Epoxy

September 9, 2022

German Support

“Wide Rescue Umbrella”: Germany Plans To Support Companies As Energy Crisis Worsens

by Tyler DurdenFriday, Sep 09, 2022 – 05:45 AM

Natural gas and electricity prices have become so expensive in Germany that the economic engine of Europe is shutting down and at risk of a ‘Lehman-style’ collapse. To mitigate energy cost burdens, the German government unveiled a new proposal to increase a pandemic-era rescue fund to save small and medium size companies that could face a wave of bankruptcies amid the worsening energy crisis.

On Thursday, Bloomberg quoted German Economy Minister Robert Habeck as saying new financial aid for businesses to cover energy costs could soon be made possible.

“We will open a wide rescue umbrella,” Habeck told lawmakers in Berlin. “We will open it widely so that small and medium enterprises can come under it,” he said.

Habeck’s comments come after German Chancellor Olaf Scholz’s coalition agreed on a 65 billion euro program to support millions of struggling households with soaring power bills.

A participant at a parliamentary committee late Wednesday said Habeck was willing to use an existing pandemic-era aid program to support companies — about 20% of the 5 billion euros has already been spent.

Habeck said at the closed-door meeting that drawing funds from the Covid program could spark constitutional debt limit issues, according to the participant, who asked not to be named.

In his speech to lawmakers, Habeck said the energy crisis could persist well beyond this winter, adding financial support for businesses will be temporary as Germany and the EU work to reform energy supply chains away from Russia.

“We are looking at the electricity market design,” said Habeck. “If this doesn’t work immediately and solidly, then we also consider the option of a windfall levy and give this back to the citizens.”

Besides Germany, UK Prime Minister Liz Truss also laid out a plan to support households and businesses amid energy hyperinflation as Russia’s energy giant shuttered the Nord Stream 1 pipeline to Europe last week.

European politicians are maneuvering ahead of a pivot meeting Friday, where they will discuss plans to reduce energy costs, consumption, possible price caps on energy products, and even suspension of power derivatives trading — as the bloc races against time to thwart what could be a ‘Minsky’ moment as we reported European energy trading risks grinding to a halt unless governments extend liquidity to cover margin calls of at least $1.5 trillion.

September 9, 2022

German Support

“Wide Rescue Umbrella”: Germany Plans To Support Companies As Energy Crisis Worsens

by Tyler DurdenFriday, Sep 09, 2022 – 05:45 AM

Natural gas and electricity prices have become so expensive in Germany that the economic engine of Europe is shutting down and at risk of a ‘Lehman-style’ collapse. To mitigate energy cost burdens, the German government unveiled a new proposal to increase a pandemic-era rescue fund to save small and medium size companies that could face a wave of bankruptcies amid the worsening energy crisis.

On Thursday, Bloomberg quoted German Economy Minister Robert Habeck as saying new financial aid for businesses to cover energy costs could soon be made possible.

“We will open a wide rescue umbrella,” Habeck told lawmakers in Berlin. “We will open it widely so that small and medium enterprises can come under it,” he said.

Habeck’s comments come after German Chancellor Olaf Scholz’s coalition agreed on a 65 billion euro program to support millions of struggling households with soaring power bills.

A participant at a parliamentary committee late Wednesday said Habeck was willing to use an existing pandemic-era aid program to support companies — about 20% of the 5 billion euros has already been spent.

Habeck said at the closed-door meeting that drawing funds from the Covid program could spark constitutional debt limit issues, according to the participant, who asked not to be named.

In his speech to lawmakers, Habeck said the energy crisis could persist well beyond this winter, adding financial support for businesses will be temporary as Germany and the EU work to reform energy supply chains away from Russia.

“We are looking at the electricity market design,” said Habeck. “If this doesn’t work immediately and solidly, then we also consider the option of a windfall levy and give this back to the citizens.”

Besides Germany, UK Prime Minister Liz Truss also laid out a plan to support households and businesses amid energy hyperinflation as Russia’s energy giant shuttered the Nord Stream 1 pipeline to Europe last week.

European politicians are maneuvering ahead of a pivot meeting Friday, where they will discuss plans to reduce energy costs, consumption, possible price caps on energy products, and even suspension of power derivatives trading — as the bloc races against time to thwart what could be a ‘Minsky’ moment as we reported European energy trading risks grinding to a halt unless governments extend liquidity to cover margin calls of at least $1.5 trillion.

September 7, 2022

European Update

How will the European energy crisis affect freight markets?

A slowing eurozone may pull ocean container rates down further

John Paul HampsteadWednesday, September 7, 2022 4 minutes read

Listen to this article 0:00 / 5:35 BeyondWords

Volatility in European power markets stemming from EU and U.K. sanctions against Russian energy — imposed in retaliation for Russia’s invasion of Ukraine in February — may soon cool off, but only after carving a slice out of the continent’s economy.

On Monday, U.K. Prime Minister Liz Truss announced plans to cap household energy bills at the equivalent of $2,300 annually. Meanwhile, German Chancellor Olaf Scholz unveiled a 65 billion euro relief package to ease the pain of energy prices that have quadrupled in his country.

These crisis measures are meant to reduce the economic damage caused by a continentwide natural gas supply crunch following the cancellation of Nord Stream 2 and Russia’s shutdown of Nord Stream 1. Historically high energy prices could sap consumers’ ability to spend money on other goods and services, dragging down economic growth.

But last week, Goldman Sachs analyst Alberto Gandolfi wrote that his team did not think that the scope of the price caps being contemplated would be nearly enough to avert a 1970s-style energy crisis.

“We see scope for the introduction of price caps in power generation, which we estimate could save Europe c.€650 bn pa,” Gandolfi wrote in a client note on Saturday. “Yet, price caps would not fully solve the affordability issue: the increase in energy bills would still be of +€1.3 tn, or c.10% of GDP, we estimate.”

Europe’s economy was relatively healthy until the energy crisis, growing GDP by 3.9% year over year (y/y) or 0.6% quarter on quarter in the second quarter of 2022. But now the eurozone manufacturing PMI has slipped to 49.6, and the S&P Global Germany Composite PMI for August was revised lower to 46.9.

Slowing economic growth in the EU has been exacerbated by high inflation, which hit 9.7% y/y in August. That has put a jumbo interest rate hike of 75 bps on the table as European Central Bank President Christine Lagarde meets with her colleagues in Jackson Hole, Wyoming, this week.

Ocean container rates from Asia to Europe have already fallen dramatically this year — and have dropped especially sharply since the beginning of August.

The Freightos Baltic Daily spot rate from China to North Europe, displayed in white in the chart above, has fallen 24% since July 3, from $10,397.55 per forty-foot equivalent unit to $7,869.10. Drewry’s spot rate from Shanghai to Rotterdam, Netherlands, displayed in green, dropped 18% over the same period, from $9,280 per FEU to $7,583.

Those recent ocean container rate cuts came after the market had already been softening for months; container rates on the Asia-Europe trade peaked last October. The sudden, violent step-down in spot rates may indicate that the incremental goods spending is way off in Europe, and ocean carriers are starting to optimize for asset utilization rather than EBIT per shipment.

If the steamship lines follow their well-established playbook, their response to soft demand could be to trim capacity, switching out vessels on the main services with smaller ships and deploying those assets elsewhere. The problem is that they might not have anywhere to go: Trans-Pacific ocean container spot rates are also way down on softening demand.

Upstream ocean container bookings data from FreightWaves Container Atlas reveals that European exports are set to slow markedly as well. Ocean container bookings outbound from Rotterdam to all global ports have experienced downward pressure since July:

The Ocean Booking Volume Index from Rotterdam to all global ports is down by 25.4% since July 5, a sharp downward trend, albeit the index is still at an elevated level compared to pre-pandemic freight flows. Lead times out of Rotterdam run a little over 10 days, so the trend lines above reflect booking activity approximately 1.5 weeks ahead of the freight physically moving on a vessel.

The widely cited European Road Freight Rates Benchmark is at all-time highs but appears to be inclusive of fuel costs (diesel in the EU is up 69% since January). The Russian invasion of Ukraine has restricted the supply of truck drivers in Germany, where migrants make up 24% of the driver workforce, as Ukrainian men returned home to fight. European road freight analysts are betting that weakening economic growth will keep rates from rising higher.

“The effect of rising costs in 2022 is now very evident with road freight rates across the European continent reaching new all-time highs,” wrote Transportation Intelligence economic analyst Nathaniel Donaldson. “Initial fuel price rises following the invasion of Ukraine have held and produced a much more costly environment for European road carriers whilst industrial action and a worsening driver shortage keep capacity tight. A range of indicators are pointing towards a drastic slowdown in consumption and production, which will ease further increases while high costs keep rates elevated.”

The EU energy crisis has already taken a bite out of Europe’s consumption and production, weakening demand for transportation capacity in, through and out of the region. Recently announced fiscal relief measures will likely not be large enough to avert an acute economic slowdown, with knock-on effects for global transportation markets like ocean container freight.

September 7, 2022

European Update

How will the European energy crisis affect freight markets?

A slowing eurozone may pull ocean container rates down further

John Paul HampsteadWednesday, September 7, 2022 4 minutes read

Listen to this article 0:00 / 5:35 BeyondWords

Volatility in European power markets stemming from EU and U.K. sanctions against Russian energy — imposed in retaliation for Russia’s invasion of Ukraine in February — may soon cool off, but only after carving a slice out of the continent’s economy.

On Monday, U.K. Prime Minister Liz Truss announced plans to cap household energy bills at the equivalent of $2,300 annually. Meanwhile, German Chancellor Olaf Scholz unveiled a 65 billion euro relief package to ease the pain of energy prices that have quadrupled in his country.

These crisis measures are meant to reduce the economic damage caused by a continentwide natural gas supply crunch following the cancellation of Nord Stream 2 and Russia’s shutdown of Nord Stream 1. Historically high energy prices could sap consumers’ ability to spend money on other goods and services, dragging down economic growth.

But last week, Goldman Sachs analyst Alberto Gandolfi wrote that his team did not think that the scope of the price caps being contemplated would be nearly enough to avert a 1970s-style energy crisis.

“We see scope for the introduction of price caps in power generation, which we estimate could save Europe c.€650 bn pa,” Gandolfi wrote in a client note on Saturday. “Yet, price caps would not fully solve the affordability issue: the increase in energy bills would still be of +€1.3 tn, or c.10% of GDP, we estimate.”

Europe’s economy was relatively healthy until the energy crisis, growing GDP by 3.9% year over year (y/y) or 0.6% quarter on quarter in the second quarter of 2022. But now the eurozone manufacturing PMI has slipped to 49.6, and the S&P Global Germany Composite PMI for August was revised lower to 46.9.

Slowing economic growth in the EU has been exacerbated by high inflation, which hit 9.7% y/y in August. That has put a jumbo interest rate hike of 75 bps on the table as European Central Bank President Christine Lagarde meets with her colleagues in Jackson Hole, Wyoming, this week.

Ocean container rates from Asia to Europe have already fallen dramatically this year — and have dropped especially sharply since the beginning of August.

The Freightos Baltic Daily spot rate from China to North Europe, displayed in white in the chart above, has fallen 24% since July 3, from $10,397.55 per forty-foot equivalent unit to $7,869.10. Drewry’s spot rate from Shanghai to Rotterdam, Netherlands, displayed in green, dropped 18% over the same period, from $9,280 per FEU to $7,583.

Those recent ocean container rate cuts came after the market had already been softening for months; container rates on the Asia-Europe trade peaked last October. The sudden, violent step-down in spot rates may indicate that the incremental goods spending is way off in Europe, and ocean carriers are starting to optimize for asset utilization rather than EBIT per shipment.

If the steamship lines follow their well-established playbook, their response to soft demand could be to trim capacity, switching out vessels on the main services with smaller ships and deploying those assets elsewhere. The problem is that they might not have anywhere to go: Trans-Pacific ocean container spot rates are also way down on softening demand.

Upstream ocean container bookings data from FreightWaves Container Atlas reveals that European exports are set to slow markedly as well. Ocean container bookings outbound from Rotterdam to all global ports have experienced downward pressure since July:

The Ocean Booking Volume Index from Rotterdam to all global ports is down by 25.4% since July 5, a sharp downward trend, albeit the index is still at an elevated level compared to pre-pandemic freight flows. Lead times out of Rotterdam run a little over 10 days, so the trend lines above reflect booking activity approximately 1.5 weeks ahead of the freight physically moving on a vessel.

The widely cited European Road Freight Rates Benchmark is at all-time highs but appears to be inclusive of fuel costs (diesel in the EU is up 69% since January). The Russian invasion of Ukraine has restricted the supply of truck drivers in Germany, where migrants make up 24% of the driver workforce, as Ukrainian men returned home to fight. European road freight analysts are betting that weakening economic growth will keep rates from rising higher.

“The effect of rising costs in 2022 is now very evident with road freight rates across the European continent reaching new all-time highs,” wrote Transportation Intelligence economic analyst Nathaniel Donaldson. “Initial fuel price rises following the invasion of Ukraine have held and produced a much more costly environment for European road carriers whilst industrial action and a worsening driver shortage keep capacity tight. A range of indicators are pointing towards a drastic slowdown in consumption and production, which will ease further increases while high costs keep rates elevated.”

The EU energy crisis has already taken a bite out of Europe’s consumption and production, weakening demand for transportation capacity in, through and out of the region. Recently announced fiscal relief measures will likely not be large enough to avert an acute economic slowdown, with knock-on effects for global transportation markets like ocean container freight.

September 7, 2022

Currency Fluctuations

Japan, China On Edge After Record Dollar Surge Sparks “Explosive” Yen Plunge; China’s Yuan Not Far Behind

by Tyler DurdenWednesday, Sep 07, 2022 – 02:04 PM

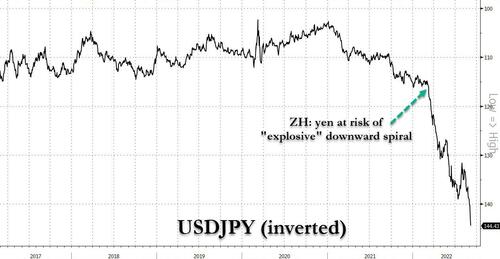

Back in late March, when USDJPY was at 121, we warned that the “Yen Was At Risk Of “Explosive” Downward Spiral With Kuroda Trapped… And Why China May Soon Devalue“, and since then the yen has… well, see for yourselves:

In short, we were right.

Having been in freefall for months, due to the “impossible dilemma” facing the BOJ which can’t have i) a stable currency and ii) yield curve control at the same time, the BOJ has clearly picked an interest rate cap instead of intervening in the yen, and containing the record freefall in the Japanese currency which is set for its worst annual drop on record – the yen this morning plunged as low as 144.99, the lowest level since 1998 and there is no end in sight to the drop.

Furthermore, and just to make it very clear that the BOJ sees nothing wrong with the precipitous drop in the yen which makes Japan seem like a B-grade emerging market, overnight the BOJ said it would buy 550BN yen of 5-10 year bonds at the latest scheduled operation, up from 500BN previously to protect the YCC yield caps; as Goldman notes, “BOJ is really the odd man out in global policy and it seems the market is piling on pressure into the yen ahead of the BOJ meeting at the end of this month.”

To be sure, the ongoing crash in the yen is not exactly shocking and is a result of Japan’s widening yield and policy divergence with the US. Still, the move which could unleash an inflationary shock across the otherwise sleepy, deflationary and demographically doomed islands, has prompted politicians to intervene if only verbally, and overnight, Japan’s top spokesman Hirokazu Matsuno said he was concerned about recent rapid, one-sided moves in yen and the government would need to take necessary action if these movements continue.

“We’re concerned about the rapid and one-sided moves being seen recently in foreign exchange markets,” Matsuno said at a press conference in Tokyo adding that “the government will continue to watch forex market moves with a high sense of urgency, and take necessary responses if this sort of move continues.”

Of course, it’s not just the yen that is getting demolished: with the Bloomberg dollar index hitting another, and another, and another all time high day after day with the Fed clearly oblivious of the impact its supertighte monetary policy is having on the world…

… it was China’s yuan that also got hammered overnight, and with the offshore currency trading just shy of 7.00, it forced the PBOC to scramble and stem the currency depreciation with a yuan fixing that was set at a record 454 pips stronger than the average estimate!

The good news is that as Bloomberg’s Simon Flint notes, the yuan tends to be rather dull after big gaps between offshore levels and the fix. To wit: “historical experience is that the yuan stabilizes after a similarly high premium is hit. Selecting for days with a similar (average) premium, I find 78 individual days when this occurred and more than 20 clusters since Bloomberg started to collect fixing consensus data. The average change in USD/CNH and CNH-CFETS was less than 0.1% one day, five days and 21 days after this premium was hit. It seems like a combination of the PBOC’s ability to pick tops in the dollar (as implied by stability in CFETS) and their resistance to appreciation is sufficient to stop the rot. Furthermore, the maximum range of outcomes over these periods is narrower than the series average. Of course, this episode may not be “average”. PBOC resistance has hit record breaking levels, suggesting a greater disconnect that the premium alone indicates.”

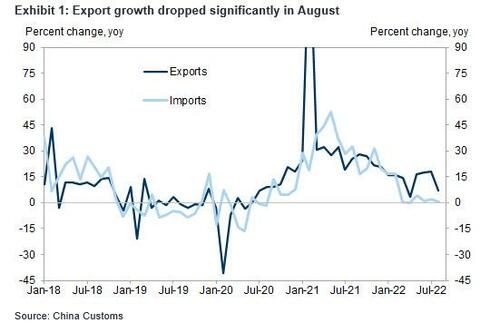

The bad news is that according to Goldman, it is only a matter of time before we trade through 7.00, for one simple reason: the collapse in China’s trade demands it and the export data in particular is a concern as the large trade surplus had been one of the main pushbacks to USDCNH going higher (the August surplus declined to 79.3BN vs 101BN last month). As Goldman concludes, “At this juncture it seems inevitable that China will have to accept a weaker currency to support trade/growth.“

For those who missed it, overnight China reported that export growth slowed more than expected in August, as the entire world careens into a recession. Specifically, China’s export growth dropped to +7.1% Y/Y in August, well below consensus expectations of a 13% increase and a sharp drop from the 18.0% in July. Import growth decelerated to +0.3% Y/Yin August, also missing the consensus estimate of 1.1%, and down from 2.3% in July.

According to Goldman, the large deceleration of year-over-year export growth was partially driven by a high base last August, when the adverse impact from Typhoon In-fa unwound. Trade surplus in August fell to US$79.4bn on weaker-than-expected exports.

That said – when setting the stage for a 7.00 yuan print – Goldman says that it isn’t such a big deal, and explains why:

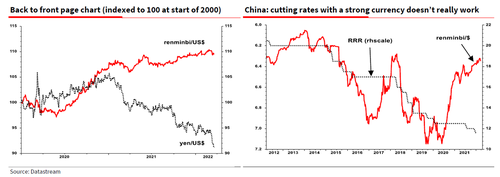

In Aug 2019, when USDCNY first traded above 7, the PBoC issued comment that “7 is not the age of man”, by which they meant it is not a number from which there is no return. The PBoC has made it clear in the press conference earlier this week that China’s monetary policy is mainly serving domestic purpose and they still have ample room. The RMB weakness is mainly due to USD strength, with RMB outperforming non-USD majors and so far there has not been meaningful spillover impact from currency depreciation on other Chinese assets (SHCOMP has been outperforming SPX of late). Another indicator to look at is onshore 1m risk reversal, which came off the highs. All these suggest there is not much to worry onshore about the PBoC allowing USDCNY to trade above 7.0 amid continued USD strength.

All of the above is why Goldman has shifted its USDCNH target to 7.20 area.

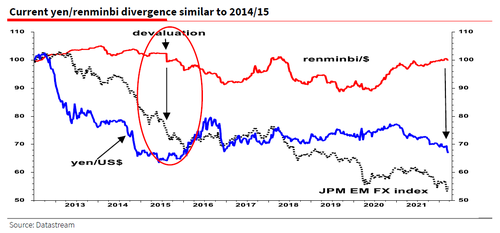

But perhaps an even bigger question is how China will react to the absolute monkeyhammering that the yen has taken in recent months, and as Albert Edwards noted back in March, maybe China will react just like they did in August 2015 when the PBoC devalued: “Back then persistent yen weakness had dragged down other competing regional currencies and left the renminbi overvalued.”

Wait, yen weakness leading to China devaluation? According to Edwards, that indeed was the sequence: as he shows in the chart below, the super weak yen of 2013-15, by driving down other competing Asian currencies, ultimately led us to the August 2015 renminbi devaluation.

Fast forward to today when the aggressive relentless easing by the BoJ – which is terrified of losing control over the JGB curve – comes at a time when the PBoC has resolutely refused to join the global tightening posture and instead is shifting towards an easier stance (after all, China has an imploding property sector it must stabilize at any cost).

Edwards concluded that the one thing to watch out for, especially in the current febrile geopolitical environment, is if China once again is ‘forced’ to devalue because of the weak yen. Economists will tell you that cutting interest rates or the reserve requirement ratio (RRR- r/h chart below) is neutralized when you have a strong currency.

https://www.zerohedge.com/markets/japan-china-edge-after-record-dollar-surge-sparks-explosive-yen-plunge-chinas-yuan-not-far