary pressure on manufacturers in Asia already grappling with higher commodity and electricity prices. While the historic rally led maritime regulators in the U.S., China and Europe to meet virtually last week to discuss the impact on snarled global supply chains, Hapag-LLoyd’s decision “was not requested by governments or regulators,” Haupt said.

While many shipping lines have taken advantage of rising spot prices, the rally is expected to “come to an end at some point,” said Jim Bureau, chief executive officer of logistics digital platform provider JAGGAER.

“The supply chain is extremely fragile right now,” he said. “How much more cost can carriers practically take on without increasing financial risk on both buyer and supplier?”

September 17, 2021

Beauchamp Joins CPI Steering Committee

CPI: Carpenter CEO, Brad Beauchamp, to join Steering Committee

On 13 September 2021, the Center for the Polyurethanes Industry (CPI) of the American Chemistry Council (ACC) announced that Brad Beauchamp, president and CEO of Carpenter Co., will join CPI’s Steering Committee. The Steering Committee is the leadership group for CPI and sets policy and direction for its advocacy, product stewardship and outreach efforts.

“Brad Beauchamp is a recognised and proven leader in our field,” said Lee Salamone, senior director, CPI. “We are thrilled he’ll be sharing his insights and experience to help direct association activities on a wide range of issues facing the polyurethanes industry.”

Carpenter Co. is one of the world’s largest chemical manufacturers, producing polyurethane foam, bedding and furniture foam, carpet cushion, expanded polystyrene, air filtration media, polyether polyols, chemical systems and tyre fill. Beauchamp has over 30 years of experience in the chemical industry and has been with Carpenter for the past decade. He has been leading the company since 2020.

“The American Chemistry Council has been assisting the industry for over a century and continues to play a critical role in areas such as sustainability, advocacy and customer awareness,” said Beauchamp. “As a company, we are excited to join the CPI and look forward to contributing to such an important organisation.”

www.americanchemistry.com