Epoxy

September 12, 2022

Potential Rail Strike

US Railroads Enact “Contingency Plans,” Preparing For Labor Strike As Union Talks Fail

by Tyler Durden

Monday, Sep 12, 2022 – 08:45 AM

Railroads and labor unions worked through the weekend to make a deal. There were little signs of progress, and rail companies are now taking steps Monday to secure shipments of hazardous and security-sensitive materials “in light of the possibility of a rail labor strike,” the Association of American Railroads (AAR) wrote in a statement.

On Sunday, Norfolk Southern released a statement detailing it had “begun enacting its contingency plans for a controlled shut down of our network at 00:01 on Friday, Sept. 16.” The railroad said two labor unions are holding out on new contracts, “we still do not have a commitment not to strike and must act accordingly,” adding, “Our goal is to ensure that in the event of a work stoppage, crews, equipment, and freight safely reach their destinations with minimal disruption.”

Union Pacific and CSX also announced contingency plans for a possible work stoppage. BNSF told customers to call Congress so lawmakers on Capitol Hill can “intervene to prevent or quickly resolve the service disruption” if a labor strike materializes on Friday. The railroad also said: “We will begin to take steps to manage and secure the shipments of hazardous and security-sensitive materials as early as Monday.”

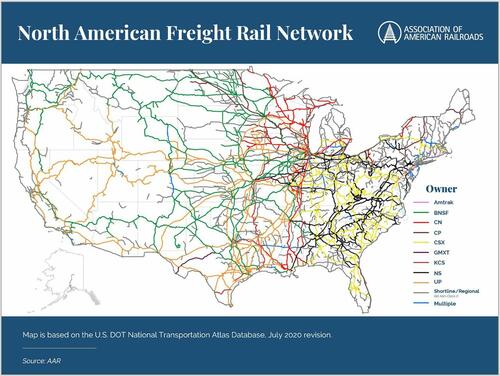

Rail freight networks are the arteries of the US economy.

Two months ago, the Biden administration imposed a two-month cooling-off period is set to expire at 12:01 am ET on Sept. 16 — after that — President Biden didn’t have the power to prevent a strike among two labor unions that had yet hammered out a deal with railroads. Only Congress can intervene after the cooling period expires.

Bloomberg said the two unions include the Brotherhood of Locomotive Engineers and Trainmen and the International Association of Sheet Metal Air, Rail and Transportation Workers, accounting for more than 90,000 rail employees. Ten of the other unions have already struck a deal with railroads.

Association of American Railroads warned that a railroad strike could cost the US economy upwards of $2 billion per day, while disruption wouldn’t be good optics for the Biden administration ahead of the midterm elections in November.

Bloomberg Intelligence analyst Lee Klaskow pointed out that BNSF and Union Pacific account for 45% of Class I intermodal traffic, while CSX and Norfolk Southern has 31%.

According to government data, about 29% of all US freight moves on the rails. Half the cargo is bulk commodities, such as energy, food, chemicals, metals, and wood productions — the other half is shipping containers of consumer goods.

“Even a temporary interruption would create a devastating ripple effect” across US supply chains, American Bakers Association, a Washington-based trade group representing more than 300 companies, warned.

Even if there’s no strike, rail networks are already clogged. Shipping line Maersk recently suspended import bookings through Fort Worth, Texas, due to “severe congestion” in railyards.

Railroads are preparing for possible work stoppages at the end of the week if the two unions can’t formulate a deal. There’s the possibility Congress could intervene before the cooling period expires. If not, then expect a flare-up in snarled supply chains.

September 12, 2022

Appliance Crisis

Alarm Bells Sound As World’s Second Largest Appliance Company Reports Demand Plunge

by Tyler Durden

Monday, Sep 12, 2022 – 09:28 AM

Swedish appliance maker Electrolux AB announced a cost reduction program after reporting a plunge in demand for its home appliances across Europe and the US.

The world’s second-largest home appliances manufacturer after Whirlpool said, “market demand for core appliances in Europe and the US so far in the third quarter is estimated to have decreased at a significantly accelerated pace compared with the second quarter, driven by the impact of high inflation on consumer durables purchases and low consumer confidence.”

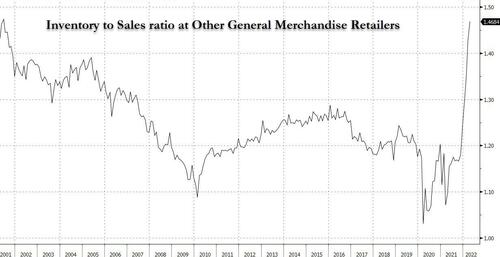

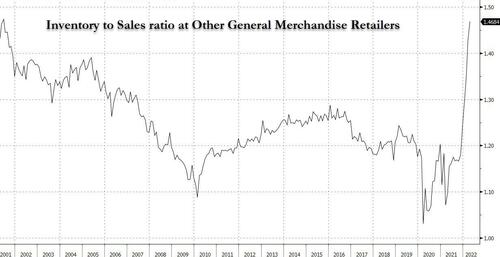

It noted: “High retailer inventory levels have amplified the impact of the slowdown in consumer demand.”

Remember, there’s a massive inventory glut of consumer goods at retailers.

Electrolux warned a combination of snarled supply chains had pressured the company, which is expected to report an even more significant operating loss in the third quarter.

“In combination with supply chain imbalances resulting in significant production inefficiencies and increased costs, the third quarter earnings for the Group are expected to decline significantly compared to the second quarter 2022 also excluding the one-time cost to exit the Russia market. This has been driven mainly by Europe and North America. Business Area North America is expected to report an operating loss in the third quarter exceeding the loss in the second quarter.”

Waning consumer demand, retailer inventory building, and mounting losses for the Swedish company forced its board to “initiate a Group-wide cost reduction program addressing both variable and structural costs.” Electrolux explained more about the cost reductions:

“The program, which starts immediately, will focus on reducing variable costs, with special attention to eliminating cost inefficiencies in our supply chain and production. The structural cost reductions will primarily take place in Europe and North America and include prioritization and efficiency measures leveraging recent organizational changes which took effect July 1. The measures include increasing productivity in operations as well as optimizing the R&D portfolio, administration, sales and marketing activities.”

The souring outlook for Electrolux initially sent shares down 7% but have since recovered most losses late in the European session.

Electrolux’s CEO Jonas Samuelson said consumer confidence is expected to stay depressed in Europe, adding, “I think people will hold on to their wallets quite hard.” The same is likely true in the US — consumers have backed off buying durables goods and focused on purchasing staple products as the highest inflation in decades has sent wage growth deeply negative for more than a year. Households on both sides of the Atlantic are struggling.

September 12, 2022

Appliance Crisis

Alarm Bells Sound As World’s Second Largest Appliance Company Reports Demand Plunge

by Tyler Durden

Monday, Sep 12, 2022 – 09:28 AM

Swedish appliance maker Electrolux AB announced a cost reduction program after reporting a plunge in demand for its home appliances across Europe and the US.

The world’s second-largest home appliances manufacturer after Whirlpool said, “market demand for core appliances in Europe and the US so far in the third quarter is estimated to have decreased at a significantly accelerated pace compared with the second quarter, driven by the impact of high inflation on consumer durables purchases and low consumer confidence.”

It noted: “High retailer inventory levels have amplified the impact of the slowdown in consumer demand.”

Remember, there’s a massive inventory glut of consumer goods at retailers.

Electrolux warned a combination of snarled supply chains had pressured the company, which is expected to report an even more significant operating loss in the third quarter.

“In combination with supply chain imbalances resulting in significant production inefficiencies and increased costs, the third quarter earnings for the Group are expected to decline significantly compared to the second quarter 2022 also excluding the one-time cost to exit the Russia market. This has been driven mainly by Europe and North America. Business Area North America is expected to report an operating loss in the third quarter exceeding the loss in the second quarter.”

Waning consumer demand, retailer inventory building, and mounting losses for the Swedish company forced its board to “initiate a Group-wide cost reduction program addressing both variable and structural costs.” Electrolux explained more about the cost reductions:

“The program, which starts immediately, will focus on reducing variable costs, with special attention to eliminating cost inefficiencies in our supply chain and production. The structural cost reductions will primarily take place in Europe and North America and include prioritization and efficiency measures leveraging recent organizational changes which took effect July 1. The measures include increasing productivity in operations as well as optimizing the R&D portfolio, administration, sales and marketing activities.”

The souring outlook for Electrolux initially sent shares down 7% but have since recovered most losses late in the European session.

Electrolux’s CEO Jonas Samuelson said consumer confidence is expected to stay depressed in Europe, adding, “I think people will hold on to their wallets quite hard.” The same is likely true in the US — consumers have backed off buying durables goods and focused on purchasing staple products as the highest inflation in decades has sent wage growth deeply negative for more than a year. Households on both sides of the Atlantic are struggling.

September 9, 2022

Quiet First Half of Hurricane Season

Quiet Start To US Hurricane Season Takes Heat Out Of Oil Prices: Kemp

by Tyler DurdenFriday, Sep 09, 2022 – 12:10 PM

By John Kemp, Senior Market Analyst at Reuters

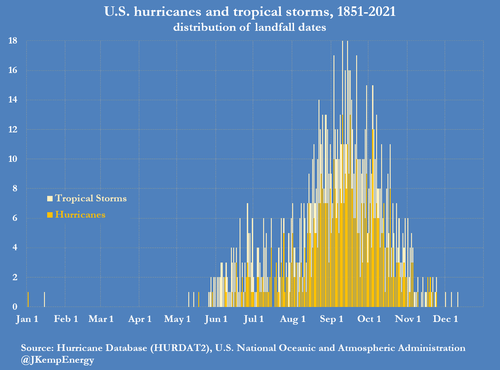

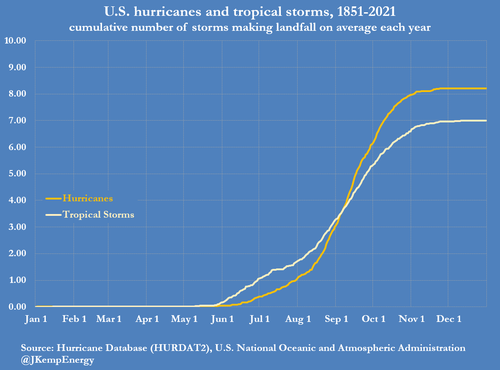

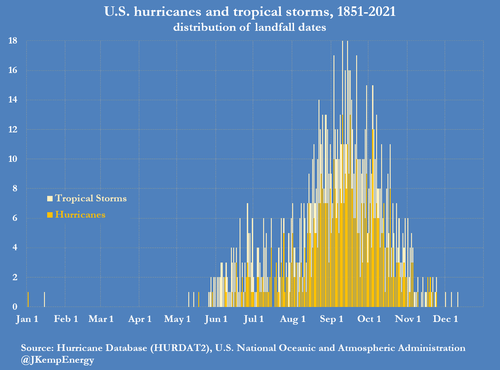

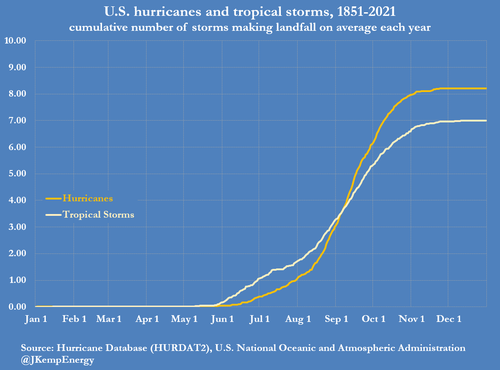

The Atlantic hurricane season is nearing its halfway point and so far no hurricanes have made landfall on the coast of the United States, contributing to the recent downward pressure on oil and fuel prices.

The Atlantic season lasts from June 1 to Nov. 30, with half of the storms usually occurring before Sept. 12, based on records compiled by the U.S. National Oceanic and Atmospheric Administration (NOAA).

On average, four hurricanes made landfall somewhere on the Atlantic or Gulf Coasts of the United States by Sept. 12 each year between 1851 and 2021 (“Hurricane database”, HURDAT2, NOAA).

But this year the start of the hurricane season has been the quietest for 25 years. There were no Atlantic hurricanes in the month of August for the first time since 1997 and only the third time since 1950 (“Quiet start to hurricane season“, Wall Street Journal, Sept. 7).

No hurricanes have made landfall on the Atlantic or Gulf Coasts so far in 2022, ensuring crude and fuel production has continued uninterrupted and helping ease concerns about the low level of inventories.

Hurricanes tracking through the oilfields of the western Gulf or making landfall near the refining centres of Texas and Louisiana have the potential to interrupt offshore crude production and onshore gasoline and diesel refining. Severe storms in these areas often create a short-term spike in crude and fuel prices and traders anticipate potential moves by bidding up futures contracts for deliveries in September and October.

In May, NOAA forecast this year would see an above-average number of hurricanes and tropical storms, based in part on La Niña conditions in the Pacific (“NOAA predicts above-normal Atlantic hurricane season”, May 24). The agency reiterated this forecast as recently as the start of August (“NOAA still expects above-normal Atlantic hurricane season”, Aug. 4).

The possibility of hurricanes disrupting oilfield output or gasoline and diesel refining was especially worrisome given sanctions on Russia’s oil and diesel exports and the low level of oil inventories especially diesel stocks.

Hurricane risk likely contributed to rapidly rising prices for crude and abnormally high refining margins for gasoline and especially diesel through the end of July.

But the forecast storms have not materialized.

Falling Prices

Half the hurricane season still lies ahead so there is plenty of time for significant damage to offshore platforms and onshore refineries. In statistical terms, however, the risk is now much lower than it seemed between June and early August, which has likely taken some of the heat out of crude and fuel prices.

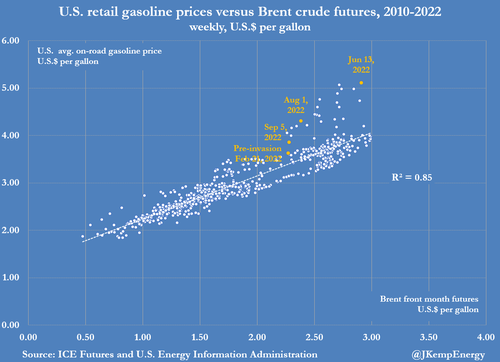

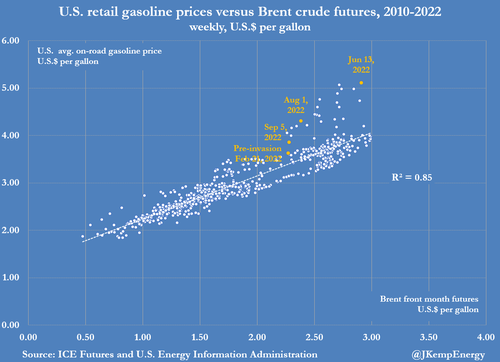

Prices for gasoline, in particular, have been falling much faster than for crude in recent weeks as the risks to the refining system have dropped.

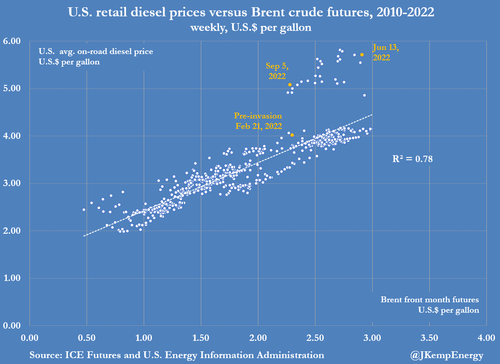

Gasoline pump prices, including taxes, were at a premium of $1.58 per gallon ($66 per barrel) to Brent crude on Sept. 5 compared with $2.35 per gallon ($99 per barrel) in the middle of June.

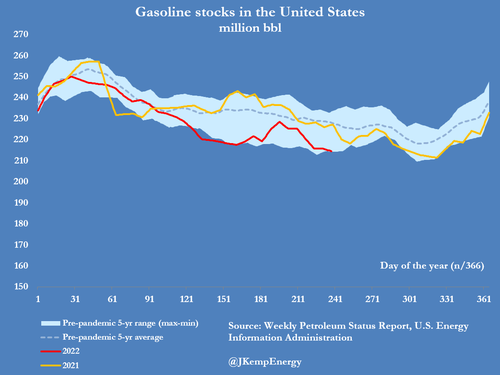

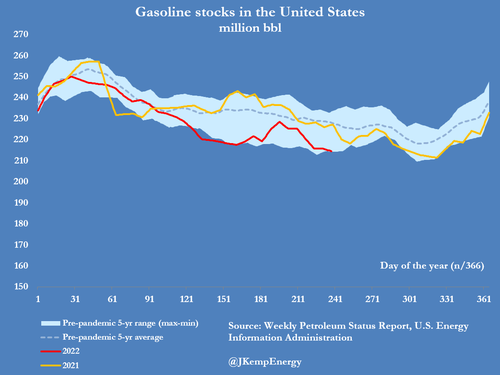

The gasoline premium has fallen close to its lowest levels since Russia invaded Ukraine in late February and is broadly similar to the premium a year ago, as some hurricane risk has evaporated. Premiums have narrowed even though gasoline inventories at the end of August were 14 million barrels (6%) below the pre-pandemic five-year average for 2015-2019.

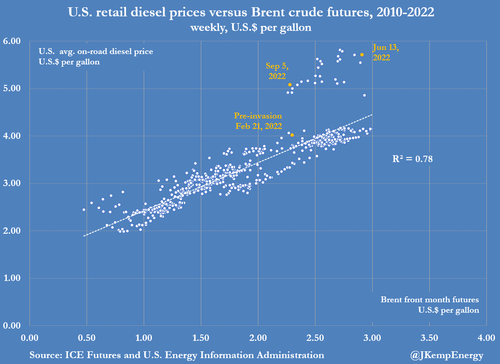

Diesel prices have remained firmer, in part because inventories remain much lower and manufacturing and freight activity has proved more resilient than expected a couple of months ago.

Distillate fuel oil inventories near the end of August were 32 million barrels (22%) below the pre-pandemic five-year seasonal average.

As a result, on-road diesel prices were at a premium of $2.80 per gallon ($118 per barrel) to Brent on Sept. 5 which was little changed from $3.10 per gallon ($130 per barrel) in the middle of June.

But it is likely that diesel prices would have moved even higher if the hurricane season had been much more active so far.

The quiet start to the season has removed one source of production risk while high prices and a slowing economy have started to dampen consumption.

The combined impact has been a significant reduction in the risk of fuel shortages with prices retreating from their mid-year highs.

https://www.zerohedge.com/commodities/quiet-start-us-hurricane-season-takes-heat-out-oil-prices-kemp

September 9, 2022

Quiet First Half of Hurricane Season

Quiet Start To US Hurricane Season Takes Heat Out Of Oil Prices: Kemp

by Tyler DurdenFriday, Sep 09, 2022 – 12:10 PM

By John Kemp, Senior Market Analyst at Reuters

The Atlantic hurricane season is nearing its halfway point and so far no hurricanes have made landfall on the coast of the United States, contributing to the recent downward pressure on oil and fuel prices.

The Atlantic season lasts from June 1 to Nov. 30, with half of the storms usually occurring before Sept. 12, based on records compiled by the U.S. National Oceanic and Atmospheric Administration (NOAA).

On average, four hurricanes made landfall somewhere on the Atlantic or Gulf Coasts of the United States by Sept. 12 each year between 1851 and 2021 (“Hurricane database”, HURDAT2, NOAA).

But this year the start of the hurricane season has been the quietest for 25 years. There were no Atlantic hurricanes in the month of August for the first time since 1997 and only the third time since 1950 (“Quiet start to hurricane season“, Wall Street Journal, Sept. 7).

No hurricanes have made landfall on the Atlantic or Gulf Coasts so far in 2022, ensuring crude and fuel production has continued uninterrupted and helping ease concerns about the low level of inventories.

Hurricanes tracking through the oilfields of the western Gulf or making landfall near the refining centres of Texas and Louisiana have the potential to interrupt offshore crude production and onshore gasoline and diesel refining. Severe storms in these areas often create a short-term spike in crude and fuel prices and traders anticipate potential moves by bidding up futures contracts for deliveries in September and October.

In May, NOAA forecast this year would see an above-average number of hurricanes and tropical storms, based in part on La Niña conditions in the Pacific (“NOAA predicts above-normal Atlantic hurricane season”, May 24). The agency reiterated this forecast as recently as the start of August (“NOAA still expects above-normal Atlantic hurricane season”, Aug. 4).

The possibility of hurricanes disrupting oilfield output or gasoline and diesel refining was especially worrisome given sanctions on Russia’s oil and diesel exports and the low level of oil inventories especially diesel stocks.

Hurricane risk likely contributed to rapidly rising prices for crude and abnormally high refining margins for gasoline and especially diesel through the end of July.

But the forecast storms have not materialized.

Falling Prices

Half the hurricane season still lies ahead so there is plenty of time for significant damage to offshore platforms and onshore refineries. In statistical terms, however, the risk is now much lower than it seemed between June and early August, which has likely taken some of the heat out of crude and fuel prices.

Prices for gasoline, in particular, have been falling much faster than for crude in recent weeks as the risks to the refining system have dropped.

Gasoline pump prices, including taxes, were at a premium of $1.58 per gallon ($66 per barrel) to Brent crude on Sept. 5 compared with $2.35 per gallon ($99 per barrel) in the middle of June.

The gasoline premium has fallen close to its lowest levels since Russia invaded Ukraine in late February and is broadly similar to the premium a year ago, as some hurricane risk has evaporated. Premiums have narrowed even though gasoline inventories at the end of August were 14 million barrels (6%) below the pre-pandemic five-year average for 2015-2019.

Diesel prices have remained firmer, in part because inventories remain much lower and manufacturing and freight activity has proved more resilient than expected a couple of months ago.

Distillate fuel oil inventories near the end of August were 32 million barrels (22%) below the pre-pandemic five-year seasonal average.

As a result, on-road diesel prices were at a premium of $2.80 per gallon ($118 per barrel) to Brent on Sept. 5 which was little changed from $3.10 per gallon ($130 per barrel) in the middle of June.

But it is likely that diesel prices would have moved even higher if the hurricane season had been much more active so far.

The quiet start to the season has removed one source of production risk while high prices and a slowing economy have started to dampen consumption.

The combined impact has been a significant reduction in the risk of fuel shortages with prices retreating from their mid-year highs.

https://www.zerohedge.com/commodities/quiet-start-us-hurricane-season-takes-heat-out-oil-prices-kemp