Epoxy

February 19, 2021

Spot Propylene Over $1.05/lb

US Gulf Coast freeze begins to thaw; plant inspections, restarts ahead

- Author

- Kristen Hays Mary Hogan Astrid Torres

- Editor

- Richard Rubin

- Commodity

- Petrochemicals, Shipping

Houston — The US Gulf Coast on Feb.19 began to emerge from the deep freeze that brought the coldest temperatures in more than a century to the region, but petrochemical producers have a long haul ahead for potential damage assessments and plant restarts, market sources said.

A source said industrial plants in the region are built to withstand hurricanes, but not sustained sub-freezing temperatures with millions of exposed pipes.

Widespread shutdowns sent propylene and ethylene prices to fresh highs Feb. 19 with numerous crackers and all three US propane dehydrogenation plants shut down. Derivative polymer prices had yet to sow much fallout, but market sources expect prices for polyethylene, polypropylene and polyvinyl chloride to rise from levels already seen as high as supply that was tight pre-freeze has tightened sharply on shutdowns.

The Electric Reliability Council of Texas said Feb. 19 that the energy emergency tied to the storm would end that day. About 34 GW of generation remained offline, of which 20 GW was thermal and the rest wind and solar. At the height of the storm, 40 GW of generation was offline.

Here is a rundown of confirmed fallout from the freeze:

FORCE MAJEURES

** Westlake Chemical: Declared Feb. 19 on US caustic soda, chlorine, PVC and VCM; company has 2.9 million mt/year of US caustic soda capacity, more than 2 million mt/year of PVC capacity, 2.6 million mt/year of VCM; more than 2.26 million mt/year of chlorine capacity at five affected sites

** Vestolit: Declared Feb. 16 on PVC produced at its Colombia and Mexico plants on lack of upstream vinyl chloride monomer feedstock from US suppliers; plants have a combined 1.8 million mt/year of capacity

Formosa Plastics USA: Declared Feb. 18 on US PVC, 1.3 million mt/year of capacity at Point Comfort, Texas, and Baton Rouge, Louisiana, complexes.

** Dow Chemical: Declared Feb. 18 on multiple intermediate chemicals produced at plants in Deer Park, Freeport, Texas City and Bayport Texas, Hahnville, Louisiana, and Louisville, Kentucky; declaration includes vinyl acetate monomer (VAM), methyl methacrylate (MMA), glacial methacrylic acid (GMAA), butyl methacrylate (BMA), glycidyl methacrylate (GMA), 2-ethylhexyl Acrylate (2EHA), butyl acrylate (BA), and others; Dow informed South American customers

** Celanese: Declared Feb. 18 on multiple intermediate chemicals normally sold to customers in the US, Europe and the Middle East, including acetic acid, VAM, ethyl acetate and ethylene vinyl acetate (EVA)

** Total: Declared Feb. 17 on polypropylene produced at its 1.15 million mt/year La Porte, Texas, facility

** Formosa Plastics USA: Declared Feb. 17 on all chlor-alkali products

** LyondellBasell: Declared Feb. 15 on US polyethylene

** Flint Hills Resources: Declared Feb. 15 on polypropylene produced at Longview, Texas

** Olin: Declared Feb. 16 on US chlorine, caustic soda, ethylene dichloride, epoxy, hydrochloric acid and other products produced at its Freeport, Texas, complex.

** OxyChem: Declared Feb. 15 on US chlorine, caustic soda, EDC, vinyl chloride monomer and polyvinyl chloride.

** LyondellBasell: Declared Feb. 15 on US polypropylene

INEOS Olefins and Polymers USA: Declared Feb. 15 on polypropylene

** OQ Chemicals: Declared Feb. 15 on US oxo-alcohols, aldehydes, acids and esters produced at its Bat City, Texas, operations

SHUTDOWNS

** Dow Chemical: 750,000 propane dehydrogenation (PDH) unit, Freeport, Texas

MEGlobal: 750,000 mt/year monoethylene glycol (MEG) plant, Freeport, Texas

Formosa Plastics USA: 513,000 mt/year PVC, 653,000 mt/year VCM, Baton Rouge, Louisiana

** Total: 1.15 million mt/year PP, La Porte, Texas

Lotte Chemical: 700,000 mt/year MEG, Lake Charles, Louisiana

** Sasol: 380,000 mt/year EO/MEG, Lake Charles, Louisiana

** Braskem: 360,000 mt/year PP Freeport, Texas; 475,000 mt/year PP La Porte, Texas; 225,000 mt/year PP Seadrift, Texas

** ExxonMobil: Cumulative 1.53 million mt/year from three units, HDPE and LLDPE capacity, Mont Belvieu, Texas

** Indorama Ventures: Port Neches, Texas, 235,867 mt/year cracker, 1 million mt/year ethylene oxide/MEG unit, 238,135 mt/year propylene oxide unit, and 988,000 mt/year of MTBE capacity; Clear Lake, Texas, 435,000 mt/year EO, 358,000 mt/year MEG.

** Olin: Freeport, Texas complex, with 3 million mt/year of caustic soda and 2.73 million mt/year of chlorine capacity; 748,000 mt/year of EDC

** OxyChem: Ingleside, Texas, 544,000 mt/year cracker; 248,000 mt/year chlor-alkali; 680,000 mt/year EDC; Deer Park and Pasadena, Texas, 1.27 million mt in PVC capacity; 1.79 million mt/year of VCM capacity; 580,000 mt/year chlor-alkali

** Shintech: Freeport, Texas: 1.45 million mt/year PVC

** Formosa Plastics USA: Entire Point Comfort, Texas, complex, including three crackers with a cumulative capacity of 2.76 million mt/year; 875,000 mt/year of high density polyethylene; 400,000 mt/year of low density PE; 465,000 mt/year of linear low density PE; two PP units with combined capacity of 1.7 million mt/year; 798,000 mt/year of PVC; 1 million mt/year of caustic soda and 910,000 mt/year of chlorine; 753,000 mt/year of VCM; 1.478 million mt/year of EDC; and a cumulative 1.17 million mt/year of monoethylene glycol operated by sister company Nan Ya Plastics.

** ExxonMobil: Baytown, Texas, refining and chemical complex, including three crackers with a combined capacity of 3.8 million mt/year; 800,000 mt/year PP

** ExxonMobil: Beaumont, Texas, refining and chemical complex, including an 826,000 mt/year cracker; 225,000 mt/year HDPE; 240,000 mt/year LDPE; 1.19 million mt/year LLDPE with some HDPE capacity

** Dow Chemical: Certain units offline within Dow sites along the US Gulf Coast, but the company did not specify. Dow’s Gulf Coast operations include a complex at Freeport, Texas, with three crackers able to produce a combined 3.2 million mt/year, two LDPE units with 552,000 mt/year and 186,000 mt/year HDPE; Dow’s Seadrift, Texas, complex includes 490,000 mt/year LLDPE and 390,000 mt/year HDPE; Dow told South American customers in a letter dated Feb. 16 that the company was assessing impact on PE production capacity “and we know that our ability to supply various products could be affected.”

** TPC Group: Houston site shut down, including 544,310 mt/year butadiene unit, when boilers lost steam

** Motiva Chemicals: Port Arthur, 635,000 mt/year mixed-feed cracker

** Shell: Deer Park, Texas, refining and chemical complex, including two crackers with a combined 961,000 mt/year of capacity

** Shell: Norco, Louisiana, refining and chemical complex, including two crackers with a combined capacity of 1.42 million mt/year

** Chevron Phillips Chemical: Pasadena, Texas, 998,000 mt/year HDPE

PRICES

** US spot polymer-grade propylene prices hit a fresh all-time high Feb. 19 of $1.05.25/lb FD USG, surpassing the previous all-time high of 98 cents/lb reached Feb. 9-11, with all three US propane dehydrogenation plants shut down, one pre-freeze for planned work and the other two on the freeze.

** US spot MTBE prices surged to a near one-year high Feb. 19 188.31 cents/gal FOB USG, up 9.10 cents/gal, just under 193.30 cents/gal reached on Feb. 25, 2020.

** US spot ethylene prices rose throughout the week as supply tightened on cracker outages; FD Mont Belvieu ended Feb. 19 at 45.25 cents/lb, up 5.25 cents/lb since Feb. 16, and FD Choctaw ended Feb. 19 at 40.25 cents/lb, up 3.25 cents/lb in the same span

** US polymer prices held steady amid muted activity amid power outages

PORTS AND RAILROADS

** Houston Ship Channel: shut mid-afternoon Feb. 14; reopened Feb. 16 until late afternoon; reopened morning of Feb. 17 until evening; reopened morning Feb. 18; fog expected the week of Feb. 22 as temperatures rise

** Sabine Pass: port shut mid-afternoon Feb. 14, resumed inbound traffic midday Feb. 16, shut Feb. 17, reopened Feb. 18

** Corpus Christi: port shut Feb. 14, resumed boarding vessels Feb. 16 until late evening when shut again per weather; resumed boarding midday Feb. 17; closed Feb. 18 due to fog

** Union Pacific advised customers Feb. 18 that recovery efforts were making progress as weather conditions improved, and commercial power and water were slowly returning to areas of its network in Texas, though ongoing road closures hindered moving crews through the South.

** BNSF Railway advised customers on Feb. 16 that many trains in Texas were holding due to widespread power outages and road closures that affected movement of train crews and other personnel, and delays in shipments were expected to last until conditions improve.

** Kansas City Southern advised Feb. 18 that the freeze has significantly delayed cross-border north and southbound traffic between Texas and Mexico.

https://www.spglobal.com/platts/en/products-services/electric-power/gas-and-power

February 19, 2021

Spot Propylene Over $1.05/lb

US Gulf Coast freeze begins to thaw; plant inspections, restarts ahead

- Author

- Kristen Hays Mary Hogan Astrid Torres

- Editor

- Richard Rubin

- Commodity

- Petrochemicals, Shipping

Houston — The US Gulf Coast on Feb.19 began to emerge from the deep freeze that brought the coldest temperatures in more than a century to the region, but petrochemical producers have a long haul ahead for potential damage assessments and plant restarts, market sources said.

A source said industrial plants in the region are built to withstand hurricanes, but not sustained sub-freezing temperatures with millions of exposed pipes.

Widespread shutdowns sent propylene and ethylene prices to fresh highs Feb. 19 with numerous crackers and all three US propane dehydrogenation plants shut down. Derivative polymer prices had yet to sow much fallout, but market sources expect prices for polyethylene, polypropylene and polyvinyl chloride to rise from levels already seen as high as supply that was tight pre-freeze has tightened sharply on shutdowns.

The Electric Reliability Council of Texas said Feb. 19 that the energy emergency tied to the storm would end that day. About 34 GW of generation remained offline, of which 20 GW was thermal and the rest wind and solar. At the height of the storm, 40 GW of generation was offline.

Here is a rundown of confirmed fallout from the freeze:

FORCE MAJEURES

** Westlake Chemical: Declared Feb. 19 on US caustic soda, chlorine, PVC and VCM; company has 2.9 million mt/year of US caustic soda capacity, more than 2 million mt/year of PVC capacity, 2.6 million mt/year of VCM; more than 2.26 million mt/year of chlorine capacity at five affected sites

** Vestolit: Declared Feb. 16 on PVC produced at its Colombia and Mexico plants on lack of upstream vinyl chloride monomer feedstock from US suppliers; plants have a combined 1.8 million mt/year of capacity

Formosa Plastics USA: Declared Feb. 18 on US PVC, 1.3 million mt/year of capacity at Point Comfort, Texas, and Baton Rouge, Louisiana, complexes.

** Dow Chemical: Declared Feb. 18 on multiple intermediate chemicals produced at plants in Deer Park, Freeport, Texas City and Bayport Texas, Hahnville, Louisiana, and Louisville, Kentucky; declaration includes vinyl acetate monomer (VAM), methyl methacrylate (MMA), glacial methacrylic acid (GMAA), butyl methacrylate (BMA), glycidyl methacrylate (GMA), 2-ethylhexyl Acrylate (2EHA), butyl acrylate (BA), and others; Dow informed South American customers

** Celanese: Declared Feb. 18 on multiple intermediate chemicals normally sold to customers in the US, Europe and the Middle East, including acetic acid, VAM, ethyl acetate and ethylene vinyl acetate (EVA)

** Total: Declared Feb. 17 on polypropylene produced at its 1.15 million mt/year La Porte, Texas, facility

** Formosa Plastics USA: Declared Feb. 17 on all chlor-alkali products

** LyondellBasell: Declared Feb. 15 on US polyethylene

** Flint Hills Resources: Declared Feb. 15 on polypropylene produced at Longview, Texas

** Olin: Declared Feb. 16 on US chlorine, caustic soda, ethylene dichloride, epoxy, hydrochloric acid and other products produced at its Freeport, Texas, complex.

** OxyChem: Declared Feb. 15 on US chlorine, caustic soda, EDC, vinyl chloride monomer and polyvinyl chloride.

** LyondellBasell: Declared Feb. 15 on US polypropylene

INEOS Olefins and Polymers USA: Declared Feb. 15 on polypropylene

** OQ Chemicals: Declared Feb. 15 on US oxo-alcohols, aldehydes, acids and esters produced at its Bat City, Texas, operations

SHUTDOWNS

** Dow Chemical: 750,000 propane dehydrogenation (PDH) unit, Freeport, Texas

MEGlobal: 750,000 mt/year monoethylene glycol (MEG) plant, Freeport, Texas

Formosa Plastics USA: 513,000 mt/year PVC, 653,000 mt/year VCM, Baton Rouge, Louisiana

** Total: 1.15 million mt/year PP, La Porte, Texas

Lotte Chemical: 700,000 mt/year MEG, Lake Charles, Louisiana

** Sasol: 380,000 mt/year EO/MEG, Lake Charles, Louisiana

** Braskem: 360,000 mt/year PP Freeport, Texas; 475,000 mt/year PP La Porte, Texas; 225,000 mt/year PP Seadrift, Texas

** ExxonMobil: Cumulative 1.53 million mt/year from three units, HDPE and LLDPE capacity, Mont Belvieu, Texas

** Indorama Ventures: Port Neches, Texas, 235,867 mt/year cracker, 1 million mt/year ethylene oxide/MEG unit, 238,135 mt/year propylene oxide unit, and 988,000 mt/year of MTBE capacity; Clear Lake, Texas, 435,000 mt/year EO, 358,000 mt/year MEG.

** Olin: Freeport, Texas complex, with 3 million mt/year of caustic soda and 2.73 million mt/year of chlorine capacity; 748,000 mt/year of EDC

** OxyChem: Ingleside, Texas, 544,000 mt/year cracker; 248,000 mt/year chlor-alkali; 680,000 mt/year EDC; Deer Park and Pasadena, Texas, 1.27 million mt in PVC capacity; 1.79 million mt/year of VCM capacity; 580,000 mt/year chlor-alkali

** Shintech: Freeport, Texas: 1.45 million mt/year PVC

** Formosa Plastics USA: Entire Point Comfort, Texas, complex, including three crackers with a cumulative capacity of 2.76 million mt/year; 875,000 mt/year of high density polyethylene; 400,000 mt/year of low density PE; 465,000 mt/year of linear low density PE; two PP units with combined capacity of 1.7 million mt/year; 798,000 mt/year of PVC; 1 million mt/year of caustic soda and 910,000 mt/year of chlorine; 753,000 mt/year of VCM; 1.478 million mt/year of EDC; and a cumulative 1.17 million mt/year of monoethylene glycol operated by sister company Nan Ya Plastics.

** ExxonMobil: Baytown, Texas, refining and chemical complex, including three crackers with a combined capacity of 3.8 million mt/year; 800,000 mt/year PP

** ExxonMobil: Beaumont, Texas, refining and chemical complex, including an 826,000 mt/year cracker; 225,000 mt/year HDPE; 240,000 mt/year LDPE; 1.19 million mt/year LLDPE with some HDPE capacity

** Dow Chemical: Certain units offline within Dow sites along the US Gulf Coast, but the company did not specify. Dow’s Gulf Coast operations include a complex at Freeport, Texas, with three crackers able to produce a combined 3.2 million mt/year, two LDPE units with 552,000 mt/year and 186,000 mt/year HDPE; Dow’s Seadrift, Texas, complex includes 490,000 mt/year LLDPE and 390,000 mt/year HDPE; Dow told South American customers in a letter dated Feb. 16 that the company was assessing impact on PE production capacity “and we know that our ability to supply various products could be affected.”

** TPC Group: Houston site shut down, including 544,310 mt/year butadiene unit, when boilers lost steam

** Motiva Chemicals: Port Arthur, 635,000 mt/year mixed-feed cracker

** Shell: Deer Park, Texas, refining and chemical complex, including two crackers with a combined 961,000 mt/year of capacity

** Shell: Norco, Louisiana, refining and chemical complex, including two crackers with a combined capacity of 1.42 million mt/year

** Chevron Phillips Chemical: Pasadena, Texas, 998,000 mt/year HDPE

PRICES

** US spot polymer-grade propylene prices hit a fresh all-time high Feb. 19 of $1.05.25/lb FD USG, surpassing the previous all-time high of 98 cents/lb reached Feb. 9-11, with all three US propane dehydrogenation plants shut down, one pre-freeze for planned work and the other two on the freeze.

** US spot MTBE prices surged to a near one-year high Feb. 19 188.31 cents/gal FOB USG, up 9.10 cents/gal, just under 193.30 cents/gal reached on Feb. 25, 2020.

** US spot ethylene prices rose throughout the week as supply tightened on cracker outages; FD Mont Belvieu ended Feb. 19 at 45.25 cents/lb, up 5.25 cents/lb since Feb. 16, and FD Choctaw ended Feb. 19 at 40.25 cents/lb, up 3.25 cents/lb in the same span

** US polymer prices held steady amid muted activity amid power outages

PORTS AND RAILROADS

** Houston Ship Channel: shut mid-afternoon Feb. 14; reopened Feb. 16 until late afternoon; reopened morning of Feb. 17 until evening; reopened morning Feb. 18; fog expected the week of Feb. 22 as temperatures rise

** Sabine Pass: port shut mid-afternoon Feb. 14, resumed inbound traffic midday Feb. 16, shut Feb. 17, reopened Feb. 18

** Corpus Christi: port shut Feb. 14, resumed boarding vessels Feb. 16 until late evening when shut again per weather; resumed boarding midday Feb. 17; closed Feb. 18 due to fog

** Union Pacific advised customers Feb. 18 that recovery efforts were making progress as weather conditions improved, and commercial power and water were slowly returning to areas of its network in Texas, though ongoing road closures hindered moving crews through the South.

** BNSF Railway advised customers on Feb. 16 that many trains in Texas were holding due to widespread power outages and road closures that affected movement of train crews and other personnel, and delays in shipments were expected to last until conditions improve.

** Kansas City Southern advised Feb. 18 that the freeze has significantly delayed cross-border north and southbound traffic between Texas and Mexico.

https://www.spglobal.com/platts/en/products-services/electric-power/gas-and-power

February 19, 2021

Great Summary of Where We Are–It’s Going to be a Rough Few Weeks

U.S. Gulf Coast storm outages rise, send ripples round global markets; Area plant status list update included

by WILL BEACHAM, Deputy Editor, ICIS Chemical Business

February 19, 2021

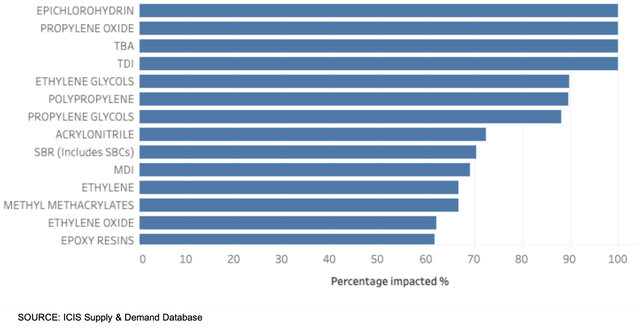

The US polar storm has now shut down 90% of US polypropylene (PP) capacity, 67% of ethylene and devastated other important products, sending ripples around global chemical markets prices soaring.

More chemical plants and refineries across the Gulf Coast region have been hit by prolonged power and feedstock outages caused by freezing weather, snow and ice which have also halted logistics networks. More bad weather, forecast for later in the week, may prolong the disruption.

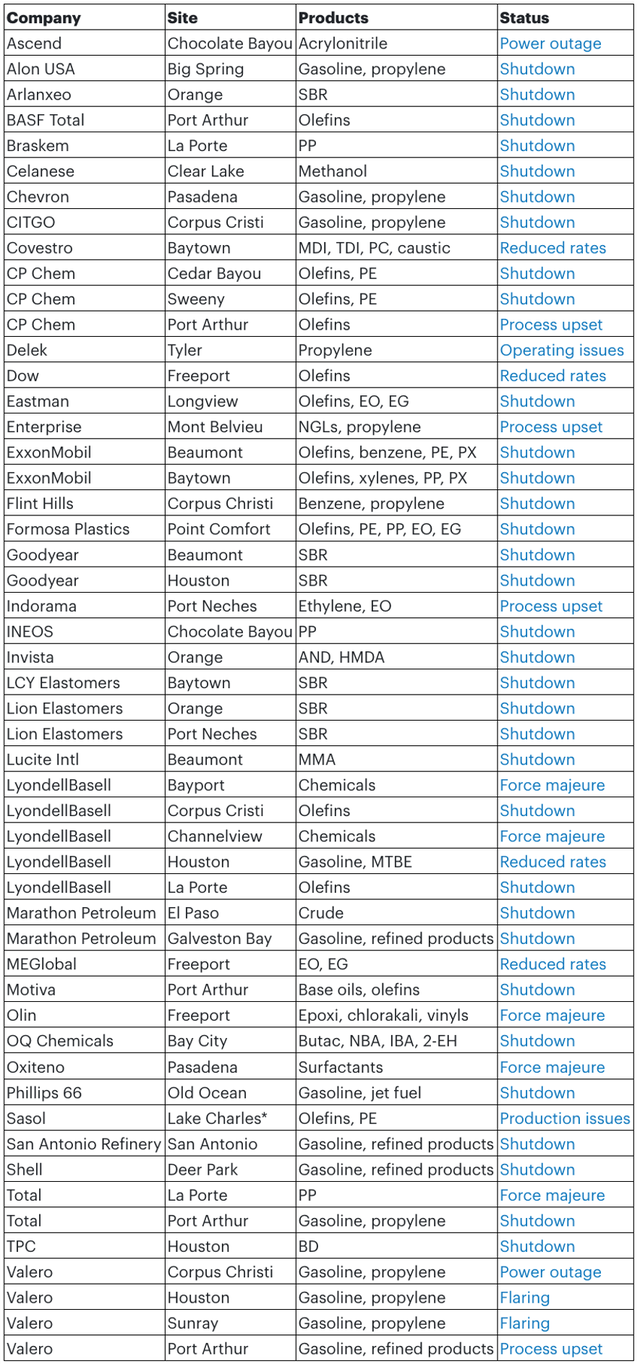

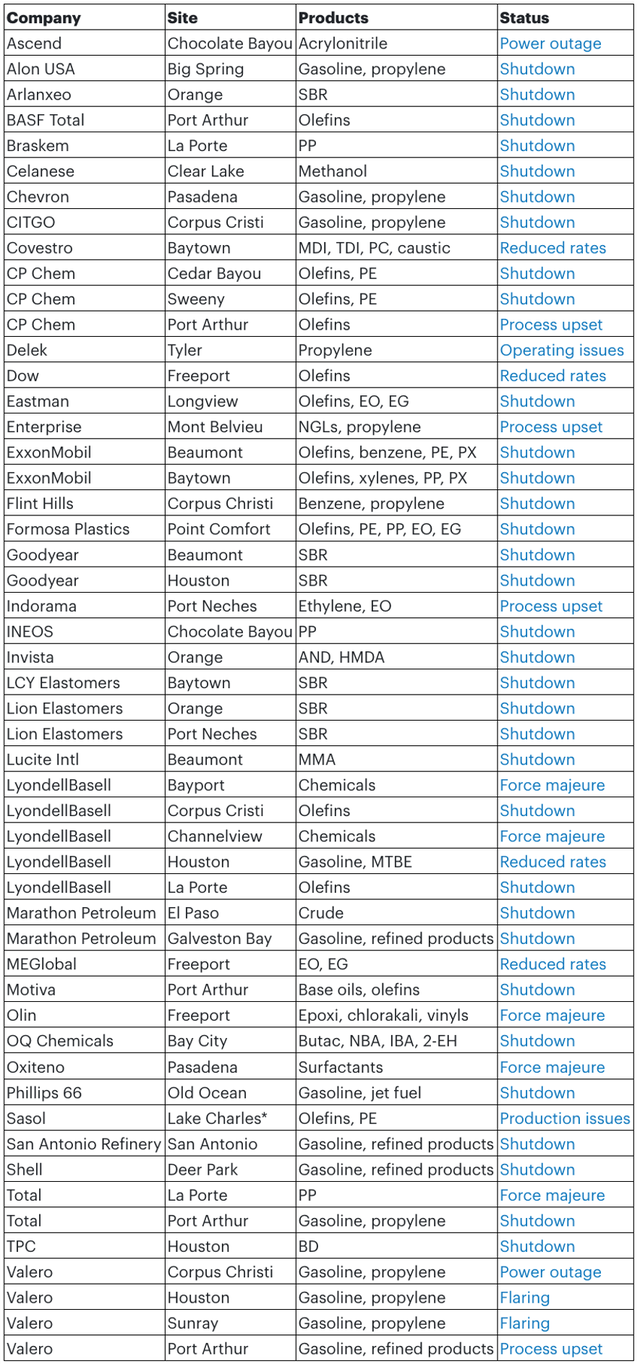

So far, ICIS has reported more than 60 plant outages as a result of the storm, with analysis using data from the ICIS Supply & Demand database showing that a wide swathe of the Gulf petrochemical sector has now been severely impacted.

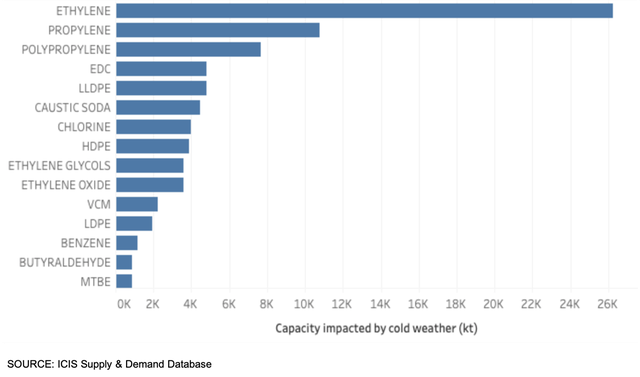

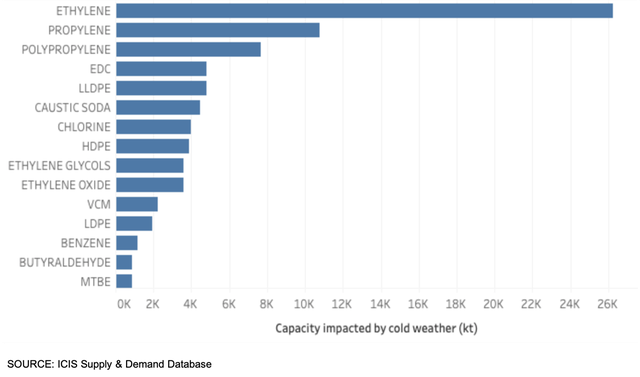

Worst hit in volume terms is ethylene, with 26m tonnes of capacity offline, representing 67% of the US total. Around 11m tonnes, or 50%, of propylene capacity is also offline, with many of the region’s oil refineries also seeing curtailed production. More than 2m bbl/day of US oil refining capacity is shut down.

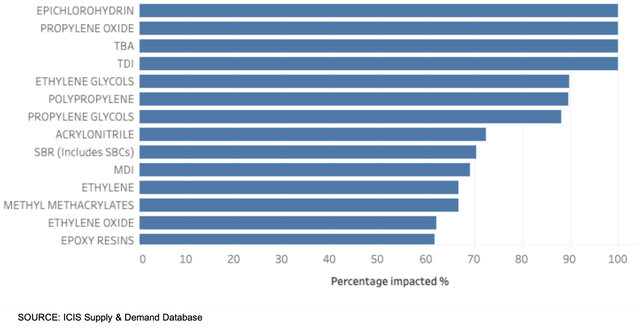

In percentage terms, the major commodities worst affected are epichlorohydrin (ECH) (100% of US capacity offline), propylene oxide (PO) (100%), toluene diisocyanate (TDI) (100%), ethylene glycol (EG) (90%), polypropylene (PP) (90%), propylene glycol (88%), acrylonitrile (ACN) (73%) and styrene butadiene rubber (SBR) (71%).

The outages are tightening global markets which were already suffering shortages of material and rising prices. Problems with the global container shipping system, plant outages plus healthy downstream demand have caused tightness, notably down the propylene and polyethylene (PE) chains.

Propylene and PP are likely to be one of the hardest-hit by the storms because the market was already in turmoil. The coronavirus pandemic has reduced demand for transport fuels, and led to oil refineries closing or cutting production, particularly in Europe and the US.

These closures had a knock-on effect on the supply of propylene and PP, leading to price spikes. With US PP production capacity so highly concentrated on the Gulf Coast, even temporarily constrained production capabilities will have a massive effect on an already tightly supplied market.

US propylene prices are at 10-year highs and inventories are roughly half of what they were a year ago. Consumption has outpaced production due to reduced propylene production over the last year.

PP inventories in the US hit seven-year lows in late 2020, partially driven by rebounding demand and partially driven by limited monomer availability. Some PP production issues also preceded this weather event.

The situation is less dramatic in PE. Constrained supply and demand for packaging has sustained global markets through the pandemic, with logistics challenges and outages causing shortages and price spikes in 2021.

With almost two thirds of US ethylene capacity now offline, global PE markets are likely to tighten further.

US methyl methacrylate (MMA) supply is also expected to be further constrained thanks to the storm, as Lucite has taken down its plant in Beaumont, Texas. Severe constraints in feedstock acetone continue to limit production. Due to high costs, a producer is heard to be levying a temporary acetone surcharge on orders starting this month.Expand

With the Chinese New Year holidays coming to an end from 17 February, demand is picking back up in the world’s largest chemicals market. ICIS reported today that a supply shortage and improving demand after the holidays, supported China’s polyolefins market, leading to a surge in futures and spot prices.

Futures prices in China also rose sharply for styrene, mono ethylene glycol (MEG), polyester and polypropylene.

Prior to the holiday, domestic petrochemical trading had been robust accompanied by sharp price increases as market players anticipated strong post-holiday demand. Surging oil prices provided additional impetus for the uptrend.

In Africa, PE and PP sellers, from all origins, have withdrawn their offers in anticipation of disruption to US exports and a strong return post-holiday market.

Asia’s monoethylene glycol (MEG) prices surged on Thursday by 11% – the biggest daily gain on record – underpinned by tightening global supply, as the Chinese markets re-opened after a week-long holiday.

There are fears that US exports to Asia of key commodities such as ethylene could be disrupted by the storm-related outages.

Europe prices have also been buoyed by the storms. Rising upstream prices and bullish sentiment sent benzene prices up, and styrene prices are now at highs not seen since April 2018.Expand

Area plant status

Additional reporting by: Lucy Shuai, Pearl Bantillo, Ben Lake, Judith Wang, Felicia Loo, Nurluqman Suratman, Amanda Hay, Tom Brown, Yashas Mudumbai, Helena Strathearn and Tarun Raizada,

https://www.bicmagazine.com/departments/operations/us-gulf-coast-storm-outages-rise-send-ripples/

February 19, 2021

Great Summary of Where We Are–It’s Going to be a Rough Few Weeks

U.S. Gulf Coast storm outages rise, send ripples round global markets; Area plant status list update included

by WILL BEACHAM, Deputy Editor, ICIS Chemical Business

February 19, 2021

The US polar storm has now shut down 90% of US polypropylene (PP) capacity, 67% of ethylene and devastated other important products, sending ripples around global chemical markets prices soaring.

More chemical plants and refineries across the Gulf Coast region have been hit by prolonged power and feedstock outages caused by freezing weather, snow and ice which have also halted logistics networks. More bad weather, forecast for later in the week, may prolong the disruption.

So far, ICIS has reported more than 60 plant outages as a result of the storm, with analysis using data from the ICIS Supply & Demand database showing that a wide swathe of the Gulf petrochemical sector has now been severely impacted.

Worst hit in volume terms is ethylene, with 26m tonnes of capacity offline, representing 67% of the US total. Around 11m tonnes, or 50%, of propylene capacity is also offline, with many of the region’s oil refineries also seeing curtailed production. More than 2m bbl/day of US oil refining capacity is shut down.

In percentage terms, the major commodities worst affected are epichlorohydrin (ECH) (100% of US capacity offline), propylene oxide (PO) (100%), toluene diisocyanate (TDI) (100%), ethylene glycol (EG) (90%), polypropylene (PP) (90%), propylene glycol (88%), acrylonitrile (ACN) (73%) and styrene butadiene rubber (SBR) (71%).

The outages are tightening global markets which were already suffering shortages of material and rising prices. Problems with the global container shipping system, plant outages plus healthy downstream demand have caused tightness, notably down the propylene and polyethylene (PE) chains.

Propylene and PP are likely to be one of the hardest-hit by the storms because the market was already in turmoil. The coronavirus pandemic has reduced demand for transport fuels, and led to oil refineries closing or cutting production, particularly in Europe and the US.

These closures had a knock-on effect on the supply of propylene and PP, leading to price spikes. With US PP production capacity so highly concentrated on the Gulf Coast, even temporarily constrained production capabilities will have a massive effect on an already tightly supplied market.

US propylene prices are at 10-year highs and inventories are roughly half of what they were a year ago. Consumption has outpaced production due to reduced propylene production over the last year.

PP inventories in the US hit seven-year lows in late 2020, partially driven by rebounding demand and partially driven by limited monomer availability. Some PP production issues also preceded this weather event.

The situation is less dramatic in PE. Constrained supply and demand for packaging has sustained global markets through the pandemic, with logistics challenges and outages causing shortages and price spikes in 2021.

With almost two thirds of US ethylene capacity now offline, global PE markets are likely to tighten further.

US methyl methacrylate (MMA) supply is also expected to be further constrained thanks to the storm, as Lucite has taken down its plant in Beaumont, Texas. Severe constraints in feedstock acetone continue to limit production. Due to high costs, a producer is heard to be levying a temporary acetone surcharge on orders starting this month.Expand

With the Chinese New Year holidays coming to an end from 17 February, demand is picking back up in the world’s largest chemicals market. ICIS reported today that a supply shortage and improving demand after the holidays, supported China’s polyolefins market, leading to a surge in futures and spot prices.

Futures prices in China also rose sharply for styrene, mono ethylene glycol (MEG), polyester and polypropylene.

Prior to the holiday, domestic petrochemical trading had been robust accompanied by sharp price increases as market players anticipated strong post-holiday demand. Surging oil prices provided additional impetus for the uptrend.

In Africa, PE and PP sellers, from all origins, have withdrawn their offers in anticipation of disruption to US exports and a strong return post-holiday market.

Asia’s monoethylene glycol (MEG) prices surged on Thursday by 11% – the biggest daily gain on record – underpinned by tightening global supply, as the Chinese markets re-opened after a week-long holiday.

There are fears that US exports to Asia of key commodities such as ethylene could be disrupted by the storm-related outages.

Europe prices have also been buoyed by the storms. Rising upstream prices and bullish sentiment sent benzene prices up, and styrene prices are now at highs not seen since April 2018.Expand

Area plant status

Additional reporting by: Lucy Shuai, Pearl Bantillo, Ben Lake, Judith Wang, Felicia Loo, Nurluqman Suratman, Amanda Hay, Tom Brown, Yashas Mudumbai, Helena Strathearn and Tarun Raizada,

https://www.bicmagazine.com/departments/operations/us-gulf-coast-storm-outages-rise-send-ripples/

February 19, 2021

Too Funny . . . What Did Farmers’ Almanac Predict?

U.S. Winter Outlook: Cooler North, warmer South with ongoing La Nina

Persistent drought dominates the Western landscape WeatherClimateclimate outlookswinter

October 15, 2020

NOAA’s winter forecast for the U.S. favors warmer, drier conditions across the southern tier of the U.S., and cooler, wetter conditions in the North, thanks in part to an ongoing La Nina. Forecasters at NOAA’s Climate Prediction Center — a division of the National Weather Service — are also closely monitoring persistent drought during the winter months ahead, with more than 45% of the continental U.S. now experiencing drought.

“NOAA’s timely and accurate seasonal outlooks and short-term forecasts are the result of improved satellite observations, more detailed computer forecast modeling, and expanding supercomputing capacity,” said Neil Jacobs, Ph.D., acting NOAA administrator. “From expansive and multi-hazard winter storms to narrow but intense lake effect snow, NOAA will provide the necessary information to keep communities safe.”

Currently, large areas of drought extend over the western half of the U.S., with parts of the Northeast also experiencing drought and near-record low stream flows. With a La Nina climate pattern in place, southern parts of the U.S. may experience expanded and intensifying drought during the winter months ahead.

“With La Nina well established and expected to persist through the upcoming 2020 winter season, we anticipate the typical, cooler, wetter North, and warmer, drier South, as the most likely outcome of winter weather that the U.S. will experience this year,” said Mike Halpert, deputy director of NOAA’s Climate Prediction Center.

This U.S. Winter Outlook 2020-2021 map for temperature shows above-average temperatures are likely in the South and below-average temperatures likely in parts of the North. (NOAA Climate.gov, using NWS CPC data)

Temperature

The greatest chances for warmer-than-normal conditions extend across the Southern tier of the U.S. from the Southwest, across the Gulf states and into the Southeast. More modest probabilities for warmer temperatures are forecast in the southern parts of the west coast, and from the Mid-Atlantic into the Northeast. Above-average temperatures are also favored for Hawaii and western and northern Alaska.

Below-normal temperatures are favored in southern Alaska and from the northern Pacific Northwest into the Northern Plains, with equal chances for below-, near- or above-average temperatures in the remaining regions.

This 2020-2021 U.S. Winter Outlook map for precipitation shows wetter-than-average weather is most likely across the Northern Tier of the U.S. and drier-than-average weather is favored across the South. (NOAA Climate.gov, using NWS CPC data) Download Image

Precipitation

Wetter-than-average conditions are most likely across the northern tier of the U.S., extending from the Pacific Northwest, across the Northern Plains, Great Lakes and into the Ohio Valley, as well as Hawaii and northern Alaska. The greatest chances for drier-than-average conditions are predicted in the Southwest, across Texas along the Gulf Coast, and in Florida. More modest chances for drier conditions are forecast in southern Alaska, and from California across the Rockies, Central Plains and into the Southeast. The remainder of the U.S., including the Mid-Atlantic and Northeast, falls into the category of equal chances for below-, near-, or above-average precipitation.

This seasonal U.S. Drought Outlook map for November 2020 through January 2021 predicts persistent drought across much of the Western U.S. in the months ahead. (NOAA Climate.gov based on NWS CPC data) Download Image

Drought

Widespread, ongoing drought is currently in place across the western half of the continental U.S. as a result of the weak Southwest summer monsoon season and near-record-high temperatures. Drought is also present in parts of the Northeast, Ohio Valley, Hawaii and Alaska. The ongoing La Nina is expected to expand and intensify drought across the southern and central Plains, eastern Gulf Coast, and in California during the months ahead. Drought conditions are expected to improve in the northern Rockies, Northwest, New England, Alaska and Hawaii over the coming months.

About NOAA’s seasonal outlooks

NOAA’s seasonal outlooks provide the likelihood that temperatures and total precipitation amounts will be above-, near- or below-average, and how drought conditions are favored to change. The outlook does not project seasonal snowfall accumulations; snow forecasts are generally not predictable more than a week in advance.

Seasonal outlooks help communities prepare for what is likely to come in the months ahead and minimize weather’s impacts on lives and livelihoods. Empowering people with actionable forecasts and winter weather safety tips is key to NOAA’s effort to build a more Weather-Ready Nation.

NOAA’s Climate Prediction Center updates the three-month outlook each month. The next update will be available November 19, 2020.

https://www.noaa.gov/media-release/us-winter-outlook-cooler-north-warmer-south-with-ongoing-la-nina