Epoxy

September 16, 2022

Huntsman Reduces Forecast

Huntsman Updates Third Quarter 2022 Outlook

THE WOODLANDS, Texas, Sept. 16, 2022 /PRNewswire/ — During Huntsman’s (NYSE: HUN) second quarter earnings conference call, the Company provided third quarter adjusted EBITDA guidance of between approximately $310 million and $355 million, excluding Textile Effects. The Company now expects third quarter adjusted EBITDA from continuing operations to be between $260 million and $280 million. As previously announced, Huntsman will begin reporting Textile Effects as discontinued operations following the announced agreement to sell the division to Archroma, a portfolio company of SK Capital Partners.

Peter Huntsman, Chairman, President, and CEO commented:

“Huntsman is feeling the same pressures as others in the industry as we are being impacted by persistent and extraordinary cost of energy in Europe, together with lower than expected demand across segments in our portfolio, primarily within Polyurethanes and Performance Products. The economy in China continues to lag our expectations due to continued Covid-related lockdowns. While the United States remains our most resilient market, demand in residential housing has slowed.

“We remain on track to exceed our previously announced cost optimization and synergy program and expect to deliver an annualized run rate of approximately $170 million by year-end. Given the current operating environment, we are evaluating further cost reduction and optimization opportunities and we are actively moving product into Europe from our facilities in the United States and Asia.”

https://www.huntsman.com/news/media-releases/detail/537/huntsman-updates-third-quarter-2022-outlook

September 16, 2022

Huntsman Reduces Forecast

Huntsman Updates Third Quarter 2022 Outlook

THE WOODLANDS, Texas, Sept. 16, 2022 /PRNewswire/ — During Huntsman’s (NYSE: HUN) second quarter earnings conference call, the Company provided third quarter adjusted EBITDA guidance of between approximately $310 million and $355 million, excluding Textile Effects. The Company now expects third quarter adjusted EBITDA from continuing operations to be between $260 million and $280 million. As previously announced, Huntsman will begin reporting Textile Effects as discontinued operations following the announced agreement to sell the division to Archroma, a portfolio company of SK Capital Partners.

Peter Huntsman, Chairman, President, and CEO commented:

“Huntsman is feeling the same pressures as others in the industry as we are being impacted by persistent and extraordinary cost of energy in Europe, together with lower than expected demand across segments in our portfolio, primarily within Polyurethanes and Performance Products. The economy in China continues to lag our expectations due to continued Covid-related lockdowns. While the United States remains our most resilient market, demand in residential housing has slowed.

“We remain on track to exceed our previously announced cost optimization and synergy program and expect to deliver an annualized run rate of approximately $170 million by year-end. Given the current operating environment, we are evaluating further cost reduction and optimization opportunities and we are actively moving product into Europe from our facilities in the United States and Asia.”

https://www.huntsman.com/news/media-releases/detail/537/huntsman-updates-third-quarter-2022-outlook

September 15, 2022

EVERCHEM UPDATE: VOL. 01 – China zero-COVID and EU Gas Crisis

The Everchem Update is a new biweekly publication of under-reported polyurethane industry news – insider views and conversation about the polyurethane market.

September 15, 2022

EVERCHEM UPDATE: VOL. 01 – China zero-COVID and EU Gas Crisis

The Everchem Update is a new biweekly publication of under-reported polyurethane industry news – insider views and conversation about the polyurethane market.

September 15, 2022

Railroad Update

Railroads And Unions Reach “Tentative Agreement” To Avert Rail Strike

by Tyler Durden

Thursday, Sep 15, 2022 – 06:31 AM

Update (0751ET):

WSJ noted the White House didn’t provide details of the tentative agreement between freight rail companies and unions.

The latest headlines show the tentative agreement goes back to unions for a vote:

- RAIL PARTIES AGREE TO COOLING OFF PERIOD AS PART OF DEAL, A STANDARD PART OF RATIFICATION PROCESS IN CASE VOTE FAILS IN ORDER TO AVERT ANY SHUTDOWN -SOURCE

- TENTATIVE U.S. RAIL DEAL GOES BACK TO UNIONS FOR A VOTE -SOURCE FAMILIAR WITH THE SITUATION

Some more good news is Amtrak “is working quickly to restore canceled long-distance trains” following the announcement of the tentative deal this morning, avoiding a rail strike Friday.

* * *

A rail stoppage that threatened to unleash widespread economic damage by snarling critical supply chains appears to have been averted after freight rail companies and union leaders reached a tentative agreement.

“Following 20 consecutive hours of negotiations at the Department of Labor, rail companies and union negotiators came to a tentative agreement that balances the needs of workers, businesses, and our nation’s economy,” according to a Labor Department statement Thursday morning.

It was a “hard-fought, mutually beneficial deal,” the statement said. “Our rail system is integral to our supply chain, and a disruption would have had catastrophic impacts on industries, travelers, and families across the country.”

President Biden commented on the agreement between railroads and unions:

“The tentative agreement reached tonight is an important win for our economy and the American people.”

A White House statement said:

“These rail workers will get better pay, improved working conditions, and peace of mind around their health care costs: all hard-earned. The agreement is also a victory for railway companies who will be able to retain and recruit more workers for an industry that will continue to be part of the backbone of the American economy for decades to come.”

The breakthrough tentative agreement was announced one day before more than 100,000 rail workers were set to strike. Even though most rail unions already agreed on labor contracts, multiple unions holding out represented a large swath of rail workers. Such a disruption would’ve cost the US economy $2 billion per day, shuttering about 30% of domestic freight traffic and stoking inflationary pressures.

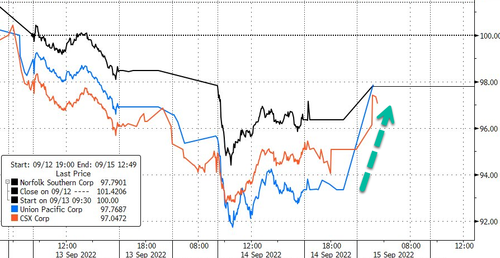

Railroad companies are moving higher premarket on the news.

Norfolk Southern is up 1.5%, with shares in Union Pacific surging nearly 5%. CSX is up about 2%.

https://www.zerohedge.com/markets/railroads-and-unions-reach-tentative-agreement-avert-rail-strike